Industrial Cabinet Air Conditioner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436354 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Cabinet Air Conditioner Market Size

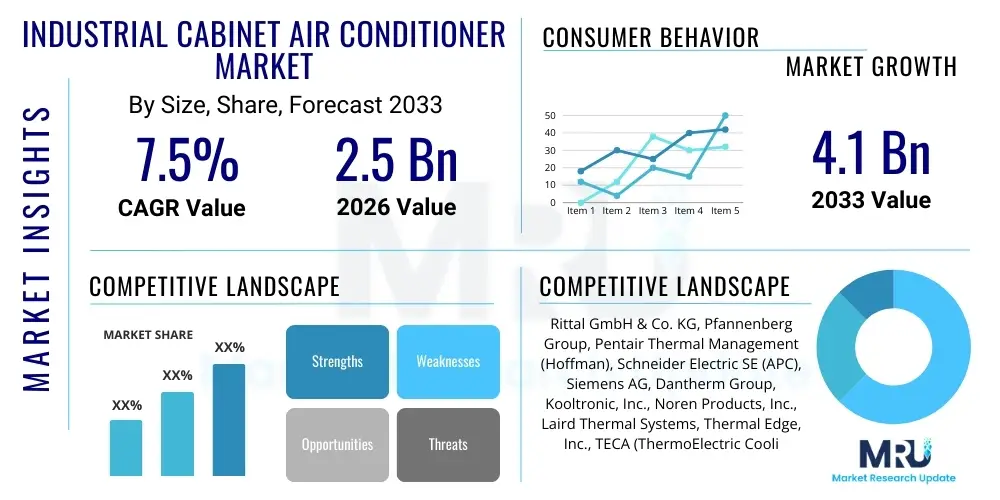

The Industrial Cabinet Air Conditioner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033. This sustained expansion is primarily fueled by the accelerating global trend of industrial automation, the proliferation of digital control systems, and the imperative requirement for robust thermal management solutions in harsh operating environments across sectors like manufacturing, telecommunications, and energy infrastructure.

Industrial Cabinet Air Conditioner Market introduction

The Industrial Cabinet Air Conditioner Market encompasses specialized thermal management systems designed to maintain precise temperature and humidity levels within electronic enclosures, control panels, and server cabinets used in industrial settings. These cooling units are crucial for protecting sensitive electronic components, such as Programmable Logic Controllers (PLCs), Variable Frequency Drives (VFDs), and communication equipment, from overheating, dust, and moisture, thereby ensuring operational reliability and extending the lifespan of critical machinery. Unlike standard commercial air conditioning units, industrial cabinet air conditioners are engineered to meet rigorous standards concerning dust ingress protection (IP ratings) and NEMA enclosure classifications, enabling their deployment in extremely challenging environments, including factory floors, outdoor substations, and chemical processing facilities.

The core product description revolves around a closed-loop cooling system that separates the ambient, contaminated external air from the clean, cooled internal air of the cabinet. Major applications span across industrial automation systems, which rely heavily on consistent performance; telecommunications, particularly in outdoor 5G infrastructure and remote relay stations; and the energy sector, where control panels in power grids and renewable energy installations require continuous thermal regulation. These products offer significant benefits, including minimized downtime due to component failure, reduced maintenance costs, and improved system performance consistency, directly contributing to overall operational efficiency and safety compliance.

Key driving factors accelerating market adoption include the ubiquitous implementation of Industry 4.0 standards, which necessitates the deployment of more computing power and heat-generating electronics at the edge of the network. Furthermore, the increasing complexity and density of electronic components within industrial control cabinets lead to higher thermal loads, making passive cooling inadequate. Regulatory mandates in safety-critical industries also drive the demand for reliable thermal management to prevent system malfunctions that could lead to environmental or safety hazards. The shift towards higher efficiency cooling technologies, such as variable speed drives and inverter technology, is also stimulating replacement cycles and new installations.

Industrial Cabinet Air Conditioner Market Executive Summary

The Industrial Cabinet Air Conditioner Market is characterized by robust business trends focusing on energy efficiency improvements, the integration of smart monitoring capabilities (IoT), and a decisive shift towards customized solutions tailored for specific industrial harsh environments. Business models are evolving to incorporate service agreements centered on predictive maintenance and remote diagnostics, moving beyond simple product sales. Geographically, the market expansion is highly concentrated in regions undergoing rapid industrialization and modernization of legacy infrastructure, particularly in Asia Pacific, driven by heavy investment in electronics manufacturing and automotive production. Developed markets in North America and Europe are focusing on replacement units that offer superior energy efficiency (e.g., utilizing thermoelectric or air-to-water cooling) to comply with stringent sustainability regulations and high operational cost pressures.

Segment trends reveal that the direct expansion (DX) or compressor-based units remain the dominant technology due to their high cooling capacity, but there is substantial growth in niche segments like liquid cooling solutions for extremely high-density cabinets, especially those supporting edge computing servers. The telecommunications sector is witnessing explosive growth in demand for smaller, highly efficient, and ruggedized side-mount units for 5G base stations. Furthermore, capacity segmentation indicates a rising demand for both lower capacity (<1,000 W) units for decentralized small controls and very high-capacity (>5,000 W) units for large automation centers and heavy-duty machinery control rooms. Customization and modularity are becoming paramount as end-users seek flexible deployment options and specific ingress protection levels tailored to corrosive or dusty environments.

Overall, the market trajectory is highly positive, underlined by the necessity of operational continuity across all industrial sectors. Key strategic actions among market players involve mergers and acquisitions aimed at expanding technological portfolios, particularly in software-driven thermal monitoring systems, and strengthening regional distribution networks, especially within emerging economies. The competitive landscape is moderately fragmented, with large international players dominating the high-end, high-efficiency segments, while regional manufacturers often specialize in cost-effective, application-specific solutions. Sustainability remains a central theme, pushing manufacturers toward refrigerants with lower Global Warming Potential (GWP) and optimizing heat rejection mechanisms to minimize power consumption.

AI Impact Analysis on Industrial Cabinet Air Conditioner Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Cabinet Air Conditioner market predominantly center on optimizing energy usage, enabling predictive failure identification, and enhancing the overall lifespan and reliability of cooling units. Users frequently ask how AI algorithms can interpret vast streams of operational data—such as temperature fluctuations, compressor runtime, filter cleanliness status, and ambient environmental conditions—to preemptively adjust cooling outputs, thereby maximizing efficiency and minimizing wear and tear. Key themes include the desire for "self-optimizing" thermal management systems that move beyond static control limits to dynamic, contextual cooling responses, and the integration of these AI insights directly into broader factory IoT and Supervisory Control and Data Acquisition (SCADA) systems for holistic asset management. Concerns often revolve around data security, the complexity of implementing AI models at the edge, and the cost justification for upgrading existing legacy cabinet cooling infrastructure with smart capabilities.

AI is transforming industrial cabinet cooling from a reactive maintenance task to a proactive, energy-saving operational strategy. By deploying machine learning models, manufacturers can develop sophisticated diagnostics that detect subtle anomalies indicative of impending component failure, such as irregular cycling patterns or slight deviations in current draw, long before traditional threshold-based alarms are triggered. This capability allows maintenance teams to schedule interventions precisely when needed, dramatically reducing unplanned downtime and the substantial associated costs of system failure in critical applications like continuous process manufacturing or pharmaceutical production. Furthermore, AI-driven algorithms can optimize fan speed, compressor load, and even refrigerant flow in real-time based on the forecasted internal thermal load, which is predicted using historical data and environmental inputs, leading to significant reductions in operational energy expenses, often the highest running cost for thermal systems.

The application of AI extends into the design and manufacturing processes of industrial air conditioners themselves. Generative design techniques, powered by AI, are being utilized to optimize heat exchanger geometry and airflow dynamics for maximum efficiency within compact cabinet footprints. In terms of market strategy, AI tools assist in analyzing customer utilization patterns across different geographies and climates, enabling manufacturers to rapidly tailor product portfolios and maintenance service offerings. This shift is crucial for maintaining competitiveness, as end-users increasingly prioritize intelligence and connectivity alongside core cooling performance, driving the market toward smart, IoT-enabled cabinet coolers that serve as crucial data points within the smart factory ecosystem.

- AI enables predictive maintenance by analyzing vibration, temperature, and current data to forecast component failure, reducing unplanned downtime.

- Machine learning algorithms optimize cooling cycle efficiency and fan speed based on real-time thermal load prediction, leading to energy savings (up to 30%).

- AI integration supports advanced diagnostics, providing detailed root cause analysis and remote troubleshooting for faster issue resolution.

- Data aggregation from multiple units via AI allows for fleet management and benchmarking performance metrics across entire facilities or geographies.

- Generative AI assists in optimizing product design for thermal performance and material use, enhancing sustainability and compactness.

DRO & Impact Forces Of Industrial Cabinet Air Conditioner Market

The dynamics of the Industrial Cabinet Air Conditioner Market are dictated by strong interconnected forces encompassing the relentless drive toward industrial automation, strict regulatory requirements for equipment protection, and emerging technological efficiencies. Drivers include the global expansion of IoT, 5G networks, and edge computing, all of which place critical, heat-sensitive electronics in challenging and often non-climate-controlled environments. Simultaneously, restraints, primarily stemming from the high initial capital investment required for specialized industrial-grade equipment and the ongoing challenge of energy consumption associated with 24/7 cooling operations, slightly temper market velocity. Opportunities are abundant, particularly in the retrofit market for integrating high-efficiency, smart cooling units into existing infrastructure and the development of sustainable cooling technologies utilizing natural refrigerants or solid-state cooling (e.g., thermoelectric cooling) to address environmental compliance pressures.

The primary impact force driving demand is the critical necessity of maintaining uptime in automated manufacturing and digital infrastructure. A failure in a single industrial control cabinet due to overheating can halt an entire production line or compromise essential services (like water treatment or power distribution), resulting in significant financial losses. This risk tolerance mandates the use of reliable, dedicated cooling solutions, irrespective of initial cost. Conversely, the market faces strong restraint from the intense competitive pressure in certain regional markets, pushing down average selling prices and making it difficult for manufacturers to invest heavily in R&D for advanced, yet costly, features like liquid cooling loops or sophisticated remote monitoring systems. Furthermore, the inherent need for specialized maintenance personnel and the complexity of integrating diverse cooling technologies into varied legacy systems present ongoing adoption barriers for smaller enterprises.

Opportunities are centered on exploiting the digital transformation wave. The integration of Condition Monitoring Systems (CMS) and advanced filtering technologies that prolong maintenance intervals offer value-added propositions that justify higher prices. Emerging markets, especially in Southeast Asia and Latin America, present significant growth potential as new manufacturing hubs are established, requiring greenfield deployments of cabinet air conditioners. The transition toward non-HFC refrigerants, mandated by international protocols, is compelling innovation, opening up avenues for companies that lead in developing efficient R290 (propane) or CO2-based industrial cooling solutions. These converging drivers, restraints, and opportunities collectively create a market environment focused on maximizing operational expenditure savings through enhanced efficiency and intelligence, making thermal reliability the foundational pillar of industrial digitalization.

Segmentation Analysis

Segmentation analysis of the Industrial Cabinet Air Conditioner Market reveals a highly diversified landscape driven by application-specific thermal requirements and installation constraints. The market is primarily segmented by Type (e.g., Top-mount, Side-mount), Cooling Capacity (e.g., Low, Medium, High), Technology (e.g., Compressor-based, Air-to-Air Heat Exchangers, Thermoelectric), and End-Use Industry (e.g., Automotive, Telecommunications, Food & Beverage). This granular segmentation is essential because the cooling needs for a roadside telecommunications cabinet (requiring high protection against environmental elements and minimal maintenance) are vastly different from those of a climate-controlled automation room in a pharmaceutical plant (requiring precision temperature control and compliance with cleanroom standards).

The growth dynamics across segments show a strong preference for side-mount units due to space constraints and aesthetic considerations in modern machinery, although top-mount units remain popular for retrofitting older, bulkier cabinets. In terms of capacity, the medium capacity range (1,000 W to 3,000 W) holds the largest market share, serving the needs of general industrial automation panels. However, the high-capacity segment (>5,000 W) is exhibiting the fastest growth due to the centralization of high-power drives and robust server infrastructure used for advanced machine vision and real-time control. The shift in technology is leaning towards inverter-driven compressor units, which provide superior energy savings compared to traditional fixed-speed units, optimizing cooling output precisely to fluctuating thermal loads, thus catering to the increasing industry focus on minimizing operational energy costs.

- By Type:

- Top-mount Cabinet Air Conditioners

- Side-mount Cabinet Air Conditioners

- Door-mount Cabinet Air Conditioners

- By Cooling Capacity:

- Low Capacity (Below 1,000 W)

- Medium Capacity (1,000 W – 3,000 W)

- High Capacity (Above 3,000 W)

- By Technology:

- Compressor-based Units (DX)

- Air-to-Air Heat Exchangers

- Air-to-Water Heat Exchangers

- Thermoelectric/Peltier Cooling

- By End-Use Industry:

- Automotive & Transportation

- Oil & Gas and Chemical Processing

- Food & Beverage

- Telecommunications (5G Infrastructure, Data Centers)

- Energy & Power Generation (Renewables, Utilities)

- Machine Tools & Robotics

Value Chain Analysis For Industrial Cabinet Air Conditioner Market

The Value Chain for the Industrial Cabinet Air Conditioner Market begins with the upstream suppliers of critical components, including compressors, heat exchangers (evaporators and condensers), microprocessors for control systems, and specialized materials (e.g., highly corrosion-resistant steel or aluminum for casings). Upstream analysis highlights the sensitivity of production costs to global commodity prices for metals and the availability of advanced, low-GWP refrigerants. Relationships with compressor and electronics suppliers are highly strategic, as these components dictate the final product's energy efficiency and reliability metrics. Manufacturers often engage in long-term contracts to stabilize supply and leverage economies of scale, particularly for inverter technology and integrated control boards that support IoT connectivity.

The manufacturing stage involves research and development focused on optimizing thermal transfer rates, ensuring adherence to strict ingress protection (IP) and NEMA standards, and integrating smart monitoring features. Manufacturers invest heavily in testing facilities to validate performance under extreme temperatures and vibration. Post-manufacturing, the distribution channel is complex, involving both direct and indirect sales methods. Direct sales are often utilized for large-scale industrial projects or highly customized solutions where technical consultation is required (e.g., defense or aerospace applications). Indirect distribution relies on specialized industrial equipment distributors, authorized value-added resellers (VARs), and system integrators who incorporate the air conditioners into larger control cabinet solutions provided to end-users.

The downstream activities involve installation, commissioning, and, most crucially, post-sales service and maintenance. Given the mission-critical nature of the protected equipment, long-term service contracts are a significant revenue stream. Predictive maintenance services, often enabled by integrated IoT sensors, are highly valued in the downstream market, promoting client loyalty and ensuring optimal operational expenditure for the end-user. The efficacy of the service network directly impacts brand reputation, making technical training for service partners a critical link in the value chain. As products become 'smarter,' software updates and cybersecurity services also enter the downstream equation, linking hardware performance to digital service provisioning.

Industrial Cabinet Air Conditioner Market Potential Customers

Potential customers, or end-users/buyers, of industrial cabinet air conditioners span a wide spectrum of capital-intensive industries where operational reliability of electronic control systems is non-negotiable. The primary customer base includes original equipment manufacturers (OEMs) of large machinery, industrial automation integrators (who design and build control panels), and large-scale facility owners or operators in sectors such as automotive manufacturing, petrochemical processing, and telecommunications. These buyers require products that meet specific environmental criteria, typically demanding high IP ratings (e.g., IP54, IP66) to withstand exposure to dust, moisture, and corrosive substances, while delivering consistent and energy-efficient cooling tailored to the specific thermal load of their electronics.

Key segments driving procurement decisions are the energy sector, including traditional power generation, transmission, and the rapidly growing renewable energy segment (solar and wind farms), where control cabinets are often located outdoors or in highly stressed environments like offshore platforms. In the telecommunications sector, customers are rapidly procuring compact, high-efficiency cooling units for edge computing infrastructure and 5G base stations, which require robust thermal management due to increased power density and distributed network architecture. Furthermore, the Food & Beverage industry represents a niche, yet growing, segment where specialized air conditioners are needed to cope with wash-down environments and temperature extremes prevalent in processing facilities, demanding stainless steel construction and highly durable seals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rittal GmbH & Co. KG, Pfannenberg Group, Pentair Thermal Management (Hoffman), Schneider Electric SE (APC), Siemens AG, Dantherm Group, Kooltronic, Inc., Noren Products, Inc., Laird Thermal Systems, Thermal Edge, Inc., TECA (ThermoElectric Cooling America), Cosmotec s.r.l., Gustav Hensel GmbH & Co. KG, Dürr Universal, Ebm-papst Group, Hammond Manufacturing, Fibox Oy Ab, Saginomiya Seisakusho, Kelvion. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Cabinet Air Conditioner Market Key Technology Landscape

The technological landscape of the Industrial Cabinet Air Conditioner Market is rapidly evolving, driven by the intersecting demands for higher efficiency, intelligent control, and environmental sustainability. Traditional fixed-speed compressor technology is increasingly being supplanted by inverter-driven variable speed compressors. These advanced units adjust cooling capacity precisely based on the detected thermal load, offering substantial energy savings, often exceeding 30% compared to conventional units. The integration of IoT and cloud connectivity is foundational, enabling remote monitoring of key operational parameters, proactive alerting, and the implementation of predictive maintenance routines, thereby minimizing manual checks and potential catastrophic failures. This smart technology facilitates true Condition-Based Monitoring (CBM), transforming the role of thermal management from a simple utility to a networked, optimized asset within the factory ecosystem.

Another crucial technological development is the expansion of closed-loop cooling alternatives tailored for specific industrial needs. Air-to-Water heat exchangers are gaining traction, especially in facilities that already have central chilled water systems, offering high-efficiency heat rejection for dense electronics. Thermoelectric (Peltier) cooling technology, while currently limited in large capacity applications, is seeing significant adoption in niche markets requiring extremely precise temperature control, small footprints, or environments where vibration-free operation is mandatory. Furthermore, material science advances are critical, focusing on lightweight yet robust casing designs with enhanced corrosion resistance and superior gasket materials to guarantee stringent NEMA 4X or IP66 environmental protection ratings, which are essential for deployments in coastal, chemical, or mining environments. Innovation is also heavily focused on filterless or self-cleaning condenser technologies to reduce maintenance frequency in heavily contaminated areas.

Sustainability is the third major technological pillar, mandating a rapid transition away from high Global Warming Potential (GWP) refrigerants such as R-407C and R-134a towards environmentally friendlier alternatives like R-290 (propane) and R-32. This regulatory pressure necessitates complete redesigns of compressor and heat exchanger components to safely handle mildly flammable refrigerants while maintaining or improving efficiency metrics. Manufacturers are also applying sophisticated Computational Fluid Dynamics (CFD) modeling during the design phase to optimize internal airflow patterns within the cabinet, ensuring uniform cooling distribution and eliminating localized hotspots, a persistent challenge in densely packed industrial control panels. The convergence of hardware efficiency, intelligent software, and sustainable chemistry defines the competitive edge in the current technology landscape.

Regional Highlights

The Industrial Cabinet Air Conditioner Market exhibits distinct regional dynamics, with growth heavily correlated to local industrial policies, modernization efforts, and climate conditions. The Asia Pacific (APAC) region currently dominates the market share and is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This growth is predominantly driven by massive investments in manufacturing expansion, particularly in China, India, and Southeast Asian nations, coupled with rapid urbanization and the deployment of extensive public and private digital infrastructure. These markets are characterized by high temperature and humidity levels, making reliable, high-capacity cooling essential for operational continuity in electronics manufacturing, automotive production, and heavy machinery.

North America and Europe represent mature markets characterized by higher adoption rates of smart, high-efficiency, and customized cooling solutions. Demand in these regions is less driven by new facility construction and more by the replacement and retrofit of legacy systems to meet stringent energy efficiency mandates (e.g., EU Ecodesign directives) and to integrate equipment into smart factory networks (Industry 4.0). Customers here place a premium on total cost of ownership (TCO), favoring inverter-driven units and advanced air-to-water cooling solutions that minimize long-term operational costs. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by investments in oil & gas infrastructure modernization, large public utility projects, and the establishment of new telecommunications networks, demanding robust, explosion-proof, or highly ruggedized units suitable for challenging climate conditions.

- Asia Pacific (APAC): Dominates market share; fueled by industrial automation, electronics manufacturing growth in China and Vietnam, and high-density 5G network rollout.

- North America: Strong demand for smart, high-efficiency units and sophisticated liquid cooling solutions for edge data centers and high-power applications in manufacturing.

- Europe: Focus on energy efficiency regulations (Ecodesign), sustainable refrigerants, and replacement cycles within the advanced automotive and machinery sectors.

- Middle East & Africa (MEA): Growth driven by large infrastructure projects, oil & gas expansion, and requirements for highly durable cooling units resistant to extreme heat and dust (NEMA 4X ratings).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Cabinet Air Conditioner Market.- Rittal GmbH & Co. KG

- Pfannenberg Group

- Pentair Thermal Management (Hoffman)

- Schneider Electric SE (APC)

- Siemens AG

- Dantherm Group

- Kooltronic, Inc.

- Noren Products, Inc.

- Laird Thermal Systems

- Thermal Edge, Inc.

- TECA (ThermoElectric Cooling America)

- Cosmotec s.r.l.

- Gustav Hensel GmbH & Co. KG

- Dürr Universal

- Ebm-papst Group

- Hammond Manufacturing

- Fibox Oy Ab

- Saginomiya Seisakusho

- Kelvion

- Vertiv Group Corp.

Frequently Asked Questions

Analyze common user questions about the Industrial Cabinet Air Conditioner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between industrial and commercial air conditioning units?

Industrial cabinet air conditioners utilize a closed-loop system to prevent ambient, contaminated air from entering the cabinet, protecting sensitive electronics from dust, moisture, and corrosive elements. They also adhere to strict industrial protection ratings (IP/NEMA) suitable for harsh factory environments, unlike standard commercial ACs.

How does the shift to Industry 4.0 impact the demand for cabinet air conditioners?

Industry 4.0 drives demand by increasing the concentration of heat-generating components (PLCs, VFDs, Edge Servers) inside industrial cabinets. This necessitates highly reliable, smart, IoT-enabled cooling systems capable of remote monitoring and predictive failure analysis to maintain continuous production flow.

What are the key technological advancements driving energy efficiency in the market?

The most crucial advancement is the adoption of inverter technology (variable speed drives) in compressors, which allows the cooling output to precisely match the thermal load, reducing power consumption by optimizing compressor runtime and fan speeds compared to traditional fixed-speed units.

Which end-use industry is expected to show the fastest market growth?

The Telecommunications sector, driven by the rapid global rollout of 5G infrastructure and the decentralization of data processing through edge computing, is expected to exhibit the fastest growth, requiring ruggedized, compact, and high-efficiency thermal management solutions for outdoor cabinets.

What are the current regulatory concerns regarding industrial cabinet cooling?

Regulations primarily focus on the phase-down of high Global Warming Potential (GWP) refrigerants (HFCs) under international agreements. This necessitates manufacturers to invest in redesigning units to utilize lower GWP alternatives like R-290 (propane) or R-32, ensuring both environmental compliance and operational safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager