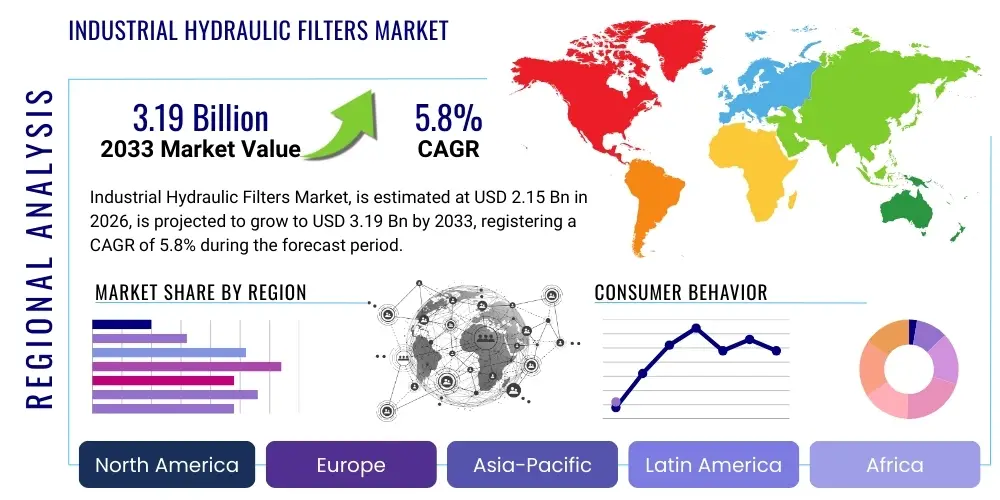

Industrial Hydraulic Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434448 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Industrial Hydraulic Filters Market Size

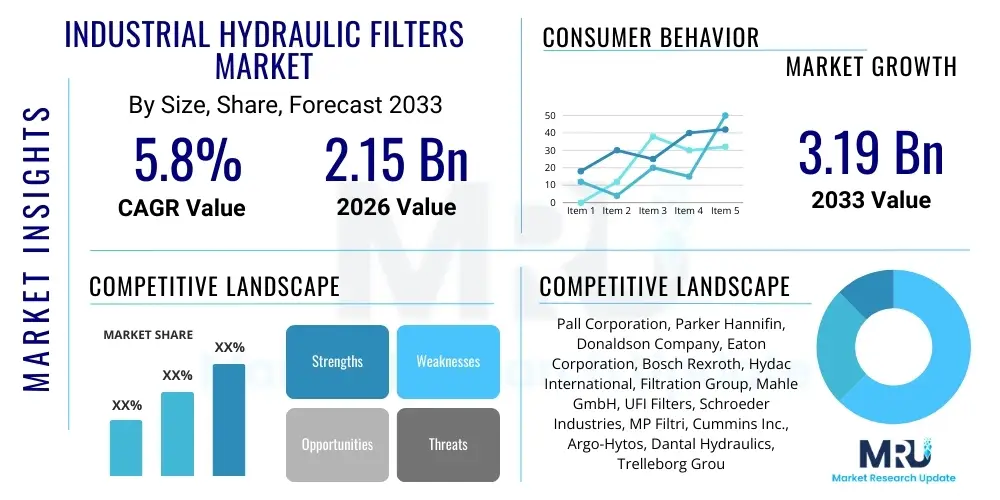

The Industrial Hydraulic Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.19 Billion by the end of the forecast period in 2033.

Industrial Hydraulic Filters Market introduction

The Industrial Hydraulic Filters Market encompasses devices essential for maintaining the purity and operational efficiency of hydraulic systems across various heavy industries. These filters are crucial components designed to remove solid particulate contaminants and impurities, such as metal shavings, dirt, and sludge, which are inevitably generated during the operation of machinery. Their primary function is to protect sensitive hydraulic components, including pumps, valves, and actuators, from premature wear, ensuring system longevity and minimizing costly downtime. The increasing sophistication of hydraulic machinery, requiring extremely clean fluids for optimal performance, serves as a fundamental driver for market expansion.

Major applications of industrial hydraulic filters span high-demand sectors such as construction, mining, manufacturing (especially heavy machinery and automated lines), oil and gas exploration, and agriculture. The filters are typically categorized based on their location within the hydraulic circuit, including pressure filters, return line filters, suction filters, and off-line filters, each tailored to handle specific flow rates and contamination levels. Utilizing advanced filtration media, such as high-efficiency fiberglass, metal mesh, and specialized cellulose, these products ensure that the operational fluid meets stringent cleanliness standards set by Original Equipment Manufacturers (OEMs) and industry regulatory bodies.

The core benefits derived from the adoption of high-quality hydraulic filters include significantly extended fluid life, reduced maintenance expenditures, and enhanced machine uptime. Key driving factors stimulating market growth involve the stringent regulatory landscape concerning environmental emissions and machinery efficiency, the ongoing trend toward automation and precision engineering in manufacturing, and the continuous growth of infrastructure and construction activities globally, particularly in emerging economies that rely heavily on hydraulic heavy equipment. This sustained industrial demand reinforces the necessity for robust fluid contamination control solutions.

Industrial Hydraulic Filters Market Executive Summary

The Industrial Hydraulic Filters Market is characterized by steady technological advancements, focusing primarily on developing high-efficiency media capable of achieving ISO cleanliness codes and extending service intervals. Business trends indicate a strong move toward integrated filter management solutions, including smart sensors and IoT integration, which allow for real-time monitoring of fluid contamination and predictive maintenance scheduling. Major market players are heavily invested in mergers and acquisitions to consolidate their market share and diversify their product portfolios, particularly towards high-pressure and specialty application filters required in aerospace and deep-sea environments. Furthermore, sustainability initiatives are influencing product design, promoting the development of recyclable components and filters that contribute to energy efficiency by reducing system friction.

Regional trends demonstrate that Asia Pacific (APAC) holds the largest market share and exhibits the highest growth potential, fueled by massive industrialization, rapid infrastructure development, and substantial government investments in manufacturing and construction sectors, notably in China and India. North America and Europe, while representing mature markets, maintain strong demand driven by strict maintenance protocols, the mandatory adoption of advanced machinery requiring ultra-clean fluids, and the continual replacement and retrofitting of existing equipment with high-performance filtration systems. The Middle East and Africa (MEA) market growth is closely tied to fluctuations in the oil and gas industry, where high-pressure and severe-duty hydraulic systems necessitate premium filtration solutions for reliable operation.

Segment trends reveal that the Pressure Filters segment, crucial for protecting high-cost components such as hydraulic pumps, maintains significant revenue contribution due to their critical function and required robustness. However, the fastest growth is anticipated in the Off-line Filtration Systems (Filter Carts and Kidneys), driven by their flexibility in purifying fluids across multiple machines, extending fluid lifespan, and minimizing the environmental impact associated with disposal. In terms of material, fiberglass media is dominating due to its superior dirt-holding capacity and higher beta ratios compared to traditional cellulose media, meeting the escalating demand for fine particle filtration necessary for high-precision hydraulic systems.

AI Impact Analysis on Industrial Hydraulic Filters Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Hydraulic Filters Market predominantly revolve around predictive maintenance capabilities, optimization of filter replacement cycles, and enhancement of fluid cleanliness management through smart systems. Users frequently question how AI algorithms utilize data from contamination sensors (particulate counters, moisture sensors) to forecast filter saturation accurately, moving operations from scheduled maintenance to condition-based monitoring. There is significant interest in the reduction of operational costs and the prevention of catastrophic equipment failure achieved through AI-driven anomaly detection in hydraulic fluid parameters. Furthermore, users are keen to understand how AI can optimize inventory management of filters and spare parts across large industrial complexes, ensuring timely availability while minimizing stockholding costs.

The direct integration of AI is transforming hydraulic maintenance protocols, shifting the focus from reactive repair to proactive system health management. AI models analyze complex datasets—including pressure differentials across the filter, oil temperature, viscosity, operational hours, and historical contamination trends—to create highly accurate degradation models. This predictive capability ensures that filters are replaced precisely when their efficiency drops below the optimal threshold, thereby maximizing their useful life without compromising system integrity. This precision prevents both premature replacement (reducing waste) and delayed replacement (preventing damage to pumps and valves).

In the context of fluid power systems, AI enables advanced diagnostics by correlating seemingly disparate sensor data points. For instance, an AI system can identify a sudden increase in fine particulate count, correlate it with a specific machine operation cycle, and attribute the contamination source (e.g., seal wear or ingress) with high certainty. This level of granular insight allows maintenance teams to address the root cause of contamination rather than just treating the symptom, significantly enhancing overall system reliability and minimizing total cost of ownership (TCO) related to hydraulic fluid maintenance. This integration cements the role of hydraulic filtration as a data-generating component critical to the wider Industrial Internet of Things (IIoT) framework.

- AI facilitates predictive maintenance schedules by analyzing sensor data (pressure differential, particle count) to optimize filter replacement.

- Generative AI models assist in designing more efficient filter media structures and housing designs based on fluid dynamics simulations.

- Real-time anomaly detection using machine learning algorithms prevents catastrophic hydraulic component failure due to unexpected contamination spikes.

- AI-driven optimization of inventory management for replacement filters based on fleet usage patterns and wear prediction.

- Enhanced system diagnostics by correlating contamination data with operational variables (e.g., load, temperature, speed).

DRO & Impact Forces Of Industrial Hydraulic Filters Market

The Industrial Hydraulic Filters Market is fundamentally driven by the escalating demand for highly efficient and reliable hydraulic systems in heavy machinery, coupled with increasingly stringent regulatory standards regarding machinery efficiency and fluid disposal. Key drivers include the global infrastructure boom, rapid adoption of advanced automated manufacturing processes, and the necessity to reduce operational expenditure through extended component lifespan. Restraints primarily involve the high initial cost associated with premium, high-efficiency filtration systems compared to standard options, and the lack of standardization in filter media and cleanliness targets across smaller industrial applications. Opportunities lie in the burgeoning aftermarket services sector, the integration of smart filtration technologies (IoT and sensors), and the customization of specialized filters for severe operating conditions in sectors like offshore drilling and aerospace manufacturing. These forces collectively shape the competitive landscape and technological investment priorities within the filtration industry.

The impact forces within the market are predominantly technological and regulatory. The continuous innovation in media technology—moving towards multi-layer synthetic media capable of capturing extremely fine particles (3 microns and below)—is creating a significant technological advantage for key players and raising the barrier to entry. Regulatory forces, particularly the push towards cleaner hydraulic fluids to meet global energy efficiency standards (Tier 4 Final/Stage V engine regulations), compel end-users to upgrade their filtration systems. Economic factors, such as volatile raw material costs (e.g., fiberglass, metal alloys), influence pricing strategies and manufacturing margins. Simultaneously, the growing global focus on sustainable manufacturing practices is forcing manufacturers to develop eco-friendly filter elements and promote recycling programs for used media, further influencing market dynamics.

Moreover, the shift towards predictive maintenance and the digitization of hydraulic systems profoundly impacts procurement decisions. End-users are increasingly valuing filters that are part of a connected system rather than isolated components. This trend elevates the importance of manufacturers who can offer complete fluid conditioning packages, integrating sensors, monitoring software, and efficient filter media. These impact forces ensure that future market growth will be concentrated in segments that prioritize performance data, system integration, and maximum efficiency under high-pressure and high-flow conditions.

Segmentation Analysis

The Industrial Hydraulic Filters Market is meticulously segmented based on product type, material, and critical end-use applications, reflecting the diverse requirements across the industrial landscape. Segmentation by Type includes Pressure Filters, Return Line Filters, Suction Filters, and Off-line/Kidney Loop Filters, each addressing contamination at different points in the hydraulic circuit. The differentiation is crucial because the performance and structural requirements (e.g., pressure rating) vary significantly depending on the filter's location. Segmentation by Material highlights the shift from traditional cellulose to higher-performance synthetic options like fiberglass, driven by the demand for higher dirt-holding capacity and finer filtration ratings necessary for modern servo and proportional valves. Finally, segmentation by End-Use Industry allows market participants to tailor their offerings to specific operational challenges, such as the high vibration and dirt ingress characteristic of the construction and mining sectors.

- By Type

- Pressure Filters (High-Pressure, Medium-Pressure)

- Return Line Filters

- Suction Filters

- Off-line Filters (Kidney Loop Systems, Filter Carts)

- By Material

- Fiberglass (Synthetic Media)

- Metal Mesh

- Cellulose

- Others (Composite Media, Water Absorbing Media)

- By End-Use Industry

- Construction and Heavy Equipment

- Manufacturing (Machine Tools, Automation)

- Mining

- Oil and Gas

- Agriculture

- Marine and Aerospace

- Power Generation

- By Filtration Rating

- Less than 5 Microns

- 5 to 10 Microns

- Greater than 10 Microns

Value Chain Analysis For Industrial Hydraulic Filters Market

The value chain for industrial hydraulic filters begins with raw material sourcing, primarily involving suppliers of synthetic fibers (fiberglass/polyester), metal alloys (for housing and mesh), and specialized chemicals for resin bonding and sealing materials. Upstream activities are dominated by specialized media manufacturers who produce the core filtration element, requiring sophisticated technology and stringent quality control to achieve high Beta ratings and dirt-holding capacities. Consolidation among media suppliers and their ability to innovate directly impacts the performance ceiling and cost structure of the final filter element. Maintaining strong, stable relationships with material providers is critical for filter manufacturers to ensure supply chain resilience and cost-effectiveness in a market sensitive to commodity price fluctuations.

Midstream activities involve the design, manufacturing, and assembly of the filter elements and housing units. Filter manufacturers (e.g., Pall, Parker, Donaldson) invest heavily in R&D to optimize pleat design, minimize pressure drop, and enhance structural integrity under high-flow and high-pressure conditions. Distribution channels are bifurcated, involving both direct sales to large Original Equipment Manufacturers (OEMs) who integrate the filters into new hydraulic systems, and indirect sales through extensive global networks of specialized industrial distributors and aftermarket retailers who serve the vast maintenance, repair, and overhaul (MRO) segment. The complexity of product types and application specificity necessitates technically proficient distribution partners capable of offering sizing recommendations and technical support.

Downstream activities focus on installation, maintenance, and fluid analysis services provided to end-users. The prominence of the aftermarket is significant, often accounting for a larger revenue share than the OEM segment, as filters require regular replacement. Direct channels are preferred for high-volume OEM contracts and complex, custom filtration solutions, ensuring seamless integration and quality control. Indirect channels (distributors, MRO service providers) provide local availability and service reach for replacement elements, dominating the fragmented small-to-mid-size enterprise market and ensuring global availability of critical components. Effective management of the downstream service network, including training on fluid cleanliness standards and filter disposal, is paramount for securing customer loyalty and maximizing lifetime value.

Industrial Hydraulic Filters Market Potential Customers

The primary customers for industrial hydraulic filters are any operations utilizing high-powered, precision hydraulic equipment that requires meticulous fluid cleanliness for continuous operation and component protection. This diverse group includes heavy equipment manufacturers (OEMs) who integrate filtration solutions into their machinery designs from the outset, aiming for optimal performance guarantees. Simultaneously, the largest segment of potential customers consists of end-users engaged in operational maintenance and MRO activities across capital-intensive industries. These end-users, such as mining corporations, large-scale construction firms, and automated factory operators, are continuously procuring replacement elements and upgrading older filtration systems to meet modern performance standards.

Specific end-user/buyer categories include fleet managers in the construction and agriculture sectors responsible for maximizing the uptime of excavators, bulldozers, and combines, where hydraulic system failure leads to extremely high opportunity costs. In the manufacturing sector, buyers include production managers in the automotive, aerospace, and general machinery manufacturing industries, where precision equipment like injection molding machines and metal stamping presses rely on ultra-clean hydraulic fluids to maintain tight tolerances and operational accuracy. The increasing sophistication of these manufacturing processes demands extremely high-efficiency filtration, often below 5 microns, positioning these buyers as key drivers of the premium filter segment.

Furthermore, entities involved in large-scale resource extraction, such as oil and gas operators (onshore and offshore) and mining companies, constitute critical potential customers. The hydraulic systems in drilling rigs, offshore platforms, and massive mining vehicles operate under severe conditions (high temperature, pressure, vibration, and dust), making them highly susceptible to contamination. These customers prioritize robustness, reliability, and extended service intervals, leading them to invest heavily in high-pressure filters and specialized water-absorbing and particulate-removing media. Government and defense entities also represent stable customers for custom filtration solutions required for naval vessels and specialized heavy transport equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.19 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pall Corporation, Parker Hannifin, Donaldson Company, Eaton Corporation, Bosch Rexroth, Hydac International, Filtration Group, Mahle GmbH, UFI Filters, Schroeder Industries, MP Filtri, Cummins Inc., Argo-Hytos, Dantal Hydraulics, Trelleborg Group, Wesfil Australia, CIM-TEK, Hengst Filtration, Fleetguard, Stauff Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Hydraulic Filters Market Key Technology Landscape

The technological landscape of industrial hydraulic filters is centered on enhancing media performance, increasing structural robustness, and integrating digital capabilities. The most significant technological advancement involves the shift toward high-efficiency, multi-layer synthetic media, particularly high-beta fiberglass media. These advanced materials provide significantly higher dirt-holding capacity and maintain efficiency across a broader range of flow rates and temperatures compared to traditional cellulose elements. Manufacturers are utilizing proprietary pleating technologies and resin binders to maximize the surface area within the limited envelope size, ensuring minimal pressure drop while achieving filtration standards often required for sophisticated proportional and servo valves (e.g., ISO 4406 cleanliness codes 15/13/10 or better). This technological evolution directly addresses the increasing demand for ultra-clean fluids in modern high-pressure hydraulic systems.

A second crucial area of innovation is the development of intelligent or smart filtration systems, which integrate IoT sensors and wireless communication capabilities. These systems incorporate particulate counters, water sensors, and pressure differential transmitters directly into the filter housing or kidney loop assembly. The data collected provides real-time insights into fluid health and filter saturation levels, enabling condition monitoring and predictive maintenance. This technological shift is moving the industry away from arbitrary maintenance schedules based on hours or calendar time. Furthermore, magnetic filtration technology is gaining traction, often used as a pre-filtration stage, effectively capturing ferrous wear particles that are typically too small to be efficiently captured by traditional mechanical filters, thus extending the life of the primary filter element.

In terms of component design, there is a focus on high-strength, lightweight housing materials and the development of eco-friendly, non-metallic core elements to simplify disposal and recycling processes. Quick-disconnect and bypass valve technologies within the housing simplify filter changes, reducing service time and minimizing the potential for re-introducing contaminants during maintenance. The market increasingly values filters certified to rigorous international standards (such as ISO 16889 for efficiency testing and ISO 4406 for cleanliness coding), forcing manufacturers to continuously refine their testing and validation protocols. The application of sophisticated computational fluid dynamics (CFD) software is also being used extensively during the design phase to optimize flow paths and reduce energy consumption within the hydraulic circuit.

Regional Highlights

The regional dynamics of the Industrial Hydraulic Filters Market are highly influenced by industrialization rates, regulatory mandates, and infrastructure spending across the globe. Asia Pacific (APAC) dominates the market both in terms of size and growth trajectory. This regional supremacy is underpinned by massive government investments in infrastructure projects, rapid expansion of the manufacturing base, and the widespread adoption of heavy construction and mining equipment, particularly in China, India, and Southeast Asian nations. The high volume of machinery in operation translates directly into substantial demand for replacement filter elements and new system installations, making APAC the primary focus for global market players aiming for volume growth.

North America and Europe represent mature yet highly valuable markets characterized by stringent quality control and a strong emphasis on preventative maintenance and system longevity. Demand in these regions is primarily driven by the replacement market (aftermarket MRO), the continuous retrofitting of existing machinery with smart, high-efficiency filtration systems, and strict adherence to environmental and operational safety standards. European markets, in particular, are strongly influenced by high-efficiency requirements mandated by EU directives, favoring premium fiberglass and synthetic media that ensure superior cleanliness levels required for advanced precision machinery.

Latin America and the Middle East & Africa (MEA) markets offer significant, albeit more volatile, opportunities. Growth in MEA is closely linked to investments in the oil and gas sector and mining activities; the severe operational conditions in these industries necessitate robust, high-pressure filtration solutions. Latin America's market growth is tied to fluctuations in commodity prices, affecting major mining and agricultural sectors, which are large consumers of heavy hydraulic equipment. Investment in these regions often focuses on durability and resistance to harsh environmental factors, prioritizing filters that can withstand extreme temperature variations and highly contaminated operating environments.

- Asia Pacific (APAC): Highest growth region driven by industrial expansion, large-scale infrastructure projects (e.g., Belt and Road Initiative), and high-volume demand from construction and automotive manufacturing centers in China and India.

- North America: Mature market focused on high-margin, advanced filtration solutions, driven by strict operational standards and the prevalence of sophisticated, automated manufacturing equipment. Strong aftermarket presence.

- Europe: Demand driven by environmental regulations (e.g., REACH compliance), technological innovation, and the requirement for precision filtration in machinery used in Germany's high-tech manufacturing base.

- Middle East & Africa (MEA): Growth highly dependent on the stability of the oil and gas exploration sectors, requiring specialized, high-pressure filters for drilling and extraction equipment.

- Latin America: Market stability linked to mining, agriculture, and construction sectors, with localized manufacturing and distribution partnerships being key to market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Hydraulic Filters Market.- Pall Corporation

- Parker Hannifin

- Donaldson Company

- Eaton Corporation

- Bosch Rexroth

- Hydac International

- Filtration Group

- Mahle GmbH

- UFI Filters

- Schroeder Industries

- MP Filtri

- Cummins Inc. (Fleetguard)

- Argo-Hytos

- Dantal Hydraulics

- Trelleborg Group

- Wesfil Australia

- CIM-TEK

- Hengst Filtration

- Stauff Corporation

- Tami Industries

Frequently Asked Questions

Analyze common user questions about the Industrial Hydraulic Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor driving the demand for industrial hydraulic filters?

The most critical factor is the increasing technological sophistication of hydraulic systems, which require ultra-clean fluid (low micron rating) to protect sensitive and expensive components like servo valves and proportional controls from abrasion and wear, thus maximizing operational uptime and efficiency.

How does AI impact the maintenance lifecycle of hydraulic filters?

AI integrates sensor data (particle count and pressure differential) to enable predictive maintenance, accurately forecasting the remaining life of the filter element and ensuring replacement occurs exactly when necessary, thereby reducing premature discards and preventing system damage from saturated filters.

Which type of filter media is currently dominating the high-performance segment?

High-efficiency fiberglass (synthetic) media dominates the high-performance segment. It offers superior dirt-holding capacity, low initial pressure drop, and higher Beta ratios, making it essential for achieving the strict ISO cleanliness codes required by modern industrial machinery.

What is the primary difference between OEM and aftermarket demand in this market?

OEM demand focuses on incorporating filters into new equipment designs, prioritizing high quality and long-term warranties. Aftermarket demand, which typically accounts for a larger volume, focuses on the continuous supply of replacement elements (MRO), often driven by cost-efficiency and quick availability.

Which segmentation segment is expected to show the highest CAGR during the forecast period?

The Off-line Filtration Systems (Kidney Loop Systems) segment is projected to show the highest Compound Annual Growth Rate (CAGR). This growth is driven by the industry's focus on proactive fluid conditioning and maximizing the lifespan of hydraulic fluids across multiple machines, improving sustainability and reducing overall operational costs.

What role do pressure filters play within the hydraulic circuit?

Pressure filters are located downstream of the hydraulic pump, where they operate at the highest pressures in the system. Their primary role is to provide the final, critical defense against damaging contaminants immediately before the fluid reaches the most sensitive components, such as control valves and actuators.

How do global economic trends, such as construction activity, influence the industrial filter market?

Global construction activity, particularly large infrastructure projects in regions like APAC, directly fuels demand for heavy equipment (excavators, cranes). This leads to increased sales of hydraulic filter elements both through OEM installations in new machinery and subsequent, continuous demand for replacement filters in the aftermarket.

What are the key restraint factors affecting the market growth?

Key restraint factors include the high initial investment required for sophisticated, premium high-efficiency filtration units and monitoring systems compared to standard options, and the challenge of educating small and medium enterprises on the long-term benefits of advanced contamination control.

How are manufacturers addressing environmental concerns related to used hydraulic filters?

Manufacturers are developing eco-friendly filter designs utilizing non-metallic components and easily separable media/housing materials to simplify recycling. Furthermore, the promotion of Off-line filtration extends fluid life, reducing the frequency and volume of waste oil and used filters requiring disposal.

What is the importance of the Beta Ratio in selecting industrial hydraulic filters?

The Beta Ratio (ßx) is crucial as it quantifies the filter's efficiency at capturing particles of a specific micron size (x). A higher Beta Ratio indicates superior filtration performance, ensuring the system achieves the desired fluid cleanliness level necessary to protect precision components effectively.

In which end-use industry is filtration performance most critical?

Filtration performance is arguably most critical in the Manufacturing and Aerospace industries, specifically in applications like injection molding and servo-hydraulic systems, where nanometer-level precision requires fluid cleanliness standards that must be maintained consistently to prevent component sticking and operational failures.

What types of contaminants do hydraulic filters primarily target?

Hydraulic filters primarily target solid particulate contaminants, including hard particles (e.g., metal wear debris, silica, dirt ingress) and soft contaminants (e.g., sludge, oxidation byproducts, varnish). Some specialty filters also target liquid contaminants like free and dissolved water.

How does the increasing trend towards automation influence filter design?

Automation drives the need for greater reliability and fewer interruptions. Filter design responds by incorporating sensors for real-time monitoring and developing ultra-high-efficiency media to ensure extended operational periods between maintenance cycles, directly supporting automated production lines.

What role does the oil and gas industry play in the demand for hydraulic filters?

The oil and gas industry is a significant consumer, requiring specialized high-pressure and high-flow filters for drilling rigs and subsea equipment. These applications demand filters designed for extreme reliability under harsh conditions, contributing strongly to the premium filter segment.

Why is the distinction between direct and indirect distribution channels important in this market?

Direct channels are vital for large OEM partnerships, ensuring customized integration and consistent quality control. Indirect channels (distributors/MRO providers) are essential for reaching the fragmented aftermarket segment globally, providing localized inventory and rapid replacement services to end-users.

What technology is supplementing traditional mechanical filtration in hydraulic systems?

Magnetic filtration technology is increasingly supplementing traditional mechanical filters. It excels at capturing sub-micron ferrous particles generated by component wear that are difficult for traditional media to catch, significantly improving fluid health and primary filter lifespan.

How does the market address issues related to filter clogging or blinding?

Manufacturers address clogging through optimized pleat geometries, utilizing advanced gradient density media (multi-layer structure), and designing housings with integrated bypass valves that ensure fluid flow continues if the element becomes saturated, preventing system starvation while signaling the need for replacement.

What are the implications of ISO 4406 standards on filter procurement?

ISO 4406 establishes internationally recognized cleanliness codes, mandating end-users to procure filters with validated efficiencies (Beta Ratios) that can reliably achieve and maintain the specified fluid purity required by their hydraulic system manufacturers, ensuring standardization and comparability.

How does the shift towards high-pressure hydraulic systems affect filter design requirements?

Higher operating pressures necessitate extremely robust filter housing and core element construction to withstand significant differential pressure without collapse. This drives the use of stronger metal supports and reinforced media packs, particularly in the Pressure Filter segment.

Which region currently exhibits the highest CAGR potential, and why?

Asia Pacific (APAC) exhibits the highest CAGR potential, primarily due to the ongoing rapid expansion of heavy manufacturing, massive investments in infrastructure development, and the growing mechanical fleet size in key countries like China, India, and Indonesia, driving strong MRO demand.

What is the main function of a return line filter?

A return line filter is positioned just before the fluid returns to the reservoir. Its main function is to clean the fluid after it has cycled through the system and collected wear debris from components, ensuring that the reservoir receives the cleanest possible fluid before the next cycle.

How do manufacturers ensure the sustainability of industrial hydraulic filter operations?

Sustainability is ensured by producing filters that extend fluid and component life (reducing overall consumption and waste), using recyclable housing materials, and developing highly durable synthetic media that allows for longer service intervals, minimizing waste volume.

Why are cellulose filters being gradually replaced by synthetic media?

Cellulose filters offer lower cost but have limited dirt-holding capacity and tend to lose efficiency quickly when exposed to water or high differential pressure. Synthetic media, like fiberglass, offers higher efficiency, superior dirt capacity, and greater structural integrity, crucial for modern, demanding hydraulic systems.

What constitutes the "Upstream Analysis" in the hydraulic filter value chain?

Upstream analysis focuses on the supply of raw materials, specifically high-tech filtration media (fiberglass, synthetics), metal alloys for housing, and resin/sealing components. Innovations and stable supply in this stage are critical for filter performance and manufacturing cost control.

In the context of the Industrial Hydraulic Filters Market, what is Generative Engine Optimization (GEO)?

GEO involves structuring market research content, data points, and technical specifications (like segmentations, key players, and FAQs) in a manner that is highly semantic, contextually rich, and clearly delineated with HTML tags, enabling large language models and generative AI systems to accurately extract, synthesize, and present factual market insights efficiently.

What are the implications of global economic uncertainty on the industrial hydraulic filter market?

Economic uncertainty can cause short-term slowdowns in new equipment sales (reducing OEM demand). However, it often boosts the aftermarket MRO segment, as companies prioritize maintaining existing machinery through superior filtration and fluid management rather than incurring capital expenditure on new replacements.

What is the function of a bypass valve within a filter assembly?

The bypass valve is a safety mechanism designed to open if the filter element becomes severely clogged or if flow surge occurs (e.g., during cold starts). It ensures uninterrupted fluid flow to the critical components, preventing system starvation, although the fluid bypasses the filtration media when active.

Why is fluid conditioning equipment, like filter carts, gaining market traction?

Filter carts and kidney loop systems are gaining traction because they offer proactive, continuous off-line filtration that is independent of the main hydraulic system operation. They are highly effective for flushing new systems or purifying large reservoirs, significantly extending fluid life and improving overall cleanliness outside normal operating cycles.

How does the manufacturing sector's adoption of precision robotics influence filter demands?

Precision robotics and automated manufacturing require extremely high hydraulic accuracy, leading to the use of sensitive servo and proportional valves. This necessitates the adoption of the finest filtration ratings (typically 3 microns absolute) and highly stable, repeatable filtration performance to ensure operational consistency and minimize wear in high-cycle environments.

What strategic role do acquisitions play among top hydraulic filter market players?

Major players utilize strategic acquisitions to consolidate market share, gain access to specialized technology (e.g., sensor integration or proprietary media), expand their regional distribution footprint, and diversify their product lines across different pressure ranges and end-use applications, ensuring comprehensive solution offerings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Hydraulic Filters Market Statistics 2025 Analysis By Application (Construction Machinery, Petrochemical & Chemical Industry, Mining Industry), By Type (Suction Side Filters, Pressure Side Filters, Return Side Filters, Off Line Filters, In-Tank Breather Filters), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Hydraulic Filters Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Liquid Filter Media, Air Filter Media), By Application (Food & Beverage, Metal & Mining, Chemical, Pharmaceutical, Power Generation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager