Industrial Oxygen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434937 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Industrial Oxygen Market Size

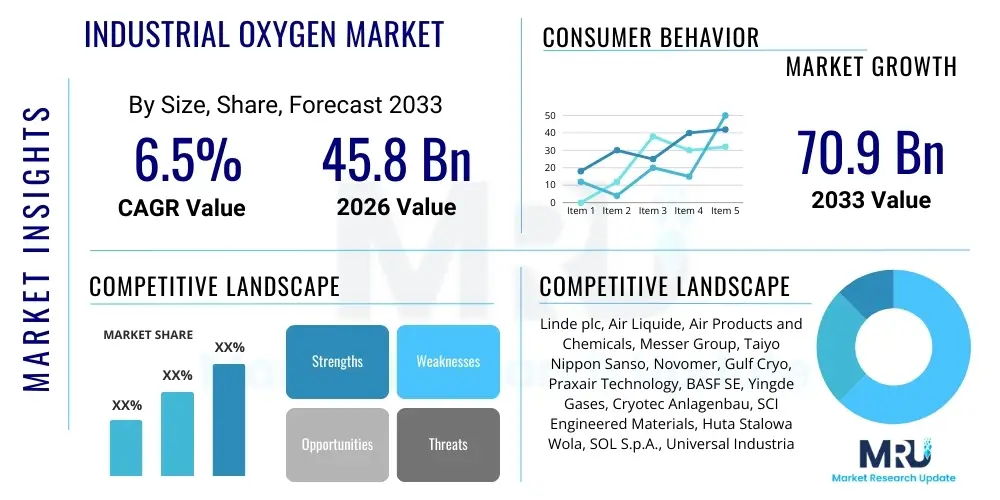

The Industrial Oxygen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 70.9 Billion by the end of the forecast period in 2033. The steady expansion is fundamentally driven by the robust demand from the metals, chemicals, and healthcare sectors globally, reflecting increased industrial activity and necessary regulatory compliance regarding efficient combustion and emission control. The indispensable nature of oxygen in critical industrial processes, ranging from steel manufacturing to petroleum refining, solidifies its essential market position, ensuring sustained investment and capacity augmentation across key geographical regions, particularly in rapidly industrializing economies.

Industrial Oxygen Market introduction

The Industrial Oxygen Market encompasses the production, distribution, and consumption of high-purity oxygen gas utilized across a diverse spectrum of non-medical industrial applications. Industrial oxygen is described as a pivotal, high-volume commodity, primarily sourced from separated ambient air, crucial for enhancing efficiency and ensuring environmental compliance across various industries. Its market introduction is characterized by its vital role in chemical reactions, combustion enhancement, and process control, which are essential for sectors such as steel production, chemicals, energy, and environmental applications. Key benefits include improved energy efficiency, increased throughput, and lower pollutant emissions, making it integral to modern manufacturing. The market's major drivers include global industrialization, stringent environmental regulations, and technological advancements like oxy-fuel combustion.

The core product offerings within this market involve high-purity oxygen delivered via distinct modes: vast, long-term pipeline networks for high-volume users; bulk liquid oxygen transportation via cryogenic tankers for medium-to-large consumers; and packaged gas in cylinders for smaller or specialized requirements. The indispensable nature of oxygen in critical industrial applications, such as the decarburization process in steelmaking, or as a fundamental reactant in petrochemical synthesis, ensures continuous and inelastic demand. This foundational utility status, combined with rising industrial output globally, sets the stage for predictable yet expansive market growth over the forecast period. The increasing focus on adopting cleaner manufacturing techniques, such as the use of oxygen-enriched air to boost efficiency in waste incineration and glass melting, further solidifies its market position.

Major applications of industrial oxygen are concentrated in sectors requiring intense thermal processing and chemical synthesis. In metallurgy, particularly steel manufacturing, oxygen is vital for the Basic Oxygen Furnace (BOF) process and electric arc furnaces (EAFs), significantly increasing production speed and efficiency while reducing overall energy consumption. The chemical and petrochemical industries utilize oxygen extensively for the partial oxidation of natural gas, methanol synthesis, and ethylene oxide production, acting as a crucial reactant to improve yield and selectivity. Furthermore, water treatment facilities are increasingly adopting oxygenation techniques to enhance biological treatment processes and odor control, driven by stringent global environmental regulations regarding wastewater discharge quality.

Industrial Oxygen Market Executive Summary

The Industrial Oxygen Market is experiencing steady expansion, underpinned by robust global industrial revival and critical infrastructure development, particularly in emerging economies. Current business trends emphasize consolidation among leading global gas producers to achieve greater operational scale and efficiency, alongside significant investment in digital technologies (Industry 4.0) to optimize highly complex supply chain logistics and improve the energy efficiency of Air Separation Units (ASUs). There is a notable strategic shift towards securing long-term, high-volume pipeline contracts with major industrial clusters, minimizing volatility and ensuring consistent revenue streams. Furthermore, market players are actively exploring symbiotic relationships with emerging low-carbon technologies, such as providing oxygen for partial oxidation processes in advanced blue hydrogen production.

Regional trends clearly highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by the accelerating pace of urbanization, infrastructural projects, and capacity expansion in heavy industries like steel, cement, and electronics manufacturing across countries such as China, India, and South Korea. Conversely, mature markets in North America and Europe are focusing growth on specialized, high-value applications, including ultra-high purity oxygen for semiconductor fabrication and the adoption of advanced oxy-fuel technologies to comply with increasingly stringent emission regulations. The Middle East demonstrates dynamic growth driven by vast investments in petrochemical complexes and refining capacities, requiring substantial tonnage volumes of oxygen, thereby driving demand for new, large-scale cryogenic production facilities.

In terms of segmentation, the demand for Cryogenic Air Separation technology continues to dominate due to the requirement for ultra-high purity levels in critical sectors, maintaining its leadership in market share. However, the Non-Cryogenic segment, particularly VPSA technology, is showing rapid growth, driven by its suitability for flexible, decentralized, and medium-scale on-site generation, providing cost advantages to remote industrial operations. The Metallurgy end-user segment remains the largest volume consumer, but the Chemical and Energy sectors are exhibiting higher growth rates, attributed to the ongoing global transformation towards more efficient chemical synthesis routes and the integration of oxygen into advanced power generation and environmental compliance processes. This layered segmentation reflects a market balancing traditional large-scale demand with specialized technological solutions for modern industrial needs.

AI Impact Analysis on Industrial Oxygen Market

The analysis of common user questions reveals a focused interest in how Artificial Intelligence (AI) and machine learning can be leveraged to tackle the core challenges of the Industrial Oxygen Market: energy costs, asset reliability, and complex logistics. Users frequently inquire about the application of AI in minimizing the immense energy consumption associated with the compression and cooling stages within Air Separation Units (ASUs). They seek concrete examples of how AI-driven optimization reduces the overall kilowatt-hour per unit of oxygen produced, thereby enhancing global competitiveness and sustainability profiles for producers. Expectations are high that AI will significantly contribute to reducing the high energy intensity inherent in air separation processes, particularly through sophisticated sensor data analysis and automated process control adjustments.

The immediate and most tangible impact of AI is seen in operational efficiency and reliability enhancement. AI systems process vast amounts of real-time sensor data from ASU components—such as compressors, turbines, and heat exchangers—to create highly accurate predictive maintenance models. By anticipating mechanical failures hours or days in advance, AI minimizes unscheduled downtime, which is highly costly in continuous production environments like industrial gas supply. Furthermore, AI algorithms dynamically adjust operational parameters based on fluctuating environmental conditions and grid energy pricing, allowing operators to shift production loads to exploit lower electricity rates, directly impacting the primary operational expenditure component.

In the distribution network, AI plays a crucial role in managing the complexity of cryogenic logistics. Machine learning models integrate historical consumption patterns, meteorological data (crucial for LOX tank pressure management), and current truck fleet metrics to develop optimized delivery routes and schedules. This advanced scheduling capability ensures that bulk liquid oxygen reaches geographically diverse customers reliably, minimizes the total distance traveled by specialized, high-cost cryogenic tankers, and significantly lowers the associated fuel consumption and greenhouse gas emissions. Ultimately, AI transforms the industrial oxygen supply chain from a reactive system into a proactive, highly efficient, and energy-aware operation, driving margin improvement across the major gas companies.

- AI-enabled Predictive Maintenance for Air Separation Units (ASUs) increases uptime reliability and reduces unplanned operational expenditures by preempting equipment failures.

- Optimization of cryogenic storage levels and complex distribution logistics using machine learning algorithms minimizes transportation costs and maximizes fleet utilization efficiency.

- Real-time process control adjustments informed by AI maximize energy efficiency during the highly intensive air compression and separation phases, mitigating high electricity costs.

- Advanced demand forecasting models enhance inventory management, ensuring stable supply for critical industrial end-user applications (e.g., steel and chemical manufacturing).

- Integration of sensor data and digital twins supports simulated optimization of new plant designs prior to construction and continuous performance benchmarking.

DRO & Impact Forces Of Industrial Oxygen Market

The Industrial Oxygen Market is governed by a robust set of Impact Forces categorized as Drivers, Restraints, and Opportunities (DRO). The primary market drivers include the resurgence of global manufacturing activity, particularly the sustained demand from the steel and non-ferrous metal industries where oxygen is indispensable for process efficiency and quality improvement. Additionally, the proliferation of strict environmental compliance mandates globally, notably those targeting carbon emissions and NOx reduction, compels sectors like glass, cement, and power generation to adopt cleaner oxy-fuel combustion techniques, thereby structurally increasing the demand for industrial oxygen as an environmentally beneficial input.

Conversely, significant restraints temper the market’s growth potential. Foremost among these is the immense capital expenditure required for establishing and maintaining modern, large-scale cryogenic Air Separation Units (ASUs) and the associated high-pressure pipeline infrastructure. Furthermore, the operational dependence on substantial, continuous electrical power subjects producers to severe sensitivity concerning volatility in global energy prices, which directly affects the cost of production and limits margin flexibility. Logistical challenges associated with transporting highly pressurized or cryogenic gases, particularly across geographically dispersed end-users, also present substantial limitations, requiring specialized fleet management and safety protocols that increase operational overhead.

The opportunities within the market are closely tied to technological evolution and emerging industrial paradigms. The growing global momentum behind the development of sustainable energy systems, particularly blue and green hydrogen production, presents new, massive opportunities, as these processes often require or co-produce large volumes of oxygen. Technological advancements in non-cryogenic methods, such as highly efficient VPSA and modular systems, offer opportunities for market penetration into small-to-medium enterprise sectors and remote locations previously underserved by bulk supply. The continuous need for industrial modernization and process efficiency enhancements across all heavy industries ensures sustained long-term contract opportunities for specialized gas services.

Segmentation Analysis

The Industrial Oxygen Market exhibits multi-dimensional segmentation, crucial for understanding its diverse consumer base and technological landscape. The fundamental separation based on Technology distinguishes between Cryogenic Air Separation, which delivers the highest purity and volume suitable for metallurgy and large petrochemical plants, and Non-Cryogenic methods like PSA and VPSA, which provide flexibility, lower initial cost, and are increasingly used for on-site, medium-volume applications such as water treatment and specialized welding. Market players strategize their investments based on the required purity and volume demands dictated by these technological distinctions.

The Delivery Mode segmentation is equally critical, reflecting the scale and location of demand. Tonnage/Pipeline supply represents long-term, direct contractual arrangements with highly integrated industrial complexes, offering the most cost-effective solution for continuous, massive consumption. Bulk Liquid Oxygen (LOX) serves customers requiring intermediate volumes or located away from existing pipelines, relying on specialized cryogenic logistics. Cylinders and packaged gases address the low-volume, specialized needs of smaller fabricators, maintenance operations, and laboratories, ensuring market reach into dispersed geographical areas and diverse small-scale applications.

- By Technology:

- Cryogenic Air Separation: Dominant for high-purity, tonnage supply.

- Non-Cryogenic Air Separation (PSA, VPSA, Membrane Separation): Growing rapidly for medium-scale, on-site generation.

- By Delivery Mode:

- Tonnage/Pipeline Supply: Long-term contracts, highest volume, most efficient for integrated industrial parks.

- Bulk Liquid Oxygen (LOX): Intermediate volume, relying on extensive cryogenic logistics networks.

- Cylinders and Packaged Gas: Low volume, high margin, catering to specialized and smaller, distributed consumers.

- By End-User Industry:

- Metallurgy (Steel, Non-Ferrous Metals): Largest volume consumer, essential for refining and processing.

- Chemicals and Petrochemicals: Key reactant for synthesis and oxidation processes; high growth segment.

- Energy and Power Generation: Used in oxy-combustion and gasification processes for efficiency.

- Pulp and Paper: Utilized for bleaching processes to replace chlorine-based compounds.

- Aerospace and Defense: Specialized, high-purity requirements for specific applications.

- Water Treatment: Oxygenation for improved biological degradation and odor control.

- Others (Glass, Food & Beverage, Healthcare Labs): Diverse applications requiring specialized purity or delivery.

Value Chain Analysis For Industrial Oxygen Market

The Industrial Oxygen value chain commences with the highly specialized and capital-intensive upstream segment, focused entirely on the production stage. This involves the acquisition of ambient air as the primary raw material, followed by the rigorous process of cryogenic air separation or non-cryogenic adsorption using proprietary technologies owned by a few global industrial gas giants. Upstream analysis highlights the critical need for massive, reliable electricity supply, as the compression and separation phases are immensely energy-intensive. Investment decisions at this stage are strategic and long-term, often requiring multi-million dollar outlays for Air Separation Units (ASUs) designed to operate continuously for decades. The efficiency of the upstream process directly dictates the final cost structure of the oxygen delivered to the end-user.

The midstream logistics and distribution segment is characterized by complexity and specialized infrastructure. Direct distribution involves delivering high volumes of gaseous oxygen via dedicated, permanently installed pipelines (tonnage contracts) directly from the ASU to large, integrated customers. This method minimizes handling costs and ensures supply reliability. Indirect distribution encompasses the bulk liquid supply chain, utilizing specialized cryogenic road and rail tankers to transport liquefied oxygen (LOX) from production facilities to regional storage depots, and subsequently to medium-scale users. Furthermore, distribution channels include the highly specialized repackaging and logistics network for cylinders (packaged gas), which requires a decentralized network of filling stations and local delivery fleets to serve smaller, geographically dispersed customers effectively.

Downstream analysis involves the end-user application and consumption. Industrial oxygen is primarily a feedstock or process enhancer, making its price sensitivity relatively low compared to the economic benefit it provides (e.g., increased production yield or energy savings). The end-users, encompassing metallurgy, chemicals, and energy sectors, dictate the purity specifications and volume requirements. Strong contractual agreements, often spanning 10 to 20 years for pipeline supply, lock in long-term demand stability for producers. The effectiveness of the entire value chain hinges on reliable, redundant supply capabilities to prevent costly production halts at the client's facilities, ensuring the perceived value of oxygen supply remains high.

Industrial Oxygen Market Potential Customers

Potential customers for industrial oxygen are concentrated across sectors characterized by heavy manufacturing, large-scale chemical processing, and processes requiring controlled, high-temperature reactions or enhanced oxidative efficiency. The primary and most significant segment of potential customers resides within the metallurgical industry, specifically steel manufacturers utilizing Basic Oxygen Furnaces (BOF) and Electric Arc Furnaces (EAF), where oxygen is essential for decarburization, refining, and increasing throughput. These customers typically require tonnage or high-volume bulk supply delivered via pipeline due to their continuous, massive consumption needs. The profitability of these facilities is often directly tied to the reliable and cost-effective supply of oxygen, making them the cornerstone buyers in the market.

Another major group of potential buyers are companies within the chemical and petrochemical complexes. These customers utilize oxygen as a vital reactant in numerous synthesis processes, including the production of essential intermediates like ethylene oxide, vinyl acetate monomer, and synthesis gas for methanol and ammonia. The growing complexity and scale of global refining operations, focused on producing cleaner fuels and higher-value petrochemical products, consistently drives demand. Furthermore, the rising adoption of coal gasification and integrated gasification combined cycle (IGCC) technology by energy producers seeking cleaner power generation represents a significant, long-term customer base requiring large volumes of ultra-high purity oxygen.

Beyond these heavy industrial users, potential customers extend to environmental applications, including wastewater treatment plants that use pure oxygen to accelerate biological oxidation and improve effluent quality, and the glass manufacturing industry where oxy-fuel burners are employed to drastically reduce energy consumption and NOx emissions in high-temperature melting processes. The expansion of these environmentally driven applications suggests a broadening customer base beyond traditional industrial giants. Additionally, smaller potential customers, such as independent fabrication shops, laboratories, and specialized repair facilities, rely on packaged cylinder gas, representing a crucial segment for maintaining geographical market coverage and ensuring ubiquitous product availability across diverse industrial ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 70.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde plc, Air Liquide, Air Products and Chemicals, Messer Group, Taiyo Nippon Sanso, Novomer, Gulf Cryo, Praxair Technology, BASF SE, Yingde Gases, Cryotec Anlagenbau, SCI Engineered Materials, Huta Stalowa Wola, SOL S.p.A., Universal Industrial Gases, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Oxygen Market Key Technology Landscape

The technological core of the Industrial Oxygen Market revolves around efficient and scalable air separation processes, with cryogenic distillation maintaining its position as the critical technology for meeting large-scale, ultra-high purity demands. Cryogenic Air Separation Units (ASUs) utilize advanced heat exchange systems and multi-stage distillation columns to produce oxygen purity exceeding 99.5%, necessary for sensitive applications like metallurgy and semiconductor production. Recent technological focus within cryogenic systems centers on optimizing the turbine-expander design and integrating highly efficient compressors to significantly reduce the overall power consumption per unit of gas produced. These incremental efficiency improvements are vital for mitigating the operational expense risks associated with volatile global energy markets and maintaining competitiveness against alternative separation methods.

Parallelly, the non-cryogenic technology landscape is rapidly evolving, driven by the demand for flexible, modular, and decentralized oxygen production. Pressure Swing Adsorption (PSA) and Vacuum Pressure Swing Adsorption (VPSA) utilize advanced adsorbent materials, such as specific zeolites, to selectively capture atmospheric components, providing medium-purity oxygen (typically 90%–95%). Technological breakthroughs in VPSA, specifically, have enhanced its energy efficiency and reduced the footprint of on-site generators, making them ideal for localized applications like aquaculture, remote mining operations, and small-to-mid-sized wastewater treatment plants. The advantage of these technologies lies in their lower capital expenditure requirement and quicker deployment time compared to permanent cryogenic infrastructure, facilitating market penetration into previously inaccessible industrial areas.

Looking forward, the integration of digital technologies represents a major technological shift. Industry 4.0 principles are being applied through the deployment of smart sensors, IoT devices, and cloud-based analytical platforms across the entire production and distribution network. This allows for the creation of digital twins of ASUs, enabling sophisticated simulations for process optimization, maintenance scheduling, and energy load balancing. Furthermore, research into advanced oxygen carriers and alternative separation membranes (e.g., Ion Transport Membranes - ITMs) promises future disruptive potential, offering the possibility of producing high-purity oxygen at lower temperatures and pressures without the need for traditional cryogenic complexity, potentially lowering the barrier to entry for smaller specialized gas providers.

Regional Highlights

The global Industrial Oxygen Market exhibits significant regional variations in demand, technology adoption, and regulatory environment. These differences influence the growth trajectory and operational strategies of key market players, requiring localized approaches to supply chain management and customer engagement.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by massive consumption from the rapidly expanding metallurgical, electronics, and infrastructure sectors, especially in China, India, and Southeast Asia. The region is characterized by extensive construction of new large-scale ASUs and pipeline networks to meet unprecedented industrialization demands. Government focus on air quality improvement also encourages the shift to cleaner combustion technologies relying on industrial oxygen.

- North America: This is a mature market focusing on high-purity oxygen for advanced applications like semiconductors, aerospace, and specialized chemical manufacturing. Growth is steady, driven primarily by technological upgrades, regulatory compliance relating to emissions (driving adoption of oxy-fuel), and optimization of existing pipeline infrastructure rather than capacity expansion.

- Europe: Europe emphasizes sustainability and efficiency. The market is defined by high adoption rates of advanced oxy-combustion technologies in glass and cement production to meet stringent EU emissions standards. Demand is stable, anchored by the chemical industry (BASF, Bayer) and strong investments in circular economy initiatives requiring enhanced industrial gases.

- Latin America (LATAM): Growth in LATAM is closely linked to fluctuating commodity prices, particularly steel and copper mining operations. Brazil and Mexico are key markets, showing growing adoption of on-site PSA/VPSA units to manage costs and logistics complexity in remote mining and refining locations.

- Middle East and Africa (MEA): This region is witnessing rapid expansion, primarily fueled by massive petrochemical projects, oil & gas refining expansions, and aluminum smelting operations, particularly in the GCC countries (Saudi Arabia, UAE). Demand is highly concentrated, favoring large-scale tonnage oxygen supply contracts tied to government-backed industrial complexes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Oxygen Market.- Linde plc

- Air Liquide

- Air Products and Chemicals, Inc.

- Messer Group

- Taiyo Nippon Sanso Corporation

- Novomer

- Gulf Cryo

- Praxair Technology, Inc. (Part of Linde plc)

- BASF SE (Internal Consumption and Production)

- Yingde Gases Group Company Limited

- Cryotec Anlagenbau GmbH

- SCI Engineered Materials

- Huta Stalowa Wola S.A.

- SOL S.p.A.

- Universal Industrial Gases, Inc.

- Nippon Gases (Part of Taiyo Nippon Sanso)

- Hangzhou Oxygen Plant Group

- Relief Medical & Industrial Gases

- CanGas Systems Co., Ltd.

- Calgaz Specialty Gases

Frequently Asked Questions

Analyze common user questions about the Industrial Oxygen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Industrial Oxygen Market?

The primary drivers are the massive global demand from the metallurgical sector (steel production), increasing adoption of oxy-fuel technologies for energy efficiency and reduced emissions compliance, and sustained expansion of the chemical and petrochemical industries requiring high-purity oxygen as a crucial reactant. Robust infrastructure development, particularly in Asia Pacific, further accelerates this demand.

How do Cryogenic and Non-Cryogenic technologies differ in the Industrial Oxygen supply?

Cryogenic separation (distillation) provides the highest purity oxygen (tonnage volume) but requires very high capital investment and significant energy input. Non-Cryogenic technologies (PSA/VPSA) are modular, offer cost-effective solutions for medium-scale volumes, and have lower purity levels (90-95%), making them ideal for localized, on-site generation for smaller or remote industrial users.

Which End-User industry holds the largest market share for Industrial Oxygen consumption?

The Metallurgy industry, specifically global steel manufacturing, accounts for the largest volume share of industrial oxygen consumption. Oxygen is indispensable in basic oxygen furnaces and electric arc furnaces to speed up the refining process, remove carbon and impurities, and substantially enhance overall furnace efficiency and metallic output.

What role does the Asia Pacific region play in the global Industrial Oxygen landscape?

Asia Pacific (APAC) is the dominant and fastest-growing regional market, largely due to rapid, widespread industrialization, intensive infrastructure spending (driving demand for metals and cement), and the concentration of dynamic manufacturing sectors in nations like China and India, necessitating vast, continuous supplies of industrial gases via pipeline and bulk delivery contracts.

What are the main restraints impacting the profitability and expansion of oxygen producers?

The key restraints include extremely high initial capital costs required for building sophisticated Air Separation Units (ASUs) and establishing extensive pipeline networks, coupled with the profound vulnerability of operational profitability to volatile global electricity and energy prices, as air separation is a highly energy-intensive, power-dependent process.

How is AI specifically enhancing the efficiency of the Industrial Oxygen supply chain?

AI is improving efficiency by enabling predictive maintenance for complex Air Separation Units, reducing unplanned downtime and maintenance costs. Furthermore, machine learning optimizes cryogenic logistics and delivery scheduling, minimizing transportation energy consumption and ensuring high reliability of supply to critical, time-sensitive industrial customers.

What are the emerging opportunities in the Industrial Oxygen Market?

Key opportunities arise from the increasing demand for oxygen in the production of blue and green hydrogen, expansion into underserved markets using modular VPSA technology, and the continuous need for advanced process gases in the high-growth electronics and semiconductor manufacturing sectors globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager