Indoor Air Quality Testing Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432966 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Indoor Air Quality Testing Service Market Size

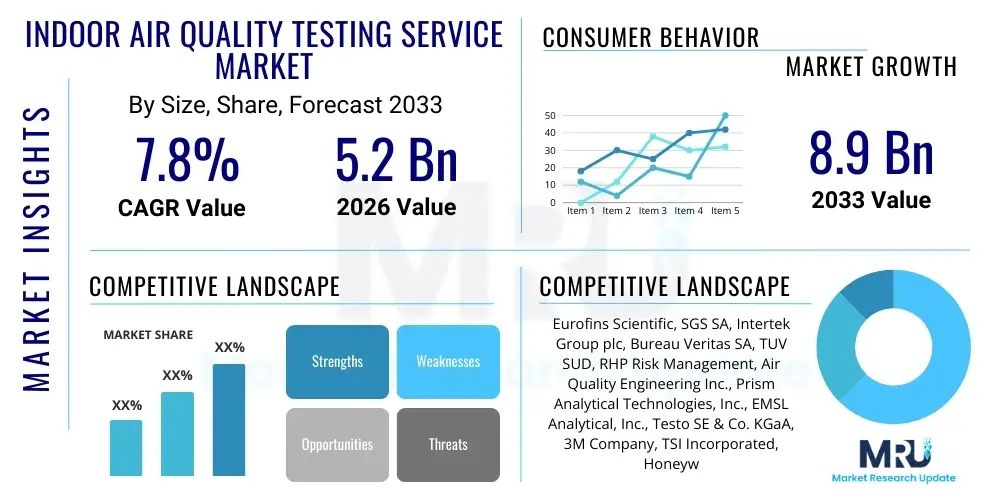

The Indoor Air Quality Testing Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.9 Billion by the end of the forecast period in 2033.

Indoor Air Quality Testing Service Market introduction

The Indoor Air Quality (IAQ) Testing Service Market encompasses professional and specialized services designed to measure, analyze, and mitigate indoor atmospheric contaminants across various building types. These services are crucial for identifying pollutants such as Volatile Organic Compounds (VOCs), particulate matter (PM2.5 and PM10), carbon monoxide, radon, mold spores, and various biological agents that can significantly impact human health and productivity. The rise in public awareness regarding the long-term effects of poor IAQ, particularly concerning chronic respiratory conditions and "sick building syndrome," has accelerated the demand for these precise diagnostic and remediation offerings. Service providers utilize advanced monitoring equipment and laboratory analysis to deliver comprehensive reports and actionable recommendations, ensuring compliance with evolving governmental health and safety standards worldwide.

The core product within this market is the provision of expert analysis rather than physical goods, although it relies heavily on sophisticated hardware such as gas chromatographs, aerosol spectrometers, and continuous monitoring systems. Major applications span commercial, industrial, residential, and institutional sectors, with significant adoption observed in schools, hospitals, corporate offices, and manufacturing facilities where regulatory compliance and occupant well-being are paramount. The benefits derived from utilizing IAQ testing services are manifold, including reduced absenteeism, enhanced employee performance, prolonged asset life (preventing damage from humidity or biological growth), and significantly improved public relations through demonstrated commitment to health and environmental sustainability. Furthermore, adherence to standards set by bodies like LEED and WELL Building further drives mandatory testing requirements.

Several critical factors are driving the robust expansion of this market. Foremost among these is the stringent enforcement of occupational safety regulations, particularly in developed economies, mandating periodic IAQ assessments in workplaces. Secondly, urbanization and increased building airtightness—a necessary feature for energy efficiency—paradoxically lead to pollutant concentration, necessitating professional testing. The global health crises have also fundamentally shifted institutional and individual priorities towards preventative environmental controls, pushing continuous monitoring and proactive testing services into the mainstream. Technological advancements, particularly in sensor miniaturization and cloud-based data analytics, are making testing services more accessible, accurate, and cost-effective, thus broadening the potential customer base considerably.

Indoor Air Quality Testing Service Market Executive Summary

The Indoor Air Quality Testing Service Market demonstrates resilient growth, underpinned by a convergence of regulatory pressures, heightened public health concerns, and technological innovation. Business trends indicate a strong move toward integrated service models, where testing is combined with mitigation recommendations, system installation, and long-term monitoring contracts, securing recurring revenue streams for key players. The market is witnessing consolidation, as larger analytical firms acquire specialized IAQ testing laboratories to expand geographic reach and technical capabilities. Furthermore, digitalization is a defining trend; the adoption of Software-as-a-Service (SaaS) platforms for real-time data visualization and predictive maintenance scheduling is transforming service delivery, allowing building managers to shift from reactive inspections to continuous environmental management.

Regional dynamics highlight North America and Europe as dominant revenue generators, driven by mature regulatory frameworks (such as ASHRAE standards and EU directives) and high disposable income allocated towards workplace and residential health improvements. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to rapid industrialization, massive construction booms, and increasing awareness of air pollution externalities, especially in densely populated urban centers like China and India. Emerging markets in Latin America and the Middle East are also accelerating adoption, primarily focusing on commercial and hospitality sectors seeking international certification standards to attract global business.

Segmentation trends reveal that the institutional segment (hospitals, schools, government buildings) continues to be the largest consumer of comprehensive, regularly scheduled testing due to critical occupancy requirements and susceptibility to legal liabilities. However, the commercial and corporate office segment is experiencing the most significant growth rate, fueled by return-to-office initiatives prioritizing employee health infrastructure. Services focusing on biological contaminants (mold, bacteria, viruses) have seen unparalleled demand spikes, particularly post-2020, shifting market expenditure away from purely chemical contaminant testing. Furthermore, technology segmentation indicates a rising preference for active sampling and continuous monitoring over traditional passive sampling, reflecting the market’s demand for immediate and actionable insights.

AI Impact Analysis on Indoor Air Quality Testing Service Market

User queries regarding AI in the IAQ testing domain primarily center on automating diagnostic processes, predicting contaminant risks, and optimizing remediation strategies. Users frequently ask if AI can replace human analysts, how machine learning algorithms handle complex mixtures of VOCs, and the expected reduction in operational costs associated with AI-driven continuous monitoring systems. Key concerns often revolve around data privacy when utilizing interconnected building management systems and the accuracy of predictive models in highly variable indoor environments. These discussions indicate a strong user expectation for AI to enhance efficiency and provide proactive, rather than reactive, IAQ management solutions.

AI's primary impact involves transforming raw sensor data into predictive intelligence. Machine learning models can analyze vast datasets—including external weather conditions, building usage patterns, HVAC performance logs, and historical pollutant levels—to identify subtle correlations and forecast potential IAQ breaches before they occur. This predictive capability allows service providers to offer proactive maintenance alerts, optimizing filter changes or ventilation rate adjustments, thus moving the business model from scheduled inspections to continuous, risk-based service contracts. Furthermore, AI streamlines the testing process by intelligently calibrating sensor networks, reducing false positives, and prioritizing the contaminants requiring immediate expert attention, significantly lowering the time and expertise required for preliminary analysis.

For large facility managers and real estate portfolio holders, AI-powered dashboards provide consolidated, real-time insights into the health performance of multiple properties, enabling standardized corrective actions across geographically dispersed assets. This technological integration not only improves the overall quality and speed of service delivery but also opens up new revenue streams for service companies offering complex data interpretation and integration services. The application of sophisticated algorithms to analyze complex spectra of airborne chemicals ensures more precise identification of low-level pollutants that might be missed by manual observation, cementing AI's role as an indispensable tool for advanced diagnostic accuracy in the highly technical IAQ landscape.

- AI-driven predictive maintenance optimizes HVAC efficiency and reduces contaminant risks proactively.

- Machine learning algorithms enhance diagnostic accuracy by correlating IAQ data with building usage and external environmental factors.

- Automation of data processing reduces the reliance on manual data review, accelerating reporting timelines.

- AI enables real-time, continuous monitoring, shifting the service paradigm from reactive testing to preventive environmental control.

- Advanced pattern recognition aids in the identification of complex or novel pollutant sources, such as emerging VOCs.

DRO & Impact Forces Of Indoor Air Quality Testing Service Market

The Indoor Air Quality Testing Service Market is significantly shaped by a powerful interplay of Driving forces, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces influencing market trajectory. Key drivers include stringent governmental regulations regarding workplace safety and environmental exposure, coupled with heightened public awareness regarding the long-term health implications of poor indoor air. Opportunities center on the integration of smart building technology and the untapped potential of the residential sector. Conversely, high initial capital investment required for sophisticated testing equipment and variability in regulatory enforcement across different geopolitical regions act as primary restraints. These dynamics ensure that companies emphasizing innovation, sensor technology, and diversified service offerings are best positioned for sustained growth.

The primary driving force is the regulatory mandate, especially in commercial and public infrastructure. Standards bodies such as OSHA, EPA, and regional equivalents frequently update exposure limits for particulates and chemical contaminants, forcing building owners to comply through professional testing services. The concurrent rise of green building certifications (e.g., LEED, BREEAM) that incorporate mandatory IAQ checks further institutionalizes demand. A secondary but equally potent driver is the increasing incidence of respiratory diseases, which is directly linked by epidemiological studies to indoor pollutants, pushing corporations and educational institutions to invest heavily in preventative health infrastructure to mitigate liability and assure occupants.

However, the market faces significant restraints. The complexity and high cost of advanced testing equipment, such as laboratory-grade analysers, pose a financial barrier to entry for smaller service providers and limit the affordability of comprehensive testing for smaller businesses or individual homeowners. Furthermore, the lack of standardized global testing protocols and reporting metrics creates market friction, necessitating country-specific operational adjustments for international service providers. Opportunities for expansion primarily reside in the advent of low-cost, high-accuracy sensor networks enabling continuous monitoring, thereby transforming IAQ testing from a periodic audit into an ongoing, data-driven utility service. The massive, relatively untouched residential market presents a substantial growth opportunity, driven by increased consumer interest in wellness and personalized health monitoring services.

Segmentation Analysis

The Indoor Air Quality Testing Service Market is structurally segmented across various dimensions including pollutant type, sampling method, application, and end-use sector. Understanding these segmentations is critical for market participants to tailor their service offerings and investment strategies. The core segmentation by pollutant type reflects the primary substances targeted during testing, ranging from biological agents like mold and allergens to specific chemical contaminants such as formaldehyde and radon. Segmentation by sampling method differentiates between quick, passive testing and more comprehensive, real-time active monitoring, each catering to different levels of diagnostic need and urgency. The end-use segmentation dictates the volume and frequency of testing required, with regulatory compliance often driving demand in public and industrial sectors, while health assurance drives demand in the residential and commercial segments.

Within the pollutant segmentation, chemical contaminants (including VOCs and combustion byproducts) traditionally held the largest market share due to their prevalence in modern building materials and cleaning agents. However, biological contaminants, particularly mold and airborne viruses, have witnessed the most dramatic growth in recent years, propelled by pandemic responses and greater understanding of moisture intrusion issues in aging infrastructure. The technology shift towards active sampling and continuous monitoring represents a major market evolution. Continuous monitoring services, while requiring higher initial setup, provide unparalleled granular data, enabling predictive analysis and superior long-term risk management, which is highly valued by sophisticated commercial clients managing critical assets.

Application-wise, the consulting and analytical services sub-segment remains the highest value component, as clients seek expert interpretation of complex data and strategic recommendations for remediation. The industrial sector requires specialized testing focused on workplace exposure and process-specific contaminants, demanding unique expertise from service providers. As the market matures, integration across segments is becoming common, where providers offer packaged deals combining specific pollutant testing (e.g., radon screening) with continuous monitoring technology installation and subsequent annual consultancy services, maximizing customer lifetime value and establishing long-term partnerships in critical infrastructure management.

- By Contaminant Type:

- Chemical Contaminants (VOCs, Formaldehyde, Ozone, Carbon Monoxide)

- Biological Contaminants (Mold, Bacteria, Viruses, Allergens)

- Physical Contaminants (Particulate Matter, Asbestos, Radon)

- By Sampling Method:

- Active Sampling

- Passive Sampling

- Continuous Monitoring

- By Application:

- Testing and Consulting Services

- System Installation and Calibration

- Remediation and Mitigation Recommendations

- By End-Use Sector:

- Commercial (Offices, Retail)

- Residential (Single-family, Multi-family)

- Industrial (Manufacturing, Processing Plants)

- Institutional (Hospitals, Schools, Government)

Value Chain Analysis For Indoor Air Quality Testing Service Market

The value chain for the Indoor Air Quality Testing Service Market initiates with upstream activities involving the manufacturing and supply of sophisticated testing hardware and laboratory chemicals. Key upstream players include specialized sensor manufacturers, instrument developers (for gas chromatography and mass spectrometry), and laboratory equipment suppliers. The quality and calibration reliability of this equipment are foundational, directly influencing the accuracy and credibility of the downstream services. Investment in R&D at this stage focuses heavily on miniaturization, enhanced sensitivity, and integration capabilities to support real-time data collection demanded by modern service models.

The midstream involves the core service providers—the testing companies themselves. These companies acquire the necessary technology, maintain accredited laboratories, and employ specialized environmental engineers and certified industrial hygienists. This is the value creation nexus, where field sampling, laboratory analysis, data interpretation, and report generation occur. Differentiation at this stage relies heavily on certifications (e.g., AIHA accreditation), turnaround time for lab results, and the quality of expert consultation provided alongside the raw data. Distribution channels for these services are primarily direct, involving contractual relationships established through sales teams targeting large facility managers or public sector procurement processes.

Downstream activities focus on the end-user application and post-testing mitigation. This includes the implementation of remediation strategies recommended by the testing service, such as HVAC upgrades, mold removal, or structural repairs. Indirect channels, although less common for full-scale testing, involve partnerships with environmental consultants, real estate management firms, and insurance companies who refer their clients to accredited IAQ testing providers. The effective closure of the value chain is achieved when the testing results translate into measurable improvements in air quality, validating the service provider’s expertise and securing future contracts for follow-up testing and long-term monitoring.

Indoor Air Quality Testing Service Market Potential Customers

The primary end-users and buyers of Indoor Air Quality Testing Services are highly diversified, ranging from large corporate real estate developers to public health institutions and individual homeowners. Corporate real estate and facility managers represent the largest segment, as they are legally obligated to maintain safe working environments and require IAQ data for compliance, litigation protection, and pursuit of high-performance building certifications like LEED or WELL. These customers typically demand continuous monitoring solutions and long-term service contracts that cover multiple properties, emphasizing operational efficiency and standardized environmental performance reporting across their portfolios.

Institutional clients, specifically hospitals, schools, and government administrative buildings, form another critical customer base. In these sensitive environments, poor air quality directly impacts vulnerable populations, making periodic, comprehensive testing mandatory. Hospitals require specialized testing for airborne pathogens and chemical sterilizing agents, while schools often focus on carbon dioxide levels, radon, and mold. Procurement for these entities is generally driven by public health policy, requiring adherence to stringent accreditation standards for service providers, prioritizing reliability and verifiable certifications over price sensitivity.

The rapidly growing potential customer group is the residential sector. While traditionally underserved, the push toward personalized wellness, coupled with concerns about specific regional issues like radon gas or localized mold problems, is increasing homeowner willingness to pay for professional services. This segment prefers quick, targeted, and user-friendly testing solutions, often accessed indirectly through home inspection services, real estate transactions, or HVAC maintenance companies acting as referral sources. Commercial insurers and legal firms also constitute important indirect customers, utilizing IAQ testing as a necessary due diligence step in settling property damage claims or environmental litigation cases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eurofins Scientific, SGS SA, Intertek Group plc, Bureau Veritas SA, TUV SUD, RHP Risk Management, Air Quality Engineering Inc., Prism Analytical Technologies, Inc., EMSL Analytical, Inc., Testo SE & Co. KGaA, 3M Company, TSI Incorporated, Honeywell International Inc., Sensirion AG, Pall Corporation, Airmid Healthgroup Ltd., Cornerstone Environmental Group, TRC Companies, Inc., Pace Analytical Services, Pure Air Control Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Indoor Air Quality Testing Service Market Key Technology Landscape

The technological landscape of the Indoor Air Quality Testing Service Market is defined by a shift from traditional, laboratory-dependent batch testing to highly integrated, real-time sensing solutions. Key technological advancements center on the miniaturization and increased accuracy of sensors for Volatile Organic Compounds (VOCs), particulate matter (PM), and specific gases (CO, CO2, O3). Metal-oxide semiconductor (MOS) sensors and electrochemical sensors have become significantly more reliable and cost-effective, enabling the widespread deployment of dense sensor networks within commercial buildings. This proliferation of low-cost yet sophisticated hardware forms the backbone of Continuous Monitoring Systems (CMS), which significantly reduce the need for periodic, labor-intensive site visits, thus streamlining service delivery and improving diagnostic consistency.

Furthermore, the integration of Internet of Things (IoT) platforms and cloud computing is critical to current market technology. These platforms facilitate seamless data transmission from remote sensors to centralized analytical engines, allowing for instant anomaly detection and trend analysis. The advancement in data analytics, particularly the use of AI and machine learning, enables service providers to process high volumes of streaming data, differentiate between background noise and true pollution events, and correlate indoor readings with external meteorological and pollution data. This predictive analytical layer moves the technology offering beyond simple measurement into proactive environmental risk management, increasing the value proposition for end-users seeking operational resilience.

The laboratory analysis segment, while supplemented by in-situ monitoring, continues to rely on high-precision technologies such as Gas Chromatography-Mass Spectrometry (GC-MS) for definitive identification of complex chemical mixtures and Polymerase Chain Reaction (PCR) techniques for highly accurate biological contaminant identification (e.g., specific mold species or viruses). Service providers are increasingly investing in mobile laboratory units and rapid on-site testing kits to reduce turnaround times for critical results. This blend of cutting-edge stationary laboratory instrumentation and mobile, connected field technology is necessary to meet the dual market demands for speed and irrefutable accuracy, driving specialized skill development in both environmental engineering and IT infrastructure management within service companies.

Regional Highlights

Regional analysis reveals distinct market maturity levels and regulatory drivers across the globe, dictating the nature and volume of IAQ testing service demand.

- North America (Dominant Market Share): The region, particularly the United States and Canada, holds the largest market share due to highly developed infrastructure, stringent occupational health and safety regulations (OSHA, EPA), and widespread adoption of green building standards (LEED, WELL). High consumer and corporate awareness regarding radon exposure, asbestos, and the financial risks of sick building syndrome fuel consistent demand for comprehensive, high-value testing and consultancy services.

- Europe (Mature Regulatory Environment): European countries, led by Germany, the UK, and France, represent a mature market characterized by robust environmental directives (e.g., EU Energy Performance of Buildings Directive) that emphasize energy efficiency often coupled with mandatory IAQ provisions. The emphasis is strong on maintaining air quality in educational institutions and public buildings, driving steady growth, particularly for services focused on energy recovery ventilation assessment and VOC monitoring.

- Asia Pacific (Fastest Growth Trajectory): APAC is expected to exhibit the highest CAGR due to rapid urbanization, massive commercial and residential construction projects, and escalating public concern over outdoor air pollution permeating indoor spaces. Key growth countries like China and India are increasingly adopting international IAQ standards in metropolitan areas, especially in the corporate and hospitality sectors seeking to attract foreign investment. The challenge remains regulatory fragmentation, but investment in advanced sensor technology is rapidly accelerating.

- Latin America (Emerging Adoption): This region shows nascent but growing demand, concentrated primarily in the industrial sector (mining, manufacturing) seeking compliance with international safety protocols and in high-end commercial real estate in major capitals (São Paulo, Mexico City). Market growth is currently hampered by economic instability and less rigorous local environmental enforcement, but international accreditation requirements are driving selective service uptake.

- Middle East and Africa (MEA) (Niche Growth): Demand in the MEA region is sector-specific, primarily driven by massive infrastructure projects, luxury hospitality, and critical facilities like data centers, particularly in the GCC states (UAE, Saudi Arabia). The focus is heavily on preventing mold and HVAC degradation due to high heat and humidity, demanding specialized services focused on system validation and continuous moisture monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Indoor Air Quality Testing Service Market.- Eurofins Scientific

- SGS SA

- Intertek Group plc

- Bureau Veritas SA

- TUV SUD

- RHP Risk Management

- Air Quality Engineering Inc.

- Prism Analytical Technologies, Inc.

- EMSL Analytical, Inc.

- Testo SE & Co. KGaA

- 3M Company

- TSI Incorporated

- Honeywell International Inc.

- Sensirion AG

- Pall Corporation

- Airmid Healthgroup Ltd.

- Cornerstone Environmental Group

- TRC Companies, Inc.

- Pace Analytical Services

- Pure Air Control Services

Frequently Asked Questions

Analyze common user questions about the Indoor Air Quality Testing Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for professional IAQ testing services?

Demand is primarily driven by stringent government regulations (OSHA, EPA) mandating safe working environments, the need for compliance with green building standards (LEED, WELL), and increased public awareness regarding the long-term health risks associated with indoor pollutants like VOCs, mold, and particulate matter.

How does the adoption of continuous monitoring systems affect traditional IAQ testing methods?

Continuous Monitoring Systems (CMS) are rapidly augmenting traditional periodic testing by providing real-time data and predictive analytics. This shift enables facility managers to transition from reactive testing to proactive, risk-based maintenance, though traditional laboratory analysis remains essential for legally defensible, high-accuracy contaminant identification.

Which end-use sector contributes most significantly to the overall market revenue?

The Commercial and Institutional sectors (including corporate offices, hospitals, and educational facilities) collectively contribute the largest share of market revenue. This is due to regulatory mandates, high occupancy rates, complex HVAC systems, and the imperative to mitigate significant legal and health liabilities associated with poor air quality.

What role does AI and machine learning play in modern IAQ services?

AI is crucial for optimizing IAQ services by interpreting large datasets from sensor networks, predicting pollutant spikes based on environmental factors and building usage, automating diagnostics, and streamlining reporting, thereby enhancing the efficiency and accuracy of preventative maintenance recommendations.

What are the major challenges restraining the growth of the IAQ testing market?

Key restraints include the high initial capital investment required for specialized, high-precision analytical equipment, the varying and often non-standardized regulatory requirements across different global regions, and the difficulty in efficiently penetrating the highly fragmented residential end-user segment.

What specific types of contaminants are covered by standard IAQ testing services?

Standard comprehensive IAQ testing covers three main categories: Chemical Contaminants (Volatile Organic Compounds (VOCs), formaldehyde, carbon monoxide); Biological Contaminants (mold spores, bacteria, viruses); and Physical Contaminants (Particulate Matter like PM2.5 and PM10, asbestos, and radon gas).

Why is the Asia Pacific region projected to experience the fastest market growth rate?

The APAC region's accelerated growth is driven by rapid industrial expansion, massive new commercial and residential construction waves, increasing public awareness of high outdoor pollution externalities, and the subsequent regulatory push in key urban areas to adopt international IAQ and building standards.

What is the primary benefit for corporations utilizing professional IAQ testing?

For corporations, the primary benefit is risk mitigation and operational resilience. Professional testing helps reduce employee absenteeism, improve cognitive function and productivity, ensure legal compliance, and protect the company from potential litigation related to employee health or property damage resulting from sick building syndrome or mold infestation.

How do green building certifications influence the demand for IAQ testing?

Certifications like LEED and WELL Building Standard mandate rigorous, often continuous, IAQ monitoring and performance testing as prerequisites for certification. This regulatory push by non-governmental organizations compels developers and property owners to integrate professional IAQ services from the design phase through ongoing operations, significantly boosting market demand.

What is the difference between active sampling and passive sampling in IAQ testing?

Active sampling involves using mechanical pumps to draw a measured volume of air through a collection medium over a defined period, providing quantitative data for contaminant concentration. Passive sampling relies on the natural diffusion of contaminants onto a collection device, typically requiring laboratory analysis but offering a simpler, less expensive method for long-term monitoring averages.

How does the value chain transition from upstream technology providers to downstream remediation services?

The chain begins upstream with specialized manufacturers supplying sophisticated sensors and lab instruments. Midstream, accredited testing service providers utilize this technology for data collection and analysis. Downstream, the service culminates in consulting and remediation recommendations, where the test results guide clients (end-users) in implementing necessary HVAC adjustments or structural mitigation efforts, completing the service lifecycle.

What specific technological advancements are making IAQ services more accessible?

Technological advancements in sensor miniaturization, combined with the decreased cost and increased reliability of electrochemical and MOS sensor arrays, have made continuous, distributed monitoring economically viable. Furthermore, cloud-based data platforms and IoT connectivity facilitate remote service delivery and centralized analytics, improving accessibility and reducing the dependency on expensive, scheduled physical site visits.

In which segment is service integration, combining testing with remediation, most prevalent?

Service integration is most prevalent in the commercial and institutional segments, particularly concerning mold and water intrusion issues. Clients prefer providers who can offer a seamless process from accurate testing and diagnosis to certified remediation and post-remediation clearance testing, simplifying vendor management and ensuring accountability.

How are key players strategically navigating the competitive landscape of the IAQ testing market?

Key players are focusing on strategic acquisitions of specialized laboratories to expand geographic reach and technical capabilities, investing heavily in digital platforms for AI-driven continuous monitoring, and achieving advanced international certifications (like ISO 17025 accreditation) to secure high-value government and multinational corporate contracts, prioritizing quality and speed of service delivery.

Why is radon gas testing a unique segment within the physical contaminants category?

Radon gas testing is unique because it is a naturally occurring radioactive contaminant derived from soil, posing a significant long-term lung cancer risk. Its detection often requires specialized long-term monitoring protocols distinct from airborne particulate or chemical testing, leading to specialized service providers focusing solely on radon detection and mitigation recommendations, especially in residential and educational sectors.

What impact did recent global health crises have on the demand dynamics of IAQ testing services?

Recent health crises dramatically accelerated demand for services focusing on biological contaminants (viruses, bacteria) and validated ventilation performance. This led to a significant market shift, prioritizing testing accuracy, rapid turnaround times for pathogen identification, and a move toward proactive system validation to ensure high levels of air change rates and filtration efficiency.

What is the critical distinction between IAQ monitoring and IAQ testing?

IAQ Testing is typically a point-in-time assessment using high-accuracy instruments or laboratory analysis to characterize indoor conditions against specific standards. IAQ Monitoring involves the continuous measurement of key indicators (like CO2, temperature, humidity, PM) using sensors over extended periods, providing data on trends and real-time fluctuations, facilitating early warnings rather than comprehensive diagnosis.

Which factor acts as the strongest restraint concerning market growth in developing regions?

The strongest restraint in developing regions is the lack of rigorous and consistently enforced governmental regulatory frameworks coupled with insufficient consumer purchasing power. This often results in IAQ services being viewed as a luxury expense rather than a mandatory compliance or health necessity, limiting market penetration outside of multinational corporate facilities.

How does the commercial insurance industry interact with the IAQ testing market?

Commercial insurance companies often mandate IAQ testing, especially after property damage incidents (e.g., flooding or fire), to assess the extent of mold, smoke residue, or structural contamination. They act as indirect demand drivers, requiring certified testing reports as a prerequisite for processing claims and determining liability, ensuring market reliance on accredited testing firms.

What are VOCs and why are they a primary focus of IAQ testing?

Volatile Organic Compounds (VOCs) are numerous carbon-containing chemicals emitted as gases from solids or liquids, frequently found in paints, cleaning supplies, new furniture, and building materials. They are a primary focus because short-term exposure can cause headaches and irritation, while long-term exposure to certain VOCs, like formaldehyde or benzene, poses serious health risks, necessitating precise measurement and mitigation.

How do providers ensure the quality and accreditation of their IAQ testing results?

Providers ensure quality by adhering to internationally recognized standards, most notably ISO 17025 for laboratory competence. Accreditation by organizations such as the American Industrial Hygiene Association (AIHA) and employing certified industrial hygienists (CIH) are standard requirements to provide legally defensible and scientifically rigorous testing results that meet industry best practices.

What opportunities exist within the residential segment that service providers are targeting?

Opportunities in the residential segment include specialized testing for specific local risks (radon, heavy metal dust), simplified DIY test kits followed by professional analysis, and subscription services for continuous environmental monitoring integrated with smart home systems. This market leverages increased consumer focus on personalized health and wellness technology.

How does the shift towards energy-efficient, sealed buildings influence IAQ requirements?

Energy-efficient buildings are often tightly sealed to minimize air exchange, which, while conserving energy, can inadvertently trap and concentrate pollutants. This increased concentration necessitates more frequent and advanced professional IAQ testing and validation services to ensure mechanical ventilation systems are operating optimally and effectively mitigating pollutant buildup.

What types of consulting services are typically provided after an IAQ test?

Post-testing consulting services typically include detailed interpretation of analytical data, identification of pollutant sources, specific recommendations for mitigation (e.g., source removal, air purification, HVAC modifications), development of long-term environmental management plans, and necessary follow-up testing to verify the effectiveness of remedial actions.

Which technology is fundamental for accurate identification of complex chemical contaminants?

Gas Chromatography-Mass Spectrometry (GC-MS) is the fundamental laboratory technology used for the precise separation, identification, and quantification of complex mixtures of chemical contaminants, especially trace amounts of Volatile Organic Compounds (VOCs) that require high analytical sensitivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager