Industrial Lead Acid Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433821 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Lead Acid Battery Market Size

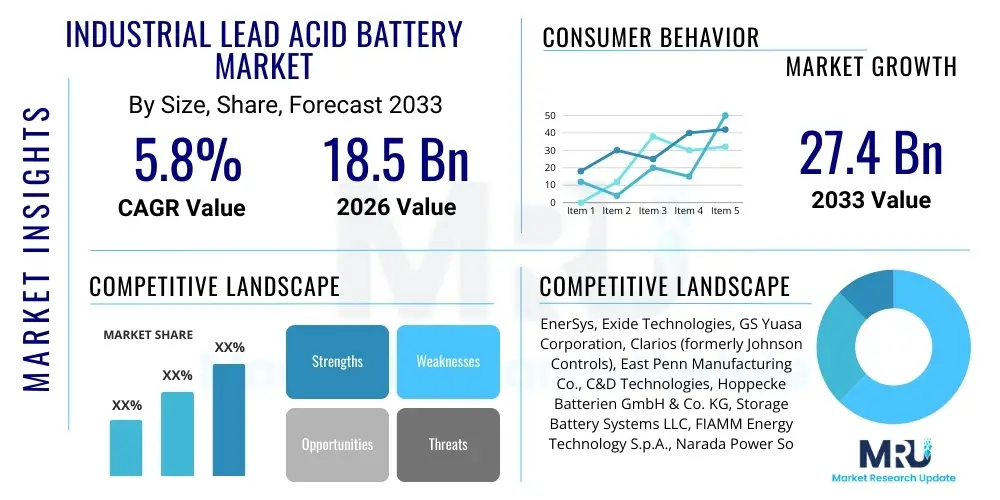

The Industrial Lead Acid Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $27.4 Billion by the end of the forecast period in 2033.

Industrial Lead Acid Battery Market introduction

The Industrial Lead Acid Battery Market encompasses a wide range of electrochemical energy storage solutions specifically designed for heavy-duty, commercial, and utility applications, distinguishing them from standard automotive batteries. These batteries utilize a chemical reaction between lead plates and sulfuric acid electrolyte to store and discharge energy. They are characterized by robust construction, reliable performance, proven cost-effectiveness, and established recycling infrastructure. Key product categories include flooded (wet cell) batteries, which require regular maintenance, and Valve Regulated Lead Acid (VRLA) batteries, such as Absorbed Glass Mat (AGM) and Gel batteries, which offer maintenance-free operation and enhanced safety features, particularly crucial for sensitive environments like data centers and telecommunication facilities.

Major applications of these industrial batteries span across three primary segments: motive power, standby power, and specialized applications. Motive power applications primarily include electric forklifts, pallet jacks, mining equipment, and automated guided vehicles (AGVs) used extensively in logistics, warehousing, and manufacturing. Standby power applications, which form a significant revenue stream, focus on ensuring continuity of operations during power outages, serving Uninterruptible Power Supplies (UPS) in data centers, critical infrastructure backup in hospitals, and backup power for telecommunication networks and utility switchgear. The inherent reliability and relatively low initial investment cost continue to make lead acid technology a preferred choice in these critical backup roles.

Market growth is substantially driven by the global expansion of digital infrastructure, necessitating robust backup power solutions for data centers and 5G network rollout. Furthermore, the persistent growth in global logistics and material handling industries is bolstering demand for motive power batteries, particularly in rapidly industrializing economies in the Asia Pacific region. While facing competitive pressure from emerging lithium-ion technologies, industrial lead acid batteries maintain relevance due to superior performance in specific high-temperature environments, established safety protocols, and a completely circular supply chain, offering a distinct sustainability advantage in end-of-life management.

Industrial Lead Acid Battery Market Executive Summary

The Industrial Lead Acid Battery Market is exhibiting resilient growth, underpinned primarily by the surging demand for reliable standby power solutions in the telecommunications and data center sectors globally. Despite the encroachment of lithium-ion alternatives, lead acid batteries maintain a competitive edge through their unparalleled safety record, lower acquisition cost, and superior performance characteristics in certain high-temperature and deep-cycle applications. Key business trends include focused innovation in VRLA technologies, aimed at extending cycle life and reducing maintenance requirements, and strategic investments in advanced manufacturing techniques to improve energy density slightly while maintaining cost efficiency. Manufacturers are increasingly focusing on battery monitoring systems (BMS) adapted for lead acid technology to predict failure and optimize replacement cycles, thereby enhancing overall service proposition and reducing total cost of ownership (TCO) for industrial users.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, driven by massive infrastructure spending, rapid urbanization, and the proliferation of manufacturing facilities requiring both motive and standby power. Countries like China and India are experiencing exponential growth in data consumption and logistics automation, directly translating into heightened demand for industrial batteries. North America and Europe, while representing mature markets, are characterized by stringent regulations emphasizing safety and recycling, prompting manufacturers to invest in environmentally conscious production and high-efficiency VRLA designs suitable for utility-scale backup and renewable energy integration projects. Furthermore, stable replacement cycles in mature markets contribute consistently to revenue streams, offsetting some of the slower new deployment growth seen in these regions compared to APAC.

Segment trends highlight the dominance of the Standby Application segment, particularly within the Uninterruptible Power Supply (UPS) category, which is crucial for protecting mission-critical systems. Within product types, VRLA batteries, encompassing AGM and Gel technologies, are gaining market share over traditional flooded batteries due to their sealed design, non-spillable nature, and zero-to-low maintenance requirement, aligning with modern industrial safety and operational efficiency standards. The Motive Power segment, driven by material handling equipment, is characterized by a strong push toward advanced battery management and rapid charging capabilities, although lithium-ion competition is most acute in this area. Strategic diversification into niche applications such, as railway signaling and emergency lighting, is also a key strategy adopted by market leaders to stabilize revenue streams against broader technological shifts.

AI Impact Analysis on Industrial Lead Acid Battery Market

Common user questions regarding AI's impact on the Industrial Lead Acid Battery Market center on how artificial intelligence can extend battery lifespan, optimize charging and discharging cycles, and improve predictive maintenance capabilities, particularly in large-scale installations like UPS farms or fleet motive power applications. Users are concerned about the capital investment required to integrate AI-driven Battery Management Systems (BMS) with existing lead acid infrastructure, and whether AI can truly mitigate the inherent limitations of the technology, such as sulfation and thermal runaway risks. The general expectation is that AI tools will transform lead acid battery ownership from a reactive replacement schedule to a highly proactive, data-driven maintenance regimen, preserving the cost benefits of the technology while minimizing operational downtime.

AI's primary influence is moving lead acid battery management from calendar-based maintenance to condition-based maintenance. AI algorithms analyze vast streams of operational data—including current, voltage, temperature fluctuations, and impedance readings—to establish highly accurate state-of-health (SOH) and state-of-charge (SOC) metrics. This predictive capability allows maintenance teams to intervene precisely when performance degradation begins, often through managed deep cycling or temperature regulation, thereby significantly delaying the irreversible effects of sulfation and grid corrosion. In fleet operations utilizing motive power batteries, AI optimizes charging schedules based on predicted workload and availability, preventing overcharging or excessive deep discharge, which are detrimental to cycle life.

Furthermore, AI-powered diagnostics are becoming instrumental in quality control during the manufacturing process, helping identify microscopic defects or inconsistencies in plate formation that could lead to premature failure. This application enhances the overall reliability and consistency of industrial lead acid products. While AI does not fundamentally alter the core chemistry of the battery, its integration significantly enhances the operational efficiency, safety, and longevity of the assets in the field, ensuring that lead acid solutions remain competitive against high-tech alternatives by maximizing their proven economic advantages.

- AI-driven Predictive Maintenance: Utilizing machine learning to forecast battery failure rates and schedule maintenance precisely, maximizing uptime for critical standby systems.

- Optimized Charging Protocols: AI algorithms adapt charging profiles in real-time based on temperature and usage patterns, minimizing stress on lead plates and extending battery life.

- Enhanced Fleet Management: In motive power, AI optimizes battery rotation and utilization across forklift fleets, reducing idle time and minimizing unnecessary deep discharges.

- Improved Thermal Management: AI systems monitor and predict thermal instability (critical for VRLA batteries), triggering cooling measures proactively to prevent thermal runaway incidents.

- Quality Control in Manufacturing: Use of computer vision and AI analytics to detect manufacturing anomalies, leading to higher product consistency and reduced warranty claims.

DRO & Impact Forces Of Industrial Lead Acid Battery Market

The dynamics of the Industrial Lead Acid Battery Market are shaped by a strong interplay between established reliability and emerging technological pressures. The market is primarily driven by the fundamental need for continuous power supply across critical infrastructure, coupled with the lead acid battery’s low acquisition cost and fully developed recycling infrastructure, which supports circular economy goals. However, growth is substantially restrained by the lower energy density and shorter cycle life relative to lithium-ion batteries, alongside environmental scrutiny regarding lead usage. Opportunities lie in developing advanced VRLA designs (such as high-rate AGM batteries) tailored specifically for demanding data center applications and expanding use in renewable energy storage systems (REES) where long duration backup is essential. These forces create a moderate impact environment, where stability in existing applications balances against slow, selective adoption of newer, higher-performance alternatives.

Driving factors are heavily centered on infrastructural dependencies. The global surge in data traffic, necessitating expansion of telecommunication networks and cloud computing facilities, translates directly into mandatory demand for UPS systems powered reliably by industrial lead acid batteries. Governments and essential service providers prioritize the established safety track record and regulatory compliance history of lead acid technology, particularly in utility switchgear and emergency lighting, often delaying the adoption of newer chemistries until long-term safety profiles are definitively proven. The massive installed base across manufacturing and warehousing sectors requiring motive power replacement batteries further stabilizes market demand, creating consistent revenue streams tied to planned obsolescence cycles.

Restraints primarily revolve around performance limitations and competitive threat. Lithium-ion batteries offer significantly higher energy density and lighter weight, making them increasingly attractive for motive power applications where space and efficiency are paramount. Furthermore, the inherent need for periodic maintenance (in flooded variants) and sensitivity to deep discharge cycles act as operational drawbacks. Regulatory pressures concerning lead handling and disposal, despite the efficient recycling loop, impose operational compliance costs that restrain profitability. Opportunities are leveraged through market fragmentation and specialization; specific applications requiring high current delivery for short durations (UPS discharge) or extremely robust tolerance to high ambient temperatures still favor lead acid, creating strategic niches for innovation focusing on carbon-enhanced VRLA batteries to mitigate sulfation issues.

- Drivers:

- Robust expansion of global data center and telecommunication infrastructure requiring reliable backup power (UPS).

- Established and efficient global recycling infrastructure for lead acid batteries, supporting sustainable supply chains.

- Lower initial capital expenditure (CAPEX) compared to advanced battery chemistries.

- Proven reliability and safety record in critical utility and emergency backup systems.

- Consistent demand for motive power replacements in material handling and logistics sectors.

- Restraints:

- Lower energy density and specific energy compared to lithium-ion alternatives, impacting application in space-constrained environments.

- Shorter cycle life and sensitivity to deep discharge, requiring careful battery management.

- Environmental concerns and regulatory complexity associated with lead and sulfuric acid handling.

- High maintenance requirements for traditional flooded lead acid variants.

- Opportunities:

- Development of specialized VRLA batteries (e.g., Ultra-Battery, Carbon-Enhanced AGM) to improve dynamic charge acceptance and cycle life.

- Integration with microgrids and smaller-scale renewable energy storage systems (REES) in remote areas.

- Increasing penetration of battery monitoring and AI diagnostic systems to optimize battery performance and extend useful life.

- Expansion into emerging markets with high infrastructure growth rates and lower sensitivity to density concerns.

- Impact Forces:

- High Impact: Infrastructure Expansion (Drivers), Competitive Pressure from Lithium-ion (Restraints).

- Medium Impact: Regulatory Scrutiny (Restraints), Recycling Economics (Drivers).

- Low Impact: Raw Material Price Volatility (Drivers/Restraints dependent on supply chain stability).

Segmentation Analysis

The Industrial Lead Acid Battery Market is segmented based on critical technical and application criteria, providing granularity necessary for manufacturers and suppliers to target specific market needs effectively. The primary segmentation dimensions include Product Type (Flooded, VRLA), Application (Standby Power, Motive Power), and End-User Industry. Understanding these segments is crucial because performance metrics and required specifications vary drastically; for instance, motive power demands high cyclic capacity, whereas standby power demands high-rate discharge capability. The continued shift toward VRLA technology underscores the industry’s pursuit of reduced maintenance and enhanced safety, particularly in data center and telecom applications where operational efficiency is paramount.

The Product Type segmentation clearly defines the technological trajectory of the market. While flooded batteries remain indispensable in heavy-duty, traditional industrial environments due to their ruggedness and ease of specific gravity monitoring, the VRLA segment (comprising AGM and Gel) is the fastest-growing category. AGM batteries excel in high-rate discharge applications like UPS due to low internal resistance, while Gel batteries are preferred in deep cycle applications, offering better tolerance to heat and partial state-of-charge operation. This technological differentiation allows lead acid batteries to retain specific market share against alternatives by optimizing design for precise operational demands rather than attempting a one-size-fits-all approach.

Application segmentation reveals the market's reliance on critical infrastructure. The Standby Power segment dominates, driven by the global imperative to minimize downtime across digital and physical infrastructure. This application is highly resilient to economic downturns because backup power is non-negotiable for critical operations. Conversely, the Motive Power segment is more cyclical, tied to manufacturing output, logistics expansion, and capital expenditure in warehousing. Strategic planning involves balancing investments in both segments, ensuring supply chain resilience for standby power components while innovating heavily in motive power to withstand intense competition from lithium-ion products that offer superior charging speeds and reduced weight crucial for logistics optimization.

- By Product Type:

- Flooded (Wet Cell) Lead Acid Batteries

- Valve Regulated Lead Acid (VRLA) Batteries

- Absorbed Glass Mat (AGM) Batteries

- Gel Batteries (Gelled Electrolyte)

- By Application:

- Standby Power (UPS, Telecom, Utility Switchgear, Emergency Lighting)

- Motive Power (Forklifts, Pallet Trucks, Mining Vehicles, AGVs)

- Specialized Applications (Railroad, Marine, Defense)

- By End-User Industry:

- Telecommunication & Data Centers

- Utilities & Power Generation (including Substations)

- Oil & Gas

- Manufacturing & Industrial (Warehousing and Logistics)

- Healthcare

- Mining

Value Chain Analysis For Industrial Lead Acid Battery Market

The value chain for industrial lead acid batteries is well-established, starting with the complex and geographically diverse upstream supply of raw materials, primarily lead and sulfuric acid, and extending through manufacturing, distribution, and critical downstream recycling operations. Upstream analysis focuses heavily on secure and sustainable sourcing of refined lead, often involving global mining and smelting operations, which exposes the value chain to commodity price volatility and geopolitical factors. Manufacturers must manage complex logistics for material transport and ensure compliance with lead purity standards, which directly impacts the performance and longevity of the final product. The robustness of the secondary lead market—driven by highly efficient recycling—is a unique and crucial differentiator, providing a sustainable source for over 90% of the lead used in new battery manufacturing, thereby mitigating environmental impact and raw material dependency.

The manufacturing stage involves highly specialized processes, including plate casting, pasting, curing, and final assembly, requiring significant capital investment in automation and quality control, especially for VRLA technologies. Distribution channels are varied: direct sales dominate high-volume applications like major data center installations or large utility projects, requiring close coordination between the battery manufacturer and the system integrator. Indirect channels, involving authorized distributors and regional dealers, handle the bulk of the replacement market and sales to smaller industrial end-users, ensuring localized inventory and specialized technical support. Efficient warehousing and transportation are critical due to the weight and hazardous nature of the product, necessitating specialized logistics providers who adhere to strict safety regulations for acid and heavy materials.

Downstream analysis highlights the crucial role of maintenance providers and the circular economy participants. Service contracts often include battery monitoring, testing, and eventual decommissioning, ensuring assets perform optimally throughout their lifecycle. The definitive end of the value chain is the recycler, which accepts spent batteries and efficiently recovers the lead, plastic, and acid components. This closed-loop system is highly centralized and regulatory-intensive, providing industrial lead acid batteries with a significant sustainability advantage often touted by manufacturers in comparison to nascent recycling infrastructures for alternative battery chemistries.

Industrial Lead Acid Battery Market Potential Customers

Potential customers for industrial lead acid batteries are concentrated in sectors where power reliability is mission-critical and where established safety protocols favor mature technology. The largest customer segment encompasses data center operators and telecommunication companies, who require massive banks of high-rate discharge VRLA batteries to bridge the power gap during utility failures until generators can assume the load. These customers prioritize performance specifications, low total cost of ownership (TCO), and robust safety certifications, often contracting directly with top-tier manufacturers for large-scale, customized UPS installations. The exponential growth in digital services ensures this sector remains the most consistent and highest-value buyer segment globally.

A second major customer category is the vast industrial and logistics sector, primarily focused on motive power. Customers here include large warehousing operations, third-party logistics (3PL) providers, and manufacturing facilities relying on electric material handling equipment like forklifts and automated guided vehicles (AGVs). For these buyers, the primary concern is operational uptime, cycle life, and ruggedness in demanding environments. While these customers are increasingly evaluating lithium-ion solutions, the replacement market for the huge installed base of lead acid battery-powered equipment provides substantial, predictable sales volumes, often procured through specialized industrial equipment distributors and dealers.

Additional significant customers include utility companies and independent power producers, who utilize lead acid batteries for substation switchgear protection and emergency backup lighting within power plants. Furthermore, customers in specialized environments such as mining (for subterranean vehicles) and the healthcare sector (for backup in critical care areas) depend on the proven reliability and cost-effectiveness of industrial lead acid solutions. Procurement decisions in these sectors are heavily influenced by regulatory mandates for safety and compliance, favoring established lead acid technology over high-risk, volatile alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $27.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EnerSys, Exide Technologies, GS Yuasa Corporation, Clarios (formerly Johnson Controls), East Penn Manufacturing Co., C&D Technologies, Hoppecke Batterien GmbH & Co. KG, Storage Battery Systems LLC, FIAMM Energy Technology S.p.A., Narada Power Source Co., Ltd., Amara Raja Batteries Ltd., NorthStar (Enersys), Leoch International Technology Ltd., Trojan Battery Company, Crown Battery, Sebang Global Battery Co., Ltd., China Shoto Power Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Lead Acid Battery Market Key Technology Landscape

The industrial lead acid battery market, while based on a century-old chemistry, continues to evolve through significant technological refinements focused on maximizing performance characteristics and addressing primary failure mechanisms. The primary area of innovation revolves around Valve Regulated Lead Acid (VRLA) batteries, particularly in the composition of the lead alloy, plate structure, and electrolyte immobilization techniques. High-rate discharge VRLA batteries, often utilizing thin-plate pure lead (TPPL) technology, are crucial for the data center market as they provide superior power output for short durations required by UPS systems. This refinement allows lead acid solutions to compete effectively in high-performance standby applications without the safety concerns associated with certain alternative chemistries.

A major technological advancement involves the incorporation of carbon additives into the negative plate active material, leading to the development of lead-carbon batteries (often termed Ultra-Batteries). These hybrid batteries are designed to mitigate sulfation—the primary failure mechanism under partial state-of-charge (PSoC) operation—by improving charge acceptance and reducing the degradation rate of the negative electrode. This technology is particularly valuable in renewable energy storage (REES) and applications where the battery frequently operates outside of a full charge cycle. The improved cyclic life and dynamic charge acceptance of lead-carbon batteries position them strategically for integration into utility and distributed generation systems, extending the viable application scope for lead acid technology beyond traditional backup roles.

Furthermore, the technology landscape includes the development of sophisticated external monitoring and management systems. Modern industrial lead acid batteries are frequently paired with advanced Battery Monitoring Systems (BMS) that utilize sensors to track critical parameters such as cell voltage, impedance, and temperature in real-time. This digital integration allows for remote diagnostics and predictive maintenance scheduling, reducing the reliance on manual inspections and significantly lowering the risk of catastrophic failure. The trend is moving towards smart batteries that communicate their state of health (SOH) and operational anomalies, ensuring high reliability and justifying the continued selection of lead acid for infrastructure resilience.

Regional Highlights

The global Industrial Lead Acid Battery Market demonstrates heterogeneous growth patterns influenced by regional economic development, infrastructure maturity, and regulatory environments. Asia Pacific (APAC) stands out as the epicenter of growth, fueled by unprecedented infrastructure investment, particularly in telecommunications, data centers, and e-commerce logistics. Nations such as China, India, and Southeast Asian economies are rapidly expanding their manufacturing base and logistics capabilities, necessitating high volumes of both standby and motive power batteries. The relatively lower labor costs and less stringent environmental regulations (compared to Western markets) often favor the high-volume production and use of cost-effective lead acid technologies in this region.

North America and Europe represent mature markets characterized by stable replacement demand and a strong focus on high-reliability, long-life VRLA products. In North America, the demand is largely driven by large-scale data center expansion and regulatory mandates for continuous power in utilities and healthcare. The focus here is less on volume growth and more on technological efficiency, high-rate performance, and established recycling compliance. European demand is highly influenced by stringent environmental standards (such as REACH regulations), pushing manufacturers toward highly efficient VRLA designs and robust closed-loop recycling programs. The consistent need for reliable power in critical public infrastructure ensures predictable, albeit moderate, market expansion.

Latin America, the Middle East, and Africa (MEA) are emerging markets exhibiting high potential, driven by urbanization and modernization projects, but constrained by political instability and economic volatility in certain sub-regions. Telecom infrastructure expansion, particularly in high-growth African nations, necessitates reliable off-grid and backup power solutions, creating strong demand for industrial batteries. In the Middle East, substantial infrastructure projects, including large data center builds and utility upgrades, provide significant opportunities. However, logistics challenges and the need for batteries highly resistant to extreme temperatures shape the product requirements in these regions, favoring rugged VRLA technologies like Gel batteries that handle heat better than standard AGM counterparts.

- Asia Pacific (APAC): Dominates the global market due to aggressive infrastructure development (data centers, 5G networks) and booming e-commerce driving motive power demand in China and India.

- North America: Stable market characterized by high demand for TPPL VRLA batteries for large-scale UPS installations and mature replacement cycles across utility and telecom sectors.

- Europe: Growth is steady, focused on advanced VRLA technologies complying with stringent environmental and safety regulations, particularly in Germany and the UK for critical infrastructure.

- Latin America: Emerging market driven by telecom expansion and industrialization, though economic instability poses procurement challenges.

- Middle East and Africa (MEA): High potential due to rapid utility upgrades and telecom rollout, requiring temperature-resistant industrial batteries for backup applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Lead Acid Battery Market.- EnerSys

- Exide Technologies

- GS Yuasa Corporation

- Clarios (formerly Johnson Controls Power Solutions)

- East Penn Manufacturing Co.

- C&D Technologies

- Hoppecke Batterien GmbH & Co. KG

- Storage Battery Systems LLC

- FIAMM Energy Technology S.p.A.

- Narada Power Source Co., Ltd.

- Amara Raja Batteries Ltd.

- NorthStar (owned by EnerSys)

- Leoch International Technology Ltd.

- Trojan Battery Company

- Crown Battery

- Sebang Global Battery Co., Ltd.

- CSB Battery Co., Ltd.

- China Shoto Power Co., Ltd.

- Coslight Technology International Group Co., Ltd.

- Power-Sonic Corporation

Frequently Asked Questions

Analyze common user questions about the Industrial Lead Acid Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Industrial Lead Acid Battery Market?

The primary driver is the rapid global expansion of digital and physical infrastructure, specifically the mandate for reliable, cost-effective standby power for Uninterruptible Power Supplies (UPS) in data centers, telecommunication networks, and critical utility applications.

How does VRLA technology differ from traditional flooded lead acid batteries in industrial use?

VRLA (Valve Regulated Lead Acid) batteries, including AGM and Gel types, are sealed, non-spillable, and require no maintenance (adding water). They offer enhanced safety and are preferred for sensitive environments like data centers, whereas flooded batteries require periodic maintenance but offer greater ruggedness and lower initial cost for heavy-duty applications.

Is the Industrial Lead Acid Battery Market threatened by Lithium-ion competition?

While Lithium-ion poses a significant threat, particularly in the Motive Power segment due to superior energy density, lead acid batteries maintain resilience in Standby Power due to lower initial capital expenditure, established safety standards, and a 100% circular recycling economy, making them highly cost-competitive and compliant for critical infrastructure.

What role does the recycling infrastructure play in the viability of industrial lead acid batteries?

The highly efficient, closed-loop recycling infrastructure is fundamental to the market's sustainability and cost structure. Over 99% of lead acid battery components are recyclable, ensuring compliance, reducing raw material volatility, and significantly lowering the total environmental footprint compared to batteries with nascent recycling processes.

How is AI impacting the maintenance and lifespan of industrial lead acid batteries?

AI integrates with Battery Monitoring Systems (BMS) to shift maintenance from scheduled checks to predictive, condition-based interventions. By analyzing real-time data, AI identifies early signs of degradation (like sulfation), optimizing charging cycles and allowing for precise intervention, thereby extending the battery’s useful service life and enhancing operational reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager