Industrial Mold Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433708 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Industrial Mold Market Size

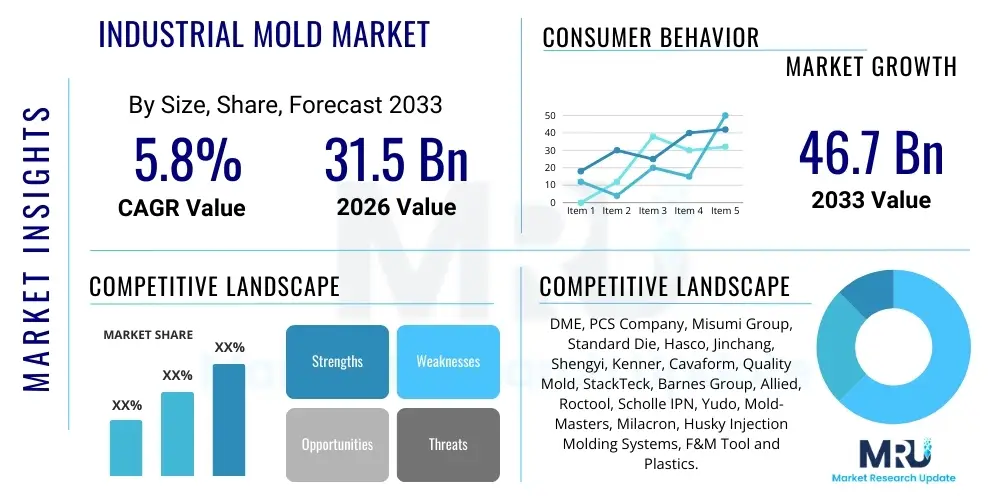

The Industrial Mold Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is underpinned by increasing industrial automation, the proliferation of complex geometry requirements across major manufacturing sectors, and advancements in tooling materials and design software. The market is estimated at USD 31.5 Billion in 2026 and is projected to reach USD 46.7 Billion by the end of the forecast period in 2033, driven largely by sustained demand from the automotive lightweighting movement and the rapid expansion of the packaging and healthcare industries globally, particularly in emerging economies.

The valuation of the market reflects the critical importance of molds in mass production processes, serving as essential components for injection molding, blow molding, compression molding, and die casting techniques. Investment in high-precision, multi-cavity molds, especially those used for medical devices and complex automotive components, significantly contributes to market value. Furthermore, the trend toward reduced product life cycles requires manufacturers to frequently retool and invest in new mold designs, maintaining a constant flow of revenue and innovation within the industry ecosystem, particularly concerning high-end, customized tooling solutions that offer superior surface finish and dimensional accuracy.

Industrial Mold Market introduction

The Industrial Mold Market encompasses the design, fabrication, and maintenance of precision tools used to shape raw materials (such as plastics, metals, glass, or ceramics) into desired products through various manufacturing processes. These molds are indispensable components in high-volume production, ensuring consistency, high quality, and cost-effectiveness across diverse sectors, including automotive, aerospace, electronics, medical, and consumer goods. Key product types include injection molds, used predominantly for plastics; die-casting molds for metal alloys; and blow molds used extensively in the packaging industry. The molds themselves are typically constructed from high-grade steel, aluminum, or specialized alloys to withstand extreme pressures and temperatures inherent in the molding process, thereby ensuring longevity and reliable performance over millions of cycles.

Major applications of industrial molds span the production of vehicle dashboards, engine components, electronic housings, disposable medical devices, beverage bottles, and construction materials. The core benefit derived from advanced mold utilization is the ability to achieve complex geometries with extremely tight tolerances at scale, far exceeding the capabilities of traditional machining methods for high-volume output. Driving factors include the global shift towards electric vehicles (EVs), which require new specialized molds for battery casings and lightweight polymer components, coupled with escalating demand for personalized packaging solutions and sophisticated medical consumables, necessitating continuous innovation in mold manufacturing technologies, including conformal cooling and additive manufacturing integration.

Industrial Mold Market Executive Summary

The global Industrial Mold Market is characterized by intense technological evolution and high fragmentation, with business trends pointing toward increased adoption of automation, integration of Industry 4.0 principles, and a strong focus on sustainability through optimized material usage and reduced energy consumption during the molding process. Key business trends involve consolidation among smaller regional mold makers to achieve economies of scale and offer comprehensive service portfolios, ranging from initial design simulation to post-production mold maintenance. Regional trends highlight the dominance of the Asia Pacific (APAC) market, primarily driven by China and India, which serve as global manufacturing hubs for electronics, automotive parts, and consumer plastics, while North America and Europe emphasize high-precision tooling for aerospace and medical devices, focusing less on volume and more on technical complexity and rapid prototyping capabilities.

Segment trends reveal that Injection Molding retains the largest market share due to its versatility and ubiquitous application across consumer goods and automotive sectors, though Die Casting Molds are experiencing accelerated growth fueled by the demand for lightweight metallic components in the automotive and aerospace industries. Furthermore, the segmentation by end-use application underscores the escalating importance of the Healthcare sector, where molds for highly specialized consumables and diagnostic equipment require exceptional surface finish, sterile manufacturing environments, and adherence to stringent regulatory standards. Material trends show a persistent preference for high-strength tool steel (P20, H13) but with growing interest in advanced aluminum alloys and hybrid molds incorporating additive manufactured inserts for localized temperature control, significantly impacting cycle times and overall productivity across all application segments.

AI Impact Analysis on Industrial Mold Market

Common user questions regarding AI’s impact on the Industrial Mold Market often revolve around its capability to dramatically compress the design-to-production timeline, ensure 'first-time-right' tooling, and minimize costly downtime through proactive maintenance strategies. Users are keenly interested in generative design algorithms that automatically optimize mold cooling channels and gate locations based on material flow simulations, thereby reducing manual iteration cycles, which traditionally consume significant engineering time. Concerns also center on the investment cost required for implementing AI-driven monitoring systems and integrating legacy Computer-Aided Engineering (CAE) platforms with modern machine learning tools capable of analyzing large datasets of sensor readings from the molding presses. The key expectations users have are achieving zero-defect production runs, predictive tool life extension, and a fundamental shift towards truly automated manufacturing cells where mold performance is continually self-optimized based on real-time operational feedback loops.

AI's role extends significantly beyond the initial design phase, penetrating quality control and operational efficiency realms. Machine learning algorithms are now being deployed to analyze high-speed camera footage and sensor data collected during the injection phase to detect subtle imperfections in product quality or minor variations in mold temperature that signal impending issues. This proactive quality assurance minimizes scrap rates and prevents potentially long, expensive production stops associated with faulty tooling. Furthermore, AI-powered systems are crucial for predictive maintenance, leveraging historical wear data and current operational parameters to accurately forecast the remaining useful life of a mold, allowing for scheduled maintenance during non-peak hours rather than disruptive, unexpected failures.

- AI-Driven Generative Design: Optimizes complex internal geometries like conformal cooling channels, reducing cycle times by 15-30%.

- Predictive Maintenance: Utilizes machine learning on sensor data (temperature, pressure, vibration) to forecast tool failure, minimizing unexpected downtime by up to 25%.

- Automated Quality Control: AI vision systems detect micro-defects in molded parts instantaneously, leading to zero-defect manufacturing objectives.

- Simulation Optimization: Enhanced CAE simulation tools powered by AI accelerate material flow analysis and stress testing, ensuring 'first-time-right' mold fabrication.

- Supply Chain Optimization: AI algorithms predict material procurement needs and manage inventory for specialty steels and mold components efficiently.

DRO & Impact Forces Of Industrial Mold Market

The Industrial Mold Market is subject to complex interplay between dynamic demand drivers and significant operational restraints, balanced by promising technological opportunities. Key drivers include the massive expansion of the global automotive industry, particularly the shift towards lightweight, multi-material structures required for electric vehicles, necessitating highly sophisticated, durable molds capable of handling high-performance engineering plastics and specialized composites. Simultaneously, restraints such as the substantial upfront capital investment required for high-precision, multi-cavity tooling, coupled with the critical shortage of highly skilled mold designers and toolmakers, challenge market growth and increase time-to-market for complex projects. The primary opportunity lies in the widespread integration of Industry 4.0 principles, including sensor embedding (smart molds) and additive manufacturing (3D printing) for rapid prototyping and creating complex mold inserts, offering customized solutions that enhance productivity and tool life, thereby mitigating some of the operational restraints.

Impact forces largely stem from two areas: economic volatility and technological disruption. Economically, fluctuations in raw material prices, particularly steel and aluminum alloys, directly influence the cost of mold fabrication, impacting profit margins for manufacturers and procurement decisions for end-users. Technologically, the rapid maturation of 3D printing for rapid tooling and production parts presents both a competition and a complement to traditional molding techniques. While 3D printing cannot yet achieve the throughput or material versatility of injection molding for mass consumer goods, it is rapidly capturing market share in low-volume, highly customized production and prototyping, forcing traditional mold makers to adapt by offering hybrid solutions or specializing in ultra-high-volume, high-precision tools where traditional methods remain superior. Geopolitical trade tensions and tariffs also act as a significant external impact force, potentially disrupting global supply chains for specialized mold components and raw materials, leading to regionalization of the manufacturing base and increased local sourcing requirements for complex tooling.

Segmentation Analysis

The Industrial Mold Market is broadly segmented based on Type, Material, and End-Use Application, reflecting the diverse manufacturing requirements across the global industrial landscape. The segmentation by Type, including Injection Molding, Blow Molding, Compression Molding, and Die Casting Mold, dictates the process methodology and the raw material used for the end product. Injection molding molds dominate the market due to their widespread use in manufacturing everything from small electronic connectors to large automotive body panels using thermoplastics. The Material segment, covering Steel, Aluminum, and various exotic alloys, reflects the required durability, thermal properties, and cost considerations for the mold itself. Steel remains the core material for high-volume, high-wear applications, while aluminum is favored for lower-volume, faster-cycle prototyping due to its excellent thermal conductivity and lower cost.

The End-Use Application segment provides the most critical insight into market drivers, highlighting the dependency on major industries such as Automotive, Electrical & Electronics, Healthcare, and Packaging. The Automotive sector is the largest consumer, driven by the need for molds for both interior and exterior components, increasingly focused on lightweighting solutions to improve fuel efficiency and battery range in EVs. Simultaneously, the Healthcare sector is emerging as the fastest-growing segment, propelled by the continuous demand for sterile, high-precision single-use devices, syringes, and diagnostic kits, which mandates molds of the highest quality and compliance standards, often requiring multi-cavity stack molds operating under extremely tight dimensional tolerances and stringent material compatibility requirements for regulatory approval in major markets like the U.S. and E.U.

- By Type:

- Injection Molding

- Blow Molding

- Compression Molding

- Die Casting Mold

- Others (RTM, Thermoforming Molds)

- By Material:

- Steel (Tool Steel, Stainless Steel)

- Aluminum Alloys

- Specialty Alloys (Nickel, Copper Beryllium)

- By End-Use Application:

- Automotive

- Electrical & Electronics

- Healthcare & Medical Devices

- Packaging (Food & Beverage, Industrial)

- Construction

- Consumer Goods

- Aerospace & Defense

Value Chain Analysis For Industrial Mold Market

The value chain of the Industrial Mold Market is highly specialized, beginning with the Upstream segment, dominated by suppliers of high-quality raw materials and specialized machinery. This includes steel mills providing specific grades of tool steel (e.g., P20, H13, 420 stainless steel) and specialized metal alloy manufacturers, who often dictate the quality, thermal performance, and longevity of the final mold. Machinery manufacturers, including providers of high-speed CNC machining centers, EDM (Electrical Discharge Machining) equipment, and advanced metrology systems, form the backbone of the fabrication process. The core value addition occurs in the middle segment—the mold manufacturers themselves—who undertake detailed design, simulation (CAE/CAD), precision machining, heat treatment, and final assembly, relying heavily on expert engineering talent to ensure dimensional accuracy and optimal functionality under high stress conditions. Direct and indirect distribution channels are employed, with customized, complex molds typically sold directly to large original equipment manufacturers (OEMs) or Tier 1 suppliers, while standard components (mold bases, hot runner systems) are often distributed indirectly through specialized engineering distributors and global marketplaces like Misumi or DME.

The Downstream segment comprises the various end-user industries, where the value of the mold is ultimately realized through the mass production of components. Automotive manufacturers, consumer electronics companies, and medical device producers are the primary beneficiaries, utilizing the molds in injection, blow, or compression presses. The relationship between the mold maker and the downstream buyer is often symbiotic; the mold maker needs precise specifications, and the buyer relies on the mold maker's expertise to optimize cycle time and part quality. Critical factors influencing the downstream relationship include after-sales service, maintenance, and modification capabilities, as mold maintenance and refurbishment are crucial throughout the product life cycle, which can span many years and millions of cycles, representing a significant recurring service revenue stream for specialized mold houses capable of rapid repair and modification.

Industrial Mold Market Potential Customers

The potential customers and primary buyers within the Industrial Mold Market are large-scale manufacturers and specialized Tier 1 and Tier 2 suppliers across capital-intensive sectors globally. These end-users require molds as strategic, long-term investments necessary for achieving high volume, consistent quality output. The Automotive industry, including conventional Internal Combustion Engine (ICE) vehicle manufacturers, Electric Vehicle (EV) producers, and their component suppliers (e.g., battery casing producers, interior component specialists), represents the single largest customer base, prioritizing molds for lightweighting materials and durable, aesthetically critical interior components. The Electrical and Electronics sector is another major customer, demanding high-precision, multi-cavity molds for small, intricate parts such as connectors, casings for smartphones, and components for IoT devices, often requiring rapid mold changes due to short product life cycles and high material specialization (e.g., heat-resistant polymers).

Beyond the high-volume segments, the Healthcare and Packaging industries constitute rapidly expanding customer segments. Healthcare buyers, including pharmaceutical companies and medical device OEMs (Original Equipment Manufacturers), seek highly specialized, often validated, single-use molds for products like surgical tools, syringes, and diagnostic cartridges, where materials must be biocompatible and dimensional tolerances are extremely rigorous. The Packaging industry, spanning food and beverage containers and industrial packaging, drives massive demand for high-cavity, fast-cycling blow and injection molds for producing bottles, caps, and closures. These customers prioritize speed, reliability, and low cost per piece, favoring standardized, highly automated molding systems that maximize throughput, making mold durability and efficient hot runner systems critical buying criteria in their procurement decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 31.5 Billion |

| Market Forecast in 2033 | USD 46.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DME, PCS Company, Misumi Group, Standard Die, Hasco, Jinchang, Shengyi, Kenner, Cavaform, Quality Mold, StackTeck, Barnes Group, Allied, Roctool, Scholle IPN, Yudo, Mold-Masters, Milacron, Husky Injection Molding Systems, F&M Tool and Plastics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Mold Market Key Technology Landscape

The Industrial Mold Market is currently undergoing a significant technological transformation, moving towards precision, efficiency, and integrated intelligence. A primary technological focus is the adoption of Additive Manufacturing (AM), or 3D printing, specifically in producing complex mold inserts and cores, enabling geometries such as conformal cooling channels that are impossible to achieve via traditional machining methods. Conformal cooling significantly reduces cycle times by ensuring uniform temperature distribution across the mold cavity, a critical factor for high-speed production, especially in complex plastic injection molding. Furthermore, high-speed, high-precision five-axis CNC machining centers remain essential for creating the main mold structures with sub-micron accuracy, complemented by advanced Electrical Discharge Machining (EDM) for intricate internal features and deep cavities, ensuring superior surface finish and structural integrity required for highly technical components.

The rise of Industry 4.0 has mandated the integration of "Smart Molds," which incorporate embedded sensors (temperature, pressure, strain) and RFID tags. These smart tools enable real-time monitoring of the molding process parameters, providing data essential for AI-driven predictive maintenance and quality assurance systems. Hot Runner Technology is another crucial area, evolving to include valve-gate systems and sequential valve gating, which offer superior control over material flow, reducing waste (runners) and improving part quality for complex, multi-gate molds. Advanced mold coatings, such as Plasma Enhanced Chemical Vapor Deposition (PECVD) layers, are increasingly utilized to enhance mold durability, reduce friction, and improve release characteristics, further extending the tool life and minimizing maintenance interventions during high-volume production cycles.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the Industrial Mold Market, commanding the largest revenue share, primarily due to the massive concentration of high-volume manufacturing hubs in China, Japan, South Korea, and India. China, specifically, serves as a dominant force in the production of molds for consumer electronics and automotive parts. The region benefits from lower operating costs, extensive industrial infrastructure, and rapidly growing domestic consumption in countries like India, driving sustained demand for both standard and high-precision tooling across electronics and plastic packaging sectors. Investment in advanced tooling technology is accelerating, shifting the focus from low-cost, high-volume production to higher-precision, complex molds required for next-generation products.

- North America: North America is characterized by a strong focus on high-precision, low-to-medium volume, and high-complexity tooling, especially in the Healthcare (medical devices, pharmaceuticals) and Aerospace industries. The region emphasizes rapid prototyping capabilities and utilizes the most advanced technologies, including extensive adoption of specialized 3D printing for rapid mold iteration and hybrid tooling solutions. Demand is stable, driven by strict regulatory requirements in sectors like medical and defense, which mandate local sourcing and stringent quality controls, supporting a strong domestic market for specialized tool and die makers known for superior engineering and service standards.

- Europe: Europe holds a significant market share, distinguished by its concentration on premium automotive tooling (Germany, Italy) and advanced packaging solutions. The region is a pioneer in integrating Industry 4.0 technologies, including smart molds and highly automated production systems, particularly in precision engineering industries. Germany, as the European industrial powerhouse, leads in technological innovation, emphasizing sustainable manufacturing processes, high energy efficiency in molding operations, and the use of cutting-edge materials and coatings to ensure the highest possible tool life and product quality for high-end industrial and consumer applications.

- Latin America (LATAM): The LATAM market exhibits steady growth, primarily centered in Mexico and Brazil, driven by the expanding automotive manufacturing base and local consumer goods demand. Mexico benefits significantly from its proximity to the U.S. and its integration into North American supply chains, increasing the requirement for domestically sourced tooling. While traditionally relying on imported molds, the region is seeing increasing investment in domestic toolmaking capabilities, focusing on mid-range complexity molds for regional consumption and export, particularly in the packaging and automotive component sectors, with governmental and private initiatives aimed at skill development and technology transfer.

- Middle East and Africa (MEA): The MEA market is currently the smallest but shows high growth potential, linked largely to infrastructure projects, increasing urbanization, and diversification away from oil economies. The expansion of packaging (especially food and beverage) and local automotive assembly operations are the primary demand drivers for industrial molds. The majority of high-precision molds are imported, but regional manufacturers, particularly in the UAE and Saudi Arabia, are initiating strategic investments in localized manufacturing capabilities to support domestic plastic fabrication and component production needs, driven by national economic diversification strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Mold Market.- DME (A division of Milacron)

- PCS Company

- Misumi Group Inc.

- Standard Die International

- Hasco Hasenclever GmbH + Co KG

- Jinchang Group Co., Ltd.

- Shengyi Technology Co., Ltd.

- Kenner Inc.

- Cavaform Inc.

- Quality Mold Inc.

- StackTeck Systems Ltd.

- Barnes Group Inc. (FOBOHA)

- Allied Systems Co.

- Roctool S.A.

- Scholle IPN (for specialized packaging molds)

- Yudo Co., Ltd. (Hot Runner Systems)

- Mold-Masters (A Milacron brand)

- Husky Injection Molding Systems Ltd.

- F&M Tool and Plastics

- Ogihara Corporation

Frequently Asked Questions

Analyze common user questions about the Industrial Mold market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Industrial Mold Market?

The primary factor driving market growth is the global automotive industry's shift toward electric vehicles (EVs) and the mandated lightweighting initiatives. This necessitates complex, high-precision molds for advanced engineering plastics used in battery casings, interior components, and specialized structural parts, sustaining high demand for advanced tooling solutions globally.

How does Additive Manufacturing (3D Printing) impact traditional mold making?

Additive Manufacturing positively impacts mold making by allowing the creation of complex internal features like conformal cooling channels in mold inserts, which reduces cycle times significantly and improves part quality. While it competes in rapid prototyping, it primarily serves as a complement, enhancing the efficiency and design flexibility of traditional, high-volume molds.

Which region holds the largest market share for Industrial Molds?

The Asia Pacific (APAC) region currently holds the largest market share, driven by its extensive and growing manufacturing infrastructure, high-volume production of consumer electronics, packaging, and automotive components, particularly across major economies like China and India, which serve as global production hubs for molded goods.

What are 'Smart Molds' and their importance in Industry 4.0?

Smart Molds are industrial molds embedded with sensors (temperature, pressure, strain) and connectivity features (IoT). They are crucial for Industry 4.0 as they enable real-time process monitoring, data collection, and integration with AI systems, facilitating predictive maintenance, automated quality control, and optimized cycle parameter adjustments to maximize tool efficiency and lifespan.

What are the main material constraints affecting the mold fabrication process?

The main material constraints include the high cost and price volatility of specialty tool steels and alloys, which are essential for durable molds. Furthermore, the requirement for specific heat treatment processes and highly precise machining of these hard materials necessitates long lead times and sophisticated machinery, influencing overall project timelines and capital expenditure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager