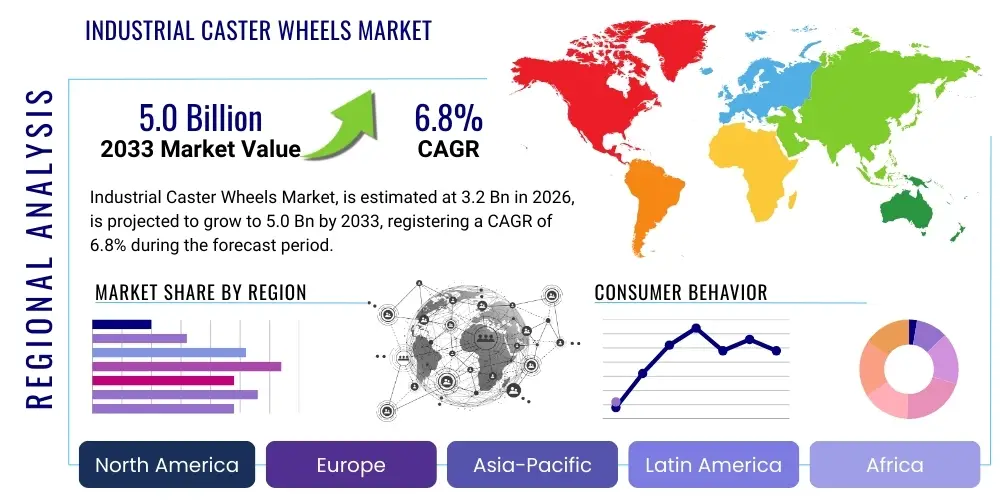

Industrial Caster Wheels Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440309 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Industrial Caster Wheels Market Size

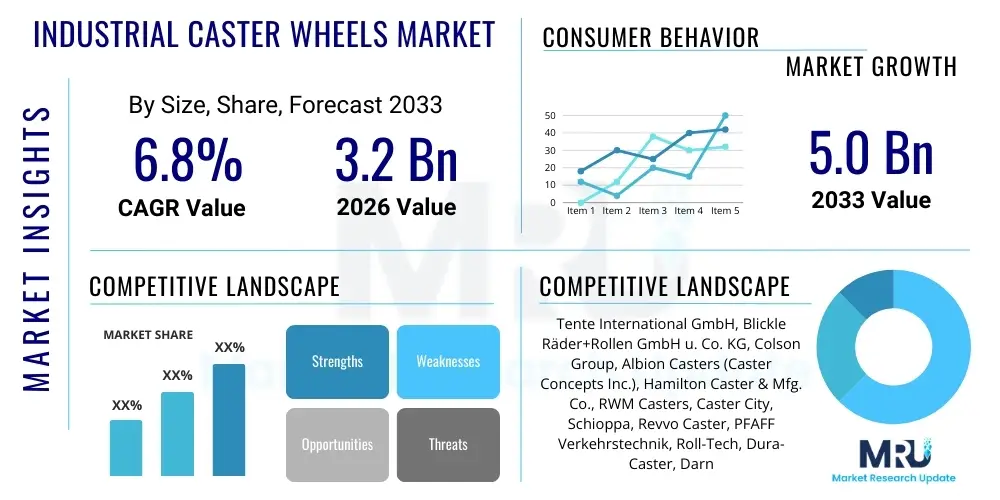

The Industrial Caster Wheels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Industrial Caster Wheels Market introduction

The industrial caster wheels market encompasses a diverse range of products designed to facilitate the movement of heavy loads and equipment across various industrial and commercial settings. These essential components are critical for enhancing mobility, efficiency, and safety in operations ranging from manufacturing and logistics to healthcare and retail. Industrial caster wheels are defined by their robust construction, specialized materials, and engineering designed to withstand demanding operational conditions, including heavy weight capacities, exposure to chemicals, extreme temperatures, and abrasive environments.

Major applications for industrial caster wheels span across numerous sectors, including material handling equipment like trolleys, carts, and dollies, as well as automotive assembly lines, medical devices, retail display units, and industrial machinery. The benefits derived from these products are extensive, notably improving operational fluidity by enabling swift repositioning of items, reducing manual labor, and enhancing ergonomic practices. They contribute significantly to workflow optimization and overall productivity within facilities.

Key driving factors for market expansion include the global surge in industrialization, particularly in emerging economies, coupled with the rapid growth of the e-commerce sector which necessitates advanced warehousing and logistics solutions. Furthermore, increasing automation in manufacturing processes and the growing demand for ergonomically designed equipment to prevent workplace injuries are continually propelling the market forward. The continuous innovation in material science and design also ensures that caster wheels meet evolving industry requirements for durability, specialized functionalities, and sustainability.

Industrial Caster Wheels Market Executive Summary

The Industrial Caster Wheels Market is currently experiencing robust growth, primarily fueled by global manufacturing expansion and the burgeoning e-commerce industry, which demands sophisticated material handling solutions. Key business trends indicate a strong focus on product innovation, with manufacturers investing heavily in developing casters that offer enhanced durability, load capacity, and specialized features such as shock absorption, noise reduction, and smart capabilities. Strategic partnerships and mergers among leading players are also shaping the competitive landscape, aiming to consolidate market share and expand geographical reach. Furthermore, the emphasis on sustainable manufacturing practices is influencing product development, leading to casters made from recycled materials or designed for greater energy efficiency in their applications.

From a regional perspective, Asia Pacific continues to be the dominant market, driven by its expansive manufacturing base, rapid urbanization, and significant investments in infrastructure and logistics. Countries like China and India are at the forefront of this growth, supported by governmental initiatives promoting industrial development. North America and Europe also hold substantial market shares, characterized by advanced industrial automation, high adoption rates of specialized casters in niche applications like aerospace and healthcare, and a strong emphasis on workplace safety standards. These regions are witnessing increased demand for premium and technically advanced caster solutions.

Segmentation trends highlight a significant shift towards heavy-duty and super heavy-duty casters, reflecting the escalating requirements for moving increasingly larger and heavier components in industries such as automotive, aerospace, and heavy machinery manufacturing. Material-wise, polyurethane casters are gaining traction due to their superior load-bearing capacity, resilience, and floor protection properties, while rubber and nylon casters maintain their steady demand for general-purpose applications. The application segment sees material handling and logistics as perennial leaders, but there is also a notable rise in demand from the medical and institutional sectors, driven by the need for quiet, hygienic, and easily maneuverable equipment in hospitals and laboratories.

AI Impact Analysis on Industrial Caster Wheels Market

Users frequently inquire about how Artificial Intelligence will revolutionize the design, manufacturing, and application of industrial caster wheels, focusing on themes such as predictive maintenance, enhanced operational efficiency, and the development of 'smart' casters. Common concerns include the integration challenges with existing infrastructure, the cost implications of AI-driven systems, and the data privacy and security aspects of connected caster technologies. Expectations are high for AI to enable more autonomous material handling systems, optimize logistics routes, and extend the lifespan of equipment through intelligent monitoring.

- AI-powered predictive maintenance through integrated sensors can monitor caster wheel wear and tear, predicting failure points before they occur, thereby reducing downtime and maintenance costs.

- Optimized inventory management and supply chain logistics for caster components, leveraging AI to forecast demand, manage stock levels, and streamline distribution.

- Development of 'smart casters' equipped with AI-driven sensors for real-time data collection on load, speed, temperature, and environmental conditions, enabling dynamic adjustments for improved performance and safety.

- AI-assisted design and simulation tools can accelerate the development of new caster wheel prototypes, optimizing material selection and structural integrity for specific applications, reducing R&D cycles.

- Enhanced automation in manufacturing processes of caster wheels, utilizing AI to improve quality control, identify defects, and increase production efficiency.

- Integration of casters into wider AI-driven industrial IoT ecosystems for seamless communication with autonomous mobile robots (AMRs) and automated guided vehicles (AGVs), enabling intelligent route planning and collision avoidance.

DRO & Impact Forces Of Industrial Caster Wheels Market

The industrial caster wheels market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form its Impact Forces. Drivers for market growth are primarily rooted in the robust expansion of global industrialization and manufacturing sectors, especially in emerging economies. The escalating demand for efficient material handling solutions, spurred by the booming e-commerce industry and increasingly complex logistics operations, further propels market demand. Additionally, stringent workplace safety regulations and the growing emphasis on ergonomic solutions necessitate the adoption of advanced caster technologies, contributing to market expansion. The continuous evolution of automated manufacturing and warehousing systems also mandates specialized casters designed for high precision and integration.

Conversely, the market faces several restraints. Volatility in raw material prices, particularly for steel, rubber, and specialized plastics, can directly impact production costs and profit margins for manufacturers. Intense competition among a fragmented landscape of both large global players and numerous regional manufacturers often leads to price wars, hindering sustainable revenue growth. Furthermore, the economic cyclicality of end-use industries, such as automotive and construction, can lead to fluctuations in demand, posing challenges for consistent market growth planning. The extended product life cycle of many industrial casters also means that replacement cycles can be long, potentially slowing new sales.

Despite these challenges, significant opportunities abound for market players. The rising demand for 'smart casters' integrated with IoT sensors for predictive maintenance and real-time operational feedback presents a lucrative avenue for innovation and premium product offerings. Customization for niche applications, such as cleanroom environments, high-temperature settings, or specialized medical equipment, allows manufacturers to differentiate their products and command higher margins. Expanding into developing regions with nascent industrial bases offers untapped growth potential. Furthermore, a growing focus on sustainability and eco-friendly manufacturing processes provides opportunities for developing casters made from recycled materials or those designed for enhanced energy efficiency, appealing to environmentally conscious industries. These forces collectively dictate the market's trajectory and competitive dynamics.

Segmentation Analysis

The Industrial Caster Wheels Market is extensively segmented to reflect the diverse applications and technical requirements of various industries. This comprehensive segmentation allows for a granular understanding of market dynamics, consumer preferences, and technological advancements across different product categories and end-use sectors. Key segments typically include distinctions based on load capacity, the type of material used for the wheel and housing, the specific application or industry, the wheel configuration, and the sales channel through which products reach end-users.

- By Load Capacity:

- Light Duty Casters (for light equipment, furniture, retail displays)

- Medium Duty Casters (for general material handling, carts, industrial equipment)

- Heavy Duty Casters (for heavy machinery, production lines, automotive)

- Super Heavy Duty Casters (for extreme loads, aerospace, specialized industrial applications)

- By Material:

- Nylon Casters (high load capacity, good for smooth floors, chemical resistant)

- Polyurethane Casters (non-marking, shock absorbent, quiet, floor protective)

- Rubber Casters (cushioning, floor protection, quiet operation, good for uneven surfaces)

- Cast Iron Casters (very high load capacity, durable, economical)

- Steel Casters (extremely strong, corrosion-resistant options)

- Phenolic Casters (high load, impact resistant, smooth rolling)

- Polyolefin Casters (chemical resistant, economical, light duty)

- By Application:

- Material Handling Equipment (carts, dollies, pallet jacks)

- Automotive Industry (assembly lines, mobile workstations)

- Industrial Machinery (mobile equipment bases, heavy tools)

- Medical & Healthcare (hospital beds, medical carts, diagnostic equipment)

- Retail & Institutional (store fixtures, display racks, office equipment)

- Food Service (kitchen equipment, utility carts)

- Aerospace (ground support equipment, specialized tooling)

- Construction (scaffolding, mobile platforms)

- Textile Industry (yarn carts, machinery)

- By Wheel Type:

- Swivel Casters (360-degree rotation for maneuverability)

- Rigid Casters (fixed direction for stability)

- Braking Casters (locks wheel and/or swivel for security)

- Kingpinless Casters (heavy duty, impact resistant, maintenance-free)

- Pneumatic Casters (air-filled tires for cushioning, uneven terrain)

- Spring-Loaded Casters (shock absorption, reduced vibration)

- Conductive Casters (dissipates static electricity)

- By End-Use Industry:

- Manufacturing Sector

- Warehousing & Logistics

- Healthcare & Pharmaceuticals

- Retail & Supermarkets

- Automotive & Transportation

- Aerospace & Defense

- Food & Beverage Processing

- Construction & Building Materials

- By Sales Channel:

- Direct Sales (OEMs, large industrial buyers)

- Distributors & Wholesalers (resellers, regional markets)

- Online Retail & E-commerce (small businesses, individual buyers)

Value Chain Analysis For Industrial Caster Wheels Market

The value chain for the industrial caster wheels market begins with the upstream activities centered on the procurement and processing of raw materials. This includes the sourcing of various metals like steel and cast iron, polymers such as nylon, polyurethane, and rubber, as well as components like bearings, axles, and fastening hardware. Suppliers in this segment focus on material quality, cost-effectiveness, and timely delivery, as these directly impact the manufacturing efficiency and final product quality of caster wheels. Material advancements, particularly in composite polymers and specialty alloys, are critical for developing casters with enhanced durability and specialized performance characteristics.

Midstream activities involve the core manufacturing processes, where raw materials are transformed into finished industrial caster wheels. This encompasses casting, molding, stamping, machining, and assembly operations. Manufacturers in this stage focus on precision engineering, adhering to strict quality control standards, and optimizing production scalability. Investments in advanced manufacturing technologies, such as automation and robotic assembly, are crucial for increasing efficiency, reducing labor costs, and maintaining competitive pricing. Product design and innovation also play a significant role here, with R&D efforts aimed at improving load capacity, maneuverability, noise reduction, and developing casters for specific challenging environments.

Downstream activities involve the distribution, sales, and post-sales support of industrial caster wheels to end-users. Distribution channels are varied, often including both direct sales to large original equipment manufacturers (OEMs) and major industrial clients, as well as indirect channels through a network of distributors, wholesalers, and increasingly, online retail platforms. Direct sales allow for customized solutions and closer client relationships, while indirect channels provide broader market reach and cater to smaller businesses and replacement markets. Post-sales services, including technical support, warranty provisions, and replacement parts availability, are vital for customer satisfaction and brand loyalty. The efficiency and reach of these distribution networks are paramount for market penetration and timely product delivery to diverse industrial clients globally.

Industrial Caster Wheels Market Potential Customers

Potential customers and end-users of industrial caster wheels represent a vast array of industries that require efficient and reliable solutions for mobilizing equipment, materials, and products within their operational environments. The primary consumers are typically businesses and organizations involved in manufacturing, logistics, healthcare, retail, and automotive sectors, all of whom rely on these components to enhance productivity and safety. These end-users are characterized by their need for specific caster attributes, such as load capacity, material compatibility with their environment, resistance to chemicals or extreme temperatures, and specialized features like anti-static properties or precision swivel actions.

Manufacturing industries, including heavy machinery, electronics, and general fabrication, utilize industrial casters for assembly lines, mobile workstations, and for moving work-in-progress components. The warehousing and logistics sector, encompassing distribution centers and freight forwarding, depends heavily on casters for pallet jacks, utility carts, and material handling trolleys to streamline the movement of goods. In the healthcare sector, hospitals and clinics purchase casters for medical carts, patient beds, and diagnostic equipment, prioritizing quiet operation, hygiene, and maneuverability. Retail and institutional clients, such as supermarkets, hotels, and schools, use casters for display racks, cleaning equipment, and furniture to ensure easy rearrangement and floor protection.

The automotive industry is a significant consumer, integrating casters into production tools, mobile jigs, and vehicle assembly systems. Furthermore, specialized industries like aerospace, food and beverage processing, and pharmaceuticals require custom-engineered casters that meet stringent regulatory standards for cleanliness, temperature control, and specific load requirements. Each segment seeks casters that not only meet their functional demands but also contribute to operational efficiency, cost reduction, and compliance with safety protocols. The diversity in these customer needs drives continuous innovation and specialization within the industrial caster wheels market, ensuring a constant demand for both standard and highly customized solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tente International GmbH, Blickle Räder+Rollen GmbH u. Co. KG, Colson Group, Albion Casters (Caster Concepts Inc.), Hamilton Caster & Mfg. Co., RWM Casters, Caster City, Schioppa, Revvo Caster, PFAFF Verkehrstechnik, Roll-Tech, Dura-Caster, Darnell-Rose, PEMCO Casters, Darcor, STEINCO Paul vom Stein GmbH, Haion Caster, CEVA Casters, Kee Safety Inc., GD Caster Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Caster Wheels Market Key Technology Landscape

The industrial caster wheels market is continually evolving with technological advancements aimed at enhancing performance, durability, and specialized functionalities. A significant area of focus is on material science, with innovations in high-performance polymers like advanced polyurethanes and specialized nylon compounds that offer superior load-bearing capacity, improved chemical resistance, and non-marking properties. These materials are engineered to reduce rolling resistance, extend service life, and perform optimally in diverse environmental conditions, including extreme temperatures and abrasive terrains. Furthermore, advancements in metal alloys contribute to lighter yet stronger caster frames and components, crucial for heavy-duty applications.

Another pivotal technological trend is the integration of smart features and IoT capabilities. This includes embedding sensors within caster wheels to monitor critical parameters such as load distribution, speed, temperature, and even vibration. These sensors can transmit real-time data to centralized systems, enabling predictive maintenance, optimizing logistics routes, and improving overall operational efficiency. Such 'smart casters' facilitate proactive decision-making, reducing unexpected downtime and enhancing workplace safety by signaling potential issues before they escalate. This connectivity allows for seamless integration into broader industrial IoT (IIoT) ecosystems and automation systems.

Ergonomic design principles and specialized functionalities are also at the forefront of technological innovation. This involves developing casters that are quieter, easier to maneuver, and provide superior shock absorption, which is particularly important in sensitive environments like healthcare facilities or for transporting delicate items. Designs that prevent floor damage, resist specific corrosive agents, or offer enhanced braking mechanisms for increased stability are increasingly in demand. The adoption of advanced manufacturing techniques, such as additive manufacturing (3D printing) for prototyping and custom component creation, further accelerates the development of highly specialized and efficient industrial caster solutions tailored to unique industry requirements, pushing the boundaries of traditional caster design and application.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to robust manufacturing growth, increasing industrialization, and significant investments in infrastructure and logistics in countries like China, India, Japan, and South Korea. Rapid urbanization and the expansion of e-commerce contribute to high demand for material handling solutions.

- North America: A mature market characterized by advanced industrial automation, high adoption of specialized casters in aerospace, medical, and automotive sectors, and stringent workplace safety standards driving demand for premium, ergonomic, and smart caster solutions.

- Europe: Exhibits strong demand driven by a well-established manufacturing base, a focus on sustainability and energy efficiency, and high standards for product quality and safety. Germany, the UK, and France are key contributors with significant R&D investments in caster technology.

- Latin America: An emerging market with growing industrial activity, particularly in Brazil and Mexico, fueled by foreign investments and expanding manufacturing capabilities. Increasing demand for efficient material handling solutions to support economic development.

- Middle East and Africa (MEA): Shows promising growth prospects, driven by ongoing infrastructure development projects, diversification of economies away from oil, and increasing industrialization. Investments in logistics and warehousing are boosting caster demand, especially in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Caster Wheels Market.- Tente International GmbH

- Blickle Räder+Rollen GmbH u. Co. KG

- Colson Group

- Albion Casters (Caster Concepts Inc.)

- Hamilton Caster & Mfg. Co.

- RWM Casters

- Caster City

- Schioppa

- Revvo Caster

- PFAFF Verkehrstechnik GmbH

- Roll-Tech A/S

- Dura-Caster

- Darnell-Rose

- PEMCO Casters

- Darcor

- STEINCO Paul vom Stein GmbH

- Haion Caster Co., Ltd.

- CEVA Casters & Wheels

- Kee Safety Inc.

- GD Caster Corp.

Frequently Asked Questions

What is the projected growth rate for the Industrial Caster Wheels Market?

The Industrial Caster Wheels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by expanding industrialization and e-commerce.

Which factors are primarily driving the demand for industrial caster wheels?

Key drivers include global industrialization, the growth of the e-commerce sector, increased automation in manufacturing and logistics, and stricter workplace safety regulations.

What are the key segments within the Industrial Caster Wheels Market?

The market is segmented by load capacity (light, medium, heavy, super heavy duty), material (nylon, polyurethane, rubber, etc.), application (material handling, medical, automotive), wheel type, and end-use industry.

How is AI impacting the Industrial Caster Wheels Market?

AI is enabling predictive maintenance through smart casters, optimizing supply chain logistics, assisting in design and simulation, and enhancing automation in manufacturing processes for caster wheels.

Which region holds the largest share in the Industrial Caster Wheels Market?

Asia Pacific (APAC) currently dominates the market due to its robust manufacturing base, significant industrial growth, and substantial investments in logistics infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager