Industrial Inkjet Printheads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435679 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Inkjet Printheads Market Size

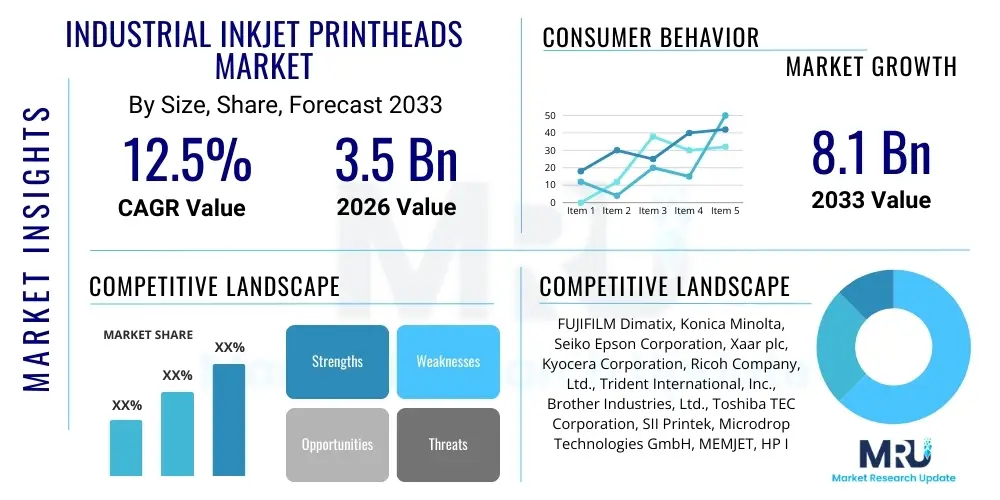

The Industrial Inkjet Printheads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Industrial Inkjet Printheads Market introduction

The Industrial Inkjet Printheads Market encompasses highly specialized, precision devices utilized in non-contact printing processes across various manufacturing sectors. These printheads are fundamental components in high-speed, high-resolution digital printing systems, offering unmatched flexibility and efficiency compared to traditional analog methods. Unlike consumer printheads, industrial units are designed for continuous, heavy-duty operation, capable of jetting a wide range of specialized fluids, including UV curable inks, solvent-based inks, and functional materials like conductive polymers or biological substances. The product differentiation lies primarily in drop volume control, firing frequency, nozzle count, and the capability to handle high-viscosity fluids, which are critical for demanding applications such as textile decoration, ceramic tile manufacturing, and advanced electronics fabrication.

Major applications driving the demand for industrial inkjet printheads include the high-growth sectors of packaging and labeling, where customization and variable data printing are paramount, and direct-to-garment (DTG) textile printing, which benefits from shorter production runs and reduced environmental footprint compared to screen printing. Furthermore, the printheads are essential in emerging functional printing markets, such as the deposition of precise material layers for printed electronics, biosensors, and 3D printing. The versatility of inkjet technology allows manufacturers to print directly onto complex substrates, including corrugated board, glass, metal, and plastic films, offering significant operational benefits.

Key driving factors propelling market expansion include the global shift towards digital manufacturing processes, heightened consumer demand for personalized products requiring on-demand production capabilities, and regulatory pressures emphasizing sustainable and low-waste printing solutions. The continuous technological advancements in printhead engineering, particularly the development of high-density MEMS-based (Micro-Electro-Mechanical Systems) printheads offering faster firing rates and smaller drop sizes, are enabling new application possibilities and maintaining the market’s robust growth trajectory. These printheads ensure superior image quality, faster throughput, and reduced maintenance downtime, making them indispensable assets in modern industrial production lines.

Industrial Inkjet Printheads Market Executive Summary

The Industrial Inkjet Printheads Market is poised for significant expansion, fueled by the accelerating adoption of digital printing technologies across Asia Pacific and Europe, particularly within the packaging, textile, and ceramics industries. Business trends indicate a strong move toward high-performance piezoelectric printheads, favored for their material compatibility and longevity, contrasting with the lower initial cost of thermal printheads. Key strategic activities focus on mergers, acquisitions, and collaborative research between printhead manufacturers and ink formulators to optimize system compatibility and introduce novel printing applications, such especially in additive manufacturing and decorative printing.

Regionally, Asia Pacific maintains the largest market share, driven by massive manufacturing base expansions in China and India, coupled with increasing investments in digital textile and corrugated packaging printing infrastructure. Europe, however, showcases the highest rate of technological innovation and leads in high-value applications, including security printing and precision industrial coding, often utilizing sophisticated integration services. North America remains a crucial hub for research and development, particularly in integrating inkjet deposition technologies with microfluidics and 3D printing systems, pushing the boundaries of functional printing capabilities.

Segmentation trends highlight the dominance of the ceramic printing segment, benefiting from the global shift toward digital decoration offering superior visual effects and design flexibility. However, the fastest growth is anticipated in the functional printing segment, driven by demand for precise material deposition in electronics manufacturing and personalized medicine. Technology-wise, while large-format graphics and signage continue to be staple applications, the focus is rapidly shifting towards industrial automation where inline integration and high-speed operation are non-negotiable requirements, reinforcing the demand for durable, maintenance-friendly industrial-grade components.

AI Impact Analysis on Industrial Inkjet Printheads Market

User queries regarding the intersection of Artificial Intelligence (AI) and industrial inkjet printheads primarily revolve around enhancing operational efficiency, predictive quality control, and automating complex printing processes. Common themes include how AI algorithms can optimize printhead firing patterns to compensate for nozzle outages (print quality compensation), predict component failure before it occurs (predictive maintenance), and dynamically adjust ink chemistry or printing parameters based on real-time substrate analysis. Concerns often center on the computational cost and the necessity for robust data infrastructure to support machine learning models capable of handling the massive data streams generated by high-frequency industrial printheads, seeking validation on whether AI integration truly translates into tangible ROI improvements for end-users facing thin operating margins.

The deployment of AI is transforming the maintenance and operational lifespan of industrial printheads, moving beyond scheduled service into highly personalized maintenance regimes. AI-driven vision systems are increasingly used to monitor jetting performance at microsecond intervals, identifying slight deviations in drop velocity or trajectory caused by temperature fluctuations or ink buildup. This capability minimizes print defects, drastically reducing material waste, and maximizing the effective utilization of expensive printhead arrays. Furthermore, AI facilitates closed-loop control systems where the print outcome is instantaneously measured and the printhead’s parameters—such as voltage or waveform—are adjusted autonomously, ensuring color consistency and deposition accuracy across long print runs, a critical feature for demanding sectors like automotive or aerospace component manufacturing.

The integration of AI is not limited to performance optimization; it also revolutionizes the development cycle of new inkjet applications. Machine learning can rapidly analyze the effectiveness of novel ink formulations interacting with various printhead types and substrates, dramatically shortening the time required for material qualification and system calibration. This acceleration is particularly important in functional and 3D printing, where the relationship between material properties (viscosity, surface tension) and jetting behavior is highly complex. Consequently, the adoption of AI-enabled diagnostic tools is becoming a significant competitive differentiator for printhead manufacturers, providing superior uptime guarantees and enhanced system intelligence to their industrial clients.

- AI-powered Predictive Maintenance: Forecasting printhead lifespan and scheduling preemptive repairs based on real-time sensor data, maximizing uptime.

- Real-time Quality Control: Utilizing machine vision and deep learning to identify and compensate for nozzle failures or jetting defects instantly during the printing process.

- Dynamic Parameter Optimization: Automated adjustment of waveform, voltage, and temperature based on environmental conditions and substrate variations to ensure consistent drop size and placement accuracy (AEO/GEO optimization).

- Ink Formulation Intelligence: AI analyzing high-dimensional data from experimental ink-jetting trials to speed up the development of new functional inks.

- Automated Workflow Integration: Seamless incorporation of printing data into manufacturing execution systems (MES) for holistic production management and reporting.

DRO & Impact Forces Of Industrial Inkjet Printheads Market

The Industrial Inkjet Printheads Market is propelled by powerful market dynamics, notably the escalating industrial requirement for mass customization and efficient short-run production, contrasted by significant technical and cost-related restraints. Key drivers include the proven ability of digital inkjet systems to provide high-speed, variable data printing, which is indispensable for modern logistics, security, and packaging sectors. Opportunities arise primarily from the convergence of inkjet technology with rapidly expanding fields like 3D printing, bioprinting, and flexible electronics manufacturing, opening entirely new avenues beyond traditional graphics applications. These dynamics collectively create strong impact forces pushing manufacturers to enhance printhead durability, resolution, and fluid compatibility, while simultaneously attempting to mitigate the complexity and capital expenditure associated with system integration and maintenance.

Significant restraints challenging market proliferation include the substantial initial capital investment required for establishing high-throughput industrial inkjet lines, which can be prohibitive for Small and Medium Enterprises (SMEs). Furthermore, the high technical expertise required for managing system integration, waveform development, and advanced ink chemistry maintenance poses a barrier to entry. Another crucial restraint involves the ongoing reliance on specific ink types that may be chemically aggressive or require specialized curing processes, thereby limiting the universal applicability of certain printhead models. The proprietary nature of waveform optimization and drive electronics often locks end-users into single-source solutions, complicating the transition between suppliers or system upgrades.

However, the market is rich with opportunities, particularly in the rapidly evolving field of functional printing, where inkjet technology’s precise deposition capabilities are unmatched. Developing printheads capable of handling high-viscosity materials and high-temperature environments will unlock new possibilities in metal deposition and advanced semiconductor manufacturing. The growing adoption of sustainable manufacturing practices globally creates an opportunity for inkjet, as it inherently minimizes material waste compared to subtractive or analog processes. Furthermore, ongoing research into MEMS-based printhead architectures promises to further reduce costs, increase nozzle density, and enhance reliability, making digital industrial solutions more accessible across diverse industrial landscapes and accelerating the pace of digital transformation across the globe.

- Drivers: Demand for high-speed, variable data printing; growth of digital textile and ceramic decoration; technological advances enabling smaller drop sizes and higher firing frequencies; shift towards on-demand and customized manufacturing.

- Restraints: High initial investment and operational complexity; reliance on specific ink chemistries; technical challenges in handling highly viscous or particulate-loaded functional fluids; rapid obsolescence of drive electronics and software interfaces.

- Opportunity: Expansion into high-growth areas like 3D printing (additive manufacturing), bioprinting, and printed electronics; development of multi-pass and single-pass system integration solutions; leveraging AI for predictive maintenance and quality assurance.

- Impact Forces: Intense competitive pressure forcing lower cost-per-print; strict quality requirements in electronics and automotive sectors; regulatory pressure driving sustainable, low-waste printing solutions; rapid pace of MEMS technology development.

Segmentation Analysis

The Industrial Inkjet Printheads Market is segmented comprehensively based on key structural and functional parameters, including technology (Piezoelectric and Thermal), application (Ceramics, Textiles, Packaging, Functional Printing, Graphics), and component type (Single-Pass and Multi-Pass). This structure allows for precise market sizing and strategic analysis tailored to specific industrial requirements. The technology segmentation is vital as piezoelectric printheads dominate industrial use due to their superior material compatibility and non-thermal operation, allowing them to handle a wider array of specialty inks necessary for industrial functional printing, whereas thermal printheads, while cheaper, are generally limited to lower viscosity fluids.

The application segmentation reveals the primary drivers of current and future demand. The packaging and labeling segment represents a massive volume driver, propelled by the need for personalized packaging and regulatory coding. Conversely, the functional printing segment, encompassing applications like OLED display manufacturing and pharmaceutical dosage printing, represents the highest growth potential, despite currently holding a smaller market share, due to the critical need for precise material deposition that only industrial inkjet can provide. Analyzing these segments is essential for stakeholders to allocate resources toward the most promising high-value growth sectors and tailor product development efforts accordingly.

Furthermore, understanding the component segmentation—Single-Pass versus Multi-Pass—is crucial for assessing capital expenditure and production throughput. Single-Pass systems, where the printhead array spans the width of the substrate, offer the highest speed and efficiency necessary for high-volume markets like corrugated packaging and ceramics, commanding a premium price point. Multi-Pass systems, typically used in large-format graphics and niche textile production, offer greater flexibility and lower initial cost but are generally slower, appealing to markets where design versatility outweighs sheer throughput volume.

- By Technology:

- Piezoelectric Inkjet Printheads

- Thermal Inkjet Printheads (TIJ)

- By Application:

- Textile Printing (DTG, Digital Fabric)

- Packaging & Labeling (Corrugated, Flexible Packaging)

- Ceramic Printing (Tile Decoration)

- Functional Printing (Printed Electronics, Bio-printing, 3D Additive Manufacturing)

- Graphics & Signage (Wide Format, Grand Format)

- Coding & Marking

- By Component/System Type:

- Single-Pass Systems

- Multi-Pass Systems

- By Substrate Compatibility:

- Porous Substrates (Paper, Textiles)

- Non-Porous Substrates (Glass, Metal, Plastic)

Value Chain Analysis For Industrial Inkjet Printheads Market

The industrial inkjet printhead value chain is characterized by high technological specialization and interdependence across distinct tiers, starting from advanced material science and culminating in complex system integration at the end-user site. The upstream segment is dominated by specialized material suppliers, specifically manufacturers of piezoelectric ceramics (PZT), MEMS components, and specialized semiconductor drive electronics. These foundational components dictate the fundamental performance characteristics—such as drop volume stability and firing frequency—of the final printhead product. Printhead manufacturers (OEMs) focus on designing the complex jetting architecture, waveform optimization, and manufacturing highly precise nozzle plates, requiring significant investment in cleanroom fabrication facilities and proprietary intellectual property, creating substantial barriers to entry.

The midstream of the value chain involves the crucial role of system integrators and equipment manufacturers (OEs), who purchase the bare printheads and integrate them into complete industrial printing machines (e.g., textile printers, ceramic decoration machines, coding systems). This integration process is complex, involving the development of custom ink supply systems, sophisticated motion control, and proprietary software interfaces tailored to the specific application environment. Distribution channels are typically indirect, relying heavily on a global network of specialized distributors and value-added resellers (VARs) who provide localized sales, technical support, and critical ongoing maintenance services. Direct sales channels are reserved primarily for large, strategic OEM partnerships or highly customized functional printing projects.

The downstream segment consists of the diverse industrial end-users, ranging from large multinational packaging converters and textile mills to niche high-tech manufacturers involved in micro-electronics. The printhead’s performance directly impacts the end-user’s operational efficiency, quality output, and profitability. The high cost and sensitivity of the printheads make service, support, and continuous supply of compatible, certified ink essential post-sale activities. Therefore, the long-term success of printhead manufacturers hinges on establishing robust service networks and strong alliances with ink suppliers to ensure optimal functionality and longevity of the integrated printing systems.

Industrial Inkjet Printheads Market Potential Customers

Potential customers for industrial inkjet printheads are diverse, spanning multiple high-volume and high-precision manufacturing sectors where digital deposition is replacing traditional analog methods. The largest and most established customer segment resides within the packaging industry, including manufacturers of corrugated cardboard, flexible films, and pharmaceutical packaging, driven by the necessity for variable data printing (VDP), track-and-trace serialization, and mass customization of promotional materials. These customers prioritize high throughput (single-pass technology), durability, and the ability to print on non-porous surfaces using robust UV-curable or solvent-based inks, seeking to reduce lead times and inventory costs associated with pre-printed materials.

Another significant customer base is found in the textile and garment manufacturing industry, particularly those involved in direct-to-garment (DTG) and high-fashion digital fabric printing. These clients are focused on color gamut, resolution, and the ability to handle reactive or disperse inks compatible with natural fibers. The shift towards sustainable, localized, and on-demand apparel production directly increases the demand for highly reliable industrial textile printheads. Similarly, the global ceramic tile manufacturing sector remains a core customer, utilizing inkjet for decorative printing that provides photorealistic images and structured surfaces, demanding printheads that can reliably jet highly abrasive frit-based inks over long periods of continuous operation.

Furthermore, emerging and high-value potential customers are increasingly concentrated in the functional printing domain. This includes manufacturers of flexible electronics (e.g., RFID tags, smart sensors), printed circuitry, solar cells, and advanced medical diagnostics. These customers require printheads capable of sub-picoliter drop sizes and precise temperature control to accurately deposit high-value functional materials (conductive pastes, polymers, biological solutions). For these highly specialized applications, the criteria for printhead selection prioritize deposition accuracy, material compatibility, and extreme reliability over sheer speed, representing a lucrative, high-margin niche for advanced printhead technology providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FUJIFILM Dimatix, Konica Minolta, Seiko Epson Corporation, Xaar plc, Kyocera Corporation, Ricoh Company, Ltd., Trident International, Inc., Brother Industries, Ltd., Toshiba TEC Corporation, SII Printek, Microdrop Technologies GmbH, MEMJET, HP Inc., Pixdro, Sensient Technologies Corporation, Agfa-Gevaert N.V., Oce Technologies B.V. (Canon), Durst Phototechnik AG, Markem-Imaje (Dover Corporation), Engineered Printing Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Inkjet Printheads Market Key Technology Landscape

The industrial inkjet printhead market is defined by two primary competing technologies: Piezoelectric and Thermal Inkjet (TIJ). Piezoelectric technology, which utilizes ceramic transducers (PZT) that deform under an electric charge to eject droplets, is the cornerstone of high-performance industrial applications. Its key advantage lies in its non-thermal operation, allowing it to reliably jet a vast array of fluid types, including aggressive solvents, highly pigmented ceramics inks, and viscous functional materials, without altering the ink's chemical composition. Modern piezoelectric printheads are increasingly leveraging advanced MEMS fabrication techniques to achieve higher nozzle density, superior uniformity, and significantly enhanced firing frequencies, leading to faster single-pass printing capabilities necessary for industrial scale. Waveform engineering—the precise control of the electrical pulse driving the PZT material—is a crucial technological expertise unique to leading printhead manufacturers, determining the printhead's ability to maintain stable drop velocity and size across varying operational conditions.

In contrast, Thermal Inkjet (TIJ) technology relies on heating resistors to rapidly vaporize a small portion of ink, forming a bubble that forces a droplet out of the nozzle. TIJ systems are characterized by their low cost, disposable nature, high nozzle density, and ease of use, making them highly effective in coding, marking, and specialized office automation. However, TIJ is generally restricted to low-viscosity, water-based or low-solvent inks, as the heating element can degrade or alter heat-sensitive industrial fluids. Despite this limitation, recent advancements are pushing TIJ into light industrial applications, specifically high-speed packaging and pharmaceutical coding, where the requirement for temporary, precise marking outweighs the need for broad material compatibility.

A critical evolutionary path in the technology landscape is the move towards Micro-Electro-Mechanical Systems (MEMS) printhead fabrication. MEMS technology allows for the integration of miniature mechanical and electrical components onto a silicon wafer, leading to printheads that are smaller, more precise, and more cost-effective to manufacture at high volumes. MEMS is being applied to both Piezoelectric and TIJ architectures, enabling the production of smaller drop sizes (down to 1 picoliter) and vastly increased nozzle counts, thereby enhancing image resolution and overall throughput. Furthermore, the integration of on-board diagnostics and temperature sensing directly into the MEMS silicon chip is facilitating the development of smart printheads capable of self-monitoring and maintenance, which is essential for maximizing uptime in demanding 24/7 industrial environments and ensuring the highest levels of deposition accuracy for functional printing applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region, primarily driven by large-scale manufacturing expansion in China, India, and Southeast Asian nations. The region's robust textile industry (e.g., Bangladesh, Vietnam) and high demand for ceramic tiles (e.g., China, India) ensure massive deployment of high-throughput industrial inkjet machinery. Government initiatives supporting digitalization and automation in manufacturing further propel the adoption of high-speed single-pass systems in packaging and corrugated board printing. Key factors include competitive manufacturing costs and a large base of OEM system integrators, making it a critical hub for production and consumption.

- Europe: Europe represents a mature market characterized by high technological sophistication and a focus on premium, niche applications. Countries like Germany, Italy, and the UK lead in advanced industrial applications such as specialized labeling, security printing, and digital textile finishing, emphasizing sustainable and high-resolution output. The region is a major center for printhead R&D, particularly in integrating inkjet technology with flexible electronics and specialized 3D printing applications (e.g., medical devices). Demand is driven by strict quality standards and a willingness to invest in superior, high-precision piezoelectric systems.

- North America: North America is characterized by high investment in R&D and rapid adoption of innovative applications, particularly in functional printing, bio-printing, and high-value packaging customization. The market emphasizes high-mix, low-volume production runs and quick turnaround times, boosting the demand for flexible, high-precision printheads. The presence of major semiconductor and aerospace manufacturers also fuels the need for extremely precise material deposition technology. Integration of AI and automated monitoring systems is highly advanced in this region to optimize operational costs and efficiency.

- Latin America (LATAM): LATAM is an emerging market with steady growth, primarily focused on traditional industrial applications like wide-format graphics, signage, and basic packaging. Brazil and Mexico are the largest markets, driven by urbanization and the corresponding increase in demand for digitally decorated building materials and consumer goods. While technology adoption lags behind APAC and Europe, the region is beginning to see increased investment in digital textile and ceramics capabilities to modernize local manufacturing.

- Middle East and Africa (MEA): MEA is a growing but highly localized market. Growth is particularly strong in the UAE and Saudi Arabia due to infrastructure development projects requiring advanced decorative materials (ceramics, glass) and in key African nations adopting digital solutions for coding and marking in the fast-moving consumer goods (FMCG) sector. Market dynamics are heavily influenced by global technology imports, with a high demand for cost-effective and robust printhead solutions capable of handling challenging environmental conditions (e.g., heat, dust).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Inkjet Printheads Market.- FUJIFILM Dimatix

- Konica Minolta

- Seiko Epson Corporation

- Xaar plc

- Kyocera Corporation

- Ricoh Company, Ltd.

- Trident International, Inc.

- Brother Industries, Ltd.

- Toshiba TEC Corporation

- SII Printek

- Microdrop Technologies GmbH

- MEMJET

- HP Inc.

- Pixdro

- Sensient Technologies Corporation

- Agfa-Gevaert N.V.

- Oce Technologies B.V. (Canon)

- Durst Phototechnik AG

- Markem-Imaje (Dover Corporation)

- Engineered Printing Solutions

Frequently Asked Questions

Analyze common user questions about the Industrial Inkjet Printheads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Piezoelectric and Thermal Inkjet (TIJ) printheads for industrial use?

Piezoelectric printheads utilize mechanical force (PZT ceramics) to eject ink, allowing them to handle a wider range of high-viscosity, particulate-loaded, and aggressive industrial fluids (like ceramic and functional inks) without using heat. TIJ printheads use heat to vaporize ink and are typically limited to low-viscosity, water-based inks, making them suitable mainly for coding, marking, and high-speed addressing applications where cost and disposability are prioritized over material versatility and durability.

How is the growth of 3D printing impacting the demand for industrial inkjet printheads?

Industrial inkjet printheads are integral to material jetting additive manufacturing, a sub-segment of 3D printing. They enable extremely fine control over the deposition of various materials, including polymers, ceramics, and metals, building objects layer-by-layer with high resolution and multi-material capability. This functional printing application is a major growth driver, requiring specialized printheads capable of handling higher viscosity and complex material properties critical for manufacturing end-use parts.

Which application segment currently holds the largest market share for industrial inkjet printheads?

The Packaging and Labeling segment, coupled with the high-volume Ceramics Printing sector, collectively hold the largest market share. The packaging industry's transition to personalized, on-demand printing for corrugated and flexible materials, alongside the global demand for digitally decorated ceramic tiles, drives significant volume consumption of durable single-pass piezoelectric printhead arrays.

What is the role of waveform technology in optimizing industrial printhead performance?

Waveform technology involves precisely engineering the electrical pulse sequence applied to the piezoelectric actuator, which dictates how the ink droplet is formed and ejected. Optimal waveforms are proprietary and critical for ensuring stable drop velocity, preventing satellite droplets, mitigating nozzle blockage, and maintaining consistent drop volume across various ink types and operating temperatures, thereby maximizing print quality and printhead longevity in industrial environments.

What major regional trends are influencing market investments in the Industrial Inkjet Printheads sector?

Investments are heavily skewed towards the Asia Pacific region, driven by massive manufacturing scale-up, particularly in digital textile and packaging production infrastructure. Concurrently, significant R&D investments are channeled into Europe and North America, focusing on high-value applications, including biomedical printing, advanced functional electronics, and the integration of AI-enabled diagnostics for superior operational uptime and quality control in specialized industrial workflows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager