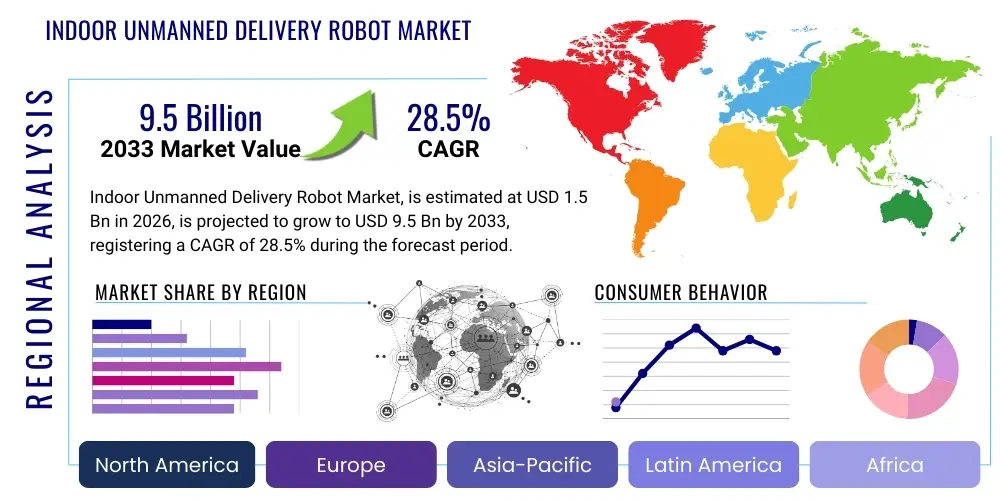

Indoor Unmanned Delivery Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438724 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Indoor Unmanned Delivery Robot Market Size

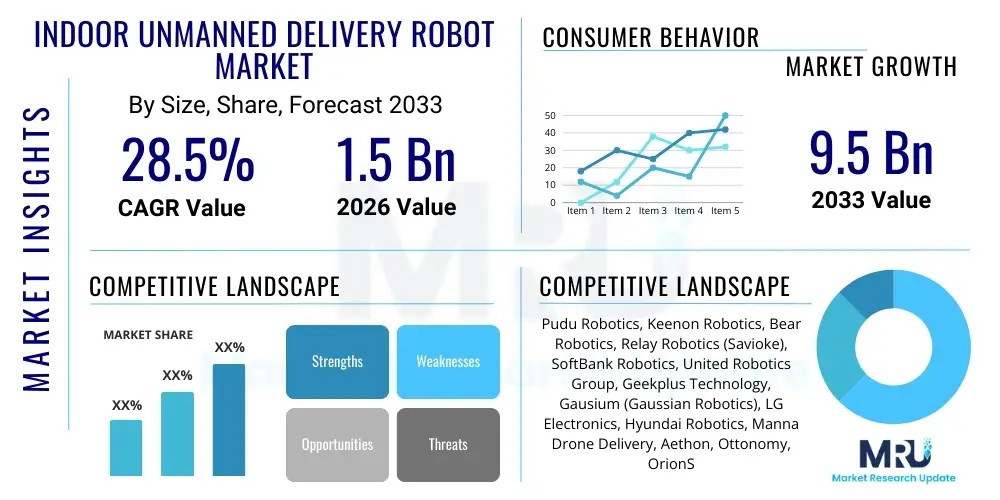

The Indoor Unmanned Delivery Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at $1.5 Billion in 2026 and is projected to reach $9.5 Billion by the end of the forecast period in 2033.

Indoor Unmanned Delivery Robot Market introduction

The Indoor Unmanned Delivery Robot market encompasses autonomous mobile robots (AMRs) designed specifically for transporting goods, documents, meals, and medical supplies within confined interior environments such as hospitals, hotels, restaurants, corporate campuses, and large retail stores. These sophisticated machines leverage advanced sensor technology, simultaneous localization and mapping (SLAM), and sophisticated navigation algorithms to operate autonomously, avoiding obstacles and dynamically optimizing routes without requiring constant human intervention. The primary goal of deploying these robots is to enhance operational efficiency, reduce labor costs associated with repetitive delivery tasks, and provide a reliable, predictable service standard, particularly in environments demanding high throughput or stringent hygiene protocols.

The core product offering in this market includes service robots equipped with secure compartments or trays for carrying items. They typically feature capabilities such as automated elevator integration, secure access protocols (PIN or biometric), and two-way communication systems for status updates. Major applications span vertical industries, including healthcare, where robots deliver medications and laboratory samples; hospitality, where they handle room service and linen transport; and logistics/retail, managing inventory movement between backrooms and distribution points. The ongoing global shift towards automation, accelerated by demographic changes and the need for contactless service, is fundamentally driving the integration of these robots into modern commercial infrastructure, positioning them as essential assets for future-proof operations.

Key benefits derived from adopting indoor unmanned delivery robots include substantial improvements in delivery speed and accuracy, 24/7 operational capability, and freeing up human staff to focus on high-value customer-facing or clinical tasks. Furthermore, the inherent safety features, such as advanced collision avoidance and adherence to established internal pathways, ensure seamless integration into busy human environments. Driving factors include significant advancements in AI and sensor fusion technologies, reductions in hardware costs, and growing consumer acceptance of robot interactions in public spaces. The critical need for operational resilience, highlighted by recent global events, has cemented the role of automation in maintaining service continuity, thereby accelerating market penetration across all targeted end-user segments.

Indoor Unmanned Delivery Robot Market Executive Summary

The Indoor Unmanned Delivery Robot market is characterized by rapid technological innovation and aggressive adoption across service-oriented industries globally. Current business trends indicate a strong move toward Robotics-as-a-Service (RaaS) models, which significantly lowers the capital expenditure barrier for potential adopters, making sophisticated automation accessible to small and medium-sized enterprises (SMEs). Strategic partnerships between robot manufacturers and established elevator companies or building management systems (BMS) providers are becoming essential, ensuring seamless navigation across multi-story buildings. Furthermore, competition is intensifying based not only on hardware capability (payload, speed, battery life) but increasingly on software intelligence, particularly the ability of fleet management systems to coordinate large numbers of robots efficiently and integrate deeply with existing enterprise resource planning (ERP) or warehouse management systems (WMS).

Regionally, Asia Pacific (APAC) currently dominates the market, driven by high population density, rapid digitalization, and proactive government support for smart city and automation initiatives, particularly in countries like China, South Korea, and Japan, where labor scarcity is a major concern. North America and Europe, while having higher initial labor costs driving the need for automation, are focusing heavily on safety standards and regulatory frameworks, ensuring responsible deployment. These regions are witnessing high investment in hospital and corporate campus automation. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, primarily focusing on luxury hospitality and large infrastructure projects (e.g., smart airports and mega-malls), creating immediate, high-value opportunities for initial deployment, albeit with slower overall penetration rates compared to mature markets.

Segment trends reveal that the hospitality and healthcare sectors are the largest consumers of indoor delivery robots. In healthcare, the focus is on sterile transport and timely delivery of sensitive materials, where reliability is paramount. In hospitality, robots enhance the guest experience by providing novel, rapid room service delivery while optimizing staff resources during peak hours. Technology segmentation highlights the dominance of Li-ion batteries due to energy density and longevity, crucial for 24/7 operation. Furthermore, there is a distinct trend towards specialized robots customized for specific tasks (e.g., high-payload logistics robots vs. aesthetically pleasing food delivery robots), indicating market maturity and the dissolution of one-size-fits-all solutions. The software segment, including fleet management and cloud services, is growing fastest, indicating the shifting value proposition from hardware to intelligent operational platforms.

AI Impact Analysis on Indoor Unmanned Delivery Robot Market

User inquiries concerning AI's role in the Indoor Unmanned Delivery Robot market frequently revolve around autonomy level, safety standards, and return on investment (ROI). Common questions ask: "How does AI guarantee safety when navigating crowded spaces?" "Can AI-driven robots handle unforeseen obstacles or dynamic human behavior without halting operations?" and "What is the role of machine learning in optimizing delivery routes and minimizing energy consumption over time?" Users are keenly interested in the progression from simple path-following robots to genuinely intelligent AMRs capable of predictive maintenance, complex decision-making, and self-optimization. The underlying concern is whether the complexity added by advanced AI translates into reliable, scalable, and economically viable solutions, especially in environments characterized by constant change and non-standardized infrastructure.

The integration of advanced Artificial Intelligence (AI), specifically deep learning and computer vision, is fundamentally transforming indoor delivery robots from simple automated carriers into highly efficient, adaptive members of the internal logistics ecosystem. AI provides the necessary intelligence layer for advanced spatial perception, allowing robots to distinguish between static obstacles and dynamic entities (such as people, carts, or cleaning equipment), leading to smoother, faster, and safer navigation. This capability is critical in high-traffic areas like hospital corridors or hotel lobbies, where unpredictable movement is the norm. Predictive algorithms, utilizing historical data captured by the robot fleet, allow for dynamic route recalculation in real-time based on predicted congestion points or elevator waiting times, significantly boosting overall service efficiency and operational throughput.

Furthermore, AI significantly enhances the robot’s ability to interact naturally and safely with human co-workers and customers. Natural Language Processing (NLP) is enabling clearer communication interfaces, while reinforcement learning is helping robots 'learn' the nuances of their specific operating environment, improving efficiency iteratively over weeks and months. This continuous learning cycle is crucial for maintaining a competitive edge. AI also powers enhanced security features, such as facial recognition for secure package retrieval and anomaly detection, immediately flagging unusual operating conditions or potential security breaches. This depth of integration ensures that the robots are not merely tools but smart, self-improving assets contributing to the resilience and intelligence of the entire facility management structure.

- Enhanced Sensor Fusion and SLAM: AI enables precise fusion of data from LiDAR, cameras, and ultrasound sensors for centimeter-level localization accuracy, crucial for operating in complex, indoor settings.

- Dynamic Path Planning: Machine learning models optimize routes in real-time, considering variable factors like elevator availability, human traffic, and time-of-day constraints, ensuring the fastest delivery paths.

- Predictive Maintenance: AI algorithms analyze motor performance, battery usage patterns, and error logs to forecast hardware failures, minimizing downtime and maintenance costs.

- Human-Robot Interaction (HRI) Improvement: Computer vision allows robots to predict human movement and intent, leading to smoother, safer, and less intrusive navigation in shared spaces.

- Autonomous Decision Making: Robots use reinforcement learning to handle unexpected scenarios (e.g., a blocked hallway) by choosing the optimal deviation strategy autonomously, reducing the need for remote human override.

DRO & Impact Forces Of Indoor Unmanned Delivery Robot Market

The Indoor Unmanned Delivery Robot Market is propelled by a potent combination of operational needs and technological advancements, yet it faces significant structural restraints. The key driver is the acute and increasing labor shortage across service sectors globally, coupled with escalating minimum wage requirements, making automation a compelling economic imperative. Opportunities reside in developing highly specialized applications, particularly in niche markets such as laboratory automation or high-security document transport, which require certified, customized solutions. The primary impact force accelerating adoption is the demonstrable ROI achieved through increased operational hours, reduction in human error, and the ability to maintain service standards regardless of staffing levels. Conversely, the high initial capital expenditure for hardware and integration, along with resistance from labor unions concerning job displacement, act as powerful restraints, necessitating flexible financing models like RaaS to mitigate initial investment risk.

The market drivers are multifaceted, encompassing not only cost savings but also demands for improved quality of service. In healthcare, the requirement for instantaneous and reliable delivery of time-critical assets (e.g., blood products, emergency medications) is non-negotiable, and robots offer superior consistency compared to human couriers burdened by multiple responsibilities. The societal shift towards preference for contactless services, accelerated by global health concerns, has further validated the use of unmanned delivery systems in hospitality and retail environments. Moreover, miniaturization and increased computational power of on-board processors allow robots to become smaller, lighter, and more maneuverable, overcoming previous spatial constraints in older buildings or densely packed interiors, thereby broadening the addressable market dramatically.

Restraints are generally concentrated around infrastructure compatibility and regulatory complexities. Integrating robots with disparate building systems—especially elevators, automated doors, and Wi-Fi networks—often requires significant upfront investment and custom engineering, proving a major hurdle for older facilities. Furthermore, cybersecurity concerns are rising, as delivery robots often handle sensitive data (e.g., patient records, inventory manifests) and must be rigorously protected against network intrusions. Opportunities are being seized through advancements in energy technology, specifically fast-charging and wireless charging solutions, which are eliminating the need for lengthy docking periods, maximizing operational uptime. The overall impact force is a systemic transformation of internal logistics, establishing autonomous delivery as the new standard for efficiency and resource allocation within high-value facilities.

Segmentation Analysis

The Indoor Unmanned Delivery Robot market segmentation provides a granular view of market dynamics, categorized primarily by application, component, payload capacity, and battery type. This detailed analysis is crucial for stakeholders to tailor product development and market entry strategies based on specific end-user needs and technological preferences. The components segment is critical, distinguishing between the high growth in software (fleet management, navigation algorithms) versus the stabilizing growth in hardware (chassis, sensors, actuators). Application segmentation clearly identifies the most mature adoption areas, with Hospitality and Healthcare maintaining significant market share due to critical operational needs, while logistics and retail are poised for exponential growth as e-commerce fulfillment centers increasingly automate their last internal mile processes.

Payload capacity segmentation separates smaller, agile robots (typically under 10 kg, used for documents, food, or small retail items) from heavy-duty industrial robots (above 50 kg, used in logistics and manufacturing for bulk transport). This distinction influences pricing, material use, and the complexity of safety features required. Furthermore, the segmentation by battery type is vital for understanding operational longevity, with Lithium-ion (Li-ion) batteries dominating due to their energy density and charging efficiency, supporting the 24/7 service requirement demanded by major end-users. Customization within these segments, such as robots designed specifically to withstand strict sterilization protocols in clinical settings or those featuring specialized food temperature controls in catering, signifies the increasing maturity and specialization of the market offering.

Ultimately, segmentation reveals a market shifting from generalized automation tools to highly specialized, purpose-built solutions designed to solve unique internal logistics challenges. The growth in the RaaS model is intrinsically linked to these segments, as it provides customers the flexibility to deploy highly specialized robots without committing to large upfront investments in technology that might rapidly become outdated. Understanding these segments allows providers to focus their technological development on areas promising the highest ROI and largest unmet need, such as advanced human-robot collaboration features or certified integration capabilities for specialized industrial software ecosystems. The clear delineation of market needs facilitates more targeted and effective competitive positioning among key players globally.

- By Component:

- Hardware (Chassis, Motors, Actuators, Sensors, Cameras, LiDAR)

- Software (Navigation Systems, Fleet Management, AI/ML Algorithms, Cloud Services, Security)

- Services (Maintenance, Integration, Support, Robotics-as-a-Service (RaaS))

- By Application/End-Use:

- Healthcare (Hospitals, Clinics, Senior Living Facilities)

- Hospitality (Hotels, Resorts, Restaurants, Theme Parks)

- Retail and E-commerce Fulfillment

- Corporate Campuses and Office Buildings

- Logistics and Warehouse Operations (Internal Transport)

- Residential and Apartment Buildings

- By Payload Capacity:

- Low Payload (Up to 10 kg)

- Medium Payload (10 kg – 50 kg)

- High Payload (Above 50 kg)

- By Navigation Technology:

- SLAM (Simultaneous Localization and Mapping)

- Vision-based Navigation

- Magnetic Tape/Beacon Guidance (Legacy Systems)

- By Battery Type:

- Lithium-ion (Li-ion)

- Lead-Acid (Used in older or high-payload systems)

Value Chain Analysis For Indoor Unmanned Delivery Robot Market

The value chain for the Indoor Unmanned Delivery Robot market begins with Upstream Analysis, which focuses on the sourcing and manufacturing of critical components. This stage involves sophisticated suppliers of specialized hardware, including high-precision LiDAR sensors, advanced computer vision cameras, high-torque brushless DC motors, and embedded systems crucial for real-time processing and decision-making. Key raw material suppliers, particularly those providing specialized plastics, lightweight alloys, and high-capacity battery cells (predominantly Li-ion), form the foundational input. Efficiency and cost optimization at this stage are paramount, as the high component costs traditionally contribute significantly to the overall product price. Relationships with advanced semiconductor manufacturers for customized System-on-Chip (SoC) solutions are becoming increasingly vital for competitive differentiation in processing power and energy consumption.

The midstream segment involves the robot manufacturers themselves, focusing on research and development (R&D), integration, assembly, and quality control. This is where proprietary software, including advanced navigation stacks, fleet management systems, and specialized AI algorithms, is developed and integrated with the hardware platform. The sophistication of the software distinguishes market leaders, as the focus shifts from reliable movement to intelligent operations. The Downstream Analysis covers distribution channels, installation, maintenance, and ongoing service delivery. Distribution can be Direct, involving large manufacturers selling directly to major hospital chains or hotel groups for high-volume deployments, or Indirect, utilizing specialized integrators, value-added resellers (VARs), and regional distributors who provide localized support, technical expertise, and tailored integration services necessary to connect robots with complex client infrastructure.

The transition to RaaS models has significantly altered the downstream dynamics. Instead of a single transaction, the value chain extends into long-term service contracts, which involve remote monitoring, software updates, predictive maintenance, and operational support. This shift emphasizes the importance of robust cloud platforms and service infrastructure. Direct distribution offers greater control over branding and customer data, which is invaluable for continuous product improvement via collected operational feedback. Indirect channels, however, are critical for penetrating diverse geographical markets and smaller enterprises that require holistic integration support beyond the core robot functionality. Ultimately, value creation is moving from the production of physical hardware (Upstream) to the provision of intelligent, reliable, and integrated service solutions (Downstream).

Indoor Unmanned Delivery Robot Market Potential Customers

The primary End-Users or Buyers of Indoor Unmanned Delivery Robots are large-scale institutions and corporations that operate in environments requiring continuous, high-volume internal logistics movements or specialized sterile transport. These customers are primarily concentrated in the healthcare, hospitality, corporate, and logistics sectors, where labor costs are high and efficiency gains are critical to maintaining profitability and service quality. Hospitals represent a core customer base, utilizing robots to manage the timely delivery of meals, linens, pharmaceuticals, and potentially infectious lab samples, thereby minimizing cross-contamination risk and freeing up clinical staff. The buying decision in healthcare is often driven by regulatory compliance, hygiene standards, and demonstrated reliability metrics rather than solely by initial cost.

The hospitality sector, including large hotels and resorts, represents another significant segment, seeking robots to enhance the guest experience through novelty and speed in delivering room service, luggage, and amenities, often operating 24 hours a day to cover shifts where human staffing may be sparse. Corporate campuses and large office buildings, particularly those belonging to technology and financial services companies, deploy these robots for mail delivery, inter-office supply transport, and internal catering, optimizing the operational efficiency of large real estate footprints. These customers prioritize seamless integration with smart building technology and aesthetically pleasing design, as the robots often interact directly with high-value employees and visitors, requiring a sophisticated and non-disruptive presence.

Finally, the rapidly expanding e-commerce and retail logistics sector forms a high-growth customer segment. While outdoor logistics utilize different robot types, indoor delivery robots are essential for the "dark stores" or micro-fulfillment centers located within or near urban cores, managing high-throughput internal staging, inventory movement from storage to picking stations, and preparing items for final external pickup. For these users, the purchasing decision is fundamentally driven by scalable throughput capacity, integration speed with existing Warehouse Management Systems (WMS), and the ability to operate safely in highly dynamic and automated environments. The move towards RaaS models has made these robots accessible to smaller, independent retailers looking to compete with large e-commerce giants by automating their inventory handling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion |

| Market Forecast in 2033 | $9.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pudu Robotics, Keenon Robotics, Bear Robotics, Relay Robotics (Savioke), SoftBank Robotics, United Robotics Group, Geekplus Technology, Gausium (Gaussian Robotics), LG Electronics, Hyundai Robotics, Manna Drone Delivery, Aethon, Ottonomy, OrionStar, JD.com, Neolix, ZhenRobotics, Shanghai Mukang Robotics Technology, Standard Bots, Robotize. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Indoor Unmanned Delivery Robot Market Key Technology Landscape

The technological landscape of the Indoor Unmanned Delivery Robot market is defined by convergence across several advanced fields, primarily focusing on creating highly reliable, adaptable, and safe autonomous navigation systems. Simultaneous Localization and Mapping (SLAM) technology remains fundamental, enabling robots to build a map of their unknown environment while simultaneously tracking their precise location within it. Modern implementations of SLAM often utilize multi-sensor fusion, combining data from LiDAR (for precise distance and 3D mapping), depth cameras (for semantic understanding of the environment and object identification), and inertial measurement units (IMUs) to maintain localization accuracy even when primary sensors are briefly obstructed. This redundancy is critical for robust operation in dynamic, real-world indoor settings where light conditions and physical layouts change frequently.

A second major technological area is the development of sophisticated Artificial Intelligence (AI) and Machine Learning (ML) algorithms, which elevate the robot’s functional intelligence far beyond basic navigation. AI algorithms are crucial for complex path planning, allowing robots to anticipate human movement, avoid potential conflicts before they arise, and negotiate complex scenarios like crowded corridors or elevator queues seamlessly. Furthermore, AI powers the fleet management system (FMS), which acts as the operational brain, coordinating hundreds of robots, managing charging schedules, optimizing delivery prioritization based on real-time demands, and integrating the robot fleet into the client's existing IT infrastructure (e.g., ordering systems, staff paging). The evolution toward highly efficient, centralized FMS platforms is a key technological differentiator.

Finally, robust human-robot interaction (HRI) technologies and enhanced safety features are pivotal for market acceptance. This includes intuitive graphical user interfaces (GUIs), natural language processing (NLP) for voice commands and status updates, and advanced collision avoidance systems utilizing redundant sensing modalities. The shift to wireless charging pads eliminates manual docking and maximizes uptime, contributing significantly to operational efficiency. Connectivity relies heavily on robust Wi-Fi 6 or potentially 5G indoor networks to ensure consistent, low-latency communication between the robot, the cloud-based FMS, and building infrastructure (elevators, doors). Continuous innovation in battery technology is also crucial, striving for higher energy density and faster charge cycles to minimize non-productive time.

Regional Highlights

The global deployment of Indoor Unmanned Delivery Robots exhibits significant regional variation, driven by differing labor economics, regulatory landscapes, and rates of technological adoption across core industry sectors. Asia Pacific (APAC) stands out as the primary market engine, benefiting from early and aggressive deployment in hospitality, elderly care, and manufacturing logistics, particularly in South Korea, Japan, and mainland China. These countries face acute demographic pressures and have strong governmental backing for automation technologies, leading to rapid scaling and high volumes of localized manufacturing. The willingness of the consumer base to interact with robots in public settings further accelerates adoption, making APAC the hub for large-scale, low-cost deployment and technological refinement.

North America represents a market characterized by high-value, specialized deployments, particularly in large hospital systems and expansive corporate and university campuses. The high cost of specialized labor and a focus on premium service delivery drive adoption. However, regulatory standards concerning robot safety, data privacy, and integration complexity with legacy building infrastructure present specific challenges. The market here demands highly sophisticated, certified solutions, focusing on robust integration with existing software systems (e.g., Electronic Health Records or inventory platforms). The business model is rapidly shifting towards RaaS to make the high-cost technology feasible for major institutional buyers, ensuring continued, steady growth focused on guaranteed ROI.

Europe mirrors North America in its focus on quality and safety, driven by stringent European Union (EU) machinery directives and data protection laws (GDPR). Key growth is seen in Northern and Western European countries, focusing on luxury hospitality and high-tech manufacturing internal logistics. While adoption might be slower than in APAC due to detailed regulatory scrutiny and stronger labor protections, the demand for efficiency in specialized environments is strong. Emerging markets, including Latin America and the Middle East, are experiencing nascent growth focused primarily on high-profile infrastructure projects like smart cities, new mega-hospitals, and luxury hotels. These regions often jump directly to the latest technologies, bypassing older automation stages, presenting niche opportunities for providers specializing in rapid, large-scale greenfield deployment projects.

- Asia Pacific (APAC): Market leader driven by government investment, strong manufacturing base, and severe labor shortages (China, Japan, South Korea). Highest volume deployment in hospitality and elderly care.

- North America (NA): High-value market focused on hospitals, corporate campuses, and universities. Driven by high labor costs and demand for specialized, secure logistics solutions. Strong RaaS uptake.

- Europe: Focused on regulatory compliance (GDPR, safety standards) and quality deployment in manufacturing and premium service sectors. Germany, UK, and Nordic countries are key adopters.

- Middle East & Africa (MEA): Emerging market concentrated in greenfield luxury infrastructure, including mega-malls, smart airports, and new healthcare facilities, favoring state-of-the-art technology.

- Latin America (LATAM): Nascent market primarily focused on large retail chains and high-end residential complexes in major metropolitan centers, prioritizing cost-efficiency and demonstrable ROI.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Indoor Unmanned Delivery Robot Market.- Pudu Robotics

- Keenon Robotics

- Bear Robotics

- Relay Robotics (Savioke)

- SoftBank Robotics

- United Robotics Group

- Geekplus Technology

- Gausium (Gaussian Robotics)

- LG Electronics

- Hyundai Robotics

- Aethon

- Ottonomy

- OrionStar

- JD.com (Logistics Robotics Division)

- Neolix

- ZhenRobotics

- Shanghai Mukang Robotics Technology

- Standard Bots

- Robotize

- YOGO Robotics

Frequently Asked Questions

Analyze common user questions about the Indoor Unmanned Delivery Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of indoor unmanned delivery robots in the healthcare sector?

The primary driver in healthcare is the critical need for improving operational efficiency, ensuring timely and sterile transport of sensitive materials (like medications, lab samples, and linens), and mitigating cross-contamination risks. Robots free up highly-skilled clinical staff from routine logistics tasks, allowing them to focus on patient care, which significantly enhances the facility's overall service quality and regulatory adherence.

What are the main technical hurdles to widespread robot deployment in existing multi-story buildings?

The main technical hurdle is achieving reliable and seamless integration with legacy building infrastructure, specifically automated access to and control of elevators and secure doors. This requires sophisticated integration protocols, often involving custom interfaces or partnerships with Building Management System (BMS) providers, alongside ensuring robust wireless network coverage across all floors for continuous connectivity.

How does Robotics-as-a-Service (RaaS) impact the Indoor Unmanned Delivery Robot Market?

RaaS significantly impacts the market by lowering the high initial capital expenditure (CapEx) barrier, making sophisticated robotics accessible to a broader range of enterprises, including SMEs. RaaS shifts the investment from an asset purchase to an operating expense (OpEx), typically including maintenance, software updates, and fleet management support, thereby improving the predictability and scalability of automation investments.

Which navigation technology is most critical for ensuring safety and reliability in crowded, dynamic indoor environments?

Simultaneous Localization and Mapping (SLAM) combined with multi-sensor fusion (using LiDAR, depth cameras, and AI processing) is most critical. This combination allows the robot to build precise 3D maps and accurately perceive and anticipate the movement of dynamic obstacles, such as people and carts, ensuring safe, non-disruptive, and efficient navigation in highly congested areas like hospital corridors or hotel lobbies.

What is the current growth trend for the software component compared to the hardware component in this market?

While hardware growth remains steady, the software component, encompassing fleet management systems, AI/ML navigation algorithms, and cloud-based services, is experiencing a faster growth trend. This reflects the market's maturity, where competitive advantage is increasingly derived from the intelligence, operational efficiency, and seamless integration capabilities provided by proprietary software, rather than just the physical robot platform itself.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager