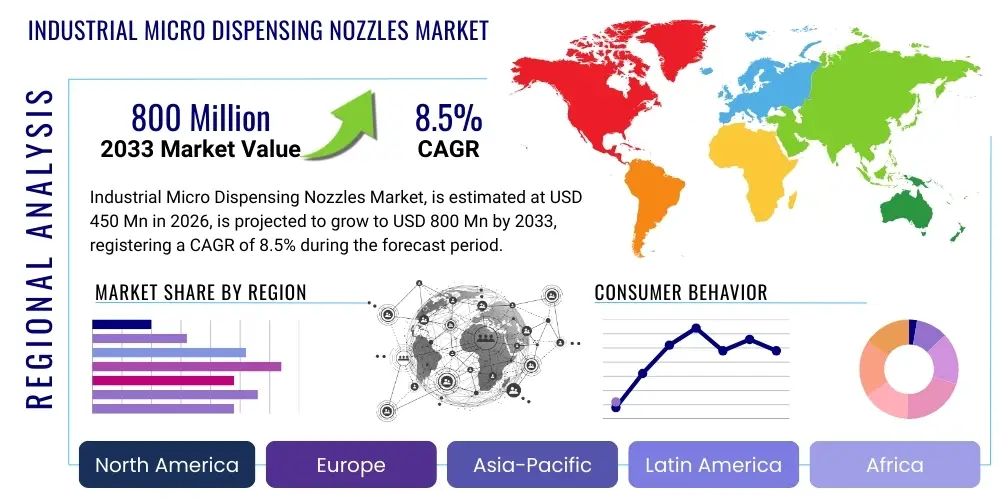

Industrial Micro Dispensing Nozzles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437803 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Industrial Micro Dispensing Nozzles Market Size

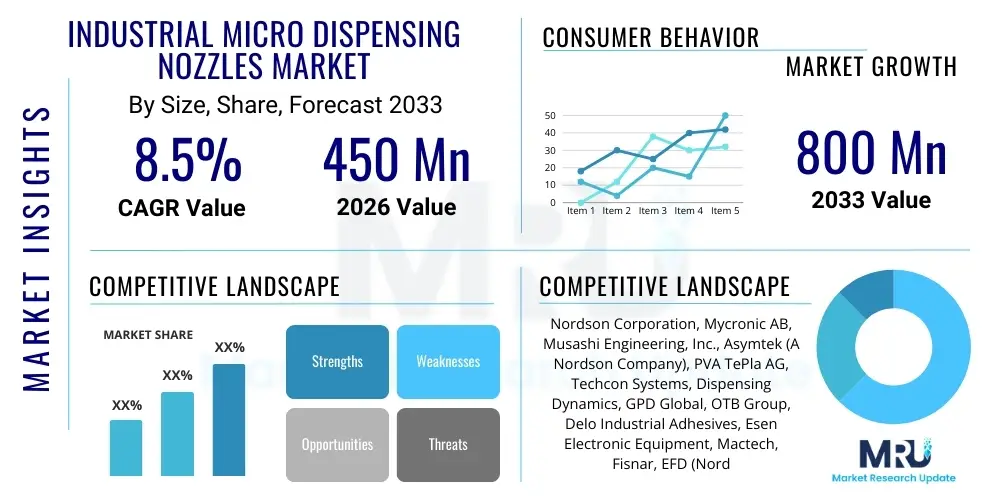

The Industrial Micro Dispensing Nozzles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Industrial Micro Dispensing Nozzles Market introduction

The Industrial Micro Dispensing Nozzles Market encompasses the manufacture, distribution, and utilization of highly specialized components designed for the precise deposition of fluids in micro-scale volumes, often measured in nanoliters or picoliters. These nozzles are critical elements within sophisticated automated dispensing systems used across various high-technology industries where accuracy, repeatability, and minimal material waste are paramount. The products are essential for applications requiring controlled application of materials such as adhesives, epoxies, solder pastes, encapsulants, and biocompatible fluids. Key performance indicators for these nozzles include aperture size (ranging from tens of micrometers down to single digits), material compatibility, wear resistance, and the ability to maintain consistent flow characteristics under high-speed operation.

These specialized components, often fabricated from materials like cemented carbide, zirconium oxide ceramics, high-grade stainless steel, or specialized polymers, serve as the interface between the dispensing system and the substrate. Product descriptions typically highlight ultra-fine geometries, minimized dead volume, and surface treatments that prevent clogging or unwanted fluid residue accumulation. The demanding nature of modern manufacturing processes, particularly in consumer electronics and advanced packaging (e.g., flip-chip bonding, wafer-level packaging), necessitates dispensing solutions capable of achieving positional accuracy and volume precision that standard industrial dispensing equipment cannot match. The increasing complexity of microelectronic devices continues to drive innovation in nozzle design, focusing on longevity and performance under extreme conditions.

Major applications of Industrial Micro Dispensing Nozzles span across critical manufacturing processes, including semiconductor packaging (die attach, underfill), flat panel display assembly, medical device manufacturing (drug delivery patches, microfluidics), and optics bonding. Benefits derived from the use of these precision tools include enhanced product reliability, significant reduction in manufacturing defects, superior material utilization leading to lower operating costs, and the capability to handle extremely viscous or temperature-sensitive materials with high throughput. The market's primary driving factors are the relentless trend toward device miniaturization, the rapid expansion of the 5G and IoT infrastructure necessitating complex semiconductor modules, and stringent quality requirements in critical industries like aerospace and life sciences, where dispensing volumes directly influence device function and safety.

Industrial Micro Dispensing Nozzles Market Executive Summary

The Industrial Micro Dispensing Nozzles Market is characterized by robust growth, primarily propelled by intense technological advancements within the semiconductor and microelectronics sectors, where precision fluidic control is non-negotiable for advanced packaging techniques. Current business trends indicate a significant pivot towards non-contact dispensing technologies, specifically piezo-driven jetting nozzles, which offer superior speed and accuracy compared to traditional contact dispensing methods. Furthermore, manufacturers are focusing heavily on developing composite and ceramic materials for nozzles to improve wear resistance and chemical inertness, thereby extending product lifespan and reducing downtime in high-volume production environments. Strategic partnerships between nozzle manufacturers and dispensing equipment providers are becoming commonplace to deliver integrated, optimized fluid control systems tailored for highly specialized applications.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, driven by the concentration of global semiconductor manufacturing facilities, consumer electronics assembly hubs, and substantial governmental investments in advanced manufacturing infrastructure, notably in China, South Korea, and Taiwan. North America and Europe demonstrate mature markets focused on high-value, niche applications such as aerospace electronics, precision medical instrumentation, and sophisticated R&D activities, commanding premium pricing for ultra-high-precision components. Market expansion opportunities are particularly prominent in Southeast Asia and India, fueled by rising foreign direct investment in electronics assembly and automotive electronics manufacturing, necessitating local supply chains for dispensing consumables.

Segment trends reveal that the ceramic nozzle segment is experiencing rapid adoption due to its superior durability and thermal stability, making it ideal for high-temperature and abrasive fluid handling, particularly in LED assembly and photovoltaic cell production. While contact nozzles remain essential for certain high-viscosity applications, the jetting nozzle segment is exhibiting the fastest growth due to its ability to perform high-speed, repeatable dispensing without mechanical contact, mitigating the risk of substrate damage and increasing throughput. The application segment analysis underscores semiconductor manufacturing, specifically wafer-level packaging and 3D stacking technologies, as the primary revenue generator, reflecting the critical role micro dispensing plays in achieving high transistor density and reliable interconnections in next-generation microprocessors and memory devices.

AI Impact Analysis on Industrial Micro Dispensing Nozzles Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration can mitigate common dispensing process challenges, such as drift in deposit volume over extended runs, nozzle clogging detection, and real-time process parameter optimization. The core theme revolving around AI's influence is the transition from static, pre-programmed dispensing sequences to dynamic, adaptive processes. Key concerns center on whether AI-driven systems can autonomously compensate for environmental variables (temperature, humidity), material batch variations, and slight mechanical wear of the nozzle itself, thereby maximizing yield and minimizing the need for manual calibration or inspection. Users expect AI to elevate dispensing quality assurance, moving beyond simple image verification to predictive analytics that forecast potential failures before they impact product quality. This proactive approach aims to significantly reduce scrap rates, especially in high-cost material deposition like micro-LED bonding or biomedical assay preparation.

AI’s influence is primarily manifested through enhanced sensor fusion and data processing capabilities integrated within dispensing equipment, which directly interacts with the nozzle's performance. Advanced vision systems, coupled with ML algorithms, analyze micro-scale deposit geometry in real-time, instantly correlating deposition characteristics with upstream parameters (pressure, temperature, valve duration) to identify and correct deviations. This capability allows for 'closed-loop' dispensing where the system iteratively refines the dispensing waveform or jetting frequency to maintain target volume and shape consistency, irrespective of minor operational fluctuations. For micro dispensing nozzles, AI algorithms monitor performance metrics such such as required actuation energy over time, indicating potential fluid path obstructions or nozzle wear, enabling predictive maintenance alerts before total failure occurs.

The long-term expectation is that AI will facilitate the design and material selection process for new nozzles. By simulating fluid dynamics and material interaction at the micro-level based on operational data collected across thousands of manufacturing runs, ML models can identify optimal nozzle geometries and material compositions that offer maximal durability and precision for specific applications and fluid types. This accelerates R&D cycles and allows manufacturers to offer highly specialized, application-specific nozzles that are inherently less prone to failure modes observed in legacy designs. Therefore, AI is not only optimizing the usage of existing nozzles but is fundamentally influencing the innovation pathway of future micro dispensing solutions, focusing on higher throughput and zero-defect manufacturing standards.

- AI optimizes dispensing parameters (pressure, time, temperature) in real-time to maintain deposition consistency, combating material and environmental variability.

- Machine Learning algorithms enable predictive maintenance for micro dispensing nozzles by analyzing operational data patterns indicating impending wear or clogging.

- Integrated AI vision systems conduct automated, high-resolution quality control, minimizing reliance on post-process human inspection and dramatically improving throughput.

- AI facilitates the autonomous creation of complex, high-precision dispensing patterns by calculating optimal tool paths and nozzle actuation sequences.

- Simulation models powered by AI accelerate the development of novel nozzle materials and geometries, focusing on enhanced durability and compatibility with emerging exotic fluids.

DRO & Impact Forces Of Industrial Micro Dispensing Nozzles Market

The dynamics of the Industrial Micro Dispensing Nozzles Market are shaped by a complex interplay of internal drivers, structural restraints, and emerging opportunities, all categorized under influential impact forces such as technological advancement, economic conditions, and regulatory imperatives. A primary driver is the pervasive trend of miniaturization across all electronic devices, necessitating increasingly smaller and more precise dispensing features, pushing the limits of current nozzle technology. Concurrently, the mass deployment of 5G infrastructure, coupled with the proliferation of IoT devices, fuels unprecedented demand for high-density interconnects and advanced semiconductor packaging (e.g., heterogeneous integration, system-in-package), where micro dispensing accuracy is crucial for component functionality and thermal management. These technological demands exert strong pull factors on the market, forcing continuous innovation in fluid control systems and the associated nozzle components.

However, the market faces significant restraints. The foremost hurdle is the high initial capital investment required for ultra-precision dispensing systems, including the cost of the nozzles themselves, which are classified as highly specialized consumables. Furthermore, the operational complexity and stringent maintenance requirements of these micro-scale systems, particularly those handling highly sensitive or high-viscosity materials, necessitate highly trained technical staff, adding to operational expenditure (OPEX). Technical limitations, such as difficulties in achieving consistent, high-speed jetting of extremely high-viscosity fluids or maintaining nozzle aperture integrity during prolonged use of abrasive materials, also act as structural inhibitors to wider market adoption, particularly in emerging industrial applications.

Opportunities for expansion are abundant, particularly in niche high-growth segments. The convergence of micro dispensing technology with the biotech and medical device manufacturing industries (e.g., production of diagnostic sensors, precision drug coating, and 3D bioprinting) represents a high-margin growth area requiring bio-inert and extremely precise dispensing capabilities. The emerging field of flexible electronics and printed electronics also presents new application venues for micro dispensing nozzles suitable for depositing conductive inks and functional materials onto non-rigid substrates. The continuous development of highly durable nozzle materials, such as single-crystal diamonds or advanced composite ceramics, promises to address the current restraint of limited lifespan, offering a significant opportunity for manufacturers to capture greater market share by improving total cost of ownership (TCO) for end-users. The collective impact forces highlight technological innovation (e.g., piezo jetting) as the strongest accelerating force, while high cost and technical skill requirements act as moderating counter-forces.

Segmentation Analysis

The Industrial Micro Dispensing Nozzles Market is systematically segmented based on crucial attributes including the mechanism Type, the material used in manufacturing, the specific minimum volume achieved, and the primary End-Use Application sector. This segmentation provides a granular view of market dynamics, revealing varying growth rates and pricing sensitivities across different product categories. The fundamental difference lies in the dispensing mechanism: contact dispensing relies on mechanical pressure or volumetric displacement where the nozzle tip often touches the substrate, while non-contact (jetting) dispensing uses high-speed actuation, such as piezoelectric or pneumatic forces, to propel a micro-droplet onto the substrate without physical contact. The material segmentation is critical as it dictates the nozzle's chemical compatibility, thermal resistance, and overall lifespan, directly influencing its suitability for specialized industrial fluids.

Further analysis of segmentation emphasizes the technological shift towards ultra-fine dispensing volumes. Segments dedicated to picoliter (pL) and sub-picoliter dispensing are witnessing accelerated growth, directly responding to the increasing component density and shrinking feature sizes in advanced microelectronics, particularly in chip packaging and micro-LED assembly. This technical requirement creates a premium segment characterized by extremely tight tolerances in nozzle bore size and geometry. Conversely, the nanoliter (nL) dispensing segment, while more mature, maintains strong demand in general electronics assembly, medical diagnostics, and specialized industrial bonding applications where slightly larger volumes are acceptable but precision remains key.

The application segmentation clearly defines the market's reliance on the semiconductor industry, which dominates demand for the highest precision, high-throughput nozzles used in underfill, die bonding, and encapsulation processes. Beyond semiconductors, the medical and pharmaceutical sectors form a rapidly growing, high-value segment, driven by strict regulatory requirements for sterility and dosage accuracy in microfluidic devices and drug-eluting coatings. Understanding these segment dynamics is essential for market participants to tailor their product offerings, focusing on material innovation for durability (e.g., ceramics for abrasive fluxes) and mechanism optimization for speed (e.g., piezoelectric jetting for high-volume consumer electronics production).

- By Type:

- Jetting Nozzles (Non-Contact)

- Needle/Contact Nozzles (Time-Pressure)

- Volumetric Dispensing Nozzles

- Spray Nozzles (Micro-Spray)

- By Material:

- Tungsten Carbide Nozzles

- Ceramic Nozzles (Zirconia, Alumina)

- Stainless Steel Nozzles

- Polymer/Plastic Nozzles

- Custom/Composite Material Nozzles

- By Minimum Dispensing Volume:

- Nanoliter (nL) Dispensing

- Picoliter (pL) Dispensing

- Sub-Picoliter Dispensing

- By Application/End-Use Industry:

- Semiconductor Manufacturing & Packaging (Underfill, Die Attach)

- Consumer Electronics (LED Assembly, Display Manufacturing)

- Medical Devices & Life Sciences (Microfluidics, Diagnostics)

- Automotive Electronics

- Aerospace & Defense

- Optics & Photonics

- General Industrial Bonding

Value Chain Analysis For Industrial Micro Dispensing Nozzles Market

The value chain for the Industrial Micro Dispensing Nozzles Market begins with upstream material suppliers, who provide high-purity and specialized raw materials such as ultra-fine ceramic powders (e.g., Zirconia, Silicon Nitride), high-grade carbides, and specialized alloys. This stage is critical because the performance and longevity of the nozzle are directly dependent on the quality and consistency of these input materials. Manufacturers of micro dispensing nozzles then take these raw materials through highly specialized processes, including micro-machining, laser drilling, precision grinding, and surface treatments (like plasma etching or coating), to achieve the required sub-micrometer tolerances. Due to the precision required, this manufacturing stage involves significant technological barriers and intellectual property related to proprietary fabrication techniques, making the upstream segment highly specialized and relatively concentrated.

The downstream analysis focuses on the integration and utilization of the nozzles. Nozzles are sold primarily to manufacturers of complete dispensing equipment systems (e.g., Nordson EFD, Musashi Engineering, Asymtek), who integrate them into sophisticated robotic dispensing platforms. These systems are then sold to the final end-users in electronics, medical, or automotive manufacturing. The relationship between the nozzle manufacturer and the system integrator is crucial, as performance validation and application-specific customization often occur at this intermediary level. Direct sales to large, established end-users who operate and maintain their own dispensing systems also form a significant part of the downstream market, particularly for high-volume consumables replacement.

Distribution channels for micro dispensing nozzles are bifurcated into direct and indirect routes. Direct distribution involves sales teams and application engineers engaging directly with major OEMs and Tier 1 manufacturers, ensuring customized technical support and rapid response for complex needs. Indirect distribution relies heavily on specialized distributors and local representatives, especially in geographically dispersed emerging markets. These partners provide inventory management, regional logistics, and localized technical service, which is vital given the consumable nature of the product and the need for prompt replacements to avoid manufacturing line stoppages. Given the high-tech nature of the product, the efficiency of the service and support network often significantly outweighs logistical speed in determining distributor effectiveness.

Industrial Micro Dispensing Nozzles Market Potential Customers

The primary potential customers and buyers in the Industrial Micro Dispensing Nozzles Market are large-scale manufacturing entities that operate automated precision assembly lines requiring consistent and accurate fluid deposition. The semiconductor fabrication and packaging industry represents the largest and most demanding customer segment. These customers utilize nozzles for critical processes such as applying underfill material beneath flip-chips, jetting encapsulants onto sensitive components, and precise die-attach material placement in high-end processors, memory chips, and sensor arrays. Their procurement decisions are driven by nozzle material stability, compatibility with advanced low-K dielectric materials, and guaranteed repeatability across millions of cycles, viewing quality assurance and uptime as paramount considerations.

The consumer electronics assembly sector, encompassing manufacturers of smartphones, tablets, wearable technology, and displays (including OLED and micro-LED), forms another significant customer base. These customers prioritize high-speed jetting capabilities to meet high-volume production quotas. Specific applications include display sealant application, lens bonding, and battery module assembly. For this segment, the Total Cost of Ownership (TCO) is a critical factor, balancing the initial cost of specialized ceramic or carbide nozzles against the improved throughput and reduced material waste they facilitate compared to cheaper, less precise alternatives.

Beyond electronics, key end-users include specialized manufacturers in the medical device and pharmaceutical sectors, who demand nozzles optimized for sterile environments and capable of handling biological fluids, micro-dosage drugs, and specialized adhesives used in catheter construction or implantable sensor assembly. Automotive electronics manufacturers, driven by the expansion of ADAS (Advanced Driver-Assistance Systems) and electric vehicle (EV) component assembly (e.g., thermal management pastes, conformal coatings), are also rapidly growing consumers, requiring durable nozzles capable of functioning reliably under fluctuating temperatures and high shock environments inherent in automotive production lines. These diverse customer bases necessitate that nozzle manufacturers provide a highly diversified product portfolio tailored to vastly different fluid properties and operational requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Mycronic AB, Musashi Engineering, Inc., Asymtek (A Nordson Company), PVA TePla AG, Techcon Systems, Dispensing Dynamics, GPD Global, OTB Group, Delo Industrial Adhesives, Esen Electronic Equipment, Mactech, Fisnar, EFD (Nordson), Henkel AG & Co. KGaA, BD (Becton, Dickinson and Company), Vici Metronics, Inc., Sono-Tek Corporation, Sono-Tek Corporation, TSD Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Micro Dispensing Nozzles Market Key Technology Landscape

The technology landscape governing the Industrial Micro Dispensing Nozzles Market is primarily defined by advancements in non-contact dispensing systems, particularly the adoption of piezoelectric jetting technology. Piezoelectric nozzles utilize the rapid deformation of a piezoelectric element to generate pressure pulses that eject highly precise droplets (often down to picoliter volumes) at extremely high frequencies (up to 1,000 drops per second or more). This technology is crucial because it eliminates physical contact with the substrate, preventing damage, improving speed, and allowing dispensing onto uneven or delicate surfaces. Continuous research focuses on optimizing the fluid chamber geometry and actuator design to handle increasingly high-viscosity materials and maintain droplet uniformity over long production runs, which is paramount for processes like micro-LED transfer and advanced wafer bumping.

Material science innovation constitutes another major technological pillar. The shift from traditional stainless steel to ultra-hard materials like Tungsten Carbide and Zirconium Oxide ceramics addresses the persistent challenges of nozzle wear and chemical erosion. Carbide nozzles offer exceptional durability and resistance to abrasive fluids such as filled epoxies and solder pastes, ensuring prolonged operational life and reduced maintenance intervals. Ceramic nozzles are favored for applications requiring high chemical inertness and thermal stability, crucial when dispensing thermally cured or aggressive polymer solutions. The integration of specialized surface coatings, such as Diamond-Like Carbon (DLC), further enhances anti-clogging properties and friction reduction, sustaining precision dispensing accuracy for longer periods.

Furthermore, the incorporation of advanced monitoring and calibration technologies, often linked to the AI analysis mentioned previously, significantly influences the technological framework. Micro dispensing systems are increasingly featuring integrated high-speed cameras, laser metrology, and thermal control mechanisms directly adjacent to the nozzle to ensure precise operating conditions. New nozzle designs often incorporate features that facilitate automated cleaning cycles or rapid, tool-free replacement, minimizing downtime. Future technological development is heavily focused on developing multi-jet nozzles capable of simultaneously dispensing multiple materials or patterns, significantly increasing throughput and complexity handling for 3D integrated circuit assembly and flexible hybrid electronics manufacturing.

Regional Highlights

Regional dynamics heavily influence the demand and technological sophistication within the Industrial Micro Dispensing Nozzles Market, reflecting global manufacturing concentrations and technological maturity. The market exhibits distinct growth patterns and dominant application areas across major geographical segments.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, dominating the market due to the high concentration of global manufacturing powerhouses in consumer electronics, semiconductors, and display technology. Countries like China, Taiwan, South Korea, and Japan house the world's leading semiconductor foundries and advanced packaging facilities, creating massive demand for high-throughput, picoliter-level jetting nozzles for underfill and die-attach processes. Government initiatives supporting local advanced manufacturing further solidify its leadership position.

- North America: Characterized by high technological maturity and a focus on high-value niche applications. North America leads in demand for ultra-precision nozzles used in aerospace, defense, and sophisticated medical device manufacturing. While production volumes may be lower than in APAC, the demand is concentrated on proprietary, highly customized nozzle designs and innovative materials (e.g., bio-inert ceramics) that command premium pricing. The region is a key hub for R&D and pilot manufacturing for next-generation fluid control systems.

- Europe: Europe represents a stable market driven by the automotive electronics sector, industrial automation, and specialized manufacturing of high-quality machinery and medical equipment. Germany, Switzerland, and the Netherlands are key contributors, focusing on implementing reliable, robust dispensing solutions for tasks such as component encapsulation in demanding automotive environments and pharmaceutical-grade adhesive dispensing. The European market prioritizes durability and long-term performance adherence.

- Latin America (LATAM): This region is an emerging market primarily driven by growth in localized assembly operations for automotive and basic consumer electronics. Demand is generally focused on reliable, cost-effective stainless steel or standard carbide nozzles suitable for nanoliter dispensing, rather than the ultra-high precision required in APAC. Market growth is contingent upon foreign direct investment into regional manufacturing hubs, particularly in Mexico and Brazil.

- Middle East and Africa (MEA): MEA holds the smallest market share, with demand concentrated in high-value, specialized sectors such as oil and gas sensor manufacturing, defense-related electronics, and localized medical device assembly. Growth is slow but steady, focusing on importing established technologies to serve localized industrial needs, often relying heavily on indirect distribution channels for sourcing and technical support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Micro Dispensing Nozzles Market.- Nordson Corporation

- Mycronic AB

- Musashi Engineering, Inc.

- Asymtek (A Nordson Company)

- PVA TePla AG

- Techcon Systems

- GPD Global

- Delo Industrial Adhesives

- Henkel AG & Co. KGaA

- EFD (Nordson)

- ITW EFD

- Dispensing Dynamics

- Fisnar

- BD (Becton, Dickinson and Company)

- Vici Metronics, Inc.

- Sono-Tek Corporation

- Mactech

- OTB Group

- Esen Electronic Equipment

- TSD Technology

Frequently Asked Questions

Analyze common user questions about the Industrial Micro Dispensing Nozzles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between jetting and contact micro dispensing nozzles?

Jetting nozzles (non-contact) propel fluid droplets at high speed onto the substrate using piezoelectric or pneumatic actuation, offering higher throughput and avoiding substrate damage. Contact nozzles (needle/time-pressure) require the tip to be placed close to or touching the surface, which is ideal for highly viscous fluids but limits speed and increases the risk of mechanical contamination. Jetting is favored for modern microelectronics assembly due to its superior speed and picoliter capability.

Which materials are most effective for manufacturing highly durable micro dispensing nozzles?

Tungsten Carbide and Zirconium Oxide ceramics are the most effective materials for high-durability applications. Carbide nozzles resist mechanical wear and abrasion from filled materials like silver epoxies or solder pastes. Ceramic nozzles offer superior chemical inertness and thermal stability, essential when handling aggressive chemicals or performing high-temperature processes such as LED bonding or pharmaceutical coating.

How does the miniaturization trend in electronics specifically drive the demand for micro dispensing nozzles?

Miniaturization demands smaller feature sizes and greater component density in devices like smartphones and IoT sensors. This requires dispensing fluid volumes in the picoliter range with extremely high positional accuracy. Micro dispensing nozzles are essential for applying underfill, encapsulants, and precise adhesives in processes like flip-chip and wafer-level packaging, enabling the necessary fine pitch and reliable component interconnection that standard dispensing systems cannot achieve.

What is the role of AI in optimizing industrial micro dispensing processes?

AI integration optimizes dispensing processes by enabling real-time closed-loop control. AI algorithms analyze data from vision systems and sensors to automatically adjust pressure, temperature, and actuation parameters to compensate for fluid variation or nozzle wear. This leads to predictive maintenance, maximized yield, and highly consistent deposition quality without manual intervention, significantly enhancing operational efficiency.

Which regions exhibit the highest growth potential for the micro dispensing nozzles market?

The Asia Pacific (APAC) region, driven by continuous expansion in semiconductor manufacturing and consumer electronics production in countries like China, South Korea, and Taiwan, offers the highest current market size and the strongest growth potential. This robust growth is fueled by massive investments in advanced packaging technologies requiring high-precision fluidic control solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager