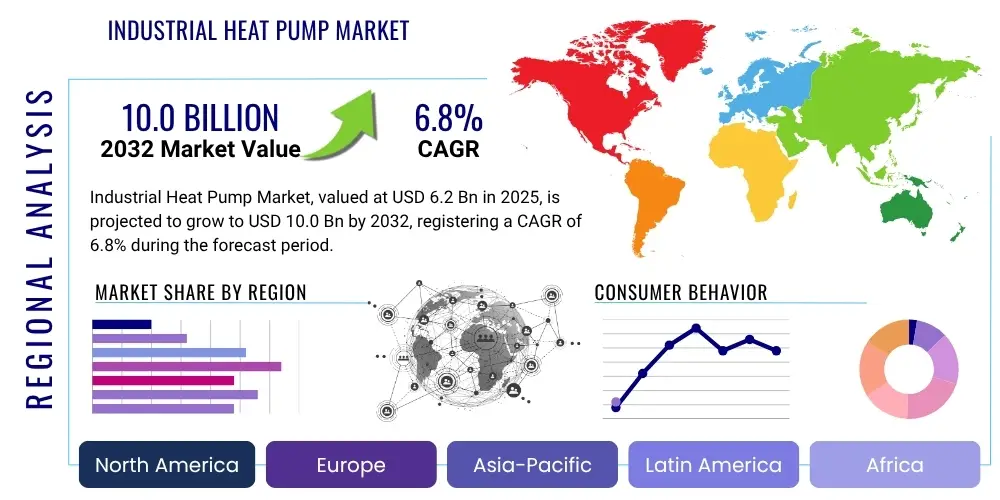

Industrial Heat Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436054 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Industrial Heat Pump Market Size

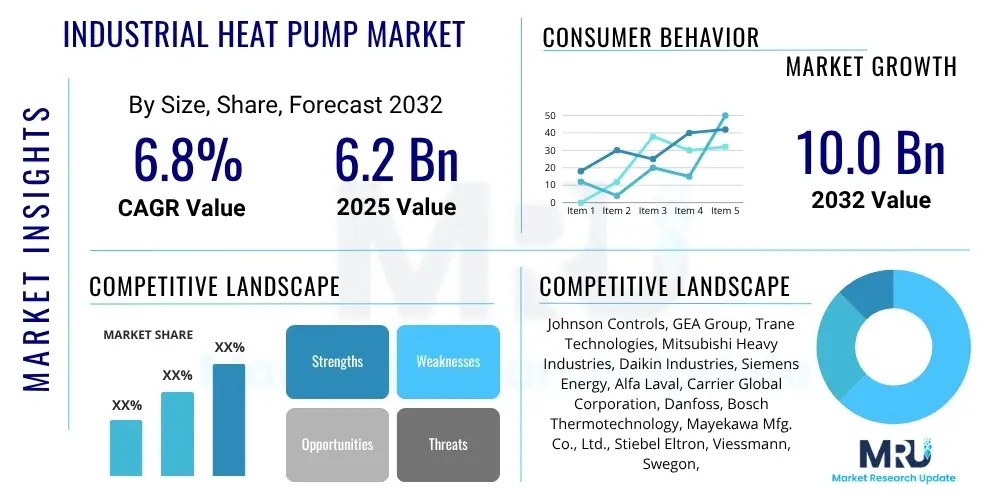

The Industrial Heat Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

The substantial growth projected for the industrial heat pump sector is primarily driven by global legislative mandates aimed at reducing carbon emissions and achieving net-zero industrial operations. Industries, particularly those reliant on high-temperature processes like chemicals, pulp & paper, and heavy manufacturing, are increasingly facing pressure from regulatory bodies and investors to transition away from fossil-fuel-intensive heating sources such as natural gas boilers. Industrial heat pumps offer a compelling solution by utilizing electricity and advanced thermodynamics to efficiently upgrade waste heat streams, thereby significantly improving energy efficiency and lowering operational greenhouse gas output. This shift is crucial for companies operating within stringent carbon pricing mechanisms or seeking competitive advantage through sustainable practices.

Furthermore, technological advancements, particularly in high-temperature heat pump designs utilizing natural refrigerants (like CO2 and ammonia) and achieving delivery temperatures exceeding 150°C, are broadening the applicability of these systems across a wider range of industrial processes. Historically, the temperature ceiling of heat pumps limited their adoption; however, modern, robust systems are closing this gap, making them viable replacements for traditional thermal energy sources even in processes requiring moderate to high-grade heat. Government subsidies, tax credits, and financial incentives in major industrialized economies (especially the EU and North America) further accelerate the capital expenditure required for adopting this energy-efficient technology, ensuring a sustained positive trajectory for market size expansion.

Industrial Heat Pump Market introduction

The Industrial Heat Pump Market encompasses specialized thermodynamic systems designed to extract thermal energy from a lower-temperature source (such as ambient air, water bodies, or industrial waste heat) and transfer it to a higher-temperature heat sink for use in industrial processes. These systems typically employ a refrigerant cycle, utilizing compression or absorption mechanisms, to upgrade the heat quality. Major applications span process heating, steam generation, drying, evaporation, and large-scale space heating, especially within sectors like Food and Beverage, Pharmaceuticals, Chemicals, and District Heating networks. The primary benefit is their exceptional energy efficiency, measured by the Coefficient of Performance (COP), which often allows them to deliver multiple units of heat energy for every unit of electrical energy consumed, contrasting sharply with resistance heating or combustion processes.

The increasing global focus on energy security, coupled with volatile fossil fuel prices, acts as a strong driving factor for the adoption of industrial heat pumps. They represent a key enabler for industrial electrification, offering a pathway for manufacturing plants to reduce their reliance on imported or centralized gas supplies. The continuous refinement of compressor technology, expansion valve control, and heat exchanger materials is enabling higher system reliability and expanded operational envelopes. Moreover, the integration of heat pumps into complex industrial energy systems—often alongside renewable electricity sources—positions them as foundational elements for smart, low-carbon industrial parks and facilities seeking long-term operational cost reduction through energy recovery.

Industrial Heat Pump Market Executive Summary

The Industrial Heat Pump Market is experiencing robust acceleration, fueled by pivotal business trends centered around sustainability and operational resilience. Businesses are prioritizing decarbonization as a core strategy, leading to significant investment in efficient thermal energy solutions. Key trends include the shift towards utilizing high-efficiency natural refrigerants (R744, R717), the development of hybrid systems that integrate heat pumps with existing boiler infrastructure, and the increasing focus on customized heat recovery loops tailored to specific industrial processes. This technological diversification mitigates implementation risks and maximizes return on investment, making heat pumps more appealing despite high initial capital costs.

Regionally, Europe dominates the market, largely driven by the ambitious goals outlined in the European Green Deal and the REPowerEU plan, which heavily incentivize the transition away from natural gas. Germany, the Netherlands, and the Nordic countries are leaders in industrial deployment and pioneering large-scale district heating integration using centralized heat pumps. Asia Pacific (APAC) is projected to exhibit the fastest growth, particularly in economies like China and Japan, where heavy industrial sectors are mandated to improve energy intensity. North America is characterized by robust policy support, such as the US Inflation Reduction Act (IRA), which provides substantial tax credits for clean energy technology adoption in manufacturing, stimulating demand across various industrial end-users.

Segment-wise, the Vapor Compression segment retains market leadership due to its proven reliability and adaptability across a range of temperature demands. However, the Absorption Heat Pump segment is gaining traction, particularly in scenarios where cheap, low-grade waste heat is abundant, allowing it to operate efficiently without drawing significant grid electricity. The High Temperature segment (delivering above 100°C) is anticipated to record the highest CAGR, reflecting the success of research and development in addressing the demanding thermal requirements of the chemicals and pulp & paper industries. End-user analysis reveals that the Food & Beverage and Chemicals sectors remain the most significant adopters, driven by large, continuous demand for sterilization, drying, and process fluid heating.

AI Impact Analysis on Industrial Heat Pump Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the operational efficiency and predictive maintenance of complex industrial heat pump systems, questioning whether AI integration justifies the additional technological overhead. Key concerns revolve around the practical application of machine learning for maximizing the Coefficient of Performance (COP) under fluctuating loads, managing real-time refrigerant charging, and anticipating component failure in high-pressure environments. Users expect AI to transcend simple data logging, providing true prescriptive analytics that integrate seamlessly with broader plant management systems, ultimately ensuring the heat pump operates optimally within the constraints of grid stability and process demand variability.

AI's role in the Industrial Heat Pump market is transformative, focusing primarily on achieving unparalleled operational precision and longevity. AI algorithms process vast amounts of sensor data—including temperature, pressure, flow rates, and vibration analysis—to identify non-linear relationships that human operators might miss. This capability allows for dynamic control of system parameters, ensuring the heat pump operates at its highest potential COP across diverse ambient and load conditions, minimizing electricity consumption, and stabilizing process temperatures. Furthermore, AI-driven digital twins are increasingly used to simulate potential faults and optimize complex heat pump networks, particularly in large installations integrated with district heating or multi-stage industrial processes.

The application extends significantly into predictive maintenance, where machine learning models analyze operational deviations—such as minor changes in compressor vibration signatures or slight refrigerant leaks—long before they escalate into critical failures. This proactive approach dramatically reduces unplanned downtime, which is critical in continuous industrial operations, and lowers lifetime maintenance costs. By integrating AI into Energy Management Systems (EMS), industrial heat pumps can also be optimized for participation in demand-response programs, strategically shifting energy consumption patterns to periods of lower grid prices or higher renewable availability, thereby enhancing both economic feasibility and sustainability metrics.

- Enhanced system Coefficient of Performance (COP) through real-time dynamic parameter adjustment.

- Predictive maintenance scheduling minimizing unplanned downtime and extending component lifespan.

- Optimization of complex heat pump cascade and hybrid systems via machine learning.

- AI-driven anomaly detection for early identification of refrigerant leaks or compressor wear.

- Integration with Smart Grid and Demand Response programs for strategic energy consumption timing.

- Automated fault diagnosis and root cause analysis, reducing troubleshooting time for plant engineers.

DRO & Impact Forces Of Industrial Heat Pump Market

The market is significantly influenced by a powerful combination of decarbonization drivers and regulatory pressures, counterbalanced by persistent investment barriers and technological limitations in extreme temperature applications. The primary drivers include stringent governmental mandates for net-zero emissions, rising costs and volatility of fossil fuels (natural gas and oil), and generous financial incentives (subsidies, tax credits) designed to accelerate industrial electrification and waste heat recovery. Restraints often center on the substantial upfront capital expenditure required for high-capacity installations, the necessary infrastructure modifications in existing plants, and inherent performance constraints when systems must deliver extremely high process temperatures (above 200°C) with natural refrigerants.

Opportunities are abundant, particularly in exploiting previously untapped low-grade and moderate-grade industrial waste heat streams, offering industries a dual benefit: cost-effective heating and reduced cooling load disposal costs. The growing deployment of industrial-scale heat pumps in centralized district heating and cooling networks presents a massive opportunity for urban energy transformation. Furthermore, advancements in compressor and heat exchanger technology, pushing the boundaries of temperature output and material compatibility, are steadily eroding the previous technical restraints. The overarching impact forces include intense competitive pricing among major manufacturers, shifting regulatory landscapes favoring renewables, and continuous innovation in modular design to simplify integration and scalability across diverse industrial sites.

Segmentation Analysis

The Industrial Heat Pump Market is segmented primarily by the type of technology used, the temperature output achieved, the capacity rating, and the end-user industry. Analyzing these segments provides critical insights into market penetration and growth trajectories. The technological segmentation between Vapor Compression and Absorption heat pumps dictates their ideal application; compression models are favored for electrical efficiency and moderate temperatures, while absorption models excel where cheap low-grade heat is plentiful. The segmentation by temperature highlights the rapid growth in the High-Temperature category (above 100°C), which is essential for unlocking high-value industrial processes previously dominated by combustion technologies.

Segmentation by capacity reflects the scale of industrial operations, ranging from smaller units used in localized process heating within manufacturing plants to multi-megawatt units deployed in large chemical complexes or centralized district heating infrastructure. The increasing demand for industrial process heat, coupled with energy efficiency targets, ensures robust growth across all capacity segments, though large-scale projects (above 10 MW) often drive higher aggregated market value. End-user segmentation reveals the critical role of heat pumps in energy-intensive sectors like Chemicals, Pulp & Paper, and Food & Beverage, where thermal energy constitutes a major operational cost component and sustainability compliance is non-negotiable.

- By Type:

- Vapor Compression Heat Pumps

- Absorption Heat Pumps

- Hybrid Systems

- By Temperature Output:

- Medium Temperature Heat Pumps (Up to 100°C)

- High Temperature Heat Pumps (Above 100°C)

- By Capacity:

- Below 5 MW

- 5–10 MW

- Above 10 MW

- By End-User Industry:

- Chemicals and Petrochemicals

- Food & Beverage

- Paper & Pulp

- Pharmaceuticals

- Textiles

- Manufacturing and Metal Processing

- District Heating and Utilities

Value Chain Analysis For Industrial Heat Pump Market

The value chain for industrial heat pumps begins with upstream component manufacturing, which is highly specialized and critical for system performance. This includes the production of high-efficiency compressors (scroll, screw, reciprocating, or turbo), specialized heat exchangers designed for corrosive or high-pressure industrial fluids, control electronics, and system casings. The reliance on advanced metallurgy and precise engineering for these components means that suppliers often possess significant bargaining power, especially those providing high-temperature capable compressors or components designed for natural refrigerants like R717 (ammonia) or R744 (CO2). Component standardization remains a challenge given the highly customized nature of industrial heat pump installations compared to residential or commercial units.

Midstream activities involve the system integration and manufacturing phase, where Original Equipment Manufacturers (OEMs) assemble these specialized components into integrated, modular units. The complexity lies in designing the overall thermodynamic cycle, selecting the appropriate refrigerant for the required temperature lift, and ensuring compliance with stringent safety and environmental regulations (particularly concerning flammable or toxic refrigerants). Distribution channels are predominantly indirect, relying on specialized engineering procurement and construction (EPC) firms, mechanical contractors, and specialized energy service companies (ESCOs) that possess the expertise necessary to size, install, and commission these sophisticated systems within existing industrial plants. Direct sales are rare but reserved for large, strategic projects or customized R&D collaborations.

Downstream activities are dominated by installation, commissioning, and long-term maintenance services. Given the complexity of integrating a heat pump into an industrial process—often involving connecting to waste heat sources, steam networks, or process cooling loops—the quality of installation and technical expertise is paramount. Post-sale services, including performance monitoring, preventative maintenance contracts, and spare parts supply, represent a significant and growing revenue stream. The ability of manufacturers or their certified partners to provide seamless integration and rapid response maintenance is a critical differentiator in this high-value, high-reliability required market segment.

Industrial Heat Pump Market Potential Customers

Potential customers for industrial heat pumps are concentrated in sectors characterized by high, continuous demand for thermal energy and the presence of recoverable waste heat streams. The primary end-users are large industrial facilities that aim to achieve significant reductions in operational energy costs and meet corporate sustainability targets. This includes major players in the Chemicals and Petrochemicals industry, which require substantial heat input for distillation, reaction, and drying processes. These customers are seeking high-temperature solutions to replace fossil fuel combustion, often requiring heat outputs well above 150°C to be viable across their extensive process heating needs.

Another major segment comprises the Food & Beverage industry, which relies heavily on moderate temperature heat for sterilization, pasteurization, cleaning-in-place (CIP), and drying. The regulated nature of this industry means that energy efficiency must be balanced with strict hygiene requirements. Heat pumps provide an excellent solution for recovering heat from cooling loops or condensation processes, significantly reducing boiler load. Similarly, the Pulp & Paper sector represents a high-potential customer base, utilizing vast amounts of heat for drying and evaporation processes. These facilities often have massive, consistent waste heat streams from their processes, making them ideal candidates for large-scale heat pump deployment to dramatically improve energy intensity per ton of product.

Furthermore, District Heating network operators and utility companies are increasingly pivotal customers. These entities use multi-megawatt industrial heat pumps, often drawing heat from sources like municipal wastewater treatment effluent, river water, or large industrial parks, to provide centralized, efficient heating to entire urban areas. This shift allows cities to decarbonize their heating supply, moving away from decentralized natural gas systems. The rapid urbanization and policy push for sustainable infrastructure ensure that this segment will continue to be a primary driver of high-capacity unit sales globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Controls, GEA Group, Mitsubishi Electric, Trane Technologies, Daikin Industries, Siemens Energy, MAN Energy Solutions, Mayekawa Mfg. Co., Ltd., Star Refrigeration, Danfoss, Carrier Global Corporation, Krones AG, Enercon GmbH, Skema S.p.A., Centrica plc, Viessmann Group, Bosch Thermotechnology, Alfa Laval, Ochsner Warmepumpen GmbH, York (Johnson Controls) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Heat Pump Market Key Technology Landscape

The technology landscape of the Industrial Heat Pump market is undergoing rapid evolution, primarily driven by the need to achieve higher temperature lifts and improve Coefficient of Performance (COP) while complying with evolving environmental regulations concerning fluorinated refrigerants. A major trend is the development and commercialization of robust high-temperature heat pumps (HTHPs) capable of producing process heat and low-pressure steam up to 180°C and beyond. This is being achieved through the use of high-pressure scroll and turbo compressors, often integrated with complex two-stage or cascade cycles. Furthermore, the selection and optimization of refrigerants are paramount; there is a distinct move towards natural refrigerants such as ammonia (R717) due to its zero Ozone Depletion Potential (ODP) and low Global Warming Potential (GWP), and CO2 (R744) for moderate temperature applications, especially in food processing and commercial refrigeration integration.

Another crucial technological advancement is the enhanced integration capability of heat pump systems into existing factory infrastructure. This includes smart controls and advanced variable speed drives (VSDs) which allow the heat pump output to modulate precisely according to the highly variable load demands characteristic of industrial processes, preventing cycling losses and maximizing efficiency. The application of sophisticated plate and shell-and-tube heat exchangers, designed specifically to handle dirty or corrosive industrial fluid streams, ensures reliability and longevity in challenging environments. The shift towards modular and containerized heat pump solutions is also simplifying installation and reducing commissioning time, making large-scale projects more manageable and less disruptive to continuous operations.

Finally, the rise of hybrid heating systems is a significant technological development. These systems strategically combine electric industrial heat pumps with conventional heat sources (such as gas boilers or solar thermal collectors) to ensure operational reliability and optimize energy cost management. Hybridization allows manufacturers to utilize heat pumps for the baseline heating load, achieving maximum efficiency, while relying on existing fossil fuel sources only during peak demand or when exceptionally high temperatures are momentarily required. This approach mitigates the risk associated with complete reliance on a single technology and accelerates market adoption by utilizing current capital assets efficiently, providing a crucial bridge during the energy transition.

Regional Highlights

- Europe: Europe is the largest and most mature market for industrial heat pumps, largely due to stringent decarbonization policies like the EU Green Deal and national energy efficiency directives. The continent benefits from robust funding mechanisms, especially within the context of the REPowerEU plan, which prioritizes the abandonment of Russian natural gas and accelerates electrification in industry and district heating. Germany, the Netherlands, and the Nordic countries are leaders in deployment, driven by high fossil fuel costs and successful large-scale pilots in the chemical and manufacturing sectors. The focus here is heavily skewed towards high-temperature applications and centralized district heating networks utilizing massive heat pump capacity.

- North America: The market growth in North America, particularly the United States, is significantly stimulated by supportive federal legislation, notably the Inflation Reduction Act (IRA). The IRA provides substantial, long-term tax credits for clean manufacturing and industrial efficiency projects, effectively reducing the pay-back period for large capital expenditures on heat pumps. While adoption rates have historically lagged behind Europe, the availability of low-cost renewable electricity in many regions, coupled with increasing corporate ESG (Environmental, Social, and Governance) targets, is driving rapid uptake in the chemicals, refining, and food processing industries. Canada also shows strong growth due to provincial carbon pricing mechanisms and abundant clean hydropower.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by the rapid industrialization and governmental commitments in countries like China, Japan, and South Korea to address severe air quality issues and reduce energy intensity. China’s extensive manufacturing base and heavy reliance on thermal processes present a vast addressable market. While cost remains a key consideration, government five-year plans are mandating energy efficiency improvements, forcing industries to explore solutions like heat recovery via heat pumps. Japan, facing high energy import costs, is also a leader in adopting advanced, high-efficiency heat pump technologies, especially in commercial and light industrial sectors.

- Latin America (LATAM): The LATAM market is emerging, characterized by localized growth primarily focused on the Food & Beverage and resource extraction industries (e.g., mining and processing), which require significant process heating and cooling. Investment tends to be concentrated in economically stable countries like Brazil and Mexico, where energy costs and sustainability targets are becoming more prominent in multinational corporation operations. Market expansion is dependent on improving local financing structures and increasing awareness regarding the long-term operational savings provided by heat pump technology.

- Middle East and Africa (MEA): The MEA market is nascent but shows potential, particularly in the Middle East due to large desalination and cooling demands, and the increasing focus on diversifying energy sources away from oil and gas. Industrial heat pumps are primarily being explored for niche applications in the petrochemical sector and for energy-efficient cooling in large industrial complexes. Growth in Africa is limited by infrastructure and high upfront costs but shows promise in specialized industrial hubs prioritizing renewable energy integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Heat Pump Market.- Johnson Controls

- GEA Group

- Mitsubishi Electric

- Trane Technologies

- Daikin Industries

- Siemens Energy

- MAN Energy Solutions

- Mayekawa Mfg. Co., Ltd.

- Star Refrigeration

- Danfoss

- Carrier Global Corporation

- Krones AG

- Enercon GmbH

- Skema S.p.A.

- Centrica plc

- Viessmann Group

- Bosch Thermotechnology

- Alfa Laval

- Ochsner Warmepumpen GmbH

- York (Johnson Controls)

Frequently Asked Questions

What is the typical return on investment (ROI) period for installing industrial heat pumps?

The ROI period for industrial heat pumps typically ranges from 3 to 7 years, highly dependent on the system size, the efficiency of the waste heat source utilized, and local energy price differentials. Projects that successfully recover high volumes of previously wasted thermal energy in industries with high natural gas costs, such as chemical or paper processing in Europe, often achieve the shortest payback times, sometimes under three years, especially when factoring in government subsidies and carbon tax avoidance.

Are industrial heat pumps capable of producing steam for process applications?

Yes, modern high-temperature industrial heat pumps (HTHPs) are increasingly capable of generating low-pressure industrial steam, typically up to 10 to 15 bar (around 180°C to 200°C), utilizing specialized compressors and high-pressure refrigerants like water or certain HFOs. While they do not yet replace high-pressure boilers for all applications, their capability to offset significant steam generation load using high-COP electricity makes them a crucial decarbonization tool for many medium-temperature steam processes.

Which industrial sectors are leading the adoption of high-temperature industrial heat pumps?

The sectors leading the adoption of high-temperature industrial heat pumps (HTHPs) are the Chemicals and Petrochemicals industry, Pulp & Paper manufacturing, and large Food & Beverage processors. These industries require continuous, high-grade heat (above 100°C) for drying, concentration, and distillation. Their adoption is driven by large-scale, continuous waste heat streams which provide reliable energy input for the heat pump, maximizing the economic viability of the technology.

What role do natural refrigerants play in the future growth of the industrial heat pump market?

Natural refrigerants, specifically Ammonia (R717) and CO2 (R744), are pivotal for future market growth. Driven by global phase-downs of high-GWP HFC refrigerants under regulations like the Kigali Amendment and the EU F-Gas Regulation, natural refrigerants offer superior environmental profiles (low or zero GWP). Ammonia is favored for high-capacity, large-scale systems due to its high efficiency, while CO2 is used in specialized high-temperature applications due to its excellent thermodynamic properties at high pressures, ensuring long-term regulatory compliance and sustainable operation.

How does the integration of industrial heat pumps affect overall plant energy intensity?

Integrating industrial heat pumps significantly reduces overall plant energy intensity by maximizing the utilization of low-grade waste heat that would otherwise be rejected to the environment. By upgrading this waste heat into useful process heat, the plant minimizes the consumption of primary energy sources (like natural gas or grid electricity for heating). This results in a substantial improvement in the facility's overall energy efficiency ratio and directly lowers operational carbon footprints, making the process cleaner and more cost-effective.

The extensive analysis of the Industrial Heat Pump Market indicates a robust future defined by technological innovation, primarily focusing on achieving higher temperature outputs and integrating natural refrigerants. The regulatory environment, particularly in Europe and North America, provides a strong financial and legislative push, making heat pump adoption mandatory for industrial sustainability goals. Key growth levers include the massive untapped potential of industrial waste heat recovery and the large-scale integration into municipal district heating systems, effectively positioning industrial heat pumps as a cornerstone technology in the global transition towards electrified and decarbonized thermal energy supply. Ongoing advancements in smart controls and AI integration will further solidify the economic case by ensuring optimal performance, predictability, and operational longevity in demanding industrial environments.

Manufacturers are strategically focusing on modular designs to enhance ease of installation and scalability, addressing a key restraint related to complex retrofitting in existing facilities. Furthermore, the capacity to operate reliably under variable load conditions, achieved through advanced compressor technologies and hybrid system integration, is expanding the addressable market dramatically, moving beyond simple low-temperature applications into complex, high-demand process heating. This technological maturity, supported by favorable geopolitical trends prioritizing energy independence and sustainability, suggests that the market trajectory will remain strongly positive throughout the forecast period, solidifying the heat pump's role as the definitive replacement for fossil fuel combustion in industrial thermal energy provision.

The competitive landscape is characterized by established refrigeration and HVAC giants alongside specialized industrial engineering firms. Differentiation is achieved through technical expertise in specific high-pressure/high-temperature refrigerants, proprietary compressor designs, and the ability to offer comprehensive, end-to-end energy system integration services. The segmentation analysis confirms that investment is flowing heavily into high-temperature R&D to capture the lucrative chemical and pulp & paper sectors, which have the largest unmet thermal energy needs. Finally, the growing requirement for predictive maintenance and remote performance monitoring highlights the necessity for digital solutions, making AI capabilities an increasingly non-negotiable factor for customer selection and market leadership in the coming years.

The confluence of these factors—regulatory pressure, technological breakthroughs, favorable economics stemming from energy efficiency, and digital optimization—ensures sustained market expansion. Industrial policymakers and plant managers worldwide recognize the heat pump not just as an energy-saving device, but as a core asset for securing competitive advantage in a carbon-constrained global economy. Future market trajectory will be heavily influenced by the successful implementation of large-scale, multi-megawatt projects utilizing waste heat from energy-intensive industrial clusters and urban infrastructure, marking a definitive step toward sustainable industrial operations.

The need for detailed engineering studies prior to deployment remains a constraint, necessitating close collaboration between heat pump manufacturers and specialized consulting engineers who can accurately model the complex interactions between the heat pump, the waste heat source, and the recipient process loop. To overcome this, many leading OEMs are investing heavily in application engineering teams capable of providing bespoke solutions. This specialized service delivery model, focusing on customized thermodynamic sizing and integration, is rapidly becoming a competitive necessity rather than a market advantage, driving consolidation and specialized skill acquisition across the value chain. The complexity of managing these highly customized, high-CAPEX installations underscores the premium placed on system reliability and long-term service agreements.

Moreover, the electrification of industry introduces new demands on grid infrastructure. Industrial heat pump adoption must be harmonized with renewable energy generation capacity and grid stability management. This interplay presents an opportunity for heat pumps equipped with smart grid communication capabilities to participate in demand side management, modulating their consumption based on grid signals. This ability to act as a flexible load is a significant value addition, particularly in regions with high penetration of intermittent renewable sources like wind and solar, transforming the heat pump from a pure consumer into a grid-interactive asset. This synergistic relationship with the power sector will be crucial for scaling up industrial electrification efficiently without compromising energy security.

Looking ahead, the development of heat pump technologies capable of producing higher temperature steam directly and efficiently will be critical for unlocking the final 20% of industrial heat demand currently served exclusively by high-pressure fossil fuel boilers. Research into high-temperature working fluids, supercritical cycles, and entirely new compression methodologies is ongoing, supported by significant government and private R&D funding, particularly in the European Union under Horizon Europe initiatives. Success in these high-risk, high-reward technological areas will dramatically increase the Total Addressable Market (TAM), positioning industrial heat pumps to eventually displace nearly all forms of conventional industrial heating within the next decade and a half, thereby achieving profound decarbonization impacts across the entire manufacturing sector globally.

The market also faces hurdles related to skills gaps. The expertise required for designing, installing, and maintaining complex high-pressure industrial heat pump systems is scarce compared to conventional boiler maintenance expertise. This deficiency necessitates substantial investment in workforce training and certification programs across major industrialized regions. Addressing this technical skills deficit is essential for ensuring successful long-term operation and maximizing the energy efficiency gains promised by the technology. Companies that invest proactively in comprehensive training programs for their client's operational staff and their own service network will gain a strategic advantage in the highly competitive maintenance and service market segment, further cementing their brand reputation for reliability and operational support.

Furthermore, standardizing industrial waste heat mapping methodologies is gaining importance. For efficient market scaling, industries need clear frameworks to quantify and categorize their available waste heat streams (temperature, flow, consistency, and chemical compatibility). This standardization facilitates quicker and more accurate initial heat pump sizing and accelerates the feasibility study phase, which often acts as a bottleneck in the project lifecycle. Regulatory bodies and industry consortia are collaborating to develop open-source tools and guidelines for heat resource assessment, which will significantly streamline the procurement process and lower the transaction costs associated with adopting these highly customized energy solutions across diverse manufacturing operations.

In summary, the Industrial Heat Pump market stands at an inflection point, transitioning from a niche energy solution to a mainstream industrial technology. The convergence of macro-environmental drivers, strong policy support, mature core technology, and ongoing high-temperature innovation creates a highly favorable market outlook. The ability of key players to manage system integration complexity, address the technical skills shortage, and leverage digital tools for operational optimization will dictate leadership positions in this rapidly expanding and strategically vital market segment over the forecast period to 2033.

The robust growth is also underpinned by the increasing availability and decreasing cost of renewable electricity, which further enhances the operational cost-effectiveness of electric heat pumps compared to gas-fired alternatives. In regions where electricity grids are rapidly decarbonizing, the industrial heat pump offers a double benefit: it is highly efficient, and its operational energy source is increasingly carbon-free. This synergy between industrial electrification and renewable energy expansion creates a compelling long-term economic argument that overcomes the initial capital investment barriers. The sustainability reporting requirements imposed by investors and regulators further amplify this pressure, as companies seek tangible, audited metrics for their decarbonization efforts, where heat pump deployment provides immediate and quantifiable results in reducing Scope 1 and Scope 2 emissions.

The trend towards distributed manufacturing and micro-grids in industrial parks also favors modular industrial heat pump designs. These decentralized energy systems allow factories to manage their energy independence and resilience, mitigating risks associated with large, centralized utility failures. Heat pumps, especially those integrated with thermal energy storage (TES) systems, are instrumental in this transition, allowing industries to store excess recovered heat for later use or to optimize consumption schedules based on fluctuating renewable energy availability. This strategic use of thermal storage enhances the flexibility and value proposition of the heat pump system far beyond simple heating, positioning it as a core component of future resilient, decentralized industrial energy architecture.

Finally, geopolitical factors, including the push for energy sovereignty in major economic blocs, continue to strengthen the market. Reducing reliance on imported fossil fuels is a strategic priority, and industrial heat pumps contribute directly to this goal by maximizing the utilization of domestic electricity resources and internal waste heat streams. This national security dimension provides additional political momentum and ensures continued governmental support, reinforcing the long-term investment case for manufacturers and end-users alike. The commitment to achieving energy independence, especially after recent global energy crises, translates directly into stable, long-term policy environments that favor technologies facilitating industrial electrification and efficiency gains.

Market penetration is being accelerated by the success of pilot projects demonstrating quantifiable energy and cost savings in challenging industrial environments. Case studies showcasing high-temperature heat pumps successfully supplying process heat for distillation columns in chemical plants or drying processes in paper mills are crucial for building confidence among skeptical plant operators accustomed to traditional combustion technologies. Manufacturers are investing heavily in performance monitoring and reporting tools to transparently demonstrate the Coefficient of Performance (COP) achieved in real-world industrial settings, validating the projected operational savings and de-risking the technology adoption for second and third wave adopters. The emphasis on data-driven proof of concept is essential for widespread commercial acceptance.

The role of specialized financing models is also critical for market scaling. Energy Performance Contracting (EPC) and Heat-as-a-Service (HaaS) models are emerging solutions that mitigate the initial high capital expenditure (CapEx) barrier for industrial end-users. Under these models, third-party energy service companies (ESCOs) fund, install, and maintain the heat pump system, selling the thermal energy output to the factory at a predictable rate below the current fossil fuel cost. This transfers the performance risk from the manufacturer to the service provider, making the adoption economically accessible even for mid-sized enterprises with constrained capital budgets. The growth of these innovative financial instruments is set to dramatically increase the uptake rate, especially among small and medium-sized enterprises (SMEs) that form the backbone of many manufacturing sectors.

Technological refinement is continuously addressing previous limitations. For instance, the use of vacuum or sub-atmospheric heat pumps is being explored for low-temperature industrial applications like concentrating liquids via evaporation, requiring minimal temperature lift but high throughput. Furthermore, magnetic refrigeration technologies, while still largely in the research phase, promise extremely high efficiency for specialized industrial cooling and low-temperature heat recovery applications in the long term. These diverse technological avenues ensure that the industrial heat pump segment is dynamically positioned to capture thermal energy demand across the full spectrum of industrial temperature requirements, from sub-zero cooling to high-pressure steam generation, guaranteeing its sustained market relevance.

The regulatory framework governing refrigerants (such as the F-Gas Regulation in Europe) drives competitive differentiation among manufacturers. Companies that have successfully engineered high-performance systems using zero-GWP natural refrigerants (like R717, R744, and increasingly R290/propane for smaller units) are gaining significant advantage, as their products offer future-proof compliance. This regulatory push incentivizes investment in specialized component manufacturing—such as leak-proof fittings and robust safety controls for ammonia systems—ensuring that the supply chain matures in line with stringent environmental standards. The focus on safety and environmental compliance further elevates the entry barrier for new competitors but solidifies the market position of established, technologically advanced players.

Finally, the growing industrial focus on circular economy principles strongly aligns with heat pump deployment. By recovering and reusing waste thermal energy, heat pumps directly contribute to resource efficiency within manufacturing processes. This aligns with corporate sustainability mandates that extend beyond simple carbon reduction to encompass broader environmental stewardship and resource optimization. The ability of the heat pump to transform a waste product (low-grade heat) into a valuable commodity (high-grade heat) makes it an essential technology for industrial systems striving for genuine circularity, cementing its long-term importance across all major manufacturing value chains worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager