Industrial Overload Relays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435939 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Overload Relays Market Size

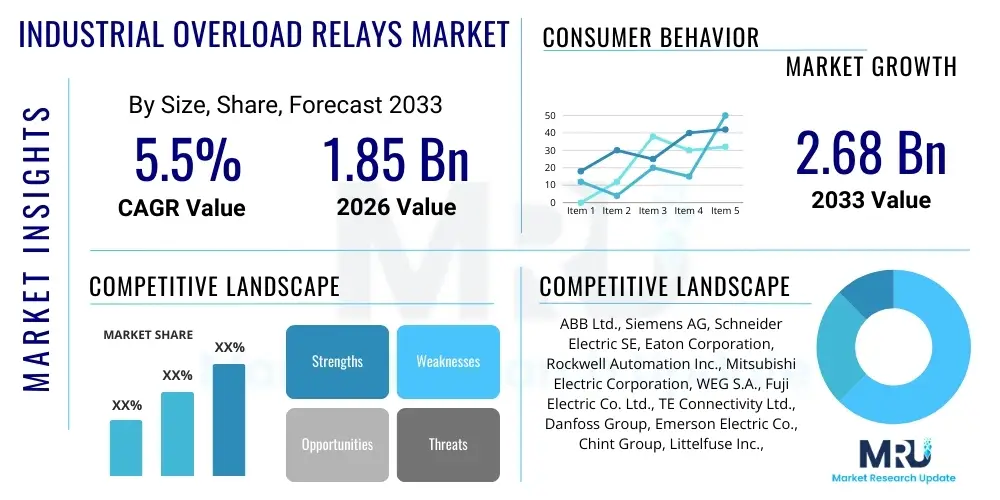

The Industrial Overload Relays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.68 Billion by the end of the forecast period in 2033.

Industrial Overload Relays Market introduction

Industrial overload relays are critical protective devices designed to safeguard electric motors, machines, and associated circuitry from damage caused by excessive current draw. These devices operate by sensing prolonged overcurrent conditions, which typically arise from mechanical overloads, phase loss, or operational failures, and subsequently triggering a trip mechanism to interrupt the power supply. The fundamental mechanism involves monitoring the current flowing to the motor and comparing it against a predetermined safe limit, ensuring that high transient currents do not lead to insulation failure or winding damage, thereby preventing costly downtime and equipment replacement.

The product portfolio encompasses various types, primarily classified into thermal, electronic (solid-state), and magnetic relays, each catering to specific application needs based on precision requirements, trip speed, and motor type. Thermal overload relays, historically dominant, utilize bimetallic strips sensitive to heat generated by overload currents. In contrast, electronic overload relays offer superior precision, wider adjustment ranges, and advanced diagnostic capabilities, making them increasingly favored in demanding industrial environments where accurate motor protection and data integration are essential. Major applications span across heavy industries such as manufacturing, oil and gas, mining, water and wastewater treatment, and automotive production, wherever continuous, reliable motor operation is non-negotiable.

Key benefits derived from implementing these relays include enhanced motor lifespan, significant reduction in unexpected operational shutdowns, improved personnel safety by mitigating electrical hazards, and compliance with stringent industrial safety standards like IEC and NEMA. The market growth is fundamentally driven by the accelerating pace of global industrial automation, increasing investments in smart manufacturing (Industry 4.0), and the mandatory need for energy efficiency and predictive maintenance strategies across various sectors. Furthermore, stringent safety regulations concerning motor protection in hazardous and critical operational zones globally propel the demand for sophisticated, reliable overload protection devices.

Industrial Overload Relays Market Executive Summary

The Industrial Overload Relays Market is experiencing robust expansion, primarily fueled by global urbanization, rapid industrialization across Asia Pacific economies, and the widespread adoption of automation technologies requiring precise motor control and protection. Business trends emphasize a distinct shift from traditional thermal relays toward advanced electronic and solid-state variants, which offer enhanced reliability, programmability, and integration capabilities with Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems. This technological pivot allows end-users to implement predictive maintenance protocols and optimize energy usage, thereby driving demand for smart, network-enabled protection solutions. Furthermore, mergers, acquisitions, and strategic collaborations focused on expanding geographical reach and integrating IoT capabilities are key strategies adopted by leading market players.

Regionally, Asia Pacific maintains its dominance and is poised for the fastest growth, largely due to massive infrastructure projects, burgeoning manufacturing sectors in China and India, and significant governmental focus on upgrading industrial machinery to meet modern efficiency standards. North America and Europe, while mature, demonstrate steady growth driven by strict industrial safety standards, the necessity of replacing aging motor infrastructure, and high adoption rates of premium electronic relays in complex industrial processes. The competitive landscape is characterized by established multinational electrical equipment manufacturers competing on technological innovation, product lifetime reliability, and comprehensive service offerings.

Segmentation trends highlight the Electronic Overload Relays segment as the fastest-growing category due to its superior current monitoring precision and diagnostic feedback capabilities. Application-wise, the machinery and manufacturing sector remains the largest segment, demanding robust protection for pumps, compressors, fans, and conveyer systems. However, the energy and utilities sector is projected to exhibit significant CAGR, driven by investment in renewable energy generation and complex grid infrastructure that requires high-reliability protection mechanisms for motors used in pumps, cooling systems, and critical auxiliary equipment. Overall market trajectory favors solutions that combine protection, monitoring, and communication functionalities, aligning with the principles of Industry 4.0.

AI Impact Analysis on Industrial Overload Relays Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Overload Relays Market commonly revolve around themes of predictive failure detection, optimization of trip curves, and integration capabilities within smart manufacturing ecosystems. Users frequently ask how AI can analyze complex operational data—such as motor temperature fluctuations, load variations, and current harmonics—to predict incipient overload conditions before a standard relay trips, thereby preventing unnecessary downtime or equipment wear. Key concerns center on the cybersecurity vulnerabilities associated with connecting protective devices to AI-driven networks and the return on investment (ROI) of upgrading existing infrastructure with AI-compatible solid-state relays. The general expectation is that AI will transform overload protection from a purely reactive measure to a sophisticated, proactive maintenance tool, optimizing operational parameters far beyond the capabilities of conventional relays.

The integration of AI leverages machine learning algorithms trained on vast datasets of motor fault signatures and operational norms. This allows smart electronic overload relays, often embedded with advanced microprocessors or connected to edge computing devices, to dynamically adjust their protection parameters based on real-time environmental and load conditions. For example, an AI system can distinguish between a brief, safe startup current surge and a developing mechanical fault that manifests as a slow, escalating overload. This level of granularity minimizes nuisance tripping while ensuring protection when genuinely needed, drastically improving overall equipment effectiveness (OEE).

Furthermore, AI facilitates highly optimized energy management. By continuously analyzing motor load profiles against efficiency models, AI can flag deviations indicative of suboptimal operation or mechanical degradation (e.g., bearing failure leading to increased current draw). This capability extends the role of the overload relay beyond simple protection into a critical component of energy auditing and asset performance management (APM) systems, positioning the latest generation of electronic relays as data generators essential for complex industrial process optimization. The market is thus shifting towards "Intelligent Motor Protection Relays" that are AI-ready.

- AI enables predictive overload detection by analyzing complex harmonic and vibration data patterns.

- Optimization of tripping characteristics based on historical load data and real-time operational context.

- Integration of relay data into Centralized Asset Performance Management (APM) systems via machine learning models.

- Enhanced root cause analysis of motor faults using AI classification algorithms on trip data logs.

- Facilitation of dynamic maintenance scheduling, reducing reliance on fixed-interval inspections.

- Development of self-adapting protection settings for variable frequency drive (VFD) applications.

- Mitigation of false trips by distinguishing between safe transients and true destructive overload events.

DRO & Impact Forces Of Industrial Overload Relays Market

The market for Industrial Overload Relays is significantly shaped by a confluence of accelerating industrial automation, rigorous safety mandates, and the continuous drive for operational efficiency. Key drivers include global proliferation of high-power motors in heavy industry and manufacturing, necessitating robust protection infrastructure. Conversely, the market faces restraints such as the relatively high initial cost of advanced electronic relays compared to traditional thermal types, especially in price-sensitive emerging markets, and the persistent challenge of seamless integration into legacy control systems. Opportunities abound through the integration of IoT and Industry 4.0 technologies, allowing relays to become smart nodes that provide rich diagnostic data, opening up lucrative avenues in predictive maintenance and remote asset monitoring services. The overall impact forces compel manufacturers to innovate toward higher precision, faster response times, and greater communication capabilities.

A primary driver is the modernization of electrical infrastructure worldwide, driven by mandates aimed at improving energy efficiency and reducing carbon footprint. Modern electrical codes often require specific classes of motor protection, favoring electronic relays that offer precise current limiting and protection across a broader temperature range than older technologies. Furthermore, the rapid growth of the water and wastewater, HVAC, and food and beverage industries—all heavily reliant on motors and pumps—creates continuous demand for reliable protection devices. These industries often require specialized, corrosion-resistant, and high-reliability relays, intensifying competition among manufacturers to offer application-specific solutions.

Restraints include the extended lifecycle of installed motor control centers (MCCs), which often delays the adoption of newer relay technologies, particularly thermal replacements which are only triggered during major facility overhauls or catastrophic failures. Another restraint is the complexity associated with configuring and commissioning sophisticated electronic relays, which requires specialized technical training often lacking in smaller industrial maintenance teams. However, the opportunity landscape is vast, especially with the standardization of communication protocols (like Modbus TCP/IP and EtherNet/IP) enabling electronic relays to become indispensable components of connected factory floors. This connectivity allows for real-time monitoring, reducing human intervention and operational risk, thereby justifying the higher capital expenditure.

Segmentation Analysis

The Industrial Overload Relays Market is comprehensively segmented based on Type, Phase, Current Rating, Mounting Type, End-User Industry, and Geography, providing a multi-dimensional view of market dynamics and targeted deployment strategies. The segmentation highlights the underlying technological shifts, particularly the dominance and projected high growth of electronic relays over their thermal counterparts, driven by demands for precision and connectivity. Analyzing these segments is critical for manufacturers to align their R&D investments with high-demand product categories, such as relays designed for high current ratings or those optimized for communication protocols essential in modern smart factories.

The segmentation by End-User Industry reveals the varying dependency and specific protection requirements across sectors like manufacturing, oil & gas, and utilities. Manufacturing, being the highest consumer, requires versatility and durability across a wide range of machinery. Conversely, segments like power generation require relays with exceptional reliability and high breaking capacity due to the critical nature of the operations. The market is also strategically segmented by region, reflecting differences in industrial maturity, regulatory environment (e.g., explosion-proof certifications in hazardous locations), and the speed of Industry 4.0 adoption, with APAC driving volume growth and North America and Europe leading technological adoption.

Understanding the interplay between Current Rating and Phase is essential for product development, as three-phase motors are standard in heavy industrial applications requiring high current capacity relays (above 100A), demanding robust design and thermal dissipation features. The movement toward standardized rail mounting (DIN rail) simplifies installation and maintenance, favoring modular designs across all technology types. This detailed segmentation aids stakeholders in identifying niche opportunities, such as high-precision relays for cleanroom environments or ruggedized relays for mining and construction applications, ensuring tailored market penetration strategies.

- By Type:

- Thermal Overload Relays (Bimetallic)

- Electronic Overload Relays (Solid-State)

- Magnetic Overload Relays

- By Phase:

- Single-Phase

- Three-Phase

- By Current Rating:

- Up to 25 A

- 25 A to 100 A

- Above 100 A

- By Mounting Type:

- Panel Mount

- DIN Rail Mount

- Standalone/Free-Standing

- By End-User Industry:

- Manufacturing and Automotive

- Oil and Gas

- Energy and Utilities (Power Generation & Transmission)

- Water and Wastewater Treatment

- Mining and Metals

- Chemical and Petrochemical

- Others (HVAC, Construction)

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Industrial Overload Relays Market

The value chain for the Industrial Overload Relays Market starts with the sourcing of essential raw materials and electronic components, followed by manufacturing, distribution, and finally, end-user installation and maintenance. Upstream analysis focuses on securing high-quality, specialized components, particularly bimetallic elements for thermal relays, advanced semiconductor chips and microcontrollers for electronic relays, and specialized plastics and metals for enclosures and contacts. Efficient procurement strategies are crucial to manage costs and ensure compliance with stringent material standards (e.g., RoHS). Key suppliers often include specialized electronics firms and metal foundries.

The manufacturing stage involves high-precision assembly, calibration, and rigorous quality testing, especially for solid-state relays requiring complex firmware programming and integration testing with motor control centers. Leading manufacturers invest heavily in automated assembly lines to ensure consistency and scale production. The distribution channel is multifaceted, relying heavily on a network of authorized distributors, electrical wholesalers, and system integrators who provide local inventory, technical support, and installation expertise. Direct sales channels are typically reserved for large-scale industrial projects or Original Equipment Manufacturers (OEMs) who integrate relays directly into their machinery.

Downstream analysis focuses on the end-user adoption and post-sales service. System integrators play a vital role in integrating sophisticated electronic relays into broader industrial control systems (PLCs, SCADA). Indirect distribution, through electrical distributors, accounts for the majority of aftermarket sales and replacements, capitalizing on the need for rapid availability of standard components. Direct engagement with large industrial end-users allows manufacturers to offer customized solutions, training, and maintenance contracts, establishing long-term customer relationships and valuable feedback loops for product refinement. The movement towards smart relays requires distributors and installers to offer enhanced technical competencies, including networking and software configuration expertise.

Industrial Overload Relays Market Potential Customers

The primary customers and end-users of Industrial Overload Relays are organizations across critical industrial sectors that rely heavily on electric motor-driven machinery for core operations. These include manufacturers of machinery (OEMs), large industrial facility operators (MRO - Maintenance, Repair, and Operations), and engineering, procurement, and construction (EPC) firms involved in setting up new industrial plants or upgrading existing infrastructure. OEMs, such as those producing compressors, industrial pumps, HVAC systems, and conveyor belts, are pivotal customers as they integrate overload relays directly into their final product assemblies, demanding high volumes of standardized, reliable units.

Specific target buyer groups within the MRO segment include plant managers, maintenance engineers, and electrical technicians in sectors like petrochemicals, power generation (coal, gas, and renewables), and automotive assembly. These buyers prioritize product longevity, reliability, ease of maintenance (especially features like plug-and-play installation), and compliance with site-specific safety regulations. The adoption of smart, electronic relays is driven by their need for diagnostic data to optimize uptime and transition from reactive to predictive maintenance models, making features like communication protocols (e.g., EtherNet/IP compatibility) highly desirable purchasing criteria.

Furthermore, water and wastewater treatment plants represent a stable segment, requiring extremely durable, often hermetically sealed, overload relays for pumps operating continuously in harsh, corrosive environments. Utility providers and energy companies purchase high-current rated relays to protect massive motors powering cooling towers and critical auxiliary systems in power stations. The purchasing decision often involves a careful balance between initial capital outlay (favoring thermal relays) and the long-term operational savings and diagnostic benefits offered by advanced solid-state relays, heavily influenced by total cost of ownership (TCO) assessments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.68 Billion |

| Growth Rate | CAGR 5.5 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation, Rockwell Automation Inc., Mitsubishi Electric Corporation, WEG S.A., Fuji Electric Co. Ltd., TE Connectivity Ltd., Danfoss Group, Emerson Electric Co., Chint Group, Littelfuse Inc., Lovato Electric S.p.A., Sprecher + Schuh, Coto Technology, Inc., Phoenix Contact, Hubbell Incorporated, IDEC Corporation, Terasaki Electric Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Overload Relays Market Key Technology Landscape

The Industrial Overload Relays market is currently dominated by two parallel technology streams: the mature but continuously optimized thermal relay technology, and the highly dynamic, future-focused electronic (solid-state) technology. Thermal relays rely on the principle of thermal expansion using bimetallic strips, offering a cost-effective and rugged solution suitable for standard, non-critical applications where high precision is not paramount. Recent technological improvements in thermal relays focus mainly on enhanced materials science to improve ambient temperature compensation and reduce component size, allowing them to remain competitive in basic motor protection scenarios. However, the future trajectory is clearly dictated by the advancements in electronic relays.

Electronic overload relays integrate microprocessors and current sensing technologies, often utilizing current transformers (CTs) or shunt resistors, to provide extremely accurate current measurement. Key technological advancements here include the incorporation of communication interfaces, most notably industrial Ethernet protocols like PROFINET, EtherNet/IP, and Modbus TCP, transforming the relay from a protective device into a data-generating sensor node. This connectivity enables remote monitoring, detailed fault diagnostics, and integration into sophisticated energy management systems. Furthermore, modern electronic relays offer customizable and programmable trip curves (e.g., Class 5, 10, 20, 30), allowing engineers to precisely match the protection characteristics to specific motor types and application requirements, a flexibility impossible to achieve with fixed thermal mechanisms.

A significant area of innovation involves the development of hybrid motor protection solutions that combine the low cost and simplicity of electro-mechanical components with the intelligence and speed of solid-state electronics. These hybrid designs aim to offer the best of both worlds, providing rapid fault clearance while maintaining high reliability and reduced heat dissipation compared to purely solid-state solutions in high-power applications. Further focus is on enhancing diagnostic capabilities, including integrated ground fault and phase imbalance detection, alongside embedded health monitoring features that track relay operating life and contact wear, moving closer toward a fully self-aware motor protection system aligned with the tenets of Industry 4.0 and cyber-physical systems.

Regional Highlights

The global Industrial Overload Relays Market exhibits distinct regional consumption and growth patterns, heavily influenced by the level of industrial maturity, regulatory frameworks, and capital investments in factory automation.

- Asia Pacific (APAC) Market Dominance and Growth

APAC currently represents the largest market share and is forecasted to be the fastest-growing region during the forecast period. This growth is predominantly driven by aggressive infrastructure development, large-scale industrialization in emerging economies like China, India, and Southeast Asian nations, and substantial investments in the manufacturing and automotive sectors. Government initiatives promoting domestic manufacturing (such as "Made in China 2025" and "Make in India") necessitate the installation of new machinery and motor control systems, thereby escalating the demand for both cost-effective thermal relays and advanced electronic protection devices. The sheer volume of new industrial capacity coming online guarantees sustained market expansion, though price sensitivity remains higher here than in Western markets, leading to robust competition among local and international players.

Countries like China and India are rapidly adopting automated manufacturing processes, moving towards digitized factory floors. This migration creates a strong underlying demand for electronic overload relays capable of seamless integration with local control architectures. Additionally, the region's expanding energy and utility sectors, particularly investment in coal-fired power plants and large-scale renewable energy farms, require high-current, robust motor protection solutions for pumps, cooling systems, and critical auxiliary equipment. Regulatory bodies are slowly tightening standards related to electrical safety and energy efficiency, compelling older facilities to upgrade their protection schemes, further boosting replacement demand.

- North America (NA) Market Maturity and Technology Adoption

North America holds a substantial market share characterized by high adoption rates of advanced, high-specification electronic overload relays. Market growth here is primarily driven by the modernization of existing industrial facilities, the replacement of obsolete motor control centers, and strict compliance with safety standards such such as NEMA and UL listings. Key consuming sectors include the oil and gas industry, demanding explosion-proof and highly reliable devices for hazardous locations, and the pharmaceutical and food and beverage industries, requiring sanitary and precise control over production machinery.

The region leads in the adoption of Industry 4.0 concepts, driving demand for smart relays featuring embedded diagnostic capabilities and interoperability via standardized industrial protocols (e.g., EtherNet/IP). Manufacturers in North America prioritize total cost of ownership (TCO) over initial capital expenditure, strongly favoring electronic relays that minimize unplanned downtime and provide rich diagnostic data essential for predictive maintenance programs. The focus on sustainability also encourages the use of highly efficient motor starters and protectors that contribute to reduced energy consumption across manufacturing processes.

- Europe Market Innovation and Regulatory Compliance

Europe is a mature market known for high technological sophistication and stringent regulatory standards (e.g., CE marking and IEC norms). The market growth is stable, driven by the strong automotive, machinery, and chemical sectors, coupled with an intense focus on operational safety and worker protection. European end-users quickly adopt the latest electronic relay technologies that offer enhanced functional safety features and integrated monitoring capabilities, aligning with directives aimed at reducing industrial accidents and improving equipment reliability.

A key trend in Europe is the pervasive push for digitalization and the smart factory concept, particularly in Germany and Italy. This environment favors solutions that integrate seamlessly into complex automation architectures. Demand is high for compact, modular, and high-performance DIN rail mountable relays that conserve panel space while delivering superior protection and advanced communication features. Furthermore, the region’s increasing investment in offshore wind and other renewable energy sources creates specialized demand for robust relays designed for harsh environmental conditions and remote monitoring applications.

- Latin America (LATAM) and Middle East & Africa (MEA) Emerging Opportunities

LATAM and MEA represent emerging markets with significant potential, though growth can be uneven. In MEA, market expansion is tied closely to large-scale investments in oil and gas processing facilities, petrochemical complexes, and new infrastructure projects in countries like Saudi Arabia and the UAE. These capital-intensive projects demand high-reliability and heavy-duty overload protection. Political and economic stability fluctuations, however, can occasionally impact project timelines and capital expenditure, resulting in fluctuating demand.

In Latin America, countries such as Brazil and Mexico drive demand through their substantial mining, manufacturing, and agricultural sectors. The adoption of advanced electronic relays is accelerating, particularly as industries seek to modernize aging infrastructure and improve operational competitiveness. Market players often adapt their offerings to address local challenges, such as voltage instability, by providing relays designed with wider operational tolerances. Both regions are characterized by a mix of new projects demanding high-tech solutions and older facilities driving demand for cost-effective, standard thermal replacements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Overload Relays Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Eaton Corporation

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- WEG S.A.

- Fuji Electric Co. Ltd.

- TE Connectivity Ltd.

- Danfoss Group

- Emerson Electric Co.

- Chint Group

- Littelfuse Inc.

- Lovato Electric S.p.A.

- Sprecher + Schuh

- Coto Technology, Inc.

- Phoenix Contact

- Hubbell Incorporated

- IDEC Corporation

- Terasaki Electric Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Industrial Overload Relays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between thermal and electronic overload relays?

Thermal overload relays utilize bimetallic strips sensitive to heat generated by motor current flow, offering reliable, cost-effective protection but with lower precision. Electronic (solid-state) relays use current transformers and microprocessors for highly precise current measurement, offering a broader range of adjustable trip settings, faster response times, and critical diagnostic communication capabilities, aligning with modern automation requirements.

Which end-user industry drives the highest demand for industrial overload relays?

The Manufacturing and Automotive sector currently drives the highest volume of demand for industrial overload relays. This is due to the vast number of electric motors used in assembly lines, conveyor systems, machining centers, and HVAC systems within these facilities, all requiring reliable protection against mechanical and electrical faults to maintain production continuity.

How is Industry 4.0 influencing the design and function of overload relays?

Industry 4.0 mandates integration and data generation. It is shifting the market towards smart electronic relays embedded with communication protocols (e.g., EtherNet/IP). These relays function as sensor nodes, providing real-time operational data on motor current, temperature, and fault history, enabling predictive maintenance, remote diagnostics, and seamless integration into centralized control systems (PLCs/SCADA).

What are the main factors restraining the growth of the electronic overload relays segment?

The primary restraints are the higher initial capital expenditure of electronic relays compared to legacy thermal units, and the complexity associated with integrating and configuring these advanced devices into older or existing motor control centers, often requiring specialized technical skills and system upgrades.

Why is the Asia Pacific region expected to exhibit the fastest growth in this market?

The Asia Pacific market growth is fueled by rapid industrialization, massive government investments in new infrastructure and manufacturing capacity, and the increasing adoption of factory automation in key economies like China, India, and Southeast Asia. These activities generate high demand for both new installations and modernization projects across multiple industrial sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager