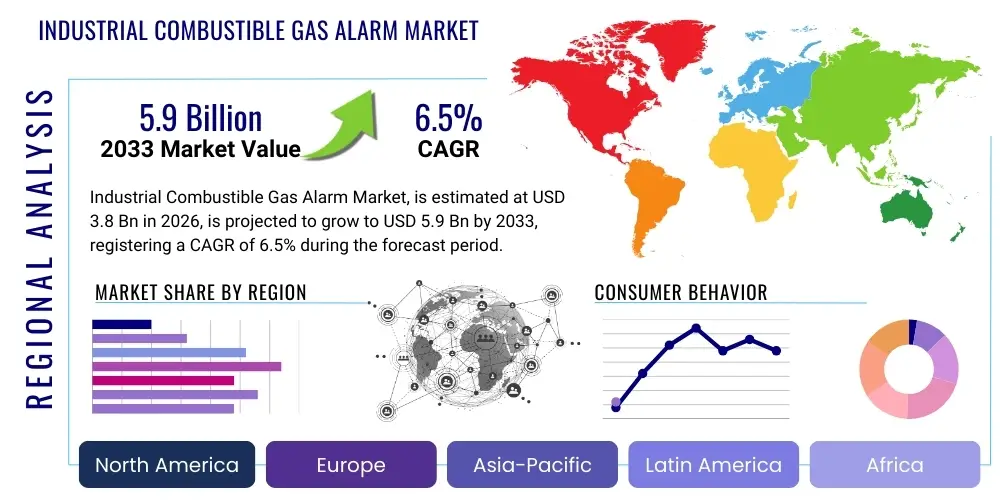

Industrial Combustible Gas Alarm Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437991 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Industrial Combustible Gas Alarm Market Size

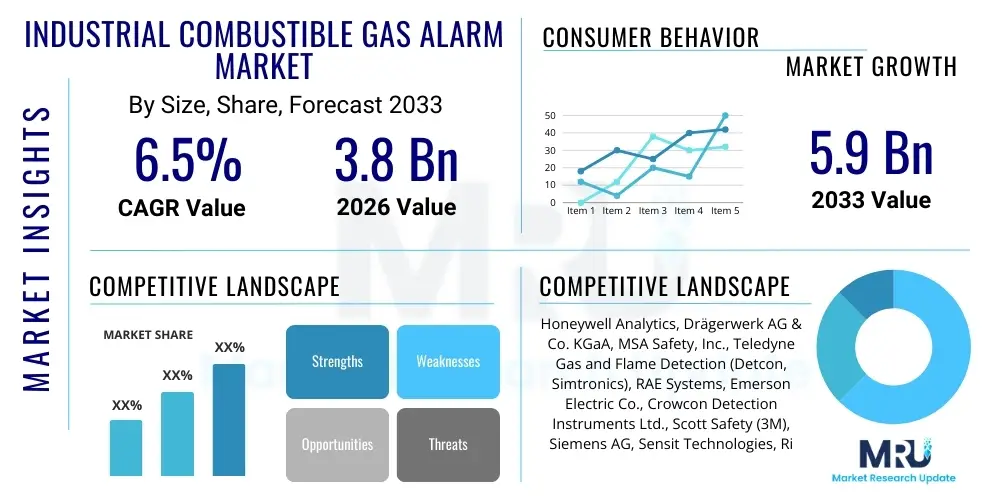

The Industrial Combustible Gas Alarm Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Industrial Combustible Gas Alarm Market introduction

The Industrial Combustible Gas Alarm Market encompasses the manufacturing, distribution, and utilization of sophisticated detection systems designed to continuously monitor the presence of flammable gases within industrial environments. These devices are crucial safety components in sectors such as oil and gas, chemical processing, mining, pharmaceuticals, and manufacturing, where the unintended release of gases like methane, propane, or hydrogen poses severe explosion risks. The primary function of these alarms is to detect gas concentrations at levels below the Lower Explosive Limit (LEL), triggering timely warnings that allow for preventive measures, including process shutdown or evacuation, thereby safeguarding personnel and critical infrastructure. Product offerings range from fixed detection systems integrated into plant infrastructure to portable, battery-operated devices used for localized inspection and worker personal protection. Key technologies employed include catalytic bead sensors, infrared (IR) sensors, and solid-state sensors, each offering distinct advantages in terms of sensitivity, lifespan, and resistance to poisoning. The continuous technological evolution toward smart, networked systems is redefining market dynamics, enhancing reliability and operational efficiency across high-risk industrial settings globally.

The core benefits derived from implementing high-quality industrial gas alarms extend beyond mere regulatory compliance, contributing significantly to operational resilience and financial stability. These systems prevent catastrophic accidents, minimizing downtime, reducing insurance liabilities, and avoiding extensive repair costs associated with explosions or fires. Furthermore, modern combustible gas alarms often integrate advanced diagnostics and communication capabilities, feeding real-time data into centralized safety management platforms. This integration supports predictive maintenance strategies, ensuring the detectors are functioning optimally and reducing the incidence of false alarms that can disrupt operations. The increasing complexity of industrial processes and the handling of diverse hydrocarbon fuels necessitate increasingly specialized and reliable detection solutions that can withstand harsh operating conditions, including extreme temperatures, high humidity, and corrosive chemical exposure, driving innovation in sensor housing and durability.

The market growth is primarily propelled by stringent global safety regulations mandated by governmental and international bodies, such as OSHA, ATEX, and IECEx, which impose strict compliance standards for explosion prevention in hazardous areas. Furthermore, the rapid expansion of industrial infrastructure, particularly in the Asia Pacific region, driven by petrochemical plant construction and liquefied natural gas (LNG) terminal development, generates substantial demand for comprehensive safety instrumentation. Driving factors also include the growing awareness among stakeholders regarding the human and economic costs of industrial accidents, pushing companies towards proactive risk mitigation strategies. The shift towards digitalization and Industry 4.0 principles encourages the adoption of smarter, wireless, and IoT-enabled gas detection solutions, offering enhanced connectivity, remote monitoring, and superior data analysis capabilities for proactive safety management and continuous environmental monitoring.

Industrial Combustible Gas Alarm Market Executive Summary

The Industrial Combustible Gas Alarm Market is experiencing robust growth characterized by the convergence of stringent regulatory enforcement and technological acceleration. Key business trends indicate a significant shift towards integrated safety ecosystems, where gas detection systems communicate seamlessly with fire control panels, SCADA systems, and centralized maintenance platforms. This integration is driven by end-users seeking holistic safety management solutions that offer superior visibility and rapid response capabilities across complex industrial sites. Furthermore, competitive pressure is leading manufacturers to focus heavily on developing highly reliable, low-maintenance sensors, particularly non-dispersive infrared (NDIR) technology, which offers long calibration intervals and resistance to common catalytic sensor poisons, thereby lowering the total cost of ownership (TCO) for industrial operators. Strategic partnerships between hardware manufacturers and software providers specializing in predictive analytics and cloud-based monitoring are becoming common, emphasizing data-driven safety management as a primary market differentiator.

Regionally, the market presents a varied growth profile. North America and Europe maintain leading market shares, primarily due to well-established industrial sectors, rigorous enforcement of occupational safety standards, and high adoption rates of advanced, often wireless, detection technologies. These regions focus on replacing legacy systems and integrating advanced features like remote diagnostics. In contrast, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by rapid industrialization, massive investments in oil and gas exploration (especially in China, India, and Southeast Asia), and increasing governmental focus on industrial safety reform following high-profile incidents. Latin America and the Middle East & Africa (MEA) are also emerging as critical growth hubs, supported by large-scale infrastructure projects in petrochemicals and mining, creating immediate, large-volume demand for both fixed and portable detection solutions, often imported from established global vendors who can meet international safety certifications.

Segment trends highlight the growing dominance of fixed gas detection systems, which are essential for continuous, area-wide monitoring in permanent industrial setups. However, the portable segment is also demonstrating significant momentum, driven by increased deployment in confined space entry applications, routine maintenance checks, and personal protection requirements for mobile workers. Technological segmentation shows NDIR sensors rapidly gaining traction over traditional catalytic bead sensors due to their reliability and reduced need for maintenance, particularly in environments rich in catalytic poisons like silicones or sulfur compounds. The end-use segmentation confirms that the Oil and Gas sector, encompassing upstream, midstream, and downstream operations, remains the largest consumer due to the inherent flammability risks associated with hydrocarbon extraction and processing, closely followed by the chemical and petrochemical industries which handle a wide range of volatile organic compounds (VOCs) and flammable solvents.

AI Impact Analysis on Industrial Combustible Gas Alarm Market

Analysis of common user questions reveals a strong interest in how Artificial Intelligence can fundamentally improve the accuracy, reliability, and proactive capabilities of combustible gas detection systems. Users frequently inquire about AI's ability to distinguish between genuine threats and false alarms caused by environmental changes (like humidity or temperature fluctuations), seeking solutions that minimize operational disruptions. Another major theme revolves around predictive maintenance—how AI algorithms can analyze sensor drift, usage patterns, and environmental data to forecast sensor failure or necessary calibration cycles before safety integrity is compromised. Furthermore, users are keen on AI integration into broader safety architectures, asking how machine learning can correlate gas detection data with video surveillance, pressure readings, and atmospheric data to provide context-aware risk assessments and optimize emergency response protocols. The overarching expectation is that AI will transform detection from a reactive alert mechanism into a proactive, intelligent risk management tool, dramatically increasing uptime and reducing catastrophic risk.

- AI enables predictive maintenance scheduling by analyzing sensor performance data and environmental variables, optimizing calibration cycles and preventing undetected faults.

- Machine Learning algorithms significantly reduce false alarms by filtering out environmental noise and non-hazardous signal fluctuations, improving operational efficiency.

- AI facilitates enhanced hazard mapping and risk modeling by correlating gas detection data with process variables, providing dynamic, real-time risk assessments of an industrial facility.

- Integration with industrial IoT (IIoT) platforms allows AI to manage complex, multi-sensor networks, optimizing power consumption and data transmission efficiency in wireless systems.

- AI-driven automated compliance reporting simplifies regulatory adherence by compiling and verifying audit trails based on historical detection events and system status.

DRO & Impact Forces Of Industrial Combustible Gas Alarm Market

The dynamics of the Industrial Combustible Gas Alarm Market are shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces. The primary driving force is the escalating global regulatory scrutiny concerning industrial safety, particularly in emerging economies where industrialization is accelerating but safety infrastructure is playing catch-up. Governments and industry bodies worldwide are continuously updating and strictly enforcing standards for LEL monitoring in hazardous locations (e.g., IEC 60079 series, ISA standards), compelling industries handling flammable substances to invest heavily in certified and regularly maintained detection equipment. Furthermore, the rising investment in major energy infrastructure projects, including LNG export terminals, petrochemical mega-complexes, and hydrogen processing facilities, intrinsically generates long-term, large-scale demand for robust combustible gas monitoring solutions tailored to extreme and diverse operational environments. This push is strongly augmented by the increasing complexity of modern industrial processes, which necessitates highly sensitive and selective detection technologies to monitor multiple gas types simultaneously, including specialized hydrocarbons and highly volatile process intermediates.

Despite strong underlying drivers, several significant restraints impede more expansive market growth. High initial investment costs for advanced detection systems, particularly those utilizing sophisticated infrared or open-path laser technologies, often pose a barrier, especially for small and medium-sized enterprises (SMEs) in price-sensitive markets. Furthermore, the operational complexity associated with calibration, maintenance, and regular bump testing of these sensors demands specialized training and continuous logistical support, adding substantially to the overall total cost of ownership. Sensor poisoning, where exposure to chemicals like silicones, heavy metal compounds, or halogens degrades the performance of catalytic sensors, remains a pervasive technical challenge, necessitating frequent sensor replacement and potentially leading to undetected hazards if maintenance schedules are not rigorously adhered to. Concerns regarding the reliability and longevity of wireless sensor communication in electrically noisy or structurally dense industrial environments also introduce hesitancy among some large industrial operators who prioritize established, hardwired systems for critical safety applications, thereby restraining the rapid shift towards fully wireless networks.

Significant opportunities are emerging from the ongoing digital transformation within industrial sectors, particularly the integration of Industrial Internet of Things (IIoT) and 5G technologies. The adoption of wireless and battery-powered detectors allows for flexible, cost-effective deployment in remote or temporary hazardous areas where traditional cabling is prohibitively expensive or physically impossible. This expansion of monitoring capability enhances area coverage and improves worker mobility safety. Additionally, the increasing global focus on the transition to hydrogen as a clean energy source presents a substantial long-term opportunity; hydrogen’s unique physical properties (high diffusivity, low LEL) require highly specialized and rapid-response detection systems, stimulating innovation in sensor materials and measurement speeds. Finally, the growing market for comprehensive, subscription-based safety services—including system leasing, remote diagnostics, and predictive maintenance contracts—allows manufacturers to offer value-added services, mitigating end-users' concerns about high upfront costs and complex maintenance, thereby unlocking new revenue streams and fostering deeper client relationships.

Segmentation Analysis

The Industrial Combustible Gas Alarm Market is comprehensively segmented based on technology, product type, end-use industry, and deployment type, allowing for tailored safety solutions across varied operational requirements. The segmentation by technology highlights the fundamental differences in sensor physics, including the traditional catalytic combustion methods known for their robustness and the rapidly growing infrared (IR) technology valued for its immunity to poisoning and extended operational life. By product type, the market distinctly separates into fixed systems, which offer continuous, permanent protection across a facility, and portable systems, which provide personal safety and flexibility for mobile workers and confined space operations. End-use segmentation underscores the diverse risk profiles of major industries, with Oil and Gas dominating demand due to extreme hazard levels, followed closely by manufacturing and chemical sectors. Deployment type distinguishes between permanently wired installations and increasingly popular wireless, battery-operated solutions driven by IIoT adoption and the need for adaptable, scalable safety infrastructure in remote or temporary sites.

- By Technology:

- Catalytic Bead (Pellistor) Sensors

- Infrared (IR) Sensors (NDIR, Open-Path)

- Metal Oxide Semiconductor (MOS) Sensors

- Photoionization Detectors (PID)

- By Product Type:

- Fixed Gas Detectors

- Portable Gas Detectors (Single Gas, Multi-Gas)

- By End-Use Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Mining

- Manufacturing (Automotive, Heavy Machinery)

- Pharmaceuticals and Biotechnology

- Power Generation (Including Nuclear and Renewable Energy)

- Wastewater Treatment

- By Component:

- Sensors

- Transmitters

- Controllers and Monitors

- Alarm Systems (Visual and Audible)

- By Type of Combustible Gas Detected:

- Methane (Natural Gas)

- Propane and Butane (LPG)

- Hydrogen

- Volatile Organic Compounds (VOCs)

Value Chain Analysis For Industrial Combustible Gas Alarm Market

The value chain for the Industrial Combustible Gas Alarm Market begins with upstream activities focused on the procurement and fabrication of specialized raw materials, primarily electronic components such as microcontrollers, sophisticated sensor elements (e.g., infrared sources, catalytic beads, semiconductor oxides), and durable, explosion-proof housing materials (e.g., stainless steel, robust polymers). Specialized component suppliers, particularly those providing patented sensor technology, hold significant bargaining power in this phase. The midstream involves core manufacturing, encompassing sensor calibration, device assembly, rigorous quality control testing, and achieving necessary regulatory certifications (ATEX, UL, CSA, etc.). This stage is dominated by major global safety equipment manufacturers who invest heavily in R&D to improve detection accuracy and system longevity. Distribution channels are varied, involving direct sales teams for large industrial projects, a network of specialized safety distributors and system integrators who customize and install complex fixed systems, and online retailers for standardized portable units. Downstream activities are crucial and involve installation, commissioning, mandatory regular maintenance, bump testing, calibration services, and long-term service contracts offered by manufacturers or third-party service providers, which constitute a significant recurring revenue stream and a critical link in maintaining system integrity for the end-user. The successful functioning of the value chain is highly dependent on close collaboration between manufacturers and integrators to ensure flawless installation and continuous system reliability in hazardous environments.

Industrial Combustible Gas Alarm Market Potential Customers

The primary customers for Industrial Combustible Gas Alarms are any facilities or organizations that handle, produce, transport, or store flammable or explosive gases, liquids, or dusts as part of their core operations, where failure to monitor LEL levels can lead to catastrophic failure. The largest segment of end-users is the heavy industrial sector, particularly global petrochemical companies, refining operations, offshore drilling platforms, and midstream pipeline operators who require continuous monitoring across vast and critical infrastructures to ensure regulatory compliance and operational continuity. Manufacturing facilities, ranging from automotive assembly plants utilizing painting booths and solvent storage areas to chemical synthesis plants producing high-hazard intermediates, represent another crucial customer base, relying on both fixed and portable systems for area and confined space protection. Beyond traditional heavy industry, growing customer segments include specialized facilities such as large-scale wastewater treatment plants, where methane and hydrogen sulfide are process byproducts, and data centers, where specialized fire suppression and detection systems are increasingly needed due to the use of complex battery technologies and increasing power density. Furthermore, government entities, including military bases and public utilities managing natural gas distribution networks, are mandatory customers requiring certified detection equipment to protect both public infrastructure and personnel safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell Analytics, Drägerwerk AG & Co. KGaA, MSA Safety, Inc., Teledyne Gas and Flame Detection (Detcon, Simtronics), RAE Systems, Emerson Electric Co., Crowcon Detection Instruments Ltd., Scott Safety (3M), Siemens AG, Sensit Technologies, Riken Keiki Co., Ltd., Halma plc (City Technology, BW Technologies), Figaro Engineering Inc., Thermo Fisher Scientific, General Monitors (MSA), Bacharach, Inc., Industrial Scientific Corporation, Kimo Instrument, GfG Instrumentation, Schauenburg Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Combustible Gas Alarm Market Key Technology Landscape

The technological landscape of the Industrial Combustible Gas Alarm Market is defined by the critical need for rapid response, stability, and resistance to environmental interference. Catalytic bead sensors (pellistors) remain the foundation of the market, offering cost-effectiveness and reliable LEL measurement, but they are increasingly challenged by limitations such as susceptibility to poisoning and the requirement for oxygen to function. Non-dispersive Infrared (NDIR) technology represents the current industry standard for high reliability, particularly for hydrocarbon detection, owing to its fail-safe nature, immunity to sensor poisons, and ability to operate in anaerobic (oxygen-free) environments. Open-path IR detection systems are crucial for monitoring large perimeter areas, providing wide-scale coverage with a single device. The rapid integration of wireless communication protocols (like Zigbee, Wi-Fi, and emerging 5G connectivity) and battery optimization techniques is transforming deployment strategies, enabling the use of IIoT-enabled detectors that send real-time data to cloud platforms for remote monitoring and predictive diagnostics, significantly reducing installation complexity and cabling costs, while adhering to stringent safety integrity level (SIL) certifications.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, adoption rates, and technological preferences within the Industrial Combustible Gas Alarm Market, driven primarily by localized industrial activity and the maturity of regulatory frameworks.

- North America (NA): Characterized by highly mature safety regulations (e.g., OSHA, API standards) and high disposable income for advanced technology adoption. The region is a leader in implementing wireless and AI-enabled detection systems, driven by robust activity in the shale gas and petrochemical processing sectors, and a strong emphasis on worker safety protocols in confined spaces.

- Europe: Governed by strict harmonized standards such as ATEX and the Machinery Directive. Demand is steady, focused on replacing older infrastructure with highly certified, SIL-rated systems. Germany, the UK, and France show strong demand stemming from chemical manufacturing and heavy industrial bases, prioritizing energy efficiency and long sensor lifespan.

- Asia Pacific (APAC): The fastest-growing regional market, propelled by massive industrial infrastructure expansion, particularly in China, India, and Southeast Asian nations. Rapid development in LNG processing, refining capacity, and general manufacturing drives high-volume demand for both fixed and portable alarms, often prioritizing volume and competitive pricing, though safety compliance is rapidly tightening.

- Middle East & Africa (MEA): Growth is intrinsically linked to massive investments in the regional oil and gas sector, particularly Saudi Arabia, UAE, and Qatar. These regions require ultra-robust, high-specification equipment capable of withstanding extreme ambient temperatures and corrosive environments inherent in large-scale upstream and downstream operations.

- Latin America (LATAM): Exhibit moderate growth tied to petrochemical development in Brazil and Mexico. Market penetration is often hampered by fluctuating economic conditions, but ongoing regulatory reforms aimed at aligning domestic safety standards with international best practices are stimulating future demand, especially in mining and heavy industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Combustible Gas Alarm Market.- Honeywell Analytics (part of Honeywell International Inc.)

- Drägerwerk AG & Co. KGaA

- MSA Safety, Inc.

- Teledyne Gas and Flame Detection (including Detcon and Simtronics)

- Emerson Electric Co.

- Crowcon Detection Instruments Ltd. (part of Halma plc)

- Scott Safety (now part of 3M Company)

- Siemens AG

- Riken Keiki Co., Ltd.

- Industrial Scientific Corporation (part of Fortive Corporation)

- Halma plc (various subsidiaries including City Technology and BW Technologies)

- Figaro Engineering Inc.

- General Monitors (now part of MSA Safety)

- SENSIT Technologies LLC

- GfG Instrumentation, Inc.

- Bacharach, Inc.

- Thermo Fisher Scientific Inc.

- Schauenburg Group

- Kimo Instrument

- Oldham Detection (part of Teledyne)

Frequently Asked Questions

What is the projected growth rate (CAGR) for the Industrial Combustible Gas Alarm Market through 2033?

The Industrial Combustible Gas Alarm Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven by increasing industrial safety regulations and technological integration.

Which sensor technology is leading the shift towards reliable combustible gas detection?

Infrared (IR) sensor technology, particularly Non-Dispersive Infrared (NDIR), is increasingly preferred over traditional catalytic beads due to its resistance to poisoning, longer lifespan, and superior reliability in harsh industrial environments, offering a lower total cost of ownership.

What role does the Oil and Gas sector play in the market demand?

The Oil and Gas sector remains the largest end-user segment, driving significant demand for both fixed and portable combustible gas alarms due to the inherent, high-level flammability risks associated with the extraction, processing, and transportation of hydrocarbons globally.

How is AI impacting the accuracy of combustible gas alarm systems?

AI is significantly improving system accuracy by employing machine learning algorithms to analyze sensor data and environmental variables, effectively minimizing false alarms while enabling predictive maintenance and optimizing calibration schedules for enhanced operational reliability.

Which geographic region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is projected to register the highest CAGR, primarily fueled by rapid industrialization, massive investments in energy infrastructure, and increasingly strict enforcement of industrial safety standards across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager