Industrial Air Cleaners Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434157 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Industrial Air Cleaners Market Size

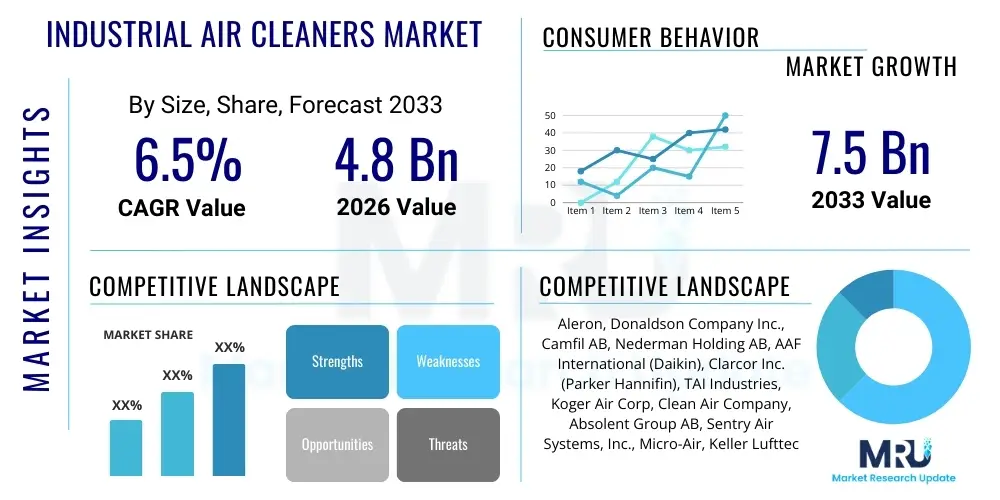

The Industrial Air Cleaners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Industrial Air Cleaners Market introduction

The Industrial Air Cleaners Market encompasses systems and devices designed to remove contaminants, particulates, fumes, mist, and volatile organic compounds (VOCs) from the air within industrial environments. These systems are crucial for maintaining regulatory compliance, ensuring occupational health and safety standards, and protecting sensitive manufacturing equipment from abrasive particles. The primary products include dust collectors, mist collectors, fume extractors, and electrostatic precipitators, utilized across various heavy and light industries where air quality degradation is a consequence of production processes, such as welding, grinding, machining, chemical processing, and woodworking. The effectiveness of these solutions is directly linked to operational efficiency and minimizing downtime associated with equipment failure or regulatory fines.

Industrial air cleaning technologies vary widely depending on the contaminant source and required efficiency level, ranging from basic media filtration utilizing HEPA or ULPA filters to advanced systems like wet scrubbers or specialized activated carbon filters for odor and gas removal. Product selection is highly application-specific, often requiring customized engineering solutions to handle high air volumes, flammable dusts, or corrosive chemical fumes. The core function remains the preservation of indoor air quality (IAQ), which is becoming increasingly scrutinized globally due to heightened awareness of respiratory illnesses linked to airborne industrial pollutants. Furthermore, cleaner air contributes significantly to extending the lifespan of machinery and ensuring the quality of end products, particularly in sensitive sectors like electronics and pharmaceuticals.

Major applications driving market demand include the automotive industry for vehicle manufacturing processes, metalworking for controlling oil mist and metal dust, and the pharmaceutical sector where stringent cleanliness standards necessitate ultra-high efficiency particulate removal. The benefits derived from deploying these solutions are multifaceted, covering reduced worker compensation claims, increased productivity due lower employee illness rates, decreased energy consumption through improved HVAC system performance, and, most critically, adherence to strict governmental emission and workplace safety regulations imposed by bodies such as OSHA in the U.S. and equivalent agencies globally. These factors collectively solidify the industrial air cleaner as an indispensable component of modern industrial infrastructure.

Industrial Air Cleaners Market Executive Summary

The global Industrial Air Cleaners Market is characterized by robust growth driven primarily by escalating governmental enforcement of occupational health and environmental protection regulations, particularly across industrialized and rapidly industrializing economies. Business trends indicate a significant shift towards integrated, smart air cleaning systems capable of real-time monitoring and predictive maintenance, thereby reducing operational complexity and overall cost of ownership for end-users. Technological advancements, specifically the integration of IoT sensors and advanced filtration media such as nanofiber filters, are enhancing system efficiency and reducing energy consumption, making high-efficiency solutions more economically viable. Furthermore, the market is highly competitive, featuring established global players focusing on strategic mergers, acquisitions, and regional expansion, alongside specialized niche manufacturers offering customized solutions for complex contaminants.

Regionally, the Asia Pacific (APAC) market is forecast to exhibit the fastest growth, propelled by the massive expansion of manufacturing and heavy industries in countries like China, India, and Southeast Asian nations. Although regulatory standards in some APAC regions are still developing, the sheer volume of new industrial installations provides a vast potential market. Conversely, North America and Europe remain key revenue generators, characterized by mature markets, stringent regulatory frameworks (e.g., EU's Industrial Emissions Directive), and a high adoption rate of sophisticated, high-cost purification technologies. The demand in these mature regions is often replacement-driven or focused on upgrades to meet evolving safety mandates, especially concerning carcinogenic substances and explosion risk (ATEX compliance).

Segment trends reveal that dust collectors, specifically cartridge and baghouse collectors, maintain the largest market share due to their widespread use in basic manufacturing processes and material handling. However, the fastest-growing segment is expected to be oil mist and fume collectors, driven by the expanding metalworking and machining industries which rely heavily on coolants and lubricants that generate aerosolized contaminants. Within technology, HEPA and ULPA filtration systems are seeing accelerated adoption in controlled environments (e.g., pharmaceutical cleanrooms, precision electronics) where absolute air purity is mandatory. The trend is moving away from reactive maintenance towards proactive, system-integrated solutions that offer data-driven insights into air quality and filter saturation levels, enhancing overall equipment effectiveness (OEE).

AI Impact Analysis on Industrial Air Cleaners Market

User queries regarding the impact of Artificial Intelligence (AI) on industrial air cleaning systems commonly center on how AI can enhance efficiency, reduce operating expenses, and improve regulatory compliance with minimal human intervention. Key themes include the feasibility of predictive maintenance algorithms for filter replacement, the use of machine learning to dynamically adjust fan speeds and filtration intensity based on real-time contaminant loading, and the deployment of smart sensors to identify contaminant types and sources immediately. Users are particularly concerned with optimizing energy use, as air cleaning systems are often major consumers of industrial power. The expectation is that AI will transform industrial air cleaning from a fixed operational cost into a dynamically managed utility that maximizes purification efficiency while minimizing energy expenditure and unexpected downtime due to saturated filters.

AI's influence is primarily manifested through advanced data analytics and autonomous system control. AI algorithms can ingest data from multiple sources, including air quality monitors, production schedules, energy consumption logs, and even weather patterns, to predict optimal operational parameters. For instance, predictive models can accurately forecast the remaining useful life (RUL) of filtration media, allowing maintenance staff to schedule replacement precisely when needed, avoiding premature disposal or detrimental late replacement. This capability moves the industry toward condition-based monitoring rather than time-based or reactive maintenance, resulting in significant savings on consumables and labor.

Furthermore, machine learning facilitates improved system design and performance validation. By analyzing historical performance data across varying operating conditions, AI can identify bottlenecks and suggest modifications to airflow dynamics or control mechanisms that human engineers might overlook. This enables manufacturers to develop next-generation modular systems that are inherently more energy-efficient and scalable. AI systems also play a pivotal role in ensuring compliance by generating highly detailed, automated reports proving adherence to mandated particulate limits, significantly streamlining regulatory auditing processes and reducing the risk of non-compliance penalties.

- AI-powered Predictive Maintenance: Forecasting filter saturation and component failure to minimize unplanned downtime.

- Dynamic Energy Optimization: Utilizing machine learning to adjust motor speed and airflow based on real-time particulate concentration, maximizing efficiency.

- Real-time Contaminant Identification: AI algorithms classifying airborne hazards (dust, mist, fumes, VOCs) for immediate, targeted filtration response.

- Automated Compliance Reporting: Generating digital audit trails and reports required by environmental and occupational safety agencies.

- Intelligent System Design: Using simulation and historical data analysis to engineer highly efficient, bespoke filtration solutions.

DRO & Impact Forces Of Industrial Air Cleaners Market

The trajectory of the Industrial Air Cleaners Market is governed by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping adoption rates and technological investment. Key drivers include the increasingly stringent environmental, health, and safety regulations promulgated worldwide, forcing industries to invest in high-efficiency air cleaning solutions to protect both workers and surrounding ecosystems. The rising prevalence of occupational respiratory diseases, such as silicosis and COPD, resulting from prolonged exposure to industrial dust and fumes, provides a significant ethical and legal incentive for companies to upgrade their air quality management infrastructure. These drivers create an unavoidable cost of doing business, compelling market expansion.

However, the market faces significant restraints, primarily revolving around the high initial capital expenditure required for installing advanced filtration systems, particularly for large-scale industrial facilities like foundries or chemical plants. Furthermore, the operational expenses associated with maintenance, including frequent filter replacement and high energy consumption by powerful blowers, can be substantial, discouraging SMEs (Small and Medium-sized Enterprises) from investing. A secondary restraint is the challenge of disposal for contaminated filters, which are often classified as hazardous waste, adding complexity and cost to the overall lifecycle management of the air cleaning system. These factors necessitate a focus on ROI calculations and long-term cost benefits when selling these solutions.

Opportunities for market expansion are centered around technological innovation and geographical penetration. The development of smart, IoT-enabled air cleaning systems that offer enhanced operational efficiency and reduced energy consumption presents a major growth avenue, appealing directly to companies seeking sustainability benefits alongside cost savings. Furthermore, vast, untapped potential exists in developing economies, particularly in sectors undergoing rapid modernization (e.g., manufacturing in Southeast Asia, mining in Africa). The increasing adoption of modular and customizable solutions designed for specific, challenging contaminants (e.g., sticky dusts, highly corrosive fumes) also provides significant market differentiation and growth potential. The cumulative effect of these drivers and opportunities outweighs the restraints, propelling the market forward.

Segmentation Analysis

The Industrial Air Cleaners Market is fundamentally segmented based on the type of collector, the filtration technology utilized, the media employed, the operational application, and the geographic region. This segmentation is critical because the required air cleaning solution is highly dependent on the contaminant profile—a dust collector designed for wood processing is inadequate for collecting corrosive chemical fumes. The core objective of segmentation analysis is to understand the diverse demands across end-user industries and tailor product development and market strategies accordingly. The market structure reflects the complexity of industrial air quality challenges, demanding specialized solutions rather than one-size-fits-all products.

By product type, the market is broadly divided into dust collectors (for solid particulates), mist collectors (for aerosols/liquids from machining), and fume extractors (for welding and combustion gases). Each type requires distinct engineering specifications, such as explosion protection for combustible dust collectors or demister elements for mist collectors. The filter media segment, which includes cartridge filters, bag filters, and panel filters, is highly dynamic, witnessing continuous innovation aimed at improving filtration efficiency (e.g., higher MERV ratings) and media durability to extend replacement cycles. The growth in specialized manufacturing, such as semiconductor fabrication and additive manufacturing (3D printing), necessitates the development of new segments tailored for ultra-fine particulate and hazardous material control.

From an end-user application standpoint, the segmentation highlights areas of highest pollution generation and strictest regulatory oversight. Metalworking, pharmaceutical, and chemical industries represent the largest and most stringent segments, demanding compliance with FDA and cGMP standards, or specialized ATEX certifications for potentially explosive atmospheres. Conversely, segments like food and beverage processing, while needing clean air, prioritize hygiene and prevention of cross-contamination. Understanding these granular application requirements allows vendors to focus resources on high-growth, high-value verticals where advanced, certified solutions command premium pricing and stronger market loyalty.

- Type:

- Dust Collectors (Baghouse, Cartridge, Wet Scrubbers, Cyclone)

- Mist Collectors (Electrostatic Precipitators, Centrifugal, Media)

- Fume & Smoke Collectors (Welding Fume Extractors, Chemical Fume Hoods)

- Technology:

- HEPA/ULPA Filtration

- Electrostatic Precipitators

- Activated Carbon Filtration

- Media Filtration

- Wet Scrubbers

- Application:

- Metalworking

- Automotive

- Chemical and Petrochemical

- Pharmaceutical and Biotechnology

- Food and Beverage

- Woodworking

- Electronics and Semiconductor

- Filter Media:

- Fiberglass

- Non-Woven Fabrics

- Synthetic Polymers

- Nanofiber Composites

Value Chain Analysis For Industrial Air Cleaners Market

The value chain for the Industrial Air Cleaners Market is intricate, beginning with the sourcing of specialized raw materials, moving through high-precision manufacturing, and culminating in specialized distribution and critical after-sales service. Upstream analysis highlights the procurement of critical components such as high-efficiency filtration media (HEPA materials, carbon pellets), specialized metals for system housing (often requiring corrosion resistance), and advanced sensor and control components for IoT integration. Raw material costs and availability, particularly for proprietary filter media, significantly influence the final product price and overall system profitability. Supply chain efficiency in this stage is crucial due to the bespoke nature of many industrial installations, requiring custom-sized or specific material components.

The core manufacturing process involves engineering design, system fabrication, and rigorous testing. Given the regulatory requirements (e.g., ATEX, NFPA standards for dust), manufacturing involves high intellectual property investment in aerodynamic design, ensuring optimal airflow and contaminant capture without compromising energy efficiency. Downstream analysis focuses on the distribution and installation phase. Due to the high complexity and customization required, distribution often bypasses conventional wholesale channels. Instead, it relies heavily on a network of specialized engineering consulting firms, direct sales teams, and certified system integrators who can assess the unique environmental challenges of a facility, design the solution, and manage the complex installation process.

Direct sales channels are typically favored for large capital projects requiring highly customized air cleaning arrays, offering the manufacturer maximum control over system performance and customer relationships. Indirect channels, consisting of regional distributors and independent sales representatives, often handle standardized, smaller-scale units or replacement components. Crucially, the after-sales service element—including maintenance contracts, continuous system monitoring, and the supply of consumable replacement filters—represents a significant and stable revenue stream for market players. This service provision ensures the longevity and effectiveness of the installed base and strengthens customer reliance on the original equipment manufacturer (OEM).

Industrial Air Cleaners Market Potential Customers

Potential customers for industrial air cleaners are essentially all manufacturing, processing, and heavy industrial facilities globally that generate airborne contaminants as a byproduct of their operations, necessitating investment to comply with occupational safety laws and environmental permits. These end-users, or buyers, span a wide spectrum from massive global automotive assembly plants and multi-site chemical processing conglomerates to smaller fabrication workshops and localized food processing units. The purchasing decision is typically driven by regulatory mandates (compliance departments), worker safety concerns (HSE departments), and operational reliability requirements (maintenance and engineering departments).

The primary high-value customers reside in sectors characterized by high contamination levels and strict quality control requirements. For example, in the pharmaceutical sector, customers purchase ULPA filtration systems not just for worker safety but primarily to prevent product contamination and meet Good Manufacturing Practice (GMP) standards. Similarly, the metalworking industry, including automotive and aerospace component suppliers, are major buyers of mist collectors to mitigate fire hazards and prevent coolant aerosols from damaging machinery electronics. The common thread among these potential customers is the realization that air quality management is not merely an overhead cost but a fundamental aspect of risk management and quality assurance.

Emerging segments representing high potential include facilities involved in additive manufacturing, where the handling of metal powders creates unique, highly volatile dust hazards requiring specialized inert collection systems. Furthermore, the growth of the Li-ion battery manufacturing sector demands extremely stringent cleanroom environments and effective management of potentially toxic metal dusts. Purchasing behavior is often characterized by long procurement cycles, requiring vendor certification, detailed technical specifications, and a strong history of regulatory compliance, meaning potential customers prioritize reliability, efficiency, and long-term service support over simple upfront cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aleron, Donaldson Company Inc., Camfil AB, Nederman Holding AB, AAF International (Daikin), Clarcor Inc. (Parker Hannifin), TAI Industries, Koger Air Corp, Clean Air Company, Absolent Group AB, Sentry Air Systems, Inc., Micro-Air, Keller Lufttechnik GmbH, Plymovent, Scientific Dust Collectors, Air Quality Engineering, Inc., Purex International Ltd., Fumex Inc., Vairex Air Systems, UAS (United Air Specialists). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Air Cleaners Market Key Technology Landscape

The industrial air cleaners market is experiencing significant technological evolution, moving beyond conventional mechanical separation methods toward highly sophisticated, digitally integrated purification systems. A key trend is the widespread adoption of advanced filtration media, particularly nanofiber composites. These materials offer enhanced filtration efficiency, often achieving HEPA-level performance while maintaining lower pressure drops compared to traditional glass fiber media, thus significantly reducing the energy burden on blower motors. Furthermore, the development of specialized filter coatings (e.g., antimicrobial or oleophobic surfaces) is improving filter lifespan and enabling effective handling of challenging contaminants like sticky dust or oil-laden air, which previously led to rapid clogging and frequent replacements.

Another dominant technological trajectory involves the integration of Internet of Things (IoT) platforms and smart sensor networks. Modern industrial air cleaning systems are increasingly equipped with integrated sensors that monitor differential pressure, particulate matter (PM) levels, gas concentrations (VOCs, CO), and motor performance in real time. This connectivity allows for continuous data logging and transmission to centralized control systems or cloud platforms. The primary benefit is the enablement of predictive maintenance capabilities, where AI algorithms analyze operational data to anticipate component failure or filter saturation, ensuring optimal performance and scheduling maintenance proactively, thus minimizing costly operational interruptions and maximizing uptime.

Furthermore, energy recovery and recirculation technologies are becoming standard, especially in temperate and cold climates where venting treated air to the outside results in substantial heating or cooling costs. High-efficiency heat exchangers and advanced airflow management systems are integrated into air cleaning units to recover thermal energy before discharging air, making the overall factory HVAC system more sustainable and compliant with evolving energy efficiency standards. The focus on modularity and customizable design is also growing, allowing end-users to quickly reconfigure or expand their air cleaning infrastructure as production needs change or as new, regulated contaminants are introduced into the manufacturing process, ensuring future-proof investment.

Regional Highlights

- North America: North America represents a mature and technologically advanced market segment, characterized by extremely strict occupational health and environmental regulations, primarily enforced by agencies like OSHA and the EPA. The demand here is driven by the necessity of compliance, resulting in high adoption rates for premium, high-efficiency systems, including advanced fume extraction and complex dust collection arrays for hazardous materials like combustible dusts (NFPA standards). The U.S. and Canada prioritize investing in smart, energy-efficient, and data-logging capable units to mitigate regulatory risks and optimize energy consumption. The automotive, aerospace, and semiconductor manufacturing sectors are major consumers, consistently demanding adherence to the highest international air quality standards.

- Europe: The European market is highly regulated, dominated by the implementation of directives such as the Industrial Emissions Directive (IED) and the ATEX directive, which specifically addresses equipment used in explosive atmospheres (e.g., handling fine metallic or chemical dusts). Sustainability and energy efficiency are critical buying criteria, driving demand for innovative, low-power consumption wet scrubbers and systems incorporating heat recovery. Western Europe, particularly Germany and Scandinavia, leads in adopting highly specialized solutions for small, precision manufacturing environments and prioritizing systems with minimal noise footprint. Replacement and upgrade cycles are frequent due to tightening regional compliance mandates concerning chemical and particulate emissions.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid industrialization, massive infrastructure development, and the relocation of global manufacturing activities, particularly to China, India, and Southeast Asia. Although regulatory enforcement varies widely, the sheer scale of industrial output, especially in metal fabrication, textile manufacturing, and electronics, necessitates high volumes of air cleaning equipment. The market here is characterized by a strong demand for cost-effective, high-capacity dust collectors and basic fume extraction systems. Increasing foreign investment and growing public awareness of pollution are gradually pushing regulatory standards toward Western levels, suggesting substantial future growth for high-efficiency, certified products.

- Latin America (LATAM): The LATAM market is experiencing steady growth, highly correlated with investments in mining, oil and gas, and foundational manufacturing sectors (e.g., steel and cement). Market penetration is generally moderate, constrained by economic volatility and slower adoption of globally rigorous regulatory standards compared to North America or Europe. However, large multinational corporations operating within countries like Brazil and Mexico drive pockets of demand for sophisticated air cleaning technologies to maintain internal corporate standards. The primary need is robust, durable equipment suitable for challenging, often remote, operating conditions in heavy industries.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, linked to substantial government investment in petrochemicals, infrastructure, and diversification into non-oil sectors. The region demands specialized solutions for handling high heat, corrosive elements (common in petrochemicals), and large volumes of dust prevalent in construction and mining. Africa remains a nascent market, but increasing industrialization in nations like South Africa and Nigeria creates niche opportunities for durable, easy-to-maintain dust and fume control equipment focused on mining and primary resource processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Air Cleaners Market.- Donaldson Company Inc.

- Camfil AB

- Nederman Holding AB

- AAF International (Daikin)

- Clarcor Inc. (Parker Hannifin)

- Absolent Group AB

- Sentry Air Systems, Inc.

- Keller Lufttechnik GmbH

- Plymovent

- Scientific Dust Collectors

- Aleron

- Koger Air Corp

- Clean Air Company

- Micro-Air

- TAI Industries

- Air Quality Engineering, Inc.

- Purex International Ltd.

- Fumex Inc.

- Vairex Air Systems

- UAS (United Air Specialists)

Frequently Asked Questions

Analyze common user questions about the Industrial Air Cleaners market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory compliance drivers affecting the industrial air cleaner demand?

The primary drivers include OSHA (Occupational Safety and Health Administration) standards on permissible exposure limits (PELs) for airborne particulates and fumes, EPA (Environmental Protection Agency) regulations governing stack emissions, and specialized international standards like the EU's ATEX directive concerning explosion prevention in dusty environments.

How does the integration of IoT technology benefit industrial air cleaning systems?

IoT integration allows for real-time monitoring of filter saturation, differential pressure, and energy consumption. This data enables predictive maintenance schedules, optimizing filter replacement frequency, reducing unexpected downtime, and ensuring the system operates at maximum energy efficiency.

What is the difference between a dust collector and a mist collector in industrial applications?

A dust collector is designed to capture dry, solid particulates (like wood dust or metal fines) and typically uses bag or cartridge filters. A mist collector is engineered to capture liquid aerosols or oil coolants generated during machining processes, often employing centrifugal force, media filters, or electrostatic precipitation to remove liquid droplets.

Which geographical region is expected to show the highest growth rate, and why?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR due to rapid and ongoing industrial expansion, particularly in manufacturing, construction, and electronics sectors in emerging economies such as China, India, and Vietnam, leading to a massive demand for foundational pollution control equipment.

What major challenges restrict the adoption of advanced industrial air cleaning solutions?

Major restrictions include the high initial capital investment required for installing complex systems, significant ongoing operational expenses related to frequent maintenance and high energy consumption, and the specialized complexities involved in the safe disposal of contaminated filtration media.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager