Industrial Biomass Boiler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433060 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Industrial Biomass Boiler Market Size

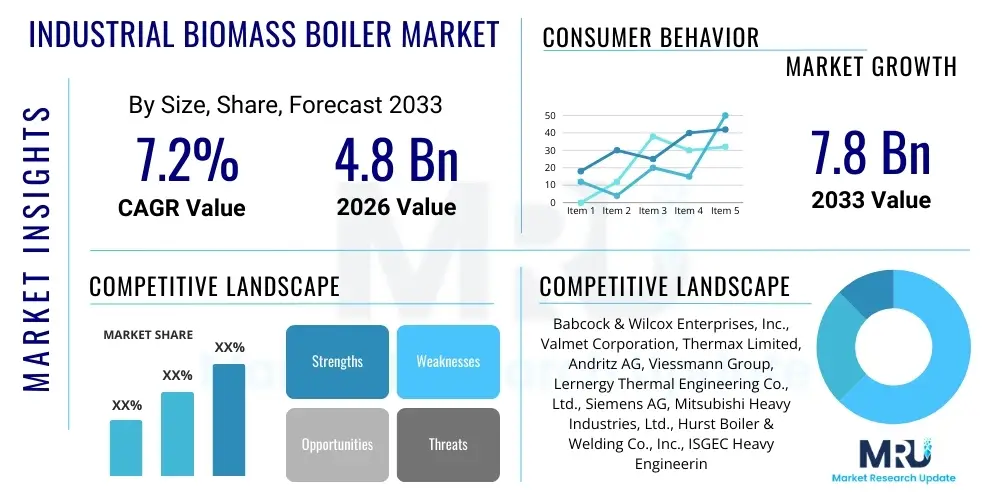

The Industrial Biomass Boiler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033.

Industrial Biomass Boiler Market introduction

The Industrial Biomass Boiler Market involves the manufacturing, deployment, and maintenance of combustion systems designed to convert organic matter (biomass) into thermal energy, typically steam or hot water, for large-scale industrial processes. These systems are critical components in the global transition toward sustainable energy sources, offering a carbon-neutral alternative to fossil fuels. Biomass boilers serve various high-demand sectors, including pulp and paper, textiles, food and beverage, and decentralized power generation, where a reliable and substantial supply of process heat is essential.

Product descriptions range from small packaged units designed for specific industrial sites to massive utility-scale installations utilizing complex fluidized bed or grate technologies. Key offerings include hot water boilers, steam boilers (low pressure and high pressure), and thermal oil boilers, segmented primarily by capacity and the type of biomass fuel handled (e.g., wood pellets, agricultural residues, forestry waste, municipal solid waste fractions). The core benefit of these systems lies in their ability to monetize waste streams, reduce reliance on volatile natural gas or coal prices, and significantly lower net greenhouse gas emissions.

Major applications span process heat requirements, space heating for large industrial complexes, and combined heat and power (CHP) generation, which maximizes energy efficiency. Driving factors for market expansion include stringent global emissions regulations (such as those imposed by the EU Green Deal and national carbon pricing schemes), increasing corporate sustainability mandates (ESG goals), and governmental subsidies aimed at accelerating renewable heat deployment. This combination of regulatory push and economic viability is fundamentally reshaping the industrial energy landscape.

Industrial Biomass Boiler Market Executive Summary

The Industrial Biomass Boiler Market is characterized by robust growth, driven primarily by favorable regulatory policies supporting decarbonization efforts across developed and rapidly industrializing economies. Business trends indicate a strong shift towards modular and containerized boiler solutions that offer faster deployment times and reduced capital expenditure, particularly appealing to medium-sized enterprises seeking immediate returns on sustainability investments. Furthermore, there is an increasing trend in merging traditional boiler manufacturing with advanced digitalization, focusing on enhancing combustion efficiency and implementing predictive maintenance schedules to minimize operational downtime and optimize fuel consumption. Key market participants are aggressively pursuing strategic mergers and acquisitions to consolidate technological expertise, particularly in sophisticated air pollution control systems and advanced fuel handling mechanisms necessary for diverse biomass sources.

Regionally, Europe continues to dominate the market, anchored by mature biomass supply chains and ambitious renewable energy targets; however, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by rapid industrial expansion in countries like China and India and governmental initiatives promoting energy security through domestic resource utilization (e.g., agricultural residue utilization). North America shows steady adoption, primarily driven by the pulp and paper and wood product sectors, benefiting from abundant forestry residues. The growth trajectory is further reinforced by the development of standardized biomass fuel quality standards, which mitigates historical concerns regarding inconsistent energy output and boiler performance.

Segment trends reveal that the <50 MW capacity segment maintains the largest market share due to widespread applicability across diverse industrial end-users, while the fluidized bed combustion (FBC) technology segment is expected to witness accelerated adoption owing to its flexibility in handling low-grade and highly variable biomass fuels efficiently. The food and beverage, chemicals, and pharmaceutical industries are emerging as crucial end-user segments, demanding high-pressure steam for sterilization and processing. These segments prioritize reliability and precise temperature control, driving innovation in boiler automation and control systems that can quickly adapt to fluctuating loads and input moisture levels, thereby sustaining the overall upward momentum of the market.

AI Impact Analysis on Industrial Biomass Boiler Market

User queries regarding the impact of Artificial Intelligence (AI) on the Industrial Biomass Boiler Market typically center on three core themes: optimization, prediction, and integration. Users frequently ask how AI algorithms can stabilize combustion when fuel quality (moisture content, calorific value) is inconsistent, which is a perennial challenge in biomass utilization. There is significant interest in using machine learning (ML) to predict component failure rates (e.g., refractory lining, heat exchanger fouling) before they occur, thus moving beyond standard preventive maintenance to true predictive maintenance. Finally, users seek clarification on how AI tools integrate with existing legacy control systems (DCS/PLC) to provide real-time operational adjustments, ensuring compliance with strict emission standards (NOx, CO) while maximizing thermal efficiency.

AI is transforming boiler operations by creating self-optimizing combustion environments. Machine learning models, trained on vast datasets of operational parameters (flue gas composition, temperature profiles, air flow rates), can instantly calculate and adjust primary, secondary, and tertiary air injections and grate movement. This capability allows the boiler to maintain peak thermal efficiency despite fluctuations in the inherent properties of the biomass feed, minimizing incomplete combustion and reducing fuel waste. This intelligent control surpasses the capabilities of traditional PID controllers, leading to higher steam quality and lower operational variability, directly addressing the industry's need for reliability comparable to fossil fuel systems.

Furthermore, AI-driven predictive analytics significantly extends the lifespan of critical boiler components and dramatically reduces unplanned downtime. By analyzing sensor data, vibration patterns, and historical maintenance logs, AI algorithms identify subtle anomalies indicative of impending failure. This insight enables plant operators to schedule interventions precisely when needed, rather than relying on fixed time intervals. Integrating AI into the overall energy management system also facilitates better load balancing, particularly in CHP installations, optimizing the distribution between thermal energy production and electrical generation based on real-time grid demands and internal process requirements, thus maximizing profitability and operational resilience.

- AI optimizes fuel-air ratio control for highly variable biomass inputs, increasing thermal efficiency by up to 3%.

- Predictive maintenance (PdM) using ML models reduces unscheduled downtime by forecasting component failure, particularly in soot blowers and feed systems.

- AI-powered emission control ensures dynamic adherence to stringent environmental limits by adjusting combustion parameters in real-time.

- Integration of Digital Twin technology, supported by AI, allows for simulation of operational changes before deployment, minimizing risk.

- Automation of fuel logistics and supply chain optimization based on geospatial and historical consumption data.

- Enhancement of operator training through AI-driven simulation platforms reflecting actual plant dynamics.

DRO & Impact Forces Of Industrial Biomass Boiler Market

The Industrial Biomass Boiler Market expansion is fundamentally propelled by the combined forces of environmental mandates and escalating energy costs, while simultaneously being constrained by infrastructure challenges related to fuel sourcing. The primary driver is the global imperative for industrial decarbonization, encapsulated in binding climate agreements and national renewable heat incentives, which make biomass adoption economically attractive over conventional fossil fuels, particularly in regions lacking accessible geothermal or abundant solar thermal options. Opportunities are emerging in the sphere of bioenergy with carbon capture and storage (BECCS), which positions biomass boilers not just as a carbon-neutral solution but potentially as a carbon-negative technology, drawing significant governmental and private investment interest in pilot and commercial deployments across mature markets.

Restraints largely revolve around the logistics and standardization of biomass supply. Inconsistent feedstock quality—specifically high moisture content and varying ash characteristics—complicates boiler design and increases maintenance requirements, driving up operational expenses. Furthermore, the ‘food vs. fuel’ debate and concerns about sustainable sourcing of forestry products pose regulatory and public relations challenges, necessitating robust certification schemes (e.g., FSC or SBP) to maintain market credibility. The high initial capital expenditure (CapEx) required for industrial biomass systems, compared to often cheaper, readily installed natural gas alternatives, remains a barrier, especially for smaller industrial operators who struggle to secure long-term financing without substantial subsidies.

The core impact forces shaping market trajectory include technological advancement in gasification and pyrolysis techniques, which transform challenging biomass feedstocks into higher-value syngas or bio-oil, enhancing energy efficiency and reducing emissions profiles compared to direct combustion. Simultaneously, the force of regulatory enforcement, particularly in Europe and parts of North America, compels early adoption, whereas the market penetration in emerging economies is driven more by the economic imperative to utilize domestic agricultural waste streams, thereby creating a decentralized energy infrastructure. Successfully navigating the complex interplay between sustainable sourcing, competitive CapEx, and operational efficiency through digitalization will determine the long-term success of stakeholders in this capital-intensive sector.

Segmentation Analysis

The Industrial Biomass Boiler Market is extensively segmented across several critical dimensions, allowing for precise targeting and technological adaptation to diverse industrial needs. Segmentation by fuel type reflects the geographic availability and specific properties of the biomass resource, influencing boiler design characteristics such as grate type and feeding systems. The capacity segmentation dictates whether the installation serves localized process heat needs (small and medium capacity) or large-scale utility/CHP applications (high capacity). Technology segmentation distinguishes between mature combustion methods and emerging thermal conversion processes that offer enhanced efficiency and reduced emissions footprints.

The end-user segmentation reveals the heterogeneous demand structure, with the pulp and paper industry historically being the largest consumer due to its inherent availability of wood waste (black liquor, bark) as a byproduct fuel source. Conversely, the food and beverage industry demands smaller, cleaner systems for hygiene-critical steam generation. Geographic segmentation highlights divergent regulatory environments and biomass availability patterns; for example, North American segmentation emphasizes wood pellets and forestry residues, while Asian segmentation prioritizes bagasse and rice husk utilization.

Analyzing these segments provides strategic insights; for instance, the rapid growth expected in the agricultural waste fuel segment mandates boiler designs that can manage high ash content and minimize slagging, driving demand for specialized traveling grate or fluidized bed boilers. Similarly, the high-pressure steam requirement within the chemicals segment mandates robust construction and precise control systems, contrasting with the simpler hot water requirements often seen in district heating applications. This complex segmentation ensures manufacturers tailor products not only for efficiency but also for resilience against specific regional biomass supply chain characteristics.

- By Fuel Type:

- Wood Pellets

- Agricultural Residues (Bagasse, Rice Husk, Straw)

- Forestry Waste (Bark, Chips, Sawdust)

- Energy Crops (Miscanthus, Switchgrass)

- Municipal Solid Waste (MSW) Fraction/Refuse Derived Fuel (RDF)

- By Capacity:

- Up to 10 MW

- 10 MW to 50 MW

- Above 50 MW

- By Technology:

- Stoker Boilers (Traveling Grate, Vibrating Grate)

- Fluidized Bed Combustion (FBC) Boilers

- Pulverized Fuel Boilers

- Gasification and Pyrolysis Systems (Emerging)

- By End-Use Industry:

- Pulp & Paper

- Food & Beverage

- Chemicals & Petrochemicals

- Textiles

- Wood Products & Furniture

- Power Generation (Utility and Decentralized CHP)

- Pharmaceuticals

Value Chain Analysis For Industrial Biomass Boiler Market

The value chain for the Industrial Biomass Boiler Market begins with the upstream sourcing of feedstock, which is arguably the most complex segment due to the decentralized and varied nature of biomass supply. This upstream process involves harvesting, collection, processing (drying, chipping, pelletizing), and establishing certification trails to ensure sustainability. Key players here include forestry companies, agricultural cooperatives, specialized waste management firms, and pellet manufacturers. Efficient logistics—transportation from often remote harvesting sites to the industrial plant—are critical, as the low energy density of raw biomass significantly impacts transportation costs. Optimization efforts in this stage focus on densification (pelletizing) to reduce logistical footprints and costs.

The intermediate stage encompasses the core manufacturing process, involving boiler design, material sourcing (steel, refractory materials, heat exchange components), fabrication, and integration of sophisticated control systems. This stage is dominated by large, established boiler manufacturers and specialized engineering, procurement, and construction (EPC) firms. Technological expertise in thermal efficiency, emissions control (e.g., flue gas treatment, ESPs), and robust material science capable of handling corrosive ash residues is paramount. Research and Development investment is heavily concentrated here, focusing on improving the flexibility of systems to handle diverse fuel mixes without compromising performance.

The downstream distribution channel involves direct sales from manufacturers to large industrial customers (e.g., pulp mills) or through specialized distributors and agents targeting smaller enterprises. Post-installation, the value chain extends significantly into long-term operations and maintenance (O&M), including fuel supply contracting, performance monitoring, spare parts provision, and digital services such as remote monitoring and AI-driven performance optimization. The trend is moving towards performance-based contracts, where manufacturers or specialized service providers guarantee uptime and efficiency targets, solidifying their role throughout the operational lifespan of the industrial asset.

Industrial Biomass Boiler Market Potential Customers

The primary consumers (End-Users/Buyers) of industrial biomass boiler systems are industries with high, continuous process heat demands and readily available or easily sourced biomass feedstock. The Pulp & Paper sector remains the anchor customer base globally, using high volumes of steam for drying, bleaching, and manufacturing processes, often leveraging their own waste streams (black liquor, bark, sludge) to achieve nearly closed-loop energy systems. These organizations require large-capacity (>50 MW) high-pressure steam boilers and prioritize operational integration and fuel flexibility.

A rapidly expanding customer base includes the Food & Beverage industry, encompassing breweries, sugar mills, dairies, and meat processing plants. These facilities require reliable, clean steam for sterilization, cooking, and pasteurization. Sugar mills, in particular, are substantial users of bagasse-fueled boilers, representing significant decentralized energy producers. Their requirements generally focus on medium capacity (10-50 MW) installations that adhere to strict hygiene and regulatory standards regarding steam purity and emissions, driving demand for optimized, cleaner combustion technologies.

Further potential customers are found in the district heating sector and independent power producers (IPPs) focused on Combined Heat and Power (CHP) generation, particularly in Europe and East Asia. These entities purchase high-capacity, highly efficient systems designed to maximize both electrical output and thermal heat supply to urban grids. Other key segments include chemical manufacturing, where steam is used as a critical process fluid and reactant, and the textile industry, which utilizes steam for dyeing and finishing processes. For all these customers, the long-term total cost of ownership (TCO) calculation, factoring in volatile fossil fuel prices and carbon tax implications, is the primary driver for switching to biomass solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Babcock & Wilcox Enterprises, Inc., Valmet Corporation, Thermax Limited, Andritz AG, Viessmann Group, Lernergy Thermal Engineering Co., Ltd., Siemens AG, Mitsubishi Heavy Industries, Ltd., Hurst Boiler & Welding Co., Inc., ISGEC Heavy Engineering Ltd., Hoval AG, GETABEC Public Company Limited, Prodesa Medioambiente S.L., DP CleanTech, E&E Co., Ltd., Foster Wheeler (Amec Foster Wheeler/Wood Group), Aalborg Energie Technik a/s (AET), Atlas Copco, Polytechnik Biomass Energy GmbH, and Vyncke. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Biomass Boiler Market Key Technology Landscape

The industrial biomass boiler technology landscape is dominated by three mature thermal conversion methods: stoker combustion, fluidized bed combustion (FBC), and, increasingly, advanced gasification systems. Stoker boilers, specifically traveling grate and vibrating grate types, represent the most established technology, valued for their robustness and ability to handle consistent, low-to-medium moisture fuels like wood chips and pellets. Innovations in stoker design focus on optimizing the primary and secondary air distribution and grate cooling to minimize clinker formation and reduce NOx emissions, maintaining their relevance for medium-capacity installations requiring high reliability.

Fluidized Bed Combustion (FBC) technologies (both bubbling fluidized bed (BFB) and circulating fluidized bed (CFB)) are pivotal for handling challenging, high-variability biomass feedstock, including agricultural residues with high ash content and low calorific value, and refuse-derived fuel (RDF). FBC excels due to its high heat transfer rates and ability to maintain stable temperatures, which is crucial for reducing emissions and enabling fuel flexibility. Recent advancements in FBC focus on optimizing bed material composition and height to further improve sulfur capture and reduce erosion, making them the preferred choice for large-scale (>50 MW) industrial and utility applications globally.

Emerging technologies, particularly biomass gasification and fast pyrolysis, are gaining traction by converting solid biomass into cleaner, gaseous (syngas) or liquid fuels (bio-oil) before combustion. Gasification offers the advantage of superior emission control and higher thermal efficiency when integrated into gas turbines or combined cycle systems (IGCC-Biomass), providing a pathway for highly efficient decentralized power generation. Although capital-intensive, the ability of gasifiers to produce high-quality process heat and electricity with minimal particulate matter emissions positions them as a strategic growth area, particularly in dense urban or environmentally sensitive industrial zones.

Regional Highlights

The regional dynamics of the Industrial Biomass Boiler Market are highly differentiated, driven by localized biomass availability, contrasting regulatory frameworks, and maturity levels of energy infrastructure. Europe remains the dominant market leader, primarily fueled by the European Union’s Renewable Energy Directive (RED II) and aggressive carbon pricing mechanisms. Nations like Sweden, Finland, and Germany have well-developed infrastructure for sustainable forestry and district heating networks, creating sustained demand for large-scale CHP and heat-only biomass facilities. The focus in Europe is on technological sophistication, integrating advanced automation, and optimizing existing systems for maximum efficiency and adherence to strict emission ceilings (e.g., Medium Combustion Plant Directive).

Asia Pacific (APAC) represents the fastest-growing region, driven by simultaneous industrialization and the critical need for energy security. Countries such as China and India are grappling with massive volumes of agricultural waste (rice husk, straw, sugarcane bagasse) and are increasingly deploying biomass boilers to convert these streams into essential process heat for textile mills, sugar factories, and decentralized power plants. Government initiatives promoting domestic biomass utilization to mitigate pollution from open field burning and reduce dependence on imported coal are providing strong financial incentives, leading to a surge in small-to-medium capacity installations focused primarily on robust, low-maintenance stoker technology suitable for variable, local feedstocks.

North America showcases stable growth, concentrated predominantly in the US Southeast and Canada, where the timber and pulp industries leverage abundant wood residuals. Regulatory drivers are fragmented, varying by state and province, but the overall shift towards cleaner energy and the economic advantage of utilizing waste heat in large mills drive deployment. The market demands high-capacity, integrated systems, often utilizing CFB technology, which can handle large volumes of wood waste efficiently. Latin America and the Middle East & Africa (MEA) are emerging regions; Latin America, led by Brazil, uses bagasse extensively in its sugarcane industry, while MEA faces challenges related to stable feedstock supply and investment capital, though isolated growth exists in specific industrial clusters utilizing local agricultural waste or dedicated energy crops.

- Europe: Dominant market share; driven by RED II, mature district heating networks, and high environmental compliance standards. Focus on high-efficiency CHP systems and pellet utilization.

- Asia Pacific (APAC): Highest CAGR; propelled by industrial expansion, use of agricultural waste streams (rice husk, bagasse), and governmental anti-pollution campaigns. Significant growth in China, India, and Southeast Asia.

- North America: Stable growth; large installations primarily in the pulp and paper and wood products industries. Driven by economic utilization of forestry residues and state-level incentives.

- Latin America (LATAM): Growth centered around the sugar and ethanol industry (Brazil and Mexico), relying heavily on bagasse as captive fuel.

- Middle East & Africa (MEA): Nascent market stage; localized installations primarily driven by specific agricultural processing needs, facing challenges related to supply chain stability and financing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Biomass Boiler Market.- Babcock & Wilcox Enterprises, Inc.

- Valmet Corporation

- Thermax Limited

- Andritz AG

- Viessmann Group

- Lernergy Thermal Engineering Co., Ltd.

- Siemens AG

- Mitsubishi Heavy Industries, Ltd.

- Hurst Boiler & Welding Co., Inc.

- ISGEC Heavy Engineering Ltd.

- Hoval AG

- GETABEC Public Company Limited

- Prodesa Medioambiente S.L.

- DP CleanTech

- E&E Co., Ltd.

- Foster Wheeler (Amec Foster Wheeler/Wood Group)

- Aalborg Energie Technik a/s (AET)

- Atlas Copco

- Polytechnik Biomass Energy GmbH

- Vyncke

Frequently Asked Questions

Analyze common user questions about the Industrial Biomass Boiler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary operational challenges associated with industrial biomass boilers?

The main operational challenges stem from feedstock variability, including fluctuating moisture content and ash composition, which can lead to inefficient combustion, boiler fouling, clinker formation, and increased maintenance requirements for flue gas cleaning and ash handling systems. Modern control systems utilizing AI are increasingly deployed to mitigate these instability issues.

How does the total cost of ownership (TCO) compare between biomass and fossil fuel boilers?

While industrial biomass boilers typically have a 20% to 50% higher initial capital expenditure (CapEx) compared to similarly sized natural gas boilers, the TCO over a 15-20 year operational lifespan is often lower. This is primarily due to significantly reduced or stable fuel costs (especially when using waste biomass) and revenues generated from carbon credits or renewable heat incentives, compensating for higher maintenance and CapEx.

Which biomass boiler technology is best suited for handling agricultural residues with high ash content?

Fluidized Bed Combustion (FBC) technology, specifically Circulating Fluidized Bed (CFB) boilers, is generally the best option for high-ash agricultural residues like rice husks or bagasse. FBC maintains lower, more uniform combustion temperatures, which prevents ash fusion and slagging, and allows for effective utilization of low-calorific, highly abrasive fuels.

What are the key regulatory drivers propelling the growth of the biomass boiler market in Europe?

The market in Europe is driven by the Renewable Energy Directive (RED II), which sets binding targets for renewable energy share, and the EU Emissions Trading System (ETS) coupled with the national implementation of the Medium Combustion Plant Directive (MCPD). These regulations enforce stringent emission limits and increase the financial penalty for using high-carbon fossil fuels, thereby boosting biomass adoption.

How is digitalization impacting the efficiency and maintenance of industrial biomass systems?

Digitalization leverages IoT sensors and data analytics to provide real-time performance monitoring, optimizing fuel feed rates and air flow based on immediate combustion conditions. This significantly improves thermal efficiency and reduces emissions. Crucially, it enables predictive maintenance, shifting from scheduled outages to condition-based maintenance, maximizing boiler uptime and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Biomass Boiler Market Statistics 2025 Analysis By Application (Paper and pulp, Biorefineries), By Type (Agriculture biomass, Urban residue, Woody biomass), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Biomass Boiler Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (1-10 MW, 10-25 MW, 25 - 50 MW), By Application (Pulp & Paper, Brewery, Sawmill, CHP production, Power generation, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager