Industrial Chocolate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432397 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Industrial Chocolate Market Size

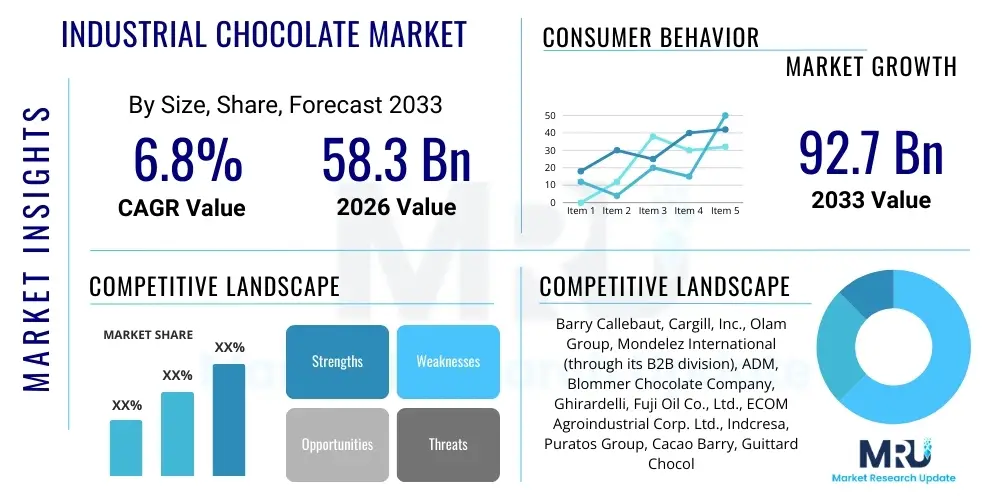

The Industrial Chocolate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 58.3 Billion in 2026 and is projected to reach USD 92.7 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing global demand for processed foods, particularly confectionery, bakery products, and dairy desserts, where industrial chocolate serves as a fundamental ingredient for both flavor and texture enhancement.

Industrial Chocolate Market introduction

The Industrial Chocolate Market encompasses the large-scale production and distribution of cocoa derivatives, including cocoa butter, cocoa liquor, cocoa powder, and various couverture and compound chocolate formulations, primarily sold to other food manufacturing industries rather than directly to consumers. These products form the essential building blocks for a vast array of downstream consumer goods, such as candies, biscuits, ice creams, beverages, and flavorings for specialized nutrition products. The versatility of industrial chocolate—ranging from dark, milk, and white varieties to specialized heat-stable compounds—makes it indispensable across multiple food sectors globally.

Major applications of industrial chocolate span the confectionery industry, which utilizes vast quantities for molding and coating; the bakery sector, where it is used in fillings, toppings, and dough; and the dairy and ice cream industry, where it provides flavor complexity and structural integrity. Key benefits of utilizing industrial chocolate include consistent quality, enhanced shelf stability, ease of large-scale incorporation into complex manufacturing processes, and cost-effectiveness compared to small-batch artisanal chocolate. Furthermore, advancements in processing technology allow manufacturers to tailor flavor profiles and viscosity levels precisely to meet specific application requirements, driving widespread adoption.

The market is significantly driven by evolving consumer preferences favoring premium and high-cocoa-content chocolates, alongside the rapid expansion of the food processing industry in emerging economies. Manufacturers are increasingly focused on ethical sourcing, sustainability certifications (like Fair Trade and Rainforest Alliance), and developing functional ingredients, such as reduced-sugar or dairy-free industrial chocolate options, responding directly to health and wellness trends. Supply chain resilience, ensuring stable access to cocoa beans amidst climate variability and geopolitical issues, remains a critical strategic priority for major players.

Industrial Chocolate Market Executive Summary

The global Industrial Chocolate Market is poised for significant expansion, driven by continuous innovation in product development aimed at addressing shifting consumer demands for healthier, sustainable, and ethically sourced ingredients. Business trends highlight strategic capacity expansion, particularly in Asia Pacific, and a strong focus on backward integration by major processors to secure raw material supply. Furthermore, large multinational food companies are increasingly seeking partnerships with certified suppliers to meet corporate sustainability goals, pushing the demand for certified sustainable cocoa derivatives and specialized functional coatings.

Regional trends indicate that Europe remains the largest consumer and innovation hub, dominating the high-quality couverture segment, whereas Asia Pacific is the fastest-growing market, propelled by urbanization, rising disposable incomes, and the Westernization of diets leading to increased consumption of packaged bakery and confectionery goods. North America continues to see robust demand for industrial chocolate used in indulgent snacks and functional food applications, especially plant-based and low-sugar formulations. Companies are focusing their investment strategies on optimizing cold chain logistics and developing localized flavor profiles to penetrate diverse regional markets effectively.

Segment trends underscore the dominance of cocoa butter and cocoa liquor segments due to their fundamental role in all chocolate products, although the compound chocolate segment is witnessing faster growth in developing regions due to its cost-efficiency and technical advantages in hot climates. Application-wise, confectionery maintains the largest share, but the bakery and dairy segments are exhibiting accelerated growth rates driven by product diversification, including elaborate chocolate decorations, complex layered fillings, and premium ice cream coatings. Sustainability and ethical sourcing standards are increasingly becoming differentiating factors across all major segments, impacting procurement decisions significantly.

AI Impact Analysis on Industrial Chocolate Market

Common user questions regarding AI's impact on the Industrial Chocolate Market typically revolve around enhancing supply chain traceability, optimizing cocoa processing yields, and developing new, personalized flavor profiles at scale. Users are concerned with how AI can mitigate risks associated with volatile cocoa harvests, improve quality consistency in large batches, and reduce the environmental footprint of manufacturing operations. The consensus expectation is that AI and machine learning (ML) will revolutionize quality control, moving away from subjective human inspection towards data-driven, predictive quality assurance, ultimately ensuring high-grade ingredients consistently reach end-users, thus minimizing waste and maximizing efficiency across complex processing lines.

The application of Artificial Intelligence is beginning to transform key stages of the industrial chocolate value chain, starting from agricultural data analysis to predict optimal harvest times and detect crop diseases early, using satellite imagery and IoT sensors in cocoa farms. In the manufacturing phase, predictive maintenance algorithms are optimizing the performance of critical machinery like conches and refiners, drastically reducing unexpected downtime and improving throughput. This technological integration allows processors to handle increasing production volumes while adhering to rigorous quality standards required by global food safety regulations, ensuring homogeneity in parameters such as particle size distribution and rheological properties of the chocolate mass.

Furthermore, AI is instrumental in accelerating product innovation. ML models can analyze vast datasets of consumer preferences, ingredient interactions, and sensory evaluations to rapidly formulate new industrial chocolate compounds tailored for specific applications (e.g., extremely low-viscosity coatings or high-protein inclusions). This capability significantly shortens the R&D cycle for industrial buyers (confectioners, bakers) seeking unique flavor experiences or functional properties. By automating complex quality checks and offering precise process control, AI enhances operational efficiency, contributing directly to cost reduction and margin improvement across the entire industrial chocolate manufacturing ecosystem.

- AI-driven supply chain transparency and traceability (Bean-to-Bar tracking).

- Machine learning optimization of conching and tempering processes for desired texture and rheology.

- Predictive quality control systems utilizing computer vision for defect detection in cocoa beans and finished products.

- Demand forecasting and inventory management optimization based on real-time market data.

- Personalized flavor development and ingredient matching through AI data analysis.

- Automated energy management in processing plants to reduce operational costs and carbon footprint.

DRO & Impact Forces Of Industrial Chocolate Market

The dynamics of the Industrial Chocolate Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact forces on market growth and strategic direction. A primary driver is the burgeoning global demand for convenience and indulgence foods, coupled with the expanding population and rising middle class in regions like Asia and Latin America, fueling continuous uptake of packaged snacks and confectionery that rely heavily on industrial chocolate. This growth is further supported by the confectionery industry's perpetual need for innovative and diverse chocolate ingredients, including specialized coatings and functional inclusions, driving higher volumes and value growth.

However, the market faces critical restraints, most notably the volatility and increasing cost of cocoa beans, driven by climate change impacts, aging cocoa tree stocks, and fluctuating global commodity markets. Furthermore, stringent regulatory scrutiny regarding food safety, ethical labor practices, and deforestation associated with cocoa sourcing imposes significant operational and compliance costs on manufacturers. The complexity of ensuring full supply chain traceability, especially for sustainable or specialty certifications, adds another layer of constraint, requiring substantial investment in technology and verification processes to maintain consumer trust and meet regulatory mandates.

Opportunities for growth are concentrated in the development and proliferation of sustainable, ethical, and "free-from" industrial chocolate varieties, such as vegan, sugar-free, or high-fiber compounds, catering to health-conscious consumers and those with dietary restrictions. Technological advancements, particularly in processing and ingredient innovation (e.g., fat bloom resistant chocolate, alternative sweeteners), offer competitive advantages. Strategic geographical expansion into untapped emerging markets and vertical integration strategies aimed at controlling the cocoa supply chain from farm gate to factory floor represent key avenues for sustained market dominance and profitability over the forecast period, leveraging the potential for direct operational control.

Segmentation Analysis

The Industrial Chocolate Market is highly segmented based on product type, application, form, and primary raw material. Understanding these segments is crucial for manufacturers to tailor their production capabilities and marketing strategies effectively, addressing the diverse technical needs of downstream food producers. The segmentation reflects differences in intended use, performance characteristics (such as melting point and viscosity), cost structures, and adherence to specific regulatory requirements, thereby delineating distinct competitive spaces within the broader industrial ingredients landscape.

Product type segmentation distinguishes between pure cocoa derivatives (liquor, butter, powder) and finished industrial products (couverture and compound chocolate), with each category serving specific functional roles in food production, from flavor base to coating material. Application analysis highlights the critical reliance of the confectionery, bakery, and dairy industries on stable and consistent chocolate ingredients for their mass-produced items. This granular segmentation allows suppliers to specialize in high-value niches, such as premium chocolate fillings for gourmet bakeries or specialized heat-stable coatings for tropical confectionery markets, optimizing their product portfolio for maximal market penetration and yield.

- By Product Type:

- Cocoa Butter

- Cocoa Liquor (Cocoa Mass)

- Cocoa Powder

- Couverture Chocolate

- Compound Chocolate

- By Application:

- Confectionery (Molding, Enrobing, Fillings)

- Bakery (Breads, Cakes, Cookies, Pastries)

- Dairy & Desserts (Ice Cream, Yogurt, Mousses)

- Beverages

- Cereals & Snacks

- By Form:

- Molded

- Liquid

- Chips/Drops/Chunks

- Powder

- By Raw Material Source:

- Conventional Chocolate

- Organic Chocolate

- Fair Trade/Sustainable Certified Chocolate

Value Chain Analysis For Industrial Chocolate Market

The value chain for industrial chocolate is complex and spans from upstream raw material cultivation to downstream application in finished food products. The upstream segment involves the cultivation and harvesting of cocoa beans, typically concentrated in West Africa, South America, and Southeast Asia. Key activities here include farming, fermentation, drying, and initial export. This stage is crucial as the quality and sustainability practices at the farm level profoundly influence the characteristics and cost of the final industrial chocolate product, requiring significant investment in traceability and ethical sourcing programs by major processors to ensure supply integrity and premium quality output.

Midstream activities center on processing and manufacturing, where raw cocoa beans are refined into essential industrial ingredients: cocoa liquor, cocoa butter, and cocoa powder. This involves cleaning, roasting, winnowing, grinding, pressing, and ultimately, blending and conching to create compound and couverture chocolates tailored for industrial use. Efficiency in this stage—particularly maximizing yield of high-value cocoa butter and ensuring consistent particle size distribution—is paramount for profitability. Manufacturers employ advanced refining technologies to meet the stringent quality and rheological specifications demanded by large-scale food producers, necessitating specialized equipment and controlled environments for complex ingredient formulation.

The downstream segment involves the distribution of bulk industrial chocolate products to B2B customers, primarily large confectionery, bakery, and dairy companies. Distribution channels are typically direct sales from manufacturer to food processor, often involving specialized logistics for temperature control (tankers for liquid chocolate, controlled environment storage for solids). Indirect channels, utilizing specialized food ingredient distributors, serve smaller or regional manufacturers. The successful fulfillment of demand relies heavily on robust logistics, technical sales support to assist customers with application specific needs, and long-term supply contracts ensuring stability and quality for the large-volume industrial buyers, emphasizing reliability and technical partnership.

Industrial Chocolate Market Potential Customers

Potential customers for the industrial chocolate market are primarily large-scale food and beverage manufacturers that require consistent, high-quality cocoa derivatives and chocolate compounds as core ingredients for their mass-produced consumer goods. The most significant customer segment remains the global confectionery industry, encompassing multinational corporations and regional players specializing in molded chocolates, bars, truffles, and seasonal novelty items, which utilize industrial chocolate for their primary product structure and flavor profiles. These buyers prioritize specific technical parameters such as viscosity, stability, and customized flavor nuances to ensure their products meet precise texture and taste expectations across various production runs.

Another major customer base includes the bakery and cereals industry, which uses industrial chocolate for coatings, inclusions (chips, chunks), fillings, and decorations in products ranging from cookies and biscuits to breakfast cereals and energy bars. For this segment, heat stability and resistance to migration (fat bloom) are critical purchasing criteria, particularly for products destined for prolonged shelf life or complex processing environments. Furthermore, the burgeoning prepared food, dairy, and ice cream sectors represent rapidly growing customer bases, demanding large volumes of specialized liquid coatings, inclusions for ice cream, and chocolate flavor bases for yogurts and beverages, all requiring stringent quality and food safety certifications.

Additionally, specialized customers include manufacturers in the nutraceutical and functional food sector, which increasingly incorporate high-cocoa-content ingredients into protein bars, meal replacement shakes, and specialized dietary supplements for both flavor masking and potential health benefits. These customers often demand organic, low-sugar, or high-fiber chocolate ingredients, necessitating complex formulation support from industrial chocolate suppliers. Overall, potential customers seek suppliers who can offer reliability, scalability, competitive pricing, extensive technical support for application development, and verifiable sustainability credentials that align with their corporate social responsibility goals, making supply chain transparency a key differentiator in procurement decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 58.3 Billion |

| Market Forecast in 2033 | USD 92.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barry Callebaut, Cargill, Inc., Olam Group, Mondelez International (through its B2B division), ADM, Blommer Chocolate Company, Ghirardelli, Fuji Oil Co., Ltd., ECOM Agroindustrial Corp. Ltd., Indcresa, Puratos Group, Cacao Barry, Guittard Chocolate Company, Valrhona, NATRA, Ferrero (Industrial Division), Nestle S.A. (B2B Ingredients), Delfi Limited, Alpezzi Chocolate, and The Hershey Company (B2B Ingredients). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Chocolate Market Key Technology Landscape

The technological landscape of the Industrial Chocolate Market is characterized by continuous refinement aimed at improving efficiency, ensuring food safety, and customizing product functionality. Modern processing facilities leverage highly automated and integrated production lines, utilizing advanced refining and conching equipment to achieve extremely precise particle size distribution and optimal rheological properties, which are critical for high-speed industrial applications like enrobing and molding. Key innovations include specialized tempering machines that utilize controlled cooling curves to enhance crystallization stability, thereby minimizing fat bloom and significantly extending the shelf life of the final consumer product, crucial for global distribution.

Furthermore, technology focusing on raw material processing and sustainability has gained prominence. Modern cocoa processing employs improved roasting techniques that maximize flavor development while minimizing potential contaminants. Advanced analytical instrumentation, including near-infrared (NIR) spectroscopy and chromatographs, is routinely used for rigorous quality control, ensuring consistent fat content, moisture levels, and detecting undesirable flavor precursors or chemical residues, ensuring compliance with strict international food regulations. This focus on analytical technology provides suppliers with definitive data on ingredient consistency, a major requirement for large industrial buyers who rely on consistent performance in their own complex manufacturing processes.

Looking ahead, the market is adopting smart manufacturing techniques, integrating IoT sensors and AI-driven control systems throughout the factory floor to achieve real-time process monitoring and optimization. This includes sophisticated systems for tracking cocoa bean origin, ensuring supply chain integrity, and utilizing big data analytics to predict machinery maintenance needs, drastically reducing downtime. Ingredient technology is also evolving, with notable advancements in developing cocoa butter alternatives (CBRs, CBES) and specialized fat systems that offer enhanced heat stability, allowing manufacturers to create chocolate products suitable for challenging environments and diverse product applications without compromising sensory quality or structural integrity.

Regional Highlights

- Europe: Europe represents the largest and most mature market for industrial chocolate, driven by high per capita consumption of confectionery and long-standing traditions in high-quality chocolate manufacturing, particularly in countries like Germany, Belgium, Switzerland, and the Netherlands. The region is characterized by stringent quality standards (e.g., the Cocoa and Chocolate Products Directives) and a strong consumer demand for certified sustainable and premium organic chocolate derivatives. Innovation here is focused on artisanal quality delivered at industrial scale, emphasizing high cocoa content and complex flavor profiles for the premium segment.

- North America: North America holds a significant market share, characterized by robust demand from the snack, bakery, and functional food sectors. The market here is highly responsive to health and wellness trends, driving demand for innovative industrial chocolate solutions such as lower-sugar, high-protein, and dairy-free (vegan) compounds used extensively in energy bars, specialized baking mixes, and frozen desserts. Product innovation focuses on optimizing ingredients for complex, multi-textured applications and meeting demands for simplified, natural ingredient lists.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, fueled by rapid urbanization, Western influence on dietary habits, and rising disposable incomes, particularly in China, India, and Southeast Asia. The industrial chocolate demand is surging across confectionery and biscuit manufacturing sectors as multinational and local food producers rapidly expand their production capacities. Key growth drivers include the need for heat-stable compound chocolates suitable for hot climates and localizing flavor applications to cater to specific regional palate preferences, necessitating specialized technical support from industrial suppliers.

- Latin America: This region is crucial not only as a major sourcing hub for high-quality cocoa beans (e.g., Ecuador, Peru) but also as a growing consumer market. Market growth is driven by expanding domestic confectionery and bakery industries. The focus is increasingly on value addition within the region, processing locally sourced, premium cocoa beans into industrial ingredients for both domestic use and export, capitalizing on the unique flavor profiles of regional cocoa varieties.

- Middle East and Africa (MEA): MEA presents a growing, albeit fragmented, market. The primary growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by significant investment in food processing and hospitality sectors. Challenges include logistical complexity and the need for extremely heat-stable compounds due to high ambient temperatures. Africa, especially West Africa, remains critical for its upstream role in cocoa bean production, while the consumer market for finished chocolate ingredients is developing slowly but steadily alongside infrastructure improvements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Chocolate Market.- Barry Callebaut

- Cargill, Inc.

- Olam Group

- ADM (Archer Daniels Midland Company)

- Blommer Chocolate Company

- Fuji Oil Co., Ltd.

- Indcresa

- Puratos Group

- Ghirardelli Chocolate Company (Industrial Division)

- Guittard Chocolate Company

- Valrhona (Industrial/Cacao Barry Division)

- Mondelez International (B2B Ingredients)

- Nestle S.A. (Industrial Ingredients)

- ECOM Agroindustrial Corp. Ltd.

- NATRA

- Aalborg Chokolade (Aalborg Industries)

- Cémoi Group

- The Hershey Company (B2B)

- Alpezzi Chocolate

- Delfi Limited

Frequently Asked Questions

Analyze common user questions about the Industrial Chocolate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between couverture and compound industrial chocolate?

Couverture chocolate contains a high percentage of cocoa butter (minimum 31%) and requires tempering to achieve a glossy finish and snap, making it preferred for premium confectionery. Compound chocolate replaces cocoa butter entirely or partially with vegetable fats (like palm kernel oil) and does not require tempering, making it more cost-effective and suitable for applications requiring high heat stability.

How is the Industrial Chocolate Market addressing sustainability and ethical sourcing challenges?

Market players are increasingly implementing rigorous supply chain traceability systems, partnering directly with farmer cooperatives, and adopting certifications (Fair Trade, Rainforest Alliance, UTZ) to ensure ethical labor practices, reduce deforestation, and promote sustainable farming methods, responding directly to regulatory pressure and consumer demand for transparency.

Which application segment drives the highest demand in the Industrial Chocolate Market?

The Confectionery segment, encompassing molded chocolates, bars, and seasonal treats, consistently accounts for the largest share of industrial chocolate consumption due to the high volume of finished products manufactured globally that rely on chocolate as a core structural and flavor ingredient.

What technological advancements are impacting the manufacturing efficiency of industrial chocolate?

Key advancements include the integration of AI and IoT for real-time process monitoring, predictive maintenance of refining machinery, and specialized fat crystallization technologies (tempering) to produce highly stable chocolate products resistant to fat bloom, ensuring consistent quality and reduced operational downtime.

What impact do rising raw material costs, particularly cocoa beans, have on market pricing?

Fluctuations and increases in cocoa bean prices significantly elevate the cost of industrial cocoa derivatives (liquor, butter), leading to price volatility for finished industrial chocolate compounds. Manufacturers often manage this through long-term procurement contracts, hedging strategies, and, in some cases, shifting formulations towards compound chocolate or using alternative fat systems to mitigate direct cost transfer to industrial buyers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager