Industrial Counters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432924 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Counters Market Size

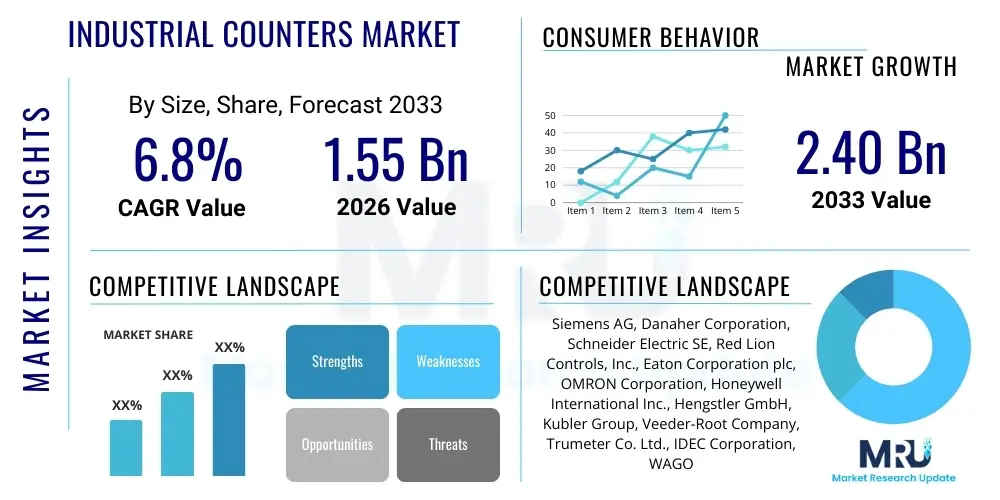

The Industrial Counters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.40 Billion by the end of the forecast period in 2033. This growth is primarily fueled by the accelerating adoption of Industry 4.0 principles, where precise real-time monitoring and data acquisition are paramount for optimizing manufacturing efficiency and operational performance across diverse industrial verticals.

Industrial Counters Market introduction

The Industrial Counters Market encompasses a wide range of devices designed to measure, display, and record specific industrial events, quantities, or time intervals. These devices are fundamental components in process control and automation systems, providing critical data necessary for production monitoring, quality control, batch counting, and system timing. Products range from simple electromechanical counters to advanced digital electronic counters, utilizing sophisticated microprocessors and communication interfaces to integrate seamlessly with Programmable Logic Controllers (PLCs), Human-Machine Interfaces (HMIs), and Supervisory Control and Data Acquisition (SCADA) systems.

Modern industrial counters, particularly digital and multifunctional variants, offer enhanced accuracy, high-speed counting capabilities, and superior flexibility compared to their analog predecessors. They often incorporate features such as multiple inputs, preset thresholds, scaling functions, and networking options (like Ethernet/IP or Profibus), making them essential for achieving high levels of automation. Major applications span discrete manufacturing, packaging machinery, textile production, food and beverage processing, energy management, and flow metering, serving as the backbone for operational transparency and efficient resource allocation in complex industrial environments.

The primary benefits driving the market include improved accuracy in batch processing, reduced downtime through precise cycle timing, optimized inventory management via accurate part counting, and enhanced quality assurance. The driving factors for market expansion are the global push towards smart manufacturing, rapid technological advancements in sensor integration and connectivity (IoT), and stringent regulatory requirements demanding highly traceable and verifiable production metrics, especially in high-stakes sectors like pharmaceuticals and aerospace.

Industrial Counters Market Executive Summary

The global Industrial Counters Market is witnessing robust growth, underpinned by fundamental business trends centered on digitalization and automation. Key business trends include the shift from traditional mechanical counters towards advanced, networked digital multifunction counters that support high-frequency measurements and integration into Industrial Internet of Things (IIoT) ecosystems. Manufacturers are focusing on developing compact, modular designs with enhanced noise immunity and robust communication protocols, catering to the demand for flexible and scalable automation solutions. Furthermore, the trend toward predictive maintenance relies heavily on the data integrity provided by these counters, pushing vendors to incorporate diagnostics and self-calibration features.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, largely due to massive investments in expanding manufacturing bases, particularly in China, India, and Southeast Asian nations adopting sophisticated automation technologies across automotive, electronics, and food and beverage sectors. North America and Europe, while mature, continue to drive innovation, exhibiting high demand for high-end, highly integrated counters essential for complex machinery operating within strict regulatory frameworks and emphasizing energy efficiency and high throughput. Political initiatives promoting local manufacturing capacity and infrastructure spending further bolster regional market stability and growth.

Segment-wise, the digital counter segment dominates the market due to its superior accuracy, programmability, and ease of integration with modern control systems. Within applications, the discrete manufacturing and process control industries hold the largest market shares, driven by the necessity for precise batch control, speed measurement, and totalizing functions. The emergence of sophisticated time interval counters capable of microsecond precision is also creating niche opportunities in specialized fields like high-speed packaging and semiconductor fabrication, ensuring steady segmental momentum throughout the forecast period.

AI Impact Analysis on Industrial Counters Market

User inquiries regarding AI's impact on industrial counting revolve around leveraging machine learning for anomaly detection, enhancing measurement accuracy in noisy environments, and moving beyond simple counting towards complex pattern recognition for predictive maintenance. Common questions address how AI can process high-velocity counter data to anticipate equipment failures, optimize batch cycles without manual input, and provide diagnostic insights into production variability. Users are concerned with the necessary computational infrastructure, data privacy associated with counter data, and the required sensor sophistication to feed meaningful information to AI algorithms. The overarching expectation is that AI integration will transform industrial counters from passive data providers into active, intelligent components of the industrial control loop.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally altering the functional role of industrial counters. Instead of merely recording events, smart counters equipped with edge computing capabilities can now preprocess data and apply ML models locally. This enables real-time identification of subtle shifts in counting patterns, speed variations, or timing anomalies that often signal impending mechanical failure in the associated equipment, thereby transitioning maintenance practices from reactive to predictive. AI algorithms optimize counter scaling factors and signal filtering, reducing measurement errors caused by electrical noise, vibration, or fluctuating input signal quality, resulting in vastly improved operational reliability and data integrity.

Furthermore, AI facilitates advanced process optimization. By analyzing historical counter data (e.g., number of parts produced per shift, average cycle time) alongside environmental and machine health data, ML models can automatically adjust control parameters in real time. For instance, in a bottling plant, AI-enhanced counters can recognize subtle degradation in machine speed associated with rising temperature and proactively adjust the conveyor speed within acceptable limits to maximize throughput while preventing overheating. This level of autonomous, data-driven optimization is a powerful value proposition accelerating the demand for AI-ready industrial counter solutions.

- AI enhances predictive maintenance by analyzing counting patterns and detecting deviations indicating mechanical wear.

- Machine learning algorithms optimize signal filtering, significantly improving counting accuracy in electrically noisy industrial environments.

- AI enables autonomous recalibration and self-diagnostics of counter devices, reducing manual intervention and maintenance costs.

- Integration with AI platforms facilitates advanced production forecasting and throughput optimization based on real-time event logging.

- Edge computing capabilities allow smart counters to process high volumes of data locally before transmission, reducing network latency.

DRO & Impact Forces Of Industrial Counters Market

The Industrial Counters Market is primarily driven by the mandatory requirements of Industry 4.0 adoption, which necessitates high-precision, networked measurement devices across all manufacturing sectors. Restraints include the high initial integration costs associated with replacing legacy mechanical systems with advanced digital counterparts and ongoing concerns regarding cybersecurity vulnerabilities inherent in networked industrial control components. Opportunities lie in the rapidly expanding application base in smart city infrastructure, such as utility metering and traffic control, and the growing demand for highly specialized counters tailored for extremely high-speed processes like 5G component manufacturing. These factors collectively exert significant impact forces, accelerating technological advancements while simultaneously challenging manufacturers to balance cost-efficiency with robust digital security features.

The primary drivers are inextricably linked to global manufacturing expansion and modernization initiatives. The proliferation of automated assembly lines, packaging machinery, and continuous process plants relies entirely on precise counting and timing functions to maintain operational synchronization and quality standards. Specific regulatory drivers, such as ISO standards for quality management and traceability requirements in pharmaceuticals and aerospace, mandate the use of highly accurate, verifiable measurement tools, further cementing the role of advanced industrial counters. The need for energy management monitoring also drives demand for sophisticated pulse counters used in monitoring utility consumption at machine level.

Conversely, significant restraints hinder market growth. The complexity of integrating new digital counters with diverse legacy industrial infrastructure poses a substantial challenge, often requiring extensive reconfiguration and specialized labor. Moreover, price sensitivity, particularly in emerging markets, limits the rapid adoption of higher-end, feature-rich networked counters. The impact forces are thus dominated by the pressure to innovate, focusing on creating backward-compatible, plug-and-play counter solutions that minimize integration complexity and total cost of ownership, while also addressing the rising need for secure industrial communication protocols to safeguard operational data.

Segmentation Analysis

The Industrial Counters Market is comprehensively segmented based on product type, display technology, application, and end-use industry, reflecting the diverse operational requirements across the industrial landscape. The segmentation highlights the underlying trend toward digital and multifunctional devices capable of handling complex timing and rate measurement tasks beyond simple totalizing. Analyzing these segments provides strategic insights into which technologies are experiencing the fastest uptake and which industrial sectors offer the most lucrative growth potential due to ongoing automation initiatives and capital expenditure focused on modernization.

Segmentation by type—predominantly electronic/digital versus mechanical/electromechanical—shows a clear migration towards electronic solutions due to superior measurement precision, integration capabilities, and extended functionalities like preset counting and communication interfaces. Application segmentation reveals that high-speed counting and rate indication are increasingly critical in discrete manufacturing (e.g., automotive and electronics), whereas elapsed time and totalizing counters remain vital in continuous process industries and facility management. These distinct demands shape product development strategies for market vendors.

- By Type:

- Electronic/Digital Counters (Totalizing, Preset, Rate/Tachometers, Multifunction)

- Mechanical/Electromechanical Counters

- By Display Technology:

- LED Displays

- LCD Displays

- OLED Displays

- By Application:

- Counting (Batch Control, Piece Counting)

- Timing (Elapsed Time, Interval Measurement)

- Rate Indication (Tachometers, Flow Rate)

- Position/Length Measurement

- By End-Use Industry:

- Automotive & Transportation

- Food & Beverage Processing

- Pharmaceuticals & Chemicals

- Packaging Machinery

- Textile & Printing

- Energy & Power Generation

- Water & Wastewater Management

Value Chain Analysis For Industrial Counters Market

The value chain for the Industrial Counters Market begins with upstream activities involving raw material suppliers, predominantly providers of high-precision electronic components such as microprocessors, high-speed ASIC chips, display panels (LED/LCD), and specialized plastic or metal enclosures. Key upstream challenges include managing the semiconductor supply chain volatility, which directly impacts the cost and availability of core digital components used in advanced counters. Manufacturers heavily rely on specialized sensor providers (e.g., proximity, photo-electric, magnetic sensors) whose output signals feed into the counter devices.

Midstream activities involve the design, assembly, and testing of the counters. Leading counter manufacturers invest heavily in R&D to improve counting speed, noise immunity, communication capabilities (e.g., IO-Link, Ethernet/IP), and modularity. Quality control and stringent certification processes are crucial at this stage, ensuring devices meet industrial operational standards (IP ratings, EMC compliance). The trend toward miniaturization and enhanced integration necessitates sophisticated manufacturing processes, often leveraging automated assembly lines to maintain precision and consistency across high-volume production.

Downstream distribution channels play a pivotal role in market access. Direct sales are common for large industrial enterprises requiring customized solutions and comprehensive technical support, particularly in highly complex automation projects. However, the majority of sales flow through indirect channels, including global and regional industrial distributors, system integrators, and specialized automation solution providers. These intermediaries provide localized inventory, technical application support, and installation services to small and medium-sized enterprises (SMEs). Efficient logistics and strong partnerships with reliable distributors are critical for market penetration and timely delivery to diverse industrial end-users globally.

Industrial Counters Market Potential Customers

Potential customers for industrial counters are broad and span nearly every sector involved in automated production, process control, or utility management. The primary buyers are Machine Builders (OEMs) who integrate these counters directly into specialized machinery, such as packaging lines, CNC machines, and textile equipment, requiring high reliability and specific communication protocols. Secondly, end-user manufacturers (e.g., automotive assembly plants, pharmaceutical facilities, food processors) purchase counters for retrofitting existing equipment, monitoring production cycles, performing quality checks, and managing resource consumption within their established factories.

In the automotive industry, customers utilize counters extensively for tracking car body assembly progression, monitoring paint shop cycles, and verifying engine component counts during assembly. Pharmaceutical customers demand verifiable batch counters that comply with stringent FDA regulations (e.g., 21 CFR Part 11) for audit trails and precise dosage tracking. The energy and utility sector is a growing customer base, utilizing specialized pulse counters for monitoring electricity, gas, and water flow rates in critical infrastructure and smart grid applications, demanding robust and secure field devices capable of operating reliably in harsh environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.40 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Danaher Corporation, Schneider Electric SE, Red Lion Controls, Inc., Eaton Corporation plc, OMRON Corporation, Honeywell International Inc., Hengstler GmbH, Kubler Group, Veeder-Root Company, Trumeter Co. Ltd., IDEC Corporation, WAGO Group, Autonics Corporation, SICK AG, Pepperl+Fuchs GmbH, Murrplastik Systemtechnik GmbH, Carlo Gavazzi Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Counters Market Key Technology Landscape

The technological landscape of the Industrial Counters Market is defined by connectivity, precision, and intelligence. The transition from basic pulse counting to advanced multifunction measurement devices is driven by the adoption of sophisticated embedded systems and microcontrollers capable of handling high-frequency inputs and complex mathematical scaling simultaneously. A core technological advancement is the widespread incorporation of industrial communication protocols such as IO-Link, Ethernet/IP, and PROFINET, which allow counters to transmit real-time data directly to enterprise resource planning (ERP) systems and cloud platforms, fundamentally supporting the centralized data management required by IIoT architectures.

Furthermore, technology development is focused on enhancing ruggedness and operational lifespan. Counters are increasingly designed with high IP ratings to withstand harsh environmental conditions, including dust, moisture, and extreme temperatures, common in heavy industry and food processing. The use of high-contrast, durable display technologies (like high-luminosity LCDs and OLEDs) improves visibility and usability in diverse factory settings. Modular designs are also becoming standard, allowing end-users to easily swap communication modules or input types, offering scalability and future-proofing against changing industrial standards without requiring full hardware replacement.

A crucial emerging technology is the integration of edge computing and enhanced sensor fusion capabilities directly within the counter module. This allows the device to not only count but also analyze related sensor data (e.g., vibration, temperature) in real time. For instance, a smart counter might process counting signals alongside acceleration data to detect subtle abnormalities in machinery speed profile immediately. This distributed intelligence minimizes reliance on central PLCs for basic diagnostics, reduces network load, and enables faster decision-making at the machine level, paving the way for truly intelligent automation systems.

Regional Highlights

- Asia Pacific (APAC): This region is the undisputed leader in terms of market volume and growth trajectory. Countries such as China, South Korea, Japan, and India are making significant capital investments in expanding their manufacturing capacities and modernizing existing factories under national automation strategies. The rapid uptake of counters is driven particularly by the automotive, consumer electronics, and textile industries, where mass production requires highly reliable, high-speed counting and batch control capabilities. Favorable government policies promoting foreign direct investment in manufacturing further solidify APAC’s dominance.

- North America: Characterized by a high demand for advanced, high-precision industrial counters, North America is focused on implementing sophisticated automation in sectors like aerospace, precision machinery, and pharmaceuticals. Market growth is spurred by the necessity for advanced data connectivity (IIoT) and regulatory requirements (e.g., high traceability) that mandate the use of networked counters. Manufacturers here prioritize counters with robust cybersecurity features and seamless integration capabilities with cloud-based analytics platforms.

- Europe: The European market, particularly Germany, Italy, and the UK, represents a mature but technologically advanced landscape. Growth is driven by the adherence to stringent safety and quality standards and the strong presence of major machine builders (OEMs). The focus in Europe is heavily skewed towards energy efficiency monitoring and sustainable manufacturing practices, boosting demand for counters capable of precise utility metering and machine-level power consumption tracking. The adoption of IO-Link technology for simplified sensor-counter communication is particularly strong here.

- Latin America (LATAM): Market expansion in LATAM is gradually accelerating, primarily driven by industrial modernization in Brazil and Mexico, focusing on the food and beverage and automotive assembly sectors. While cost sensitivity remains a factor, there is increasing investment in digital counters to enhance operational efficiency and reduce reliance on manual tracking methods, moving away from older mechanical systems.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in infrastructure development, oil and gas, and utility management projects. Industrial counters are essential for flow metering and process control in these industries. Market growth is heavily influenced by large-scale government spending on smart city initiatives and the diversification of economies away from traditional resource extraction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Counters Market.- Siemens AG

- Danaher Corporation

- Schneider Electric SE

- Red Lion Controls, Inc.

- Eaton Corporation plc

- OMRON Corporation

- Honeywell International Inc.

- Hengstler GmbH

- Kubler Group

- Veeder-Root Company

- Trumeter Co. Ltd.

- IDEC Corporation

- WAGO Group

- Autonics Corporation

- SICK AG

- Pepperl+Fuchs GmbH

- Murrplastik Systemtechnik GmbH

- Carlo Gavazzi Holding AG

- Pulsotronic GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Industrial Counters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and electronic industrial counters?

Mechanical counters use physical components and gearing to display counts, offering high durability but limited speed and no connectivity. Electronic counters use sensors and digital circuitry, providing high accuracy, speed, programmability, preset functions, and seamless integration with modern control networks (PLCs/IIoT).

How is Industry 4.0 influencing the design and functionality of industrial counters?

Industry 4.0 demands that counters incorporate advanced communication interfaces like Ethernet/IP and IO-Link for real-time data exchange, enabling remote monitoring, centralized data analytics, and integration into cloud-based maintenance systems. Devices are shifting towards intelligent, networked components.

Which end-use industry is expected to show the fastest growth rate in the Industrial Counters Market?

The Automotive and Electronics manufacturing sectors are expected to exhibit the fastest adoption rates, driven by the need for extremely high-speed, verifiable counting for quality control in complex assembly lines and semiconductor fabrication, where timing precision is paramount.

What are the main technological challenges facing industrial counter manufacturers today?

Key challenges include ensuring high noise immunity in electrically demanding industrial settings, providing secure connectivity against cyber threats, and managing the increasing complexity of integrating counters with diverse legacy and modern automation protocols without extensive modification.

What role does Artificial Intelligence play in modern industrial counting devices?

AI is integrated at the edge level to enable predictive diagnostics by analyzing counting patterns for anomalies, optimizing sensor signal quality, and facilitating autonomous adjustments to process parameters, thereby improving throughput and reducing unscheduled downtime.

Market Overview and Technological Imperatives

The sustained evolution of the Industrial Counters Market is closely tied to the global emphasis on operational efficiency and resource optimization. Beyond simple totalizing, modern industrial counters are being redefined as crucial data acquisition hubs, offering insights into machine performance, production pacing, and resource consumption. This transition requires manufacturers to focus on highly robust hardware capable of enduring severe industrial conditions while maintaining sophisticated digital functionality. The competitive edge is increasingly determined by the counter's ability to interface seamlessly across proprietary and open industrial network protocols, ensuring maximum interoperability within complex automation environments.

One notable trend is the push toward miniaturization and enhanced power efficiency, making industrial counters suitable for integration into confined spaces or mobile industrial assets. Battery-operated or low-power variants are gaining traction in remote monitoring applications, particularly in utility metering or infrastructure surveillance where wired power sources are impractical. The standardization of communication protocols, particularly the widespread adoption of IO-Link, is democratizing the integration process, allowing even small and medium-sized enterprises (SMEs) to implement sophisticated digital counting solutions without significant upfront infrastructure overhaul.

Furthermore, the shift in market demand reflects a strong preference for multifunction counters that consolidate several capabilities—such as counting, timing, and rate indication—into a single, compact unit. This consolidation simplifies inventory management for end-users and reduces the panel space required for installation. Vendors who successfully package advanced features like customizable HMI displays, intuitive programming interfaces, and built-in diagnostic tools into cost-effective, rugged devices are strategically positioned to capture significant market share over the forecast period, especially as automation adoption accelerates in emerging economies.

Growth Drivers: Detailed Analysis

The primary driver accelerating the Industrial Counters Market is the pervasive integration of the Industrial Internet of Things (IIoT) across manufacturing floors globally. IIoT requires thousands of accurate data points from machine-level devices, and industrial counters serve as key sensors quantifying events and throughput. The real-time visibility provided by networked counters allows factories to transition from scheduled maintenance to condition-based and predictive maintenance models. This capability significantly reduces unplanned downtime, improves overall equipment effectiveness (OEE), and justifies the investment in sophisticated counting technology.

A secondary, yet powerful, driver is the increasingly stringent requirement for product traceability and regulatory compliance, particularly in regulated industries like pharmaceuticals, food and beverage, and medical devices. These sectors must precisely record and verify production metrics, batch sizes, and processing times to meet quality standards (e.g., cGMP, HACCP). Advanced electronic counters provide the high accuracy, data logging, and tamper-proof features necessary to generate auditable records, making them indispensable tools for quality assurance departments and regulatory compliance officers.

Moreover, global capital expenditure towards infrastructure modernization acts as a significant market impetus. Developing nations are upgrading existing industrial infrastructure, while developed economies are investing in advanced machinery capable of higher throughput and quality. This modernization cycle inherently mandates the replacement of older, mechanical counting systems with highly precise digital equivalents that can communicate with centralized control systems, thereby continually refreshing the market demand for sophisticated industrial counters and related components such as specialized sensors and input devices.

Restraints and Challenges

Despite strong growth drivers, the Industrial Counters Market faces notable challenges, particularly related to implementation complexity and economic barriers. The initial cost of procurement for high-end digital counters, especially multifunction models integrated with advanced communication chips, can be substantial. For smaller manufacturing operations or those in highly price-sensitive regions, this investment often represents a significant capital outlay, slowing the pace of transition away from inexpensive, yet less capable, mechanical or electromechanical alternatives.

A fundamental technical restraint revolves around integration hurdles within brownfield environments. Many factories operate using decades-old machinery and proprietary control systems. Seamlessly integrating a modern, networked industrial counter into such diverse and fragmented legacy architectures requires specialized programming, custom interfaces, and extensive testing. This complexity increases deployment time and necessitates highly skilled technicians, which can inflate the total cost of ownership (TCO) and serve as a deterrent for cautious facility managers.

Furthermore, cybersecurity vulnerability presents a growing concern as counters become essential nodes in the IIoT network. If a counter, which reports critical production volume or batch timings, is compromised, it could lead to inaccurate data reporting, process manipulation, or denial of service attacks, severely impacting operational integrity. Manufacturers must invest heavily in embedding robust security features, such as advanced encryption and authentication protocols, which inevitably adds to the cost and complexity of the product, creating a difficult balancing act between feature richness, security, and affordability.

Opportunity Analysis

Significant market opportunities reside in the burgeoning sector of smart infrastructure and utility management. As smart cities evolve, the need for highly accurate and secure pulse counters for monitoring utility distribution—electricity, water, and gas—is skyrocketing. Industrial counter manufacturers can capitalize by developing specialized, ultra-low-power counters designed for remote, wide-area network (WAN) communication (e.g., LoRaWAN or NB-IoT), enabling precise, distributed metering and revenue tracking across large geographical areas.

Another major opportunity lies in the specialization of counters for extremely high-speed applications. Industries such as semiconductor manufacturing, high-speed bottling, and automated inspection require counting frequencies far exceeding traditional capabilities, often in the megahertz range. Developing highly specialized, high-resolution time interval counters and rate meters capable of handling these intense data rates with minimal latency positions companies advantageously in these high-value niche segments where precision translates directly to material yield and production quality.

Finally, the growing trend of modularity and platform-based solutions offers substantial commercial opportunity. Companies that provide configurable industrial counter platforms—where end-users can select and swap display types, communication modules, and input sensors via a unified hardware backbone—can capture a broader range of customer needs with a single product family. This approach streamlines manufacturing, simplifies the aftermarket service process, and accelerates time-to-market for tailored solutions across various industrial applications, appealing especially to large OEMs seeking standardization.

Competitive Landscape and Strategic Positioning

The Industrial Counters Market features a competitive landscape dominated by global diversified automation giants alongside specialized manufacturers focused purely on measurement and control instruments. Key players leverage their extensive distribution networks, established brand reputation, and deep integration capabilities within their broader automation product portfolios (PLCs, sensors, drives) to maintain market leadership. Companies like Siemens, Danaher, and Schneider Electric offer end-to-end solutions, making it attractive for large industrial clients to single-source their automation needs.

Specialized companies, such as Red Lion Controls and Trumeter, often compete effectively by focusing intensely on specific counter features, offering market-leading precision, user-friendly configuration software, and exceptional customer support for niche applications. Their strategic positioning emphasizes flexibility and rapid response to emerging technological standards, often achieving higher technological refinement in specific counter types than their larger, more generalized competitors.

To sustain growth, market participants are employing several strategic initiatives: significant investment in R&D to embed AI and machine learning for predictive capabilities; geographical expansion, particularly into high-growth APAC markets through local partnerships; and strategic acquisitions of smaller technology firms to quickly incorporate specialized sensor or communication expertise. Furthermore, developing ecosystem partnerships with cloud providers (e.g., AWS, Azure) is critical for offering robust IIoT counter solutions that meet modern data management requirements.

Summary of Market Dynamics

In essence, the Industrial Counters Market is undergoing a rapid metamorphosis driven by digitalization. The dynamic forces shaping the market require manufacturers to shift their focus from simple, standalone devices to integrated, intelligent components essential for the modern automated factory. Technological convergence—where counting, timing, and communication functions are centralized and networked—is now the norm. The interplay between strong global industrial drivers (Industry 4.0) and market constraints (integration complexity, cost) dictates a trajectory favoring flexible, scalable, and highly accurate digital solutions.

The future market performance is heavily reliant on the successful mitigation of cybersecurity risks and the ability of manufacturers to deliver cost-effective solutions that cater to both advanced, high-precision industrial sectors and emerging markets rapidly adopting automation. Success hinges on innovation in sensor integration and communication technology, ensuring that industrial counters remain the most reliable source of quantifiable operational data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager