Industrial Interlock Switch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434013 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Interlock Switch Market Size

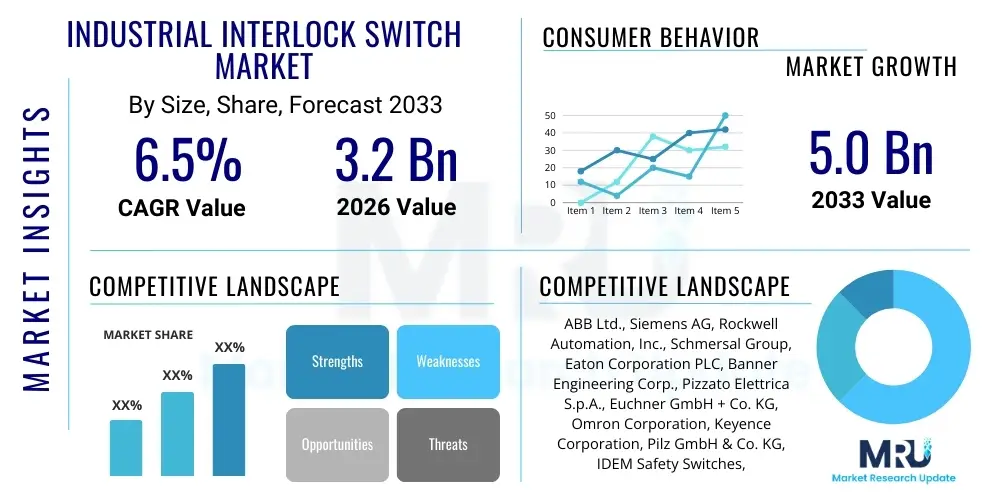

The Industrial Interlock Switch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $3.2 Billion in 2026 and is projected to reach $5.0 Billion by the end of the forecast period in 2033.

Industrial Interlock Switch Market introduction

The Industrial Interlock Switch Market encompasses safety devices designed to prevent machinery from operating under unsafe conditions, primarily by ensuring guards and protective doors are securely closed before power is engaged or preventing unauthorized access to hazardous areas while machinery is running. These critical components are foundational to industrial safety protocols, mandated by stringent international standards such as ISO 14119 and OSHA regulations. Interlock switches range from mechanical and electromechanical types to advanced non-contact solutions utilizing magnetic or RFID technology, catering to varying levels of hazard and operational robustness required across different industrial environments. The core function is to maintain operational integrity and protect personnel from catastrophic injuries resulting from equipment misuse or failure.

The primary applications of industrial interlock switches span across high-speed manufacturing, packaging lines, robotics, CNC machining centers, and heavy process industries such as chemical and pharmaceuticals. Benefits derived from deploying these safety mechanisms include significantly reduced downtime due to safety-related incidents, compliance with mandatory safety certifications, and substantial long-term cost savings associated with avoiding injury claims and equipment damage. Furthermore, modern smart interlocks contribute to operational efficiency by providing diagnostic data that aids in predictive maintenance strategies, shifting their role from purely passive safety components to integrated elements of the smart factory ecosystem. The inherent reliability and robustness of these devices make them indispensable in automated and high-risk environments.

Driving factors propelling market growth include the global trend toward automation and the increasing deployment of sophisticated robotics systems, which necessitate advanced safety mechanisms capable of handling complex operational scenarios and rapid emergency stops. Mandatory regulatory enforcement, particularly in rapidly industrializing economies, acts as a continuous impetus for adopting certified safety switches. Additionally, the technological transition towards non-contact and intelligent interlock switches, featuring integrated diagnostics and connectivity capabilities (such as IO-Link), enhances reliability and ease of integration into Programmable Logic Controller (PLC) systems, fostering a strong replacement and upgrade cycle across established industrial sectors globally.

Industrial Interlock Switch Market Executive Summary

The Industrial Interlock Switch Market is characterized by robust growth driven by accelerating global factory automation initiatives, coupled with increasingly stringent regulatory mandates emphasizing worker safety. Key business trends include the shift toward smart interlocks equipped with sensor fusion, offering comprehensive diagnostic feedback crucial for Industry 4.0 implementations. Manufacturers are focusing on miniaturization, enhanced durability (IP67/IP69K ratings), and seamless integration capabilities to meet the demands of flexible manufacturing systems. The market landscape is moderately consolidated, with major global automation providers leveraging their extensive distribution networks and comprehensive safety portfolios to gain competitive advantages, while specialized niche players focus on developing highly customized, application-specific non-contact solutions.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market segment, fueled primarily by massive investments in manufacturing expansion and modernization across China, India, and Southeast Asia. The adoption rate in these regions is accelerating due to governmental pressure to align local safety standards with global norms. North America and Europe, representing mature markets, continue to drive demand through replacement cycles, technological upgrades focusing on functional safety standards (up to SIL 3 and PLe), and the extensive adoption of collaborative robotics, which requires highly reliable and precise interlocking mechanisms for safe human-robot interaction zones.

Segment trends reveal that non-contact interlock switches, particularly those based on RFID and magnetic principles, are experiencing superior growth compared to traditional mechanical and electromechanical types, owing to their increased resistance to tampering, enhanced reliability in harsh environments, and reduced maintenance requirements. The application segment is dominated by the manufacturing and automotive industries, which require high-frequency switching and reliable gate monitoring. Furthermore, the increasing complexity of safety circuits is driving the demand for integrated safety systems rather than standalone components, prompting interlock switch manufacturers to offer packaged solutions that include safety relays, controllers, and comprehensive software tools for configuration and monitoring, addressing complex machine safety architectures.

AI Impact Analysis on Industrial Interlock Switch Market

Common user questions regarding AI's impact on the Industrial Interlock Switch Market frequently revolve around how AI can enhance the reliability and predictive capabilities of safety systems, whether AI-driven diagnostics will reduce maintenance costs, and concerns regarding the cybersecurity implications of connecting safety devices to network systems. Users are keen to understand if AI can move interlocks beyond simple on/off state monitoring to preemptively identify potential component failure or safety circuit degradation, thereby improving overall operational safety and uptime. There is also significant interest in the use of machine learning to analyze historical safety data generated by smart interlocks to optimize maintenance schedules and potentially redesign safer factory layouts, making safety a dynamic, data-driven process rather than a static compliance measure.

The primary influence of Artificial Intelligence on the industrial interlock market is centered on transforming safety mechanisms from reactive devices into predictive assets. AI algorithms can process continuous telemetry data streams—including actuation frequency, vibration data, temperature variances, and electrical resistance—collected by advanced smart interlocks. By analyzing these multi-variable data sets, machine learning models can detect subtle anomalies indicative of impending mechanical wear, sensor drift, or wiring degradation long before a catastrophic failure or unauthorized machine start-up occurs. This capability enables true condition-based monitoring for safety components, shifting safety management from time-based maintenance to predictive intervention, significantly enhancing the reliability integrity of the entire safety loop.

Furthermore, AI is instrumental in streamlining compliance and auditing processes. Interlock switches integrated into smart factory networks generate vast quantities of operational data detailing every open/close cycle, bypass attempt, or fault condition. AI systems can automatically categorize, analyze, and generate compliance reports, verifying that operational practices consistently adhere to relevant safety standards (e.g., ISO 13849 Performance Level). This automated verification drastically reduces the manual effort associated with safety audits and ensures instantaneous identification of procedural non-compliance or equipment tampering. However, the introduction of AI necessitates rigorous adherence to functional safety standards (like IEC 61508) within the AI deployment framework itself, ensuring that the intelligent diagnostic layer does not compromise the deterministic operation of the core safety interlock function.

- AI enables predictive failure analysis based on operational telemetry from smart interlocks.

- Machine learning algorithms optimize safety maintenance schedules, reducing unplanned downtime.

- AI facilitates automated compliance reporting and audit verification for safety systems.

- Integration of AI improves tampering detection capabilities by analyzing usage patterns.

- AI is utilized for sophisticated remote diagnostics and fault isolation within complex safety circuits.

- Enhanced cybersecurity protocols are necessary to protect AI-connected interlocks from network threats.

DRO & Impact Forces Of Industrial Interlock Switch Market

The Industrial Interlock Switch Market is powerfully shaped by converging forces, primarily driven by mandatory global safety regulations and the exponential adoption of automation technologies. Drivers encompass the strict adherence to machine safety directives (such as the Machinery Directive 2006/42/EC in Europe and OSHA mandates in the U.S.), coupled with the increasing complexity of automated production lines which demand high-integrity safety components. Restraints include the significant initial investment costs associated with upgrading legacy equipment to modern, intelligent safety systems, particularly for Small and Medium-sized Enterprises (SMEs), and ongoing challenges related to false tripping and complex troubleshooting, especially with highly sensitive non-contact switches. Opportunities lie in the burgeoning demand for fail-safe, highly certified components in high-risk sectors like oil & gas and nuclear power, and the development of standardized, plug-and-play IO-Link compatible safety devices that simplify integration.

The primary impact force remains regulatory pressure; as standards continuously evolve to address new technologies like collaborative robotics, the market is consistently compelled toward adopting higher Performance Level (PL) and Safety Integrity Level (SIL) rated switches. The second major force is the pervasive trend of Industry 4.0, which mandates that all components, including safety switches, must possess diagnostic capabilities and network connectivity. This technological shift is accelerating the obsolescence of purely mechanical switches, pushing demand toward sophisticated RFID and coded magnetic devices that offer both security against bypassing and valuable operational data feedback. This transition ensures that the safety system contributes positively to overall equipment effectiveness (OEE), rather than merely acting as a regulatory hurdle.

Furthermore, the competitive landscape is intensely focused on innovation surrounding anti-tampering features, as bypassing safety guards remains a common issue in poorly managed operational environments. Manufacturers are responding by developing interlocks with unique coding capabilities and robust physical designs that resist environmental damage and deliberate manipulation. The availability of skilled labor capable of installing, commissioning, and maintaining these complex integrated safety systems presents an external restraining force. Addressing this restraint involves simplifying system architecture and providing extensive training and software support, turning complex safety installation into a more accessible offering, thereby unlocking new market potential in regions struggling with technical expertise scarcity.

Segmentation Analysis

The Industrial Interlock Switch Market segmentation is crucial for understanding specific product adoption trends and targeted end-user requirements. The market is primarily segmented based on the product type, which defines the underlying technology used; the application, which dictates the environmental and operational demands; and the safety level or compliance rating, determining the integrity and reliability required for hazardous operations. Traditional segmentation includes mechanical (tongue/key) interlocks and non-contact types (magnetic, RFID), with a pronounced trend favoring the latter due to superior reliability and immunity to misalignment and contamination. Regional segmentation highlights distinct adoption patterns, with highly regulated regions prioritizing high-PL systems and developing regions focusing on foundational mechanical safety compliance.

The dominant end-user segments are discrete manufacturing sectors, notably automotive and robotics, where high operational frequency and complex guard arrangements necessitate highly reliable, tamper-resistant switches. Segmentation by connectivity—distinguishing between hardwired safety relays and networked solutions (e.g., using protocols like EtherNet/IP Safety or PROFIsafe)—is becoming increasingly important, reflecting the move toward decentralized intelligence and faster fault diagnostics in large-scale automated facilities. Analyzing these segments provides strategic insights into investment opportunities, highlighting the rapid expansion potential within the specialized safety-rated switches segment driven by the integration into decentralized safety control systems.

- By Type:

- Mechanical Interlock Switches (Tongue/Key Operated, Hinge Operated)

- Electromechanical Interlock Switches

- Non-Contact Interlock Switches (Magnetic, RFID Coded, Electronic)

- By Safety Level:

- Safety Integrity Level (SIL) Rated (SIL 1, SIL 2, SIL 3)

- Performance Level (PL) Rated (PLa, PLb, PLc, PLd, PLe)

- By Application:

- Guard Door and Gate Monitoring

- Access Control (Trapped Key Interlocks)

- Position and Limit Switching

- By End-Use Industry:

- Automotive and Transportation

- Food and Beverage

- Pharmaceutical and Chemical

- Packaging and Logistics

- Robotics and Assembly

- Metals and Mining

Value Chain Analysis For Industrial Interlock Switch Market

The value chain for the Industrial Interlock Switch Market begins with the upstream suppliers providing essential raw materials and specialized electronic components. This includes precision metal alloys (stainless steel, heavy-duty aluminum) for housing, high-durability polymers for non-contact switch casings, specialized magnetic materials (for magnetic switches), and highly reliable semiconductor chips and RFID transponders for smart interlocks. The quality and sourcing of these upstream materials significantly influence the interlock switch's robustness, operational lifetime, and ability to achieve high IP ratings (ingress protection). Supply chain resilience, especially for microelectronic components required for networked safety switches, is a critical factor influencing manufacturing costs and lead times for major OEMs.

The core manufacturing stage involves high-precision assembly, testing, and certification. Manufacturers must adhere to rigorous quality control processes to ensure that switches meet global safety standards (UL, CSA, CE, TUV), often involving independent third-party assessments for PLe/SIL 3 ratings. Following production, the distribution channel is highly reliant on specialized industrial distributors and system integrators. Direct distribution is common for large-volume OEM agreements, particularly with major machine builders (OEMs) who integrate the switches into new equipment. Indirect channels leverage extensive networks of local distributors who provide inventory, technical support, and rapid supply to maintenance, repair, and operations (MRO) end-users requiring replacement parts or localized safety upgrades.

Downstream analysis focuses on installation, commissioning, and aftermarket services. System integrators and authorized distributors play a crucial role in designing complex safety systems, ensuring the interlocks are correctly integrated with safety relays, PLCs, and safety controllers. The after-sales market is sustained by the need for spare parts, mandatory safety system recalibration, and software updates for smart interlocks. The increasing complexity of safety circuits is driving demand for value-added services, including remote diagnostics and training on functional safety protocols. This emphasizes the shift toward a service-oriented approach, where the continuous reliability of the safety system, supported by expert integration, drives long-term customer loyalty.

Industrial Interlock Switch Market Potential Customers

Potential customers for the Industrial Interlock Switch Market encompass any sector operating automated machinery or hazardous equipment requiring controlled access and guaranteed machine cessation upon guard opening. The largest and most influential buyers are major machinery builders (Original Equipment Manufacturers or OEMs) that incorporate interlock switches directly into the design of new production lines, robotics cells, packaging machines, and CNC equipment, seeking highly certified components that enhance their final product's safety compliance and marketability. These buyers demand switches that offer high performance, compact form factors, and seamless digital integration (e.g., IO-Link compatibility).

The second major category involves Maintenance, Repair, and Operations (MRO) buyers and end-users across established industrial facilities, including automotive assembly plants, large-scale food processing facilities, and chemical refineries. These customers purchase switches for replacement, retrofit, or compliance upgrade projects aimed at modernizing older equipment to meet current safety standards. Their purchasing decisions are heavily influenced by product durability, ease of installation (to minimize production disruption), and localized availability through industrial distributors. The increasing focus on human-robot collaboration in manufacturing also positions collaborative robotics manufacturers as critical high-growth potential customers, requiring specialized, instantaneous reaction safety switches.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.2 Billion |

| Market Forecast in 2033 | $5.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Rockwell Automation, Inc., Schmersal Group, Eaton Corporation PLC, Banner Engineering Corp., Pizzato Elettrica S.p.A., Euchner GmbH + Co. KG, Omron Corporation, Keyence Corporation, Pilz GmbH & Co. KG, IDEM Safety Switches, Inc., Jokab Safety (A part of ABB), Telemecanique Sensors, Schneider Electric SE, Honeywell International Inc., Dold & Söhne GmbH & Co. KG, Fortress Interlocks, Inc., STI Safety Technology International, SICK AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Interlock Switch Market Key Technology Landscape

The technological evolution of the Industrial Interlock Switch Market is defined by the integration of digital capabilities into traditional safety mechanisms to enhance reliability, tamper resistance, and diagnostic functionality. A dominant trend is the widespread adoption of non-contact technologies, specifically high-coded RFID interlock switches. These switches utilize uniquely encoded tags that must match the sensor unit, offering significantly higher security against deliberate bypassing compared to standard magnetic or mechanical switches. This advanced coding capability allows these systems to achieve the highest possible safety ratings (PLe/SIL 3), making them essential for high-risk applications. Furthermore, miniaturization is a key focus, allowing these robust safety devices to be integrated discreetly into increasingly compact and visually oriented machine designs without compromising protective integrity.

Another crucial technological development involves integrated diagnostics via industrial communication protocols, most notably IO-Link. Smart interlocks equipped with IO-Link provide continuous, bidirectional communication regarding the switch status, temperature, fault codes, and actuation counts directly to the PLC or central control system. This digital connection moves beyond simple safety I/O, facilitating predictive maintenance alerts and precise fault localization, drastically reducing the time required to diagnose safety circuit faults. This convergence of safety and standard industrial communication is essential for the seamless operation of smart factories, enabling real-time condition monitoring of critical safety components, ensuring the safety layer is an active part of the operational intelligence framework.

The emergence of trapped key interlocks incorporating electronic monitoring features represents a fusion of mechanical robustness and digital intelligence, primarily serving complex isolation and access procedures in hazardous environments (e.g., valve interlocking in chemical processing). Additionally, advanced materials science is contributing to the landscape, with manufacturers using robust stainless steel and specialized thermoplastics capable of withstanding extreme temperatures, corrosive chemicals, and high-pressure washdown (e.g., IP69K rating required in the Food and Beverage industry). Future technology directions include the exploration of wireless safety communications, though widespread adoption is currently limited by the stringent latency and deterministic requirements of high-integrity functional safety standards.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by massive government-backed initiatives for industrial modernization (e.g., Made in China 2025). The regional demand is fueled by the establishment of new manufacturing hubs, high adoption rates of robotics in automotive and electronics production, and increasing regulatory pressure to comply with international safety standards, leading to substantial investment in retrofitting and new plant construction.

- North America: Characterized by high adoption of advanced, highly-rated interlock systems (PLe, SIL 3) due to stringent OSHA enforcement and high labor costs, which incentivize automation coupled with robust safety measures. The market is mature, emphasizing technological upgrades, smart interlocks with predictive diagnostics, and safety solutions tailored for complex robotic applications and aerospace manufacturing.

- Europe: A dominant force in establishing global safety standards (Machinery Directive, EN ISO 14119). The market is mature, saturated with highly compliant, premium-priced safety components. Key drivers include sustained demand for non-contact switches, mandatory compliance with the latest European functional safety norms, and a strong focus on high-quality, long-lifecycle products used extensively in complex machinery building and high-precision manufacturing across Germany and Italy.

- Latin America (LATAM): Growth is steady but uneven, concentrated in industrialized nations like Brazil and Mexico. The market shows strong potential for basic mechanical and electromechanical switches, driven by localized manufacturing expansion and increasing basic safety regulation compliance, though the uptake of high-end smart interlocks is slower compared to North America and Europe.

- Middle East and Africa (MEA): Growth is primarily sector-specific, dominated by heavy industry, particularly Oil & Gas, Petrochemicals, and Mining. Demand centers on robust, explosion-proof (ATEX/IECEx certified) interlocks and trapped key systems for access control and isolation procedures in harsh and potentially explosive environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Interlock Switch Market.- ABB Ltd.

- Siemens AG

- Rockwell Automation, Inc.

- Schmersal Group

- Eaton Corporation PLC

- Banner Engineering Corp.

- Pizzato Elettrica S.p.A.

- Euchner GmbH + Co. KG

- Omron Corporation

- Keyence Corporation

- Pilz GmbH & Co. KG

- IDEM Safety Switches, Inc.

- Telemecanique Sensors

- Schneider Electric SE

- Honeywell International Inc.

- Dold & Söhne GmbH & Co. KG

- Fortress Interlocks, Inc.

- STI Safety Technology International

- SICK AG

- Wieland Electric GmbH

Frequently Asked Questions

Analyze common user questions about the Industrial Interlock Switch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and non-contact industrial interlock switches?

Mechanical interlocks rely on a physical connection (like a key or tongue) to actuate the safety circuit, making them robust but susceptible to wear and potential tampering. Non-contact switches, typically using magnetic or RFID coding, actuate without physical contact, offering greater resistance to contaminants, enhanced security against bypassing, and significantly longer operational life with reduced maintenance.

How does the integration of IO-Link technology benefit industrial interlock systems?

IO-Link integration transforms the interlock from a simple binary safety device into a smart component. It allows for the transmission of detailed diagnostic data, such as device temperature, operational hours, actuation count, and specific fault codes, directly to the central control system, enabling predictive maintenance and simplifying rapid troubleshooting, thereby boosting Overall Equipment Effectiveness (OEE).

What are the key safety standards governing the Industrial Interlock Switch Market?

The market is primarily governed by international standards such as ISO 14119 (Interlocking Devices), ISO 13849 (Performance Level, PL), and IEC 62061 (Safety Integrity Level, SIL). Compliance with high performance levels (PLe) and high integrity levels (SIL 3) is mandatory for applications involving severe hazards, especially in automated robotic cells and heavy machinery.

Which industry segment drives the highest demand for advanced safety interlock switches?

The Automotive and Robotics manufacturing sectors drive the highest demand for advanced safety interlock switches. These industries operate high-speed, automated production lines with frequent access requirements, necessitating highly reliable, high-coded non-contact switches capable of meeting stringent PLe safety ratings and integrating seamlessly into complex safety networks.

What is a Trapped Key Interlock system and when is it typically used?

A Trapped Key Interlock system is a sequential safety mechanism that uses uniquely coded mechanical keys to ensure a predetermined sequence of operation is followed, guaranteeing safety before accessing hazardous areas. It is typically used for complex isolation procedures in process industries like oil and gas, petrochemicals, and power generation, where absolute machine isolation is required before maintenance access is granted.

How is cybersecurity relevant to modern industrial interlock switches?

Cybersecurity is critical for modern smart interlocks connected to industrial networks (Industry 4.0). Any malicious or unintended network access could compromise the integrity of the safety circuit, leading to unsafe operation or unauthorized bypassing. Manufacturers must ensure switches and integrated communication modules adhere to robust industrial cybersecurity standards to maintain functional safety integrity.

What are the primary factors restraining the market growth in developing economies?

Restraints in developing economies include higher initial cost of modern non-contact and smart switches compared to legacy mechanical systems, limited capital expenditure for safety upgrades in small and medium enterprises (SMEs), and a shortage of technical expertise required for the complex installation and maintenance of high-integrity networked safety systems.

How do IP ratings affect the selection of industrial interlock switches?

IP (Ingress Protection) ratings determine the switch's resistance to dust and liquid ingress, which is crucial for durability in specific industrial environments. For instance, switches used in food and beverage or pharmaceutical industries require high ratings like IP67 or IP69K to withstand frequent, high-pressure, high-temperature washdowns without internal component failure.

What role does the Internet of Things (IoT) play in the interlock switch market?

IoT facilitates the connectivity of smart interlocks, allowing them to report real-time status and diagnostic data over secure networks. This enables remote monitoring, centralized data aggregation for trend analysis, and seamless integration into factory-wide asset management and Supervisory Control and Data Acquisition (SCADA) systems, enhancing both safety and operational visibility.

Why is anti-tampering capability a significant focus for interlock switch manufacturers?

Anti-tampering is a major safety requirement because operators sometimes bypass safety guards to maximize production speed, leading to severe injury risks. Manufacturers are developing features like unique RFID coding, magnetic differential sensing, and robust physical designs that adhere strictly to EN ISO 14119 standards to make intentional bypassing extremely difficult or impossible.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager