Industrial Coding Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434589 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Industrial Coding Equipment Market Size

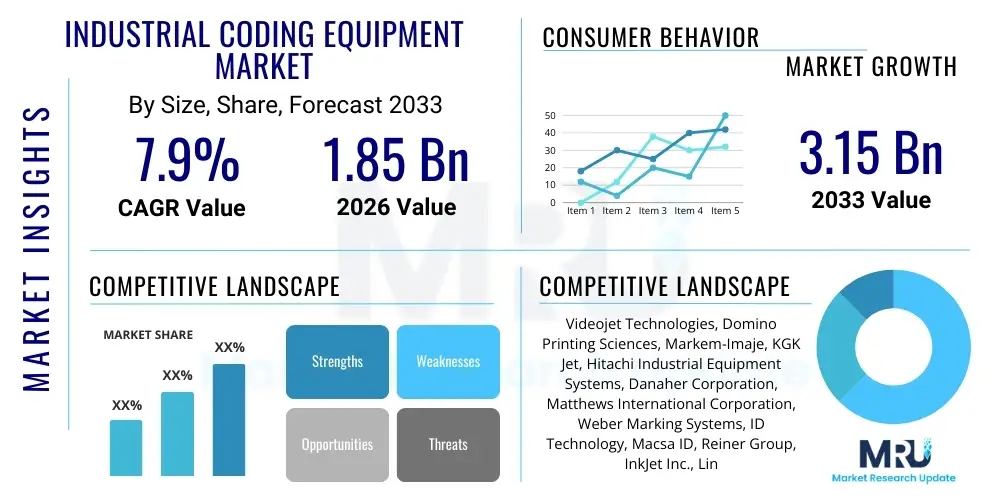

The Industrial Coding Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.15 Billion by the end of the forecast period in 2033.

Industrial Coding Equipment Market introduction

The Industrial Coding Equipment Market encompasses specialized machinery and systems designed for marking essential information—such as batch codes, expiration dates, barcodes, and serial numbers—directly onto products and packaging materials across various industrial sectors. This critical equipment ensures product traceability, regulatory compliance, and consumer safety by embedding high-contrast, durable codes suitable for diverse substrates, including plastics, metals, glass, and flexible films. The primary technologies driving this market include Continuous Inkjet (CIJ), Thermal Inkjet (TIJ), Drop-on-Demand (DOD), Laser Coding, and Thermal Transfer Overprinting (TTO), each catering to specific speed, substrate, and environmental requirements within manufacturing processes. Effective coding is non-negotiable for supply chain management and inventory tracking.

Major applications of industrial coding equipment span the Food and Beverage, Pharmaceutical, Automotive, Cosmetics, and Electronics sectors. In highly regulated industries like Pharmaceuticals, coding equipment must meet stringent validation requirements to support serialization and anti-counterfeiting initiatives, ensuring compliance with global standards such as the Drug Supply Chain Security Act (DSCSA) in the US and the Falsified Medicines Directive (FMD) in Europe. The increasing automation of production lines necessitates coding solutions that offer high-speed operation, minimal maintenance downtime, and seamless integration with existing Manufacturing Execution Systems (MES) and enterprise resource planning (ERP) platforms. This integration capacity is crucial for maintaining throughput and accuracy in high-volume environments.

The market growth is fundamentally driven by the escalating global focus on product traceability and regulatory mandates concerning transparency and labeling accuracy. Key benefits derived from utilizing advanced industrial coding equipment include improved operational efficiency through reduced manual errors, enhanced brand protection against illicit copying, and optimized supply chain visibility from the point of manufacture to the consumer. Furthermore, the transition toward sustainable packaging materials and the demand for higher resolution, permanent codes are accelerating the adoption of advanced coding technologies, particularly laser marking systems and environmentally friendly ink formulations, positioning the market for sustained expansion over the forecast period.

Industrial Coding Equipment Market Executive Summary

The Industrial Coding Equipment Market is experiencing robust growth driven primarily by stringent global regulatory frameworks, particularly those mandating serialization and traceability in the pharmaceutical and food sectors. Current business trends indicate a strong shift towards digitalization and integration, where coding equipment is no longer viewed as a standalone utility but as a critical component of the integrated smart factory ecosystem, leveraging IoT capabilities for real-time performance monitoring and predictive maintenance. This technological maturation is fostering demand for equipment capable of printing variable data at high speeds with exceptional accuracy, pushing manufacturers to innovate systems that are modular, highly flexible, and future-proof to handle evolving packaging formats and sustainability requirements.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, massive expansion of the consumer goods manufacturing base, and increasing adoption of automated packaging lines, especially in high-growth economies like China, India, and Southeast Asia. North America and Europe, while mature, maintain dominance in terms of technological adoption and value, driven by high labor costs necessitating full automation and early implementation of complex traceability legislation. These regions are prioritizing the adoption of sophisticated laser coding and specialized Thermal Transfer Overprinting (TTO) technologies for sustainable packaging applications, maintaining their positions as key innovators in equipment efficiency and data integrity standards.

Segment trends highlight the dominance of Continuous Inkjet (CIJ) technology due to its versatility and cost-effectiveness across a broad range of applications, although Laser Coding is rapidly gaining share, particularly in high-reliability and low-maintenance environments such as beverage canning and premium plastics marking. In terms of end-use, the Food and Beverage sector remains the largest segment, continually demanding robust solutions to manage short shelf-life products and complex promotional coding, while the Pharmaceutical segment is experiencing the highest growth rate due to mandatory global serialization requirements. The long-term trajectory points toward highly integrated, software-driven solutions that minimize human intervention and maximize data accuracy throughout the production lifecycle.

AI Impact Analysis on Industrial Coding Equipment Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Industrial Coding Equipment Market typically revolve around enhancing equipment efficiency, ensuring code quality validation, and integrating coding processes into broader smart factory ecosystems. Key concerns focus on how AI can transition coding operations from reactive maintenance schedules to predictive maintenance models, reducing costly unplanned downtime. Users are keen to understand AI’s role in automated visual inspection systems (AI-powered vision systems) to guarantee 100% code accuracy, thereby minimizing recalls and regulatory penalties. Furthermore, there is significant interest in how AI algorithms can optimize consumable usage (ink, solvent, ribbon) based on real-time operational variables, leading to substantial cost savings and waste reduction in high-volume production environments.

AI is transforming industrial coding by enabling intelligent control systems that dynamically adjust parameters to environmental changes, such as temperature or humidity, ensuring consistent print quality across shifts without manual calibration. The application of machine learning within operational technology (OT) is allowing coding machines to self-diagnose minor malfunctions before they escalate into major failures, scheduling maintenance precisely when components show early signs of degradation. This predictive capability shifts the operational expenditure model for manufacturers, maximizing uptime and overall equipment effectiveness (OEE), a crucial metric in lean manufacturing settings.

Moreover, AI algorithms are vital in processing the massive volumes of data generated by modern coding equipment, facilitating advanced analytics that inform strategic business decisions, not just operational ones. For instance, analyzing code application rates correlated with specific product batches allows companies to refine inventory management strategies or pinpoint process bottlenecks far upstream. This capability transforms coding data from simple product marking into actionable business intelligence, linking shop floor performance directly to enterprise-level data architecture, thus cementing AI's role as a driver of process optimization and enhanced compliance verification.

- AI-powered vision systems enable real-time, 100% code quality verification and immediate rejection of non-compliant products.

- Machine learning algorithms facilitate highly accurate predictive maintenance, drastically reducing unplanned equipment downtime.

- AI optimizes ink and consumable usage by analyzing printing patterns and environmental conditions dynamically.

- Intelligent integration with MES systems allows for automated job setup and parameter adjustment based on production schedules.

- AI supports advanced anomaly detection, identifying potential regulatory non-compliance issues before they leave the factory floor.

DRO & Impact Forces Of Industrial Coding Equipment Market

The dynamics of the Industrial Coding Equipment Market are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively form significant Impact Forces. Primary drivers include the global proliferation of stringent serialization and track-and-trace mandates across major industries, forcing manufacturers to invest in advanced, verifiable coding solutions. Concurrently, the necessity for high-speed, integrated automation on production lines pushes demand for reliable, fast equipment like high-resolution thermal inkjet systems and ultrafast lasers. Opportunities are abundant, primarily centered on developing sustainable coding solutions—such as systems compatible with biodegradable packaging and eco-friendly inks—and capitalizing on the Industry 4.0 movement by offering fully networked, data-generating coding systems that integrate seamlessly with cloud platforms and AI analytics.

Conversely, the market faces several restraining factors that temper growth. The initial high capital investment required for advanced laser and Continuous Inkjet (CIJ) equipment can be prohibitive for small and medium-sized enterprises (SMEs), particularly in developing regions. Furthermore, the complexities associated with integrating new coding equipment into legacy production infrastructure often lead to significant operational challenges and extended transition periods. Another key restraint involves the variable performance and shelf-life limitations of consumables (inks, solvents, ribbons), which require constant inventory management and generate specialized waste, contributing to operational costs and environmental concerns, thus challenging the sustainability goals of large corporations.

These drivers and restraints generate powerful impact forces. The dominant impact force is the unrelenting pressure for regulatory compliance and product safety, which ensures a baseline demand regardless of economic cycles. The secondary impact force stems from technological obsolescence; as coding requirements (e.g., smaller fonts, higher contrast, 2D matrix codes) become more demanding, older equipment rapidly becomes inadequate, forcing cyclical replacement and upgrades. This continuous need for modernization, paired with the opportunity presented by Industry 4.0 connectivity, ensures that vendors focusing on IoT integration, software enhancements, and comprehensive service contracts are positioned for market leadership and sustained profitability in the competitive landscape.

Segmentation Analysis

The Industrial Coding Equipment Market is meticulously segmented based on technology, product type, end-use industry, and geography, reflecting the highly specialized nature of marking and coding requirements. Technological segmentation is the most crucial, determining the speed, substrate compatibility, and resolution capabilities available to end-users, with major categories including Continuous Inkjet (CIJ), which remains the workhorse for high-speed, general-purpose applications, and Laser Coding, favored for permanent, high-resolution marking on premium or difficult materials. The choice of segmentation is dictated by regulatory compliance needs and the specific packaging material used in the manufacturing environment.

Segmentation by end-use highlights the varying demands across vertical markets. The Food and Beverage segment requires robust equipment capable of handling wet and dusty environments and complying with strict hygiene standards, focusing heavily on expiration dates and promotional codes. In contrast, the Pharmaceutical sector mandates equipment designed for serialization, demanding extremely precise, validated systems to ensure compliance with global track-and-trace mandates. These differences necessitate highly customized solutions, driving market diversity and specialization among key equipment manufacturers to address sector-specific challenges like temperature sensitivity, line speed, and data management complexity.

Moreover, the segmentation by product type—encompassing dedicated printers, laser markers, thermal transfer overprinters (TTO), and label applicators—helps delineate the market based on application complexity and integration needs. The rapid proliferation of digital printing solutions is blurring some traditional boundaries, yet discrete segments like TTO remain vital for flexible packaging films where high-quality, real-time printing is necessary. Strategic analysis of these segments is essential for vendors to target the most lucrative opportunities, focusing either on mass-market CIJ versatility or high-value, niche solutions like advanced UV laser coding for specialized plastics.

- By Technology:

- Continuous Inkjet (CIJ)

- Thermal Inkjet (TIJ)

- Drop-on-Demand (DOD)

- Laser Coding (CO2, Fiber, UV)

- Thermal Transfer Overprinting (TTO)

- By Product Type:

- Printers and Coders

- Laser Markers

- Label Applicators and Print & Apply Systems

- By End-Use Industry:

- Food and Beverage

- Pharmaceutical and Healthcare

- Automotive and Aerospace

- Cosmetics and Personal Care

- Electronics and Electrical

- Chemicals and Construction

- By Ink Type (for Inkjet systems):

- Solvent-based Inks

- Water-based Inks

- UV-curable Inks

Value Chain Analysis For Industrial Coding Equipment Market

The value chain for the Industrial Coding Equipment Market initiates with upstream activities involving the sourcing of highly specialized components and raw materials. Key inputs include precision mechanical components, sophisticated electronic control boards, high-performance lasers (for laser markers), and specialized chemical formulations for inks and solvents. The successful development and procurement of these core inputs, particularly the chemistry behind durable, fast-drying, and compliant ink solutions, represent a significant competitive advantage. Manufacturers maintain tight relationships with chemical suppliers to ensure the consistent quality and regulatory adherence of consumables, which often constitute a recurring revenue stream critical to overall market profitability.

Midstream processes involve the intricate assembly and manufacturing of the coding systems themselves. This stage requires significant investment in advanced manufacturing techniques, quality control (QC), and intellectual property (IP) related to printhead design and fluidic systems. Companies focus on optimizing modular design to facilitate ease of maintenance and speed of installation. The value-add here stems from integrating proprietary software and high-speed processing capabilities into the hardware, enabling seamless communication with production lines and external data management systems, which is the cornerstone of modern Industry 4.0 compliance and operational excellence.

Downstream activities center on distribution channels, installation, post-sale service, and the recurring supply of consumables. Distribution often utilizes a dual approach: direct sales teams for major, highly customized projects (like pharmaceutical serialization lines) and a vast network of authorized distributors and value-added resellers (VARs) for general industrial sales and regional support. The service component is crucial; comprehensive service contracts, rapid response technical support, and the efficient supply of proprietary inks and parts are essential for customer retention and minimizing end-user downtime, making the service ecosystem a major profit center within the overall market structure.

Industrial Coding Equipment Market Potential Customers

The potential customer base for industrial coding equipment is extensive, encompassing virtually all sectors involved in high-volume manufacturing and packaging where product identification and traceability are mandated or desired. The largest and most consistently demanding customer segment is the Food and Beverage industry, including major global producers of soft drinks, packaged foods, and snacks, where codes are essential for managing 'best by' dates, lot tracking, and complying with food safety regulations. These buyers prioritize equipment robustness, high print speed on continuous lines, and resistance to challenging environments characterized by moisture, temperature fluctuations, or wash-down procedures, demanding high-uptime performance.

Another high-growth segment comprises the Pharmaceutical and Healthcare industries, driven by global mandates requiring unit-level serialization for drugs. These customers require highly specialized, validated coding solutions—often utilizing high-resolution Thermal Inkjet (TIJ) or precise laser systems—to mark small packaging components (vials, blister packs) with complex 2D data matrix codes. For pharmaceutical buyers, system accuracy, compliance reporting capabilities, and seamless integration into stringent quality management systems are far more critical than initial cost, leading to high-value contract opportunities focused on long-term data integrity and audit readiness.

Beyond the core regulated sectors, significant demand originates from the Automotive components industry, requiring permanent coding (often via laser or dot peen marking) for anti-counterfeiting and long-term warranty tracking on durable parts, and the Cosmetics and Personal Care industry, which focuses on aesthetic, high-contrast coding on premium packaging materials. The electronics sector also utilizes coding equipment heavily for marking printed circuit boards (PCBs) and component housings for quality control and lifecycle management. These diverse needs ensure that manufacturers must maintain a broad portfolio of technologies to satisfy the highly varied technical and regulatory requirements of the global manufacturing base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.15 Billion |

| Growth Rate | 7.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Videojet Technologies, Domino Printing Sciences, Markem-Imaje, KGK Jet, Hitachi Industrial Equipment Systems, Danaher Corporation, Matthews International Corporation, Weber Marking Systems, ID Technology, Macsa ID, Reiner Group, InkJet Inc., Linx Printing Technologies, Diagraph, SATO Holdings, Zebra Technologies, KBA-Metronic, Allen Coding Systems, Control Print Ltd., Codeology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Coding Equipment Market Key Technology Landscape

The technological landscape of the industrial coding equipment market is characterized by intense competition between legacy and emerging marking techniques, constantly pushing for faster speeds, higher resolution, and increased environmental sustainability. Continuous Inkjet (CIJ) remains the foundational technology, valued for its ability to print on almost any substrate at high velocity; however, the ongoing challenge involves reducing solvent evaporation, improving startup reliability, and expanding its integration capabilities. Manufacturers are heavily investing in proprietary CIJ ink formulations that adhere better to difficult, recycled plastics and specialized food contact materials, while also developing more robust fluidic systems that require less maintenance intervention and minimize consumable waste.

The most transformative area of the market is the rapid deployment of Laser Coding systems, including CO2, Fiber, and UV lasers. Laser technology is preferred for its permanent, high-contrast, and low-maintenance operation, eliminating the need for consumables like ink and solvent, aligning perfectly with sustainability goals. Fiber lasers are dominating metal and hard plastic applications, while advanced UV lasers are proving crucial for pharmaceutical packaging and delicate materials where thermal stress must be minimized. The technological edge in laser marking is now moving from simple hardware speed to sophisticated software control, enabling dynamic code placement and integration with high-speed vision inspection systems to guarantee code integrity across entire production batches.

Furthermore, the rise of Thermal Inkjet (TIJ) technology, originally common in office printing, is being rapidly adopted for industrial applications requiring clean, high-resolution printing, particularly on porous and semi-porous substrates and increasingly on flexible film using specialized inks. TIJ systems benefit from their simplicity, zero maintenance due to replaceable print cartridges, and environmental cleanliness. Crucially, the integration of these coding devices into the broader framework of the Industrial Internet of Things (IIoT) is paramount. Equipment now includes embedded sensors, secure network interfaces, and standardized communication protocols (like OPC UA or Ethernet/IP) to facilitate real-time performance data aggregation, remote diagnostics, and automated data exchange for streamlined factory management and enhanced traceability reporting.

Regional Highlights

Regional dynamics heavily influence the type and complexity of industrial coding equipment adopted, reflecting local manufacturing intensity and regulatory stringency.

- Asia Pacific (APAC): Characterized by the highest growth rate, driven by expansive manufacturing output in consumer goods, electronics, and food processing across China, India, and ASEAN nations. Demand is high for cost-effective, durable coding solutions (primarily CIJ and entry-level TIJ) necessary for scaling production and complying with emerging local food safety laws and export requirements.

- North America: A mature market defined by high levels of automation and early adoption of advanced technologies like laser coding and complex print-and-apply systems. Growth is spurred by stringent pharmaceutical serialization regulations (DSCSA) and the constant need for labor-saving, fully integrated Industry 4.0 solutions across the Food & Beverage and Automotive sectors.

- Europe: Driven by strict regulatory environments (e.g., EU FMD) and a strong corporate commitment to sustainability. This region leads in the adoption of sophisticated laser coding, solvent-free inks, and specialized TTO solutions for complex flexible packaging. Emphasis is placed on maximizing energy efficiency and minimizing waste in all coding processes.

- Latin America (LATAM): Exhibits solid growth fueled by expanding local manufacturing and increasing consumer expectations for product traceability. The market primarily adopts reliable CIJ and entry-level laser systems, seeking a balance between initial investment cost and operational reliability, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Emerging market focused on infrastructure development and local production capabilities. Demand is concentrated in the packaging and beverages sectors, often sourcing robust, field-tested CIJ technology to handle harsh climate conditions and ensure compliance with importing country standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Coding Equipment Market.- Videojet Technologies (Danaher Corporation)

- Domino Printing Sciences (Brother Industries)

- Markem-Imaje (Dover Corporation)

- KGK Jet

- Hitachi Industrial Equipment Systems Co., Ltd.

- Matthews International Corporation

- Weber Marking Systems

- ID Technology (ProMach)

- Macsa ID

- Reiner Group

- InkJet Inc.

- Linx Printing Technologies (Danaher Corporation)

- Diagraph (ITW)

- SATO Holdings Corporation

- Zebra Technologies Corporation

- KBA-Metronic GmbH

- Allen Coding Systems

- Control Print Ltd.

- Codeology

- Avery Dennison Corporation (Marking & Coding Solutions)

Frequently Asked Questions

Analyze common user questions about the Industrial Coding Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological segments driving industrial coding market growth?

The market is primarily driven by Continuous Inkjet (CIJ) technology due to its versatility and high speed, and increasingly by Laser Coding systems (CO2, Fiber, UV) favored for their permanent marking capabilities, low maintenance, and environmental benefits, especially in regulatory-heavy sectors like Pharmaceuticals and premium packaging.

How does the shift to Industry 4.0 affect industrial coding equipment requirements?

Industry 4.0 mandates that coding equipment must offer seamless digital integration, using IoT sensors and standardized communication protocols (like OPC UA) to enable real-time data collection, remote monitoring, automated parameter adjustments, and predictive maintenance, transforming coders into smart factory assets.

Which end-use industry represents the highest growth potential for coding equipment?

The Pharmaceutical and Healthcare segment exhibits the highest growth potential, driven by mandatory global regulatory compliance, specifically unit-level serialization requirements for traceability and anti-counterfeiting efforts, necessitating investment in high-precision, validated coding and vision systems.

What are the key differences between Continuous Inkjet (CIJ) and Thermal Inkjet (TIJ) systems?

CIJ is highly suitable for high-speed, continuous marking on non-porous surfaces, relying on solvents. TIJ is characterized by high resolution, zero maintenance (using disposable cartridges), cleanliness, and suitability for porous or semi-porous materials, making it ideal for packaging requiring detailed, clean codes like barcodes and 2D matrices.

What role does sustainability play in the development of new coding equipment?

Sustainability is a major trend, driving demand for eco-friendly solutions such as Laser Coding (which eliminates consumables), the development of volatile organic compound (VOC)-free and plant-based inks, and equipment designed to minimize energy consumption and waste generation during high-volume production cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager