Industrial Grade Aqua Ammonia Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433993 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Grade Aqua Ammonia Market Size

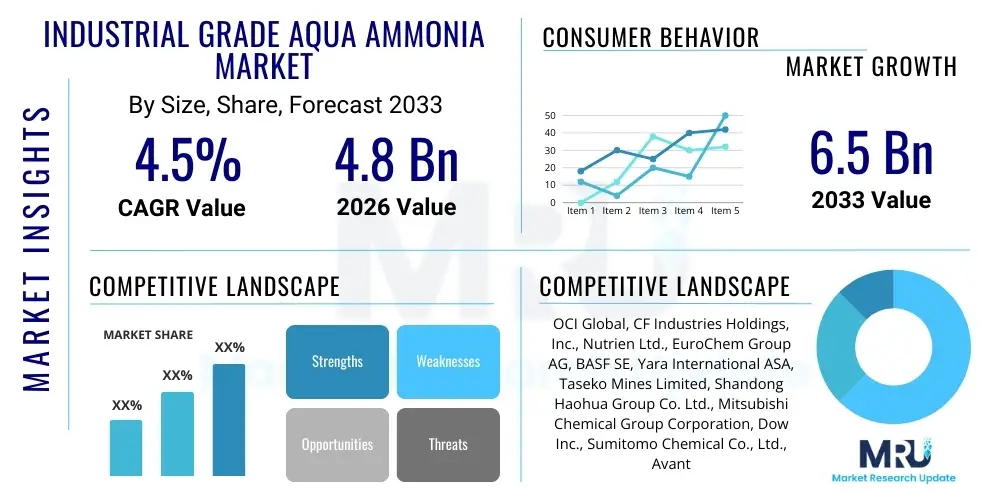

The Industrial Grade Aqua Ammonia Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by the increasing global demand for nitrogenous fertilizers, especially in developing economies focusing on agricultural yield enhancement, coupled with stringent environmental regulations promoting Selective Catalytic Reduction (SCR) and Selective Non-Catalytic Reduction (SNCR) processes for NOx emission control in industrial and power generation sectors.

The market valuation reflects the essential role of aqua ammonia (ammonium hydroxide solution) across diversified industrial applications, including water treatment, specialized chemical manufacturing, and as a buffering agent. While the market faces volatility related to upstream ammonia pricing and energy costs associated with production, the irreplaceable utility of industrial-grade solutions in processes requiring precise pH control and nitrogen sourcing maintains a robust demand trajectory. Future growth is expected to be catalyzed by innovations in handling and transportation logistics, aiming to reduce operational risks and broaden accessibility in remote industrial hubs across Asia Pacific and Latin America.

Industrial Grade Aqua Ammonia Market introduction

Industrial Grade Aqua Ammonia, chemically known as ammonium hydroxide (NH4OH), is an aqueous solution of ammonia gas dissolved in deionized water, typically supplied in concentrations ranging from 10% to 35%. It is a versatile commodity chemical characterized by its alkaline nature, making it a critical reagent in numerous industrial processes where a stable source of nitrogen or a reliable neutralizing agent is required. The product is fundamentally distinct from anhydrous ammonia due to its diluted, safer-to-handle liquid state, which makes it preferable for applications demanding lower concentration reactivity and enhanced safety protocols, particularly in densely populated industrial areas or smaller-scale chemical operations.

Major applications of industrial grade aqua ammonia span environmental protection, agriculture, chemical synthesis, and electronics manufacturing. In the environmental sector, it is extensively used as a critical reducing agent for removing nitrogen oxides (NOx) from flue gases generated by coal-fired power plants, cement production, and large marine vessels, thus complying with increasingly strict air quality standards. Agriculturally, it serves as a foundational component in the production of complex fertilizers, enhancing soil nitrogen content necessary for crop development. Furthermore, its application in water treatment ensures effective pH balance adjustment and heavy metal precipitation in municipal and industrial effluent streams, contributing significantly to global sanitation and resource management efforts.

The primary driving factors sustaining the market's growth momentum include the persistent need for effective air pollution control, mandatory global shifts toward cleaner energy practices, and the continuous expansion of the global population necessitating enhanced agricultural output. The inherent benefits of using aqua ammonia, such as lower storage pressure requirements compared to anhydrous ammonia, reduced hazard profiles, and simplified transportation logistics, bolster its adoption over alternative nitrogen sources. However, market dynamics are also influenced by evolving regulatory landscapes concerning hazardous chemical transport and storage, pushing manufacturers to invest continuously in advanced storage solutions and supply chain integrity protocols to ensure safe and efficient delivery to end-users.

Industrial Grade Aqua Ammonia Market Executive Summary

The Industrial Grade Aqua Ammonia Market demonstrates resilient growth, underpinned by fundamental demand drivers in environmental compliance and agricultural productivity. Key business trends indicate a strong focus on optimizing the supply chain to minimize volatility associated with raw material (ammonia) procurement and energy-intensive manufacturing processes. Manufacturers are increasingly adopting modular production facilities closer to high-demand clusters, particularly in Southeast Asia and North America, to mitigate escalating logistics costs and ensure just-in-time delivery for sensitive applications like semiconductor cleaning and pharmaceutical synthesis. Strategic partnerships focusing on vertical integration—from feedstock sourcing to specialized concentration formulation—are defining the competitive landscape, prioritizing reliability and product purity levels required for high-tech industries.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, characterized by rapid industrialization, extensive fertilizer consumption, and growing investments in environmental infrastructure, particularly in China and India. Europe and North America, while relatively mature, exhibit robust growth driven by stringent NOx emission control regulations mandated by bodies such as the EPA and the European Environment Agency, thereby sustaining high demand in the power generation and large-scale manufacturing sectors for SCR/SNCR reductants. Conversely, the market in Latin America and the Middle East & Africa (MEA) is experiencing accelerated adoption, fueled by expansions in mining operations, chemical processing facilities, and investments in public utility water treatment plants, though political and economic instability in certain MEA nations poses minor localized restraints.

Segment trends reveal that the Fertilizer application segment remains the largest volume consumer, although the NOx Reduction segment is projected to register the fastest CAGR due to ongoing global commitments to climate change mitigation and air quality improvement. In terms of concentration, the 20% to 30% segment dominates, providing the optimal balance between handling safety and reactive potency for most industrial processes. Furthermore, within the chemical segment, demand for ultra-high purity aqua ammonia is burgeoning, driven specifically by the electronics sector's stringent requirements for cleaning agents in the fabrication of integrated circuits and sophisticated electronic components, necessitating significant technological investment in purification processes by key market players.

AI Impact Analysis on Industrial Grade Aqua Ammonia Market

Common user questions regarding AI's impact on the Industrial Grade Aqua Ammonia Market revolve around optimization of production efficiency, predictive maintenance for sensitive manufacturing equipment, and dynamic supply chain management, particularly concerning the logistics of hazardous chemicals. Users are keen to understand how AI-driven analytics can mitigate risks associated with fluctuating upstream ammonia prices and optimize inventory levels to prevent supply shortages or overstocking of a perishable solution. The core expectation is that AI will enhance operational safety, improve yield rates in synthesis processes (especially high-purity grades), and provide superior predictive modeling for regulatory compliance and environmental monitoring, ensuring sustainable and cost-effective market operations amidst global logistical complexities.

- AI-Powered Production Optimization: Implementation of machine learning algorithms to fine-tune reaction parameters (temperature, pressure, flow rates) in ammonia absorption towers, leading to maximized yield, reduced energy consumption per unit produced, and consistent product concentration quality.

- Predictive Maintenance Protocols: Utilization of sensor data analyzed by AI models to predict potential equipment failures in compressors, pumps, and storage tanks, particularly those handling corrosive or volatile materials, thereby minimizing unplanned downtime and enhancing safety standards in production facilities.

- Enhanced Supply Chain Visibility: Application of advanced analytics for real-time tracking of specialized transportation fleets, optimizing routing to reduce transit times and carbon footprint, and improving inventory management across geographically dispersed distribution centers handling regulated materials.

- Demand Forecasting Accuracy: AI models processing historical consumption patterns, seasonal agricultural demands, and regulatory timelines (e.g., new environmental deadlines) to generate highly accurate demand forecasts, reducing overproduction and minimizing storage risks associated with hazardous liquids.

- Quality Control Automation: Deployment of AI-vision systems and automated spectrophotometers for continuous, non-subjective quality assurance checks on concentration and purity levels, critical for high-specification applications like semiconductor manufacturing.

- Safety and Risk Management: Use of AI to simulate emergency scenarios, train personnel through virtual reality interfaces, and continuously monitor environmental parameters (leak detection, air quality) near production and storage sites, significantly reducing human error and compliance breaches.

- Market Trend and Pricing Prediction: Leveraging natural language processing and quantitative models to analyze global energy markets, feedstock availability, and geopolitical factors, providing robust predictive insights into future pricing volatility for both manufacturers and large-scale buyers.

DRO & Impact Forces Of Industrial Grade Aqua Ammonia Market

The Industrial Grade Aqua Ammonia Market is primarily driven by rigorous environmental regulations mandating NOx emission control (Driver), sustained global demand for nitrogenous fertilizers critical for food security (Driver), and the cost-effectiveness of aqua ammonia compared to high-pressure anhydrous alternatives for specific applications (Opportunity). However, the market faces significant restraints, chiefly stemming from the high volatility and energy intensity inherent in the upstream production of ammonia, fluctuating natural gas prices being a core cost component (Restraint). Furthermore, the classification of aqua ammonia as a corrosive, hazardous substance necessitates complex, expensive handling, storage, and transportation infrastructure, imposing substantial operational restraints on smaller market participants and limiting geographical market penetration (Restraint).

Opportunities for market expansion are evident in the rapidly growing electronics and semiconductor industry, which demands extremely high-purity ammonium hydroxide for cleaning and etching processes, representing a high-value niche market. Additionally, innovation in closed-loop systems and recycling technologies for industrial wastewater treatment presents a long-term growth avenue, as aqua ammonia is increasingly preferred for neutralizing acidic wastes. The geopolitical focus on hydrogen as a clean fuel also indirectly impacts this market; as ammonia is a primary carrier for hydrogen, future shifts in energy infrastructure might necessitate scaled-up ammonia production, stabilizing and potentially lowering raw material costs for aqua ammonia manufacturers, creating a synergistic opportunity.

Impact forces currently shaping the market trajectory include the accelerating global push for decarbonization, which increases the immediate demand for NOx reduction solutions in fossil fuel industries, directly boosting aqua ammonia consumption. Conversely, the continuous escalation of global energy prices, exacerbated by international conflicts and supply chain disruptions, exerts persistent cost pressure on manufacturers, which is then transferred downstream. Technological forces, specifically the development of safer, solid-state ammonia storage alternatives, present a long-term threat to the liquid market, but currently, the established infrastructure and proven efficacy of industrial-grade aqua ammonia ensure its continued dominance in environmental and bulk chemical applications.

Segmentation Analysis

The Industrial Grade Aqua Ammonia Market is comprehensively segmented based on its application, concentration level, and the purity grade required by various end-use industries. This structure allows for granular analysis of demand drivers, pricing sensitivities, and technological requirements across different vertical markets. The complexity of segmentation is rooted in the distinct physical and chemical properties required for specific end-uses; for example, fertilizer production utilizes lower concentration, standard grade solutions, whereas the stringent microelectronics sector requires highly dilute, ultra-high purity grades with minimal metallic ion contamination. Understanding these segments is crucial for manufacturers to tailor production processes and distribution channels effectively.

- By Application:

- Fertilizer Production

- NOx Reduction (SCR/SNCR)

- Water Treatment

- Pharmaceuticals

- Chemical Synthesis

- Pulp and Paper

- Mining and Metallurgy

- Electronics and Semiconductors

- By Concentration:

- 10% to 20%

- 20% to 30%

- Above 30% (High Strength Solutions)

- By Purity Grade:

- Standard Industrial Grade

- Technical Grade

- High Purity Grade (Electronic/Reagent Grade)

- By End-Use Industry:

- Agriculture

- Power Generation

- Chemicals and Petrochemicals

- Water and Wastewater Utilities

- Manufacturing

Value Chain Analysis For Industrial Grade Aqua Ammonia Market

The value chain for industrial grade aqua ammonia begins with the highly capital-intensive upstream segment, dominated by the synthesis of anhydrous ammonia (NH3), primarily utilizing natural gas as a feedstock via the Haber-Bosch process. Key upstream activities involve securing reliable, cost-effective sources of natural gas, steam methane reforming, and subsequent ammonia synthesis. The efficiency and cost structure of upstream operations directly dictate the final price and profitability of aqua ammonia, making manufacturers highly susceptible to volatile natural gas markets and energy costs. Reliability in this stage is paramount, as any disruption in anhydrous ammonia supply immediately impacts downstream production capacity.

The midstream process involves the conversion of anhydrous ammonia into aqueous solutions through absorption in deionized water, followed by purification, filtration, and stabilization processes to meet industrial or ultra-high purity specifications. This stage requires specialized equipment to handle the exothermic reaction and ensure precise concentration control. Distribution channels form the critical link to end-users. Due to the hazardous and corrosive nature of the product, distribution relies heavily on specialized logistics—dedicated tank trucks, rail cars, and barges, often utilizing temperature-controlled, corrosion-resistant stainless steel or lined tanks. Direct distribution is common for large-volume contracts (e.g., power plants, fertilizer units), ensuring immediate delivery and specialized handling consultation.

Indirect distribution often involves regional chemical distributors who purchase in bulk and repackage or deliver smaller, specific volumes to diversified end-users, such as small chemical laboratories, specialized water treatment facilities, or local manufacturing sites. The downstream segment encompasses the consumption by various end-use industries. Key players focus on providing not just the product but comprehensive service, including application engineering support, safety training for handling personnel, and management of spent or residual solutions. The effectiveness of the value chain is measured by the ability to maintain product integrity (concentration and purity) while minimizing the high risks and costs associated with transportation and storage across the supply network.

Industrial Grade Aqua Ammonia Market Potential Customers

The primary potential customers and end-users of Industrial Grade Aqua Ammonia are large-scale industries requiring a bulk, reliable source of nitrogen or a pH control agent, driven overwhelmingly by regulatory compliance and agricultural necessities. The largest volume buyers include major fertilizer manufacturers, utilizing aqua ammonia as a primary precursor for urea, ammonium nitrate, and diammonium phosphate (DAP). These customers operate continuously and require long-term, high-volume supply contracts, making logistical efficiency and price stability critical components of their procurement strategy.

Another major customer cluster resides in the power generation and heavy manufacturing sectors (cement, glass, metal smelting) that operate large thermal combustion units. These facilities are compelled by environmental laws to reduce nitrogen oxide emissions and utilize aqua ammonia extensively in SCR and SNCR systems. These customers seek customized concentrations and guaranteed purity for injection processes to maximize NOx reduction efficiency without generating harmful byproducts. Their procurement decisions are heavily influenced by regulatory audit requirements and the total cost of ownership, including storage and injection system maintenance.

Emerging, high-value potential customers are found in the specialized chemical and electronics sectors. Semiconductor fabricators, for instance, are high-demand users of ultra-pure ammonium hydroxide (often referred to as Electronic Grade Ammonium Hydroxide or EHA) for critical cleaning and etching solutions during wafer manufacturing. These buyers are extremely sensitive to metallic impurity levels, demanding stringent quality control and certified purity documentation from their suppliers, driving a premium pricing structure for this specific market segment. Pharmaceutical manufacturers and large-scale municipal water treatment facilities also represent steady, long-term clientele requiring consistent supply for use as pH adjusters, neutralizers, and raw material synthesis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OCI Global, CF Industries Holdings, Inc., Nutrien Ltd., EuroChem Group AG, BASF SE, Yara International ASA, Taseko Mines Limited, Shandong Haohua Group Co. Ltd., Mitsubishi Chemical Group Corporation, Dow Inc., Sumitomo Chemical Co., Ltd., Avantor, Inc., Merck KGaA, Honeywell International Inc., Air Products and Chemicals, Inc., Linde plc, Praxair Technology, Inc., Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC), Rashtriya Chemicals & Fertilizers Ltd. (RCF), Coromandel International Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Grade Aqua Ammonia Market Key Technology Landscape

The technology landscape surrounding the Industrial Grade Aqua Ammonia market is primarily focused on enhancing safety, optimizing the purification process, and improving logistical solutions. The core production technology relies on highly efficient absorption towers to dissolve high-purity ammonia gas into deionized water. Recent technological advancements center on developing modular and containerized production units, which allow for on-site or near-site production for major consumers like power plants, mitigating the high risks and costs associated with long-distance transportation of bulk hazardous liquids. These modular systems often incorporate automated monitoring and dosing controls, minimizing human intervention and ensuring precise concentration integrity under varying operational conditions.

For the specialized high-purity grades required by the microelectronics industry, the technological focus is on advanced multi-stage purification techniques, including ultrafiltration, reverse osmosis, and sophisticated ion-exchange resin systems. These technologies are crucial for removing trace metal ions and particulate matter down to parts per trillion (ppt) levels, which are critical contaminants in semiconductor fabrication. Manufacturers invest heavily in specialized cleanroom environments and chemically resistant materials for storage and packaging (e.g., fluoropolymer-lined containers) to prevent contamination during the final handling stage, guaranteeing the requisite Electronic Grade purity for sensitive etching and cleaning applications.

Furthermore, technology related to safety and environmental control is paramount. This includes implementing advanced sensor technology for continuous leak detection of ammonia vapor, sophisticated ventilation and scrubbing systems, and the utilization of inert gas blanketing in storage tanks to prevent atmospheric contamination and decomposition. Logistically, the introduction of telematics and IoT devices into transportation infrastructure allows for real-time tracking of parameters like temperature and pressure within transport vessels, enhancing regulatory compliance and dramatically reducing the incidence of transit-related incidents involving this corrosive chemical solution, thus improving overall supply chain reliability across all grades of industrial aqua ammonia.

Regional Highlights

Regional dynamics play a crucial role in shaping the Industrial Grade Aqua Ammonia Market, influenced by varying regulatory stringency, agricultural scale, and industrial maturity.

- Asia Pacific (APAC): Dominates the global market volume due to its vast agricultural sector, particularly in India and China, driving massive demand for nitrogenous fertilizers. Rapid industrialization and expanding power generation capacity also fuel the market, specifically for NOx reduction applications. Furthermore, the region houses the largest global hub for semiconductor manufacturing, creating peak demand for ultra-high purity grades. Investments in environmental protection infrastructure across Southeast Asia are expected to ensure the highest growth rate during the forecast period.

- North America: Characterized by mature regulatory environments and strong adoption in the chemicals and power generation sectors. Stricter EPA regulations concerning air quality and water treatment necessitate widespread use of aqua ammonia for pollution control. The market benefits from highly established logistics networks and a significant presence of key players focused on high-specification, reliable supply chains for major industrial clusters. Demand is highly inelastic in the environmental application segment.

- Europe: Growth is driven primarily by stringent EU environmental directives, especially the Industrial Emissions Directive (IED), pushing heavy industries toward highly efficient NOx reduction technologies. While fertilizer use is substantial, the mature agricultural sector sees moderate growth. The focus here is increasingly on sustainable sourcing and developing closed-loop systems for handling and recycling ammonia-containing waste streams, particularly in Germany and the Benelux countries.

- Latin America (LAMEA): Exhibits strong growth potential linked to expanding mining activities (where aqua ammonia is used in metallurgy and extraction processes) and the modernization of its agricultural sector, especially in Brazil and Argentina. Market growth is sensitive to commodity price fluctuations and relies heavily on imported feedstock or localized, smaller-scale production facilities. Investment in water infrastructure projects is a key secondary driver.

- Middle East and Africa (MEA): This region is critical due to its massive, low-cost access to natural gas, making it a major hub for upstream ammonia production. Demand for aqua ammonia is rising in the region, particularly in Saudi Arabia and the UAE, driven by large-scale petrochemical developments and municipal water treatment plants. However, the African market remains nascent, limited by underdeveloped logistical infrastructure and fragmented industrial bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Grade Aqua Ammonia Market.- OCI Global

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- EuroChem Group AG

- BASF SE

- Yara International ASA

- Taseko Mines Limited

- Shandong Haohua Group Co. Ltd.

- Mitsubishi Chemical Group Corporation

- Dow Inc.

- Sumitomo Chemical Co., Ltd.

- Avantor, Inc.

- Merck KGaA

- Honeywell International Inc.

- Air Products and Chemicals, Inc.

- Linde plc

- Praxair Technology, Inc.

- Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC)

- Rashtriya Chemicals & Fertilizers Ltd. (RCF)

- Coromandel International Limited

Frequently Asked Questions

Analyze common user questions about the Industrial Grade Aqua Ammonia market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Industrial Grade Aqua Ammonia?

The primary driver is the rigorous enforcement of global environmental regulations, particularly those mandating the reduction of Nitrogen Oxide (NOx) emissions from industrial sources and power plants using Selective Catalytic Reduction (SCR) and Selective Non-Catalytic Reduction (SNCR) systems, where aqua ammonia acts as the essential reductant agent.

How does the electronics industry utilize high-purity aqua ammonia?

The electronics and semiconductor industry uses ultra-high purity (Electronic Grade) ammonium hydroxide solution for critical cleaning, etching, and development processes in the fabrication of integrated circuits and silicon wafers, where the absence of metallic impurities is essential for component functionality.

What are the main risks associated with the production and transportation of aqua ammonia?

The main risks include volatility in raw material (anhydrous ammonia) pricing, the energy-intensive nature of production, and logistical challenges due to the chemical's classification as a corrosive and hazardous material, requiring specialized, expensive, and regulated transportation and storage infrastructure.

Which concentration segment holds the largest share of the industrial market?

The 20% to 30% concentration segment holds the largest market share. This range offers an optimal balance between chemical reactivity required for most industrial applications (such as NOx reduction and neutralization) and relative safety/ease of handling and storage compared to higher-strength solutions.

How is the Industrial Grade Aqua Ammonia market responding to supply chain disruptions?

Market participants are responding by focusing on geographical localization of production (modular facilities near demand centers), enhanced integration within the upstream ammonia value chain, and deploying AI-driven predictive logistics models to maintain inventory stability and ensure consistent supply amidst global transportation complexities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager