Industrial Gas Spring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434355 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Industrial Gas Spring Market Size

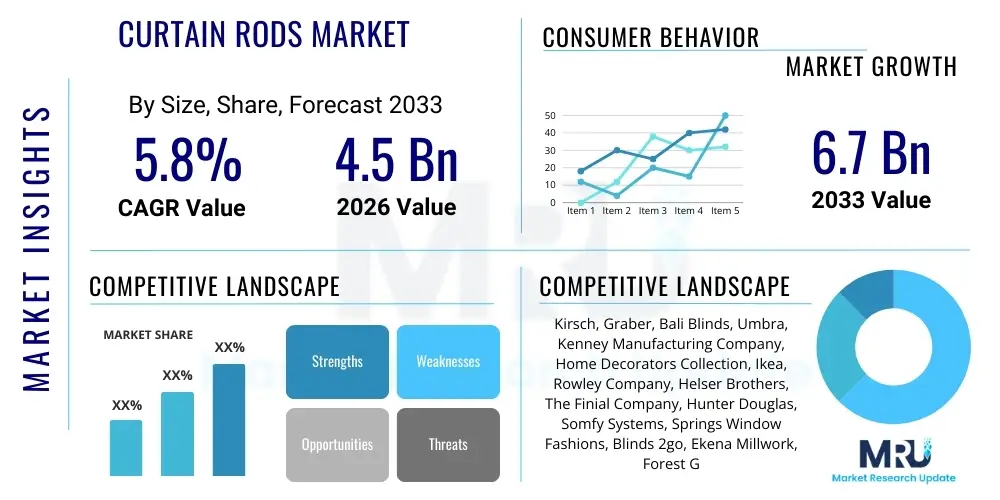

The Industrial Gas Spring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.91 Billion by the end of the forecast period in 2033.

Industrial Gas Spring Market introduction

The Industrial Gas Spring Market encompasses the global production, distribution, and consumption of specialized mechanical devices designed to provide controlled motion, force assistance, and damping capabilities in diverse industrial applications. These devices, commonly utilizing compressed nitrogen gas and hydraulic fluid within a sealed cylinder, are critical components in systems requiring ergonomic counterbalance, precise lifting, lowering, and positional holding. Unlike traditional mechanical springs, gas springs offer a consistent, predictable force curve throughout their stroke length, making them essential for enhancing operational efficiency, safety, and user experience across various heavy-duty and precision environments. The primary product variations include standard compression springs, tension springs, lockable gas springs, and stainless steel versions tailored for corrosive environments.

Major applications of industrial gas springs span the automotive sector, where they are integral in hoods, trunks, and seating mechanisms; the aerospace and defense industries, used in specialized access panels and storage compartments; the medical field for adjusting hospital beds, imaging equipment, and operating tables; and the general industrial machinery domain, including machine tools, heavy-duty enclosures, and handling equipment. The versatility and customization potential of these components—allowing for specific force ratings, damping rates, and mounting options—drive their widespread adoption across sectors demanding reliability and repeatable performance. Furthermore, gas springs contribute significantly to workplace safety by reducing manual strain and ensuring controlled movement of heavy components, aligning with increasingly stringent occupational health and safety regulations globally.

The principal driving factors accelerating market growth include the robust expansion of the global automotive manufacturing sector, particularly the rising production of SUVs and commercial vehicles that require sophisticated lift assist mechanisms; the growing demand for ergonomic solutions in medical and office furniture design; and the escalating investment in automated machinery and robotics where precise counterbalancing is crucial for smooth operation. Furthermore, continuous technological advancements focused on enhancing sealing technologies, extending service life, and improving corrosion resistance, particularly for high-demand applications in marine and offshore industries, further solidify the market's trajectory. The transition towards lightweight materials and integrated smart factory concepts is also spurring innovation in gas spring design and functionality.

Industrial Gas Spring Market Executive Summary

The Industrial Gas Spring Market is experiencing sustained growth driven by macroeconomic stability in key manufacturing regions and significant technological shifts favoring precision engineering and automation. Business trends indicate a strong focus among leading manufacturers on vertically integrated production processes and strategic mergers and acquisitions aimed at expanding product portfolios, particularly in highly specialized segments such as lockable gas springs and stainless steel variants optimized for sterile or harsh operating environments. Key market players are prioritizing digital transformation, leveraging predictive analytics and IoT integration within their manufacturing operations to optimize yield rates and minimize component failure, thereby addressing the crucial industry need for enhanced product reliability and longevity in mission-critical applications.

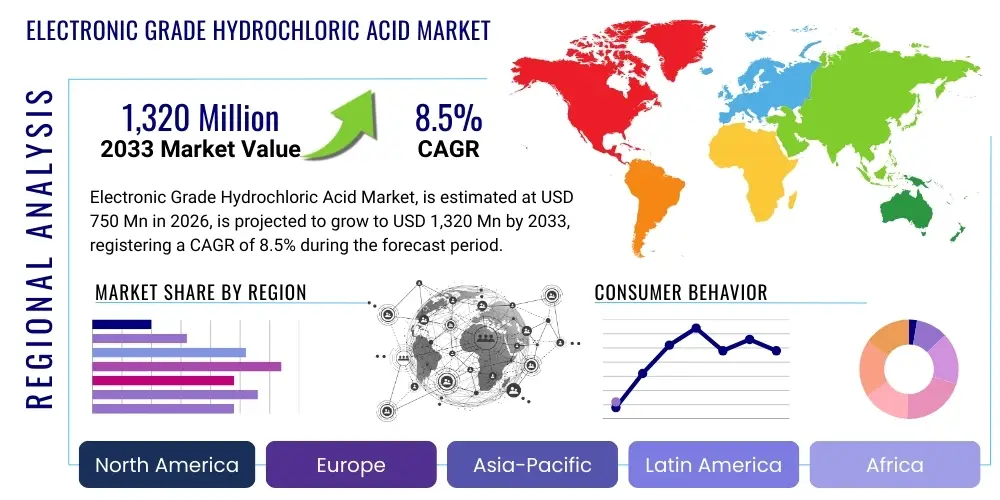

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by the rapid expansion of automotive manufacturing hubs, extensive infrastructure development projects, and the accelerating pace of industrial automation, particularly in China, India, and Southeast Asian nations. North America and Europe, while mature markets, continue to contribute significant revenue, primarily driven by replacement demand, strict safety standards necessitating high-quality components, and substantial investment in the medical device and aerospace sectors. European manufacturers maintain a competitive edge through expertise in customized, high-precision springs tailored for niche machinery applications, whereas North America exhibits strong demand tied to the robust commercial vehicle and heavy equipment industries.

Segment trends reveal that the compression gas spring type maintains the largest market share due to its ubiquitous application across lift assist functions, although the lockable gas spring segment is forecast to exhibit the highest CAGR, propelled by increasing adoption in medical equipment and adjustable ergonomic furniture requiring infinite positional holding capabilities. Application-wise, the automotive industry remains the dominant segment, benefiting from high-volume production cycles and increasing vehicle complexity. However, the medical and aerospace sectors are rapidly increasing their market contribution, characterized by high-value, low-volume requirements demanding extremely high levels of certification, material purity, and performance predictability, thus driving up Average Selling Prices (ASPs) in these specialized sub-markets.

AI Impact Analysis on Industrial Gas Spring Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Industrial Gas Spring Market primarily revolve around optimizing product design parameters, enhancing manufacturing efficiency through predictive maintenance, and integrating AI-driven feedback loops into complex machinery utilizing gas springs. Common user questions seek to understand how AI tools can simulate performance under diverse environmental stresses, how machine learning (ML) algorithms can predict the end-of-life for gas springs based on real-time usage data, and whether AI can facilitate the rapid customization and mass production of bespoke spring solutions. The analysis reveals that users anticipate AI will fundamentally shift the design phase, moving from empirical testing to predictive simulation, dramatically reducing time-to-market for specialized industrial components, while also improving the operational reliability of the equipment where these springs are installed by forecasting potential failures before they occur.

The application of AI is primarily concentrated in two strategic areas: advanced manufacturing and predictive product lifecycle management. In manufacturing, AI algorithms analyze sensor data from assembly lines to optimize gas filling pressures, welding integrity, and sealing processes, ensuring every unit meets precise specifications and reducing waste from flawed components. For predictive maintenance, ML models ingest data streams (load cycles, temperature, vibration) from installed gas springs in heavy machinery or specialized medical equipment. These models identify subtle deviations in performance characteristics that signal imminent failure of the seals or loss of pressure, allowing maintenance schedules to be optimized based on actual wear rather than arbitrary time intervals, thereby maximizing uptime and operational safety for end-users.

Furthermore, AI-driven topology optimization is transforming the design process. Generative design tools, powered by AI, can rapidly explore thousands of potential spring geometries, material combinations, and fluid dynamics setups based on specific user requirements (e.g., force output, stroke length, size constraints). This capability allows manufacturers to offer highly optimized, lightweight, and efficient gas springs that were previously impossible to design using traditional methods. This shift from standardized products to highly tailored, AI-engineered solutions is critical for maintaining competitiveness, especially in demanding sectors like aerospace and robotics where precision and weight reduction are paramount concerns.

- AI-enhanced Predictive Maintenance: ML algorithms analyze real-time usage data to forecast component failure, optimizing replacement cycles and minimizing unplanned downtime in critical machinery.

- Generative Design Optimization: AI tools accelerate the development of highly customized gas spring geometries and material compositions, reducing weight and improving operational efficiency.

- Automated Quality Control: AI vision systems monitor manufacturing lines for micro-defects in seals and welding, ensuring zero-defect production standards are met consistently.

- Supply Chain Forecasting: Machine learning models improve inventory management for raw materials (steel, nitrogen) and finished goods based on dynamic demand forecasting.

- Simulation and Testing: AI significantly reduces the need for extensive physical prototyping by accurately simulating spring performance under extreme load and temperature conditions.

DRO & Impact Forces Of Industrial Gas Spring Market

The Industrial Gas Spring Market is influenced by a powerful confluence of Driving forces (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and growth trajectory, referred to as Impact Forces. A key driver is the relentless focus on enhancing industrial safety and ergonomics across global regulatory frameworks, especially in developed economies. Regulations mandating controlled movement of heavy components in manufacturing, construction, and medical facilities necessitate the reliable dampening and assistance provided by gas springs. Concurrently, the increasing complexity and automation within machinery design, including CNC machines, robotics, and complex automotive assemblies, requires highly consistent, force-specific components for precise counterbalancing, propelling demand for customized, high-performance gas springs. This demand is further amplified by global urbanization trends and associated infrastructure spending, boosting sectors utilizing heavy-duty lifting equipment.

However, the market faces significant Restraints, primarily stemming from the inherent price sensitivity in high-volume applications like the automotive and furniture sectors, where cost pressure often favors cheaper, lower-quality alternatives or basic mechanical springs. The customization complexity associated with specialized industrial gas springs—requiring precise calculation of pressure, piston rod diameter, and sealing technology for unique load requirements—adds lead time and cost, potentially hindering adoption in projects with short turnaround times. Furthermore, maintenance issues related to seal degradation and potential nitrogen pressure leakage over extended operational periods remain a technical challenge that requires continuous material science investment, often leading end-users to seek out long-life, maintenance-free alternatives, though rarely achieving the same functional versatility.

Opportunities for market expansion are substantial, particularly through technological innovation and penetration into emerging high-growth industries. The transition towards electric vehicles (EVs) presents an opportunity for specialized gas springs in battery housing access and charging port mechanisms. Secondly, the growth of smart factories (Industry 4.0) opens avenues for integrating intelligent, sensor-enabled gas springs capable of transmitting performance data (load, cycles, temperature) for advanced predictive maintenance systems. Geographically, untapped potential lies in expanding sophisticated product lines into rapidly industrializing regions in Africa and parts of Latin America. Finally, increasing demand for medical equipment, driven by an aging global population and rising healthcare expenditures, requires highly reliable, sterile, stainless steel gas springs for operating tables and patient mobility devices, offering manufacturers higher margin opportunities.

Segmentation Analysis

The Industrial Gas Spring Market is intricately segmented based on product type, application, material, and end-user vertical, reflecting the diversity of functional requirements across industrial sectors. Analyzing these segments provides critical insights into market dynamics, identifying areas of rapid growth and technological specialization. The primary segmentation by type distinguishes between standard compression springs, which are the market mainstay used for basic lift assist; tension springs, utilized when pulling action is required; and the technologically advanced lockable springs, crucial for positional control. The complexity of manufacturing and the precision required vary significantly across these types, impacting pricing and competitive positioning. This segmentation highlights the shift toward functional specialization, moving beyond basic lift assistance to sophisticated motion control.

Application-based segmentation is crucial for understanding demand elasticity and regulatory compliance drivers. While the automotive industry commands the largest volume due to mass production requirements for doors, hoods, and seating, the fastest growth is observed in specialized sectors like medical equipment and aerospace, which demand higher quality, rigorous certification, and often unique material compositions (e.g., non-magnetic or corrosion-resistant stainless steel). Material segmentation, primarily standard steel versus stainless steel, dictates suitability for specific environments, with stainless steel dominating niche segments like food processing, marine, and medical where hygiene and corrosion resistance are non-negotiable prerequisites.

Geographical segmentation emphasizes regional manufacturing output and regulatory environments. APAC dominates in volume manufacturing, driven by automotive and general industrial machinery production. Europe excels in high-precision, customized springs for machinery and tool manufacturing, characterized by robust engineering standards. North America focuses heavily on heavy-duty applications in construction, agriculture, and defense. Overall, the increasing demand for customized solutions across all segments drives innovation in sealing technology, damping control, and force variability, pushing the market towards higher-performance, premium products capable of longer life cycles under harsh operating conditions.

- Product Type:

- Compression Gas Springs

- Tension Gas Springs (Traction Springs)

- Lockable Gas Springs (Rigid and Elastic variants)

- Damping/Non-Damping Gas Springs

- Application:

- Automotive (Hoods, Trunks, Tailgates, Seating)

- Aerospace and Defense (Access Panels, Storage, Hatch Mechanisms)

- Medical Equipment (Hospital Beds, Imaging Machines, Operating Tables)

- Industrial Machinery (Machine Guards, Enclosures, Control Panels)

- Furniture and Ergonomics (Office Chairs, Desks, Cabinetry)

- Construction and Agriculture Equipment (Heavy Vehicle Doors, Hatches)

- Material:

- Standard Steel

- Stainless Steel (304, 316 Grades)

- Force Range:

- Low Force (Below 200 N)

- Medium Force (200 N to 1000 N)

- High Force (Above 1000 N)

Value Chain Analysis For Industrial Gas Spring Market

The value chain for the Industrial Gas Spring Market begins with the upstream segment, primarily focused on the sourcing and processing of core raw materials. This includes high-grade steel and stainless steel alloys for the piston rods and cylinders, precision seals (such as NBR or Viton) crucial for maintaining gas pressure integrity, and high-purity nitrogen gas used as the primary compressed medium. Manufacturers must establish stable, reliable relationships with steel suppliers capable of delivering materials meeting stringent surface finish and dimensional tolerance requirements, as the performance and longevity of the gas spring are heavily reliant on the quality of these input materials. Price volatility in global steel markets directly impacts manufacturing costs and overall profitability, necessitating robust risk management strategies at the sourcing stage.

The core manufacturing and assembly stage involves high-precision machining, specialized welding techniques (often laser welding for hermetic sealing), and controlled gas charging processes. Quality control at this stage is paramount, focusing on leak detection, force calibration, and cycle testing to ensure components meet the specified force curves and durability requirements. This middle segment of the value chain is highly capital-intensive, requiring advanced automation and proprietary tooling. Downstream activities involve distribution, sales, and post-sales service. Distribution channels are bifurcated: direct sales channels cater to large Original Equipment Manufacturers (OEMs) in automotive and aerospace, involving long-term supply contracts and tailored logistics. Indirect distribution, leveraging specialized industrial distributors and retailers, serves the replacement market (MRO) and smaller machinery builders, offering localized inventory and technical support.

The efficiency of the distribution channel is critical, particularly for the aftermarket segment where rapid fulfillment of replacement parts is essential for minimizing customer downtime. Direct channels offer greater control over pricing and customer feedback, facilitating faster product improvement cycles based on OEM requirements. Conversely, indirect channels provide broader market penetration and reduced logistical overhead for the manufacturer. The value chain concludes with installation and maintenance support, where product longevity and reliability become the primary determinants of customer satisfaction and repeat business. Companies focusing on superior sealing technology and offering extended warranties often gain a competitive advantage by reducing the total cost of ownership for the end-user, thereby maximizing value delivered through the final stages of the chain.

Industrial Gas Spring Market Potential Customers

Potential customers for the Industrial Gas Spring Market are diverse, spanning multiple heavy and light industrial sectors, and can be categorized primarily as Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) end-users. OEMs represent the largest volume segment, integrating gas springs directly into their finished products. The most significant OEM customers reside in the automotive sector, including major car and truck manufacturers, requiring massive volumes of standardized compression springs for hoods, tailgates, and seating mechanisms. Other crucial OEM segments include producers of industrial machinery (CNC machines, packaging equipment), medical device manufacturers (hospital beds, operating tables), and manufacturers of specialized aerospace components and high-end ergonomic office furniture.

The decision-making units (DMUs) within OEM organizations often involve procurement departments, design engineers, and quality assurance teams, who prioritize parameters such as force precision, cycle life, material certifications, and the supplier's capacity for high-volume, just-in-time delivery. Customized solutions, particularly lockable springs for positional holding in high-end medical or furniture applications, command higher margins and require deep collaborative engineering between the gas spring supplier and the OEM design team. MRO customers, conversely, purchase gas springs for replacement purposes, typically through distributors, prioritizing immediate availability, competitive pricing, and compatibility with legacy equipment models. These customers are crucial for sustaining revenue in mature markets.

In addition to traditional industrial applications, emerging potential customer segments include manufacturers focusing on renewable energy infrastructure, such as access panels and damping systems for wind turbines and solar tracking equipment, demanding highly durable, corrosion-resistant springs capable of withstanding extreme outdoor conditions. Furthermore, the burgeoning logistics and warehouse automation sector, utilizing robotics and automated storage and retrieval systems (AS/RS), represents a fast-growing customer base that requires specialized, maintenance-free gas springs for repetitive, high-speed movement and counterbalancing in automated handling mechanisms. Addressing the distinct procurement cycles, technical specifications, and budgetary constraints of these varied customer groups is essential for effective market penetration and long-term sustainable growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.91 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stabilus, Suspa, Bansbach easylift, ACE Controls, Camloc Motion Control, KALLER, WGS, AVM Industries, Lantek, Special Springs, Enertrols, IGS, Piston Limited, Weforma, HAHN Gasfedern, VAPSINT, Alrose Products, Attwood Corporation, Guden, Service Springs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Gas Spring Market Key Technology Landscape

The technological landscape of the Industrial Gas Spring Market is defined by continuous innovation focused on improving product longevity, operational consistency, and specialized functionality. A critical area of development involves advanced sealing technology. Traditional elastomeric seals are increasingly being replaced or augmented by proprietary low-friction seals and specialized hydraulic fluid compositions that minimize wear and pressure loss, significantly extending the operational life cycle of the spring, which is paramount in maintenance-intensive industries. Manufacturers are investing heavily in materials science to develop piston rod coatings (e.g., nitride or ceramic treatments) that enhance corrosion resistance and surface hardness, making the springs suitable for harsh environments such as marine, chemical processing, and outdoor agricultural applications.

Furthermore, the shift towards highly specialized and complex applications has driven the need for sophisticated damping control mechanisms. Technology now allows for dynamically adjustable damping characteristics, enabling the gas spring to provide different levels of resistance and speed control during both compression and extension phases. This level of control is achieved through complex internal piston designs incorporating oil bypass valves and multi-stage damping structures. For lockable gas springs, precision mechanical and hydraulic locking mechanisms are being refined to ensure absolutely rigid positional holding, critical for patient positioning in medical devices or securing heavy tools in machining centers, necessitating extremely tight manufacturing tolerances and robust internal engineering to prevent creeping or unintentional movement under load.

The integration of Industry 4.0 principles is introducing 'smart' gas springs equipped with embedded micro-sensors (force, temperature, cycle count) and wireless communication capabilities (IoT). These technological additions allow the gas spring to function as a data source, feeding real-time performance metrics into centralized predictive maintenance platforms. This technological capability enables end-users to transition from reactive or scheduled maintenance to condition-based monitoring, optimizing asset utilization and safety. Simulation and computational fluid dynamics (CFD) software also plays a pivotal role, allowing engineers to accurately model the thermal and pressure dynamics inside the spring cylinder under various operating conditions before physical prototyping, significantly accelerating product development cycles and ensuring first-time design accuracy for highly customized industrial orders.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Drivers: APAC represents the largest and fastest-growing regional market, primarily driven by mass production capacity in the automotive and general manufacturing sectors, particularly in China, Japan, and South Korea. China's enormous appetite for automation and the establishment of new manufacturing facilities, coupled with India's expanding infrastructure and heavy machinery production, fuels high-volume demand for standard compression gas springs. The region's competitive landscape is characterized by a mix of established global players and rapidly expanding local manufacturers that focus on cost-competitive solutions. Growth is additionally bolstered by the rising demand for sophisticated consumer goods and electronics manufacturing requiring precision counterbalancing components.

- North America's Focus on High-Value and Heavy-Duty Applications: The North American market is characterized by a strong demand for high-force and heavy-duty gas springs, predominantly driven by the robust commercial vehicle, agricultural, construction, and defense industries. The region also maintains significant market share in specialized areas like aerospace and medical devices, which necessitate components meeting strict regulatory standards (e.g., FDA clearance for medical applications) and requiring high-grade materials like stainless steel. Market trends in North America emphasize reliability, customization capabilities, and compliance with high safety standards, often leading to a preference for premium-priced, high-performance European and domestic brands.

- Europe's Emphasis on Precision Engineering and Niche Specialization: Europe is a mature yet highly innovative market, serving as a global hub for specialized machinery and tool manufacturing. Countries like Germany, Italy, and Sweden drive demand for high-precision, lockable, and custom-designed gas springs critical for complex industrial applications, including robotics and high-end automotive production (luxury and performance vehicles). The European market is highly regulated, particularly concerning environmental and safety standards, which incentivizes manufacturers to adopt advanced material recycling practices and produce components with superior durability and minimum leakage rates, supporting higher ASPs and continuous investment in R&D focused on proprietary damping technologies.

- Latin America, Middle East, and Africa (LAMEA) Emerging Demand: LAMEA represents a developing market, exhibiting patchy but significant growth tied to specific national investments in oil & gas, mining, and basic infrastructure projects. In the Middle East, substantial infrastructure development, coupled with investments in local automotive assembly plants, drives demand. Africa's market potential is tied to agricultural machinery and local manufacturing expansion initiatives. These regions primarily focus on durability and cost-effectiveness, relying heavily on imports from APAC and Europe, though local assembly and distribution partnerships are gradually strengthening to meet localized MRO and low-volume OEM requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Gas Spring Market.- Stabilus

- Suspa

- Bansbach easylift

- ACE Controls

- Camloc Motion Control

- KALLER

- WGS (Weiguang Spring)

- AVM Industries

- Lantek

- Special Springs

- Enertrols

- Industrial Gas Spring, Inc. (IGS)

- Piston Limited

- Weforma

- HAHN Gasfedern

- VAPSINT

- Alrose Products

- Attwood Corporation

- Guden

- Service Springs

Frequently Asked Questions

Analyze common user questions about the Industrial Gas Spring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between standard compression gas springs and lockable gas springs?

Standard compression gas springs provide force assistance and controlled damping during motion but cannot hold a position rigidly. Lockable gas springs, conversely, incorporate a sophisticated internal valve system that, when activated, hydraulically locks the spring at any desired position throughout its stroke, offering rigid or elastic positional holding capabilities crucial for applications like adjustable medical tables and ergonomic furniture.

How does the rising adoption of electric vehicles (EVs) impact the demand for industrial gas springs?

The transition to EVs positively impacts demand, requiring specialized gas springs for heavier components like battery housing access panels and charging port mechanisms. EVs often have different weight distributions and structural requirements compared to traditional Internal Combustion Engine (ICE) vehicles, necessitating unique, precisely calibrated gas spring solutions that can handle increased loads and stringent safety criteria.

What are the most critical factors determining the lifespan of an industrial gas spring?

The lifespan is primarily determined by the quality of the sealing technology used to maintain nitrogen pressure, the material composition and surface finish of the piston rod (which prevents corrosion and wear), and the operational environment (temperature, exposure to contaminants, and frequency of load cycling). High-quality seals and corrosion-resistant coatings are essential for maximizing product durability.

Which regional market holds the highest growth potential for industrial gas spring manufacturers?

The Asia Pacific (APAC) region is projected to hold the highest growth potential. This growth is driven by massive investments in automotive manufacturing, increasing rates of industrial automation adoption, and large-scale infrastructure projects across countries like China, India, and Southeast Asia, fueling high-volume demand across all segments.

How is Industry 4.0 influencing the technological development of gas springs?

Industry 4.0 is driving the development of 'smart' gas springs integrated with sensors for monitoring key performance indicators (force, temperature, cycles). This integration facilitates predictive maintenance, allowing end-users to anticipate component failure and optimize replacement schedules, enhancing overall operational efficiency and safety in automated industrial settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager