Indoor Rotary Fans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431964 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Indoor Rotary Fans Market Size

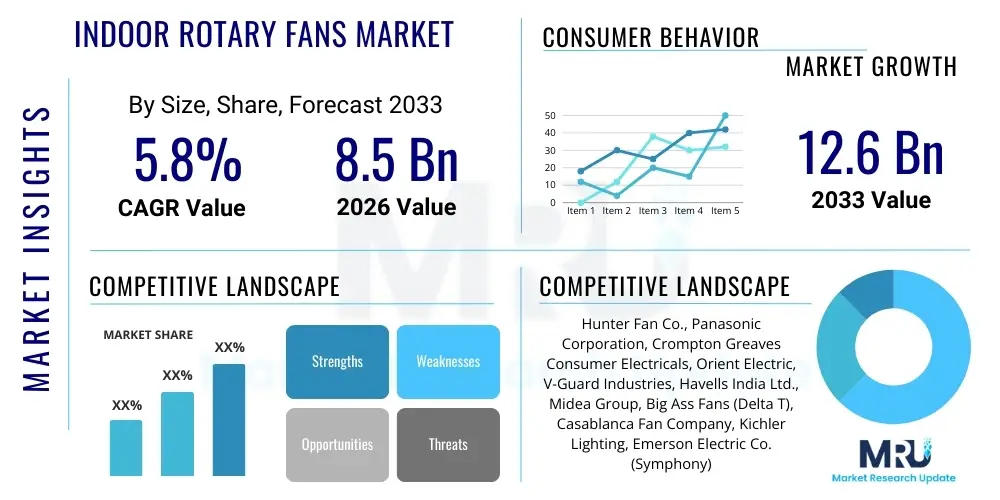

The Indoor Rotary Fans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Indoor Rotary Fans Market introduction

The Indoor Rotary Fans Market encompasses the manufacturing, distribution, and sales of various types of electric fans designed specifically for indoor air circulation, cooling, and ventilation purposes. These devices, ranging from ceiling fans and pedestal fans to table and wall-mounted units, are essential household and commercial appliances globally, driven by the fundamental human need for thermal comfort and efficient air movement within enclosed spaces. The continuous innovation in motor efficiency, blade design, and integrated smart features is redefining the product landscape, moving beyond simple cooling to include aesthetic integration and energy conservation capabilities.

Major applications of indoor rotary fans span across the residential sector, where they are integral components in bedrooms, living rooms, and kitchens, serving as energy-efficient alternatives or complements to air conditioning systems. In the commercial sphere, rotary fans are extensively utilized in offices, retail stores, hospitals, educational institutions, and hospitality venues to maintain comfortable environments and improve air quality. Their benefit lies primarily in providing personalized cooling, reducing reliance on expensive central cooling systems, and offering relatively low energy consumption, making them a sustainable choice in various climate zones.

The market is primarily driven by global urbanization trends, rising disposable incomes in emerging economies, and the increasing frequency of extreme heat events, which necessitate affordable and reliable cooling solutions. Furthermore, stringent energy efficiency standards and consumer preference for aesthetically pleasing, silent, and technologically advanced fans (such as those incorporating DC motors or IoT capabilities) are acting as key propulsion factors, ensuring sustained market growth across the forecast period. The convergence of energy efficiency mandates and smart home integration forms a powerful driver for product modernization and market expansion.

Indoor Rotary Fans Market Executive Summary

The Indoor Rotary Fans Market is characterized by robust business trends focusing heavily on energy efficiency, particularly the rapid adoption of DC (Direct Current) motor technology, which offers significant power savings compared to traditional AC motors. Manufacturers are increasingly prioritizing design innovation, integrating features such as remote operation, Wi-Fi connectivity, and ambient lighting, transforming fans from utility products into lifestyle appliances. Competitive strategies are centered on securing supply chains, particularly for raw materials like copper and advanced plastics, and expanding distribution networks, especially through e-commerce platforms, which have seen accelerated growth in market penetration and consumer reach.

Regionally, the Asia Pacific (APAC) continues to dominate the market share, fueled by high population density, rapid infrastructural development, and extreme climatic conditions in countries like India and China, driving massive demand for affordable cooling solutions. However, North America and Europe are exhibiting faster growth rates in the premium segment, where consumers prioritize smart features, aesthetic integration, and high energy efficiency ratings (such as Energy Star compliance). Regulatory frameworks mandating higher efficiency standards in developed regions are dictating product development cycles and investment in R&D, influencing global manufacturing standards.

Segment-wise, the ceiling fan category remains the largest in terms of revenue, but the pedestal fan segment is showing substantial growth due to its portability and ease of installation, catering effectively to rental housing and temporary spaces. Furthermore, the residential application segment accounts for the largest volume, while the commercial and industrial segments are driving higher average selling prices (ASPs) due to the demand for heavy-duty, large-volume air movers. The online distribution channel is rapidly gaining ground, challenging traditional brick-and-mortar sales channels by offering greater price transparency, product variety, and direct-to-consumer services, especially for smart and designer fans.

AI Impact Analysis on Indoor Rotary Fans Market

Common user questions regarding AI's influence on the Indoor Rotary Fans Market often revolve around how AI can enhance fan performance, optimize energy consumption, and integrate seamlessly into existing smart home ecosystems. Users frequently ask about the practical application of machine learning for predictive maintenance, intelligent scheduling based on occupancy detection, and automatic speed adjustments in response to localized microclimate changes (temperature, humidity). A primary concern is the cost premium associated with AI integration and whether the efficiency gains justify the investment. Based on this analysis, the key themes summarize that users expect AI to transition the rotary fan from a simple mechanical device to a sophisticated, self-regulating climate control component, offering unparalleled energy savings and personalized comfort without manual intervention.

AI is primarily influencing the market through the enablement of predictive algorithms within smart fan controllers. These algorithms utilize data collected from integrated sensors (temperature, ambient light, motion) and external data feeds (weather forecasts) to anticipate cooling needs and proactively adjust fan settings. This level of granular control maximizes energy efficiency by ensuring the fan operates only when necessary and at the optimal speed, leading to substantial long-term cost reductions for the end-user. This capability also contributes significantly to the overall stability and reliability of the connected home environment, positioning rotary fans as critical nodes in comprehensive energy management systems.

Furthermore, AI-driven diagnostics are transforming the after-sales service and maintenance landscape. By continuously monitoring motor performance, vibration levels, and electrical consumption patterns, AI systems can detect potential malfunctions before catastrophic failure occurs, triggering alerts for preventative maintenance. This reduces downtime for commercial applications and extends the lifespan of residential units, improving customer satisfaction and strengthening brand loyalty. While initial integration costs pose a challenge, the demonstrable return on investment (ROI) through energy savings and reduced maintenance is driving rapid adoption in the premium and commercial segments, setting a new benchmark for product intelligence in this mature industry.

- Enhanced Energy Optimization: AI algorithms predict thermal loads and adjust fan speed autonomously, minimizing power waste.

- Predictive Maintenance: Machine learning monitors operational metrics to forecast and prevent component failures, improving reliability.

- Seamless Smart Home Integration: AI enables fans to communicate effectively with other IoT devices (thermostats, smart vents) for synchronized climate control.

- Occupancy and Usage Pattern Learning: Fans learn user preferences and operating schedules based on real-time occupancy data.

- Voice and Gesture Control Sophistication: AI refines natural language processing for more intuitive and reliable smart control interfaces.

- Customized Comfort Profiles: Development of personalized air flow and temperature zones within a single room using decentralized fan control.

DRO & Impact Forces Of Indoor Rotary Fans Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the direction and velocity of market growth. The primary Drivers include burgeoning urbanization, which increases the density of residential and commercial structures needing efficient air circulation, and the pervasive shift towards energy-efficient appliances, fueled by rising energy costs and government subsidies for green technology. Opportunities largely arise from integrating advanced connectivity features (IoT, Wi-Fi) and developing high-performance, aesthetically integrated designer fans that appeal to the discerning urban consumer. However, the market faces significant Restraints, notably the intense price competition, particularly in the mass-market segment dominated by manufacturers in the APAC region, and the inherent substitution threat posed by increasingly affordable and ubiquitous air conditioning units, especially in extremely hot climates. These forces create a dynamic environment where technological superiority and cost competitiveness are paramount for sustained success.

Drivers: A major driver is the global climate shift, leading to hotter and longer summers, which intrinsically increases the demand for basic and supplemental cooling methods. Furthermore, government initiatives and mandatory energy labeling programs in regions like the EU (ErP Directive) and North America (Energy Star) are forcing manufacturers to innovate, accelerating the transition from standard AC motor fans to high-efficiency DC motor and PMSM (Permanent Magnet Synchronous Motor) fans. This regulatory push not only ensures better performance but also aligns the market with global sustainability goals, appealing to environmentally conscious consumers and large institutional buyers.

Restraints: The primary restraint remains the highly fragmented and competitive nature of the market, which keeps profit margins suppressed, especially for conventional models. The reliance on imported components, such as microcontrollers and rare-earth magnets (for DC motors), exposes manufacturers to supply chain volatility and geopolitical risks. Moreover, while developing countries represent high volume potential, the lower purchasing power often dictates demand towards cheaper, less efficient models, slowing the overall adoption of premium, smart technology. The perception that fans are merely supplemental cooling devices, rather than primary climate control tools, also limits investment in advanced features by some end-users.

Opportunity and Impact Forces: Significant opportunities lie in exploiting the massive residential renovation and retrofitting market, where old, inefficient fans are being replaced with modern, smart, and silent alternatives. The development of specialized fans for unique environments, such as moisture-resistant models for bathrooms or industrial-grade fans for large warehouses, opens up niche revenue streams. Impact forces, such as rapid technological convergence (integrating fans with lighting and air purification systems) and socio-economic changes (increasing remote work necessitating comfortable home office environments), further accelerate market growth and segmentation. Manufacturers who can successfully blend high energy efficiency with sophisticated design and connectivity will capture premium market share.

Segmentation Analysis

The Indoor Rotary Fans Market is systematically segmented based on product type, application, motor technology, and distribution channel, providing a multi-dimensional view of the market structure and consumer behavior. Analyzing these segments is crucial for manufacturers to tailor their product offerings and marketing strategies effectively. The segmentation highlights key differences in consumer preferences, ranging from the preference for silent DC motors in residential settings to the need for robust industrial-grade fans in manufacturing facilities. This structural division allows stakeholders to identify high-growth areas, allocate resources efficiently, and understand the competitive landscape specific to each category, thereby optimizing their market penetration strategies and product lifecycle planning.

Product Type segmentation distinguishes between fixed installations like ceiling fans and portable units such as pedestal, table, and tower fans. Ceiling fans traditionally hold the largest revenue share due to their permanent fixture status and ability to circulate large volumes of air across wide spaces, making them a staple in both commercial and residential construction. However, the portability and space-saving design of tower and pedestal fans are driving their increased adoption, especially in smaller apartments and temporary living situations. The application analysis further refines demand insights, with the residential sector being the volume driver, while commercial and industrial applications command specialized, higher-margin products requiring superior durability and power output. The complexity of these segments dictates targeted R&D efforts to meet diverse end-user requirements.

- By Type:

- Ceiling Rotary Fans (Standard, Decorative, Low Profile)

- Pedestal Rotary Fans

- Table Rotary Fans

- Wall-Mounted Rotary Fans

- Tower Fans

- Exhaust and Inline Fans (For specific ventilation tasks)

- By Motor Technology:

- AC Motor Fans

- DC Motor Fans (High Efficiency and Silent Operation)

- PMSM (Permanent Magnet Synchronous Motor) Fans

- By Application:

- Residential (Houses, Apartments, Condominiums)

- Commercial (Offices, Retail, Hospitality, Healthcare)

- Industrial (Warehouses, Factories, Workshops)

- By Distribution Channel:

- Offline (Retail Stores, Wholesalers, HVAC Distributors)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Indoor Rotary Fans Market

The value chain for the Indoor Rotary Fans Market begins with the upstream activities centered on the procurement and processing of key raw materials, primarily steel, aluminum, copper (critical for motor windings), plastics, and advanced electronic components like microcontrollers and sensors. Efficiency at this stage is crucial, as the fluctuating prices of base metals directly impact manufacturing costs and final pricing stability. Key stakeholders in the upstream segment include metal refineries, specialized component manufacturers (motor assemblies, bearings), and electronics suppliers. Strategic sourcing and establishing long-term contracts with reliable component providers are essential to mitigate supply chain risks and maintain production consistency, particularly for high-volume manufacturers operating under tight margins.

The midstream phase involves the core activities of manufacturing, assembly, and quality assurance. This stage is highly competitive and characterized by varying levels of automation, depending on the scale and technological sophistication of the manufacturer. Leading players invest heavily in automated assembly lines and lean manufacturing processes to maximize efficiency and maintain stringent quality controls, especially for DC and smart fans. Distribution channels form the crucial link between production and the downstream market, encompassing wholesalers, large retail chains (e.g., home improvement stores), specialized HVAC distributors (for commercial fans), and increasingly, e-commerce platforms. The choice of channel significantly affects market reach, inventory management, and promotional expenditure, with a growing emphasis on digital storefronts for direct consumer engagement.

The downstream analysis focuses on the end-users—residential, commercial, and industrial buyers—and the after-sales support ecosystem, including installation services, maintenance, and warranties. Direct sales through manufacturer-owned websites allow for greater control over brand messaging and customer data, fostering direct relationships, while indirect channels leverage the established logistics and retail footprint of third-party partners. Effective post-sales service, including remote diagnostics for smart fans, is becoming a significant differentiator, influencing brand reputation and repurchase decisions. Optimizing the entire value chain, from raw material sourcing efficiency to responsive customer support, is vital for achieving competitive advantage in this mature and cost-sensitive market.

Indoor Rotary Fans Market Potential Customers

Potential customers for the Indoor Rotary Fans Market are broadly categorized into three distinct groups: residential consumers, commercial enterprises, and industrial facilities, each possessing unique purchasing criteria and product requirements. Residential buyers, representing the largest volume segment, prioritize energy efficiency, aesthetic appeal, quiet operation, and smart features that integrate seamlessly with their home automation systems. They are highly sensitive to price but show willingness to pay a premium for designer fans or models certified for high energy savings. Key purchasing periods for this segment align with new construction cycles, home renovations, and seasonal demand spikes coinciding with summer months. Targeted marketing emphasizing lifestyle integration and utility bill reduction is most effective for this massive end-user base.

Commercial customers, including office buildings, hotels, restaurants, and retail spaces, require fans that offer robust performance, high reliability, and effective air circulation across expansive areas, often prioritizing concealed or architecturally integrated solutions. Their procurement decisions are heavily influenced by building codes, energy efficiency standards (to lower operating costs), and maintenance simplicity. They typically purchase through specialized HVAC distributors or contractors, focusing on bulk orders and detailed technical specifications rather than aesthetic variability. The shift towards sustainability in commercial building design further necessitates the adoption of highly efficient, often DC-powered, large-diameter fans to complement central air systems, ensuring optimal air mixing and reduced stratification.

Industrial facilities, such as manufacturing plants, warehouses, and agricultural operations, constitute a specialized customer segment requiring heavy-duty fans (like High Volume Low Speed or HVLS fans) designed for extreme durability, noise tolerance, and the movement of massive air volumes to ensure worker comfort and process stability. Their purchasing decisions are primarily based on operational requirements, safety certifications, and total cost of ownership (TCO), focusing on reliability over aesthetics. Industrial customers often engage directly with specialized fan manufacturers or engineering procurement construction (EPC) firms, demanding customized solutions to meet stringent regulatory and environmental controls specific to their operational environment. Servicing this segment requires expertise in industrial ventilation dynamics and robust after-sales support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Fan Co., Panasonic Corporation, Crompton Greaves Consumer Electricals, Orient Electric, V-Guard Industries, Havells India Ltd., Midea Group, Big Ass Fans (Delta T), Casablanca Fan Company, Kichler Lighting, Emerson Electric Co. (Symphony), Godrej Appliances, Rheem Manufacturing Company, Monte Carlo Fan Company, Zephyr Ventilation, Lasko Products, Kenroy Home, Modern Fan Co., Fanimation, Broan-NuTone. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Indoor Rotary Fans Market Key Technology Landscape

The Indoor Rotary Fans Market is undergoing a rapid technological transformation, moving far beyond traditional induction motors towards highly efficient and intelligent systems. The most critical technological shift is the widespread adoption of DC (Direct Current) and PMSM (Permanent Magnet Synchronous Motor) technologies. These motors offer superior energy efficiency, consuming up to 70% less power than comparable AC induction motors, which is a major selling point in regions with high electricity costs or strict energy efficiency mandates. Furthermore, DC motors facilitate precise speed control, enabling a wider range of settings, and significantly reduce operational noise, meeting the increasing consumer demand for silent appliances in residential settings. This motor evolution is foundational to the market’s premium segment growth.

The second major technological theme is the integration of connectivity and smart features, driven by advancements in miniaturized microcontrollers and affordable Wi-Fi/Bluetooth modules. Contemporary indoor fans are increasingly equipped with IoT capabilities, allowing for remote operation, scheduling, and integration with voice assistants (like Alexa or Google Home). Advanced features now include environmental sensors that measure temperature, humidity, and even air quality, enabling the fan to adjust its speed and direction autonomously based on real-time environmental data. This level of smart functionality significantly enhances the user experience, transforming a basic fan into an integrated component of a sophisticated home climate control system, positioning manufacturers as technology providers rather than just appliance makers.

Aesthetic and aerodynamic innovations also form a key part of the technology landscape. Manufacturers are utilizing computational fluid dynamics (CFD) simulations to optimize blade profiles, leading to increased air delivery efficiency (CFM per Watt) and reduced drag noise. Materials science plays a role in reducing weight and vibration through the use of high-strength, lightweight polymers and composite materials. For the commercial sector, technologies like HVLS (High Volume Low Speed) fan systems are utilizing complex gearboxes and large airfoil blades to circulate massive volumes of air quietly and efficiently, addressing the unique ventilation challenges of large industrial and commercial spaces. Overall, the technology trajectory emphasizes efficiency, silence, connectivity, and superior aerodynamic performance to differentiate products in a crowded marketplace.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Indoor Rotary Fans Market, driven by its massive population base, rapid urbanization, and persistent hot and humid climate conditions, particularly across South Asia and Southeast Asia. Countries like India, China, and Indonesia exhibit enormous volume demand for both basic, affordable ceiling fans and energy-efficient premium models. The market here is highly price-sensitive but is seeing accelerating adoption of DC motor fans due to rising awareness of long-term energy savings. The high volume of residential and commercial construction activity acts as a consistent engine for market expansion. Local manufacturing hubs enjoy lower production costs, creating a dominant global supply position, though this also leads to intense domestic competitive pressure. Governments in the region are gradually introducing stricter energy rating systems, forcing compliance and driving technological upgrades among local and international players. The sheer scale of consumer demand and the relatively lower penetration of centralized air conditioning systems in middle-income households ensure APAC's dominance in terms of market volume and revenue growth over the forecast period.

- North America: North America represents a mature, high-value market characterized by strong consumer preference for smart features, high design aesthetics, and guaranteed energy efficiency (Energy Star certification is a major purchasing determinant). The market exhibits a clear segmentation between premium designer fans (often integrated with advanced lighting) and basic utility fans. The demand is heavily influenced by the robust smart home ecosystem, with consumers seeking seamless integration with popular control platforms. Replacement cycles are often driven by home renovation projects and technology upgrades rather than purely seasonal needs. The market is also a leading adopter of specialized HVLS fans for commercial and industrial applications, reflecting the stringent climate control and energy efficiency mandates in large facilities. E-commerce plays an oversized role in distribution, especially for specialized and niche brands, emphasizing direct-to-consumer relationships and digital marketing strategies.

- Europe: The European market, particularly Western Europe, is strongly guided by environmental concerns and the European Union’s energy-related products (ErP) Directive, which mandates high energy efficiency standards. Consumers prioritize sustainability, quiet operation, and sleek, minimalist design that integrates discreetly into contemporary architecture. Ceiling fans are growing in popularity as highly efficient, supplemental cooling solutions compared to energy-intensive air conditioning. The relatively mild climate across much of the region means that demand is more concentrated on improving air circulation and ventilation, rather than intense cooling. Germany, France, and the UK are key markets exhibiting strong growth in the premium DC motor fan segment. The commercial sector is also focused on adopting advanced ventilation systems to meet stringent indoor air quality (IAQ) regulations, boosting demand for sophisticated industrial and commercial-grade rotary systems.

- Latin America (LATAM): The LATAM market is experiencing steady growth, fueled by rising temperatures, expanding middle classes, and increased electrification rates. Brazil and Mexico are the primary markets, showcasing strong demand for both conventional and medium-efficiency ceiling and pedestal fans. Price remains a critical factor for the vast majority of consumers, making affordability a competitive necessity. The adoption of smart features is lagging compared to North America and Europe but is accelerating in major urban centers. Infrastructural investment, particularly in residential construction and light commercial spaces, is the main market driver. Manufacturers often need to adapt products to handle varying power grids and regional climate extremes, focusing on durability and reliable performance under fluctuating conditions, while navigating complex import/export tariffs and local assembly requirements.

- Middle East and Africa (MEA): The MEA region presents a market of contrasts. The Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) possess high disposable incomes and extreme heat, leading to demand for high-performance, aesthetically luxurious fans, often complementing powerful centralized AC systems. Here, smart features, high-end finishing, and brand prestige are important. In contrast, many African nations focus heavily on basic, durable, and highly affordable fans to meet essential cooling needs. The infrastructural gap and reliance on off-grid or unreliable power sources in some areas drive niche demand for solar-powered or highly efficient low-voltage DC fans. Market growth is closely tied to infrastructure development, government housing projects, and the expansion of the commercial sector (malls, hotels) across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Indoor Rotary Fans Market.- Hunter Fan Co.

- Panasonic Corporation

- Crompton Greaves Consumer Electricals

- Orient Electric

- V-Guard Industries

- Havells India Ltd.

- Midea Group

- Big Ass Fans (Delta T)

- Casablanca Fan Company

- Kichler Lighting

- Emerson Electric Co. (Symphony)

- Godrej Appliances

- Rheem Manufacturing Company

- Monte Carlo Fan Company

- Zephyr Ventilation

- Lasko Products

- Kenroy Home

- Modern Fan Co.

- Fanimation

- Broan-NuTone

Frequently Asked Questions

Analyze common user questions about the Indoor Rotary Fans market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Indoor Rotary Fans Market?

The primary factor driving market growth is the global imperative for energy efficiency and the rising adoption of high-performance DC motor fans. These fans significantly reduce energy consumption compared to traditional AC models, aligning with stringent regulatory standards and consumer demands for lower utility costs, especially amid increasing global temperatures.

How do smart fans enhance home climate control and justify their higher cost?

Smart fans enhance climate control by integrating AI and IoT capabilities, allowing for autonomous speed adjustments based on occupancy and real-time temperature/humidity data. This intelligent operation maximizes energy efficiency and personalized comfort, justifying the higher initial cost through substantial long-term savings and seamless integration into the smart home ecosystem.

Which geographical region dominates the Indoor Rotary Fans Market and why?

The Asia Pacific (APAC) region dominates the market in terms of volume and revenue. This dominance is attributed to high population density, rapid residential construction, and intense climatic conditions in major economies like India and China, necessitating widespread, affordable cooling solutions.

What are the main technical differences between AC motor and DC motor fans?

AC motor fans use standard alternating current, are generally less efficient, and offer fewer speed settings. DC motor fans use direct current via an adaptor, are significantly more energy efficient (up to 70% better), operate nearly silently, and provide a wider range of precise speed controls, making them the standard for premium products.

What is the role of the online distribution channel in the market dynamics?

The online distribution channel is rapidly expanding its role by offering greater product variety, competitive pricing, and direct access to niche or technologically advanced fan models (like IoT-enabled fans). It facilitates direct-to-consumer sales, allowing manufacturers to bypass traditional retail margins and quickly launch new smart products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager