Industrial Food Extruder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433225 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Industrial Food Extruder Market Size

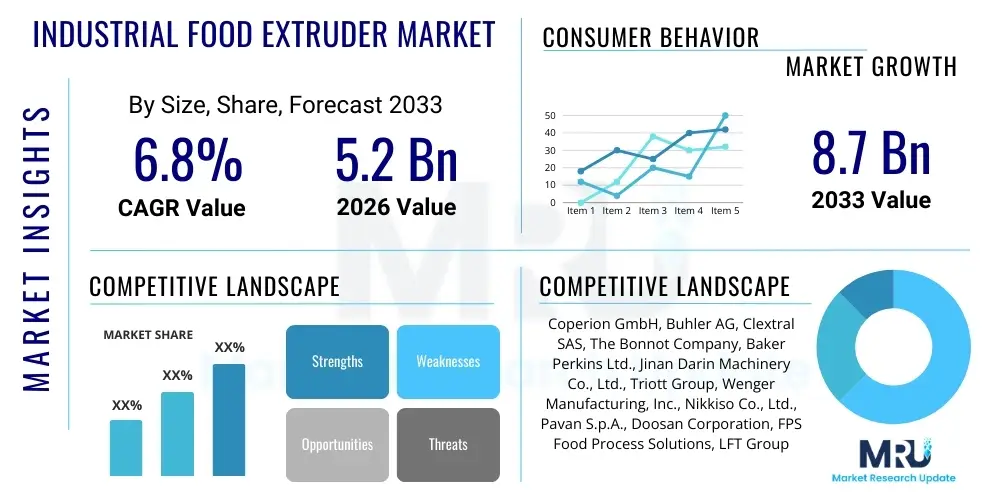

The Industrial Food Extruder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Industrial Food Extruder Market introduction

The Industrial Food Extruder Market encompasses the manufacturing, distribution, and utilization of advanced extrusion machinery employed in large-scale food processing operations. These complex systems are critical for transforming raw food materials into diverse, structured products through thermal and mechanical energy input, enabling high-volume production efficiency and versatility. Extrusion technology is fundamentally utilized across various sectors, ranging from snacks and cereals to pet food and functional ingredients, driven by its capacity to modify texture, shape, density, and nutritional profiles in a cost-effective manner. The technology facilitates gelatinization of starch, denaturation of proteins, reduction of microbial load, and the creation of novel food formats essential for the modern consumer palate.

Products manufactured using industrial food extruders include breakfast cereals (puffed and flaked), savory snacks (puffs, crisps, and pellets), textured vegetable protein (TVP) for meat substitutes, specialty starches, and ready-to-eat (RTE) meals components. Major applications are centered around enhancing product shelf life, improving digestibility, and incorporating functional ingredients such as fibers and vitamins. The inherent benefits of using these systems include continuous processing capabilities, reduced processing time, minimization of waste, and precise control over final product characteristics, making them indispensable in highly automated food production lines globally.

Driving factors for this market are closely linked to global demographic shifts, particularly the rising population requiring consistent and safe food supplies, and the accelerating demand for convenient, processed, and ready-to-eat snacks in developing economies. Furthermore, the significant growth in the plant-based protein sector relies heavily on extrusion technology to create realistic meat analogs, providing a strong impetus for investment in high-capacity, twin-screw extruders. Continuous technological advancements, focusing on automation, higher energy efficiency, and flexibility in handling various raw material inputs, further contribute to the market's robust growth trajectory, positioning industrial food extruders as foundational machinery in modern food manufacturing.

Industrial Food Extruder Market Executive Summary

The global Industrial Food Extruder Market is characterized by intense innovation focused on optimizing production throughput and expanding application scope, particularly in the health and wellness sector. Business trends indicate a strong shift towards flexible manufacturing systems capable of producing small batches of specialized products, driven by consumer demand for customization and niche dietary options, such as gluten-free or high-protein items. Key manufacturers are prioritizing the integration of IoT and advanced sensing technologies into extruder lines to facilitate predictive maintenance, minimize downtime, and ensure stringent quality control, thereby maximizing operational efficiency and reducing total cost of ownership (TCO) for food processors.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, increasing disposable incomes, and the corresponding shift in dietary habits favoring packaged foods and convenience snacks in countries like China and India. North America and Europe maintain dominance in terms of technology adoption and market value share, primarily due to established, high-capacity manufacturing bases and early adoption of sophisticated twin-screw extrusion systems for complex applications like specialized pet food and functional foods. Regulatory convergence regarding food safety and processing standards across these regions is also driving investments in technologically compliant, high-sanitation equipment.

Segmentation trends highlight the dominance of twin-screw extruders due to their superior versatility, handling capacity for sticky or complex ingredients, and ability to achieve a wider range of shear rates and temperatures, crucial for advanced product development, especially in meat alternatives and aquaculture feeds. Application-wise, the snacks and breakfast cereals segment remains a high-volume revenue generator, but the fastest growth is observed in the pet food segment, driven by the humanization of pets and the rising demand for premium, nutrient-dense kibble and treats. The increasing need for energy-efficient cold extrusion methods for sensitive ingredients also represents a significant area of future segment growth.

AI Impact Analysis on Industrial Food Extruder Market

Common user questions regarding AI's impact on industrial food extrusion typically center around operational efficiency, product consistency, and predictive maintenance. Users frequently inquire about how AI can optimize recipe formulation based on real-time raw material variability, ensure zero-defect production through enhanced quality checks, and predict equipment failure long before it occurs. The core themes revolve around leveraging AI for autonomous control systems that minimize human intervention, improve energy consumption models, and rapidly adapt extrusion parameters (temperature, pressure, shear) to maintain precise final product specifications, such as texture and moisture content, across varying batch inputs. Users anticipate that AI integration will substantially elevate food safety standards and significantly reduce energy wastage in high-throughput environments.

The primary influence of Artificial Intelligence in the Industrial Food Extruder Market is the transition from reactive process management to highly proactive and autonomous manufacturing. AI algorithms, particularly machine learning models, are being deployed to analyze massive datasets generated by sensors monitoring screw speed, barrel temperature, motor load, and mass flow rate. This analysis allows the system to establish intricate correlation patterns between operational parameters and final product quality attributes. Consequently, AI enables dynamic adjustments to be made automatically within milliseconds, far exceeding human response capability, ensuring consistent quality even when faced with minor ingredient inconsistencies or equipment wear. This capability is pivotal for specialized, high-margin products where quality deviation is unacceptable.

Furthermore, the integration of deep learning models facilitates advanced anomaly detection, moving predictive maintenance from simple threshold alerts to sophisticated forecasting based on subtle, multi-variable shifts. For extrusion lines, which involve high friction and wear, predicting the optimum time for component replacement (e.g., screws and barrels) based on operational stress history, rather than fixed time schedules, significantly reduces maintenance costs and unplanned downtime. AI also assists in optimizing complex energy models by analyzing the specific energy input (SEI) required per kilogram of product, recommending operational speeds and temperatures that maximize output while minimizing electricity consumption, thereby supporting sustainability goals in food processing plants.

- AI-Driven Process Optimization: Real-time, autonomous adjustment of temperature, pressure, and screw speed for consistent product texture and quality.

- Predictive Maintenance: Use of machine learning to forecast wear and tear on high-stress components (screws, barrels), minimizing unplanned downtime.

- Enhanced Quality Control (QC): Utilizing computer vision and AI classifiers to identify and reject defective products post-extrusion with greater accuracy than traditional sensors.

- Recipe Formulation Optimization: AI models recommend ingredient mixtures and process parameters to achieve desired nutritional or physical properties, especially crucial for novel plant-based foods.

- Energy Efficiency Management: Dynamic optimization of Specific Energy Input (SEI) to reduce energy consumption during continuous operation.

- Supply Chain Variability Management: Algorithms adjust processing parameters based on the detected variability in incoming raw material characteristics (e.g., moisture, protein content).

DRO & Impact Forces Of Industrial Food Extruder Market

The Industrial Food Extruder Market is primarily driven by the escalating global consumption of convenience foods, high demand for fortified and functional snacks, and the rapid expansion of the pet food and aquafeed industries which are heavily reliant on extrusion technology for producing high-quality, buoyant feeds. Restraints primarily involve the substantial initial capital investment required for high-capacity, sophisticated twin-screw extrusion systems, which can be prohibitive for small and medium-sized enterprises (SMEs), alongside the complex regulatory landscape concerning food safety and machinery standards in different global jurisdictions. Opportunities are largely concentrated in the burgeoning market for plant-based meat alternatives, utilizing extrusion to achieve fiber structure and texture fidelity, and in the development of modular, flexible extrusion systems adaptable to varied production runs.

Key impact forces shaping this market include the pervasive trend of health consciousness, which mandates that extruded products must increasingly incorporate healthy ingredients, such as whole grains and high-fiber components, while minimizing sodium and fat content. This necessitates continuous innovation in extruder die design and processing capabilities to handle these difficult materials without compromising efficiency. Furthermore, sustainability pressures are a major force, pushing manufacturers towards designing systems that consume less water and energy, and can utilize recycled or alternative raw materials, such as insect proteins or upcycled food waste, transforming extrusion into a crucial tool for circular economy initiatives in food production.

The competitive rivalry within the market is high, characterized by established European and North American players (e.g., Buhler, Coperion) continuously launching highly automated, robust machinery, while Asian manufacturers focus on offering cost-effective, high-output solutions. This competitive environment drives rapid technological diffusion and pushes prices down in certain segments. The bargaining power of customers (large food conglomerates) remains substantial, requiring suppliers to offer comprehensive service packages, including process optimization consultation, training, and rapid spare parts supply, transforming the extruder sale into a long-term partnership focused on total cost of ownership rather than initial price point.

Segmentation Analysis

The Industrial Food Extruder Market is extensively segmented based on machine type, operational technique, application sector, and regional presence, providing a detailed framework for market dynamics and technological focus. The segmentation analysis reveals diverse growth trajectories, with high-shear twin-screw extruders showing superior market penetration due to their capacity for complex product formulation, while the application segment is being fundamentally reshaped by the accelerated growth in non-traditional areas like specialized functional ingredients and meat alternatives. Understanding these specific segments is vital for stakeholders aiming to capture niche market demands and allocate research and development resources effectively.

The classification by operational technique, distinguishing between cold extrusion and hot extrusion, reflects the critical differences in product objectives; hot extrusion (cooking extrusion) dominates volume for snacks and cereals by utilizing thermal energy, whereas cold extrusion is rapidly growing for products requiring minimal heat damage, such as dough, confectioneries, and certain nutritional bars. Furthermore, the capacity and automation level of the machines are becoming increasingly important segmentation criteria, with high-volume industrial machines targeting large global corporations and mid-range machines catering to regional specialty processors, influencing pricing strategies and service models across the industry landscape.

- Type:

- Single-Screw Extruders

- Twin-Screw Extruders

- Plunger Extruders

- Application:

- Snacks and Savory Products (Puffs, Pellets, Direct-Expanded)

- Breakfast Cereals (Flakes, Puffed Grains)

- Pet Food and Aquafeed (Kibble, Specialized Feeds)

- Meat Substitutes (Textured Vegetable Protein - TVP)

- Functional Ingredients and Starch Modification

- Confectionery and Baking

- Operation:

- Cold Extrusion

- Hot Extrusion (Cooking Extrusion)

- End-Use Capacity:

- High-Capacity Industrial

- Medium-Capacity Commercial

Value Chain Analysis For Industrial Food Extruder Market

The value chain for the Industrial Food Extruder Market begins with upstream activities dominated by specialized component suppliers, including manufacturers of high-wear parts like barrels, screws, and dies, alongside providers of high-precision sensors, motors, and control systems. The complexity of twin-screw geometries and the requirement for highly durable, food-grade materials (often specialized stainless steels or proprietary alloys) grant these upstream component suppliers significant leverage. Efficiency in this stage is crucial, as the performance and lifespan of the entire extrusion system depend on the quality and metallurgy of these core parts, directly impacting maintenance frequency and operational costs for end-users.

Midstream activities involve the core extruder manufacturers (OEMs), who undertake machine design, assembly, integration of automation and control software, and rigorous testing. This stage is highly knowledge-intensive, requiring expertise in thermodynamics, rheology, fluid dynamics, and food science to develop systems capable of processing diverse raw materials into high-quality food structures. Value is added through customization—tailoring systems to specific product lines (e.g., aquatic feed vs. crispy snacks)—and through the provision of comprehensive pre-sale consultation and pilot testing services, ensuring the machinery meets precise production requirements before installation.

Downstream analysis focuses on distribution and end-user deployment. The distribution channel is typically direct or involves highly specialized regional agents who possess deep technical knowledge of food processing machinery. Direct sales are common for large multinational food corporations. After-sales support, including installation, commissioning, preventative maintenance contracts, and the timely supply of replacement parts, forms a critical part of the downstream value proposition. Direct and indirect channels both focus heavily on providing process optimization training, ensuring that the end-user (food processor) can maximize the efficiency and flexibility of the industrial extruder system over its lifecycle.

Industrial Food Extruder Market Potential Customers

Potential customers for industrial food extruders are diverse, spanning the entire processed food manufacturing spectrum, with specific emphasis on companies requiring continuous, high-shear, or high-temperature processing capabilities. The primary buyers are large multinational food and beverage conglomerates (e.g., Nestlé, PepsiCo, General Mills) who operate multiple production facilities globally and demand high-capacity, highly automated twin-screw systems for the consistent production of established snack lines, breakfast cereals, and new product innovations. These organizations prioritize system reliability, energy efficiency, and compliance with rigorous global food safety standards.

A rapidly growing segment of potential customers includes specialized manufacturers focusing on niche, health-oriented products. This incorporates companies producing specialized pet nutrition (premium kibble, veterinary diets), emerging manufacturers of plant-based meat substitutes (requiring high-moisture extrusion technology), and functional ingredient suppliers modifying starch and protein structures for use in other foods. These buyers often require flexibility, smaller batch capabilities, and precise temperature control, driving demand for advanced, modular extruder designs.

Furthermore, government agencies and large commercial farms involved in aquaculture and animal feed production represent significant buyers, particularly in high-growth regions like Southeast Asia and Latin America. Extrusion is essential here for creating buoyant fish feed and highly digestible animal feed pellets. These customers seek robust, durable machines that can operate reliably in challenging environments, often prioritizing throughput and low maintenance requirements over cutting-edge automation features, unless subsidized through modernization programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coperion GmbH, Buhler AG, Clextral SAS, The Bonnot Company, Baker Perkins Ltd., Jinan Darin Machinery Co., Ltd., Triott Group, Wenger Manufacturing, Inc., Nikkiso Co., Ltd., Pavan S.p.A., Doosan Corporation, FPS Food Process Solutions, LFT Group, Marel hf, Extru-Tech, Inc., Sanyuru Co., Ltd., Shandong Light M&E, Kahl Group, Flo-Mech Ltd., Feihe International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Food Extruder Market Key Technology Landscape

The core technology landscape in the industrial food extruder market is dominated by twin-screw extrusion systems, which represent the apex of versatility and control. These systems utilize two intermeshing, co-rotating, or counter-rotating screws housed within a barrel, allowing for precise control over shear, mixing, conveying, and heat transfer. Recent technological advancements focus on modular screw and barrel configurations, enabling rapid changeovers and customization of the machine setup to handle a wide variety of raw materials, from high-protein flours and starches to high-fiber ingredients, maximizing the operational flexibility required by modern food processors attempting to meet rapidly shifting consumer trends.

Significant technological investment is also being directed toward improving energy efficiency and sanitary design. Modern extruders incorporate sophisticated thermal management systems, including highly efficient barrel heating/cooling jackets and advanced insulation, to minimize specific energy input (SEI). Furthermore, the trend towards enhanced hygienic design (EHEDG compliance) mandates easy-to-clean components, minimal horizontal surfaces, and features like quick-opening barrels to ensure complete cleaning and sterilization between batches, which is critical for preventing allergen cross-contamination and maintaining stringent food safety standards required by global regulators.

The integration of advanced sensing and IoT (Internet of Things) technologies is revolutionizing how extruders are operated and maintained. High-resolution sensors monitor variables such as torque fluctuation, internal pressure profiles, and moisture content in real-time, feeding data into sophisticated Process Analytical Technology (PAT) systems. These technologies enable precise, closed-loop control and remote diagnostics, allowing technicians to optimize performance and troubleshoot issues across geographically dispersed manufacturing sites, ultimately improving yield and consistency while supporting the remote monitoring and optimization services provided by leading OEMs.

Regional Highlights

North America maintains a commanding position in the Industrial Food Extruder Market, characterized by early adoption of advanced extrusion technologies, especially in the high-volume production of breakfast cereals, specialized pet food, and complex functional snacks. The region benefits from the presence of major global food processing corporations and a strong emphasis on R&D leading to innovations in high-moisture extrusion for plant-based meat substitutes. Stringent regulatory standards regarding quality and safety also drive continuous investment in state-of-the-art, automated extrusion lines, ensuring market value remains high.

Europe represents a mature but highly dynamic market, demonstrating leadership in developing sustainable and energy-efficient extrusion processes. European manufacturers are focused heavily on incorporating recycled or novel protein sources (e.g., insect protein for feed) and meeting specific regional demands for organic, non-GMO, and allergen-free products. Germany, France, and Italy are key centers for both extruder manufacturing and application innovation, particularly in confectionery, specialized pasta, and sophisticated texturization techniques.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid expansion is fueled by rising discretionary income, shifting dietary habits towards Western-style packaged and convenience foods, and massive investment in industrialization, particularly in China and India. The demand is strong for medium-capacity, robust extruders for the domestic production of snacks, noodles, and cost-effective animal feed, driven by large, local processing operations scaling up to meet domestic and export demands.

Latin America (LATAM) and the Middle East & Africa (MEA) present emerging opportunities. LATAM’s growth is spurred by the expanding aquaculture industry, requiring high-quality floating feed, and increasing demand for local snack production. The MEA region is witnessing infrastructure investment aimed at improving food security and local processing capabilities, leading to growing demand for versatile extrusion systems suitable for processing locally sourced grains and pulses into affordable, shelf-stable foods.

- North America: Dominant in high-value segments (pet food, functional foods); high automation adoption; strong focus on plant-based innovations.

- Europe: Leader in sustainable extrusion; mature market characterized by sophisticated technology integration and strict hygiene standards (EHEDG).

- Asia Pacific (APAC): Fastest growing market; driven by urbanization, rising middle class, and high demand for packaged snacks and localized extruded products.

- Latin America (LATAM): Growth driven by expanding aquaculture and localized savory snack production.

- Middle East and Africa (MEA): Emerging market focusing on building local food processing capacity and ensuring regional food security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Food Extruder Market.- Coperion GmbH

- Buhler AG

- Clextral SAS

- The Bonnot Company

- Baker Perkins Ltd.

- Jinan Darin Machinery Co., Ltd.

- Triott Group

- Wenger Manufacturing, Inc.

- Nikkiso Co., Ltd.

- Pavan S.p.A.

- Doosan Corporation

- FPS Food Process Solutions

- LFT Group

- Marel hf

- Extru-Tech, Inc.

- Sanyuru Co., Ltd.

- Shandong Light M&E

- Kahl Group

- Flo-Mech Ltd.

- Feihe International Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Food Extruder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between single-screw and twin-screw industrial food extruders?

Twin-screw extruders offer superior mixing, higher shear rates, greater operational flexibility for diverse raw materials (including viscous or high-fat mixtures), and tighter process control compared to single-screw extruders, which are typically simpler, lower in cost, and used for more uniform, lower-complexity products like simple pellets or pasta.

How does extrusion technology contribute to the plant-based protein market?

Extrusion is crucial for creating realistic meat analogs (TVP) by texturizing plant proteins (soy, pea) under high pressure and heat. High-moisture extrusion specifically mimics the fibrous texture of muscle meat, enabling the production of high-quality, whole-muscle plant substitutes for consumers seeking non-animal protein options.

Which application segment currently drives the highest demand for industrial extruders?

While the demand for machinery across all segments is robust, the Snacks and Breakfast Cereals segment continues to generate the highest volume demand globally due to consistent consumer need for convenient, expanded, and puffed products. However, the Pet Food and Meat Substitutes segments exhibit the fastest growth trajectory.

What are the key technological advancements influencing modern extruder design?

Key advancements include enhanced modularity for quick component changeovers, integration of IoT sensors for real-time Process Analytical Technology (PAT) and remote diagnostics, improved energy-efficient heating and cooling systems, and advanced hygienic designs (EHEDG compliance) for easier cleaning and superior food safety management.

What is the projected Compound Annual Growth Rate (CAGR) for the Industrial Food Extruder Market?

The Industrial Food Extruder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period of 2026 to 2033, driven primarily by increasing global demand for processed foods and the expansion of the high-value plant-based food industry.

The utilization of industrial food extruders extends beyond traditional applications, increasingly becoming fundamental to the development of nutraceuticals and specialized medical foods. The precision provided by advanced twin-screw technology allows manufacturers to encapsulate sensitive ingredients, such as probiotics and vitamins, or create micro-pellets with controlled release characteristics, serving the burgeoning functional food market. This technical capability ensures that nutritional integrity is maintained throughout the high-temperature and high-shear process, delivering products that meet specific health and dietary requirements. This innovation area demands extruders with extremely precise dosing and temperature control mechanisms, often integrated with sophisticated upstream dosing feeders and downstream drying systems.

The environmental footprint of extrusion processes is a growing concern, impacting machine design. Modern extruders are being engineered to minimize water usage, especially in cooling and cleaning cycles. Furthermore, the ability of extrusion technology to effectively process co-products and food waste streams into valuable secondary ingredients or animal feed—a concept known as upcycling—is gaining prominence. This capability positions the extruder not just as a manufacturing tool, but as a critical component in achieving circular economy objectives within the food industry, driving investment in machines specifically optimized for handling high variability and non-traditional ingredient matrices, thus providing a sustainable competitive advantage.

The market also faces challenges related to skilled labor. Operating and maintaining complex, high-throughput extrusion lines requires specialized knowledge in polymer and food rheology, automation, and mechanical maintenance. This scarcity of expertise is compelling manufacturers to design more user-friendly Human-Machine Interfaces (HMIs) and to embed AI-powered diagnostic tools that can guide operators through complex procedures and rapidly diagnose system faults. Training and digitalization services offered by OEMs are therefore becoming non-negotiable value-adds, shifting the competitive focus beyond just machine specifications to encompass comprehensive lifecycle support, crucial for maximizing the return on investment for end-users, particularly in regions where technical talent pools are shallow.

In terms of segmentation by application, the Pet Food and Aquafeed sector showcases particular resilience and innovation. The demand for premium pet food, which includes grain-free, high-protein, and specialized therapeutic diets, necessitates high-end twin-screw extruders capable of achieving specific expansion ratios and density control to create floating, sinking, or vacuum-coated pellets. Similarly, the highly technical requirements of aquaculture—ensuring pellet stability, water resistance, and optimal digestibility for various fish species—continue to drive demand for extruders featuring advanced vacuum coating apparatus and precise die configuration, marking this segment as a crucial driver of high-value system sales.

The influence of industry consolidation within the food manufacturing sector means that extruder suppliers must cater to a smaller number of extremely large clients with global procurement needs. These large buyers often require standardized machine platforms that can be deployed consistently across different continents, facilitating unified maintenance protocols and predictable operational performance worldwide. This trend necessitates that top extruder manufacturers offer robust global support networks, extensive spare parts inventory, and sophisticated global service level agreements (SLAs), making international operational capability a mandatory prerequisite for market leadership.

The regulatory environment, particularly concerning Novel Foods and specific processing standards like those set by the Food and Drug Administration (FDA) in the U.S. and the European Food Safety Authority (EFSA), exerts considerable influence. Extruder design must account for traceability and validation requirements. New machinery often includes integrated data logging capabilities that automatically record all critical control points (CCPs) such as time, temperature, and pressure, providing auditable proof of process compliance. This enhanced data transparency is not just a feature but a necessary requirement for processors selling into highly regulated markets, significantly impacting the technology architecture of new extrusion line installations.

The competitive landscape is further intensified by ongoing research into supercritical fluid extrusion (SCFE), an emerging technology that utilizes carbon dioxide as a blowing agent to achieve highly porous, low-density structures without the intense thermal degradation associated with traditional expansion. While still niche, SCFE represents a potential disruptive force, particularly for functional food and snack segments where preserving heat-sensitive nutrients and creating unique textures are paramount. Extruder manufacturers are therefore strategically investing in R&D to commercialize or integrate aspects of SCFE technology into existing high-pressure systems, preparing for the next generation of food structuring methods.

The ongoing push for automation is visible through the adoption of robotic handling systems integrated directly into the downstream process flow, managing tasks such as cutting, drying, cooling, and packaging the extruded product. This seamless integration ensures minimal manual intervention, which further reduces contamination risks and increases overall line speed and efficiency. The market demand is shifting from simply procuring a processing unit to acquiring a fully automated, synchronized extrusion line solution, requiring OEMs to develop stronger partnerships with robotic and packaging equipment providers to deliver complete, turn-key solutions to their global clientele, thereby enhancing their market offering and competitive edge.

Regional dynamics are also influenced by local energy costs. In regions with high electricity tariffs, the adoption rate of energy-efficient twin-screw extruders is accelerated, as the lifetime operational savings significantly outweigh the higher initial capital cost. Conversely, in regions with lower labor costs, simpler single-screw systems might still be preferred for certain bulk applications where energy efficiency is secondary to basic functional capacity. This regional economic variability requires extruder suppliers to maintain diverse product portfolios catering to differing cost-benefit analyses across global markets.

Finally, the growing consumer aversion to artificial additives and preservatives mandates that food processors utilize methods, like extrusion, that naturally extend product shelf life through thorough cooking and moisture reduction. This intrinsic benefit of the extrusion process—which provides microbial lethality and stabilization—reinforces its central role in manufacturing shelf-stable, ready-to-eat products. Consequently, technological improvements focusing on optimizing the final product moisture and water activity (Aw) post-extrusion and drying are continually prioritized, ensuring both safety and optimal texture for the end consumer.

The material science employed in extruder construction is crucial for longevity and performance. High-performance extruders utilize proprietary alloys for screws and barrel liners to resist the high-abrasion environment caused by processing high-fiber, high-mineral content ingredients like whole grains, corn grits, and specialized pet food premixes. Continuous research into coatings and surface treatments, such as plasma nitriding or special carbide overlays, is essential to extend the service life of wear parts, thereby reducing maintenance downtime and increasing the overall equipment effectiveness (OEE) for food manufacturers, making material innovation a silent yet powerful competitive differentiator in the market.

The global increase in chronic diseases and lifestyle disorders has driven demand for extruded products specifically designed for dietary management. This includes low-glycemic index foods, high-fiber supplements, and fortified breakfast items targeting specific nutritional deficits. Extrusion technology allows for the precise incorporation and stable dispersion of sensitive ingredients (like vitamins, minerals, and resistant starches) that would otherwise degrade under traditional cooking methods. This complex functional food application segment demands extruders with enhanced mixing zones and highly controlled temperature profiles, validating the continuous technological superiority of twin-screw systems for such specialized, high-margin product lines.

The role of digitalization extends to implementing sophisticated control algorithms that compensate for fluctuating utility inputs. For instance, integrated systems can adjust extrusion parameters in real-time to counteract momentary drops in steam pressure or water temperature, maintaining a steady-state process crucial for product consistency. This resilience to external operational variables, achieved through advanced control architecture, is a major selling point for modern industrial extruders, ensuring that production remains uninterrupted and compliant, even in manufacturing environments where utility supplies might be inconsistent, particularly in emerging economies.

In conclusion, the trajectory of the Industrial Food Extruder Market is one of convergence, where mechanical engineering excellence meets advanced food science, automation, and digitalization. The market is propelled by non-traditional applications—plant-based foods and functional ingredients—and is constrained primarily by initial investment barriers. Success in this market is determined by the ability of OEMs to deliver integrated, highly flexible, energy-efficient, and globally supported extrusion solutions that directly address the dual industry pressures of sustainability and stringent food safety compliance, securing extrusion technology's indispensable role in the future of global food production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager