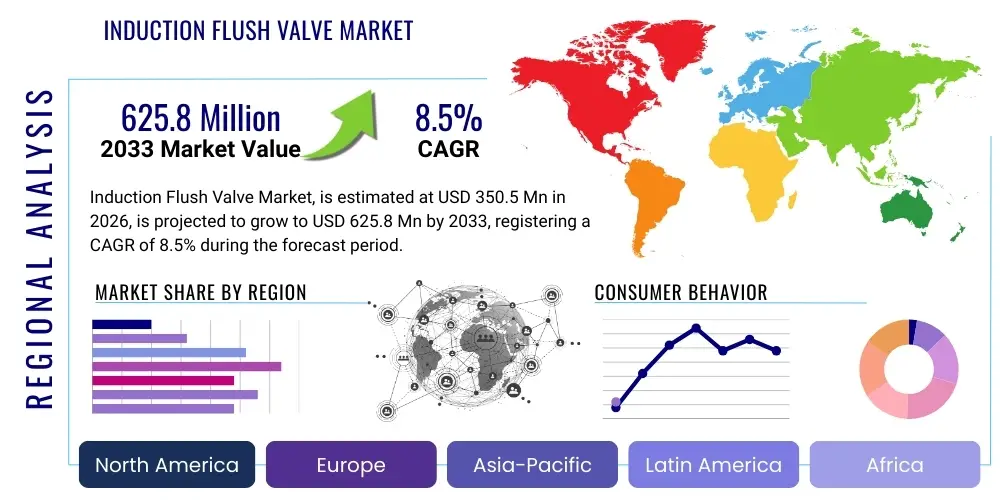

Induction Flush Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438855 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Induction Flush Valve Market Size

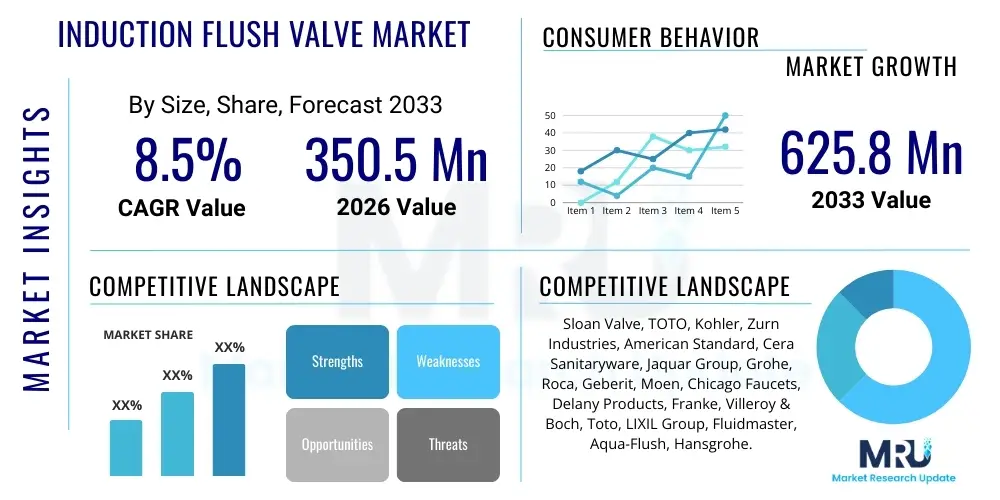

The Induction Flush Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 625.8 Million by the end of the forecast period in 2033.

Induction Flush Valve Market introduction

The Induction Flush Valve Market encompasses the global sales and deployment of automated, touchless flushing mechanisms, primarily utilizing sensor technology to detect user presence and initiate the flushing cycle without physical contact. These devices, often referred to as automatic or sensor flush valves, are crucial components in modern sanitary systems, offering significant enhancements in public hygiene, water conservation, and operational efficiency, particularly in high-traffic commercial and institutional environments. The core product incorporates sophisticated sensing modules, usually based on infrared or radar technology, coupled with electronic actuators that regulate water flow, thereby replacing traditional manual handles and reducing the risk of pathogen transmission. The rapid global shift towards hygienic infrastructure, spurred by increased public health awareness and stringent building codes, is fundamentally accelerating the adoption trajectory of these advanced flushing systems across diverse sectors.

Major applications for induction flush valves span the entire spectrum of commercial and public infrastructure, including airports, shopping malls, corporate offices, educational institutions, and critical healthcare facilities. In the healthcare sector, the imperative for infection control makes touchless operation an absolute necessity, driving premium installation rates. Furthermore, the hospitality industry leverages these valves not only for hygiene but also as part of a high-end, modern amenity offering that enhances the guest experience while demonstrating commitment to sustainable water management practices. The versatility of these valves allows them to be integrated seamlessly into both new construction projects and extensive retrofit programs aimed at modernizing aging plumbing infrastructure, ensuring broad market penetration potential across mature and emerging economies.

Key driving factors fueling the market expansion include global urbanization trends leading to increased construction of commercial spaces, supportive governmental regulations promoting water-efficient fixtures (such as LEED certifications and regional efficiency standards), and heightened consumer expectations regarding public restroom cleanliness and sanitation levels. The benefits derived from induction flush valves are multifaceted: they significantly reduce water wastage by employing precision-timed flushes or dual-flush mechanisms based on usage detection; they minimize operational costs related to maintenance and manual cleaning; and most critically, they serve as a fundamental layer of defense against cross-contamination, a concern that has been amplified in the current geopolitical climate. These interwoven factors create a compelling value proposition for facility managers, contributing to sustained market growth.

Induction Flush Valve Market Executive Summary

The Induction Flush Valve Market is characterized by robust technological innovation focusing on integration with building management systems (BMS) and enhanced water efficiency protocols, driving significant business trends towards smart sanitation solutions. Major market growth is fundamentally propelled by the post-pandemic focus on public hygiene, necessitating the widespread deployment of touchless fixtures in densely populated urban centers and commercial complexes globally. Competitive dynamics are concentrating on developing reliable, long-lasting battery life solutions for easier installation in existing infrastructure, coupled with advanced diagnostics features that allow facility managers to monitor water usage in real-time and predict maintenance requirements, optimizing overall operational expenditure. This technological race among key players ensures that product differentiation increasingly relies on sensor reliability, durability, and integration capabilities rather than solely on basic functionality, leading to a premiumization of sophisticated products.

Regionally, the market exhibits divergent trends. North America and Europe currently represent the largest revenue share due to early adoption of stringent water conservation standards and a highly developed commercial infrastructure base, emphasizing retrofit opportunities in older buildings. However, the Asia Pacific region (APAC) is forecasted to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, driven primarily by massive investments in new urban development, rapid commercialization in countries like China and India, and the construction of state-of-the-art airports, hospitals, and high-rise corporate campuses. Latin America, the Middle East, and Africa (MEA) are also showing promising growth, albeit starting from a smaller base, fueled by governmental initiatives to upgrade public sanitation standards and increasing tourism infrastructure development, leading to a substantial demand for reliable and efficient flushing systems across emerging metropolitan areas.

Segment trends reveal that the commercial application segment, encompassing office buildings and shopping centers, dominates the market share due to the sheer volume of installations required in high-traffic areas. Furthermore, within the product segment, piston-type induction valves are generally preferred for heavy-duty commercial environments requiring robust performance and high water pressure tolerance, while diaphragm-type valves are gaining traction for their cost-effectiveness and simpler maintenance profiles, particularly in smaller commercial or institutional settings. Technology-wise, infrared sensor technology remains the industry standard due to its maturity and cost efficiency, but the market is slowly moving towards more advanced, reliable technologies, including radar or ultrasonic sensors, especially in premium product lines where sensor accuracy under varying environmental conditions is paramount for sustained performance and user satisfaction.

AI Impact Analysis on Induction Flush Valve Market

Users frequently inquire about how artificial intelligence (AI) and machine learning (ML) are transforming basic sanitary technology, specifically focusing on improved maintenance, predictive failure, and water consumption optimization. Key questions revolve around whether AI integration can genuinely lower the total cost of ownership by reducing false flushes, extending battery life, and scheduling maintenance proactively based on usage patterns rather than fixed intervals. Furthermore, there is significant interest in how networked valves, supported by AI algorithms, can contribute to facility-wide water efficiency goals and provide granular data on restroom usage to optimize cleaning schedules and resource allocation. The core concern is transitioning flush valves from simple reactive sensors into intelligent, data-generating nodes essential for sophisticated Building Management Systems (BMS), driving the expectation that AI will deliver superior operational predictability and sustainability metrics.

- AI algorithms enable predictive maintenance by analyzing sensor data (e.g., flow rate anomalies, battery degradation, and usage frequency), preempting component failures.

- Machine Learning optimizes water usage patterns by dynamically adjusting flush volume based on real-time traffic analysis and accumulated historical data, minimizing wastage.

- Integration with IoT platforms allows centralized control and monitoring, using AI to generate sophisticated usage reports and benchmark performance across multiple facilities.

- AI enhances sensor calibration and reliability, reducing occurrences of ghost flushing (false positives) or non-flushing (false negatives) in varying lighting or environmental conditions.

- Natural Language Processing (NLP) integration in smart facilities aids maintenance teams by providing voice-activated diagnostics and operational troubleshooting guides for complex valve systems.

DRO & Impact Forces Of Induction Flush Valve Market

The Induction Flush Valve market dynamics are profoundly shaped by a combination of powerful drivers, structural restraints, and emerging opportunities, all contributing to the overall impact forces that dictate market expansion and product innovation trajectories. The principal driver is the non-negotiable societal demand for elevated hygiene standards in public spaces, a trend significantly amplified by recent global health crises, compelling commercial entities and governments alike to invest heavily in touchless technologies. Coupled with this is the accelerating global focus on environmental sustainability, where water conservation mandates and certifications (such as BREEAM and Green Building standards) create a mandatory market pull for high-efficiency fixtures. Restraints predominantly center on the initial capital expenditure associated with installing sensor-based systems, which is markedly higher than traditional manual valves, coupled with the complexity of retrofitting older infrastructure that may lack suitable plumbing layouts or electrical access for sophisticated electronic components. Furthermore, reliance on battery power and the need for regular replacement or maintenance of electronic components pose operational challenges that can deter some cost-sensitive institutional buyers, particularly those with limited technical maintenance staff.

Opportunities for market growth are abundant, particularly in the rapid commercialization and urbanization occurring in Asia Pacific, which demands massive new installation volumes. Furthermore, the growing trend of smart building integration presents a significant avenue for expansion, allowing induction valves to become interconnected components of comprehensive Building Management Systems (BMS), offering utility monitoring and centralized control that appeals directly to large corporate facility owners seeking optimized energy and water usage. The development of self-sustaining or hydro-powered induction valves, eliminating the need for frequent battery replacement, represents a key technological opportunity that addresses a major existing restraint. Additionally, the increasing demand for accessible design in public restrooms, catering to diverse populations, reinforces the importance of touchless activation, making induction valves a key component of universally designed spaces, further broadening their market appeal beyond just hygiene concerns into areas of social responsibility and compliance.

The collective impact forces resulting from these DRO elements exert strong upward pressure on market size. Regulatory pressure for water efficiency acts as a constant demand generator, overriding cost concerns for long-term operational savings. The high rate of commercial construction worldwide ensures a steady stream of new installations, while technological advancements in sensor reliability and battery longevity are actively mitigating the primary restraints related to maintenance and complexity. Overall, the market exhibits high resilience and strong growth potential, driven fundamentally by permanent shifts in public health standards and sustained global movements towards environmentally conscious infrastructure. The shift from a novelty product to a mandatory standard fixture in premium and high-traffic public facilities underscores the deep and structural nature of the market’s growth momentum, solidifying its trajectory towards substantial expansion over the forecast period, supported heavily by technological sophistication.

Segmentation Analysis

The Induction Flush Valve Market is systematically segmented based on Product Type, Application, and Sensing Technology, providing a granular view of market dynamics and adoption patterns across various user groups and performance requirements. Understanding these segmentations is crucial for manufacturers and stakeholders to tailor their product offerings, sales strategies, and marketing campaigns to specific market niches. The segmentation by product type, differentiating between diaphragm-based and piston-based mechanisms, reflects the varied performance demands concerning water pressure tolerance, durability, and cost efficiency in different commercial settings. Applications segmentation—covering commercial, institutional, and healthcare sectors—highlights the varying levels of performance and specialized compliance requirements unique to each industry, such as stringent infection control protocols in hospitals versus heavy-duty cycle demands in airports. Finally, the technical segmentation by sensing mechanism, such as infrared or radar, dictates the reliability, responsiveness, and energy efficiency of the device.

The dominant segment by application remains the Commercial sector, comprising office towers, retail centers, and recreational facilities, which account for the largest volume consumption due to the high density of required installations and continuous usage. However, the Healthcare segment, while smaller in volume, often commands higher average selling prices due to the mandatory requirements for certified anti-microbial materials, extreme reliability, and seamless integration with specialized plumbing systems necessary for maintaining sterile environments. Geographically, segmentation analysis confirms that high-income, mature economies prioritize replacement and efficiency upgrades (retrofit market), whereas emerging economies are dominated by new construction installations (greenfield market). This dual nature necessitates flexible production and distribution models capable of serving disparate end-user financial and technical capacities.

Segmentation analysis also reveals clear preferences for product type based on operational demands. Piston-type valves, known for their superior performance under high pressure and robustness, are overwhelmingly favored in large public venues like stadiums and airports where performance reliability under stress is paramount. Conversely, diaphragm-type valves are often the choice for lighter-duty commercial installations and institutional settings, such as educational facilities, where simplicity in maintenance and lower initial procurement costs are key purchasing criteria. The market trend indicates a growing consumer appreciation for precision and reliability, leading to increased investment in advanced, higher-cost sensing technologies across all primary application segments, gradually displacing cheaper, less reliable infrared sensors in new premium projects seeking maximized uptime and reduced service calls.

- By Product Type:

- Piston Type Induction Flush Valves

- Diaphragm Type Induction Flush Valves

- By Application:

- Commercial Buildings (Offices, Retail, Malls)

- Healthcare Facilities (Hospitals, Clinics)

- Institutional Buildings (Schools, Universities, Government)

- Hospitality (Hotels, Resorts)

- Industrial & Manufacturing

- By Technology:

- Infrared Sensing Technology

- Capacitive Sensing Technology

- Ultrasonic & Radar Sensing Technology

- By End-User:

- Facility Management Companies

- Architects and Consultants

- Plumbing Contractors

Value Chain Analysis For Induction Flush Valve Market

The value chain for the Induction Flush Valve Market is characterized by a complex interplay between specialized component suppliers, precision manufacturing processes, and a multi-tiered distribution network targeting institutional and commercial buyers. Upstream analysis highlights the critical reliance on suppliers of high-precision electronic components, particularly infrared and micro-radar sensors, solenoid valves, and specialized brass or composite material castings for the body structure. The quality and longevity of the product are heavily dependent on the procurement of reliable, long-life batteries or hydro-powered energy conversion systems, creating strong negotiating power for highly specialized component manufacturers in the electronics space. Assembly and manufacturing processes involve strict quality control for water tightness, sensor calibration, and electronic reliability, transforming raw materials into sophisticated plumbing fixtures.

Midstream activities involve core manufacturing, branding, and extensive product testing to meet diverse global standards (e.g., ANSI, CE, and water efficiency ratings like WaterSense). Key players invest substantially in R&D to improve sensor accuracy, reduce water consumption per flush, and integrate Internet of Things (IoT) capabilities for remote monitoring and diagnostics, which adds significant value. This R&D investment is crucial for maintaining competitive advantage and navigating the evolving regulatory landscape surrounding water efficiency and smart building standards. Effective supply chain management is necessary to handle the global logistics of heavy, yet sensitive, plumbing fixtures, ensuring timely delivery to large-scale construction sites or retrofit projects.

Downstream distribution channels are bifurcated, primarily involving direct sales to large facility managers or major commercial construction firms for high-volume orders, and indirect sales through a network of specialized plumbing wholesalers, distributors, and engineering procurement contractors (EPCs). The role of plumbing contractors and specialized installers is paramount in the final stage, as proper installation and calibration are essential for the valves to operate efficiently and reliably. Marketing efforts heavily target architects, engineers, and consultants who specify the products in the design phase. Customer service and technical support are crucial post-sale requirements, particularly regarding troubleshooting sensor or electronic malfunctions. The dominance of indirect channels is high, leveraging established relationships between wholesalers and local construction professionals, although direct e-commerce channels are emerging for replacement parts and smaller commercial clients seeking efficiency.

Induction Flush Valve Market Potential Customers

The potential customer base for induction flush valves is primarily concentrated in the institutional and commercial sectors, driven by regulatory compliance, hygiene requirements, and mandates for water use reduction. End-users typically include facility managers responsible for maintaining public health standards and controlling operational expenditures in high-traffic environments. Key buyers are those entities operating infrastructure where rapid, frequent use necessitates robust, touchless solutions to minimize maintenance cycles and prevent the spread of infectious agents. This group includes owners and operators of large corporate campuses, government buildings, and educational complexes seeking long-term reliability and adherence to green building principles. Furthermore, professional specifiers such as architects, mechanical engineers, and plumbing consultants act as crucial gatekeepers, heavily influencing product selection during the design and construction phases of both renovation and new build projects, ensuring brand visibility and technical specification alignment are critical marketing goals for manufacturers.

A second major customer segment comprises the rapidly expanding hospitality and travel industries, including international hotel chains, convention centers, and airports. These entities view induction flush valves not merely as functional necessities but as elements that enhance the guest experience, reflecting a commitment to modern amenities and high-level sanitation. In these sectors, the aesthetic integration, low noise operation, and reliability of the sensor system are often weighted equally with water efficiency. The decision to purchase is frequently made centrally by corporate procurement teams based on standardized specifications that favor globally reliable brands capable of consistent product support across multiple international locations, making standardization and global service capability essential competitive differentiators.

Finally, the growing retrofit market, which focuses on upgrading existing, older commercial facilities to meet modern hygiene and water conservation benchmarks, represents a significant and ongoing opportunity. Potential customers here are primarily facility management firms and property owners looking to maximize the asset value of their existing portfolio. These buyers prioritize ease of installation, compatibility with existing plumbing infrastructure, and demonstrable return on investment (ROI) through reduced water bills and lower labor costs associated with manual cleaning and repairs. Products targeting this segment must emphasize flexible power options (battery-operated or solar-assist) and user-friendly diagnostic interfaces to appeal to the operational constraints faced by managers of older commercial properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 625.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sloan Valve, TOTO, Kohler, Zurn Industries, American Standard, Cera Sanitaryware, Jaquar Group, Grohe, Roca, Geberit, Moen, Chicago Faucets, Delany Products, Franke, Villeroy & Boch, Toto, LIXIL Group, Fluidmaster, Aqua-Flush, Hansgrohe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Induction Flush Valve Market Key Technology Landscape

The technological landscape of the Induction Flush Valve Market is rapidly evolving, driven by the demand for enhanced reliability, improved water efficiency, and seamless integration into interconnected smart building ecosystems. The foundational technology remains the solenoid-actuated valve governed by a sensing mechanism, traditionally infrared (IR) based. However, modern innovations are focusing on refining sensor performance to overcome common issues such as false activations due to reflective surfaces or varying ambient light conditions. This includes the increasing adoption of micro-radar and ultrasonic sensing technologies, which offer superior accuracy and environmental stability, minimizing the costly problem of "ghost flushing" and ensuring optimal water conservation in diverse operational settings. Furthermore, there is a distinct move toward low-power electronics and optimized fluid dynamics within the valve body itself to maximize water flow efficiency while reducing noise generation, addressing key concerns for premium commercial installations like luxury hotels and high-end offices.

A critical trend shaping the technology landscape is the integration of IoT (Internet of Things) capabilities, transforming standalone flush valves into network-enabled endpoints. These smart valves incorporate microprocessors and wireless communication modules (Wi-Fi, Bluetooth Low Energy, or proprietary mesh networks) that facilitate real-time monitoring of performance metrics, including usage frequency, battery life, and water volume per flush. This connectivity is essential for leveraging predictive maintenance analytics, enabling facility managers to anticipate component failures or schedule cleaning based on actual traffic data, significantly reducing reactive maintenance costs and ensuring maximum uptime. Moreover, data gathered by these networked systems feeds directly into centralized Building Management Systems (BMS), allowing for holistic resource optimization across an entire facility portfolio, aligning with the broader smart city and smart building mandates globally.

Power management represents another significant technological focus area. While battery-powered units offer installation flexibility, the cost and labor associated with frequent battery changes remain a major concern. Manufacturers are innovating with energy harvesting techniques, such as hydro-powered turbines that generate sufficient electricity from the flowing water during the flush cycle to recharge a capacitor or backup battery, thereby extending the maintenance interval dramatically or achieving full self-sustainability. Coupled with advances in valve material science, incorporating resilient, non-corrosive polymers and anti-microbial coatings, the latest generation of induction flush valves offers markedly superior lifespan and reduced contamination risk compared to previous iterations. This commitment to durability, intelligence, and sustainable power sources defines the competitive edge in the current market, driving out older, less efficient models and establishing new benchmarks for commercial sanitary fixtures.

Regional Highlights

- North America (US, Canada): This region is a mature market characterized by high consumer awareness regarding hygiene and stringent governmental regulations concerning water conservation (e.g., EPA WaterSense program). The market here is predominantly driven by the replacement and retrofit of existing commercial infrastructure, especially in metropolitan hubs like New York and Chicago. Adoption rates are high in healthcare and educational facilities, where investment in sophisticated, reliable plumbing infrastructure is prioritized. Manufacturers focus heavily on smart features, data connectivity, and durable, low-maintenance products to cater to the demanding corporate and institutional customer base.

- Europe (Germany, UK, France): European market growth is steady, bolstered by rigorous building codes, strong emphasis on sustainability (EU Green Deal), and a preference for aesthetically pleasing, integrated design. Germany and the UK lead in adoption, driven by high standards in public sanitation and major investments in sustainable city infrastructure. The market leans towards high-quality, water-efficient models that comply with specific European norms (EN standards), often favoring systems that offer easy installation and minimum disruption during refurbishment projects across the public and private commercial sectors.

- Asia Pacific (China, India, Japan): APAC is the fastest-growing market globally, fueled by exponential commercial and infrastructure development, particularly the construction of new airports, high-rise residential towers, and corporate offices in rapidly urbanizing areas. China and India represent massive opportunities due to scale. While price sensitivity exists, there is a growing demand for premium, branded fixtures in major cities, largely driven by multinational corporate presence and heightened public expectations for cleanliness, particularly following the pandemic. Standardization and volume manufacturing are critical competitive factors in this region.

- Latin America (Brazil, Mexico): Growth in Latin America is uneven but promising, tied closely to economic stability and investment in tourism and public infrastructure. Market penetration is lower than in developed regions, but the demand for improved public health standards and water conservation is rising, particularly in large urban centers like São Paulo and Mexico City. The market often requires a balance between cost-effectiveness and reliability, with local manufacturing presence sometimes offering a competitive advantage due to logistical ease and lower import duties.

- Middle East and Africa (MEA): The Middle East, especially the GCC nations (UAE, Saudi Arabia), shows high adoption rates in luxurious commercial and hospitality projects, supported by significant investment in large-scale smart city developments and tourism infrastructure (e.g., Expo sites). Water scarcity issues make high-efficiency flush valves a non-negotiable requirement, driving demand for technologically advanced, high-precision products. The African market, while nascent, is seeing increasing governmental focus on improving public sanitation and infrastructure, particularly in South Africa and Nigeria, although adoption is largely concentrated in capital cities and high-end commercial areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Induction Flush Valve Market.- Sloan Valve Company

- TOTO Ltd.

- Kohler Co.

- Zurn Industries, LLC

- American Standard Brands

- Cera Sanitaryware Ltd.

- Jaquar Group

- Grohe AG (LIXIL Group)

- Roca Sanitario, S.A.

- Geberit AG

- Moen Inc. (Fortune Brands)

- Chicago Faucets (Geberit AG)

- Delany Products

- Franke Holding AG

- Villeroy & Boch AG

- Fluidmaster Inc.

- Aqua-Flush

- Hansgrohe SE

- LIXIL Corporation

- Spartan Flush Valve

Frequently Asked Questions

Analyze common user questions about the Induction Flush Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Induction Flush Valve Market?

The Induction Flush Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven primarily by global hygiene mandates and increasing water efficiency regulations in commercial construction.

Which application segment currently holds the largest market share for induction flush valves?

The Commercial Buildings segment, encompassing offices, retail spaces, and high-traffic public venues, holds the largest market share due to the necessity for robust, high-cycle touchless fixtures and strong regulatory adherence to public health standards.

How is AI impacting the functionality of induction flush valve systems?

AI is transforming flush valve systems by enabling predictive maintenance through usage data analysis, optimizing water consumption based on real-time traffic, and enhancing sensor reliability to prevent ghost flushing and extend component lifespan in smart facility environments.

What are the primary restraints hindering the widespread adoption of induction flush valves?

The primary restraints include the significantly higher initial capital expenditure compared to manual systems, complexity associated with electronic component maintenance, and installation challenges related to power requirements (battery dependency) in retrofit projects.

Which regional market is expected to exhibit the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by massive government and private investment in new commercial infrastructure, rapid urbanization, and rising public health consciousness across economies such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager