Industrial Edge Computing Gateway Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432011 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Edge Computing Gateway Market Size

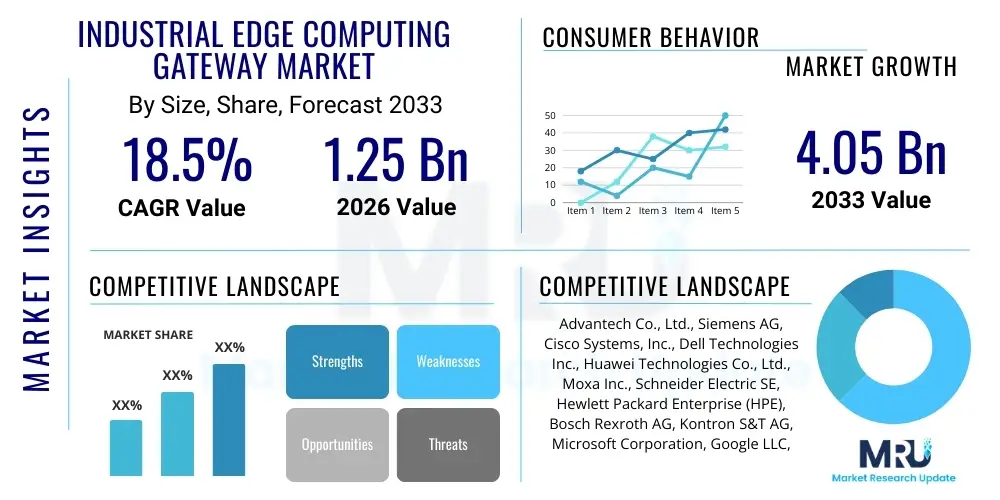

The Industrial Edge Computing Gateway Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 4.05 Billion by the end of the forecast period in 2033.

Industrial Edge Computing Gateway Market introduction

The Industrial Edge Computing Gateway Market encompasses specialized hardware and software solutions deployed at the periphery of industrial networks, designed to aggregate, preprocess, and analyze data generated by Operational Technology (OT) assets before transmission to the cloud or central data center. These gateways act as critical conduits, bridging the gap between legacy industrial equipment (machinery, sensors, controllers) and modern IT infrastructure, thereby enabling real-time decision-making, reducing network latency, and enhancing operational efficiency within demanding environments such as manufacturing, oil and gas, and utilities. The fundamental product description involves robust, fanless, and often ruggedized computing devices that incorporate diverse connectivity protocols (e.g., Modbus, OPC UA, MQTT) and support containerized application deployment for tasks like predictive maintenance and quality control.

Major applications of Industrial Edge Computing Gateways span across critical industrial functions, including asset performance management (APM), remote monitoring, industrial control system optimization, and enhancing supply chain visibility. By providing local processing power, these gateways ensure that time-sensitive applications, which require sub-millisecond response times, can function reliably even with intermittent cloud connectivity. The proliferation of the Industrial Internet of Things (IIoT) is fundamentally reliant on these gateways, as they normalize disparate data formats and apply security policies at the ingress point of the network, securing sensitive OT data.

The principal driving factors fueling market expansion include the urgent need for manufacturers to realize Industry 4.0 objectives, the escalating volume and velocity of sensor data generated by smart factories, and the necessity for improved cybersecurity defenses against sophisticated industrial threats. Additionally, the shift towards decentralized computing architectures, driven by the desire for low-latency operational control and reduced backhaul costs associated with transmitting massive datasets to centralized cloud environments, significantly accelerates the adoption rate of these specialized gateways across various industrial verticals globally.

Industrial Edge Computing Gateway Market Executive Summary

The Industrial Edge Computing Gateway market is characterized by rapid technological innovation, focused heavily on integrating advanced processing capabilities and robust security features suitable for harsh industrial conditions. Business trends indicate a strong move towards subscription-based software models (Edge-as-a-Service), offering customers greater flexibility and lower initial capital expenditure, coupled with increasing strategic partnerships between hardware providers and industrial software platforms (e.g., MES, SCADA vendors) to deliver comprehensive, integrated solutions. There is a notable emphasis on gateways that support virtualization and containerization technologies (like Docker and Kubernetes) to facilitate scalable deployment and management of AI/ML models directly at the factory floor, driving performance improvements and operational autonomy.

Regionally, Asia Pacific is forecasted to exhibit the highest growth rate, primarily driven by massive government investments in smart manufacturing initiatives in countries like China, India, and Japan, coupled with the widespread installation of new industrial infrastructure requiring IIoT connectivity from the outset. North America and Europe, while representing mature markets, maintain dominance in terms of technological complexity and early adoption of advanced use cases, particularly in highly regulated sectors such as aerospace, automotive, and pharmaceuticals, focusing intensely on achieving regulatory compliance through localized data processing and residency.

Segment trends highlight the dominance of the software segment, driven by the increasing complexity of edge orchestration, device management, and application runtime environments necessary for utilizing the gateway hardware effectively. By application, the segment comprising predictive maintenance and asset monitoring remains the largest revenue contributor, as enterprises prioritize minimizing downtime and maximizing asset lifespan. Furthermore, segmentations based on connectivity technology are seeing rapid evolution, with 5G and Time-Sensitive Networking (TSN) capabilities becoming standard requirements for new generation gateways, ensuring ultra-reliable low-latency communication (URLLC) essential for future critical industrial control loops.

AI Impact Analysis on Industrial Edge Computing Gateway Market

User inquiries regarding the impact of Artificial Intelligence on Industrial Edge Gateways frequently center on questions of processing capacity, model deployment complexity, and the tangible ROI derived from running machine learning inferences locally. Key concerns revolve around whether current gateway hardware can sufficiently handle the computational demands of deep learning models and how easily these models can be updated and managed remotely across potentially thousands of endpoints. Users are keenly interested in edge AI benefits such as enhanced real-time anomaly detection, superior quality control via machine vision, and the autonomous optimization of complex machinery parameters without reliance on continuous cloud communication.

AI significantly transforms the role of the Industrial Edge Gateway from a mere data aggregator to an intelligent, autonomous decision-making hub. Integrating specialized AI accelerator chips (like NPUs or FPGAs) directly into the gateway architecture is becoming standard practice, enabling rapid execution of pre-trained models for tasks such as defect recognition, predictive maintenance forecasting, and robot control optimization. This localized intelligence minimizes data latency, ensuring that critical adjustments to production processes are made instantaneously, which is unattainable through traditional cloud-based analytics workflows. The deployment of lightweight, optimized AI models is crucial, driving the market towards specialized software toolkits designed for model quantization and compression suitable for resource-constrained edge environments.

The ability of the Industrial Edge Gateway to perform AI inferencing locally enhances operational resiliency. By decoupling critical control applications from cloud dependency, production lines are protected against connectivity failures or high data transfer costs. Furthermore, AI capabilities embedded at the edge facilitate continuous learning loops, where newly processed, labeled data can be used to retrain local models, incrementally improving performance. This shift necessitates new security paradigms, focusing not just on protecting the data in transit, but also securing the integrity of the AI models themselves against manipulation or adversarial attacks.

- AI enables real-time inferencing directly on the factory floor, minimizing operational latency.

- Integration of specialized AI hardware (NPUs, FPGAs) accelerates deep learning model execution at the edge.

- AI models facilitate enhanced predictive maintenance accuracy and autonomous process optimization.

- Edge AI reduces reliance on constant cloud connectivity for critical decision-making processes.

- The market sees growth in software solutions for AI model deployment, management, and continuous learning at scale.

DRO & Impact Forces Of Industrial Edge Computing Gateway Market

The dynamics of the Industrial Edge Computing Gateway Market are shaped by powerful factors driving demand, balanced by structural restraints, and presenting significant long-term growth opportunities, collectively defining the market's trajectory and competitive landscape. The primary drivers stem from the global push for digitalization and the resulting massive data flows from IIoT sensors, necessitating localized data processing for efficiency and regulatory compliance. Restraints, conversely, largely involve the complexities associated with integrating new edge technologies with disparate legacy industrial systems and the inherent challenges in guaranteeing robust cybersecurity across a distributed network of gateways. Opportunities are substantial, centered on the expansion into specialized industrial verticals, particularly those adopting 5G private networks, and the integration of sophisticated AI and blockchain technologies for enhanced trust and operational visibility.

The immediate impact forces relate significantly to the urgent requirement for operational technology convergence with information technology (OT/IT Convergence). The demand for reduced downtime and maximized asset utilization directly translates into increased investments in edge gateway solutions capable of executing complex real-time analytics. However, the high initial cost of deploying ruggedized, high-performance gateways, especially in sectors with tighter capital expenditure constraints, acts as a short-term dampener on adoption rates. Furthermore, the lack of standardized protocols for edge device management across various vendor platforms necessitates customized solutions, increasing implementation complexity and requiring specialized technical expertise.

In the medium to long term, the market will be heavily influenced by the widespread rollout of 5G infrastructure, which provides the necessary bandwidth and reliability to connect thousands of edge devices seamlessly. This connectivity, coupled with rising concerns over data privacy and sovereignty regulations (like GDPR), reinforces the value proposition of edge computing, as localized processing ensures compliance and data control. The increasing sophistication of cyber threats targeting industrial control systems compels manufacturers to adopt gateways with embedded hardware security modules (HSMs) and zero-trust architecture capabilities, making robust security a non-negotiable driver for market expansion.

- Drivers:

- Accelerating demand for real-time operational control and low-latency data processing in industrial settings.

- Rapid growth in the volume of data generated by IIoT sensors and smart factory initiatives (Industry 4.0).

- Need for enhanced operational efficiency, predictive maintenance, and reduction of unplanned downtime.

- Increasing regulatory requirements pertaining to data localization and sovereignty across global regions.

- Restraints:

- High initial deployment cost and complexity associated with retrofitting legacy industrial infrastructure.

- Interoperability challenges stemming from the fragmentation of industrial communication protocols (e.g., Profinet, EtherCAT).

- Shortage of skilled personnel capable of deploying, managing, and securing distributed edge computing architectures.

- Opportunities:

- Integration of 5G and Time-Sensitive Networking (TSN) technologies for ultra-reliable connectivity.

- Growing adoption of cloud-to-edge platforms offered by major hyperscalers, simplifying deployment.

- Expansion into niche applications like autonomous mobile robots (AMRs) and industrial augmented reality (AR).

- Development of standardized, open-source edge operating systems and orchestration tools.

- Impact Forces:

- Digital transformation mandates across manufacturing and energy sectors.

- Geopolitical focus on securing critical national infrastructure (CNI) through localized computing.

- Advancements in AI/ML model miniaturization for efficient edge deployment.

Segmentation Analysis

The Industrial Edge Computing Gateway Market is systematically segmented across various dimensions, including Component Type, Connectivity Technology, Application, and End-Use Industry, reflecting the diverse requirements of the industrial landscape. The segmentation by Component Type typically splits the market into Hardware and Software segments, with the software component, including operating systems, management platforms, and security suites, showing higher dynamic growth due to the complexity of orchestration and application lifecycle management at the edge. Connectivity segmentation is crucial, distinguishing between wired protocols (Ethernet, Fieldbus) and wireless technologies (Wi-Fi, Cellular/5G, LPWAN), where 5G adoption is rapidly gaining traction due to its low-latency characteristics.

Further segmentation by Application delineates key use cases such as asset monitoring and management, process automation, energy management, and remote diagnostics. Asset monitoring consistently dominates, driven by the immediate return on investment provided by predictive maintenance programs. The End-Use Industry segmentation captures the market penetration across different vertical sectors, with discrete manufacturing (automotive, electronics) and process manufacturing (oil and gas, chemicals) being the dominant consumers. The nuanced needs of each sector—for instance, high reliability in energy versus high throughput in electronics manufacturing—drive customized gateway specifications and technology preferences, influencing market distribution.

- By Component Type:

- Hardware (Physical Gateway Devices, Edge Servers, Modular I/O)

- Software (Edge Operating Systems, Data Ingestion and Analytics Platforms, Device Management Solutions, Security Software)

- By Connectivity Technology:

- Wired (Ethernet/Gigabit Ethernet, Fieldbus, Industrial Protocol Converters)

- Wireless (Wi-Fi 6/7, 4G/LTE, 5G, LoRaWAN, NB-IoT)

- By Application:

- Asset Performance Management (APM) and Predictive Maintenance

- Real-time Process Monitoring and Control

- Industrial Security and Surveillance

- Energy Management and Optimization

- Remote Diagnostics and Service

- By End-Use Industry:

- Discrete Manufacturing (Automotive, Machinery, Electronics)

- Process Manufacturing (Oil & Gas, Chemicals, Pharmaceuticals)

- Energy and Utilities (Power Generation, Distribution, Water Treatment)

- Transportation and Logistics (Rail, Maritime, Fleet Management)

- Healthcare and Life Sciences (Medical Device Monitoring)

Value Chain Analysis For Industrial Edge Computing Gateway Market

The value chain for the Industrial Edge Computing Gateway Market begins with the upstream suppliers of core components, including semiconductor manufacturers specializing in high-performance, low-power microprocessors (CPUs, GPUs, NPUs), memory providers (RAM, SSDs), and robust enclosure manufacturers capable of meeting IP65/IP67 industrial standards. This phase is critical as the performance and longevity of the gateway hardware are directly dependent on the quality and industrial rating of these foundational components. Suppliers often need to adhere to specialized industrial certifications and operate within long lifecycle product availability models, contrasting sharply with standard consumer electronics supply chains.

Midstream activities involve the crucial steps of design, manufacturing, and integration. Gateway manufacturers procure components and integrate them with specialized industrial I/O modules, proprietary security hardware, and embedded operating systems optimized for real-time performance (e.g., real-time Linux variants). This stage also includes the development of essential middleware and protocol conversion software necessary to communicate with diverse legacy OT assets. System integrators (SIs) and value-added resellers (VARs) play a pivotal role here, customizing the hardware/software stack to meet specific end-user application requirements, particularly concerning connectivity standards and deployment environments.

Downstream activities are focused on distribution, deployment, and ongoing support. The distribution channel involves a combination of direct sales for large, customized enterprise deployments and indirect channels utilizing industrial distributors specializing in electrical components and automation solutions. Direct interaction ensures technical alignment for complex projects, while indirect channels provide market breadth. Post-sale, the value chain emphasizes sophisticated remote device management and security patching, often delivered through managed service providers (MSPs), ensuring the sustained operational reliability and cyber resilience of the distributed fleet of gateways deployed across diverse and geographically dispersed industrial sites.

Industrial Edge Computing Gateway Market Potential Customers

The primary customers for Industrial Edge Computing Gateways are organizations heavily invested in industrial operations and seeking to leverage digital technologies to enhance efficiency, safety, and productivity. These customers typically fall within the discrete manufacturing sector, particularly large-scale automotive assembly plants and electronics manufacturers who rely on massive data ingestion from CNC machines, robotic arms, and high-speed inspection systems to maintain quality control and throughput. These users prioritize low-latency processing to enable closed-loop control systems and sophisticated machine vision applications that cannot tolerate cloud-based delays.

Another significant customer segment comprises the Energy and Utilities sectors, including power generation companies, grid operators, and oil and gas exploration firms. These end-users require robust, ruggedized gateways for deployment in remote or hazardous environments where network connectivity is intermittent, and equipment monitoring is critical for safety and compliance. For these sectors, the gateway’s primary function is often predictive maintenance of high-value assets (turbines, pumps, pipelines) and ensuring the security and stability of Supervisory Control and Data Acquisition (SCADA) systems through localized firewall and intrusion detection capabilities.

Furthermore, the Transportation and Logistics sector represents a growing customer base, especially for applications involving fleet management, warehouse automation, and port operations. Customers here utilize edge gateways embedded in vehicles or logistics infrastructure to perform real-time route optimization, asset tracking, and monitoring of perishable goods conditions (cold chain management). The ability to preprocess and filter data locally before sending only actionable insights to the central system is highly valued by these end-users to manage communication costs and ensure timely logistical decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Advantech Co., Ltd., Siemens AG, Cisco Systems, Inc., Dell Technologies Inc., Huawei Technologies Co., Ltd., Moxa Inc., Schneider Electric SE, Hewlett Packard Enterprise (HPE), Bosch Rexroth AG, Kontron S&T AG, Microsoft Corporation, Google LLC, IBM Corporation, Eurotech S.p.A., Intel Corporation, Samsara Inc., Adlink Technology Inc., Lanner Electronics Inc., NXP Semiconductors N.V., Emerson Electric Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Edge Computing Gateway Market Key Technology Landscape

The technological evolution of the Industrial Edge Computing Gateway market is centered around maximizing computational power within restricted industrial footprints while ensuring robust security and seamless connectivity. A core technological aspect involves the transition towards heterogeneous computing architectures, where standard CPUs are augmented by dedicated accelerators like GPUs for vision processing, FPGAs for custom control logic, and TPUs/NPUs specifically for AI inference tasks. This heterogeneous approach is crucial for handling the parallel processing demands of modern industrial applications, enabling the gateway to execute real-time control, analytics, and machine vision concurrently without compromising performance.

Connectivity standards represent another vital technological pillar. The current landscape is rapidly shifting towards incorporating 5G cellular capabilities, offering high throughput and ultra-low latency critical for mission-critical applications such as remote machine operation and real-time robotic coordination. Alongside 5G, Time-Sensitive Networking (TSN) is emerging as a fundamental protocol, ensuring deterministic communication across standard Ethernet networks, thereby allowing industrial edge gateways to reliably integrate control systems that traditionally required specialized, proprietary fieldbus networks. The combination of 5G and TSN facilitates the long-sought convergence of IT and OT networks onto a unified, resilient infrastructure.

Furthermore, the focus on software technology is driving innovation in operating systems and orchestration tools. Edge gateways are increasingly relying on containerization technologies (like Docker, specifically Kubernetes distributions optimized for resource-constrained edge devices) to manage the lifecycle of applications, ensuring portability, scalability, and secure remote updates. Security technology is also paramount; advanced gateways incorporate hardware security modules (HSMs) for secure key storage and cryptographic operations, coupled with sophisticated embedded security software utilizing zero-trust principles to authenticate every device and user attempting to access the industrial network through the gateway.

Regional Highlights

The regional analysis reveals distinct market maturity and growth dynamics across North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America, driven by high investments in digital oilfields, smart grid infrastructure, and advanced manufacturing sectors (aerospace and automotive), leads the market in terms of technological complexity and deployment of high-performance, AI-enabled gateways. The region benefits from early adoption of cloud-to-edge architectures provided by major hyperscalers, alongside robust regulatory frameworks pushing for localized data processing.

Asia Pacific (APAC) is positioned as the fastest-growing region globally, primarily fueled by extensive government-backed initiatives like "Made in China 2025" and similar industrial modernization programs across South Korea and India. The sheer scale of new factory construction and expansion in countries like Vietnam and Indonesia, combined with lower labor costs driving automation adoption, creates massive demand for new IIoT infrastructure, making this region critical for volume growth. However, deployment complexity related to diverse infrastructure standards remains a regional challenge.

Europe represents a highly concentrated market, particularly in Germany and the Nordic countries, focusing intensely on achieving energy efficiency and circular economy objectives. European companies prioritize highly secure and standardized edge solutions compatible with stringent data privacy regulations (GDPR). The market growth is largely driven by retrofit projects in the established manufacturing base and heavy investment in sustainable energy management applications utilizing edge gateways for distributed control and optimization of renewable energy assets.

- North America: Dominance in high-value applications; strong focus on energy, oil & gas, and defense sectors; pioneering AI integration at the edge.

- Asia Pacific (APAC): Highest projected CAGR due to rapid industrialization, extensive government investments in smart manufacturing, and large-scale factory automation projects.

- Europe: High adoption rate in mature industrial sectors (automotive, machinery); emphasis on regulatory compliance (GDPR) and sustainable energy management applications.

- Latin America (LATAM): Emerging market driven by modernization efforts in mining, agriculture, and energy sectors; facing challenges related to connectivity infrastructure variability.

- Middle East and Africa (MEA): Growth focused on infrastructure projects, smart cities, and modernization of oil and gas facilities, requiring robust, ruggedized solutions for harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Edge Computing Gateway Market.- Advantech Co., Ltd.

- Siemens AG

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Huawei Technologies Co., Ltd.

- Moxa Inc.

- Schneider Electric SE

- Hewlett Packard Enterprise (HPE)

- Bosch Rexroth AG

- Kontron S&T AG

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Eurotech S.p.A.

- Intel Corporation

- Samsara Inc.

- Adlink Technology Inc.

- Lanner Electronics Inc.

- NXP Semiconductors N.V.

- Emerson Electric Co.

Frequently Asked Questions

Analyze common user questions about the Industrial Edge Computing Gateway market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Industrial Edge Computing Gateway?

The primary function is to securely aggregate, preprocess, and analyze massive volumes of data from industrial assets (OT) locally at the network edge. This enables real-time decision-making, reduces network latency, minimizes backhaul costs, and ensures operational continuity even when cloud connectivity is compromised.

How does 5G technology impact the adoption of Industrial Edge Gateways?

5G significantly boosts adoption by providing the high bandwidth and ultra-low latency connectivity necessary for deploying mission-critical applications, such as remote control and real-time robotics synchronization, directly through the gateway, thus simplifying complex industrial wireless architectures.

What are the key differences between industrial and commercial edge gateways?

Industrial edge gateways are designed with ruggedized hardware (high IP ratings, fanless operation, wide temperature tolerance) to withstand harsh industrial environments, feature specialized security modules (HSMs), and support critical industrial communication protocols (e.g., Modbus, OPC UA, EtherCAT).

Which application segment drives the most revenue in this market?

Asset Performance Management (APM) and Predictive Maintenance applications drive the most significant revenue. These applications rely on edge gateways for real-time data analysis to predict equipment failures, minimize downtime, and maximize the lifespan of critical industrial assets, offering a clear return on investment (ROI).

What security concerns are most critical for Industrial Edge deployments?

The most critical security concerns include securing the OT network from IT threats, ensuring the integrity and authenticity of firmware and application updates delivered remotely (supply chain security), and implementing zero-trust access controls to protect sensitive operational data processed and stored locally on the gateway device.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager