Industrial Pump Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434350 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Industrial Pump Rental Market Size

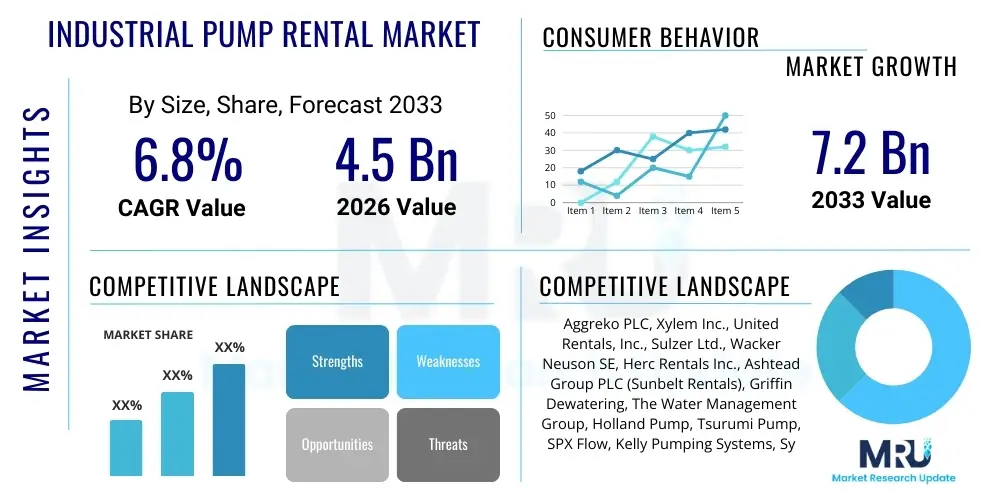

The Industrial Pump Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Industrial Pump Rental Market introduction

The Industrial Pump Rental Market encompasses the provision of various types of industrial pumps—such as centrifugal, positive displacement, submersible, and specialized slurry pumps—on a temporary lease basis to end-user industries including construction, mining, oil and gas, manufacturing, and municipal utilities. This service allows companies to avoid significant upfront capital expenditures (CapEx) associated with purchasing, maintaining, and storing specialized pumping equipment, offering a flexible solution for handling fluctuating operational demands, emergency situations, or specific project requirements like dewatering, fluid transfer, and sewage bypass. The primary market drivers include the increasing need for temporary solutions in infrastructure development projects, stringent environmental regulations requiring immediate fluid control measures, and the growing preference among large industrial players to convert fixed costs into variable operational expenses (OpEx).

Industrial pump rental services are characterized by the comprehensive support provided, which often includes delivery, installation, maintenance, and technical expertise, ensuring optimal pump performance and compliance with site-specific regulatory standards. The product portfolio ranges from high-pressure pumps used in oil and gas fracking to robust wastewater pumps essential for municipal bypass operations and construction dewatering. Major applications span critical infrastructure projects, including large-scale tunnel construction and highway development, where reliable and immediate dewatering capabilities are paramount. The inherent benefits of rental models—such as accessing the latest technology without investment, reduced maintenance burden, and scalability—drive widespread adoption across various industrial sectors.

The market benefits significantly from the cyclical nature of end-user industries like construction and mining, which often require specialized equipment only for specific phases of a project. Furthermore, the market's stability is reinforced by the persistent demand for emergency response services, particularly during natural disasters or infrastructure failures requiring immediate fluid management, such as flood control or burst pipe repair. Key factors fueling growth include globalization of supply chains demanding efficient logistics for temporary equipment deployment and the increasing complexity of industrial processes that necessitate highly specialized, high-efficiency pumps, which are often uneconomical to purchase outright for short-term use.

Industrial Pump Rental Market Executive Summary

The Industrial Pump Rental Market is undergoing robust expansion driven primarily by escalating global infrastructure spending and the strategic shift among corporations toward asset-light operational models. Business trends indicate a strong move towards integrated rental solutions, where providers offer not just the pump hardware but also advanced monitoring, filtration systems, and full-service operational support, catering especially to complex industries like petrochemicals and deep mining. Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market due to rapid industrialization, urbanization, and large-scale government investments in water treatment and construction, while North America and Europe remain mature markets characterized by replacement cycles, regulatory compliance demands, and high technology adoption rates, particularly concerning emission standards for diesel-powered equipment.

Segment trends reveal that the centrifugal pump segment maintains market dominance owing to its versatility and high-volume fluid handling capacity, essential for construction and utility sectors. However, the positive displacement pump segment is experiencing accelerated growth, fueled by specialized requirements in the oil and gas industry for high-viscosity fluid transfer and metering applications. End-user segmentation shows that the construction sector consistently holds the largest share due to continuous demand for dewatering and slurry handling, followed closely by the municipal segment, which relies heavily on rentals for critical bypass pumping operations during maintenance or infrastructure upgrades. The transition toward electric and hybrid pump rentals is a key emerging trend influencing segment dynamics, driven by corporate sustainability goals and noise reduction requirements in urban environments.

Overall market dynamics suggest that consolidation among major rental companies is increasing, leading to optimized fleet management and broader geographical reach, enhancing the accessibility and efficiency of rental services globally. The shift towards digitized fleet management, incorporating telematics and IoT devices for remote diagnostics, is enabling rental companies to offer superior uptime guarantees and predictive maintenance, adding significant value proposition for end-users. The market outlook remains positive, underscored by the fundamental need for reliable fluid management across all industrial activities, positioning the rental model as an economically viable and operationally flexible alternative to outright ownership, especially in highly regulated and time-sensitive operational environments.

AI Impact Analysis on Industrial Pump Rental Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) in the Industrial Pump Rental Market frequently center on themes such as predictive maintenance efficacy, optimization of fleet logistics, implementation costs of sensor technology, and the potential for autonomous monitoring to reduce labor requirements on site. Users are keen to understand how AI-driven diagnostics can minimize downtime, a critical factor in high-stakes rental applications like emergency bypasses or deep mining operations. Furthermore, there is significant interest in how machine learning algorithms analyze historical usage data to improve rental forecasting, asset utilization rates, and dynamic pricing strategies, ensuring that rental firms can maximize return on assets while providing competitive and transparent pricing structures to customers. The consensus expectation is that AI will transform service delivery from reactive repair to proactive intervention, drastically improving operational efficiency and customer satisfaction within the rental ecosystem.

The integration of AI into pump rental operations primarily focuses on enhancing asset performance monitoring. By deploying IoT sensors across pump fleets, AI algorithms continuously analyze vibration, temperature, pressure, and power consumption data to detect subtle anomalies that precede equipment failure. This capability allows rental providers to schedule maintenance precisely when needed, minimizing unexpected breakdowns at the client's site, which is paramount given the critical nature of many rental applications. This predictive approach significantly extends the Mean Time Between Failures (MTBF) and allows rental companies to guarantee higher equipment reliability, differentiating their offerings in a competitive market space. The optimization extends beyond the hardware to the operational lifespan of consumables, such as seals and bearings, predicting their remaining useful life based on specific duty cycles and environmental conditions.

Beyond maintenance, AI algorithms are revolutionizing the logistical backbone of the rental business. Machine learning is used to analyze demand patterns, geographical movement data, and historical utilization to optimize fleet location, ensuring that the right type of pump is available at the nearest depot when a customer requires it, thereby dramatically reducing response times and transportation costs. AI-powered scheduling systems also consider regulatory constraints, driver availability, and real-time traffic conditions to plan the most efficient delivery and retrieval routes. In essence, AI shifts the rental market toward a 'smart' service model where resource allocation, inventory management, and operational deployment are data-driven, creating substantial efficiency gains and reducing the environmental footprint associated with unnecessary equipment movement.

- AI-driven Predictive Maintenance: Reduces unscheduled downtime by forecasting component failure, enhancing equipment reliability and uptime guarantees.

- Optimized Fleet Logistics: Machine learning algorithms enhance routing, inventory placement, and mobilization efficiency, lowering operational costs and improving response times.

- Remote Diagnostics and Monitoring: Enables real-time assessment of pump health and performance parameters without requiring on-site personnel, particularly valuable in hazardous or remote locations.

- Dynamic Pricing Models: AI analyzes demand seasonality, utilization rates, and competitive pricing to offer optimal rental rates, maximizing asset yield.

- Enhanced Demand Forecasting: Predictive analytics improve inventory management and purchasing decisions by accurately anticipating regional and sectoral demand fluctuations.

DRO & Impact Forces Of Industrial Pump Rental Market

The Industrial Pump Rental Market is primarily driven by the imperative among businesses to manage capital efficiently by favoring operational expenditures over large, fixed capital investments, coupled with the rising global demand for temporary fluid management solutions in construction and utility repair. A key driver is the accelerated pace of urbanization and infrastructure modernization, particularly in developing economies, which necessitates extensive dewatering and sewage bypass operations requiring immediate, scalable pump solutions. Furthermore, increasingly stringent environmental regulations regarding wastewater discharge and flood control compel companies to quickly deploy compliant, high-capacity rental pumps. The major restraints include the high transportation and mobilization costs associated with moving large, specialized pump units and the potential for equipment damage or misuse by clients, leading to unpredictable maintenance expenses. Opportunities abound in adopting smart technology, integrating IoT and telematics for remote monitoring, and targeting specialized sectors like petrochemicals and green energy projects where unique pumping needs arise infrequently.

The impact forces influencing the market are multifaceted, balancing technological advancement against economic volatility. Economic downturns often favor the rental model as businesses postpone CapEx, reinforcing the market’s counter-cyclical resilience. Technological advances, such as the introduction of lighter, more powerful pumps and emission-compliant engines, necessitate fleet upgrades, which small and medium enterprises (SMEs) prefer to access via rental rather than purchase. However, the market is also impacted by the competitive pressure from manufacturers who offer long-term leasing options directly, blurring the line between rental and ownership. The scarcity of skilled labor capable of maintaining and operating sophisticated rental fleets poses a persistent challenge, influencing the service component offered by rental providers, who must invest heavily in technician training and remote support capabilities.

The critical impact force driving future growth is the increasing complexity of industrial projects, particularly those involving hazardous fluids or extremely high pressures, such as deep-sea oil extraction or advanced chemical processing. These projects require highly specialized and costly pumping technology that justifies only temporary deployment, cementing the role of specialized rental firms. Moreover, climate change-related events, leading to unpredictable flooding and water management crises, create significant emergency demand surges, a cornerstone of the rental business model. The market's overall equilibrium is defined by the rental companies' ability to manage a diverse, high-value asset base efficiently, ensuring maximum utilization rates while delivering rapid, reliable, and technologically advanced solutions tailored to highly diverse industrial applications across the globe, focusing heavily on safety and environmental compliance.

Segmentation Analysis

The Industrial Pump Rental Market is comprehensively segmented based on Pump Type, End-User Industry, Application, and Operating Capacity, reflecting the diverse and specialized requirements of industrial clients globally. This segmentation is crucial as it helps rental providers tailor their fleet composition and service packages to specific market needs, such as providing high-head submersible pumps for mining dewatering or chemical-resistant positive displacement pumps for pharmaceutical manufacturing. The dominance of the centrifugal pump segment is attributed to its broad applicability across dewatering, transfer, and boosting functions, making it a foundational asset for nearly all end-user groups. Furthermore, the segmentation by operating capacity (e.g., small, medium, and high horsepower) allows for precise targeting of projects, ranging from small-scale municipal maintenance to large industrial wastewater treatment facilities. The market is increasingly seeing growth in segments demanding specialized materials, driven by the handling of corrosive or abrasive fluids in demanding environments.

- By Pump Type:

- Centrifugal Pumps (Submersible Pumps, Trash Pumps, Slurry Pumps, Standard End Suction Pumps)

- Positive Displacement Pumps (Diaphragm Pumps, Peristaltic Pumps, Piston Pumps)

- By End-User Industry:

- Construction (Infrastructure, Residential, Commercial)

- Oil and Gas (Upstream, Midstream, Downstream)

- Mining (Dewatering, Tailings Management)

- Municipal (Water & Wastewater Treatment, Sewage Bypass)

- Industrial (Chemical Processing, Power Generation, Manufacturing)

- By Application:

- Dewatering and Fluid Transfer

- Sewage Bypass

- Testing and Cleaning (Hydrostatic Testing)

- Waste Management

- By Operating Capacity:

- Less than 50 HP

- 50 HP to 200 HP

- Above 200 HP (High Capacity)

- By Power Source:

- Diesel Engine Driven

- Electric Driven

Value Chain Analysis For Industrial Pump Rental Market

The value chain for the Industrial Pump Rental Market begins with Upstream activities centered on the procurement and manufacturing of reliable, high-quality industrial pumps, including components such as motors, impellers, and specialized materials (e.g., corrosion-resistant alloys). Manufacturers often collaborate closely with major rental companies to design pumps optimized for rugged rental use, focusing on durability, easy maintenance, and portability. The primary activities in the midstream involve the core rental operations: fleet management (purchasing, depreciation, maintenance scheduling), logistics (transport, installation, and retrieval), and the provision of specialized technical support and engineering consultation to match the correct pump to the specific client application. Efficient fleet utilization and rigorous maintenance protocols are critical value-add components in this stage, ensuring maximum uptime and reliability for the end-user.

Downstream activities involve direct interaction with the end-users. Distribution channels are typically Direct, with major rental companies operating extensive networks of physical depots and service centers strategically located near major industrial hubs or large-scale projects, allowing for rapid response times, especially for emergency services. Indirect channels, although less common, involve partnerships with equipment distributors or regional sub-rental agreements, expanding geographical coverage without requiring massive capital outlay on new depots. Customer support, including 24/7 technical assistance and training for client personnel on pump operation and safety, represents a significant final layer of value creation, establishing long-term customer relationships and repeat business.

The overall structure of the value chain is highly service-intensive. The differentiation in the market often hinges less on the pump itself and more on the quality of the service surrounding the rental agreement—prompt delivery, expert installation, and reliable breakdown support. Digitalization further enhances the value chain by integrating telematics and remote monitoring into the service offering. This allows for predictive maintenance, remote troubleshooting, and optimized operational parameters, creating substantial operational efficiencies and reducing risks for both the rental provider and the end-user, thereby maximizing the total economic value delivered throughout the entire rental lifecycle from procurement to decommissioning.

Industrial Pump Rental Market Potential Customers

The primary End-Users or Buyers of industrial pump rental services are organizations engaged in large-scale projects requiring temporary fluid management, often driven by project-based timelines, emergency needs, or regulatory compliance mandates. The Construction industry, particularly large infrastructure developers and civil engineering firms involved in tunneling, foundation work, and road building, constitutes the largest segment, requiring extensive dewatering and slurry handling solutions to manage groundwater and construction waste effectively. The Municipal sector, encompassing city water authorities and wastewater treatment plants, is another core customer group, relying on rentals for critical sewage bypass pumping during scheduled maintenance, facility upgrades, or emergency pipe failures, where service continuity is non-negotiable and demand is typically immediate and high-volume.

The Oil and Gas industry represents a highly lucrative segment, needing specialized high-pressure and high-temperature pumps for various upstream operations, including hydrostatic testing of pipelines, fluid injection during well maintenance, and emergency transfer of refined products in midstream and downstream facilities. Due to the high cost and specialized nature of equipment needed for these extreme conditions, renting is often the preferred economic choice. Similarly, the Mining industry is a consistent user, primarily for dewatering open-pit mines and managing the recirculation and transfer of abrasive slurries and tailings, demanding rugged, durable submersible and heavy-duty centrifugal pumps capable of continuous operation in harsh environments.

Furthermore, general Industrial customers, including power generation plants (for cooling and intake/outflow management), chemical manufacturers (for temporary process boosting or emergency transfers), and large manufacturing facilities, utilize rentals to supplement their existing fleet during peak production times, planned outages, or when testing new lines before full capital investment. These customers prioritize flexibility, access to the latest environmentally compliant equipment (such as TIER 4 Final diesel engines), and comprehensive service packages that include certified operators and environmental spill containment protocols, ensuring that the rental equipment seamlessly integrates into their complex operational procedures and meets stringent internal safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aggreko PLC, Xylem Inc., United Rentals, Inc., Sulzer Ltd., Wacker Neuson SE, Herc Rentals Inc., Ashtead Group PLC (Sunbelt Rentals), Griffin Dewatering, The Water Management Group, Holland Pump, Tsurumi Pump, SPX Flow, Kelly Pumping Systems, Sykes Pumps, Weir Group PLC, Pioneer Pump, Atlantic Plant Hire, Global Pump, Rain for Rent, Godwin Pumps (Xylem). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Pump Rental Market Key Technology Landscape

The technological landscape of the Industrial Pump Rental Market is rapidly evolving, driven primarily by the need for increased efficiency, reduced emissions, and enhanced monitoring capabilities. A critical technological trend is the proliferation of Internet of Things (IoT) sensors and telematics integrated into pump units. These devices monitor crucial operational parameters such as fluid flow rate, discharge pressure, engine temperature, fuel level, and vibration analysis in real-time. This real-time data transmission allows rental providers to remotely diagnose issues, ensuring optimal performance and proactive scheduling of maintenance, thereby significantly boosting asset utilization rates and reducing unexpected field failures, a major value differentiator for complex rental contracts.

Furthermore, there is a substantial shift towards environmentally conscious technologies, particularly in North America and Europe, where stringent emission standards (like EPA Tier 4 Final and EU Stage V) dictate the use of low-emission diesel engines or, increasingly, fully electric pump drive systems. Electric-driven pumps offer advantages in enclosed spaces or noise-sensitive areas, reducing operational complexity and environmental impact. Advancements in pump materials, such as wear-resistant alloys and specialized coatings, are also critical, particularly for slurry and abrasive fluid applications in mining, extending the operational life of rental assets and minimizing the downtime required for component replacement.

Another pivotal technological advancement involves the implementation of advanced hydraulic and impeller designs that maximize efficiency (lower horsepower consumption for the same flow rate) and improve solids handling capacity, particularly in municipal sewage bypass applications. This focus on hydraulic efficiency not only saves operating costs for the end-user but also reduces the carbon footprint associated with pumping operations. Additionally, the development of sophisticated mobile applications and cloud-based platforms allows clients to manage their rented equipment, access operational reports, and communicate directly with rental technical support, transforming the rental service into a highly digital, interconnected experience that enhances transparency and operational control.

Regional Highlights

- North America: North America holds a dominant position in the Industrial Pump Rental Market, characterized by high adoption rates of advanced equipment and a strong reliance on rental solutions across major industries. The market here is primarily driven by massive ongoing investments in aging infrastructure replacement, particularly in water and wastewater systems, and significant activity in the oil and gas sector (e.g., shale exploration and pipeline maintenance) which demands high-pressure, specialized pumps. Environmental regulations concerning dewatering and spill control are rigorously enforced, necessitating the use of compliant and well-maintained rental fleets, favoring larger, technologically adept rental firms. The high cost of labor and capital equipment in the U.S. and Canada further incentivizes businesses to leverage rental models, ensuring access to cutting-edge, low-emission equipment without the significant associated ownership costs and maintenance burden.

- Europe: The European market is mature and highly fragmented, driven by stringent environmental standards (EU Stage V emissions) and a strong focus on circular economy practices. Demand is consistently high from the construction sector, particularly in Germany, the UK, and France, often requiring specialized, low-noise, electric-driven pumps for urban projects. The municipal sector is a reliable source of demand, particularly for planned maintenance of extensive sewer networks, requiring sophisticated bypass pumping solutions. Innovation in Europe is focused heavily on developing hybrid and electric pump rental options to meet urban air quality targets and noise pollution regulations, pushing rental providers to rapidly update their fleet technology.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period due to rapid industrialization, massive urbanization waves, and large-scale infrastructure development projects, especially in China, India, and Southeast Asian nations. Governments are investing heavily in new ports, highways, and water treatment facilities, creating sustained, high-volume demand for general-purpose centrifugal and submersible pumps, particularly for dewatering applications. While pricing remains highly competitive, the sheer volume of construction and mining activity ensures exponential market expansion. The region is quickly adopting Western standards regarding equipment reliability and emissions, though the penetration of IoT-enabled fleet management is still developing compared to North America.

- Latin America (LATAM): The LATAM market growth is closely tied to the commodities cycle, particularly mining (Chile, Peru) and oil and gas (Brazil, Mexico). The rental market provides essential flexibility for these industries, which experience volatile investment cycles. Logistical challenges and infrastructure deficits in some countries make the localized presence and robust service network of major international rental players particularly valuable. Demand often focuses on durable, rugged equipment capable of operating reliably under challenging site conditions, with an increasing emphasis on safety compliance.

- Middle East and Africa (MEA): The MEA market is largely driven by large-scale oil and gas exploration (Middle East) and substantial infrastructure and construction mega-projects (Saudi Arabia, UAE, Qatar). The region requires high-capacity pumps for large-volume fluid transfer and cooling applications, often under extreme heat conditions. In Africa, mining and infrastructure development in resource-rich nations are key demand drivers. Rental is preferred due to the often temporary nature of large projects and the need for specialized equipment that can withstand high temperatures and abrasive environments, emphasizing reliability and technical support services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Pump Rental Market.- Aggreko PLC

- Xylem Inc.

- United Rentals, Inc.

- Sulzer Ltd.

- Wacker Neuson SE

- Herc Rentals Inc.

- Ashtead Group PLC (Sunbelt Rentals)

- Griffin Dewatering

- The Water Management Group

- Holland Pump

- Tsurumi Pump

- SPX Flow

- Kelly Pumping Systems

- Sykes Pumps

- Weir Group PLC

- Pioneer Pump

- Atlantic Plant Hire

- Global Pump

- Rain for Rent

- Godwin Pumps (Xylem)

Frequently Asked Questions

Analyze common user questions about the Industrial Pump Rental market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving growth in the Industrial Pump Rental Market?

Market growth is primarily driven by the increasing global emphasis on CapEx reduction, enabling companies to utilize operational budgets (OpEx) for specialized equipment. This shift is coupled with rapid urbanization and infrastructure projects requiring temporary, reliable dewatering and fluid transfer solutions, alongside strict environmental regulations mandating immediate flood control and sewage bypass capabilities.

Which end-user industry accounts for the largest share of the Industrial Pump Rental Market?

The Construction sector holds the largest market share, predominantly driven by the continuous demand for dewatering operations in large-scale civil engineering, infrastructure development, and tunneling projects. The need for temporary solutions to manage groundwater and slurry is constant across all phases of construction, maintaining high demand for various pump types, especially high-volume centrifugal and submersible pumps.

How is AI impacting the efficiency of industrial pump rental services?

AI significantly impacts rental services through the implementation of predictive maintenance based on IoT data, reducing unscheduled downtime and improving asset utilization rates. Furthermore, machine learning optimizes fleet logistics and inventory management, ensuring faster response times and lower transportation costs, fundamentally transforming service delivery from reactive repair to proactive management.

What is the key technological trend defining the Industrial Pump Rental fleet composition?

The key technological trend is the transition toward electric-driven and Tier 4 Final/Stage V compliant diesel pumps, driven by stringent global emission regulations and corporate sustainability mandates. This transition necessitates continuous fleet upgrades, which end-users prefer to access via rental rather than purchase, ensuring compliance and reduced operational noise in urban environments.

Which region offers the greatest future growth potential for pump rentals?

The Asia Pacific (APAC) region offers the greatest future growth potential. This accelerated growth is fueled by massive government investments in infrastructure, rapid industrialization, and escalating urbanization rates across countries like China, India, and Southeast Asia, leading to sustained, high-volume demand for temporary fluid management solutions in construction and municipal utilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager