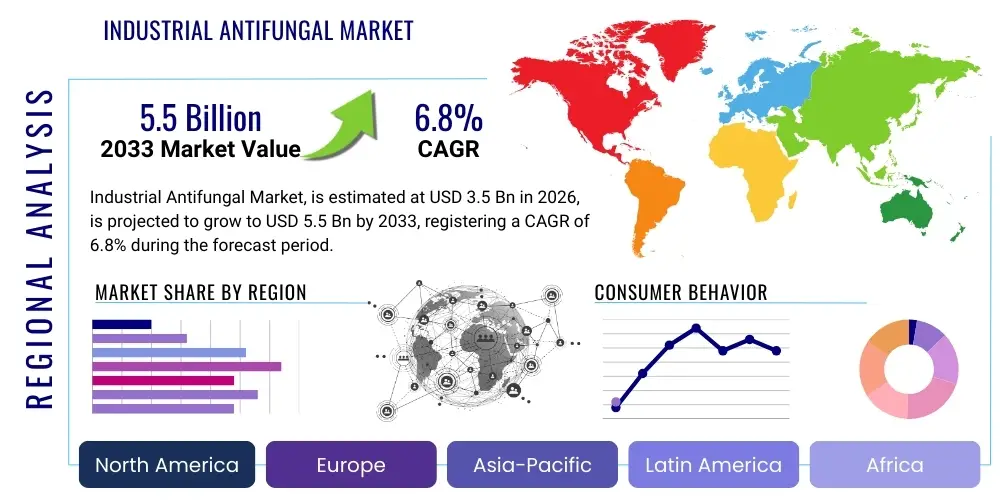

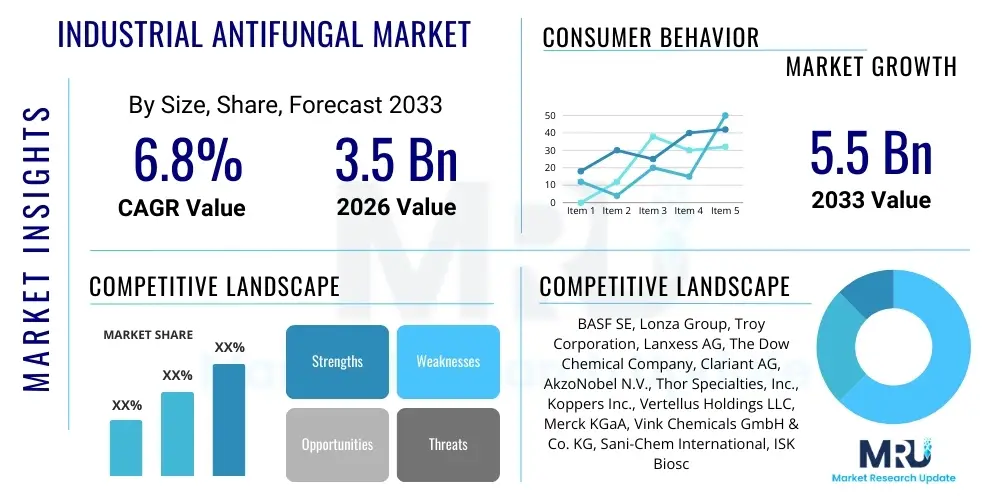

Industrial Antifungal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437240 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Industrial Antifungal Market Size

The Industrial Antifungal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.5 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating demand for advanced material preservation solutions across high-growth sectors such as construction, textiles, and paints & coatings, particularly in regions experiencing high humidity and tropical climates, which accelerate fungal and microbial degradation. The market valuation reflects the essential role these chemical agents play in extending the lifespan and maintaining the aesthetic and structural integrity of industrial products and infrastructure, minimizing premature replacement costs and ensuring product quality compliance across global supply chains. Furthermore, stringent regulations governing material durability and sanitation standards in public infrastructure and consumer goods necessitate the integration of highly efficacious antifungal agents, thereby underpinning the financial trajectory and overall market volume growth.

Industrial Antifungal Market introduction

The Industrial Antifungal Market encompasses the production, distribution, and utilization of specialized chemical compounds designed to inhibit the growth of fungi, molds, and mildews on manufactured goods, materials, and process fluids. These biocide agents, ranging from azoles and organosulfurs to highly effective iodopropynyl butylcarbamate (IPBC) formulations, are crucial for protecting industrial assets from biodegradation and biofouling. Their primary applications span highly diverse industries, including the preservation of paints and coatings, textiles, wood, leather, plastics, adhesives, and various construction materials, ensuring that materials retain their functional properties, appearance, and structural integrity throughout their intended lifecycle. The critical benefit of utilizing industrial antifungals is the significant extension of product longevity, prevention of costly failures, and maintenance of hygienic standards, especially in moisture-prone environments where microbial activity is rampant. This protective capability is a foundational requirement for quality control in many manufacturing processes globally.

The global demand for superior antifungal solutions is fundamentally propelled by several macro-environmental factors. Rapid urbanization and the corresponding surge in construction activities, especially in the developing economies of Asia Pacific and Latin America, intensify the need for durable building materials resistant to tropical bio-attack. Simultaneously, the increasing awareness regarding indoor air quality and the adverse health effects associated with mold growth in residential and commercial spaces push manufacturers toward incorporating higher concentrations of effective industrial antifungals into construction components and finished consumer products. The shift towards water-based paint systems, which are inherently more susceptible to microbial contamination than solvent-based alternatives, further accelerates the demand for specialized in-can and dry-film preservatives. These combined market dynamics ensure a robust and continuous demand cycle for industrial antifungal chemicals.

Driving factors also include technological advancements in fungicide chemistry, focusing on developing environmentally benign and less volatile organic compound (VOC) containing formulations that comply with evolving regulatory frameworks such as REACH in Europe and similar mandates worldwide. Manufacturers are increasingly prioritizing active ingredients that offer broad-spectrum protection at lower dosage rates, enhancing cost-effectiveness while minimizing ecological impact. The challenge of developing resistance to existing chemicals among fungal species continually forces the market to innovate and introduce novel mechanisms of action. This constant innovation loop, coupled with persistent environmental challenges like climate change leading to increased humidity and temperature fluctuations globally, solidifies the industrial antifungal market as an indispensable component of modern material science and industrial preservation practices.

Industrial Antifungal Market Executive Summary

The Industrial Antifungal Market is navigating a period of significant strategic realignment, characterized by intensified focus on sustainable chemistry and robust regional market diversification. Business trends indicate a strong move toward forward integration by key chemical producers, aiming to capture greater value by offering tailored biocide solutions and technical support specific to end-user application requirements, such as paint formulations or specialized wood coatings. Consolidation through mergers and acquisitions is a prominent feature, with larger corporations acquiring specialized antifungal producers to broaden their product portfolios, particularly in niche segments like marine antifouling or pharmaceutical intermediates. Financial strategies are pivoting towards high-margin, regulatory-compliant products, favoring potent, next-generation active ingredients over conventional, often restricted, older chemistries. The emphasis on supply chain resilience, exacerbated by recent global logistical disruptions, drives companies to establish localized production and distribution hubs, ensuring stability and timely delivery to geographically dispersed customer bases, which further optimizes operational efficiency and market responsiveness.

Regional market trends reveal Asia Pacific (APAC) as the powerhouse of growth, primarily fueled by massive infrastructure development, rapid industrialization, and favorable regulatory environments for manufacturing output, making it the largest consumption hub for industrial antifungals, especially in China and India. North America and Europe, while being mature markets, command higher revenue shares due to stringent regulatory demands that necessitate premium, high-specification products and complex formulations, such as those used in high-performance construction materials and specialized textile treatments. The European market, specifically, is highly attuned to biosafety and environmental standards, driving the rapid adoption of non-metal, halogen-free, and bio-based antifungals. Emerging markets in Latin America and the Middle East and Africa (MEA) are showing promising growth trajectories, linked directly to the expansion of their domestic construction and manufacturing sectors, creating new avenues for market penetration for global suppliers seeking diversified revenue streams.

Segmentation trends highlight the increasing dominance of specialized chemistry types, particularly the development of high-efficacy Triazole derivatives and advanced formulations of Iodopropynyl Butylcarbamate (IPBC), which offer excellent broad-spectrum efficacy in dry-film protection applications. The Paints & Coatings segment remains the largest end-use application due to the sheer volume of paint production globally and the essential need for both in-can preservation and long-term film protection against fungal attack on exterior surfaces. Conversely, the Wood Preservation segment is projected to exhibit robust CAGR, driven by the global focus on sustainable forestry and the necessity to treat engineered wood products for extended outdoor use in moisture-heavy environments. Formulations are trending toward microencapsulated liquid systems, which enhance stability, reduce leaching, and provide controlled release of the active ingredients, offering superior protection over traditional powder or bulk liquid forms and optimizing performance attributes across various industrial matrices.

AI Impact Analysis on Industrial Antifungal Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) in the industrial antifungal sector frequently center on the potential for accelerated new chemical discovery, optimization of formulation efficacy, and enhancement of manufacturing sustainability. Users often question whether AI can predict the antifungal activity of novel compounds before costly laboratory synthesis, thereby drastically reducing research and development timelines and improving the hit rate for effective biocides. There is also significant interest in AI's role in predictive maintenance within chemical production facilities, optimizing reactor conditions for higher yield synthesis of active ingredients, and ensuring consistent product quality in complex microencapsulation processes. Key concerns revolve around the ethical deployment of highly potent chemicals identified through AI and the ability of existing chemical manufacturers, often traditional enterprises, to integrate sophisticated machine learning platforms into their established research protocols and legacy production infrastructure, signaling a demand for accessible, validated AI tools tailored to biocide chemistry.

AI is poised to revolutionize the industrial antifungal landscape by shifting the paradigm from iterative, trial-and-error chemistry to precision material science. Machine learning algorithms, fed vast datasets of chemical structures, efficacy profiles, and toxicity data, are now capable of rapidly screening billions of potential molecules to identify candidates with optimal broad-spectrum antifungal properties and low mammalian toxicity. This computational approach drastically cuts the time and cost associated with synthesizing and testing ineffective compounds, enabling companies to swiftly bring superior, next-generation biocides to market, particularly those targeting emerging resistant fungal strains. The implementation of AI is not merely confined to discovery; it extends deep into product development where algorithms optimize solvent ratios, surfactant requirements, and particle sizes in complex formulations to maximize stability, environmental performance, and sustained release characteristics, leading to highly customized and efficient products.

Furthermore, the integration of AI-powered analytics into manufacturing operations enhances operational efficiencies and ensures regulatory compliance on an unprecedented scale. AI systems monitor real-time sensor data from production lines—measuring pH levels, temperature, and concentration gradients—to predict and preempt quality deviations during the synthesis of active ingredients. This capability minimizes batch failures, reduces waste generation, and lowers energy consumption, aligning with global sustainability mandates. For end-users, AI algorithms can process environmental data (humidity, temperature, substrate type) to recommend the exact dosage and specific type of antifungal agent needed for optimal protection in applications like façade coatings or timber treatment, moving away from generalized recommendations to highly prescriptive and effective solutions, thus delivering significant value addition across the entire supply chain.

- AI accelerates the discovery and design of novel antifungal compounds through predictive modeling and virtual screening, reducing R&D cycles.

- Machine learning optimizes industrial formulation parameters, enhancing biocide stability, dispersibility, and controlled-release mechanisms.

- Predictive analytics minimizes manufacturing defects and optimizes synthesis yield for active ingredients, improving cost efficiency and sustainability.

- AI-driven sensor data analysis supports predictive maintenance in production facilities, preventing unplanned downtime.

- Algorithm-based consultation provides precise dosage recommendations for end-users based on specific environmental and substrate variables.

- AI models analyze resistance development trends in fungal strains, guiding the development of cross-resistance-free compounds.

DRO & Impact Forces Of Industrial Antifungal Market

The trajectory of the Industrial Antifungal Market is shaped by a confluence of influential driving factors, stringent restraints, and significant opportunities, which collectively define the competitive and regulatory landscape. A primary driver is the pervasive and growing issue of biological degradation across diverse materials, exacerbated by global warming trends that favor fungal proliferation in temperate and tropical zones. The persistent need to protect valuable assets—from housing infrastructure and textiles to sophisticated electronics—from mold and mildew attack creates a non-negotiable demand for effective preservation chemicals. This is strongly reinforced by mandatory public health standards and quality expectations from consumers and industrial purchasers alike, demanding product longevity and indoor air quality assurances. Simultaneously, the market benefits from rapid technological shifts, including the increasing penetration of water-based paint formulations which, due to their higher moisture content, require robust in-can and dry-film protection, thereby increasing the consumption volume of specialized biocides.

However, the market faces considerable restraints, predominantly centered around increasingly stringent and complex governmental regulations concerning the registration, handling, and use of biocidal products, exemplified by the European Union’s Biocidal Products Regulation (BPR). Regulatory pressure forces manufacturers to undertake costly and time-consuming testing to prove both efficacy and safety, often leading to the withdrawal of cost-effective, but environmentally sensitive, conventional active ingredients. Public concern and media scrutiny regarding chemical residues, VOC emissions, and potential ecological toxicity also restrict the use of certain high-efficacy compounds, forcing a perpetual cycle of reformulation and ingredient substitution. Furthermore, the inherent risk of fungal species developing resistance to commonly used chemical classes necessitates constant R&D investment, posing a financial burden and an operational challenge for market participants striving to maintain the efficacy of their product lines in the long term.

Despite these challenges, substantial opportunities exist, particularly in the realm of green and sustainable chemistry. The burgeoning development and commercialization of bio-based antifungals derived from natural sources, such as plant extracts and microbial metabolites, present a compelling alternative to traditional synthetic chemicals, offering lower environmental impact and better consumer acceptance. The rapidly expanding field of material science offers opportunities for integrating antifungal properties directly into polymer matrices or surface structures via nanotechnology, leading to permanent protection without the need for high chemical leaching rates. Moreover, the vast, under-served markets in emerging economies, where construction and textile manufacturing are booming and regulatory oversight is still evolving, offer significant expansion potential for established market leaders capable of providing cost-efficient and broadly applicable preservation solutions, thereby ensuring a strong foundation for future growth and product diversification.

Segmentation Analysis

The Industrial Antifungal Market is systematically segmented across various dimensions, primarily categorized by the specific type of chemical active ingredient, the formulation state, and the end-use application industry, allowing for precise market analysis and targeted strategic planning. Segmentation by Type reflects the core chemical composition and mechanism of action, with major classes including Triazoles, which are known for high efficacy and durability in dry-film protection; IPBC, favored for its broad-spectrum performance in paints and wood; and Quaternary Ammonium Compounds (QACs), often utilized for surface disinfection and milder preservation requirements. This categorization is crucial as regulatory approval and efficacy profiles vary significantly between these chemical groups, dictating their suitability for specific applications and geographical markets. The diverse performance requirements across different industrial sectors necessitate this highly granular approach to segmentation, ensuring that specialized demand is met with chemically appropriate supply.

Segmentation by Application is arguably the most critical dimension, revealing the major consumption drivers and revenue centers. Paints and Coatings represent the dominant application segment, demanding both in-can preservation (to protect the liquid formulation) and dry-film protection (to preserve the painted surface). High growth is observed in the construction sector, particularly in materials like drywall and concrete additives designed to prevent structural mold growth. Similarly, the Wood Preservation segment is vital, focusing on industrial treatments to protect lumber and engineered wood products from rot and fungal decay in outdoor or structural environments. The variety in end-use environments, ranging from high-humidity textile manufacturing to sterile pulp and paper processing, requires antifungals formulated to withstand specific industrial conditions like high shear mixing, UV exposure, or alkaline pH levels, further delineating market needs.

Finally, segmentation by Formulation—Liquid, Powder, or Solid (e.g., granules or concentrates)—reflects how the antifungal agent is prepared for integration into the final manufactured product. Liquid formulations are the most widely used, offering ease of incorporation and homogenous dispersion, particularly in aqueous systems like water-based paints and industrial fluids. Powder formulations are preferred in dry blending processes, such as cement additives or certain textile finishes, requiring excellent stability and shelf life. The trend is moving towards enhanced, often proprietary, formulations like microencapsulated systems, which provide superior handling safety, reduced volatilization, and sustained protective efficacy, representing the technological future of market offerings and addressing growing concerns about operator safety and environmental leaching.

- By Type:

- Triazoles (e.g., Azoles)

- Iodopropynyl Butylcarbamate (IPBC)

- Quaternary Ammonium Compounds (QACs)

- Organosulfurs

- Phenolics

- Others (Inorganics, Natural Extracts)

- By Application:

- Paints & Coatings (In-can and Dry-film preservation)

- Construction Materials (Concrete additives, Drywall)

- Textiles (Industrial fabrics, Carpets)

- Pulp & Paper

- Wood Preservation

- Leather and Footwear

- Plastics and Polymers

- Adhesives and Sealants

- Industrial Water Treatment

- By Formulation:

- Liquid Formulations (Dispersions, Solutions)

- Powder Formulations

- Solid Formulations (Concentrates, Pellets)

Value Chain Analysis For Industrial Antifungal Market

The value chain for the industrial antifungal market is complex, beginning with the upstream sourcing of specialized raw chemical intermediates and culminating in the highly specialized distribution and application within specific end-user manufacturing processes. The upstream phase is dominated by petrochemical companies and large chemical synthesis enterprises that supply foundational building blocks such as iodine derivatives, amines, various alcohols, and specialized heterocyclic compounds required for synthesizing complex active ingredients like IPBC, Triazoles, and biocidal polymers. Efficiency and cost optimization at this stage depend heavily on stable commodity pricing and secure long-term supply agreements with key suppliers, as any fluctuation in raw material availability or cost directly impacts the final product pricing and market competitiveness. Manufacturers must navigate intricate global supply chains for these specialty chemicals, often sourcing intermediates from diverse geographical regions.

The middle segment of the chain involves the core manufacturing and formulation expertise. This phase encompasses the high-purity synthesis of the active antifungal ingredient, followed by its conversion into a marketable formulation (e.g., microemulsions, stabilized aqueous dispersions, or powders). This step requires highly specialized chemical engineering, rigorous quality control, and adherence to strict manufacturing practices to ensure product efficacy, stability, and regulatory compliance. Companies heavily invest in proprietary formulation technologies, such as microencapsulation or controlled-release systems, to differentiate their offerings and provide enhanced performance attributes, leading to superior material protection and reduced environmental impact compared to generic alternatives. Intellectual property rights surrounding these advanced formulations are a critical source of competitive advantage.

Downstream activities involve the distribution channel and eventual integration by the end-user. Distribution primarily utilizes a hybrid model: direct sales channels for very large industrial customers (e.g., major international paint manufacturers or large wood treating facilities) who require tailored technical support, and indirect sales through a vast network of specialized chemical distributors and regional agents. These distributors play a vital role in local stocking, regulatory navigation, and providing smaller-volume packaging, serving mid-to-small-sized enterprises across diverse application fields. Success at the downstream level hinges on deep application knowledge, efficient logistics, and the ability to provide robust technical support to ensure the antifungal agent is correctly integrated into the complex matrix of the final product, optimizing both efficacy and cost-in-use for the ultimate industrial purchaser.

Industrial Antifungal Market Potential Customers

The potential customer base for the Industrial Antifungal Market is expansive and highly diversified, spanning multiple sectors where material degradation due to fungal growth poses both aesthetic and structural risks. The largest and most consistent buyers are companies within the Paints and Coatings industry, encompassing manufacturers of architectural paints, protective coatings for marine and industrial assets, and specialty finishes. These customers rely heavily on industrial antifungals for two distinct purposes: preserving the wet paint (in-can preservation) to ensure shelf stability and protecting the applied dry film on substrates (dry-film preservation) for guaranteed product longevity against weathering and bio-attack. The continuous production cycle and high volume of output from global paint companies ensure they remain the anchor customers for the industrial biocide market.

Another crucial segment of buyers resides in the Construction and Building Materials sector. This includes manufacturers of engineered wood products (plywood, OSB), gypsum boards, concrete additives, roof membranes, and sealants. As modern construction trends prioritize sustainability and long-term durability, these materials must be treated to resist mold and mildew, particularly in humid climates or areas prone to water intrusion, preventing structural failure and mitigating risks associated with sick building syndrome. The requirement for construction materials to meet stringent fire safety and durability standards often complements the necessity for anti-microbial treatment, positioning these manufacturers as essential buyers focused on high-performance, long-lasting antifungal solutions that can withstand the rigors of construction environment and structural lifespan.

Furthermore, significant demand originates from the Textile, Leather, and Paper industries. Textile manufacturers, particularly those producing industrial fabrics, outdoor gear, carpets, and non-woven materials, integrate antifungals to prevent rot, odor, and discoloration caused by mildew, essential for product quality and hygiene. Pulp and Paper mills require biocides to control slime and biofouling within their process water systems, which affects paper machine efficiency and final product quality. These customers are highly sensitive to regulatory approval, demanding products that are safe for human contact and compliant with effluent discharge limitations, driving them toward advanced, low-toxicity, and highly targeted preservation systems, forming a distinct purchasing profile focused on compliance and environmental safety alongside functional performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Lonza Group, Troy Corporation, Lanxess AG, The Dow Chemical Company, Clariant AG, AkzoNobel N.V., Thor Specialties, Inc., Koppers Inc., Vertellus Holdings LLC, Merck KGaA, Vink Chemicals GmbH & Co. KG, Sani-Chem International, ISK Biosciences Corporation, Remedial Technologies Inc., Archroma, Kemira, Nippon Paint Holdings Co. Ltd., Shandong Dacheng Pesticide Co. Ltd., Hangzhou Bayee Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Antifungal Market Key Technology Landscape

The industrial antifungal market is characterized by continuous technological innovation, primarily driven by the need to enhance efficacy, improve safety profiles, and comply with strict environmental mandates. One of the most significant technological advancements is the refinement and widespread adoption of microencapsulation techniques. This technology involves enclosing the active antifungal ingredient within a polymeric shell, forming particles typically ranging from several hundred nanometers to a few micrometers. Microencapsulation offers multiple advantages: it protects the active ingredient from degradation during high shear mixing or storage, improves handling safety for industrial workers by reducing exposure, and most importantly, facilitates controlled or sustained release. This sustained-release mechanism ensures that the biocide is released slowly over the product's lifespan, providing longer-term dry-film protection in applications like exterior paints and coatings, optimizing performance while reducing the required dosage concentration and minimizing leaching into the environment.

Another pivotal area of research focuses on developing novel active ingredients with alternative mechanisms of action to combat the growing resistance of fungal species to conventional chemistries, particularly Triazoles. This involves exploring non-metal-based, environmentally benign compounds and bio-inspired materials, such as specific plant-derived oils, natural extracts, or synthesized peptides that disrupt fungal cell walls or metabolic pathways in a different manner than traditional biocides. The goal is to create "green" antifungals that possess high selective toxicity towards fungi while exhibiting low toxicity towards humans and the ecosystem. Furthermore, nanotechnology is being explored to create fungicidal surfaces. By incorporating nanomaterials like silver or zinc oxide into coatings or polymers, manufacturers can create surfaces that inherently resist microbial attachment and growth, offering a permanent and durable solution without the issue of chemical leaching over time. This push towards intrinsic protection represents a major paradigm shift.

The digitization of formulation science, leveraging Artificial Intelligence (AI) and High-Throughput Screening (HTS), is rapidly becoming a standard technological tool within leading companies. HTS allows chemical manufacturers to test thousands of potential compounds simultaneously against a panel of challenging fungal species, vastly accelerating the screening process. Combined with AI-driven predictive modeling, researchers can quickly identify optimal structure-activity relationships, predict environmental fate, and streamline the path to successful commercialization. This technological convergence ensures that new, compliant, and highly effective antifungals can be developed and introduced swiftly to address both persistent and emerging industrial bio-contamination challenges, securing the long-term effectiveness of industrial preservation strategies worldwide and maintaining the high-performance expectations of end-user industries.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the dominant region in terms of volume consumption and the highest growth potential, driven by rapid industrialization, massive infrastructure projects in countries like China, India, and Southeast Asia, and high humidity levels endemic to the region. The proliferation of manufacturing bases for textiles, paints, and construction materials ensures a continuous, high-volume demand for antifungals. The market here is characterized by a balance between cost-effectiveness and increasing regulatory sophistication, particularly as regional standards align more closely with European and North American mandates.

- North America: This region represents a highly mature and high-value market, characterized by stringent environmental and safety regulations, particularly concerning VOC emissions and the handling of biocides. Demand is consistently strong across residential and commercial construction, driven by public awareness of mold-related health issues (sick building syndrome). The market favors premium, specialized formulations, including encapsulated systems and high-efficacy, low-toxicity products that meet strict compliance standards set by the EPA and regional bodies, leading to higher average selling prices.

- Europe: The European market is defined by the rigorous Biocidal Products Regulation (BPR), which mandates exhaustive testing and registration for all active ingredients, significantly influencing product portfolios. This regulatory environment drives innovation towards sustainable, ecologically preferred solutions, accelerating the adoption of bio-based and non-metal alternatives. Germany, France, and the UK are major consumption centers, with strong demand from the coatings, wood preservation, and textile industries, maintaining a steady, albeit slower, growth rate compared to APAC.

- Latin America (LATAM): LATAM is an emerging high-growth market, primarily fueled by urbanization and infrastructure spending, particularly in Brazil and Mexico. The region's tropical climate exacerbates material degradation, leading to a critical need for durable preservation solutions in coatings and construction materials. While price sensitivity is often higher here, the adoption of international quality standards is increasing, opening opportunities for suppliers of robust, broad-spectrum antifungals tailored for high-moisture environments.

- Middle East and Africa (MEA): This region is witnessing steady growth, largely dependent on major infrastructure and real estate developments in the Gulf Cooperation Council (GCC) countries and increased manufacturing activity in parts of Africa. Although water scarcity limits some biofouling applications, the demand for antifungals in paints, protective coatings for oil and gas infrastructure, and structural materials remains essential due to localized high-humidity conditions and the necessity for long-term material protection in extreme heat environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Antifungal Market.- BASF SE

- Lonza Group

- Troy Corporation

- Lanxess AG

- The Dow Chemical Company

- Clariant AG

- AkzoNobel N.V.

- Thor Specialties, Inc.

- Koppers Inc.

- Vertellus Holdings LLC

- Merck KGaA

- Vink Chemicals GmbH & Co. KG

- Sani-Chem International

- ISK Biosciences Corporation

- Remedial Technologies Inc.

- Archroma

- Kemira

- Nippon Paint Holdings Co. Ltd.

- Shandong Dacheng Pesticide Co. Ltd.

- Hangzhou Bayee Chemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Industrial Antifungal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the growth of the Industrial Antifungal Market?

The key drivers include accelerated global construction and manufacturing activities, the pervasive necessity to protect materials against biological degradation in high-humidity climates, and the industry-wide shift toward water-based coating formulations, which inherently require robust biocide protection for long-term efficacy and shelf stability, coupled with increasingly stringent material longevity standards.

How is regulatory pressure impacting the development of new industrial antifungals?

Regulatory frameworks such as the EU's Biocidal Products Regulation (BPR) are profoundly impacting the market by increasing the cost and complexity of product registration, leading to the phase-out of certain conventional chemicals. This pressure forces manufacturers to heavily invest in R&D for safer, next-generation, environmentally favorable active ingredients, such as IPBC variants and bio-based antifungals, that offer both high efficacy and low ecotoxicity profiles.

Which application segment holds the largest share in the industrial antifungal market?

The Paints & Coatings segment consistently holds the largest market share. This dominance is attributable to the massive global production volume of architectural and industrial coatings, which require dual protection: in-can preservation to prevent spoilage during storage and dry-film protection to prevent mold and mildew growth on exterior and interior painted surfaces over the product's entire service life.

What technological advancements are shaping the future of industrial antifungal products?

The future is being shaped by advanced formulation technologies, notably microencapsulation, which provides controlled release and enhanced durability while improving safety. Furthermore, the integration of Artificial Intelligence for accelerated compound discovery and the development of sustainable, non-metal-based, and bio-inspired active ingredients are key technological trends driving innovation toward superior, compliant products.

How significant is the role of Asia Pacific in the global industrial antifungal consumption?

Asia Pacific is the most critical region for market consumption and growth due to its extensive manufacturing base across textiles, construction, and petrochemicals, coupled with tropical climatic conditions that necessitate high levels of material preservation. High rates of urbanization and infrastructure development in economies like China and India sustain the region's position as the leading volume driver globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager