Industrial Ethernet Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434207 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Industrial Ethernet Cables Market Size

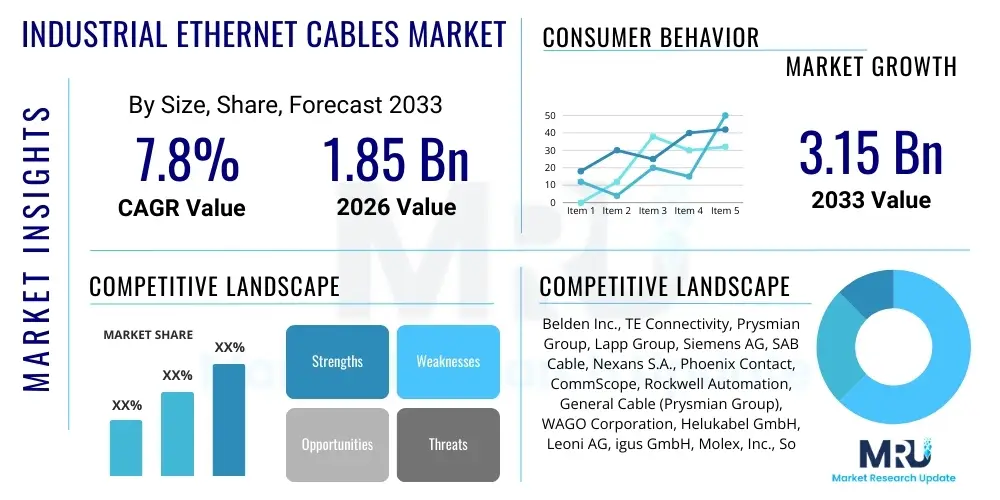

The Industrial Ethernet Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.15 Billion by the end of the forecast period in 2033.

Industrial Ethernet Cables Market introduction

The Industrial Ethernet Cables Market encompasses specialized cabling solutions designed to support high-speed data transmission in harsh and challenging industrial environments. Unlike standard commercial Ethernet cables, industrial variants are engineered with enhanced physical attributes, including robust jackets (often PUR or PVC), superior shielding, and optimized conductor geometry to withstand factors such as extreme temperatures, electromagnetic interference (EMI), vibration, corrosive chemicals, and continuous flex cycling. These cables form the backbone of modern industrial automation systems, facilitating communication between Programmable Logic Controllers (PLCs), Human-Machine Interfaces (HMIs), sensors, actuators, and various machinery on the factory floor. They are essential for protocols like EtherCAT, PROFINET, and EtherNet/IP, enabling real-time control and data integration critical for Industry 4.0 initiatives.

Major applications for industrial Ethernet cables span critical sectors globally, particularly in manufacturing, process industries, energy, and transportation. In discrete manufacturing, they are deployed in robotic cells and assembly lines where reliable, high-flex performance is mandatory. Process industries, such as chemical and pharmaceutical plants, utilize shielded and chemical-resistant versions to ensure network integrity despite exposure to aggressive substances. The core benefit of adopting these specialized cables is the establishment of a unified, high-bandwidth network architecture, replacing legacy fieldbus systems. This standardization simplifies network management, enhances data transparency, and drastically reduces latency, which is vital for time-sensitive applications like motion control and synchronized operations across complex machinery installations.

The market is primarily driven by the accelerating global trend towards smart manufacturing and the Internet of Things (IIoT). As operational technology (OT) and information technology (IT) converge, the demand for reliable, high-speed, and durable network infrastructure grows exponentially. Furthermore, the continuous introduction of sophisticated automation equipment, requiring higher data throughput (e.g., GigE Vision cameras for quality inspection), necessitates the deployment of Category 6A and Category 7 industrial cables. Regulatory standards promoting safety and efficiency in industrial processes also contribute to market expansion, compelling end-users to upgrade outdated infrastructure with resilient, future-proof industrial Ethernet solutions capable of handling demanding continuous operations and ensuring maximal uptime.

Industrial Ethernet Cables Market Executive Summary

The Industrial Ethernet Cables Market is characterized by robust growth fueled primarily by the global transition to connected factories and smart infrastructure. Current business trends indicate a strong preference for hybrid cable designs that integrate power, data, and occasionally fiber optics within a single jacket, optimizing installation costs and minimizing space requirements in crowded industrial settings. Furthermore, there is a significant shift towards cables rated for higher performance categories (Cat 6A and Cat 7) to support 10 Gigabit Ethernet speeds, meeting the increasing data demands generated by advanced monitoring and predictive maintenance systems. Key manufacturers are focusing heavily on developing highly flexible and torsion-resistant cables specifically tailored for dynamic applications like robotics and automated guided vehicles (AGVs), which represent a major vertical driver within the logistics and automotive sectors.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapid industrialization, extensive government investment in manufacturing modernization (such as China's "Made in China 2025" and India's "Make in India" initiatives), and the high adoption rate of new automation technologies in countries like South Korea and Japan. North America and Europe, while being mature markets, continue to demonstrate steady growth, primarily through the retrofit and upgrade of existing brownfield sites to incorporate IIoT infrastructure and cybersecurity enhancements, necessitating the replacement of older fieldbus installations with robust Ethernet networks. These regions are also leading the adoption of advanced PROFINET and EtherCAT solutions, particularly in high-precision industries such as aerospace and specialized machinery manufacturing, influencing the global trend toward standardized industrial communication protocols.

Segmentation trends highlight the dominance of the Cat 5e/Cat 6 segment due to its established reliability and suitability for many standard industrial applications, although the higher categories (Cat 6A and Cat 7) are rapidly gaining market share as bandwidth requirements increase. In terms of shielding, shielded twisted pair (STP) cables dominate the market because they provide essential protection against the high levels of electromagnetic noise typical in industrial environments, ensuring data integrity. The major end-user segment remains the discrete manufacturing industry, particularly automotive and electronics, although the robust growth of the process industry (oil & gas, chemicals) is increasingly demanding specialized, intrinsically safe, and hazardous location-rated industrial cables to manage complex operational risks and stringent safety standards effectively.

AI Impact Analysis on Industrial Ethernet Cables Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Ethernet Cables Market frequently center on two core themes: the resulting data proliferation and the necessity for ultra-low latency networking. Users are concerned about whether existing cable infrastructure can handle the massive, real-time data flows generated by AI-driven systems, particularly those utilizing machine learning for quality control (e.g., high-resolution image processing) or complex predictive maintenance algorithms. Expectations revolve around the need for guaranteed deterministic data transmission paths and whether AI-optimized industrial systems will exclusively require Category 6A and higher shielded cables to support the sustained high bandwidth and minimized jitter essential for cognitive automation applications. The consensus among technical queries suggests that AI deployment acts as a catalyst, accelerating the obsolescence of lower-performance cables and driving immediate demand for premium, high-speed, and fault-tolerant infrastructure designed to support distributed edge computing and real-time sensory data fusion necessary for truly autonomous industrial operations.

- AI algorithms demand high-volume, real-time data transfer from sensors and machines, drastically increasing bandwidth requirements on the factory floor network infrastructure.

- Implementation of AI-driven robotics and autonomous systems necessitates industrial Ethernet cables with superior torsional stability and continuous flex ratings.

- AI enhances predictive maintenance systems, generating massive datasets that require robust Cat 6A/Cat 7 infrastructure to support 10 Gigabit backbones.

- Edge computing, often leveraged by industrial AI, relies heavily on high-speed industrial Ethernet links to minimize latency between data processing units and controllers.

- The complexity of AI deployment drives the requirement for cables with enhanced electromagnetic compatibility (EMC) properties to ensure data integrity during intense computing operations.

DRO & Impact Forces Of Industrial Ethernet Cables Market

The dynamics of the Industrial Ethernet Cables Market are shaped by a potent combination of driving forces (D), restrictive challenges (R), and compelling opportunities (O), creating distinct impact forces. The primary driver is the pervasive adoption of Industry 4.0 paradigms globally, which mandates seamless, unified communication across all levels of the industrial hierarchy, pushing enterprises to transition from legacy fieldbus systems to standardized, high-speed Ethernet. Opportunities are primarily centered around the integration of Power over Ethernet (PoE) in industrial settings, simplifying deployment of numerous IIoT sensors and devices without separate power wiring, and the burgeoning market for specialized hybrid cables tailored for extreme environments like deep-sea exploration or hazardous areas (Class I, Division 2). These elements together exert a strong positive impact, accelerating infrastructure investment and innovation in cable materials science.

Despite significant growth momentum, the market faces notable restraints. High initial investment costs associated with upgrading brownfield sites—replacing existing, functional fieldbus infrastructure—deter small and medium-sized enterprises (SMEs) from rapid adoption. Furthermore, the complexity of managing and standardizing numerous industrial Ethernet protocols (e.g., PROFINET, EtherCAT, CC-Link IE) presents a fragmentation challenge for end-users and installation contractors, demanding specialized training and expertise. Supply chain volatility, especially concerning key raw materials like copper and high-performance polymers, introduces cost fluctuations and potentially slows down production timelines, creating economic pressure points that impact vendor profitability and end-user pricing strategies.

The interplay of these factors defines the core impact forces. The convergence of Information Technology (IT) and Operational Technology (OT) acts as a powerful accelerating force, demanding infrastructure parity across enterprise and plant networks. Conversely, the necessity for extreme durability and specific environmental ratings (e.g., oil, UV, flame resistance) imposes constraints on manufacturing processes and material choices, increasing product development complexity and cost. Ultimately, the relentless pursuit of maximized operational efficiency and the reduction of total cost of ownership (TCO) compel manufacturers to continuously improve cable robustness and performance, while simultaneously addressing the interoperability challenges presented by a multi-protocol industrial landscape.

Segmentation Analysis

The Industrial Ethernet Cables Market is systematically segmented based on various technical and application criteria, allowing for a granular understanding of demand patterns and technological specialization. Key segmentation vectors include the type of network standard (e.g., Cat 5, Cat 6A, Cat 7), the shielding mechanism (UTP vs. STP), the material used for the jacket (PVC, PUR, TPE), and the specific end-use industry (discrete manufacturing, process industry, etc.). This detailed breakdown is essential because industrial demands vary drastically; a robotics application requires high flex-rated PUR cables, whereas a chemical plant might necessitate fire-retardant, chemical-resistant PVC jackets, demonstrating that customization and adherence to specific standards drive segment growth.

The performance-based segmentation, particularly by category (Cat), remains highly relevant as it correlates directly with data throughput requirements. While lower categories still hold market volume, the accelerating trend toward 10 Gbps and beyond is causing a rapid shift towards Cat 6A and Cat 7, especially in data-intensive areas like machine vision and centralized server clusters within the plant. Moreover, the segmentation based on jacket material reflects the harsh realities of industrial environments. Polyurethane (PUR) cables are dominant in dynamic applications due to their high abrasion resistance and excellent flexibility, while PVC maintains a strong foothold in less abrasive, fixed installations due to its lower cost and ease of handling.

Geographic segmentation is critical, revealing disparities in technological maturity and adoption rates. Developed regions (North America, Europe) show higher penetration of specialized, high-category cables for advanced retrofitting, whereas developing regions (APAC) display high growth across all categories driven by greenfield projects and initial factory automation setup. Understanding these segmented dynamics allows stakeholders to tailor product offerings—for example, focusing on robust, entry-level Cat 5e/Cat 6 solutions in emerging markets and specializing in high-flex, Cat 7/7A solutions incorporating single-pair Ethernet (SPE) technology for advanced automation hubs in mature markets.

- By Category: Cat 5e, Cat 6, Cat 6A, Cat 7, Cat 7A, Cat 8

- By Shielding Type: Shielded Twisted Pair (STP), Unshielded Twisted Pair (UTP)

- By Jacket Material: Polyvinyl Chloride (PVC), Polyurethane (PUR), Thermoplastic Elastomer (TPE)

- By Application Type: Standard Use, High Flex, Torsion, Continuous Motion

- By Protocol: PROFINET, EtherNet/IP, EtherCAT, Modbus TCP, CC-Link IE

- By End-Use Industry: Discrete Manufacturing (Automotive, Electronics), Process Industry (Oil & Gas, Chemicals), Hybrid Industries (Energy & Power, Water & Wastewater), Transportation

Value Chain Analysis For Industrial Ethernet Cables Market

The value chain for the Industrial Ethernet Cables Market begins with upstream activities, dominated by raw material suppliers providing essential components such as high-purity copper conductors, specialized shielding materials (e.g., aluminum foil, braided copper), and advanced polymer resins for cable jacketing and insulation (PVC, PUR, TPE). The quality and stable pricing of these raw materials directly impact the final product cost and performance characteristics, particularly concerning crucial features like fire resistance, chemical inertness, and flexibility. Strategic relationships with specialized polymer compounders are vital, as the performance requirements in industrial settings often exceed those of commercial-grade cabling, necessitating specific formulations capable of extreme temperature ranges or resistance to industrial solvents and oils. Manufacturers often integrate backwards or establish long-term contracts to mitigate supply volatility and ensure consistent material quality for high-reliability products.

The midstream involves cable manufacturing and assembly, where core competencies lie in precision stranding, shielding processes, and jacket extrusion to meet strict industrial standards (e.g., TIA, ISO/IEC, PROFINET guidelines). Manufacturers, including major players like Belden, Lapp Group, and Siemens, invest heavily in highly automated production lines capable of producing cables with uniform electrical characteristics and mechanical durability, specifically focusing on complex hybrid cables and assemblies tailored for M12/M8 connectors. Distribution channels are highly fragmented yet critical for market penetration. Direct sales channels are often used for large-scale greenfield projects or specialized system integrators requiring bespoke solutions. However, the majority of volume flows through indirect channels, including global electrical distributors, regional specialized industrial suppliers, and Value-Added Resellers (VARs) who bundle cables with connectivity components, switches, and installation services.

Downstream activities involve system integration, installation, and ultimately, the end-user deployment across diverse industrial sectors. System integrators and automation solution providers play a crucial role in specifying the appropriate cable type and category based on the required protocol (e.g., EtherCAT for high-speed motion control) and environmental conditions. The efficiency and reliability of the cable installation directly impact the network's uptime and performance, making robust cable components essential for minimizing maintenance and troubleshooting costs for the end-user. Post-sale services, including technical support and compliance verification for hazardous location installations, further enhance the downstream value proposition, ensuring the longevity and proper functioning of the critical network infrastructure supporting Industry 4.0 applications.

Industrial Ethernet Cables Market Potential Customers

The primary consumers, or end-users, of Industrial Ethernet Cables are businesses engaged in large-scale industrial operations that require deterministic, high-speed data communication between controllers and machinery. Discrete manufacturing industries constitute the largest segment of potential customers. Within this segment, the automotive manufacturing sector, characterized by highly automated assembly lines, robotic welding, and synchronized conveyance systems, is a massive consumer, demanding continuous flex and torsion-resistant cables (Cat 5e/Cat 6A) for dynamic robotic arms and automated guided vehicles (AGVs). Similarly, the electronics and semiconductor industries, which rely on precision machine vision and cleanroom-compliant components, necessitate specialized, low-outgassing industrial cables to ensure product quality and network reliability in sensitive production environments.

The process industries represent another significant category of potential customers, particularly those operating in harsh or regulated environments, such as oil and gas extraction, chemical processing, pharmaceuticals, and pulp and paper production. These customers require cables with specialized characteristics, including intrinsic safety ratings, resistance to hydrocarbons and corrosive chemicals, and flame-retardant or low-smoke, zero-halogen (LSZH) jacketing for compliance with stringent safety regulations. The necessity for these high-specification cables, often deployed in long, fixed runs across challenging terrains, ensures sustained demand for heavy-duty, heavily shielded industrial Ethernet infrastructure capable of maintaining signal integrity under extreme operational stress.

Furthermore, customers in emerging hybrid industrial sectors are increasingly driving demand. The energy sector (utility-scale renewables and traditional power generation) requires cables for smart grid communication and monitoring systems that can withstand outdoor exposure and UV radiation. The water and wastewater management sector utilizes industrial Ethernet for SCADA systems across distributed pump stations, demanding moisture-resistant and rodent-proof exterior cables. These buyers prioritize product longevity, durability, and compliance with specific regional regulatory standards, often preferring vendors who can provide integrated cable solutions optimized for minimal maintenance and extended operational life in complex environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Belden Inc., TE Connectivity, Prysmian Group, Lapp Group, Siemens AG, SAB Cable, Nexans S.A., Phoenix Contact, CommScope, Rockwell Automation, General Cable (Prysmian Group), WAGO Corporation, Helukabel GmbH, Leoni AG, igus GmbH, Molex, Inc., Southwire Company, LLC, Trelleborg AB, Eldon Group, Rittal GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Ethernet Cables Market Key Technology Landscape

The technological landscape of the Industrial Ethernet Cables Market is rapidly evolving, driven by the demand for higher bandwidth, reduced installation complexity, and increased durability in extreme operating conditions. A pivotal development is the accelerated adoption of higher performance categories, specifically Cat 6A and Cat 7, which support 10 Gigabit Ethernet (10GbE) transmission over distances critical for industrial backbones and high-speed data acquisition systems like advanced machine vision. Manufacturers are focusing on optimizing cable geometries to ensure minimal cross-talk and enhanced immunity to noise, often achieved through advanced foil and braid shielding techniques and superior termination methods. Furthermore, the integration of Power over Ethernet (PoE and PoE+) is becoming standard, requiring cables designed with larger gauge conductors (lower AWG numbers) to minimize voltage drop and safely deliver power simultaneously with data to numerous edge devices such as cameras, sensors, and wireless access points without requiring auxiliary power lines.

Another transformative technology is Single Pair Ethernet (SPE), based on the IEEE 802.3cg standard (10BASE-T1L and 100BASE-T1). SPE utilizes only one twisted pair instead of the traditional two or four pairs, drastically reducing cable size and weight, and offering power delivery (PoDL – Power over Data Line) and data transmission up to 1,000 meters. This technology is viewed as a significant game-changer, facilitating the seamless connection of simple field devices, sensors, and actuators directly into the Ethernet network, eliminating the need for complex gateways. SPE represents the ultimate convergence of industrial communication, bridging the gap between legacy fieldbus installations and the modern Ethernet architecture at the edge, offering simplified installation and material cost savings, especially critical in space-constrained industrial machinery and remote monitoring applications across vast facilities.

In addition to performance and miniaturization, material science innovation remains critical. Manufacturers are continuously developing proprietary jacket materials that offer superior resistance profiles. Polyurethane (PUR) and Thermoplastic Elastomer (TPE) compounds are engineered to maximize resistance to dynamic stresses (high flex/torsion cycles), chemical exposure (oils, coolants), and extreme temperature fluctuations common in robotic cells and machine tools. The focus is not just on survivability but also on compliance with stringent standards, such as UL Listing for specific harsh environments (e.g., wet locations, flame retardancy), and adherence to industrial protocols requiring specific cable colors and characteristics, such as green for PROFINET or yellow for EtherNet/IP, ensuring visual distinction and protocol compliance in complex automation setups.

Regional Highlights

- North America (NA): This region is characterized by early adoption of advanced automation technologies and a robust market for retrofitting existing manufacturing infrastructure with IIoT capabilities. The US, in particular, drives demand for high-performance (Cat 6A/7) and specialized heavy-duty industrial cables for sectors like aerospace, automotive assembly, and oil & gas. High labor costs necessitate maximizing automation density, thus increasing the requirement for complex, flexible, and reliable industrial Ethernet connections, especially those compliant with EtherNet/IP standards, a dominant protocol in the region. The focus here is on reducing downtime and maximizing data transparency for predictive maintenance applications.

- Europe: A mature market deeply influenced by German engineering standards, Europe is a global leader in the adoption of advanced industrial protocols, notably PROFINET (driven heavily by Siemens) and EtherCAT. European manufacturers emphasize precision engineering, which translates into high demand for highly flexible, torsion-resistant cables crucial for robotics and high-dynamic machine tools. Regulations regarding factory safety and electromagnetic compatibility (EMC) are rigorous, necessitating the pervasive use of superior shielded twisted pair (STP) cables and adherence to strict LSHZ (Low Smoke Zero Halogen) requirements in public and enclosed industrial spaces.

- Asia Pacific (APAC): APAC represents the most dynamic and fastest-growing market globally, fueled by massive greenfield manufacturing projects in China, India, and Southeast Asian nations. The region is driven by rapid industrialization, government investment in smart factories, and the relocation of manufacturing bases. Demand spans the entire spectrum, from cost-effective Cat 5e solutions for entry-level automation to high-end Cat 6A/7 for advanced semiconductor and electronics manufacturing hubs. China's sheer manufacturing scale makes it the largest consumer, where the focus is on scaling production capabilities efficiently using protocols like CC-Link IE and general-purpose Ethernet.

- Latin America (LATAM): Growth in LATAM is steady, primarily driven by investments in resource extraction (mining, oil & gas) and food & beverage processing. The market requires durable, reliable cables capable of withstanding the challenging environmental conditions often associated with these industries (e.g., humidity, dust, remote locations). Brazil and Mexico are key markets, with demand centered on standard industrial automation upgrades and maintaining system integrity in potentially volatile operational environments.

- Middle East and Africa (MEA): MEA exhibits strong growth tied primarily to massive infrastructure and energy projects, particularly in the Gulf Cooperation Council (GCC) countries. The demand is heavily skewed towards specialized cables for the oil, gas, and petrochemical sectors, requiring extreme resistance to heat, chemicals, and potentially explosive atmospheres (Hazardous Area Classification cables). Investments in smart city initiatives and manufacturing diversification also contribute to the nascent adoption of industrial Ethernet infrastructure in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Ethernet Cables Market.- Belden Inc.

- TE Connectivity

- Prysmian Group

- Lapp Group

- Siemens AG

- SAB Cable

- Nexans S.A.

- Phoenix Contact

- CommScope

- Rockwell Automation

- General Cable (Prysmian Group)

- WAGO Corporation

- Helukabel GmbH

- Leoni AG

- igus GmbH

- Molex, Inc.

- Southwire Company, LLC

- Trelleborg AB

- Eldon Group

- Rittal GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Industrial Ethernet Cables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between commercial and industrial Ethernet cables?

Industrial Ethernet cables are specifically engineered with enhanced physical protection, including robust jacketing (often PUR or TPE), superior shielding against electromagnetic interference (EMI), and specialized features like high-flex or torsion resistance, allowing them to reliably operate in harsh industrial environments involving temperature extremes, vibration, and chemical exposure, unlike standard office-grade commercial cables.

Which cable category is recommended for modern Industry 4.0 applications?

For modern Industry 4.0 applications, Category 6A (Cat 6A) and Category 7 (Cat 7) cables are highly recommended. Cat 6A supports 10 Gigabit Ethernet (10GbE) up to 100 meters, essential for handling the massive real-time data flow generated by machine vision, AI, and integrated manufacturing systems, ensuring the bandwidth and low latency required for synchronous industrial control.

How does Single Pair Ethernet (SPE) impact the industrial cable market?

Single Pair Ethernet (SPE) significantly impacts the market by enabling the seamless connection of simple sensors, actuators, and field devices directly into the Ethernet network using only one twisted pair. This reduces cable size and weight, simplifies installation, and extends transmission distances, thereby accelerating the convergence of operational technology (OT) and information technology (IT) at the field level.

What role does shielding (STP vs. UTP) play in industrial environments?

Shielded Twisted Pair (STP) cables are predominantly required in industrial settings. Factory floors are inherently noisy environments due to motors, variable frequency drives (VFDs), and heavy machinery, which generate significant Electromagnetic Interference (EMI). STP cables provide essential electromagnetic compatibility (EMC) by minimizing external noise interference and maintaining data integrity and reliability, crucial for deterministic control applications.

Which geographical region is currently experiencing the fastest growth in the industrial Ethernet cable adoption?

The Asia Pacific (APAC) region is currently experiencing the fastest growth in industrial Ethernet cable adoption. This is primarily driven by extensive government-backed initiatives for smart manufacturing, widespread industrial automation across developing economies, and significant foreign direct investment into new, large-scale greenfield manufacturing facilities, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager