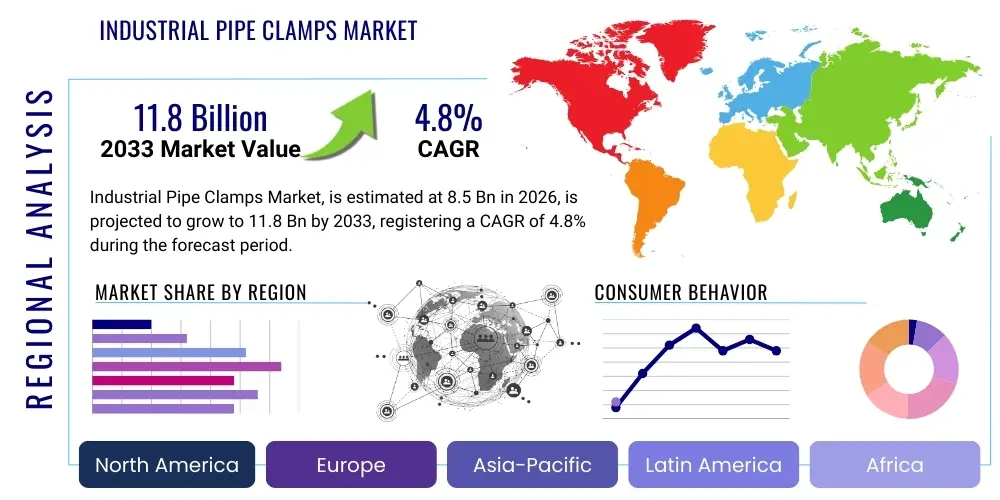

Industrial Pipe Clamps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440059 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Industrial Pipe Clamps Market Size

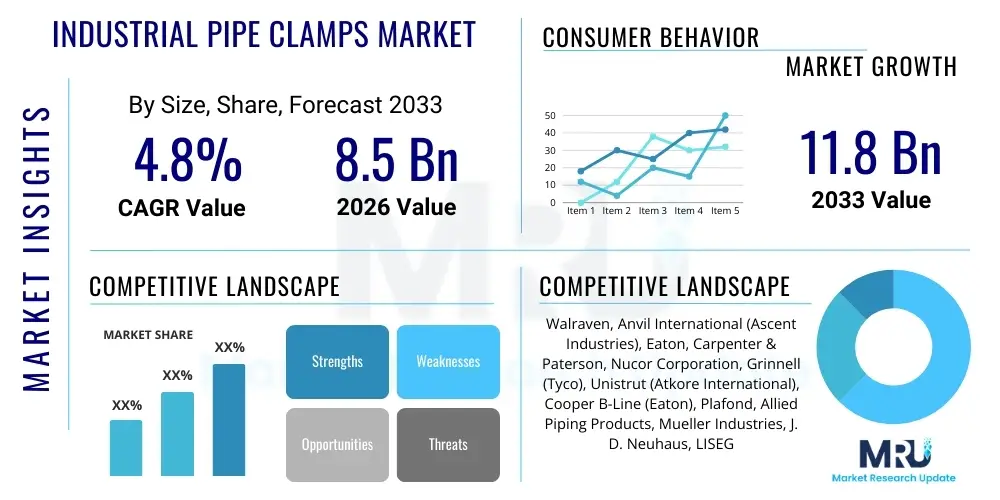

The Industrial Pipe Clamps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 11.8 Billion by the end of the forecast period in 2033.

Industrial Pipe Clamps Market introduction

The Industrial Pipe Clamps Market encompasses the manufacturing, distribution, and sale of various clamping solutions designed to support, secure, and stabilize pipes across diverse industrial applications. These essential components play a critical role in preventing pipe movement, reducing vibration, isolating noise, and ensuring the structural integrity of piping systems. The market is driven by continuous infrastructure development, industrial expansion, and the ongoing need for maintenance and upgrades in existing facilities, particularly within sectors such as oil and gas, chemical processing, power generation, and water treatment. The inherent benefits of these clamps, including enhanced safety, improved operational efficiency, and prolonged equipment lifespan, underscore their indispensable nature in modern industrial operations.

Industrial pipe clamps are fundamental mechanical fasteners engineered to provide robust support for fluid and gas transportation systems. Their primary function is to secure pipes to structural elements, walls, or ceilings, thereby managing static and dynamic loads, thermal expansion, and vibration. The product range is extensive, including heavy-duty clamps for large diameter pipes under high pressure, cushioned clamps for vibration dampening and noise reduction, U-bolts for sturdy multi-directional support, and specialized clamps for corrosive or high-temperature environments. These products are manufactured from a variety of materials such as carbon steel, stainless steel, galvanized steel, and various plastics or composites, selected based on the specific operational demands, environmental conditions, and fluid characteristics. The precise engineering of these clamps ensures that they meet rigorous industry standards for performance and safety.

Major applications of industrial pipe clamps span across a multitude of industries, including petrochemicals, where they secure pipelines transporting crude oil and refined products; power generation, for steam and cooling water lines; HVAC systems in large commercial and industrial buildings; and municipal water and wastewater treatment plants. They are also extensively used in marine applications, shipbuilding, food and beverage processing, and general manufacturing facilities to manage fluid transfer and waste disposal systems. The benefits associated with their deployment are substantial, ranging from the prevention of costly leaks and structural damage to the optimization of system layouts and compliance with stringent safety regulations. The market growth is principally driven by the global energy demand, industrialization in emerging economies, and technological advancements leading to more durable and versatile clamping solutions, capable of withstanding extreme conditions and offering enhanced installation efficiency.

Industrial Pipe Clamps Market Executive Summary

The Industrial Pipe Clamps Market is experiencing robust growth, fueled by escalating global industrialization, significant investments in infrastructure, and the continuous demand for energy and utilities. Key business trends indicate a shift towards specialized and high-performance clamps, particularly those offering enhanced corrosion resistance, vibration dampening, and ease of installation, reflecting an industry-wide focus on operational efficiency and extended asset life. The competitive landscape is characterized by both global conglomerates and regional specialists, driving innovation in material science and design to meet evolving industry standards and application-specific requirements. Mergers and acquisitions are also playing a role in market consolidation and geographic expansion, as companies seek to bolster their product portfolios and capture larger market shares, especially in rapidly developing regions.

Regionally, the market exhibits diverse growth patterns. Asia Pacific stands out as a dominant force, propelled by extensive manufacturing activities, burgeoning construction sectors, and significant investments in oil and gas and power generation infrastructure, particularly in countries like China, India, and Southeast Asian nations. North America and Europe demonstrate a mature yet stable growth trajectory, driven by stringent regulatory frameworks, continuous maintenance of aging infrastructure, and a strong emphasis on technological advancements and specialized solutions for high-value applications. Latin America and the Middle East and Africa are emerging as high-potential markets, benefiting from increased exploration and production activities in oil and gas, coupled with rapid urbanization and industrial development projects, necessitating robust piping support systems. These regional dynamics highlight the global nature of demand for reliable industrial pipe clamping solutions.

Segmentation trends reveal strong performance across various product types and end-use industries. Heavy-duty clamps and cushioned clamps are experiencing heightened demand due to their critical role in supporting large-diameter pipes and mitigating noise and vibration in sensitive environments. Materials such as stainless steel and galvanized steel remain highly preferred for their durability and corrosion resistance, especially in harsh industrial settings. Among end-use industries, the oil and gas sector continues to be a primary revenue generator, driven by extensive pipeline networks and the ongoing need for exploration and production infrastructure. The water and wastewater treatment sector is also showing significant growth, propelled by global initiatives to improve water infrastructure and sanitation, requiring durable and reliable clamping solutions for large-scale municipal projects. This diversified demand across segments underscores the essential nature and broad applicability of industrial pipe clamps in modern industrial ecosystems.

AI Impact Analysis on Industrial Pipe Clamps Market

The integration of Artificial Intelligence (AI) into the industrial landscape is poised to significantly transform various facets of the Industrial Pipe Clamps Market, influencing everything from design and manufacturing to predictive maintenance and supply chain management. User questions often revolve around how AI can enhance the performance and longevity of these critical components, optimize their application, and streamline the entire lifecycle. Key themes emerging from these inquiries include the potential for AI-driven analytics to predict clamp failure, personalize clamp designs for unique environmental stressors, automate quality control in production, and optimize inventory management for vast industrial projects. Users are particularly keen on understanding how AI can move the industry beyond reactive maintenance to proactive, data-driven strategies, ultimately reducing downtime and improving safety margins in complex piping systems.

The common concerns articulated by industry stakeholders often center on the practical implementation challenges, data security, and the initial investment required for AI technologies. There is a strong expectation that AI will lead to more intelligent clamping solutions that can self-monitor or provide real-time performance data, enabling earlier intervention and preventing catastrophic failures. Furthermore, the role of AI in material selection and advanced simulation for extreme conditions is a recurring topic, as engineers seek ways to develop more resilient and application-specific clamping products. The overall sentiment suggests an optimistic outlook for AI's capacity to drive innovation, improve efficiency, and enhance the reliability of industrial pipe clamps, transforming traditional practices into more data-centric and preventative approaches across the industrial ecosystem. The convergence of AI with IoT sensors embedded within or around clamps represents a frontier for smart infrastructure, moving towards a future where components actively contribute to system health monitoring.

- AI-powered predictive maintenance algorithms for identifying potential clamp failures based on vibration, temperature, and stress data.

- Optimized clamp design through generative AI, simulating various load conditions and material stresses to create more robust and efficient solutions.

- Automated quality inspection systems using computer vision and machine learning for defect detection during manufacturing, ensuring higher product reliability.

- Enhanced supply chain and inventory management for pipe clamps, leveraging AI to forecast demand, optimize logistics, and reduce stockouts.

- Development of smart clamps with integrated sensors, enabled by AI for real-time monitoring of pipe integrity, movement, and environmental conditions.

- AI-driven material science research for developing advanced composites or alloys tailored for specific corrosive or high-temperature environments, improving clamp lifespan.

- Personalized application recommendations and installation guidance using AI, based on specific project parameters, pipe characteristics, and environmental factors.

DRO & Impact Forces Of Industrial Pipe Clamps Market

The Industrial Pipe Clamps Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various impact forces ranging from economic shifts to technological advancements and regulatory changes. The overarching demand for robust and reliable infrastructure across global industries serves as a primary driver, compelling sustained investment in high-quality piping support systems. However, this growth is often tempered by inherent market restraints, such as the volatility of raw material prices and the intense competitive landscape, which can squeeze profit margins and slow down innovation for smaller players. Meanwhile, emerging technologies and increasing environmental consciousness present significant opportunities for market participants to differentiate their offerings and capture new segments, particularly in specialized or eco-friendly solutions.

Drivers for the market include the rapid industrialization and urbanization in emerging economies, leading to extensive construction projects and expansion of manufacturing bases. The growing global energy demand necessitates continuous investment in oil and gas pipelines, power generation facilities, and renewable energy infrastructure, all of which require sophisticated pipe clamping solutions. Additionally, stringent safety regulations and environmental compliance standards across industries compel organizations to adopt higher-quality, more reliable clamping systems to prevent leaks, structural failures, and environmental hazards. The aging infrastructure in developed countries also fuels a consistent demand for maintenance, repair, and overhaul (MRO) activities, ensuring a steady market for replacement and upgrade of existing pipe clamp installations.

Restraints on market growth encompass the fluctuating prices of raw materials, such as steel and various alloys, which directly impact manufacturing costs and product pricing, creating uncertainty for suppliers and buyers. Intense competition from both established global players and local manufacturers, especially in price-sensitive markets, can lead to commoditization and pressure on profit margins. The high capital expenditure associated with establishing advanced manufacturing facilities and complying with diverse international standards can also pose a barrier to entry for new players. Furthermore, the complexity of diverse application requirements, demanding specialized engineering and testing for different environments (e.g., high pressure, extreme temperatures, corrosive media), can limit standardization and increase development costs, thereby acting as a significant restraint.

Opportunities abound in the market, particularly in the development of innovative and smart clamping solutions that integrate IoT capabilities for real-time monitoring and predictive maintenance. The increasing focus on sustainable and lightweight materials offers avenues for developing environmentally friendly and easier-to-handle clamps without compromising strength. Growth in specialized sectors like offshore oil and gas, cryogenic applications, and semiconductor manufacturing, which require highly customized and precision-engineered clamps, presents lucrative niches. Expanding into untapped geographical markets and leveraging e-commerce platforms for wider distribution also offers significant growth prospects. The continuous evolution of industrial automation and robotics further presents opportunities for clamp manufacturers to develop components that are optimized for automated installation processes, enhancing efficiency and reducing labor costs.

The impact forces influencing the Industrial Pipe Clamps Market are multifaceted. Economic impact forces, such as global GDP growth and industrial output, directly correlate with the demand for new construction and infrastructure projects. Technological advancements in material science, manufacturing processes, and digital integration are reshaping product capabilities and market expectations. Regulatory impact forces, including evolving safety standards, environmental protection mandates, and building codes, dictate product specifications and market entry requirements, pushing for higher quality and compliance. Political stability and government infrastructure spending policies significantly influence the scale and pace of industrial development projects, thus affecting market demand. Finally, social trends like increased awareness for worker safety and environmental sustainability are driving the adoption of safer, more durable, and eco-friendly pipe clamping solutions across various industrial applications.

Segmentation Analysis

The Industrial Pipe Clamps Market is meticulously segmented across various dimensions to provide a granular understanding of its diverse landscape and growth opportunities. This segmentation allows for targeted market strategies, identifying specific product preferences, material demands, and application-specific needs across different end-use industries. Analyzing these segments helps stakeholders understand the competitive dynamics and pinpoint emerging trends that are shaping future market directions. The market can be broadly categorized by product type, material, application, and end-use industry, each revealing unique growth drivers and market characteristics. This comprehensive breakdown is essential for strategic planning and resource allocation within the industrial pipe clamping ecosystem, enabling businesses to focus on high-potential areas and tailor their offerings to specific customer requirements.

- By Product Type:

- Heavy-Duty Clamps

- Light-Duty Clamps

- Cushioned Clamps

- U-Bolt Clamps

- Split Clamps

- Loop Clamps

- Clevis Hangers

- Strap Clamps

- Beam Clamps

- Lateral Support Clamps

- Adjustable Clamps

- Riser Clamps

- Pipe Rollers

- Specialty Clamps (e.g., cryogenic, high-temperature, seismic)

- By Material:

- Stainless Steel

- Carbon Steel

- Galvanized Steel

- Aluminum

- Plastic (e.g., Polypropylene, Nylon)

- Composite Materials

- Copper

- Ductile Iron

- By Application:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical & Petrochemical

- Power Generation (Thermal, Nuclear, Renewables)

- HVAC (Heating, Ventilation, Air Conditioning)

- Water & Wastewater Treatment

- Food & Beverage

- Pharmaceuticals

- Marine & Shipbuilding

- Mining

- Pulp & Paper

- Construction

- General Manufacturing

- By End-Use Industry:

- Heavy Industrial

- Commercial

- Institutional

- Residential (limited industrial application)

- By Distribution Channel:

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Industrial Pipe Clamps Market

The value chain for the Industrial Pipe Clamps Market is a complex network of activities that transforms raw materials into finished products delivered to end-users, encompassing upstream, manufacturing, and downstream segments. The upstream segment involves the sourcing and processing of essential raw materials like steel (carbon, stainless, galvanized), aluminum, various plastics, and elastomers for cushioning. Suppliers of these materials play a crucial role in determining the quality, cost, and availability of components for clamp manufacturers. Innovations in material science at this stage directly influence the performance characteristics and durability of the final products, fostering opportunities for differentiation in a competitive market. Close collaboration with reliable material suppliers is essential for manufacturers to maintain consistent production quality and manage cost fluctuations effectively, thereby ensuring a stable supply chain.

The manufacturing and assembly phase constitutes the core of the value chain, where raw materials are transformed into various types of pipe clamps through processes such as stamping, forging, welding, casting, and extrusion. This stage also includes the application of protective coatings, such as galvanization or specialized paints, and the integration of cushioning materials where required. Quality control and adherence to industry standards (e.g., ASTM, ASME, DIN) are paramount here, as product reliability directly impacts safety and operational efficiency in end-use applications. Manufacturers invest significantly in advanced machinery, skilled labor, and R&D to enhance product design, reduce production costs, and improve manufacturing efficiency. This segment often sees differentiation through specialization in particular clamp types, materials, or custom-engineered solutions tailored for specific industrial needs, showcasing technological prowess and operational excellence.

Downstream activities involve the distribution, sales, and after-sales support of industrial pipe clamps. Distribution channels are diverse, including direct sales from manufacturers to large industrial clients, a network of distributors and wholesalers catering to a broader customer base, and increasingly, online retail platforms. Direct sales are common for highly specialized or large-volume orders, allowing for direct communication and customization. Distributors and wholesalers provide crucial logistical support, stocking a wide range of products and offering local availability, which is vital for maintenance and repair operations. After-sales services, such as technical support, installation guidance, and warranty services, add significant value, building customer loyalty and ensuring proper product application. Both direct and indirect distribution channels are critical for market penetration and reaching the diverse spectrum of end-users, from large petrochemical complexes to smaller commercial HVAC installers, each requiring different levels of support and accessibility.

Industrial Pipe Clamps Market Potential Customers

The Industrial Pipe Clamps Market serves a vast and diverse clientele, primarily encompassing various sectors that rely heavily on robust and reliable piping infrastructure for their operations. These potential customers are essentially the end-users and buyers of the product, ranging from large-scale industrial complexes to specialized engineering and construction firms. Their purchasing decisions are driven by factors such as the criticality of their piping systems, regulatory compliance requirements, operational efficiency goals, and the need for long-term durability in challenging environments. Understanding these varied customer profiles is crucial for manufacturers and distributors to tailor their product offerings, marketing strategies, and distribution channels to meet specific industry needs and capture maximum market share.

Key potential customer segments include companies within the oil and gas industry, covering exploration, production, refining, and transportation, which demand high-performance clamps for their extensive pipeline networks. The chemical and petrochemical sectors are also significant buyers, requiring clamps that can withstand corrosive substances and extreme temperatures. Power generation facilities, including thermal, nuclear, and renewable energy plants, consistently purchase pipe clamps for their steam lines, cooling systems, and general fluid transfer applications. Furthermore, the water and wastewater treatment sector represents a substantial customer base, with municipalities and private operators requiring durable clamps for their vast networks of water supply and sewage systems. These heavy industrial sectors typically prioritize product reliability, material compatibility, and adherence to stringent safety standards, often engaging in direct procurement from manufacturers or specialized industrial suppliers.

Beyond the heavy industrial landscape, other crucial customers include HVAC contractors and building management firms responsible for large commercial and institutional buildings, where pipe clamps are essential for air conditioning, heating, and ventilation systems. The food and beverage industry, pharmaceuticals, and marine and shipbuilding sectors also represent important segments, each with unique requirements for hygiene, corrosion resistance, or structural integrity. Engineering, Procurement, and Construction (EPC) companies act as significant intermediaries, procuring clamps for their large-scale project undertakings across multiple industries. These diverse customer groups, each with distinct technical specifications and purchasing processes, collectively drive the demand for a broad spectrum of industrial pipe clamping solutions, from standard utility clamps to highly specialized, custom-engineered components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 11.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Walraven, Anvil International (Ascent Industries), Eaton, Carpenter & Paterson, Nucor Corporation, Grinnell (Tyco), Unistrut (Atkore International), Cooper B-Line (Eaton), Plafond, Allied Piping Products, Mueller Industries, J. D. Neuhaus, LISEGA SE, Zhejiang Kaidi Pipeline Equipment, Hilti Corporation, Georg Fischer, Victaulic, Clampco, Flexco, Halfen (CRH plc). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Pipe Clamps Market Key Technology Landscape

The Industrial Pipe Clamps Market is continually evolving with advancements in materials science, manufacturing techniques, and smart integration technologies, shaping a dynamic technological landscape. Traditional manufacturing methods like stamping, welding, and casting remain foundational but are increasingly augmented by precision engineering and automated processes to improve consistency and reduce production costs. Innovations in metallurgy have led to the development of higher-grade stainless steels, corrosion-resistant alloys, and specialized coatings that extend the lifespan of clamps in harsh environments. The focus is shifting towards developing solutions that offer enhanced performance under extreme conditions such as high pressure, seismic activity, or cryogenic temperatures, requiring advanced material formulations and rigorous testing protocols to ensure reliability and compliance with international standards.

In addition to material advancements, the adoption of advanced manufacturing technologies like robotic welding, laser cutting, and additive manufacturing (3D printing) for prototyping or specialized components is gaining traction. These technologies enable greater precision, customization, and efficiency in the production of complex clamp designs. Furthermore, the integration of computational fluid dynamics (CFD) and finite element analysis (FEA) software in the design phase allows engineers to simulate various stress scenarios, optimize clamp geometry for load distribution, and predict performance more accurately, reducing the need for extensive physical prototyping. This digital engineering approach not only accelerates product development but also ensures that clamps meet specific application requirements with a higher degree of confidence, contributing to safer and more efficient piping systems across industries.

The emerging technological frontier in industrial pipe clamps involves the incorporation of smart features and IoT capabilities. This includes the development of clamps with integrated sensors that can monitor critical parameters such as vibration, temperature, pipe movement, and stress levels in real-time. These "smart clamps" can transmit data to centralized monitoring systems, enabling predictive maintenance, early detection of potential failures, and optimized operational management. The use of advanced polymer and composite materials for cushioning and insulation is also improving vibration dampening, noise reduction, and thermal isolation properties, addressing key challenges in sensitive industrial applications. These technological advancements collectively contribute to creating more intelligent, durable, and performant pipe clamping solutions, enhancing overall system integrity and operational safety in modern industrial environments.

Regional Highlights

- North America: This region represents a mature yet robust market for industrial pipe clamps, characterized by stringent regulatory standards, a significant focus on infrastructure maintenance and upgrades, and a strong presence of oil and gas, chemical, and power generation industries. The demand is largely driven by replacement and retrofitting activities in aging infrastructure, coupled with new investments in renewable energy projects and advanced manufacturing facilities. Emphasis on safety, efficiency, and adherence to standards like ASME B31.1 and B31.3 fuels the adoption of high-quality, specialized clamping solutions.

- Europe: Europe is another key region, driven by continuous industrial automation, a strong focus on environmental regulations, and ongoing investments in water and wastewater treatment infrastructure. Countries like Germany, the UK, and France are leading in adopting advanced and eco-friendly pipe clamping solutions. The presence of a mature industrial base and the ongoing need for maintenance and upgrades in diverse sectors such as petrochemicals, pharmaceuticals, and manufacturing contribute significantly to market growth.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the industrial pipe clamps market, propelled by rapid industrialization, massive infrastructure development projects, and burgeoning manufacturing activities in countries like China, India, and Southeast Asian nations. Significant investments in oil and gas exploration, power generation, and urban development are creating immense demand. The region benefits from a large population, expanding industrial base, and relatively lower manufacturing costs, making it a hub for both production and consumption.

- Latin America: This region exhibits promising growth potential, primarily driven by increasing investments in the oil and gas sector, particularly in countries like Brazil and Mexico, alongside expanding mining operations and infrastructure development. The demand for industrial pipe clamps is influenced by new project installations and the modernization of existing facilities. Economic stability and foreign direct investment are key factors influencing the pace of market expansion in this region.

- Middle East & Africa (MEA): The MEA region is a significant market for industrial pipe clamps, predominantly due to its extensive oil and gas industry, including large-scale production, refining, and transportation infrastructure. Gulf Cooperation Council (GCC) countries are investing heavily in new petrochemical complexes and diversification projects, leading to substantial demand. Infrastructure development related to smart cities and industrial zones further contributes to market growth, requiring robust and high-performance clamping solutions suited for harsh desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Pipe Clamps Market.- Walraven

- Anvil International (Ascent Industries)

- Eaton

- Carpenter & Paterson

- Nucor Corporation

- Grinnell (Tyco)

- Unistrut (Atkore International)

- Cooper B-Line (Eaton)

- Plafond

- Allied Piping Products

- Mueller Industries

- J. D. Neuhaus

- LISEGA SE

- Zhejiang Kaidi Pipeline Equipment

- Hilti Corporation

- Georg Fischer

- Victaulic

- Clampco

- Flexco

- Halfen (CRH plc)

Frequently Asked Questions

What are the primary types of industrial pipe clamps and their main uses?

Industrial pipe clamps come in various types, each designed for specific applications and load requirements. Heavy-duty clamps are utilized for supporting large-diameter pipes and heavy loads in critical industrial settings like power plants and petrochemical facilities. Cushioned clamps, on the other hand, incorporate elastomeric inserts to reduce vibration, noise, and galvanic corrosion, making them ideal for sensitive environments or hydraulic systems. U-bolt clamps provide robust, multi-directional support and are commonly used in structural pipe connections or marine applications, ensuring pipes are securely fastened against movement. Each type serves a distinct purpose, from basic support to specialized functions like seismic bracing or thermal expansion management, contributing to the overall integrity and operational safety of complex piping systems. The selection depends heavily on the pipe's size, material, temperature, pressure, and environmental conditions, ensuring optimal performance and compliance with industry standards. Specialized clamps also exist for unique environments, such as cryogenic or high-temperature applications, necessitating advanced material selection and design.

Which industries are the largest consumers of industrial pipe clamps?

The largest consumers of industrial pipe clamps are predominantly industries that rely on extensive and critical piping infrastructure for their core operations. The oil and gas sector stands as a primary market, utilizing clamps across upstream, midstream, and downstream segments for exploration, production, refining, and transportation of hydrocarbons. The chemical and petrochemical industries are also significant consumers, requiring clamps that can withstand corrosive chemicals and extreme temperatures in processing plants. Additionally, the power generation sector, encompassing thermal, nuclear, and renewable energy facilities, extensively uses pipe clamps for supporting steam lines, cooling systems, and various fluid transfer networks. These industries prioritize durability, reliability, and adherence to stringent safety regulations, making them consistent buyers of high-performance clamping solutions. Emerging markets and continuous infrastructure development in these sectors further drive sustained demand for advanced pipe clamping technologies globally.

How do technological advancements influence the industrial pipe clamps market?

Technological advancements significantly influence the industrial pipe clamps market by driving innovation in materials, design, and functionality, ultimately enhancing performance and extending product lifespan. Innovations in metallurgy have led to the development of corrosion-resistant alloys and specialized coatings, allowing clamps to operate reliably in harsh environments like offshore oil rigs or chemical processing plants. Advanced manufacturing techniques, such as robotic welding and precision machining, improve consistency, reduce production costs, and enable the creation of complex, customized clamp designs. The integration of smart technologies, including IoT sensors, allows for real-time monitoring of pipe stress, vibration, and temperature, enabling predictive maintenance and proactive intervention to prevent failures. This shift towards intelligent and durable clamping solutions not only improves operational safety and efficiency but also reduces maintenance costs, making technological advancement a key differentiator in a competitive market and pushing the industry towards more sustainable and resilient infrastructure components.

What are the key drivers for growth in the industrial pipe clamps market?

The industrial pipe clamps market is propelled by several robust growth drivers stemming from global industrial expansion and infrastructure needs. A primary driver is the rapid industrialization and urbanization occurring in emerging economies, which necessitates extensive construction of new factories, power plants, and utility networks that require comprehensive piping systems. The increasing global demand for energy, particularly from the oil and gas sector and expanding renewable energy projects, fuels continuous investment in pipeline infrastructure and related support components. Furthermore, stringent safety regulations and environmental compliance standards across industries compel businesses to adopt high-quality, reliable pipe clamping solutions to prevent leaks, ensure structural integrity, and mitigate environmental risks. Lastly, the ongoing need for maintenance, repair, and overhaul (MRO) activities in aging infrastructure across developed nations ensures a steady demand for replacement and upgrade of existing pipe clamp installations, providing a stable foundation for market growth. These factors collectively underscore the essential role of pipe clamps in modern industrial operations and sustainable development.

What challenges does the industrial pipe clamps market face?

The industrial pipe clamps market faces several significant challenges that can impact its growth and profitability. One major restraint is the volatility of raw material prices, particularly for steel, aluminum, and various alloys. Fluctuations in these prices directly affect manufacturing costs, leading to unpredictable product pricing and potentially squeezing profit margins for manufacturers. Intense competition from both established global players and smaller, regional manufacturers, especially in price-sensitive markets, can lead to commoditization and downward pressure on product prices. Additionally, the need to comply with a diverse array of international and local regulatory standards adds complexity to product development and market entry, requiring substantial investment in testing and certification. The increasing demand for highly specialized and customized clamping solutions for unique applications, such as cryogenic or seismic environments, also poses a challenge by requiring significant R&D investment and limiting economies of scale. These factors necessitate continuous innovation and strategic cost management for market players to remain competitive and sustainable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager