Industrial Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432236 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Industrial Machinery Market Size

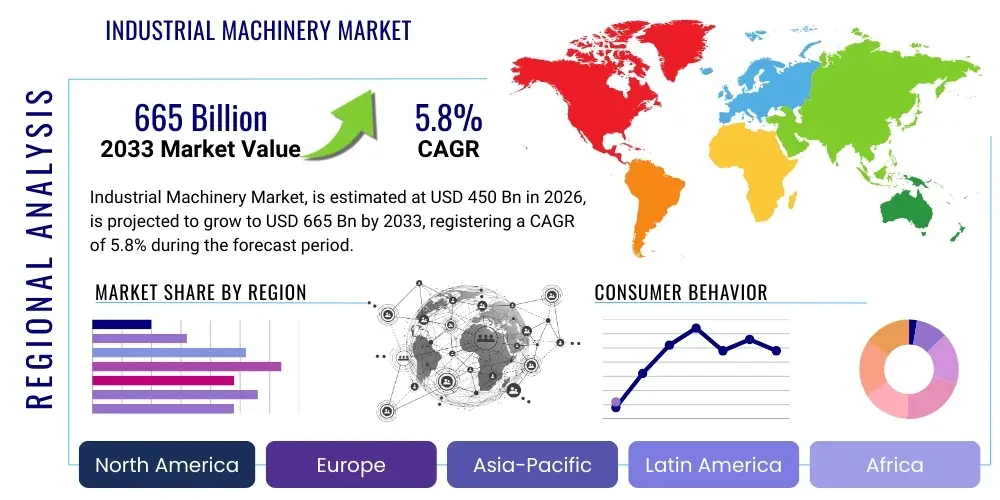

The Industrial Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is fueled by accelerated industrialization in emerging economies, coupled with significant technological advancements focusing on automation and efficiency in developed regions. The persistent need for infrastructure development, coupled with the mandatory replacement of aging equipment across key manufacturing sectors such as automotive, aerospace, and general manufacturing, contributes substantially to the market expansion. Furthermore, the increasing complexity of manufacturing processes necessitates higher precision and specialized machinery, driving investment in advanced capital goods.

The market is estimated at USD 450 Billion in 2026, reflecting a strong recovery phase characterized by normalized supply chains and renewed capital expenditure budgets post-global economic adjustments. This valuation encompasses sales of heavy construction machinery, specialized process machinery, material handling equipment, and metalworking tools. The introduction of smart manufacturing techniques and the integration of IoT (Internet of Things) capabilities into traditional machinery are also enhancing the overall market valuation by increasing the average selling price and improving operational performance metrics globally.

The market is projected to reach USD 665 Billion by the end of the forecast period in 2033. This projected value underscores the transformative impact of Industry 4.0 adoption across industries. Key growth drivers include governmental policies supporting domestic manufacturing capabilities, particularly in the Asia Pacific region, and the global push towards sustainable and energy-efficient machinery. Companies are increasingly investing in research and development to offer machinery that complies with stringent environmental regulations, thereby creating new revenue streams focused on retrofitting and modernizing existing industrial assets.

Industrial Machinery Market introduction

The Industrial Machinery Market encompasses the design, production, and trade of complex mechanical devices and systems used in industrial processes, spanning manufacturing, infrastructure development, energy production, and material processing. This vast sector includes specialized equipment such as CNC machines, robotics, material handling systems, processing equipment (e.g., pumps, compressors), and construction machinery. These products are foundational to modern economic activity, enabling mass production, precise fabrication, and efficient resource utilization across various verticals, ensuring that industrialized nations maintain competitive advantages through optimized operational output and reduced manual labor reliance.

Major applications of industrial machinery are distributed across diverse sectors, including automotive assembly lines, chemical processing plants, food and beverage packaging, textile production, mining operations, and large-scale public works projects. The immediate benefits derived from the deployment of advanced industrial machinery include significantly enhanced production efficiency, superior product quality consistency, reduced operational bottlenecks, and improved worker safety dueability to automation. The machinery facilitates economies of scale, making complex, high-volume production economically viable and meeting the growing global demand for manufactured goods.

The market is principally driven by several macroeconomic and technological factors. Global infrastructure investment, particularly in transportation and utilities, remains a significant accelerator for construction and heavy-duty machinery. Technologically, the pervasive adoption of digitalization, characterized by the integration of sensors, cloud computing, and advanced analytics (Industry 4.0), drives demand for smart, connected machinery that offers predictive maintenance capabilities and real-time performance monitoring. Additionally, the necessity for efficient resource management and adherence to evolving global safety standards compels industries to upgrade to the latest, often automated, machinery models, further propelling market growth.

Industrial Machinery Market Executive Summary

The Industrial Machinery Market is undergoing significant transformations driven by globalization, digitalization, and sustainability mandates. Key business trends indicate a shift towards servitization, where manufacturers offer maintenance, software, and operational insights alongside the core equipment, moving from purely transactional sales to comprehensive lifecycle management partnerships. Furthermore, supply chain diversification and localization efforts, spurred by recent geopolitical volatility, are driving regional capacity expansion, particularly benefiting machinery manufacturers capable of providing tailored, flexible solutions. Mergers and acquisitions remain a central strategy for market leaders seeking to acquire specialized technology, expand geographical reach, and consolidate market share in highly fragmented sub-segments, particularly those focused on automation and robotics.

Regionally, Asia Pacific continues to dominate the market, primarily fueled by massive government investment in manufacturing infrastructure in China, India, and Southeast Asian nations, positioning the region as the global manufacturing hub. North America and Europe, while slower in pure volume growth, lead in the adoption of high-precision, highly automated machinery, focusing on labor productivity enhancement and advanced sustainable manufacturing techniques, driving demand for premium-priced, technologically sophisticated equipment. Latin America, Middle East, and Africa exhibit high potential, particularly in construction and energy machinery, driven by urbanization and significant investment in oil and gas infrastructure, despite facing intermittent economic volatility challenges.

Segment trends reveal robust growth in the robotics and automation segment, propelled by labor shortages and the drive for high-throughput, continuous manufacturing operations. The specialized industrial machinery segment, including advanced 3D printing equipment and customized fabrication tools, is also witnessing substantial momentum due to the increasing demand for tailored products and complex component manufacturing across aerospace and medical device industries. Conversely, traditional heavy machinery segments are focusing on incorporating telematics and efficiency features to maintain relevance against newer, lighter, and more specialized alternatives, emphasizing fuel efficiency and lower total cost of ownership (TCO) as primary value propositions for customers.

AI Impact Analysis on Industrial Machinery Market

User queries regarding AI's influence in the Industrial Machinery Market frequently center on practical applications like predictive failure detection, optimized maintenance scheduling, and enhancing operational precision in manufacturing. Users are keen to understand how AI-driven analytics can minimize downtime, which is a critical metric in capital-intensive industries. Common concerns revolve around the complexity of integrating AI models into legacy systems, the requisite data infrastructure investment, and cybersecurity vulnerabilities associated with connected machinery. Expectations are high, anticipating AI to move beyond simple monitoring into autonomous operational control, dynamic process optimization based on real-time external variables, and improving energy consumption across entire factory floors.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming industrial machinery, moving it from fixed, programmed operation to adaptive, intelligent systems. AI algorithms are crucial in processing the massive streams of data generated by embedded sensors (IoT), allowing equipment to diagnose potential malfunctions far in advance of actual failure, thereby shifting the paradigm from preventative maintenance to highly efficient predictive maintenance. This capability significantly increases the Mean Time Between Failures (MTBF) and minimizes unplanned production interruptions, providing substantial cost savings and justifying the initial investment in AI-enabled machinery.

Furthermore, AI is instrumental in optimizing complex manufacturing parameters. In CNC machining, for instance, AI can dynamically adjust cutting speeds, feed rates, and tool paths based on material density variations or ambient conditions, achieving higher precision and reducing material wastage far better than traditional human or programmed control systems. This level of optimization allows manufacturers to handle increasingly intricate designs and tight tolerances, maintaining competitive edge in high-value manufacturing segments like aerospace and medical implants. The future trajectory involves greater autonomy, with machinery capable of self-calibrating, self-diagnosing, and potentially self-repairing specific component issues using swarm robotics or remote operational inputs.

- AI enables highly accurate Predictive Maintenance (PdM) schedules, reducing downtime by up to 40%.

- Optimization of energy consumption through dynamic operational adjustments based on real-time load and external factors.

- Enhanced quality control via computer vision and deep learning models detecting minute defects during high-speed production.

- Automation of complex tasks, improving overall throughput and precision in robotics and CNC applications.

- Creation of digital twins for simulation, training, and remote monitoring of large industrial assets.

- Improved supply chain efficiency through AI-driven forecasting of raw material requirements and production scheduling.

- Accelerated design cycles by using generative design algorithms for optimizing machinery components based on performance criteria.

DRO & Impact Forces Of Industrial Machinery Market

The dynamics of the Industrial Machinery Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces shaping strategic decisions within the sector. Key drivers include global infrastructure spending and the necessity of automation to counter rising labor costs and shortages, especially in developed economies. Restraints largely center on the high initial capital expenditure required for advanced machinery, coupled with the slow rate of technology adoption in Small and Medium-sized Enterprises (SMEs) due to financial and integration complexities. Opportunities are abundant in sustainable manufacturing practices, retrofitting existing machinery with IoT capabilities, and targeting specialized, high-growth sectors like electric vehicle manufacturing and renewable energy infrastructure development.

The primary impact force driving current market momentum is the relentless pursuit of operational efficiency through Industry 4.0 standards. Manufacturers across the globe recognize that connecting machinery, utilizing big data analytics, and employing advanced robotics are no longer optional but essential requirements for global competitiveness. This driver is counterbalanced by the significant restraint of global trade uncertainties and geopolitical fragmentation, which can disrupt complex international supply chains for specialized components, leading to delays and increased cost volatility in equipment delivery, thereby affecting capital spending decisions by end-users.

Another major impact force is the regulatory environment, particularly concerning emissions and energy efficiency. Stricter global standards, especially in Europe and North America, necessitate continuous innovation in engine technology for construction and agricultural machinery, presenting both a high-cost restraint for compliance and a massive opportunity for manufacturers who can commercialize genuinely green and highly efficient equipment. Ultimately, the market trajectory is defined by how effectively manufacturers can mitigate the financial restraints associated with high technology costs while capitalizing on the universal drivers of efficiency and sustainability, using opportunities like AI integration to bridge the performance gap between old and new industrial assets.

Segmentation Analysis

The Industrial Machinery Market is highly diversified, categorized primarily based on Machine Type, End-User Industry, and Geographic Region. Analyzing the market through these segments provides critical insights into consumption patterns, technological adoption rates, and regional investment priorities. Segmentation by machine type often distinguishes between specialized machinery (e.g., semiconductor equipment), general-purpose machinery (e.g., pumps, compressors), and heavy construction machinery, each exhibiting unique demand cycles and competitive landscapes. The performance of these segments is intrinsically linked to global macroeconomic health, capital expenditure cycles, and industry-specific innovation rates.

The End-User Industry segmentation is crucial for targeted marketing and product development, revealing that the automotive sector and the infrastructure development sector are consistently among the largest consumers of high-value machinery. However, rapid growth is currently being observed in emerging sectors such as renewable energy manufacturing (e.g., wind turbine components, solar panel production) and advanced medical device manufacturing, which require highly specialized, precision-engineered machinery. Understanding the distinct needs—such as the need for extremely sterile environments in pharma vs. rugged durability in mining—allows manufacturers to tailor their product offerings and after-sales services effectively.

Geographically, the market segmentation highlights the disparities in maturity and growth potential. Asia Pacific drives volume growth due to expansive manufacturing base growth, while North America and Europe lead in value growth per unit due to the demand for premium, automated, and IoT-enabled machinery. This segmentation framework aids market strategists in allocating resources, setting regional pricing strategies, and anticipating compliance challenges related to localized environmental and safety regulations, ensuring a localized yet globally coherent market approach.

- By Machine Type:

- Heavy Construction Machinery (Excavators, Loaders, Cranes)

- Metalworking and Machine Tools (CNC Machines, Lathes, Milling Machines)

- Material Handling Equipment (Conveyors, Forklifts, Automated Guided Vehicles)

- Processing Machinery (Pumps, Compressors, Mixers, Filters)

- Power Transmission Equipment (Gears, Bearings, Drives)

- Specialized Industrial Machinery (Textile Machinery, Semiconductor Equipment, Robotics)

- By End-User Industry:

- Automotive and Transportation

- General Manufacturing

- Construction and Mining

- Energy and Power (Oil & Gas, Renewables)

- Food and Beverage

- Chemical and Petrochemical

- Aerospace and Defense

- By Technology/Automation Level:

- Conventional Machinery

- Semi-Automated Machinery

- Fully Automated & Robotic Systems

- IoT-Enabled Smart Machinery

Value Chain Analysis For Industrial Machinery Market

The value chain of the Industrial Machinery Market begins with Upstream Analysis, which focuses on the sourcing of critical raw materials (metals, specialized alloys, advanced polymers) and essential components (microprocessors, sensors, hydraulic systems, and power transmission parts). The quality and stability of this upstream segment are paramount, as volatility in commodity prices (e.g., steel, copper) directly impacts the final manufacturing cost. Key activities at this stage involve meticulous supplier management, strategic long-term procurement contracts, and investment in specialized component manufacturers to ensure consistent supply of high-precision parts necessary for machinery performance and durability. Effective inventory management and risk assessment related to geopolitical supply bottlenecks are crucial for maintaining manufacturing schedules.

Mid-stream activities encompass the actual design, engineering, and manufacturing processes, where significant value addition occurs through precision fabrication, assembly, and rigorous testing. This stage is highly capital-intensive and requires substantial expertise in advanced manufacturing techniques, quality assurance protocols, and intellectual property protection related to proprietary machine designs and automation software. Companies often outsource non-core manufacturing processes (e.g., standard metal fabrication) while maintaining control over specialized assembly and complex system integration. The deployment of lean manufacturing principles and advanced robotics within factory floors is a key competitive differentiator in the mid-stream segment, driving efficiency and reducing time-to-market.

The Downstream Analysis involves distribution channels, sales, and comprehensive after-sales services. Industrial machinery distribution is often complex, utilizing a blend of Direct and Indirect channels. Direct sales are common for high-value, highly customized machinery (e.g., large turbines, specialized CNC systems), allowing manufacturers direct control over installation and client relationships. Indirect channels involve extensive networks of authorized distributors, dealers, and third-party maintenance providers, which are essential for reaching SMEs and offering localized service, parts, and maintenance support globally. Servitization—the offering of ongoing maintenance contracts, remote diagnostics, and software updates—is a rapidly growing downstream activity that stabilizes revenue streams and enhances customer lifetime value, moving the focus beyond the initial equipment sale.

Industrial Machinery Market Potential Customers

The potential customer base for the Industrial Machinery Market is exceptionally broad, encompassing virtually every sector that requires precision manufacturing, infrastructure development, or material handling. These end-users, or buyers, are typically large corporations, government entities, or medium-sized enterprises with significant capital budgets allocated for facility upgrades and expansion. Key customers in the construction segment include large civil engineering firms and mining operators who require robust, high-performance excavators, dozers, and crushing equipment. Their purchasing decisions are primarily driven by equipment durability, fuel efficiency, and the availability of responsive, comprehensive service contracts that minimize costly on-site downtime.

In the manufacturing domain, potential customers include global automotive OEMs, aerospace component manufacturers, and major electronics producers. These buyers focus intensely on machinery capable of high precision, repeatable quality, and seamless integration with their existing IT and automation infrastructure. The demand here is skewed toward specialized industrial machinery, such as multi-axis CNC machines and advanced robotics for assembly and inspection. Purchasing cycles in these industries are often long, involving extensive vendor qualification processes centered on technological capabilities, software compatibility, and adherence to stringent industry-specific quality standards like ISO or AS9100.

Emerging segments, which represent rapidly growing potential customers, include renewable energy providers and large-scale data center operators. Renewable energy manufacturers require machinery for fabricating massive components like wind turbine blades or processing specialized materials for solar panels, prioritizing efficiency and customization. Data center operators, while not direct machinery consumers in the traditional sense, drive demand for specialized industrial cooling systems, power generation equipment (generators), and material handling systems necessary for constructing and maintaining these expansive facilities. These customers emphasize reliability, energy efficiency, and long-term asset performance tracking through advanced IoT and cloud-based monitoring solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Billion |

| Market Forecast in 2033 | USD 665 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Deere & Company, Siemens AG, General Electric, Mitsubishi Heavy Industries, Ltd., ABB Ltd., Fanuc Corporation, KUKA AG (Midea Group), Sandvik AB, Atlas Copco AB, Doosan Bobcat Inc., Mazak Corporation, TRUMPF Group, Liebherr Group, Hitachi Construction Machinery, Konecranes, Emerson Electric Co., Honeywell International Inc., Schneider Electric SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Machinery Market Key Technology Landscape

The technological landscape of the Industrial Machinery Market is undergoing a rapid evolution, primarily centered around the seamless convergence of mechanical engineering with advanced digital technologies. The dominant technological paradigm is Industry 4.0, which mandates the integration of Cyber-Physical Systems (CPS), Industrial Internet of Things (IIoT), and cloud computing into traditional machinery. This integration allows for unprecedented levels of data collection and exchange, enabling functions such as real-time performance monitoring, remote diagnostics, and integrated quality control. This technological shift is fundamental to increasing Overall Equipment Effectiveness (OEE) and is driving the demand for machinery equipped with integrated sensors, gateways, and edge computing capabilities.

Additive Manufacturing (3D Printing) is another transformative technology influencing both the production of industrial machinery and the products they create. Manufacturers are leveraging 3D printing for rapid prototyping of machine components, creating highly customized tools, and producing complex, lightweight parts that are impossible to fabricate using conventional subtractive methods. Furthermore, the adoption of advanced materials science, particularly in developing high-strength, low-wear components and corrosion-resistant coatings, is extending the operational life and performance metrics of machinery, particularly in harsh environments like mining and deep-sea drilling. This focus on durability and material efficiency is a core trend in engineering departments across leading machinery producers.

Robotics and Advanced Automation constitute a vital part of the contemporary technology landscape. The evolution from fixed-position industrial robots to collaborative robots (cobots) has expanded automation possibilities, making it accessible even to smaller manufacturing operations where safety and flexibility are paramount. Coupled with sophisticated vision systems and advanced haptic feedback, modern machinery is capable of performing intricate tasks with sub-micron precision. This technological advancement is essential for manufacturers competing in highly regulated and quality-sensitive sectors like semiconductor fabrication and pharmaceuticals, where human error must be virtually eliminated. The increasing reliance on sophisticated control software and human-machine interface (HMI) systems is simplifying operation and maintenance, democratizing access to complex industrial automation.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, underpinned by massive government initiatives like "Made in China 2025" and "Make in India." This region serves as the global manufacturing hub, driving enormous demand for metalworking, robotics, and processing machinery. Infrastructure spending in countries like Vietnam, Indonesia, and India remains extremely high, fueling the construction and mining machinery sectors. Technological adoption is increasing rapidly, particularly in major economies transitioning towards high-value manufacturing and smart factories.

- North America: Characterized by high technological maturity and a focus on high-precision manufacturing, North America is a key adopter of advanced automation, AI-enabled machinery, and specialized equipment for aerospace and energy sectors. The region’s growth is driven by the modernization of aging infrastructure and the nearshoring of manufacturing activities, which necessitates investment in efficient, high-throughput automated systems to offset high labor costs. The demand here favors quality, reliability, and integrated IoT capabilities.

- Europe: Europe emphasizes sustainability, circular economy principles, and stringent safety standards (e.g., CE marking), driving demand for energy-efficient and compliant machinery. Germany, as a manufacturing powerhouse, leads in Industry 4.0 adoption. Growth is concentrated in specialized segments, including advanced machining tools, packaging machinery, and highly automated material handling systems. The region often sets the global benchmark for machinery design and environmental performance.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity markets (mining, agriculture, oil and gas). Brazil and Mexico are key markets, driven by automotive manufacturing and significant investment in large-scale public infrastructure projects. While capital constraints can limit rapid technological upgrades, there is a steady demand for reliable, durable construction and agricultural machinery, often prioritizing ruggedness over the most cutting-edge features.

- Middle East and Africa (MEA): This region exhibits high demand for construction and heavy-duty machinery due to rapid urbanization, large-scale construction projects (e.g., Saudi Arabia’s Vision 2030), and continuous investment in the energy sector. Machinery procurement often involves large tenders, emphasizing robust performance under extreme climatic conditions. Demand for advanced oil and gas processing machinery and power generation equipment remains a primary growth pillar.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Machinery Market, focusing on their strategic capabilities, product portfolios, recent developments, and global presence.- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- Siemens AG

- General Electric

- Mitsubishi Heavy Industries, Ltd.

- ABB Ltd.

- Fanuc Corporation

- KUKA AG (Midea Group)

- Sandvik AB

- Atlas Copco AB

- Doosan Bobcat Inc.

- Mazak Corporation

- TRUMPF Group

- Liebherr Group

- Hitachi Construction Machinery

- Konecranes

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

Frequently Asked Questions

Analyze common user questions about the Industrial Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Industrial Machinery Market?

The market growth is primarily driven by three factors: accelerating global infrastructure spending, the mandatory shift towards automated and smart manufacturing (Industry 4.0) to enhance productivity, and the sustained need for specialized machinery in high-growth sectors like electric vehicle production and renewable energy.

How is Industry 4.0 influencing the design and function of industrial machinery?

Industry 4.0 necessitates machinery design incorporating Cyber-Physical Systems (CPS) and IIoT capabilities. This enables machinery to self-monitor, utilize predictive maintenance algorithms based on AI analytics, communicate seamlessly within the factory ecosystem, and perform dynamic operational adjustments for optimal efficiency and throughput.

Which geographical region represents the largest market share for industrial machinery?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to high levels of manufacturing activity, significant industrialization efforts across Southeast Asia, and massive government-led capital investments in infrastructure and factory modernization, especially in China and India.

What role does sustainability play in industrial machinery purchasing decisions?

Sustainability is increasingly critical, with end-users prioritizing machinery that offers superior energy efficiency, reduced emissions, and minimal material waste. Regulatory compliance, particularly in Europe, drives demand for advanced electric or hybrid machinery models over conventional fossil fuel-powered alternatives, reducing long-term operational costs.

What is the 'servitization' business model in the industrial machinery sector?

Servitization is a strategic trend where machinery manufacturers move beyond selling the physical asset to offering comprehensive service packages. These packages typically include long-term maintenance contracts, software subscriptions, remote monitoring services, and performance consulting, guaranteeing uptime and providing a stable, recurring revenue stream for vendors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Industrial Machinery Contactor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Service Lifescale Management Market Size Report By Type (Cloud-Based Software, Web-Based Software, Dealer-Based Model, Performance-Based Model, Depot-Based Model, Field-Based Model), By Application (Automotive and Transportation, Aerospace and Defence, Medical Equipment, High Technology, Industrial Machinery and Equipment, Telecommunication), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Programmatic Display Market Size Report By Type (Private Marketplaces, Real time Bidding, Automated Guaranteed), By Application (Automotive, Manufacturing, Manufacturing Type, Food and Beverages, Industrial Machinery and Heavy Equipment, High Tech and Consumer Electronics, Others, Healthcare, Government, IT and Telecom, Others, Others Type, Energy and Utilities, Transportation, Media), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Coil Wound Equipment Market Statistics 2025 Analysis By Application (Transportation, Industrial Machinery & Equipment, Medical Devices, Mining, Energy), By Type (Sensors, Bobbins, Electromagnetic Coils, Solenoids, Lightning Coil), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager