Industrial Cable Reels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433687 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Cable Reels Market Size

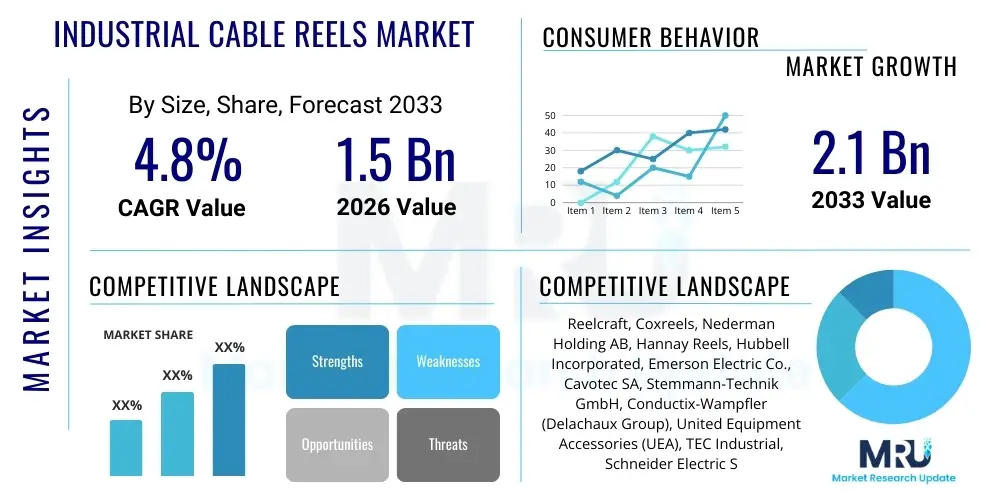

The Industrial Cable Reels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Industrial Cable Reels Market introduction

The Industrial Cable Reels Market encompasses specialized mechanical or motorized devices designed for the safe, efficient, and organized storage and retrieval of electrical cables, hoses (for fluid or air), or fiber optic lines in demanding industrial environments. These essential components play a critical role in optimizing workflow, enhancing operational safety by preventing trip hazards, and extending the lifespan of conductors through controlled winding and unwinding mechanisms. Industrial cable reels are primarily utilized in dynamic applications where power, data, or media transfer is required across variable distances, such as in material handling systems, automated machinery, mobile equipment, and large-scale manufacturing lines.

Key applications span diverse sectors including manufacturing, mining, energy production (especially oil, gas, and renewable sectors), and ports where heavy-duty performance and reliability under harsh conditions are prerequisites. The primary benefits derived from the deployment of industrial cable reels include significant improvements in workplace safety, reduction in cable wear and tear, and streamlined maintenance procedures. These systems ensure that cables are precisely managed, minimizing downtime associated with damaged wiring or logistical constraints in movement-intensive operations. The demand for robust and reliable power supply solutions in automated environments is a fundamental growth catalyst for this market.

Driving factors for market expansion include the global surge in industrial automation and the proliferation of advanced material handling equipment like overhead cranes, stacker cranes, and automated guided vehicles (AGVs), all of which rely heavily on efficient cable management for continuous operation. Furthermore, stringent global safety regulations requiring organized cabling in heavy industry, coupled with the rising investment in renewable energy infrastructure (wind farms, solar installations) which utilizes specialized slip ring assemblies and cable reels, further accelerate market growth. The ongoing modernization of aging infrastructure in developed economies and rapid industrialization in emerging markets fuel consistent demand for high-performance industrial cable reel systems.

Industrial Cable Reels Market Executive Summary

The Industrial Cable Reels Market demonstrates robust growth driven by accelerating industrial automation trends globally, particularly within the manufacturing and logistics sectors. Business trends indicate a strong shift towards intelligent, motorized, and sensor-equipped reels (smart reels) that integrate seamlessly with Industry 4.0 architectures, offering predictive maintenance capabilities and enhanced operational efficiency. Manufacturers are focusing heavily on developing reels capable of handling high-capacity power and complex hybrid cables (combining power and fiber optics) necessary for advanced robotics and large-scale automated machinery. Mergers and acquisitions focusing on specialized niche technologies, such as explosion-proof or harsh environment reels, are defining the competitive landscape, aiming to consolidate expertise and expand geographical reach into demanding sectors like mining and petrochemicals. The emphasis on standardization and compliance with international safety protocols remains a central theme guiding product innovation and market acceptance.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure projects, rapid industrialization, and the establishment of large-scale smart factories, especially in China, India, and Southeast Asian nations. North America and Europe maintain stable demand, driven primarily by the modernization and replacement of existing legacy infrastructure, adherence to rigorous safety standards, and increasing adoption of advanced material handling solutions in logistics and ports. These mature markets prioritize durability, customization, and sustainable design, often favoring high-end, maintenance-free motor-driven reels. Emerging markets in Latin America and the Middle East and Africa (MEA) are seeing localized spikes in demand associated with expanding mining operations, oil and gas exploration, and investments in port development, requiring heavy-duty, corrosion-resistant reel solutions.

Segment trends reveal that the motor-driven reel segment, encompassing electric, hydraulic, and pneumatic actuation types, is experiencing the fastest growth due to its suitability for heavy-duty, long-distance applications requiring precise speed control and tensioning, such as those found in dockside cranes and large conveyors. Conductor type segmentation shows increasing penetration of hybrid reels, accommodating both power delivery and high-speed data transfer (fiber optics), essential for complex integrated systems like AGVs and robotic arms. Vertically, the Manufacturing segment, led by automotive and heavy machinery production, remains the largest consumer base, although the Energy sector, particularly renewable energy installations, exhibits superior growth potential requiring specialized, highly durable cable management solutions optimized for outdoor and challenging environments.

AI Impact Analysis on Industrial Cable Reels Market

Common user questions regarding AI's impact on industrial cable reels typically revolve around how artificial intelligence can enhance predictive maintenance, optimize reel operation cycles, and integrate reel systems into broader smart factory networks. Users are concerned with whether AI can anticipate cable fatigue, manage tension variability dynamically, and minimize catastrophic failures in heavy-duty applications like port cranes or mining excavators. Key themes emerging from these inquiries include the expectation that AI-driven monitoring systems will transform the industry from reactive maintenance to proactive operational management, ensuring maximum uptime and minimizing associated labor costs. The market anticipates AI will not only monitor physical parameters (temperature, vibration, cable position) but also optimize the reel’s winding speed based on real-time operational demands of the connected machinery, leading to significant efficiencies in power consumption and longevity.

- AI-powered Predictive Maintenance: Utilization of machine learning algorithms analyzing vibration, temperature, and usage patterns to forecast cable fatigue and component failure, enabling just-in-time repair and maximizing operational uptime.

- Dynamic Tension Optimization: AI systems adjusting reel motor torque and speed in real-time based on load, movement speed, and extension length, ensuring optimal cable tension and preventing premature wear or snap-back damage.

- Integration with Smart Factory Systems: Seamless integration of reel operational data (utilization rates, fault codes) into centralized AI-managed industrial IoT platforms for holistic plant performance analysis and energy optimization.

- Automated Fault Diagnostics: Implementation of deep learning models to instantly identify and classify specific operational anomalies, accelerating troubleshooting and reducing reliance on manual inspection.

- Enhanced Safety Protocols: AI monitoring reel performance metrics relative to set safety thresholds, automatically initiating shutdown or adjustment procedures to prevent hazards related to cable misalignment or excessive force.

DRO & Impact Forces Of Industrial Cable Reels Market

The Industrial Cable Reels Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's trajectory and impact forces. The primary drivers stem from the global wave of industrial automation, mandatory adherence to rigorous industrial safety standards worldwide, and the expanding scope of material handling operations in ports and logistics. Automation necessitates reliable, continuous power and data supply across moving parts, making specialized industrial reels indispensable. Simultaneously, strict safety regulations concerning cable management drive the adoption of enclosed, automatically managed reel systems to mitigate workplace hazards such as tripping and electrical damage. Furthermore, increasing capital expenditure in heavy industries like mining and construction, particularly in emerging economies, creates sustained demand for durable, large-capacity reel solutions.

Despite these robust drivers, the market faces notable restraints. The initial high capital investment required for heavy-duty, motorized, or specialized ATEX-certified cable reel systems often deters smaller enterprises or projects with limited budgets, leading them to opt for less efficient manual or stationary alternatives. Moreover, the technical complexity involved in installing, integrating, and maintaining advanced slip ring assemblies, especially in extreme environmental conditions (e.g., high heat, corrosive marine air), requires highly specialized technical expertise, which presents a challenge in certain geographic markets. Market volatility in key raw materials, particularly steel, copper, and specialized polymers used in reel construction, also affects manufacturing costs and profitability, subsequently impacting end-user pricing and adoption rates.

Significant opportunities are emerging from the shift towards Industry 4.0 and smart manufacturing initiatives. The demand for 'smart reels' equipped with integrated sensors for condition monitoring and digital connectivity offers a substantial avenue for growth. Furthermore, the burgeoning global investment in renewable energy infrastructure, specifically offshore wind farms and large solar power generation facilities, requires highly specialized, robust, and weather-resistant cable reels for maintenance and power collection applications. Market players are also capitalizing on the opportunity presented by customizing hybrid reels that effectively manage both electrical power and critical high-speed data communication lines (fiber optics), satisfying the complex needs of modern industrial robotics and integrated factory systems. These opportunities promise long-term revenue growth and technological differentiation for market participants focused on innovation.

Segmentation Analysis

The Industrial Cable Reels Market segmentation provides a granular view of demand patterns across different types of power delivery mechanisms, the specific media handled, the industry sectors utilizing the equipment, and the final application of the reels. Segmentation by type—categorizing reels into spring-driven, motor-driven, and manual—is critical as it defines complexity, capacity, and automation level. Motor-driven reels represent the high-growth, high-value segment due to their application in large, critical, and automated environments requiring precise tension control. Conductor type segmentation distinguishes between electrical power, fluid/air hoses, and specialized fiber optic/hybrid lines, reflecting the diversification of industrial needs beyond simple power transmission. Understanding these segments is vital for manufacturers tailoring products to specific operational requirements, from simple workshop applications to complex offshore operations.

- By Type:

- Spring-Driven Reels

- Motor-Driven Reels (Electric, Hydraulic, Pneumatic)

- Manual Reels

- By Conductor Type:

- Electrical Cables

- Hoses (Air, Water, Hydraulic Fluid)

- Fiber Optic/Data Cables

- Hybrid (Combined Power and Data)

- By Industry Vertical:

- Manufacturing (Automotive, Heavy Machinery)

- Energy (Oil & Gas, Renewable Energy)

- Ports & Shipyards

- Mining & Metallurgy

- Construction & Infrastructure

- Aerospace & Defense

- By End-Use Application:

- Material Handling Equipment (Cranes, Conveyors)

- Mobile Equipment (Trucks, Forklifts)

- Industrial Robotics & Automation

- Power Transmission & Distribution

- Maintenance & Repair Operations (MRO)

Value Chain Analysis For Industrial Cable Reels Market

The value chain for the Industrial Cable Reels Market begins with upstream activities focused on the procurement of core raw materials and components, including high-grade steel and aluminum for housing and framework, copper for slip rings and conductors, specialized polymers for protective casings, and complex electronic components such as motors, gears, and advanced sensors (for smart reels). Suppliers of these specialized components, particularly manufacturers of robust slip ring technology and precision motors, hold significant leverage due to the technical requirements for reliability and longevity in industrial settings. Effective supplier relationship management, focusing on quality assurance and consistent material supply, is crucial at this stage to maintain competitive pricing and product integrity.

Midstream operations involve the core manufacturing processes, including design, fabrication, assembly, and rigorous testing. Given the diverse applications, manufacturers must invest heavily in R&D to develop customized solutions, such as explosion-proof reels (ATEX certified) or reels designed for extreme weather resistance. Assembly is complex, requiring precision engineering to ensure smooth winding mechanisms and reliable electrical conductivity through the slip rings. Operational efficiency in manufacturing, including lean production techniques and quality control, dictates profitability margins, especially for standardized, high-volume spring-driven reel models. The trend toward modular design is simplifying customization and installation, adding value to the manufacturing stage.

Downstream activities center on distribution channels and end-user deployment. The distribution strategy typically involves a blend of direct sales to large industrial customers (e.g., major crane manufacturers or shipyard operators) and indirect distribution through specialized industrial equipment distributors, system integrators, and value-added resellers (VARs). VARs often provide installation, integration services, and after-sales support, adding crucial value, especially when integrating complex motor-driven or hybrid reels into existing plant infrastructure. Post-sales service, including maintenance contracts and provision of spare parts (especially replacement slip rings and tension springs), is a vital revenue stream and a key differentiator in securing long-term customer relationships. The choice between direct and indirect channels often depends on the complexity of the reel system and the geographic reach required, with indirect channels dominating the MRO and smaller project segments.

Industrial Cable Reels Market Potential Customers

The potential customer base for industrial cable reels is exceptionally broad, spanning any heavy industrial setting requiring managed power, fluid, or data transmission across moving equipment or variable distances. The largest and most consistently demanding end-users are heavy manufacturing facilities, particularly those involved in automotive assembly, steel production, and shipbuilding. These sectors rely on vast networks of overhead cranes, gantry systems, and robotic welding lines, all necessitating continuous, reliable cable management solutions provided by motor-driven and heavy-duty spring-driven reels. These customers prioritize robustness, high duty cycle capacity, and compliance with stringent operational safety standards, often requiring specialized coatings or protective housings to withstand harsh shop floor environments.

Another significant customer segment includes companies operating within the Energy sector, encompassing traditional oil and gas drilling operations (both onshore and offshore) and the rapidly expanding renewable energy sector. Oil rigs and petrochemical plants require explosion-proof (Ex/ATEX) rated reels for hoses and power cables. Conversely, utility companies and wind farm operators require specialized, weather-resistant reels for turbine maintenance access and subterranean power collection systems. These buyers place a high premium on corrosion resistance, reliability in extreme temperatures, and long mean time between failures (MTBF). Port authorities and logistics centers, operating container cranes (RTGs, RMGs) and bulk material loaders, represent a third critical customer group, demanding high-speed, durable motor-driven reels capable of managing large, heavy cables for continuous heavy-lifting operations, where downtime results in significant financial losses.

Furthermore, specialized industries like mining, construction, and water treatment plants constitute substantial potential buyers. Mining operations, characterized by harsh, dirty, and often remote locations, require robust cable reels for massive mobile equipment like excavators and stackers, focusing on durability and capacity for very long cable runs. Construction sites utilize medium-duty reels for temporary power distribution and fluid supply, emphasizing portability and ease of deployment. The increasing automation within warehouse and distribution centers, driven by e-commerce expansion, also generates demand for smaller, precision-oriented cable reels integrated into automated guided vehicles (AGVs) and robotic sorting systems, where hybrid (power and data) reels are becoming the standard requirement for high-efficiency operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | CAGR 4.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reelcraft, Coxreels, Nederman Holding AB, Hannay Reels, Hubbell Incorporated, Emerson Electric Co., Cavotec SA, Stemmann-Technik GmbH, Conductix-Wampfler (Delachaux Group), United Equipment Accessories (UEA), TEC Industrial, Schneider Electric SE, Siemens AG, D.G. Global Inc., Jiangsu Hongli Electric Co., Ltd., Metreel Limited, Siba Elektrik, Scaglia Indeva S.p.A., Igus GmbH, Woodhead Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Cable Reels Market Key Technology Landscape

The technological landscape of the Industrial Cable Reels Market is currently characterized by a fundamental transition from purely mechanical systems to advanced electro-mechanical and digitally connected solutions. Central to this evolution is the ongoing refinement of slip ring technology, which is crucial for reliably transferring power and data across rotating interfaces. Modern slip rings must handle increasingly higher data transmission rates (often involving fiber optics) and robust power loads simultaneously, driving the development of hybrid slip ring assemblies that combine traditional copper rings with fiber optic rotary joints (FORJs). Furthermore, advancements in motor control technology, particularly the use of Variable Frequency Drives (VFDs) and specialized servo motors in motor-driven reels, allow for highly precise tensioning and spooling control, minimizing cable stress and extending operational life, which is critical for complex automation applications like robotic arms and gantry systems.

The most significant emerging technology is the integration of sensing and IoT capabilities, leading to the creation of "Smart Reels." These systems incorporate proximity sensors, temperature sensors, vibration monitoring devices, and precise encoder feedback to provide real-time operational data. This data is processed locally or transmitted wirelessly via protocols like Bluetooth or Wi-Fi to centralized control systems or cloud platforms. The primary function of this digitalization is to enable predictive maintenance strategies; instead of relying on scheduled checks, operators can monitor cable tension irregularities or motor performance deviations indicative of imminent failure. This smart monitoring capability significantly reduces unexpected downtime, optimizes MRO schedules, and enhances overall operational efficiency, aligning directly with Industry 4.0 objectives across major industrial verticals.

Another crucial technological focus is material innovation, specifically the development of durable, lightweight, and environmentally resistant materials for reel construction. High-performance engineering plastics and specialized powder coatings are increasingly used to resist corrosion, chemical exposure, and UV radiation, making reels suitable for harsh environments such as offshore platforms, chemical processing plants, and port operations. Finally, the design trend is moving towards modularity and standardization. Modular reels allow end-users to easily swap out components, such as changing cable drums or slip ring assemblies, without replacing the entire unit, improving maintainability and reducing the total cost of ownership (TCO). Standardization efforts aim to improve compatibility between different manufacturers' equipment, simplifying procurement and integration for large industrial projects globally.

Regional Highlights

Geographic analysis reveals that the Industrial Cable Reels Market exhibits distinct growth patterns and maturity levels across major global regions. Asia Pacific (APAC) dominates the market in terms of volume growth and investment potential. This region is witnessing unprecedented levels of industrialization, driven by massive government-led infrastructure investments, particularly in transportation, utilities, and large-scale manufacturing facilities in countries like China, India, and South Korea. The rapid adoption of automated production lines and the expansion of maritime trade (necessitating major port upgrades) act as core demand drivers. APAC manufacturers often prioritize cost-effectiveness alongside functionality, leading to strong growth in standardized spring-driven and essential motor-driven reel segments, although the demand for high-end, hybrid reels is accelerating in high-tech manufacturing hubs.

North America and Europe represent mature markets characterized by replacement demand, modernization, and strict adherence to safety and quality regulations. These regions are major consumers of technologically advanced reels, including smart reels with integrated IoT connectivity, specialized explosion-proof models (especially in the European petrochemical sector), and highly customized solutions for aerospace and high-precision manufacturing. Growth in these areas is sustained by continuous investment in renewable energy infrastructure (offshore wind) and the overhaul of aging logistics and manufacturing systems. European standards, such as ATEX directives for hazardous environments, drive specific technological requirements that differentiate regional product offerings, favoring vendors with robust compliance credentials and high-quality construction.

The Middle East and Africa (MEA) and Latin America are emerging markets heavily reliant on commodity extraction and infrastructure development. Demand in MEA is highly concentrated within the oil and gas sector, requiring explosion-proof and highly corrosion-resistant reels. Significant port expansion projects across the Arabian Gulf also fuel demand for large, motor-driven gantry crane reels. Latin America's market growth is tied closely to mining operations (Chile, Peru, Brazil) and heavy construction, necessitating rugged, high-capacity cable and hose reels capable of operating in challenging, remote environments. Although smaller in market share compared to APAC and established markets, these regions show substantial potential driven by large-scale, capital-intensive industrial projects requiring durable, specialized cable management solutions.

- Asia Pacific (APAC): Highest growth trajectory, driven by industrialization, port expansion, and smart factory development in China and India. Focus on both volume manufacturing and high-tech integration.

- North America: Stable, high-value market emphasizing safety compliance, technological integration (IoT), and modernization of existing infrastructure across manufacturing and logistics.

- Europe: Demand dominated by strict regulatory requirements (ATEX, CE), strong presence in renewable energy infrastructure (offshore wind), and preference for highly customized, high-quality motor-driven systems.

- Middle East & Africa (MEA): Growth tied heavily to oil & gas capital expenditure and port modernization projects, demanding specialized hazardous area and corrosion-resistant reels.

- Latin America: Market driven primarily by mining and heavy construction activities, favoring rugged, high-capacity cable and hose reels for mobile and stationary heavy equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Cable Reels Market.- Reelcraft

- Coxreels

- Nederman Holding AB

- Hannay Reels

- Hubbell Incorporated

- Emerson Electric Co.

- Cavotec SA

- Stemmann-Technik GmbH

- Conductix-Wampfler (Delachaux Group)

- United Equipment Accessories (UEA)

- TEC Industrial

- Schneider Electric SE

- Siemens AG

- D.G. Global Inc.

- Jiangsu Hongli Electric Co., Ltd.

- Metreel Limited

- Siba Elektrik

- Scaglia Indeva S.p.A.

- Igus GmbH

- Woodhead Industries

Frequently Asked Questions

Analyze common user questions about the Industrial Cable Reels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between spring-driven and motor-driven industrial cable reels?

Spring-driven reels are typically used for shorter cable lengths and lighter loads, relying on a pre-tensioned spring mechanism for retraction, making them cost-effective for localized workstations or handheld tools. Motor-driven reels (electric, hydraulic, or pneumatic) are designed for heavy-duty applications, long cable runs, and high retrieval speeds, providing precise control over cable tension, which is essential for large gantry cranes and complex automation systems.

How is Industry 4.0 influencing the design and function of industrial cable reels?

Industry 4.0 drives demand for 'Smart Reels' equipped with integrated sensors, microprocessors, and communication modules. These reels offer real-time monitoring of operational parameters like tension, temperature, and cycle count. This data enables predictive maintenance, centralized control via Industrial IoT platforms, and optimization of reel performance, significantly reducing unexpected downtime in highly automated factories.

Which industry vertical is the largest consumer of industrial cable reels globally?

The Manufacturing industry, specifically the automotive, heavy machinery, and metal production sub-segments, represents the largest consumer base. These sectors utilize extensive overhead cranes, robotic systems, and assembly lines that require continuous, managed power and data feeds, making cable reels indispensable for material handling and process automation.

What are hybrid cable reels and why are they gaining importance?

Hybrid cable reels are designed to manage multiple types of conductors simultaneously, typically combining high-capacity electrical power cables with high-speed data transmission lines, such as fiber optic cables or Ethernet. They are crucial for modern industrial robotics and Automated Guided Vehicles (AGVs) where simultaneous power delivery and real-time data communication are mandatory for complex, integrated operations.

What factors should be considered when selecting a cable reel for a hazardous area application, such as oil and gas?

For hazardous areas, the primary consideration is compliance with local safety standards, such as the European ATEX directive or North American NEC requirements. Reels must be explosion-proof, utilizing sealed, certified enclosures (Ex-rated motors and slip rings) to prevent ignition of flammable gases or dust. Material selection is also critical, requiring corrosion-resistant coatings and specialized construction to withstand extreme environmental conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager