Industrial Rectifiers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433369 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Rectifiers Market Size

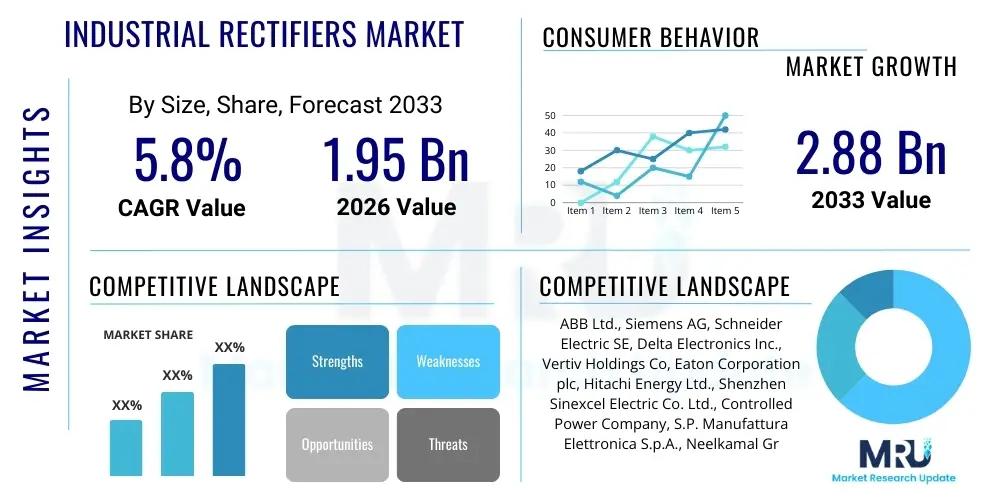

The Industrial Rectifiers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.88 Billion by the end of the forecast period in 2033.

Industrial Rectifiers Market introduction

Industrial rectifiers are essential power conversion devices designed to convert alternating current (AC) into direct current (DC) for heavy-duty industrial applications. These systems are crucial in processes requiring stable and high-quality DC power, such as electroplating, aluminum smelting, chlor-alkali production, railway traction, and uninterruptible power supplies (UPS). The operational reliability and efficiency of these rectifiers directly impact the productivity and energy consumption of major industries, making them indispensable components in modern manufacturing and infrastructure sectors.

The product portfolio encompasses various designs, including silicon-controlled rectifier (SCR)-based rectifiers, diode rectifiers, and switch-mode power supply (SMPS) rectifiers, tailored to specific voltage, current, and ripple requirements. Major applications span utility infrastructure, chemical processing, metal refining, and defense. The primary benefits derived from using advanced industrial rectifiers include enhanced energy efficiency, precise current control, reduced harmonic distortion, and improved system reliability compared to older mechanical rectification methods. These benefits are increasingly critical as global industries prioritize sustainability and operational uptime.

Market growth is predominantly driven by the accelerating pace of industrial automation globally, especially in emerging economies requiring vast power infrastructure expansions. Furthermore, the rising demand for electric vehicle (EV) charging infrastructure and large-scale battery energy storage systems (BESS) necessitates robust, high-power DC sources, positioning industrial rectifiers at the core of the energy transition. Regulatory mandates focusing on grid stability and energy efficiency also compel industries to upgrade to newer, more sophisticated rectification technologies, further fueling market expansion.

Industrial Rectifiers Market Executive Summary

The global Industrial Rectifiers Market is characterized by robust growth, primarily propelled by massive investments in infrastructure development, notably in the telecommunications, chemical, and metal processing sectors. Business trends indicate a strong pivot towards high-frequency switch-mode power supply (SMPS) rectifiers due to their superior efficiency, compact size, and rapid response capabilities, gradually displacing bulkier, low-frequency thyristor-based systems in non-critical applications. Key market players are concentrating on developing modular, smart rectifiers integrated with Internet of Things (IoT) capabilities for remote monitoring and predictive maintenance, addressing the industrial demand for higher operational reliability and reduced total cost of ownership (TCO).

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by rapid industrialization, large-scale urbanization projects, and substantial government spending on expanding railway networks and utility grids, particularly in China and India. North America and Europe maintain stable growth, focusing intensely on modernization projects, replacing aging infrastructure with highly efficient, digitally controlled rectifier units to meet stringent environmental and energy consumption standards. The increasing adoption of renewable energy sources globally also necessitates high-capacity rectifiers for grid interfacing and energy storage integration, providing a stable, high-voltage DC backbone.

Segment trends reveal that the high-power segment (above 100 kW) retains the largest market share, predominantly serving energy-intensive sectors like chlor-alkali and aluminum smelting, where continuous high current is mandatory. Conversely, the medium-power segment (10 kW to 100 kW) is witnessing the fastest expansion, fueled by increasing automation in manufacturing, robust data center construction, and the proliferation of DC fast charging stations for electric vehicles. Furthermore, the SCR/Thyristor-based segment, while mature, continues to dominate highly rugged environments requiring exceptional overload tolerance, while the IGBT-based segment leads in applications demanding high precision and dynamic performance, such as advanced research facilities and specialized metal treatment processes.

AI Impact Analysis on Industrial Rectifiers Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Rectifiers Market frequently center around how AI enhances predictive maintenance, optimizes energy consumption, and improves the overall resilience of power conversion systems. Users are keen to understand the shift from traditional reactive maintenance to AI-driven condition monitoring, expecting tangible reductions in downtime and operational costs. Key themes emerging from these questions involve the integration of machine learning algorithms to analyze massive datasets generated by smart rectifier systems, focusing on identifying subtle anomalies in temperature, current ripple, and voltage stability that precede component failure. Furthermore, there is significant interest in using AI to dynamically optimize rectifier output based on real-time load requirements and electricity pricing, ensuring minimal energy wastage and maximal efficiency.

The integration of AI into industrial rectifier control systems is rapidly moving beyond mere monitoring into proactive control and optimization. AI algorithms can analyze historical operational data alongside environmental factors (such as ambient temperature and humidity) to fine-tune switching frequencies, minimize thermal stress on power semiconductors, and extend the lifespan of critical components like capacitors and cooling fans. This deep learning capability allows rectifiers to adapt autonomously to changing grid conditions or load profiles, ensuring continuous delivery of stable DC power even under volatile input conditions. This capability is particularly valued in sensitive applications like server farms, telecommunication hubs, and specialized chemical production where even momentary power fluctuations can be catastrophic.

Expectations for AI integration include the development of self-calibrating rectifiers that utilize neural networks to maintain optimal performance parameters throughout their operational life without manual intervention. This technological leap addresses the shortage of specialized maintenance personnel in remote industrial locations. Moreover, AI is being leveraged in the design phase, using generative design principles to model and simulate rectifier topologies, leading to smaller, lighter, and intrinsically more efficient hardware designs before physical prototyping begins. The ultimate goal is to create truly autonomous power management solutions that communicate seamlessly within the broader industrial IoT ecosystem.

- AI enhances Predictive Maintenance (PdM) through real-time data anomaly detection, forecasting component failure with high accuracy.

- Machine learning optimizes energy consumption by dynamically adjusting output based on load prediction and energy price signals.

- AI facilitates autonomous fault diagnosis and self-correction, significantly reducing mean time to repair (MTTR).

- Deep learning algorithms are utilized for waveform analysis to minimize harmonic distortion and improve power quality under varying load conditions.

- Integration of neural networks enables self-tuning and calibration of rectifier control loops, maintaining peak efficiency over extended periods.

DRO & Impact Forces Of Industrial Rectifiers Market

The Industrial Rectifiers Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include global industrialization, the exponential growth of data centers and telecommunications infrastructure demanding reliable DC backup power, and the aggressive push towards electrification in transportation and specialized manufacturing processes. Conversely, the market faces restraints such as the high initial capital investment required for installing high-capacity, specialized rectifier units and the technical challenges associated with thermal management and minimizing electromagnetic interference (EMI) in high-power density systems. Opportunities largely stem from technological advancements in wide-bandgap (WBG) semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), which promise significantly higher efficiency and smaller form factors, alongside the burgeoning demand for high-voltage DC (HVDC) power transmission infrastructure and renewable energy integration projects.

The primary impact forces shaping the market are economic shifts, technological evolution, and regulatory pressure. Economically, fluctuations in global commodity prices, particularly aluminum and copper, directly affect the cost structure of manufacturing rectifiers, impacting pricing strategies. Technological forces, particularly the rapid adoption of digital controls and smart grid technologies, necessitate constant innovation in rectifier design, moving towards modular, redundant, and highly communicative units. Regulatory bodies worldwide are imposing stricter efficiency standards (e.g., EU Ecodesign requirements) and power quality mandates (IEEE 519), forcing industries to upgrade legacy systems to modern, highly efficient rectifiers, thus acting as a consistent market accelerator.

The collective influence of these forces suggests a future where high-efficiency, digitally controlled rectifiers become the industry standard. While initial costs remain a hurdle, the long-term operational savings driven by high efficiency and AI-enhanced predictive maintenance provide a strong economic justification for adoption. Furthermore, geopolitical stability and trade policies can influence supply chain resilience, especially concerning specialized semiconductor components sourced globally. Successful market participants are those investing heavily in WBG technology adoption, developing integrated thermal solutions, and offering comprehensive service contracts that leverage advanced data analytics and remote diagnostics, transforming the service model from repair-based to proactive asset management.

- Drivers: Rapid industrialization globally; Growth in data centers and telecom; Increasing adoption of DC-based infrastructure (EV charging, BESS).

- Restraints: High initial capital expenditure; Complex thermal management challenges in high-power systems; Intense competition from low-cost manufacturers.

- Opportunities: Integration of Wide-Bandgap (WBG) semiconductors (SiC/GaN); Expansion of High-Voltage DC (HVDC) transmission networks; Retrofit and modernization demand in mature markets.

- Impact Forces: Strict governmental regulations on energy efficiency and power quality; Evolution of modular and redundant power architecture; Global push towards renewable energy integration necessitating stable DC conversion.

Segmentation Analysis

The Industrial Rectifiers Market is systematically segmented based on Technology Type, Power Output, End-Use Industry, and Region, providing a granular view of market dynamics and specialized demands. Understanding these segments is critical for manufacturers to tailor product specifications, pricing, and distribution strategies. The technology segmentation defines the core operational mechanism, influencing efficiency, footprint, and transient response characteristics. Power output is crucial as it dictates the primary application scope, ranging from low-power telecom infrastructure to extremely high-power metal refining operations. End-use categorization demonstrates where the demand concentration lies, highlighting the reliance of heavy industry (e.g., Chlor-Alkali, Aluminum) on large-scale rectification solutions versus the high-volume demand from sectors like data centers and energy storage.

The dominant segments in terms of current adoption include the SCR/Thyristor-based rectifiers due to their proven reliability, robustness, and ability to handle extremely high current loads, making them the preferred choice for primary metal and chemical processing where efficiency takes secondary importance to absolute reliability. However, the fastest growth is observed in the IGBT (Insulated Gate Bipolar Transistor) and overall Switch-Mode Power Supply (SMPS) based segments. These technologies offer higher switching frequencies, leading to smaller magnetics, reduced weight, and superior energy conversion efficiency, crucial factors for space-constrained and energy-conscious modern facilities like hyper-scale data centers and fast charging hubs. Market participants are increasingly focusing R&D on refining the control architectures for IGBT-based rectifiers to maximize their operational lifespan.

Geographically, market segmentation underscores the divergence between industrialized and developing regions. While established markets (North America, Europe) focus heavily on replacement and highly specialized custom solutions, emerging markets (APAC, MEA) emphasize volume production for new infrastructure build-out. Analyzing these segments helps in identifying investment priorities, such as focusing on modular design for telecom in Southeast Asia or designing rugged, high-capacity thyristor systems for mining and smelting in Latin America and Africa. Furthermore, within the end-use sectors, the electrochemical segment consistently demands the most significant installed capacity, directly linking the rectifier market health to global production volumes of essential chemicals and base metals.

- By Technology Type:

- SCR/Thyristor-based Rectifiers

- Diode Rectifiers

- IGBT-based Rectifiers

- Switch-Mode Power Supply (SMPS) Rectifiers

- By Power Output:

- Low Power (Up to 10 kW)

- Medium Power (10 kW to 100 kW)

- High Power (Above 100 kW)

- By End-Use Industry:

- Chemical and Electrochemical (Chlor-Alkali, Electroplating)

- Metal Processing and Refining (Aluminum, Copper Smelting)

- Railways and Transportation (Traction Substations)

- Telecommunications and Data Centers

- Utility and Energy Storage (BESS, Grid Interface)

- Oil and Gas

- Others (Defense, Research)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Industrial Rectifiers Market

The Value Chain for the Industrial Rectifiers Market commences with the upstream activities centered on raw material procurement and highly specialized component manufacturing. Key upstream suppliers include producers of magnetic components (transformers and inductors), power semiconductors (diodes, thyristors, IGBTs, SiC/GaN), cooling systems (heat sinks, fans), and control electronics (microcontrollers, sensing components). The quality and cost of these specialized electronic components, particularly WBG power semiconductors, heavily influence the final product’s performance and profitability. Strategic partnerships with reliable, high-volume semiconductor manufacturers are crucial for maintaining a competitive edge and ensuring resilience against supply chain disruptions, which have become increasingly prevalent in recent years.

The middle segment involves the core manufacturing, assembly, and testing of the rectifier units. Manufacturers focus on meticulous design, particularly thermal design and control algorithm development, to ensure high efficiency and operational reliability under harsh industrial conditions. Advanced quality assurance processes, including rigorous load testing and environmental simulation, are mandatory before deployment. Distribution channels are typically a mix of direct sales and specialized indirect channels. Direct sales are common for high-value, custom-engineered projects, such as those required for large metal smelting plants or HVDC substations, where client specifications are highly unique. Indirect distribution relies on global electrical equipment distributors, engineering, procurement, and construction (EPC) firms, and authorized system integrators who provide local installation, configuration, and after-sales support.

Downstream activities focus on installation, commissioning, maintenance, and end-of-life management. After-sales service, including long-term maintenance contracts, spare parts supply, and modernization/retrofit services, represents a significant revenue stream and a competitive differentiator. The shift towards smart, interconnected rectifiers allows manufacturers to leverage remote diagnostics and IoT platforms to offer value-added services like predictive maintenance, enhancing customer relationships and extending the product lifecycle. Effective waste management and component recycling at the end of the rectifier's operational life are also becoming increasingly relevant, driven by circular economy principles and environmental regulations.

Industrial Rectifiers Market Potential Customers

Potential customers for industrial rectifiers are diverse, spanning numerous heavy and utility-driven sectors globally. The largest volume consumers are entities involved in energy-intensive processes, specifically the Chlor-Alkali industry, which uses rectification extensively for the electrolysis required in producing chlorine and caustic soda, and the primary Aluminum and Copper smelting industries, which require massive, continuous DC power for the Hall-Héroult and electrorefining processes. These end-users are characterized by extremely high power demands, often requiring custom-designed units in the megawatt range, and prioritize robustness and low operational variance over initial cost.

Another major customer segment includes utility companies and independent power producers (IPPs) involved in renewable energy integration and grid stabilization. This segment purchases rectifiers for battery energy storage systems (BESS), providing the critical DC link for charging and discharging large-scale batteries, and for establishing HVDC transmission links. Furthermore, the burgeoning electric vehicle charging infrastructure developers represent a rapidly growing customer base, requiring high-power, high-frequency SMPS rectifiers for DC fast charging stations. These customers demand modularity, high efficiency, and rapid deployment capabilities to keep pace with EV adoption rates.

The telecommunications and data center industries constitute another vital customer segment. They rely on high-reliability, often redundant, rectifier systems and associated battery banks to ensure continuous power supply to network equipment and servers. Their purchasing criteria are centered on power density (small footprint), high efficiency (to minimize cooling load), and stringent uptime guarantees. Other specialized customers include research laboratories (e.g., particle accelerators), defense contractors (for specialized power systems), and various specialized manufacturing facilities requiring controlled DC sources for processes like magnetizing, coating, or welding.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Delta Electronics Inc., Vertiv Holdings Co, Eaton Corporation plc, Hitachi Energy Ltd., Shenzhen Sinexcel Electric Co. Ltd., Controlled Power Company, S.P. Manufattura Elettronica S.p.A., Neelkamal Group, Kirloskar Electric Company, American Plating Power, PCE GmbH, Hind Rectifiers Limited, L&T Electrical & Automation, Ametek Inc., Schaefer Power Systems, Friem S.p.A., Zhejiang Meishuo Electric Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Rectifiers Market Key Technology Landscape

The technological evolution within the Industrial Rectifiers Market is primarily focused on enhancing efficiency, reducing physical size, and improving system intelligence. The shift from line-commutated (thyristor-based) to self-commutated (IGBT and MOSFET-based) switch-mode topologies represents the most significant technological trend. Modern rectifiers increasingly leverage high-frequency switching to drastically reduce the size and weight of passive components like transformers and filters, allowing for smaller installations suitable for dense urban or constrained industrial environments. Furthermore, digital signal processors (DSPs) are replacing older analog control circuits, enabling faster control loops, sophisticated fault protection, and precise power factor correction, which is crucial for meeting utility harmonic standards.

The most disruptive technological advancement is the deployment of Wide-Bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC MOSFETs and diodes allow rectifiers to operate at much higher temperatures and switching frequencies than traditional Silicon devices, leading to unprecedented efficiency levels (often exceeding 98%) and a dramatic reduction in system size and cooling requirements. While GaN is currently more prevalent in lower-power applications, its adoption in medium-power industrial rectification is accelerating. This WBG technology integration is critical for applications like high-power EV fast charging and compact data center power supplies, where space and energy efficiency are paramount competitive factors.

Beyond core hardware, the landscape is defined by connectivity and modularity. New generation rectifiers are designed as modular units, facilitating N+1 redundancy, hot-swappability, and simplified scaling of power capacity, thereby ensuring maximum uptime. Communication protocols such as Modbus TCP/IP, SNMP, and CAN bus are standard features, allowing rectifiers to integrate seamlessly into industrial control systems (ICS) and SCADA networks. This connectivity forms the foundation for implementing AI-driven monitoring and predictive maintenance strategies, transforming rectifiers from simple power converters into intelligent, communicative assets within the industrial IoT ecosystem, ensuring operational longevity and optimized performance.

Regional Highlights

The global Industrial Rectifiers Market demonstrates significant regional variation in growth dynamics, end-use structure, and technological maturity, primarily categorized into North America, Europe, Asia Pacific (APAC), Latin America (LATAM), and the Middle East and Africa (MEA). APAC is the undisputed engine of growth, propelled by relentless infrastructure expansion and industrialization initiatives in major economies such as China, India, and Southeast Asian nations. These countries are undertaking massive projects in rail electrification, establishing new chemical plants, and building out extensive telecommunication networks, generating high-volume demand for both low-cost, reliable thyristor rectifiers and modern SMPS solutions. Government support for manufacturing and electric vehicle infrastructure further solidifies APAC's leading position in market volume and growth rate.

North America and Europe represent mature markets characterized by stringent regulatory environments and a strong emphasis on efficiency and modernization. Growth in these regions is driven primarily by replacement cycles, facility upgrades to comply with new energy efficiency mandates, and significant investment in hyper-scale data centers and renewable energy grid integration projects, including major HVDC interconnectors. The demand here skews towards high-specification, technologically advanced rectifiers utilizing IGBT and SiC technologies, with a strong emphasis on smart grid compatibility and remote monitoring capabilities. The competitive landscape in these regions favors manufacturers offering comprehensive service packages and highly customized solutions tailored to sophisticated industrial requirements.

LATAM and MEA regions exhibit substantial potential, albeit with greater market volatility tied to commodity prices, particularly oil and gas, and mining sectors. Middle Eastern countries are heavily investing in large-scale infrastructure and industrial diversification projects, including substantial aluminum smelters and new smart city initiatives (like NEOM in Saudi Arabia), driving demand for very high-power, robust rectification systems. LATAM's market expansion is focused on mining, telecommunications, and increasing investments in localized manufacturing, which requires reliable power solutions. Future growth in these emerging regions will depend heavily on sustained foreign direct investment in core industrial sectors and the consistent rollout of stable power grids, which necessitates rugged, high-capacity rectifiers for traction and industrial applications.

- Asia Pacific (APAC): Highest growth rate globally, driven by infrastructure development (railways, telecom, chemical plants), rapid industrial automation in China and India, and massive government investment in utility expansion.

- North America: Stable growth fueled by data center construction, grid modernization projects, significant investment in EV charging infrastructure, and strict adoption of high-efficiency, WBG-based rectifiers for compliance.

- Europe: Focus on replacement and upgrade cycles targeting energy efficiency and harmonic reduction; strong demand from specialized manufacturing and chemical sectors, supported by robust regulatory pushes like the Green Deal.

- Latin America (LATAM): Demand concentrated in mining operations, basic metal processing, and telecom expansion; market stability often linked to regional commodity price cycles and infrastructure funding availability.

- Middle East and Africa (MEA): Growth tied to mega industrial projects (e.g., petrochemicals, aluminum smelting) and new city construction; increasing reliance on rectifier systems for uninterruptible power supply in unstable grid environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Rectifiers Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Delta Electronics Inc.

- Vertiv Holdings Co

- Eaton Corporation plc

- Hitachi Energy Ltd.

- Shenzhen Sinexcel Electric Co. Ltd.

- Controlled Power Company

- S.P. Manufattura Elettronica S.p.A.

- Neelkamal Group

- Kirloskar Electric Company

- American Plating Power

- PCE GmbH

- Hind Rectifiers Limited

- L&T Electrical & Automation

- Ametek Inc.

- Schaefer Power Systems

- Friem S.p.A.

- Zhejiang Meishuo Electric Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Industrial Rectifiers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Industrial Rectifiers Market?

The market growth is primarily driven by three key factors: the acceleration of global industrialization, especially in APAC, demanding high-capacity power supplies; the exponential increase in data center and telecommunication infrastructure requiring reliable DC backup systems; and the global transition towards electrification, necessitating high-power rectifiers for electric vehicle (EV) charging stations and utility-scale battery energy storage systems (BESS).

How do Wide-Bandgap (WBG) semiconductors impact modern rectifier design?

WBG semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN) are highly impactful as they allow rectifiers to operate at much higher switching frequencies and temperatures. This results in superior energy efficiency (over 98%), a significant reduction in the physical size and weight of the units, and lower cooling requirements, making them essential for high-density, energy-critical applications like hyper-scale computing and fast charging.

Which segment holds the largest share in the Industrial Rectifiers Market by power output?

The High Power segment (rectifiers rated above 100 kW) holds the largest market share. This is attributed to the substantial and continuous DC power requirements of energy-intensive heavy industries, particularly chemical production (Chlor-Alkali), primary metal processing (Aluminum and Copper smelting), and large-scale railway traction substations, which necessitate massive, robust rectification installations.

What role does Artificial Intelligence (AI) play in the operation of industrial rectifiers?

AI integration is crucial for enhancing operational intelligence. AI enables sophisticated predictive maintenance by analyzing system data in real-time to forecast component failures and significantly minimizes unexpected downtime. Furthermore, AI algorithms optimize energy management by dynamically adjusting the rectifier output based on load predictions and grid conditions, maximizing efficiency and minimizing operating costs.

What are the major technological challenges facing industrial rectifier manufacturers?

Manufacturers face significant challenges in managing thermal dissipation in increasingly compact, high-power density systems, particularly those using new WBG technologies. Additionally, minimizing electromagnetic interference (EMI) and harmonic distortion while maintaining high reliability and cost-effectiveness remains a continuous engineering challenge, especially when integrating with increasingly sensitive industrial control networks and public utility grids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager