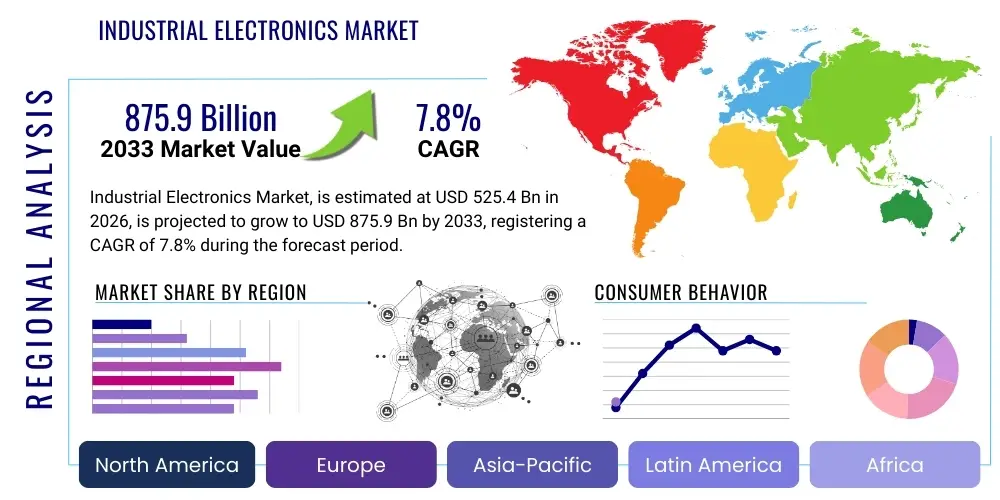

Industrial Electronics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439110 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Electronics Market Size

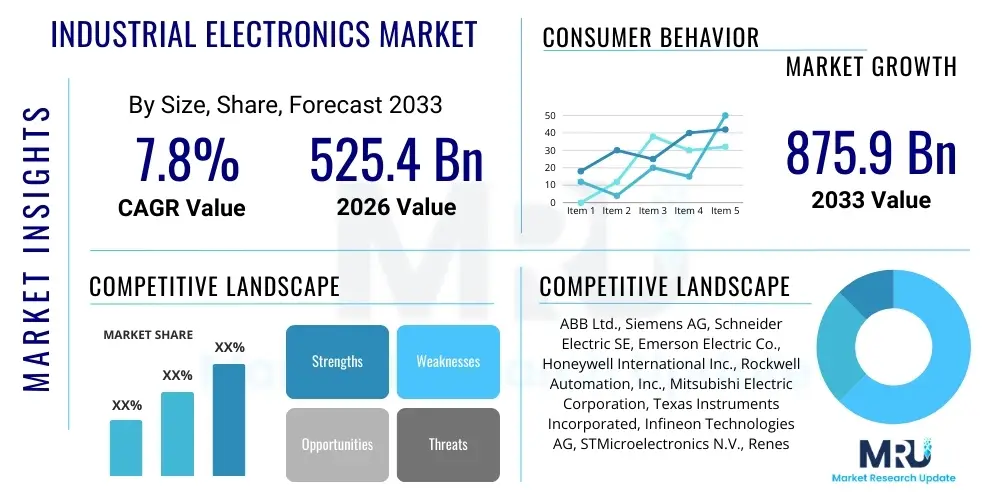

The Industrial Electronics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 525.4 Billion in 2026 and is projected to reach USD 875.9 Billion by the end of the forecast period in 2033.

Industrial Electronics Market introduction

The Industrial Electronics Market encompasses a diverse range of electrical and electronic components, systems, and devices specifically designed for robust and reliable operation within industrial environments. These products are crucial for automation, control, monitoring, and efficient power management across various heavy and light industries. Key products include power semiconductors, sensors, programmable logic controllers (PLCs), motor drives, human-machine interfaces (HMIs), and embedded systems. The primary function of industrial electronics is to enhance operational efficiency, improve safety standards, and facilitate the transition towards smart manufacturing and Industry 4.0 paradigms.

Major applications of these technologies span manufacturing automation, energy and power distribution systems, transportation infrastructure, oil and gas processing, and specialized machinery. The deployment of industrial electronics enables highly precise control over production processes, reduces downtime through predictive maintenance capabilities, and optimizes resource utilization, particularly energy consumption. The inherent ruggedness and reliability requirements of industrial settings mandate that these electronic components withstand extreme temperatures, vibrations, and electromagnetic interference, distinguishing them from consumer-grade electronics.

Driving factors for sustained market growth include the global impetus toward digital transformation, increasing labor costs compelling automation adoption, and governmental mandates promoting sustainable and energy-efficient industrial operations. The benefits derived by end-users—such as enhanced throughput, superior product quality consistency, and minimized operational risks—cement the foundational role of industrial electronics in the modern economy. Furthermore, the integration of advanced connectivity standards like 5G and industrial IoT (IIoT) is rapidly expanding the capabilities and complexity of installed electronic systems.

Industrial Electronics Market Executive Summary

The Industrial Electronics Market is characterized by robust business trends driven by global manufacturing relocation and technological convergence, primarily focusing on smart factory implementation and decentralized control architectures. Business trends indicate a significant shift towards modular systems, enabling faster deployment and easier scalability, alongside a growing demand for high-power density components, particularly in electric vehicle manufacturing and renewable energy infrastructure. Strategic mergers and acquisitions are common as established players seek to integrate specialized software and AI capabilities into their hardware offerings, creating holistic industrial solutions rather than standalone components.

Regionally, Asia Pacific (APAC) continues to dominate the market in terms of production and consumption, fueled by extensive manufacturing bases in China, India, and Southeast Asia, benefiting from rapid infrastructure expansion and supportive government policies favoring industrial digitalization. North America and Europe, while possessing slower absolute growth rates, lead in terms of technological adoption maturity, focusing heavily on highly complex, integrated systems for advanced robotics, edge computing, and stringent cybersecurity protocols necessary for critical infrastructure. These regions demonstrate strong demand for replacement cycles featuring modern, energy-efficient power electronics.

Segmentation trends highlight the increasing importance of power electronics (semiconductors, IGBTs, MOSFETs) due to their centrality in industrial motor control and energy conversion processes crucial for automation and EV infrastructure. The software and services segment is exhibiting the fastest growth, moving beyond simple integration to offering sophisticated data analytics and cloud-based management platforms, transforming industrial processes from reactive to predictive. Furthermore, the demand for industrial sensors capable of measuring granular data points (vibration, temperature, pressure) with high precision is accelerating across all end-use sectors, supporting the proliferation of condition monitoring systems.

AI Impact Analysis on Industrial Electronics Market

User queries regarding AI's influence in the Industrial Electronics Market frequently center on its role in achieving genuine autonomy, minimizing operational risks, and managing the vast datasets generated by IIoT infrastructure. Common concerns revolve around the cybersecurity vulnerabilities introduced by connected AI systems and the steep requirement for specialized data scientists and AI engineers in traditional industrial settings. Users expect AI to move beyond simple data logging, providing real-time prescriptive actions, enabling highly accurate predictive maintenance schedules, and optimizing energy consumption dynamically based on load predictions. The consensus expectation is that AI will fundamentally transform how industrial control systems operate, demanding smarter, faster, and more integrated electronic hardware to process complex algorithms at the edge.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transitioning industrial electronics from fixed control logic towards dynamic, self-optimizing systems. AI algorithms embedded within industrial controllers and edge devices allow for complex pattern recognition in operational data, enabling true predictive maintenance before failures occur, thus significantly increasing asset uptime. This shift necessitates higher computational power in industrial hardware, driving demand for specialized AI accelerators and high-performance microcontrollers optimized for low-latency processing at the factory floor level. AI also plays a crucial role in optimizing complex manufacturing processes, such as optimizing robotic movements, controlling furnace temperatures, or adjusting chemical mixing ratios in real-time, leading to superior quality control and waste reduction.

Furthermore, AI significantly impacts the design and efficiency of power electronics. By analyzing real-time power demand fluctuations and grid stability metrics, AI systems can optimize switching cycles in inverters and converters, reducing energy losses and extending the lifespan of critical components. The implementation of AI-driven anomaly detection is paramount for industrial cybersecurity, offering a layer of protection against sophisticated attacks by recognizing unusual network traffic or unauthorized control commands. This pervasive influence of AI is accelerating the obsolescence cycle for legacy industrial electronics that lack the necessary processing capabilities or connectivity standards to integrate these advanced functionalities.

- AI enhances predictive maintenance accuracy, minimizing unscheduled downtime.

- It optimizes complex process control loops for quality and throughput.

- AI algorithms facilitate dynamic energy management and consumption optimization.

- It enables advanced quality inspection and defect detection via computer vision.

- AI drives the development of autonomous robotics and self-configuring systems.

- It strengthens cybersecurity protocols through real-time anomaly detection at the network edge.

DRO & Impact Forces Of Industrial Electronics Market

The dynamics of the Industrial Electronics Market are shaped by a powerful confluence of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate investment and innovation priorities. The overarching driver is the global adoption of Industry 4.0 initiatives, pushing manufacturers worldwide to integrate digital technologies to maintain competitive parity. This push is strongly supported by the need for increased resource efficiency and sustainability mandates, favoring electronics capable of high-efficiency operation. However, the market faces significant restraints, chiefly the substantial initial capital expenditure required to upgrade legacy infrastructure and the acute shortage of highly skilled technical personnel capable of deploying and maintaining complex IIoT ecosystems. Opportunities are plentiful, particularly in leveraging 5G connectivity for ultra-reliable low-latency communication (URLLC), expanding into emerging economies undergoing rapid industrialization, and specializing in robust edge computing hardware.

The primary Impact Forces driving market expansion are technological innovation and competitive intensity. Innovation is centered around miniaturization, higher power density in power electronics, and the rapid evolution of sensor technology that enables granular data collection. The competitive intensity forces companies to continually invest in R&D to offer differentiated products that meet evolving industrial standards, especially concerning functional safety (e.g., ISO 13849). Secondary impact forces include governmental regulations regarding emissions and energy usage, which mandate the adoption of high-efficiency motor drives and smart energy management systems, thereby accelerating market turnover. The increasing geopolitical fragmentation affecting global semiconductor supply chains acts as a persistent dampener, forcing diversification of component sourcing and regionalizing manufacturing capabilities.

Segmentation Analysis

The Industrial Electronics Market is fundamentally segmented based on Component, Application, and Region, reflecting the diverse requirements and technological demands across the industrial landscape. The Component segment, which includes power semiconductors, sensors, and passive components, dictates the performance and efficiency of the overall system. Application segmentation highlights the specialized needs of core industries such as manufacturing, which demands high-speed PLCs and robotics, versus the energy sector, which requires robust high-voltage power electronics and smart grid control systems. Understanding these segment dynamics is crucial for strategic market positioning, allowing companies to tailor their product offerings to specific industrial pain points and regulatory environments.

Detailed analysis reveals that the sensors segment is experiencing rapid growth due to the proliferation of IIoT devices that require continuous data input for condition monitoring and process optimization. Within the power electronics category, insulated-gate bipolar transistors (IGBTs) and silicon carbide (SiC) devices are gaining traction, especially in demanding applications like electric transportation and large-scale renewable energy conversion, due to their superior efficiency and thermal performance compared to traditional silicon-based components. The service segment, encompassing integration, maintenance, and data analytics consultation, is also projected to grow significantly faster than hardware segments, signifying the shift towards value-added digital services in the industrial domain.

- Component:

- Power Electronics (IGBTs, MOSFETs, Diodes)

- Control Systems (PLCs, DCS, Industrial PCs)

- Sensors and Actuators (Proximity, Temperature, Pressure, Flow)

- Industrial Communication (Gateways, Routers, Ethernet Switches)

- Passive Components (Capacitors, Resistors, Inductors)

- Application:

- Manufacturing (Discrete and Process)

- Energy & Power (Generation, Transmission, Distribution)

- Automotive and Transportation

- Oil and Gas

- Chemical and Petrochemical

- Healthcare and Medical Devices (Specialized Industrial use)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Industrial Electronics Market

The value chain for the Industrial Electronics Market is complex and highly integrated, starting from the upstream procurement of raw materials and specialized semiconductors, progressing through complex manufacturing and assembly, and culminating in highly tailored installation and service provision downstream. Upstream activities involve sourcing high-purity silicon, rare earth metals, and specialized components like high-frequency magnetics. This stage is dominated by specialized semiconductor fabricators and materials suppliers who possess the necessary capital and technological expertise for advanced component manufacturing, facing challenges related to volatile raw material pricing and stringent quality control standards mandated by industrial reliability requirements.

Midstream activities primarily involve the design, assembly, and testing of modules such as power converters, motor drives, and programmable controllers. Key players in this segment differentiate themselves through software integration, proprietary firmware, and adhering to strict industry standards (e.g., IEC, UL). Distribution channels are highly critical; they involve a mix of direct sales for large, customized industrial projects (like entire factory automation systems) and indirect channels utilizing specialized industrial distributors and system integrators. System integrators play a vital role, bridging the gap between component manufacturers and end-users by designing, installing, and commissioning the integrated industrial automation systems.

Downstream activities focus on deployment, maintenance, and after-sales services. Direct channels are preferred for high-value, bespoke installations where manufacturers provide specialized engineering consultation and support. Indirect channels, through local distributors, provide essential logistics and accessibility for standard components and replacement parts, ensuring regional presence and immediate technical support. The profitability in the downstream segment is increasingly tied to long-term service contracts that include software updates, predictive diagnostics, and remote monitoring capabilities, transforming hardware providers into solution providers focused on maximizing asset lifecycle performance for the end-user.

Industrial Electronics Market Potential Customers

Potential customers for the Industrial Electronics Market are extensive and highly segmented, driven by the universal need for process efficiency and automation across all major industrial verticals. The primary buyers are organizations engaged in large-scale manufacturing operations, including automotive OEMs, aerospace and defense contractors, and specialized machine builders (OEMs). These customers require sophisticated control systems, robust power supplies, and highly accurate sensing devices to manage assembly lines, material handling, and quality inspection processes with minimal human intervention. Their purchasing decisions are heavily influenced by total cost of ownership (TCO), reliability ratings, compliance with safety standards, and ease of integration into existing IT infrastructure.

A second crucial customer segment is the infrastructure sector, notably utility companies involved in power generation, transmission, and distribution, as well as water and wastewater treatment facilities. These buyers invest heavily in industrial electronics for supervisory control and data acquisition (SCADA) systems, protection relays, intelligent meters, and high-voltage power components necessary for grid modernization and stability. Their procurement is often guided by governmental regulations, long operational lifecycles, and the necessity for robust cybersecurity features due to the critical nature of their assets. Furthermore, the rapidly expanding renewable energy sector, including solar and wind farm developers, represents a high-growth customer base for specialized high-efficiency industrial inverters and control gear.

Other significant end-users include the oil and gas industry, which utilizes industrial electronics for monitoring pipeline pressure, controlling remote wellheads, and managing complex refining processes in hazardous environments. The logistics and warehousing sectors are also becoming major customers, driven by the explosion of e-commerce, requiring industrial control systems, drives, and sensors for automated guided vehicles (AGVs) and robotic sorting systems. In essence, any organization seeking to enhance operational precision, reduce manual error rates, improve worker safety, or comply with stringent environmental controls represents a viable and growing customer for industrial electronic components and integrated solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 525.4 Billion |

| Market Forecast in 2033 | USD 875.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Emerson Electric Co., Honeywell International Inc., Rockwell Automation, Inc., Mitsubishi Electric Corporation, Texas Instruments Incorporated, Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, Fuji Electric Co., Ltd., Yaskawa Electric Corporation, Delta Electronics, Inc., Yokogawa Electric Corporation, General Electric Company, Eaton Corporation plc, KEB Automation KG, Bosch Rexroth AG, Fanuc Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Electronics Market Key Technology Landscape

The Industrial Electronics Market is underpinned by several critical and rapidly evolving technological advancements designed to meet the demands of higher speeds, greater efficiency, and enhanced connectivity characteristic of modern industrial operations. Central to this landscape is the proliferation of Wide Bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials are replacing traditional silicon-based components, particularly in power electronics, because they offer superior performance in high-temperature, high-voltage, and high-frequency environments. WBG devices significantly reduce power losses in motor drives and inverters, leading to smaller, lighter, and more energy-efficient industrial equipment, which is crucial for applications like electric mobility manufacturing and utility-scale energy storage.

Another pivotal technology is the advancement in industrial communication protocols, moving towards unified, deterministic networks. The convergence of Information Technology (IT) and Operational Technology (OT) is being facilitated by technologies like Time-Sensitive Networking (TSN), which ensures ultra-reliable, real-time data exchange across the industrial local area network (LAN). This low-latency communication is essential for coordinated robotic control, distributed control systems (DCS), and effective edge computing deployments. Furthermore, the integration of 5G connectivity is set to revolutionize wireless industrial control, providing the necessary bandwidth and reliability for applications such as augmented reality-assisted maintenance and mobile asset management across large factory complexes.

The rise of edge computing is fundamentally reshaping how industrial data is processed and utilized. Instead of relying solely on centralized cloud infrastructure, industrial electronics are being equipped with sophisticated processing capabilities (like dedicated AI chips and powerful embedded CPUs) to analyze data locally, reducing latency and ensuring operational continuity even if external connectivity is compromised. This allows for real-time decision-making, which is vital for safety-critical systems. Coupled with advancements in ruggedized sensor technology—including micro-electro-mechanical systems (MEMS) and advanced spectral sensors—the technological landscape emphasizes decentralization, real-time control, and seamless integration of operational data into enterprise-level management systems, defining the current competitive advantage in the industrial electronics sector.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market globally, driven by massive investments in manufacturing automation, particularly in China, South Korea, and Japan. The region benefits from supportive governmental initiatives such as "Made in China 2025," focusing on upgrading domestic industrial capabilities. High population density and subsequent demand for infrastructure development further fuel the need for industrial electronics in power distribution and transportation. The APAC market is characterized by rapid adoption of new technologies, though price sensitivity remains a key factor in component procurement.

- North America: This region is defined by early and sophisticated adoption of advanced automation technologies, concentrating on high-value, complex manufacturing processes in aerospace, automotive, and pharmaceuticals. North America shows high demand for industrial cybersecurity solutions and integrated software platforms that leverage AI and cloud computing. The strong emphasis on reshoring manufacturing operations and modernizing aging infrastructure significantly drives the uptake of cutting-edge industrial electronics, particularly in highly efficient power components and advanced robotics control.

- Europe: Europe is a mature market focusing heavily on sustainability, energy efficiency, and functional safety standards (e.g., machinery directive compliance). Germany and the Nordic countries lead in implementing smart factory concepts (Industry 4.0), emphasizing modular production units and sophisticated industrial IoT integration. Demand is high for robust, reliable components with long operational lifecycles, and the region sets global benchmarks for environmental compliance and high-efficiency motor control technology.

- Latin America (LATAM): This region exhibits moderate but accelerating growth, primarily centered on modernizing resource extraction industries (mining, oil and gas) and expanding manufacturing capabilities in Brazil and Mexico. The market often lags in adopting the most advanced technologies but shows strong potential for industrial communication systems and basic automation equipment as manufacturers seek cost reduction and quality improvement.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in GCC nations, driven by large-scale infrastructure projects, diversification away from oil dependence, and significant government investment in smart city development and renewable energy. This creates strong demand for high-reliability power electronics for grid infrastructure and specialized industrial electronics for desalination plants and petrochemical processing under harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Electronics Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Mitsubishi Electric Corporation

- Texas Instruments Incorporated

- Infineon Technologies AG

- STMicroelectronics N.V.

- Renesas Electronics Corporation

- Fuji Electric Co., Ltd.

- Yaskawa Electric Corporation

- Delta Electronics, Inc.

- Yokogawa Electric Corporation

- General Electric Company

- Eaton Corporation plc

- KEB Automation KG

- Bosch Rexroth AG

- Fanuc Corporation

Frequently Asked Questions

Analyze common user questions about the Industrial Electronics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Industrial Electronics Market?

The primary drivers include the accelerated adoption of Industry 4.0 technologies, the global shift towards manufacturing automation to offset rising labor costs, and increasing regulatory pressure for energy efficiency and sustainability in industrial operations.

How is the integration of Industrial IoT (IIoT) impacting the demand for industrial electronics?

IIoT significantly boosts demand by requiring specialized, networked industrial electronics such as smart sensors, ruggedized communication gateways, and edge computing devices capable of processing and securely transmitting vast quantities of operational data in real-time.

What role do Wide Bandgap (WBG) semiconductors play in the future of industrial power electronics?

WBG materials like SiC and GaN are essential for future industrial power electronics as they enable higher switching frequencies, greater power density, and significantly reduced energy losses, making components smaller and more efficient for demanding applications like electric motor drives and renewable energy inverters.

Which geographical region holds the largest market share for industrial electronics?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by extensive manufacturing activity, large-scale industrialization efforts, and significant government backing for technological upgrades across countries like China and India.

What are the major challenges restraining the Industrial Electronics Market growth?

Key challenges include the high initial investment costs associated with modernizing legacy infrastructure, the complexity of ensuring interoperability between diverse proprietary systems, and a pervasive skills gap related to deploying and maintaining sophisticated integrated digital industrial platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Electronics Packaging Materials Market Statistics 2025 Analysis By Application (Electronic Components, Electronic Devices), By Type (Plastic, Paper and Paperboard), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aluminum Capacitors Market Statistics 2025 Analysis By Application (Consumer Electronics, Industrial Electronics and Lighting Industry, Computer and Telecommunications Related Products, New Energy and Automobile Industries), By Type (SMD Type, Lead Wire (Radial) Type, Screw Type, Snap-in Type, Polymer Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aluminum Electrolytic Capacitors Market Statistics 2025 Analysis By Application (Consumer Electronics Industry, Industrial Electronics and Lighting Industry, Computer and Telecommunications Related Products Industry, New Energy and Automobile Industries), By Type (Solid Type Aluminum Electrolyte Capacitor, Non-Solid Type Aluminum Electrolyte Capacitor), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Electronics Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Avionics, Transportation, Industrial Automation, Medical, Test and Measuring, Wearables, Professional Exercise Equipment, Semiconductor Capital Equipment, Others), By Application (Power Electronics, DC/AC Converters, Material Handling, Industrial Robots), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Industrial Electronics Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Semiconductor Capital Equipment, Process Control Instrumentation/Environmental Controls, Test And Measuring (TandM) Instruments, Automation Systems, Others), By Application (Power Electronics, Dc/Ac Converters, Material Handling, Industrial Robots), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager