Industrial Endoscope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432866 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Industrial Endoscope Market Size

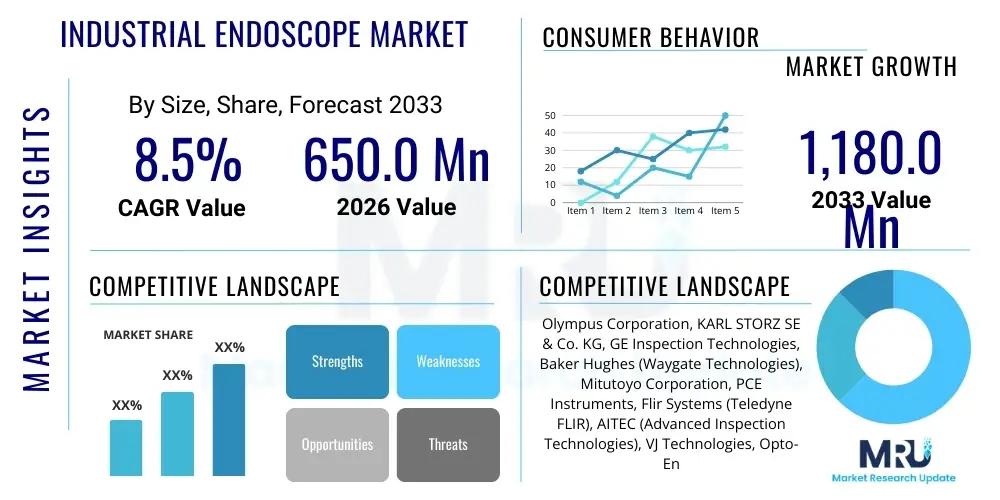

The Industrial Endoscope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650.0 Million in 2026 and is projected to reach USD 1,180.0 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for non-destructive testing (NDT) methodologies across critical infrastructure sectors and high-value manufacturing environments, where visual inspection without disassembly is paramount for maintaining operational safety and efficiency.

Industrial Endoscope Market introduction

The Industrial Endoscope Market encompasses specialized remote visual inspection (RVI) tools designed to access and inspect internal cavities, complex machinery, and inaccessible areas without causing damage or necessitating costly dismantling. These sophisticated devices, also known as borescopes or videosopes, utilize advanced optics, high-resolution sensors, and flexible insertion tubes to provide clear, actionable insights into component integrity, structural defects, and maintenance requirements within industrial assets. Key products include flexible video borescopes, rigid borescopes, and specialized pipe inspection cameras, tailored for diverse environments ranging from corrosive chemical plants to high-temperature aerospace engines. The primary function of industrial endoscopes is to facilitate preventative maintenance and quality control, ensuring compliance with stringent regulatory standards across various industries.

Major applications of industrial endoscopes span across sectors such as aerospace for turbine blade inspection, automotive manufacturing for engine block and casting verification, oil and gas pipelines for corrosion monitoring, and power generation for boiler and heat exchanger surveillance. The benefits derived from deploying these instruments are numerous, including significant reduction in downtime, enhanced safety for inspectors, early detection of component failures, and overall improved asset reliability. The shift towards predictive maintenance strategies, coupled with the need for high-definition documentation of inspection processes, solidifies the integral role of these tools in modern industrial operations management.

Driving factors propelling market growth include the global aging infrastructure necessitating rigorous inspection regimes, the proliferation of complex manufacturing processes demanding zero-defect tolerance, and technological advancements such as high-definition imaging, articulation capabilities, and integrated measurement software. Furthermore, the increasing adoption of Industry 4.0 principles, which emphasize data integration and real-time monitoring, significantly boosts the utility and deployment frequency of advanced industrial endoscope systems. These technological leaps enable faster, more accurate inspections, directly translating into operational cost savings and prolonging the lifespan of critical industrial assets.

Industrial Endoscope Market Executive Summary

The global Industrial Endoscope Market is characterized by robust growth, primarily fueled by the accelerating requirement for reliable non-destructive testing (NDT) solutions in high-stakes industries like aerospace and energy. Current business trends indicate a strong focus on miniaturization and enhanced portability, allowing for inspections in increasingly confined spaces, alongside the integration of digital features such as Wi-Fi connectivity, cloud data storage, and advanced reporting functions. Market leaders are strategically investing in developing systems with superior image quality and advanced measurement capabilities (e.g., stereo measurement and phase measurement), which allows users to accurately quantify defect dimensions without removing the component from service. This emphasis on quantitative analysis over merely qualitative observation is a key driver for technological competition and market expansion.

Regionally, North America and Europe maintain dominance due to established infrastructure, stringent regulatory requirements for asset integrity, and high adoption rates of advanced RVI technologies, particularly in the aerospace and power generation sectors. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, driven by rapid industrialization, massive investments in infrastructure development (e.g., new power plants, large-scale manufacturing hubs), and the growing automotive manufacturing base, particularly in countries like China, India, and South Korea. Emerging markets are demonstrating increased appetite for cost-effective, high-performance endoscope solutions, pushing vendors to establish localized distribution and service networks to capture this accelerating demand.

In terms of segmentation trends, the flexible endoscopes and video borescopes segment holds the largest market share due to their superior versatility, maneuverability, and ability to navigate complex pathways within machinery. Technological advances in sensor size and illumination optimization continue to enhance the capabilities of flexible systems, making them the preferred choice over rigid alternatives in most high-end inspection scenarios. Furthermore, the application segment of Oil & Gas and Power Generation remains critical, given the massive capital expenditure associated with these assets and the severe consequences of failure, leading to consistent demand for high-end, durable, and certified inspection tools suitable for hazardous environments. The convergence of RVI tools with broader asset performance management (APM) software is cementing the endoscope's role as a vital diagnostic tool.

AI Impact Analysis on Industrial Endoscope Market

Common user questions regarding AI’s integration into the Industrial Endoscope Market center around several key themes: the capability of AI to automate defect detection, the accuracy improvement AI offers over human visual inspection, the cost-effectiveness of AI-powered systems, and the integration complexity with existing NDT workflows. Users frequently inquire whether AI can differentiate subtle surface cracks from cosmetic anomalies, how machine learning (ML) models are trained for specific industrial defects (e.g., corrosion pitting in aircraft engines or weld inconsistencies in pipelines), and the potential for real-time, on-site diagnostics without extensive post-processing. These questions reveal high expectations for AI to transform RVI from a labor-intensive, subjective assessment into a rapid, objective, and standardized diagnostic process, thereby reducing human error and improving overall inspection efficiency and reliability, especially in repetitive or highly complex inspection routines.

The integration of Artificial Intelligence, specifically computer vision and deep learning algorithms, is fundamentally revolutionizing the Industrial Endoscope Market by automating critical aspects of the inspection process. AI systems are increasingly being deployed to analyze the vast amounts of high-resolution video and image data captured by borescopes, allowing for rapid and accurate detection and classification of defects such as cracks, corrosion, erosion, and foreign object debris (FOD). This shift reduces the dependence on the human eye for monotonous tasks, mitigating fatigue and inconsistencies, and standardizing defect recognition across multiple inspection cycles and operators. Furthermore, AI algorithms can be trained on proprietary datasets specific to particular assets (e.g., a specific model of gas turbine), dramatically increasing the sensitivity and specificity of flaw identification compared to general inspection protocols.

The most significant impact of AI lies in its ability to facilitate predictive maintenance programs by not only identifying existing defects but also tracking their propagation over time, feeding this quantitative data directly into asset health monitoring platforms. This advanced capability allows industrial operators to schedule repairs proactively, optimize component lifespan, and avoid catastrophic failures, moving far beyond traditional scheduled or reactive maintenance approaches. While the initial investment in AI-enabled hardware and software can be substantial, the long-term benefits derived from increased operational uptime, reduced inspection time, and enhanced safety compliance make it a compelling proposition, particularly for industries handling high-value assets and operating under tight regulatory scrutiny, driving the market toward smart inspection solutions.

- AI-powered automated defect recognition minimizes human error and inspection time.

- Machine learning models enable real-time classification of complex flaws (cracks, pitting, erosion).

- Integration of AI facilitates quantitative measurement and progression tracking of defects.

- Predictive analytics based on endoscopic data supports proactive maintenance scheduling.

- AI enhances the repeatability and standardization of remote visual inspection (RVI) procedures.

- Deep learning is used for advanced foreign object debris (FOD) detection in critical systems.

- Automated reporting and digital documentation streamline compliance and audit trails.

DRO & Impact Forces Of Industrial Endoscope Market

The Industrial Endoscope Market is shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities, all interacting to define its growth trajectory. The predominant drivers include stringent government regulations mandating regular non-destructive testing (NDT) across critical infrastructure, such as in aviation and nuclear power plants, coupled with the increasing emphasis on operational efficiency and preventative maintenance strategies globally. The primary restraining factors often revolve around the high initial capital investment required for advanced video borescope systems, particularly those incorporating high articulation and high-definition measurement capabilities, which can deter small and medium-sized enterprises (SMEs). Furthermore, the necessity for specialized operator training to effectively utilize and interpret advanced RVI data presents a bottleneck in rapid global adoption.

Opportunities for market expansion are largely concentrated in the integration of cutting-edge technologies like 3D measurement, thermal imaging modules, and the pervasive application of augmented reality (AR) overlay for real-time guidance during complex inspections. The growing demand for specialized endoscopes tailored for harsh environments—such as those dealing with extreme temperatures, high radiation, or corrosive chemicals—presents lucrative niche market opportunities. The market impact forces indicate that technological advancement is the strongest positive force, consistently overcoming the pressure of high cost by demonstrating clear returns on investment through enhanced safety and reduced downtime. Standardization efforts in data protocols and interface design are also exerting a positive influence, making systems more interoperable and user-friendly across different organizational platforms.

Ultimately, the impact of these forces suggests a future where high-performance, data-integrated industrial endoscopes become indispensable tools for asset integrity management. While cost remains a barrier for basic users, the long-term cost benefits derived from predictive failure prevention heavily outweigh this initial outlay in large industrial settings. The dynamic interplay between regulatory push (drivers) and technological pull (opportunities) ensures sustained growth, with restraints being incrementally mitigated through increased competition, modular designs, and focused training programs supported by manufacturers. This strategic alignment positions the market for continuous innovation and broader industrial penetration over the forecast period, especially as connectivity standards (like 5G) enhance remote inspection capabilities.

Segmentation Analysis

The Industrial Endoscope Market is comprehensively segmented based on Type, Diameter, Application, and Geography, providing a granular view of market dynamics and adoption patterns across diverse industrial ecosystems. This segmentation highlights the technological preferences of different end-users and the specific performance requirements dictated by the assets being inspected. The Type segment, differentiating between flexible, rigid, and video systems, reveals a decisive trend toward video borescopes due to their superior articulation, data capture capabilities, and ease of use compared to traditional optical rigid endoscopes. Diameter segmentation is crucial as it directly relates to the accessibility of complex internal geometries, with smaller diameters (< 4 mm) seeing rapid technological advancement driven by miniaturization demands in aerospace and small component manufacturing.

Application-based segmentation demonstrates the critical role endoscopes play in high-value asset environments. Industries like Aerospace & Defense and Oil & Gas consistently drive demand for the most sophisticated and durable systems due to the severity of potential failures and the associated high inspection costs. Conversely, segments like General Manufacturing and Infrastructure offer higher volume potential but often require less complex, more cost-effective instruments. Understanding these segmentation nuances is vital for market players to tailor product development and strategic pricing, ensuring their offerings align precisely with the operational requirements and budget constraints of specific end-user verticals. Geographic segmentation confirms that regulatory frameworks and the maturity of industrial infrastructure significantly influence regional adoption rates and technology preferences.

- By Type:

- Rigid Endoscopes

- Flexible Endoscopes

- Video Borescopes (Viedoscopes)

- By Diameter:

- Less than 4 mm

- 4 mm to 8 mm

- Greater than 8 mm

- By Application:

- Aerospace & Defense

- Automotive

- Oil & Gas

- Power Generation (Nuclear, Thermal, Wind)

- Manufacturing (Casting, HVAC)

- Infrastructure and Construction

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Industrial Endoscope Market

The value chain for the Industrial Endoscope Market begins with upstream activities focused on raw material sourcing and highly specialized component manufacturing. This stage involves the procurement of high-grade optical fibers, advanced CMOS/CCD image sensors, complex micro-mechanisms for articulation (e.g., steering cables), and durable, chemically resistant insertion tube materials (e.g., Tungsten braiding). Key upstream suppliers include specialized firms in micro-optics, micro-electronics, and precision machining. The sophistication and quality of these foundational components directly dictate the performance characteristics—such as image resolution, flexibility, and durability—of the final endoscope system, emphasizing the high barriers to entry for new component suppliers due to required precision engineering and reliability standards.

The subsequent stages involve core manufacturing and assembly by Original Equipment Manufacturers (OEMs), where R&D, software integration, calibration, and rigorous quality control take place. This stage is highly value-additive, focusing on integrating mechanical articulation with high-definition digital imaging and advanced software features like 3D modeling and defect measurement tools. The distribution channel is crucial in connecting these complex systems to end-users. Direct channels are predominantly used for high-value, customized systems required by major entities in aerospace or power generation, where specialized technical support and long-term service agreements are necessary. OEMs often maintain direct sales forces and dedicated application engineers to handle these complex sales cycles, ensuring proper training and integration assistance.

Conversely, indirect channels, involving specialized distributors, technical resellers, and local equipment rental companies, serve the broader market, including automotive maintenance shops, general manufacturing firms, and smaller NDT service providers. These indirect partners offer localized inventory, faster deployment, and localized technical support, making advanced inspection technology more accessible to a wider industrial base. Downstream activities involve post-sales service, including calibration, repair, software updates, and training, which represent a significant and recurring revenue stream for OEMs and specialized service centers. The effectiveness of the service network significantly influences customer satisfaction and loyalty, making robust after-sales support a critical competitive differentiator in this highly technical market.

Industrial Endoscope Market Potential Customers

Potential customers for the Industrial Endoscope Market are diverse organizations characterized by a strong dependence on high-value, complex mechanical or structural assets that require frequent, non-disruptive internal inspection for safety, regulatory compliance, and performance optimization. The primary buyers are typically Maintenance, Repair, and Overhaul (MRO) departments, Quality Assurance (QA) teams, and NDT service contractors operating within capital-intensive industries. These end-users utilize endoscopes to prevent catastrophic failures, reduce operational downtime, and minimize the risk associated with dismantling machinery, often integrating the data generated by the endoscope directly into their Enterprise Asset Management (EAM) or Asset Performance Management (APM) software suites to inform maintenance decision-making processes.

Specific high-priority customer segments include global airlines and aerospace manufacturers inspecting turbine engine blades, combustion chambers, and airframe structures for cracks or foreign object damage (FOD). Furthermore, the Power Generation sector, covering nuclear, thermal, and emerging wind energy facilities, represents a constant customer base, requiring endoscopes to inspect boiler tubes, steam turbines, heat exchangers, and gearboxes for corrosion, fatigue, and fouling. The Oil & Gas industry utilizes these instruments extensively for upstream, midstream, and downstream operations, including the inspection of storage tanks, processing vessel internals, and crucial pipeline welds, especially in hard-to-access subsea or highly pressurized environments, prioritizing robustness and certification.

Other significant customer groups include major automotive Original Equipment Manufacturers (OEMs) using endoscopes for internal casting verification, engine R&D quality control, and warranty analysis, alongside chemical processing plants needing inspection of reaction vessels and piping for integrity against corrosive agents. The decision to purchase is usually driven by regulatory necessity (mandated inspection intervals), the cost-benefit analysis of preventing system failure, and the need for high-resolution, quantifiable inspection documentation. Consequently, purchasing decisions often involve collaboration between NDT specialists, procurement managers, and sometimes high-level safety and compliance officers, making the sales cycle typically long and technical, requiring extensive product demonstration and proven return on investment (ROI) documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Million |

| Market Forecast in 2033 | USD 1,180.0 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, KARL STORZ SE & Co. KG, GE Inspection Technologies, Baker Hughes (Waygate Technologies), Mitutoyo Corporation, PCE Instruments, Flir Systems (Teledyne FLIR), AITEC (Advanced Inspection Technologies), VJ Technologies, Opto-Engineering S.r.l., Teslong Technology, Gradient Lens Corporation, JME Technologies, VIZAAR Industrial Imaging, InterTest Inc., Lenox Instrument Company, R. Wolf GmbH, Schott AG, Dioptrix GmbH, Optimax Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Endoscope Market Key Technology Landscape

The contemporary technology landscape of the Industrial Endoscope Market is characterized by a drive towards digital transformation, enhanced imaging fidelity, and integration with data analytics. A pivotal technological shift involves the widespread adoption of high-resolution CMOS (Complementary Metal-Oxide-Semiconductor) sensors, replacing older CCD technology. These modern sensors enable 4K resolution imaging and superior low-light performance, crucial for accurately detecting minute defects in poorly lit industrial interiors. Furthermore, advanced illumination techniques, including high-intensity LED and specialized fiber optic lighting, combined with sophisticated image processing software, significantly improve image clarity, contrast, and color accuracy, ensuring inspectors can reliably distinguish between different types of material deterioration or flaws. The focus on superior optics is non-negotiable, as the precision of the visual data is the foundation of all subsequent diagnostic and preventative actions.

Measurement capabilities represent another critical technological frontier. Modern industrial endoscopes are increasingly equipped with sophisticated 3D measurement tools, such as stereo measurement and phase measurement systems. Stereo measurement uses dual objectives to capture images from slightly different perspectives, allowing the integrated software to triangulate and calculate the dimensions (depth, length, and area) of a defect with high precision. Phase measurement, a more advanced technique, provides even higher accuracy, often used for critical dimensioning in aerospace applications. These quantitative measurement features eliminate the reliance on subjective estimation, providing auditable and traceable data necessary for regulatory compliance and fitness-for-service assessments. The convergence of measurement accuracy and ease of use is driving the premium segment of the market.

Connectivity and data management are rapidly evolving key technologies. The market is witnessing a major trend toward systems featuring integrated Wi-Fi or Bluetooth connectivity, allowing real-time sharing of inspection footage and data with remote experts or centralized monitoring systems. This capability supports remote visual inspection (RVI) programs and collaborative decision-making, significantly enhancing operational flexibility. Furthermore, manufacturers are incorporating robust, built-in memory storage and advanced file management systems that allow inspectors to geo-tag, time-stamp, and organize thousands of inspection images and videos, ensuring complete traceability. The ability to seamlessly interface these digital outputs with existing enterprise resource planning (ERP) or asset management platforms via proprietary APIs or standardized protocols is paramount for achieving the full benefits of Industry 4.0 applications in the NDT space, including robust data security protocols to protect sensitive industrial information.

Regional Highlights

- North America: North America, particularly the United States, represents a mature and dominant market for industrial endoscopes, primarily driven by the stringent regulatory environment imposed by bodies such as the FAA (Federal Aviation Administration) and the ASME (American Society of Mechanical Engineers). The region hosts major aerospace and defense contractors, a vast network of aging oil and gas infrastructure, and a robust power generation sector, all necessitating continuous, high-precision non-destructive evaluation. High-end video borescopes with integrated 3D measurement and AI analytics see high adoption rates here, reflecting the region's strong commitment to adopting the latest NDT technologies for enhanced asset integrity management and predictive maintenance strategies. The high labor costs also incentivize the adoption of automation tools like AI-powered defect detection.

- Europe: Europe maintains a significant market share, characterized by advanced manufacturing capabilities, especially in Germany, France, and the UK. The European market demand is supported by strict environmental and safety regulations, pushing industries like automotive (for casting quality control and engine inspection) and nuclear energy (for safety compliance) to invest in certified inspection equipment. The focus in Europe is heavily on precision and long-term reliability. Furthermore, the push towards green energy, including offshore wind farm maintenance, drives niche demand for specialized, environmentally ruggedized endoscopes suitable for inspecting large gearboxes and structural components exposed to harsh marine conditions. Innovation often centers on modular systems and ease of data integration across multinational operations.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, propelled by rapid industrial expansion, massive infrastructural projects in China and India, and the burgeoning automotive and electronics manufacturing base across South East Asia. While the market initially focused on cost-effective rigid endoscopes, the increasing complexity of industrial machinery and the focus on export quality standards are rapidly accelerating the adoption of high-definition video borescopes. Major investment in new power plants (both conventional and nuclear) and expanding refinery capacities in countries like India and Indonesia are creating immense, sustained demand. This region is highly price-sensitive, yet simultaneously demanding advanced features to quickly establish global quality parity, making localization of manufacturing and service vital for market success.

- Latin America (LATAM): The Latin American market exhibits moderate growth, driven primarily by the cyclical investments in the Oil & Gas sector, particularly in Brazil and Mexico, and mining operations. Demand is concentrated on durable, reliable systems suitable for harsh field conditions. Economic volatility and currency fluctuations sometimes restrain large-scale technology adoption, leading to a preference for renting or leasing advanced equipment rather than outright purchase. As regional economies stabilize and invest more heavily in infrastructure modernization, the market for mid-range, flexible endoscopes capable of general industrial maintenance and inspection is expected to gain momentum, with connectivity improvements being a key regional enabler for remote support.

- Middle East and Africa (MEA): The MEA region’s market growth is intimately tied to the colossal scale of its oil, gas, and petrochemical operations, particularly within the Gulf Cooperation Council (GCC) countries. These national oil companies and their service providers invest significantly in premium, high-specification inspection tools to ensure the integrity and safety of massive refinery and pipeline infrastructure. The adoption of advanced RVI technology here is critical for operational safety and preventing major environmental incidents. Africa’s market, though smaller, is developing through investments in power infrastructure and mining, demanding robust, easily portable equipment. The demand is heavily weighted towards highly specialized, certified endoscopes capable of operating in extreme heat and dusty environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Endoscope Market.- Olympus Corporation

- KARL STORZ SE & Co. KG

- GE Inspection Technologies

- Baker Hughes (Waygate Technologies)

- Mitutoyo Corporation

- PCE Instruments

- Flir Systems (Teledyne FLIR)

- AITEC (Advanced Inspection Technologies)

- VJ Technologies

- Opto-Engineering S.r.l.

- Teslong Technology

- Gradient Lens Corporation

- JME Technologies

- VIZAAR Industrial Imaging

- InterTest Inc.

- Lenox Instrument Company

- R. Wolf GmbH

- Schott AG

- Dioptrix GmbH

- Optimax Systems Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Endoscope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using a video borescope over a rigid endoscope?

Video borescopes offer superior flexibility, allowing navigation through complex curves and tight spaces inaccessible to rigid scopes. They also provide high-resolution digital image capture, integrated measurement capabilities (like 3D stereo measurement), and easier data sharing, significantly enhancing inspection efficiency and documentation.

How does Artificial Intelligence (AI) improve industrial inspection quality?

AI, through computer vision, automates the detection and classification of defects (e.g., cracks, corrosion) from endoscopic footage. This automation reduces human subjective error, speeds up the inspection process, and provides consistent, standardized, and traceable defect recognition, crucial for predictive maintenance accuracy.

Which industry vertical drives the highest demand for advanced industrial endoscopes?

The Aerospace & Defense and Power Generation industries generate the highest demand for highly advanced, small-diameter, and precise measurement-enabled video borescopes. These sectors operate high-value, safety-critical assets requiring rigorous, regulatory-mandated non-destructive testing (NDT) to prevent catastrophic failure and ensure airworthiness or operational safety.

What is the typical lifespan and maintenance requirement for industrial endoscopes?

The lifespan of an industrial endoscope, particularly the highly flexible insertion tube, depends heavily on the application environment and handling. Regular maintenance includes calibration, cleaning the optics, and ensuring the articulation mechanisms are free of debris. Due to high usage in abrasive environments, tube replacement is a common maintenance event, typically requiring professional servicing every 1–3 years for heavy users.

What are the main segments driving the Asia Pacific (APAC) industrial endoscope market growth?

The APAC market growth is primarily driven by expanding general manufacturing, rapid infrastructure development, and significant governmental investment in new power generation facilities and the automotive sector. Increased focus on quality control and rising adherence to global manufacturing standards are compelling local industries to adopt higher-quality RVI solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Endoscope Market Size Report By Type (Fiberscopes, Rigid Borescopes, Others), By Application (Automotive Industry, Power Industry, Aerospace Industry, Construction Industry, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Industrial Endoscope Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fiberscopes, Rigid Borescopes, Others), By Application (Automotive Industry, Power Industry, Aerospace Industry, Construction Industry, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager