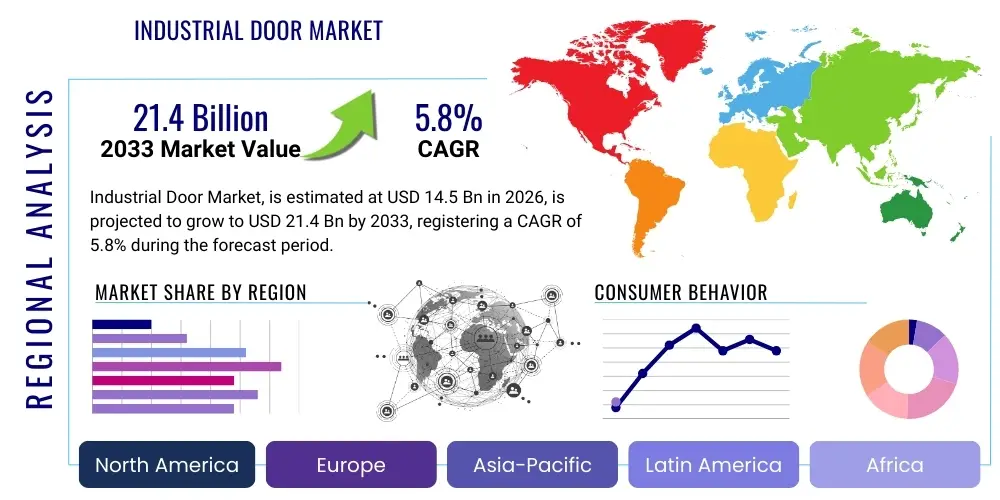

Industrial Door Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438408 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Door Market Size

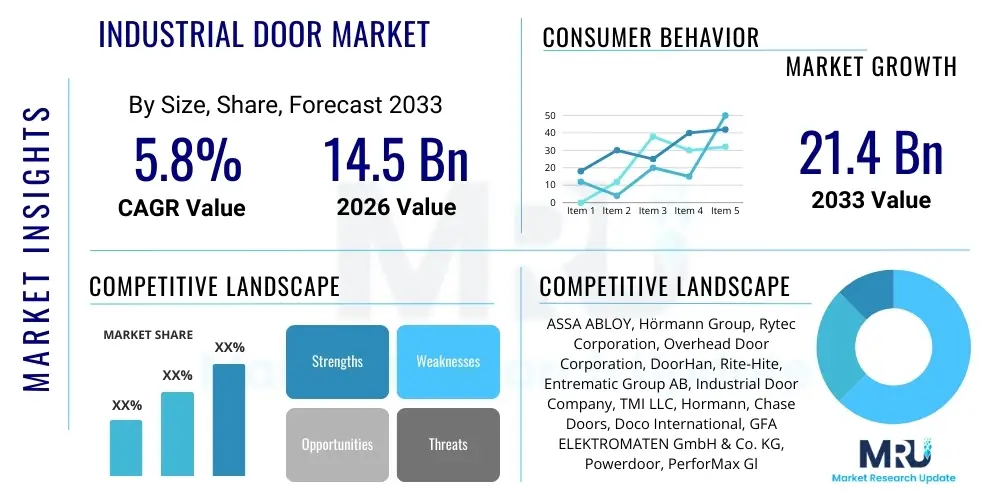

The Industrial Door Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 billion in 2026 and is projected to reach USD 21.4 billion by the end of the forecast period in 2033.

Industrial Door Market introduction

The Industrial Door Market encompasses specialized access control and barrier systems engineered for harsh, high-traffic, and security-critical environments within commercial and industrial facilities. These doors, which include high-speed doors, sectional doors, rolling shutters, and fire-rated doors, are fundamental components of modern logistics, manufacturing, and storage infrastructures. Unlike standard commercial doors, industrial doors are designed to offer enhanced durability, superior insulation properties, critical safety features, and often integrated automation capabilities, addressing operational demands such as temperature control, high frequency of opening and closing cycles, and rigorous security protocols. The increasing adoption of Industry 4.0 paradigms necessitates highly efficient and reliable access solutions that minimize downtime and optimize internal logistics flow.

Major applications of industrial doors span across critical sectors including warehousing and distribution centers, heavy manufacturing plants, automotive assembly lines, food and beverage processing facilities, and pharmaceutical cleanrooms. Benefits derived from deploying advanced industrial doors include significant energy savings achieved through effective thermal barriers, improved security against unauthorized access, enhanced operational safety for personnel and machinery due to integrated sensor technology, and streamlined material handling processes. The longevity and resilience of these specialized doors translate directly into lower total cost of ownership (TCO) compared to conventional access solutions, making them a crucial capital expenditure for businesses focused on long-term operational excellence and compliance with stringent environmental standards.

The market is predominantly driven by sustained global investment in infrastructure development, particularly the exponential expansion of e-commerce and subsequent growth in logistics and fulfillment center construction, which requires high-speed, reliable door systems. Furthermore, stringent regulatory mandates concerning industrial safety, fire protection, and energy efficiency, particularly in developed economies, compel industrial operators to upgrade outdated door systems with modern, compliant alternatives. Technological advancements, such as the incorporation of advanced sensing systems, remote diagnostics, and improved materials science offering lighter yet stronger door constructions, further fuel market growth by addressing evolving industrial needs for speed, reliability, and interconnectivity within automated supply chains.

Industrial Door Market Executive Summary

The Industrial Door Market is experiencing robust growth fueled by several macroeconomic factors, primarily the global shift towards sophisticated automation and the rapid proliferation of large-scale logistics and distribution networks. Business trends indicate a strong move towards customization, where manufacturers are increasingly developing specialized door solutions, such as high-speed roll-up doors for cold storage applications and heavy-duty folding doors for aircraft hangars, to meet specific vertical industry requirements. Key market players are prioritizing investments in research and development to integrate IoT capabilities, enabling predictive maintenance, remote monitoring, and seamless synchronization with facility management systems. Consolidation through mergers and acquisitions is also a prominent trend, as major firms seek to expand their geographic footprint and acquire niche technology expertise, driving market maturity and enhancing competitive intensity across all product segments.

Regional trends reveal significant growth opportunities emerging from the Asia Pacific (APAC) region, spearheaded by rapid industrialization in countries like China, India, and Southeast Asian nations. This expansion is characterized by massive investments in new manufacturing hubs and modern warehousing facilities designed to support global supply chains, thereby increasing the demand for efficient, durable industrial doors. Conversely, markets in North America and Europe, while mature, are driven primarily by replacement demand, regulatory compliance upgrades, and the adoption of high-specification, energy-efficient smart door systems essential for achieving strict carbon reduction targets and maintaining cutting-edge operational efficiency within sophisticated facilities.

Segment trends highlight the high-speed door segment as the fastest growing category, attributed to its necessity in operations demanding minimal temperature fluctuation and rapid access, such as food processing and pharmaceutical warehousing. Operationally, the shift from manual to fully automatic and semi-automatic doors is evident across all industrial settings, driven by the imperative to reduce labor costs, minimize human error, and integrate access points into automated material flow systems. Material segmentation shows a growing preference for lightweight, durable composite materials and PVC fabric doors in applications requiring high cycle rates and superior thermal properties, while heavy-gauge steel remains dominant in high-security and fire-rated installations, ensuring comprehensive market coverage across the diverse requirements of industrial end-users.

AI Impact Analysis on Industrial Door Market

User inquiries regarding the impact of Artificial Intelligence on the Industrial Door Market frequently center on themes of predictive maintenance efficacy, the integration of doors into larger automated logistics ecosystems, and the potential for AI-enhanced security and traffic management. Users are specifically concerned about how AI algorithms can minimize unexpected downtime by forecasting component failure, optimizing opening/closing cycles based on real-time traffic patterns, and enhancing the safety envelope around industrial doorways through advanced anomaly detection. The consensus among industrial stakeholders is that AI will transform industrial doors from static barriers into intelligent, interconnected nodes within the smart factory environment, thereby increasing operational throughput and reducing lifecycle costs significantly.

The application of AI and machine learning (ML) allows door systems to learn usage patterns and environmental variables, enabling dynamic adjustments to operating parameters. For instance, in cold storage facilities, AI can optimize insulation effectiveness by fine-tuning door speed based on internal temperature differentials and external weather conditions, leading to substantial energy savings. Furthermore, ML-driven analysis of sensor data (e.g., motor strain, cycle count, vibration metrics) allows door manufacturers to transition from time-based maintenance schedules to highly accurate condition-based maintenance (CBM), drastically improving reliability and extending the lifespan of critical components. This sophisticated level of operational insight is the primary expectation driving interest in AI integration within the industrial door sector.

AI's role also extends into enhanced safety and security protocols. By integrating computer vision capabilities, AI can accurately distinguish between personnel, forklifts, and objects, enabling nuanced response mechanisms, such as adjusting door height or triggering immediate stops, minimizing accidents and product damage. This intelligent access control transcends simple proximity sensing, moving towards anticipatory safety measures. As industrial facilities become more complex and rely heavily on Autonomous Mobile Robots (AMRs) and automated guided vehicles (AGVs), AI ensures seamless, collision-free interaction between automated traffic and door operations, thereby ensuring continuous flow and adherence to safety regulations, representing a fundamental shift in how industrial access is managed and secured.

- Predictive Maintenance: AI algorithms analyze motor vibration, current consumption, and cycle frequency to forecast component failure, reducing unplanned downtime by recommending pre-emptive repairs.

- Traffic Flow Optimization: Machine Learning models assess real-time congestion and internal logistics patterns to dynamically adjust door opening/closing speeds, optimizing material throughput.

- Enhanced Security and Access Control: AI-powered vision systems enable highly accurate object recognition, distinguishing authorized personnel or vehicles and flagging unusual access attempts or security breaches instantly.

- Energy Management: AI optimizes thermal regulation by analyzing ambient and internal temperatures, minimizing the time doors remain open, thus reducing HVAC energy consumption significantly in temperature-controlled environments.

- Seamless AGV/AMR Integration: Door systems communicate wirelessly with automated vehicles, ensuring synchronized, safe, and efficient passage without requiring physical interaction or manual override.

- Remote Diagnostics and Calibration: AI facilitates remote troubleshooting and fine-tuning of door parameters based on performance deviation analysis, improving service efficiency and reducing technician travel time.

DRO & Impact Forces Of Industrial Door Market

The Industrial Door Market is strategically positioned for growth, primarily driven by compelling factors such as the global focus on industrial automation and efficiency, which necessitates high-speed and reliable door systems capable of integrating seamlessly into automated assembly and logistics lines. A major driver is the substantial increase in global warehousing capacity, fueled by the e-commerce boom, demanding specialized doors for high-throughput environments like sortation and fulfillment centers. Simultaneously, the persistent trend of replacing older, inefficient door systems with modern, insulated, and energy-compliant models in developed markets acts as a steady growth mechanism. These driving forces are strongly supported by regulatory pressures, particularly concerning stringent fire safety standards and mandated energy efficiency protocols across various industrial sectors.

However, the market faces notable restraints, most significantly the relatively high initial capital investment required for installing specialized, high-performance industrial doors, particularly those featuring complex automation, advanced sensors, and superior thermal insulation. Furthermore, the complexity involved in custom fabrication and specialized installation, which requires highly trained technicians, can slow down deployment and increase overall project costs. Economic volatility in specific regions, leading to reduced capital expenditure on non-essential infrastructure upgrades, also presents a temporary restraint, particularly affecting small and medium-sized enterprises that might defer replacement cycles for older, functioning equipment despite inefficiency concerns.

Opportunities abound, primarily centered on technological innovation, specifically the integration of Internet of Things (IoT) connectivity for remote diagnostics and performance monitoring, leading to a lucrative aftermarket for software and maintenance services. The growing demand for specialized doors in niche applications, such as pharmaceutical cleanrooms and cryogenic storage facilities, presents high-margin potential for manufacturers capable of meeting stringent compliance requirements (e.g., GMP standards). The impact forces driving the market are dominated by the push for energy efficiency (shifting doors from being a utility cost to an investment in energy savings) and safety regulations (mandating sensors and interlocks), which collectively ensure continuous, mandatory upgrades and expansion, solidifying the market’s positive long-term trajectory.

Segmentation Analysis

The Industrial Door Market is extensively segmented based on the critical attributes defining product performance, operation, material composition, and end-use application, reflecting the heterogeneous demands across the industrial landscape. Segmentation provides critical insight into the varying needs of users, from those requiring extreme speed and thermal efficiency (e.g., high-speed PVC doors in food processing) to those prioritizing security and fire protection (e.g., steel rolling shutters in heavy manufacturing). Analyzing these segments allows manufacturers to tailor product development and marketing strategies precisely, focusing on the specific regulatory environments and operational cycling demands of each vertical, ensuring optimized solutions that maximize ROI for the end-user.

- By Type

- Rolling Doors (Roller Shutters)

- Sectional Doors (Overhead Doors)

- High-Speed Doors (Roll-up, Folding, Rigid)

- Sliding Doors

- Folding Doors

- Swing Doors

- Fire-Rated Doors

- Dock Leveler and Shelter Doors

- By Operation Mode

- Automatic (Sensor-Activated, Remote Control)

- Semi-Automatic

- Manual

- By Material

- Metal (Steel, Aluminum)

- Fabric (PVC, Vinyl)

- Wood and Composite Materials

- By End-Use Industry

- Manufacturing (Heavy, Automotive, Assembly)

- Warehousing and Logistics (Distribution Centers)

- Food and Beverage Processing

- Pharmaceutical and Cleanrooms

- Retail and Commercial Facilities (Large Format)

- Transportation (Aviation, Rail)

- Chemical and Petrochemical

Value Chain Analysis For Industrial Door Market

The industrial door value chain begins with the upstream suppliers responsible for providing raw materials, which primarily include various grades of steel, aluminum alloys, high-performance PVC fabrics, specialized polymer composites, and sophisticated electronic components such as motors, sensors, and control systems. Key upstream activities involve metal sheet rolling, extrusion processes for aluminum, and the manufacturing of specialized fabrics that meet demanding specifications for durability, insulation, and fire resistance. The efficiency and quality of the raw material supply directly impact the final product's performance, cost-effectiveness, and compliance with industry standards, necessitating strong, long-term relationships between door manufacturers and certified material suppliers to ensure consistent quality and supply chain resilience.

Midstream activities are centered around core door manufacturing, assembly, and fabrication. This stage involves highly specialized processes such as precision cutting, welding, component integration, and the critical assembly of complex systems including high-speed door mechanisms and automated sectional door panels. Manufacturers often differentiate themselves through superior design engineering, focusing on reducing maintenance cycles and maximizing thermal efficiency. Following production, the finished products move through established distribution channels, which are typically bifurcated into direct sales to large corporate clients or major construction projects, and indirect channels relying on a network of authorized regional distributors, certified dealers, and specialized installation contractors. These distribution partners often handle customized fabrication, local stockholding, and critical on-site services.

The downstream segment encompasses installation, maintenance, and comprehensive after-sales service, which represents a significant revenue stream and crucial point of customer interaction. Direct distribution channels are often used for highly customized or technically complex installations where specialized factory technicians are required. Indirect channels, utilizing trained third-party service providers, manage routine maintenance, urgent repairs, and periodic safety inspections. Potential customers, including large warehouse operators, manufacturing plant managers, and facility management companies, rely heavily on the efficiency of this downstream service network. Therefore, effective value capture is highly dependent on establishing a robust, responsive service infrastructure capable of ensuring minimal operational disruption for end-users, underscoring the shift towards service-centric business models in the market.

Industrial Door Market Potential Customers

Potential customers for industrial door systems are highly diverse but predominantly concentrated within sectors characterized by high asset utilization, strict regulatory compliance, and intensive material handling demands. The largest segment of potential buyers includes major logistics and warehousing corporations, particularly those operating vast distribution centers for e-commerce, third-party logistics (3PL) providers, and cold storage facilities. These customers require high-speed, durable doors that can withstand thousands of cycles daily while maintaining climate control integrity and ensuring rapid, safe passage for automated and manual traffic, making efficiency a non-negotiable purchasing criterion.

Another crucial customer group is the manufacturing sector, spanning heavy industry, automotive assembly, aerospace, and light manufacturing. These facilities often require specialized doors, such as fire-rated systems, large hangar doors, or doors capable of separating different manufacturing zones (e.g., cleanrooms from general assembly areas) to maintain environmental control and safety standards. Procurement decisions in this segment are heavily influenced by durability, compliance with specific industry standards (e.g., FDA or OSHA), and the ability of the door system to integrate seamlessly with existing production line automation and Building Management Systems (BMS).

Furthermore, entities within the food and beverage industry, pharmaceutical companies, and biotechnology firms represent high-value potential customers due to their stringent hygiene and temperature control requirements. For these end-users, doors must often feature non-corrosive materials, easy-to-clean surfaces, and exceptional sealing capabilities to prevent contamination and maintain precise environmental parameters (e.g., refrigeration or cleanroom pressure). The emphasis here is placed on material composition, sealing technology, and reliability in extreme conditions, driving demand for specialized high-speed insulated PVC and stainless steel doors, underscoring the segmented nature of potential buyer requirements across the industrial ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 21.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, Hörmann Group, Rytec Corporation, Overhead Door Corporation, DoorHan, Rite-Hite, Entrematic Group AB, Industrial Door Company, TMI LLC, Hormann, Chase Doors, Doco International, GFA ELEKTROMATEN GmbH & Co. KG, Powerdoor, PerforMax Global, Kelley Entrematic, DMF International, Loading Dock Equipment Co., Steel Built Doors Inc., Gandhi Automations Pvt Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Door Market Key Technology Landscape

The contemporary industrial door market is heavily influenced by the adoption of sophisticated technological advancements centered on automation, connectivity, and superior sensor technology, moving the product beyond basic barrier function into the realm of intelligent operational assets. A primary technological focus is on high-performance motor and drive systems, utilizing variable frequency drives (VFDs) to achieve ultra-high opening and closing speeds while minimizing wear and tear and ensuring smooth acceleration and deceleration, critical for minimizing air exchange in temperature-controlled environments. Furthermore, advanced material science is driving innovation, with manufacturers deploying lightweight, durable, and highly insulated materials, such as multi-layer PVC curtains and specialized composite panels, to enhance thermal efficiency and resilience against frequent impacts.

Connectivity stands out as a defining technological trend, characterized by the integration of IoT (Internet of Things) devices and embedded sensors that allow industrial doors to become nodes within a facility’s larger operational network. These smart doors are equipped with Wi-Fi or cellular modules, enabling real-time performance monitoring, remote diagnostics, and automated reporting on cycle counts, motor health, and error logs directly to facility management systems or cloud-based maintenance platforms. This connectivity facilitates the implementation of predictive maintenance strategies, significantly improving uptime and reducing reactive service costs, which is highly valued by logistics and manufacturing operators aiming for near-zero operational disruptions.

Safety and integration technologies form another crucial layer of the technology landscape. Modern industrial doors incorporate highly advanced safety sensors, including high-resolution laser scanners and infrared light curtains, which offer comprehensive area detection, significantly surpassing the capabilities of traditional photocells. These intelligent sensing technologies ensure the immediate, non-contact reversal of door movement upon obstruction detection, enhancing both personnel and equipment safety, particularly in areas with high forklift traffic. Moreover, seamless integration protocols, such as Modbus TCP and standardized API interfaces, allow industrial doors to communicate directly with Automated Guided Vehicles (AGVs), conveyor systems, and facility access control software, creating a synchronized, safe, and efficient material flow ecosystem aligned with the tenets of Industry 4.0 infrastructure.

Regional Highlights

- Asia Pacific (APAC): Dominates the market growth trajectory, driven by massive foreign direct investment in manufacturing capacity expansion, particularly in China, India, and Vietnam. The rapid construction of massive logistics parks to support booming e-commerce activities further accelerates demand for high-speed, durable doors.

- North America: Characterized by a high demand for technologically advanced, high-specification doors, driven primarily by the need for regulatory compliance (e.g., fire safety, insulation standards) and the continuous modernization of aging industrial infrastructure, focusing heavily on integration with advanced warehouse automation.

- Europe: A mature market focused on replacement and upgrade cycles, heavily influenced by strict environmental and energy efficiency mandates (e.g., EU building directives). The adoption of energy-saving, highly insulated sectional and rolling doors is paramount across Central and Western European industrial facilities.

- Latin America (LATAM): Exhibiting steady growth, primarily localized in industrialized nations like Brazil and Mexico, driven by burgeoning automotive manufacturing and expanding food processing industries. The market here prioritizes durability and cost-effectiveness in foundational industrial door segments.

- Middle East and Africa (MEA): Poised for significant future growth, spurred by massive infrastructure projects, especially in the GCC countries (e.g., logistics hubs, smart city developments, climate-controlled warehousing). Demand is particularly high for specialized doors resilient to extreme heat and requiring high levels of security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Door Market.- ASSA ABLOY

- Hörmann Group

- Rytec Corporation

- Overhead Door Corporation

- DoorHan

- Rite-Hite

- Entrematic Group AB

- Industrial Door Company

- TMI LLC

- Chase Doors

- Doco International

- GFA ELEKTROMATEN GmbH & Co. KG

- Powerdoor

- PerforMax Global

- Kelley Entrematic

- DMF International

- Loading Dock Equipment Co.

- Steel Built Doors Inc.

- Gandhi Automations Pvt Ltd

- JMS Industrial Doors

Frequently Asked Questions

Analyze common user questions about the Industrial Door market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand for high-speed industrial doors?

The primary drivers are the exponential growth of e-commerce logistics requiring rapid throughput in distribution centers, stringent temperature control requirements in cold storage and food processing, and the integration needs of advanced automated material handling systems (AGVs/AMRs).

How does the implementation of IoT affect the lifespan and maintenance of industrial doors?

IoT integration allows for real-time remote monitoring and diagnostic reporting, facilitating predictive maintenance (CBM). This approach minimizes unexpected failures, optimizes service schedules, and significantly extends the operational lifespan of high-cycle industrial door systems.

Which industrial door segment exhibits the fastest growth potential in the next decade?

The High-Speed Doors segment, particularly fabric roll-up and rigid spiral doors, shows the fastest growth, driven by the need for superior energy efficiency, minimal air exchange, and increased operational tempo in logistics and specialized manufacturing environments.

What is the key difference between sectional doors and rolling doors in an industrial setting?

Sectional doors offer superior insulation and sealing, making them ideal for exterior, climate-controlled environments requiring high energy efficiency. Rolling doors (roller shutters) maximize vertical space, provide excellent security, and are often preferred in high-security or interior partition applications where space savings are critical.

What regulatory factors are most significantly influencing the industrial door market in Europe?

The market in Europe is heavily influenced by mandates related to fire safety (e.g., stricter certifications for fire-rated barriers) and aggressive targets for energy efficiency, compelling businesses to adopt highly insulated doors that comply with European Union energy performance standards for buildings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager