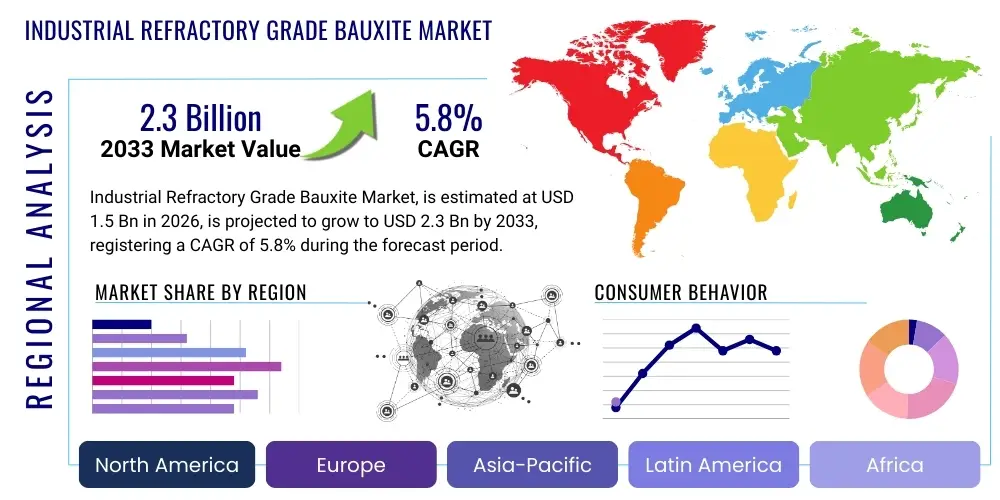

Industrial Refractory Grade Bauxite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434861 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Refractory Grade Bauxite Market Size

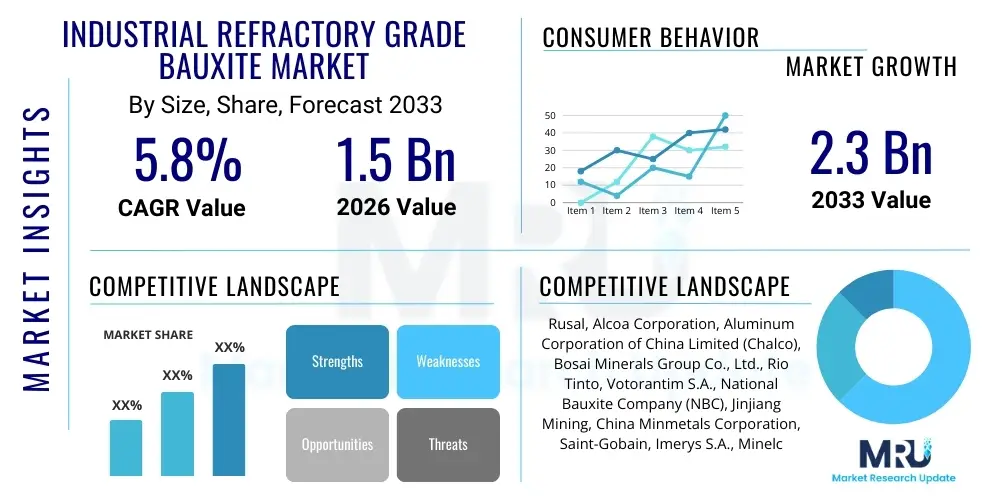

The Industrial Refractory Grade Bauxite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Industrial Refractory Grade Bauxite Market introduction

Industrial Refractory Grade Bauxite (IRGB) is a high-quality mineral commodity characterized by its high alumina content (typically over 85% Al2O3), low iron, and low fluxing impurities, making it indispensable for the production of advanced refractory materials. Refractories are critical linings used in high-temperature industrial processes, primarily within the metallurgical, cement, glass, and ceramics industries, providing thermal insulation and resistance to chemical corrosion and mechanical wear. The superior chemical inertness and high melting point of IRGB derived products ensure operational efficiency and longevity of industrial furnaces and kilns, directly supporting core heavy industries globally. This market is fundamentally driven by the robust expansion of global steel production and the necessity for energy-efficient industrial processes that demand longer-lasting refractory linings.

The primary source for IRGB is high-purity bauxite ore, which undergoes extensive calcination or sintering processes at temperatures exceeding 1600°C to remove chemically bound water and transform the material into a dense, hard, and stable mineral aggregate. This process significantly enhances the refractory properties, including volume stability and high-temperature strength. Key applications include the manufacture of high-alumina bricks, monolithic refractories, castables, and gunning mixes. These products are essential in environments requiring extreme resistance to thermal shock and chemical attack, such as ladle linings, tundishes, and continuous casting processes in steel manufacturing, or high-wear zones in rotary cement kilns.

Market growth is largely influenced by technological advancements in refractory production, focusing on optimizing energy consumption during processing and developing specialty bauxite grades for ultra-high-temperature applications. Furthermore, stringent environmental regulations requiring reduced carbon emissions in heavy industries push manufacturers toward high-performance refractories that improve furnace efficiency and decrease downtime. The limited global availability of ultra-high-grade crude bauxite suitable for refractory purposes, concentrated mainly in specific geographic regions like China, Australia, and Guyana, adds complexity to the supply chain and pricing dynamics, emphasizing the strategic importance of secure sourcing and processing capabilities for market participants.

Industrial Refractory Grade Bauxite Market Executive Summary

The Industrial Refractory Grade Bauxite (IRGB) market demonstrates sustained growth, underpinned by the cyclical nature of the global steel and non-ferrous metals industries, which constitute the largest end-user segment. Business trends indicate a shift towards consolidation among primary processors and miners seeking greater control over raw material quality and supply security, especially given the rising costs of energy-intensive calcination processes. Innovation is concentrated on developing alternative processing methods and optimizing bauxite utilization through advanced milling and blending techniques to meet increasingly tight specifications required by modern continuous casting technologies. Sustainability concerns are driving demand for recycling spent refractories, yet high-purity IRGB remains the foundational material, leading to significant investment in expanding mining and beneficiation capacities, particularly in regions outside of traditional supply centers to mitigate geopolitical risks and diversification of supply.

Regionally, the Asia Pacific (APAC) dominates the market, largely due to the massive scale of industrial expansion, especially in China and India, where steel, cement, and glass production capacity continues to grow significantly. China, historically the leading supplier and consumer, is facing increasing pressure to control pollution and manage resource depletion, which has led to fluctuating export volumes and prices, forcing downstream global refractory producers to seek stable supply from regions like North America and Latin America. Europe and North America, while having mature industrial bases, exhibit steady demand driven by the replacement and maintenance cycle of existing high-temperature infrastructure, focusing heavily on premium, specialized IRGB products that offer exceptional thermal efficiency and reduced maintenance frequency.

In terms of segmentation, the Calcined Bauxite segment retains the largest market share due to its established performance profile and broad applicability across various refractory types, while the Sintered Bauxite segment is projected to exhibit the fastest growth, driven by its superior density and minimal porosity, making it ideal for the most demanding ultra-high-temperature environments. Application-wise, the Iron and Steel industry remains the largest consumer, utilizing IRGB for critical components such as blast furnace tapholes, ladles, and electric arc furnace linings. The ongoing trend across all segments is the increasing requirement for higher purity (higher Al2O3 concentration) to withstand severe operating conditions and extend product lifespan, thereby reducing operational costs for the end-users.

AI Impact Analysis on Industrial Refractory Grade Bauxite Market

Common user questions regarding AI's impact on the Industrial Refractory Grade Bauxite market frequently revolve around its potential to optimize the energy-intensive calcination process, improve raw material quality control, and enhance demand forecasting capabilities amidst volatile industrial cycles. Users are concerned about whether AI-driven geological analysis can uncover new high-grade bauxite deposits more efficiently, thereby stabilizing supply. Key themes emerging from these inquiries include the application of predictive maintenance in refractory-lined furnaces (reducing IRGB consumption variability), the use of machine learning for process optimization in refractory brick manufacturing (improving yield and reducing waste), and the integration of large language models for quicker, more accurate market trend analysis, especially concerning infrastructure and industrial capital expenditure forecasts that drive IRGB demand. The expectation is that AI will primarily serve as an efficiency multiplier, mitigating risks associated with supply chain disruptions and volatile energy costs inherent in the sector.

AI's primary influence is manifesting in operational excellence throughout the IRGB value chain. In the mining phase, AI-powered image recognition and geological modeling are being deployed to enhance selective mining techniques, ensuring only the highest quality crude bauxite is extracted, minimizing waste, and maximizing resource recovery, which is critical for maintaining the stringent purity standards required for refractory grades. Furthermore, in the processing stage—specifically calcination and sintering—AI algorithms analyze real-time sensor data related to temperature, gas flow, and material composition within rotary kilns. By precisely modulating these parameters, AI systems minimize fuel consumption while ensuring optimal mineralogical transformation of the bauxite, leading to consistent material quality and significantly lower energy expenditure, a major cost component for IRGB producers.

Downstream, AI is proving invaluable in refractory manufacturing and end-user application. Manufacturers utilize machine learning to predict the optimal formulation and pressing parameters for refractory bricks based on desired performance characteristics (e.g., thermal shock resistance, corrosion immunity). For end-users in steel and cement plants, AI implements predictive maintenance schedules for furnace linings. By analyzing temperature gradients, acoustic emissions, and wear patterns, AI can accurately forecast the remaining useful life of a refractory lining, allowing for timely, targeted repairs rather than costly full replacements. This optimization reduces unexpected downtime and lowers overall refractory consumption, potentially impacting the steady-state demand growth for IRGB, although demand for high-performance, higher-purity material persists.

- AI-driven optimization of calcination kiln temperature profiles for reduced energy consumption.

- Machine learning models enhance selective bauxite mining and beneficiation processes, improving purity.

- Predictive analytics for precise global demand forecasting, mitigating inventory and pricing volatility.

- Automated vision systems for quality control in raw material grading and finished refractory product inspection.

- AI-enhanced predictive maintenance in end-user furnaces, extending lining life and optimizing replacement cycles.

- Integration of advanced data analytics for supply chain transparency and risk management.

DRO & Impact Forces Of Industrial Refractory Grade Bauxite Market

The Industrial Refractory Grade Bauxite (IRGB) market is influenced by a complex interplay of growth drivers and inherent constraints, framed by significant opportunities arising from global shifts in industrial practices. Key drivers include the sustained expansion of the global steel industry, particularly in emerging economies, which requires high volumes of refractories for new capacity and maintenance. Furthermore, the mandatory need for high-performance, ultra-pure refractories to support modern, high-intensity industrial processes (like continuous casting and high-efficiency cement production) drives demand for premium IRGB grades. Conversely, the market faces strong headwinds, primarily the high energy intensity and associated carbon footprint of the calcination process, the geopolitical risks tied to concentrated sourcing (especially in China), and increasing environmental scrutiny on mining operations. These factors elevate operational costs and necessitate substantial investment in sustainable practices and technological innovation.

Restraints are crucial limiting factors; these include the growing substitution risk from alternative high-purity refractory materials, such as synthetic alumina, magnesia, and silicon carbide, which offer comparable or superior performance in niche, ultra-high-temperature applications. Moreover, fluctuations in the pricing and availability of natural gas and electricity directly impact the profitability of IRGB processors, as calcination constitutes a large portion of the final product cost. Opportunities, however, abound through the development of specialized, low-cement castables and pre-cast shapes that use highly processed bauxite, catering to the growing trend of monolithic refractory systems that offer faster installation and superior performance characteristics. The expanding focus on the recycling of spent refractories also presents opportunities for high-quality bauxite recovery and reuse, reducing reliance on primary resources while meeting circular economy goals.

The cumulative impact forces shaping the IRGB market are primarily centered on resource security and environmental compliance. Impact forces driven by environmental, social, and governance (ESG) standards compel producers to adopt cleaner mining technologies and implement carbon capture or alternative energy sources for calcination, increasing initial capital expenditure but securing long-term operational viability. Additionally, the strategic importance of IRGB to core national industries (steel and infrastructure) means that supply chain stability is a high-impact factor, influencing trade policies, tariffs, and direct investment decisions by major industrial nations into secure raw material sources outside established hubs. The delicate balance between ensuring high-quality supply stability and managing the volatility inherent in heavy industrial demand cycles defines the strategic landscape for all market participants.

Segmentation Analysis

The Industrial Refractory Grade Bauxite (IRGB) market is comprehensively segmented based on product type, which reflects the different levels of thermal processing and resultant material characteristics; application, representing the primary end-use industries driving demand; and geographical region, detailing key consumption and production hubs. Segmentation by product type—primarily Calcined Bauxite, Sintered Bauxite, and Tabular Alumina (which, while synthesized, is closely linked in application and often uses high-purity bauxite as a precursor)—is vital, as it dictates the material's suitability for specific high-temperature environments. Calcined bauxite, being less dense but highly refractory, caters to mainstream applications, while sintered bauxite and tabular alumina target demanding zones requiring extreme volume stability and corrosion resistance. The increasing complexity and performance demands of end-user industries necessitate a diverse range of bauxite products tailored for specific thermal, chemical, and mechanical stresses.

Analysis by application clearly highlights the overwhelming dominance of the Iron and Steel industry, which relies on IRGB for lining materials in electric arc furnaces, blast furnaces, and secondary metallurgy operations (ladles and tundishes). The performance and lifespan of these refractory linings directly affect the steel plant's efficiency and cost structure, making refractory quality a strategic concern. Other significant application segments include the Cement and Lime industry, where bauxite-based refractories line rotary kilns; the Glass industry, utilizing specialized high-purity bauxite in melting tanks; and the Petrochemical and Chemical industries, where IRGB products provide inert linings for reactors and high-temperature processing equipment. The unique thermal profile and chemical environment of each application necessitate distinct IRGB specifications, thereby driving specialization within the supply market.

Geographical segmentation reveals that APAC is both the largest producer and consumer, driven by extensive infrastructure and manufacturing activities. The market dynamics within this region are highly influenced by Chinese policy regarding mining quotas and environmental controls. Conversely, markets in North America and Europe, while growing at a slower pace in terms of volume, exhibit a high demand for advanced, premium IRGB products and are characterized by stringent quality standards and a higher rate of technological adoption in refractory recycling. Understanding these diverse segments and their interrelated drivers is fundamental for accurate market forecasting and strategic planning, as pricing, lead times, and required product specifications vary significantly across material types, applications, and regional procurement norms.

- By Product Type:

- Calcined Bauxite

- Sintered Bauxite

- Tabular Alumina (Often included as a high-end derivative)

- By Application:

- Iron & Steel Industry

- Cement & Lime Industry

- Glass Industry

- Non-ferrous Metals Industry

- Chemical & Petrochemical Industry

- Others (Foundry, Ceramics)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Industrial Refractory Grade Bauxite Market

The value chain for Industrial Refractory Grade Bauxite (IRGB) begins with upstream activities focused on the meticulous extraction and primary processing of high-purity bauxite ore. Upstream analysis involves geological surveying, mining (often open-pit), crushing, and washing to remove initial impurities. The quality of the crude bauxite—specifically high Al2O3 content and minimal reactive contaminants like iron oxide and silica—is paramount at this stage. Key players in this phase are large-scale mining corporations and state-owned enterprises that control access to the most desirable deposits. Subsequent processing involves high-temperature calcination or sintering (sometimes reaching 1800°C) to produce the final, dense, refractory-grade aggregate. This energy-intensive transformation is a critical cost driver and a major point of differentiation in the value chain, as it determines the final refractory characteristics such as density and porosity.

The midstream involves the transformation of processed IRGB aggregate into finished refractory products. Refractory manufacturers act as the core link, purchasing specific bauxite grades (often blended with other materials like clay, carbon, or synthetic minerals) to formulate customized products, including bricks, monolithic castables, and pre-formed shapes. Distribution channels are complex, involving both direct sales and indirect routes through specialized distributors and trading houses. Direct sales are common for large volume, standard products sold to major steel and cement groups under long-term contracts. Indirect channels leverage regional distributors with technical expertise to serve smaller foundries, glass manufacturers, and diverse industrial clients requiring just-in-time delivery and specialized technical support for installation and maintenance.

Downstream analysis focuses on the end-users and the cyclical consumption patterns that drive demand volatility. The Iron and Steel industry dominates consumption, followed by Cement, Glass, and Chemicals. The refractory product's lifecycle dictates the purchase frequency; for instance, high-wear zones require frequent replacement, creating steady maintenance demand. Direct sales facilitate strong technical collaboration between the refractory producer and the end-user, often resulting in co-development of improved materials. Indirect sales via distributors offer necessary inventory management and local logistics support, vital for reducing end-user inventory carrying costs and ensuring rapid response to unexpected equipment failures. The entire chain is currently focusing downstream on lifecycle management, including technical installation services and the nascent but growing market for refractory recycling and reclamation, aiming to close the material loop.

Industrial Refractory Grade Bauxite Market Potential Customers

The primary potential customers for Industrial Refractory Grade Bauxite (IRGB) are enterprises operating large-scale, high-temperature industrial processes where thermal containment and chemical resistance are critical operational requirements. These customers are predominantly major integrated steel producers (using blast furnaces and basic oxygen furnaces), mini-mill operators (using electric arc furnaces), and secondary processing facilities involved in ladle metallurgy and continuous casting. Their buying decisions are driven by the need for refractory linings that maximize campaign life, minimize unscheduled downtime, and improve energy efficiency. Since refractory failures can halt entire production lines, these customers prioritize product consistency, guaranteed supply volume, and the technical support offered by the supplier over marginal cost savings.

A secondary, but highly influential, customer base includes global cement manufacturers and lime producers. These customers rely on IRGB-based refractories, particularly in the high-temperature burning zones of their rotary kilns, where materials must withstand severe abrasion, high dust loads, and chemical attack from alkaline components. Similarly, large-volume float glass and container glass producers represent a steady customer segment, demanding highly specialized, often zircon- or chrome-modified bauxite refractories to prevent glass contamination and resist corrosion in melting tanks. The purchasing cycle for these users often involves significant capital expenditure planning, integrating refractory replacement into scheduled maintenance shutdowns, meaning suppliers must maintain long-term relationships and technical certification.

Furthermore, specialty segments such as non-ferrous metal refineries (aluminum, copper), foundry operations, and the ceramics industry also constitute important buyers. In these niche applications, customers seek specific physical properties offered by IRGB, such as high refractoriness under load (RUL) and superior creep resistance. The purchasing structure typically involves direct engagement with refractory product manufacturers, who then incorporate the bauxite into their custom formulations. The ultimate decision-makers are often procurement specialists in conjunction with materials engineers, who vet suppliers based on certified quality reports (e.g., Al2O3 content, bulk density, and porosity metrics) and audited sustainable sourcing practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rusal, Alcoa Corporation, Aluminum Corporation of China Limited (Chalco), Bosai Minerals Group Co., Ltd., Rio Tinto, Votorantim S.A., National Bauxite Company (NBC), Jinjiang Mining, China Minmetals Corporation, Saint-Gobain, Imerys S.A., Minelco, Carborundum Universal Limited (CUMI), Orient Refractories Ltd., Refratechnik Holding GmbH, Kumas Magnesite Industry A.S., Magnesita Refratários S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Refractory Grade Bauxite Market Key Technology Landscape

The technology landscape in the Industrial Refractory Grade Bauxite market centers on achieving higher purity, greater energy efficiency in processing, and developing advanced material blending techniques. The foundational technology remains high-temperature thermal treatment—calcination, typically executed in large rotary kilns, or sintering, often utilizing shaft kilns or specialized circular kilns. Technological innovation here focuses on improving the thermal efficiency of these kilns through advanced insulation, recuperation systems, and optimized burner technology to reduce natural gas or coal consumption, directly addressing the critical restraints of high energy costs and environmental impact. Furthermore, advanced process control systems, increasingly integrating AI and IoT sensors, are used to maintain ultra-precise temperature profiles, ensuring complete dehydroxylation and uniform mineral transformation (e.g., converting gibbsite/boehmite to stable alpha-alumina phases) necessary for superior volume stability in the final product.

In the beneficiation stage, sophisticated sorting and separation technologies are becoming standard to meet the rising demand for ultra-high-grade bauxite (over 88% Al2O3). Techniques such as optical sorting, magnetic separation, and advanced wet processing methods are employed upstream to remove detrimental impurities like titanium dioxide and iron oxide before thermal treatment. Post-processing innovation involves controlled crushing and milling techniques to produce aggregates with specific, highly engineered particle size distributions (PSDs). Precise PSD control is vital for refractory manufacturers, enabling the creation of dense, low-porosity bricks and advanced monolithic castables that exhibit superior packing density and mechanical strength, ultimately extending the operational life of the end-user linings. These technological requirements drive continuous capital investment by primary bauxite processors to maintain a competitive edge.

Downstream technological advancements in the refractory formulation sector indirectly impact IRGB demand. Key technologies include the development of low-cement or cement-free castables (LCCs/UFCCs), which often require specific, narrowly graded IRGB fines to achieve optimal rheology and setting behavior. Additionally, pre-cast and pre-fired refractory shapes (PCCs) utilize highly processed IRGB and complex binding systems to deliver ready-to-install components with certified performance metrics, reducing installation time at the end-user site. The emergence of specialized high-performance insulating refractories, often incorporating lightweight bauxite aggregates or microspheres, also represents a growing technological niche aimed at optimizing thermal efficiency across various industrial furnaces, indicating a future where material customization based on thermal and mechanical performance specifications will intensify.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of both demand and supply for Industrial Refractory Grade Bauxite. China remains the dominant player, holding significant reserves and processing capacity, although recent governmental environmental closures and stricter mining quotas have disrupted global supply and driven up international prices. India and Southeast Asian nations, with their rapidly expanding steel and cement sectors, represent the primary consumption growth engines. The region’s focus is currently shifting toward securing stable supply sources outside of China and investing in local processing capabilities to mitigate trade risks and meet burgeoning domestic infrastructure demands.

- Europe: Europe is characterized by mature, technologically advanced refractory manufacturing sectors that prioritize quality and specialized products over sheer volume. Demand is steady, driven mainly by replacement cycles in the steel, glass, and petrochemical industries. European consumers typically require premium-grade bauxite with extremely consistent chemical and physical properties. The market is increasingly influenced by strict EU regulatory frameworks, pushing manufacturers toward energy-efficient production methods and exploring regional sourcing alternatives or high-quality synthetic substitutes to reduce reliance on volatile distant imports.

- North America: The North American market exhibits stable demand, primarily fueled by the strong domestic steel sector, particularly electric arc furnace (EAF) operations which necessitate high-quality basic and high-alumina refractories. While mining activity is limited, the region is a key consumer, focusing on optimizing refractory consumption through predictive maintenance and high-performance monolithic solutions. Supply chain resilience is a major concern, leading to strategic investments in securing diversified international supply and optimizing domestic processing efficiency to reduce reliance on single-source regions.

- Latin America: Latin America, led by Brazil, possesses significant bauxite reserves, making it a critical regional supplier. The market is characterized by captive consumption by large integrated industrial groups (e.g., mining and metals conglomerates) that also process bauxite for local and export markets. Growth is tied to infrastructure spending and the cyclical performance of the Brazilian and Mexican steel industries. The focus is on expanding mining capacity responsibly and upgrading local processing facilities to meet international quality standards.

- Middle East & Africa (MEA): The MEA market is seeing accelerating demand, driven by large-scale infrastructure projects, expansion in regional steel production (especially in the GCC countries), and development of aluminum smelters. While Africa holds significant undeveloped reserves, consumption is concentrated in the Middle East. The market presents growth opportunities for international suppliers who can provide reliable, high-specification bauxite and advanced refractory services to support rapidly commissioned industrial plants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Refractory Grade Bauxite Market.- Rusal

- Alcoa Corporation

- Aluminum Corporation of China Limited (Chalco)

- Bosai Minerals Group Co., Ltd.

- Rio Tinto

- Votorantim S.A.

- National Bauxite Company (NBC)

- Jinjiang Mining

- China Minmetals Corporation

- Saint-Gobain

- Imerys S.A.

- Minelco

- Carborundum Universal Limited (CUMI)

- Orient Refractories Ltd.

- Refratechnik Holding GmbH

- Kumas Magnesite Industry A.S.

- Magnesita Refratários S.A.

- Australian Bauxite Limited (ABX)

- HP Materials Solutions Inc.

- Waardals A/S

Frequently Asked Questions

Analyze common user questions about the Industrial Refractory Grade Bauxite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Industrial Refractory Grade Bauxite (IRGB) and how does it differ from metallurgical bauxite?

Industrial Refractory Grade Bauxite (IRGB) is a high-purity bauxite ore specifically processed for use in manufacturing materials that must withstand extremely high temperatures, chemical attack, and mechanical wear. Unlike metallurgical bauxite, which is primarily used to produce aluminum metal via the Bayer process, IRGB must have an exceptionally high alumina content (typically 85-90% Al2O3) and critically low levels of fluxing agents (like iron oxide, potash, and soda) to maintain volume stability and high-temperature performance after calcination or sintering. This higher specification and rigorous thermal treatment distinguishes IRGB as a premium material used mainly in refractory linings.

Which industry is the largest consumer of Refractory Grade Bauxite and what drives their demand?

The Iron and Steel industry is overwhelmingly the largest consumer of Refractory Grade Bauxite. Demand is primarily driven by the continuous replacement and maintenance requirements of refractory linings in critical equipment such as electric arc furnaces (EAFs), blast furnaces, steel ladles, and tundishes, where extreme thermal and chemical stresses occur. Modern steel production processes, especially continuous casting, require highly reliable, high-alumina refractories derived from IRGB to maximize operational uptime, improve steel quality, and reduce energy consumption, directly linking bauxite demand to global steel production rates and facility modernization efforts.

What are the primary geopolitical risks affecting the global supply of Refractory Grade Bauxite?

The primary geopolitical risks stem from the concentrated nature of high-grade bauxite reserves and processing facilities, particularly in China, which has historically dominated both mining and calcining. Supply volatility is caused by unpredictable export policies, fluctuating quotas, and increasingly stringent domestic environmental protection measures implemented by the Chinese government, leading to sporadic facility closures. This concentration creates supply chain fragility; thus, international refractory manufacturers must continuously manage sourcing risks by diversifying their procurement strategies toward stable regions like Guyana, Australia, and Brazil, leading to higher logistics costs but greater supply security.

How do high energy costs impact the profitability and pricing of Industrial Refractory Grade Bauxite?

High energy costs, particularly for natural gas and electricity, significantly impact the profitability and pricing of IRGB because the transformation process—calcination or sintering—is extremely energy-intensive, requiring temperatures up to 1800°C to achieve the required density and mineral stability. Energy consumption represents a major operating expenditure for processors. Consequently, volatility in global fossil fuel markets directly translates into higher production costs, which are subsequently passed on to refractory manufacturers. This pressure incentivizes producers to invest heavily in advanced, energy-efficient kiln technologies and process optimization, including utilizing AI, to mitigate the effect of rising utility expenses on the final product price.

What is the role of sustainability and recycling in the future market dynamics of Industrial Refractory Grade Bauxite?

Sustainability and recycling are growing in importance, driven by increasing regulatory pressures (ESG standards) and resource depletion concerns. While IRGB remains a primary requirement, the future market dynamics involve integrating advanced refractory recycling technologies to reclaim high-purity aggregates from spent furnace linings. Successful recycling reduces the industry's reliance on primary mining, lowers landfill waste, and potentially offers a more localized supply source. However, technical challenges related to separating and cleaning mixed, spent refractory materials mean that recycled content will initially supplement, rather than fully replace, high-quality virgin IRGB, particularly for ultra-demanding applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager