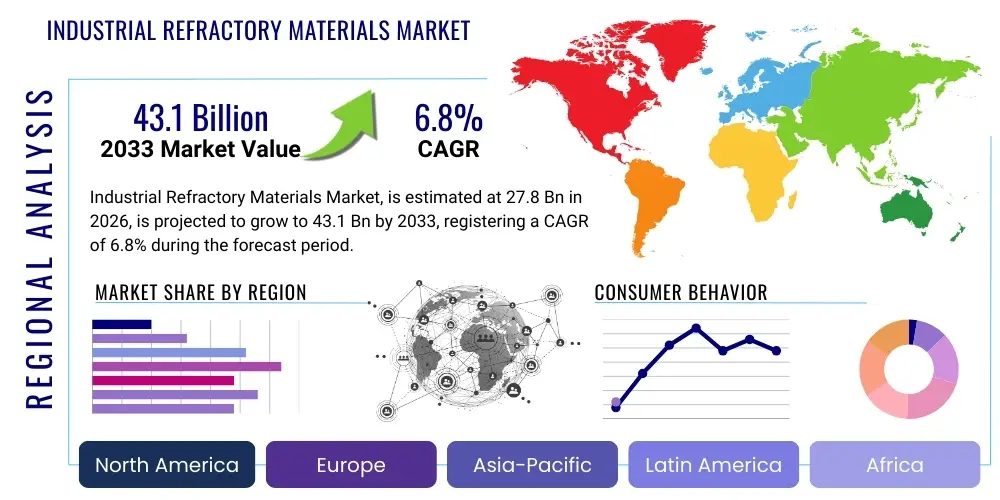

Industrial Refractory Materials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439657 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Refractory Materials Market Size

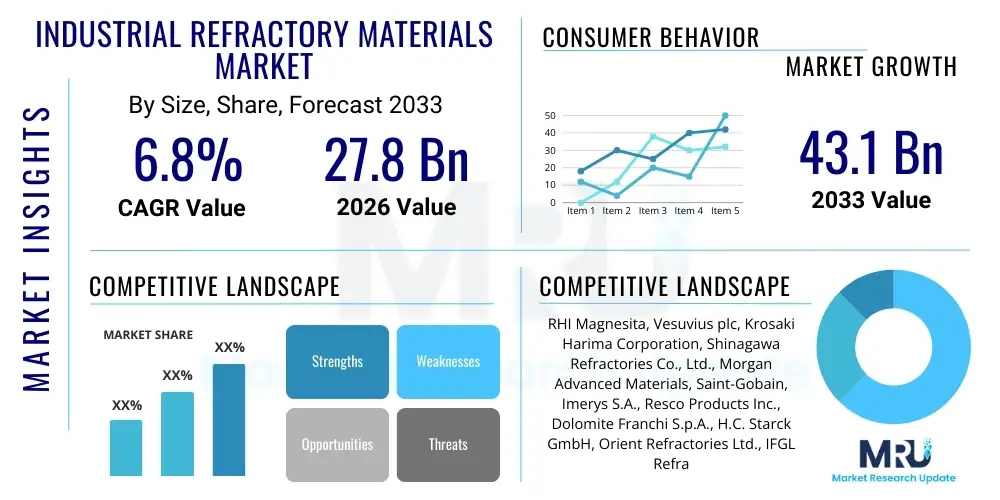

The Industrial Refractory Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 27.8 Billion in 2026 and is projected to reach USD 43.1 Billion by the end of the forecast period in 2033.

Industrial Refractory Materials Market introduction

Industrial refractory materials are specialized non-metallic substances engineered to withstand extremely high temperatures, chemical corrosion, and mechanical stress within industrial processes. These materials are fundamental to the operation of high-temperature units such as furnaces, kilns, incinerators, and reactors across a diverse range of heavy industries. Their unique properties enable them to maintain structural integrity and insulating capabilities in environments where conventional materials would fail, thereby ensuring operational efficiency, safety, and longevity of industrial equipment. The core function of refractories is to line these critical thermal processing units, protecting the structural components from the harsh conditions encountered during manufacturing.

Major applications for industrial refractory materials span key sectors including iron and steel production, cement and lime manufacturing, glass melting, non-ferrous metals processing, ceramics, and chemical industries. In these applications, refractories serve as the primary contact layer with molten metals, glass, clinker, and various corrosive gases, facilitating processes that are vital to global industrial output. The benefits derived from these materials are multifaceted, encompassing enhanced energy efficiency through superior insulation, reduced wear and tear on expensive equipment, improved product quality by preventing contamination, and extended operational lifecycles of industrial assets, leading to significant cost savings and increased productivity.

The market's growth is predominantly driven by several interconnected factors. Rapid industrialization and urbanization in emerging economies, particularly across Asia Pacific, fuel demand for basic materials like steel, cement, and glass, which are heavily reliant on refractory technology. Concurrently, ongoing infrastructure development globally necessitates a steady supply of these foundational industrial products. Technological advancements in refractory formulations, aimed at improving performance characteristics such as thermal shock resistance, abrasion resistance, and spallation resistance, further propel market expansion. Additionally, a growing emphasis on energy efficiency and environmental sustainability encourages industries to invest in higher-quality, more durable refractory solutions that can withstand longer operational campaigns and contribute to reduced energy consumption and emissions.

Industrial Refractory Materials Market Executive Summary

The industrial refractory materials market is experiencing dynamic shifts, characterized by several prominent business, regional, and segment trends. Globally, the industry is increasingly focused on developing advanced, high-performance, and sustainable refractory solutions to meet stringent environmental regulations and the escalating demands for energy efficiency across end-user sectors. Manufacturers are investing heavily in research and development to create materials with enhanced properties, such as improved thermal cycling resistance, better corrosion resistance, and extended service life, which are critical for optimizing industrial processes and reducing operational costs. Automation and digitalization in manufacturing processes are also gaining traction, aiming to improve product consistency and production efficiency, alongside a growing emphasis on robust supply chain management to mitigate raw material price volatility.

From a regional perspective, Asia Pacific continues to dominate the industrial refractory materials market, driven by robust industrial growth, extensive infrastructure development, and significant production capacities in key sectors like iron and steel, cement, and glass, particularly in countries such as China and India. The region's expanding manufacturing base and increasing urbanization are creating an insatiable demand for refractory products. Europe and North America, while mature markets, are witnessing growth fueled by stringent environmental policies, a strong focus on advanced material innovation, and the modernization of existing industrial facilities to improve energy efficiency and reduce carbon footprints. Latin America and the Middle East & Africa regions are also showing promising growth, attributed to investments in mining, oil and gas, and burgeoning construction industries.

Segmentation analysis reveals a continued prominence of shaped refractories, such as bricks and pre-cast blocks, due to their traditional applications and proven performance in various high-temperature linings. However, unshaped refractories, including monolithic castables, ramming mixes, and gunning mixes, are rapidly gaining market share owing to their versatility, ease of application, and cost-effectiveness in repair and maintenance operations, offering flexibility in complex geometries. The iron and steel industry remains the largest end-use segment, dictating a substantial portion of market demand, but the cement, glass, and non-ferrous metals sectors are also significant contributors, with specific material requirements driving innovation. The market is seeing a trend towards specialized, application-specific refractory solutions designed to address unique challenges within each industrial segment, leading to a diversified product portfolio.

AI Impact Analysis on Industrial Refractory Materials Market

The integration of Artificial intelligence (AI) is poised to revolutionize the industrial refractory materials market, addressing common user questions related to optimizing production, enhancing material performance, and improving operational efficiency. Users are keenly interested in how AI can streamline complex manufacturing processes, predict material degradation, and ultimately extend the lifespan of refractory linings. There is a strong expectation that AI will play a critical role in reducing waste, minimizing downtime, and enabling the development of next-generation refractory materials with superior properties. The key themes revolve around achieving higher precision in material design, smarter process control, and more sustainable production cycles, transforming both the manufacturing and application phases of refractory products.

Concerns often center on the initial investment costs, the complexity of integrating AI systems into existing infrastructure, and the need for a skilled workforce capable of managing and interpreting AI-driven insights. However, the anticipated benefits, such as enhanced quality assurance, predictive maintenance capabilities, and optimized resource allocation, are compelling. Users foresee AI-driven data analytics providing unprecedented insights into material behavior under extreme conditions, leading to more informed decisions in material selection and application. The drive towards customization and agile manufacturing is also a significant expectation, where AI can quickly adapt production parameters to meet specific customer requirements for specialized refractory solutions. Ultimately, the market anticipates AI as a pivotal tool for fostering innovation, driving competitiveness, and ensuring the long-term sustainability of the refractory industry.

- Enhanced Predictive Maintenance: AI algorithms analyze operational data from furnaces and kilns to predict refractory wear and failure, enabling proactive maintenance and reducing unscheduled downtime.

- Optimized Production Processes: AI-driven systems monitor and adjust manufacturing parameters in real-time, improving consistency, reducing defects, and increasing overall production efficiency of refractory products.

- Accelerated Material Design and Development: Machine learning facilitates the rapid screening of new material compositions, predicting performance characteristics and accelerating the R&D cycle for novel refractory formulations.

- Improved Quality Control: AI-powered vision systems and sensors detect subtle defects during manufacturing, ensuring higher product quality and reducing material waste.

- Supply Chain Optimization: AI analyzes market trends, raw material availability, and logistics data to optimize procurement, inventory management, and distribution, enhancing supply chain resilience.

- Energy Consumption Reduction: AI models identify opportunities for energy savings in refractory production and application processes by optimizing heating cycles and insulation strategies.

- Workforce Automation and Safety: Robotics and AI can automate hazardous tasks in refractory installation and repair, improving worker safety and precision.

- Customization and Personalization: AI enables rapid design and production of custom refractory shapes and compositions tailored to specific industrial requirements, increasing flexibility and responsiveness.

DRO & Impact Forces Of Industrial Refractory Materials Market

The Industrial Refractory Materials Market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. Key drivers include the escalating demand from primary industries such as steel, cement, and glass, particularly fueled by rapid industrialization and urbanization in developing economies, necessitating robust high-temperature linings for production units. Significant infrastructure development projects globally further underpin the demand for these foundational materials. Moreover, the increasing emphasis on energy efficiency and operational longevity across industries pushes the adoption of advanced, higher-performance refractories that offer superior insulation and extended service life. Continuous technological advancements in refractory compositions and manufacturing processes also act as a crucial driver, enabling the development of materials capable of withstanding even harsher operating conditions and meeting evolving industrial requirements.

However, the market also faces considerable restraints. Volatility in the prices and supply of critical raw materials, such as bauxite, magnesia, and chromite, directly impacts production costs and market stability. Stringent environmental regulations related to mining, processing, and emissions associated with refractory production pose challenges, requiring significant investments in compliance and sustainable practices. The high capital expenditure and extensive research and development costs involved in innovating new refractory materials can be a barrier to entry for new players and slow down the adoption of advanced technologies. Furthermore, the relatively long product lifecycle of refractories, once installed, means that replacement cycles can be extended, potentially limiting consistent demand growth for new installations.

Opportunities for growth are abundant, particularly in the development of eco-friendly and sustainable refractory solutions, driven by global efforts to reduce carbon footprints and promote circular economy principles. The adoption of advanced manufacturing technologies like 3D printing for producing complex and customized refractory shapes presents a significant opportunity for market expansion and efficiency. Furthermore, the burgeoning industrial growth in emerging economies continues to offer untapped market potential, while the increasing demand for specialized refractories in niche applications, such as waste incineration, hydrogen production, and advanced ceramics, opens new revenue streams. The integration of smart technologies, like embedded sensors for real-time monitoring of refractory health, represents a transformative opportunity for predictive maintenance and enhanced operational safety.

External impact forces also play a critical role. Geopolitical instability and trade disputes can significantly disrupt global supply chains for raw materials and finished refractory products, affecting production costs and market availability. Economic downturns or recessions can lead to reduced industrial output, subsequently dampening demand for refractories. The pace of technological innovation, not just within the refractory industry but also in the end-user sectors, can redefine material requirements and drive shifts in market preferences. Lastly, increasingly stringent environmental policies and regulations around the world continue to exert pressure on manufacturers to develop cleaner production processes and more sustainable refractory products, impacting investment decisions and market strategies.

Segmentation Analysis

The industrial refractory materials market is comprehensively segmented to provide a detailed understanding of its diverse applications, material compositions, and forms. This segmentation allows for precise market analysis, identifying key trends and growth opportunities across different industry verticals and product types. The primary segmentation categories include classification by type of material, form, and the end-use industry. Each segment exhibits unique demand drivers, technological requirements, and competitive landscapes, reflecting the specialized nature of high-temperature industrial processes. The continuous innovation in material science and manufacturing techniques further refines these segments, leading to a broader array of specialized products tailored for specific operational challenges and environmental considerations.

- By Type:

- Clay Refractories (e.g., Fireclay, High Alumina)

- Non-Clay Refractories (e.g., Magnesia, Zirconia, Chromite, Silica, Silicon Carbide, Carbon-based, Dolomite)

- Specialty Refractories (e.g., Fused Cast, Ceramic Fiber, Insulating Firebricks)

- By Form:

- Shaped Refractories (e.g., Bricks, Pre-cast Shapes, Tiles)

- Unshaped Refractories (e.g., Monolithics, Castables, Ramming Mixes, Gunning Mixes, Mortars, Plastics)

- By Application/End-Use Industry:

- Iron & Steel

- Cement & Lime

- Glass

- Non-Ferrous Metals (e.g., Aluminum, Copper, Lead, Zinc)

- Ceramics

- Chemicals

- Power Generation

- Others (e.g., Waste Incineration, Petrochemicals)

Value Chain Analysis For Industrial Refractory Materials Market

The value chain for the industrial refractory materials market is a multi-stage process, commencing from the extraction of raw materials to their final application in various industrial settings. The upstream segment involves the sourcing and processing of essential minerals such as bauxite, magnesia, chromite, silica, alumina, and various clays. This stage is critical as the quality and purity of these raw materials directly influence the performance characteristics of the final refractory products. Key players in this phase include mining companies and raw material processors who specialize in preparing these minerals to meet stringent industrial specifications, often involving extensive purification, crushing, grinding, and blending processes. Supply chain resilience and ethical sourcing are becoming increasingly important in this segment, driven by environmental and social governance (ESG) considerations.

Midstream activities primarily encompass the manufacturing of refractory products. This involves sophisticated production processes such as pressing, firing, casting, and blending to transform processed raw materials into shaped products like bricks, blocks, and tiles, or unshaped products such as monolithic castables, ramming mixes, and mortars. Refractory manufacturers invest heavily in research and development to innovate new formulations and production techniques that enhance thermal stability, chemical resistance, mechanical strength, and energy efficiency. This stage also includes quality control and testing to ensure products meet performance standards and application requirements. Technological advancements, including automation and digital manufacturing, are continuously being integrated to improve efficiency and product consistency within this manufacturing phase.

The downstream segment focuses on the distribution, sales, and installation of refractory materials to a wide array of end-user industries. Distribution channels can be direct, where large refractory manufacturers sell directly to major industrial clients like steel mills or cement plants, often providing technical support and installation services as part of the package. Indirect distribution involves a network of specialized distributors, agents, and local suppliers who cater to smaller businesses or specific regional markets, offering a broader range of products and logistical support. The selection of distribution channels often depends on the scale of the customer, the complexity of the refractory solution required, and geographical reach. Installation services, maintenance, and repair are also critical components of the downstream value chain, ensuring proper application and extending the lifespan of refractory linings, thus providing ongoing value to end-users.

Industrial Refractory Materials Market Potential Customers

The primary potential customers for industrial refractory materials are diverse heavy industries that operate high-temperature processes, where specialized heat-resistant linings are indispensable. These end-users rely on refractories to protect their equipment, optimize operational efficiency, and ensure the safety and longevity of their production facilities. The demand for refractory materials is intrinsically linked to the output and expansion plans of these core industries, making them the central focus of refractory manufacturers and suppliers. Understanding their specific operational challenges, material requirements, and procurement strategies is key to market penetration and sustained growth.

Key sectors represent the largest consumer base for refractory products. The iron and steel industry is by far the most significant end-user, utilizing refractories in blast furnaces, electric arc furnaces, converters, ladles, and tundishes. Similarly, the cement and lime industry requires robust refractories for rotary kilns and preheaters to withstand extreme heat and abrasive conditions during clinker production. The glass industry depends on high-quality refractories for melting furnaces to ensure product purity and operational stability. Non-ferrous metal industries, including aluminum, copper, and zinc production, also demand specialized refractories for smelting and refining processes. Beyond these major consumers, other important potential customers include manufacturers in the ceramics industry, chemical processing plants, power generation facilities, and those involved in waste incineration, all requiring tailored refractory solutions for their distinct high-temperature applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 27.8 Billion |

| Market Forecast in 2033 | USD 43.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RHI Magnesita, Vesuvius plc, Krosaki Harima Corporation, Shinagawa Refractories Co., Ltd., Morgan Advanced Materials, Saint-Gobain, Imerys S.A., Resco Products Inc., Dolomite Franchi S.p.A., H.C. Starck GmbH, Orient Refractories Ltd., IFGL Refractories Ltd., Calderys, Allied Mineral Products, HarbisonWalker International, Minteq International Inc., Posco C&C, Refratechnik Group, Magnezit Group, P-D Refractories. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Refractory Materials Market Key Technology Landscape

The industrial refractory materials market is undergoing significant technological advancements driven by the need for enhanced performance, energy efficiency, and sustainability. A key area of innovation lies in the development of advanced ceramic composites and novel material formulations that offer superior resistance to thermal shock, chemical corrosion, and mechanical abrasion at ultra-high temperatures. This includes integrating materials like silicon carbide, zirconia, and various forms of carbon to create refractories with improved spallation resistance and extended service life. Nanotechnology is also being explored to engineer refractory materials at a molecular level, leading to finer microstructures and enhanced properties, which can translate into more durable and efficient linings for industrial equipment.

Manufacturing processes are also being revolutionized with the adoption of cutting-edge technologies. Additive manufacturing, specifically 3D printing, is gaining traction for producing highly complex and customized refractory shapes with intricate internal geometries that were previously impossible or cost-prohibitive to achieve through traditional methods. This allows for tailored solutions that precisely fit specific furnace designs, reducing material waste and improving thermal efficiency. Furthermore, smart refractories, incorporating embedded sensors, are emerging to provide real-time data on temperature distribution, wear patterns, and structural integrity. This allows for predictive maintenance, optimizing replacement cycles, and preventing catastrophic failures, thereby significantly enhancing operational safety and reducing downtime in critical industrial processes.

Beyond material science and manufacturing, automation and digital tools are transforming the installation and maintenance of refractories. Robotic systems are being deployed for lining installation, repair, and inspection in hazardous high-temperature environments, improving precision, speed, and worker safety. Additionally, the development of eco-friendly binding agents and sustainable production methods is a growing focus, aiming to reduce the environmental footprint of refractory manufacturing by minimizing CO2 emissions and optimizing resource utilization. Innovations in insulation techniques, such as advanced insulating firebricks and ceramic fiber modules, also contribute to energy savings by significantly reducing heat loss from industrial furnaces and kilns, aligning with global energy conservation initiatives.

Regional Highlights

- North America: A mature market characterized by a strong emphasis on technological advancements, automation, and high-performance refractory solutions. The region's demand is driven by the modernization of existing industrial infrastructure, stringent environmental regulations necessitating efficient materials, and a focus on reducing energy consumption in the steel, glass, and chemical industries. Investments in advanced manufacturing and a push towards sustainable practices are key trends.

- Europe: Known for its stringent environmental standards and a strong R&D base, Europe focuses on developing eco-friendly and energy-efficient refractory materials. Key industries such as steel, cement, and non-ferrous metals drive demand, with a significant shift towards circular economy principles in refractory production and recycling. Germany, Italy, and the UK are prominent contributors to the regional market, exhibiting high demand for specialized and high-quality refractories.

- Asia Pacific (APAC): The largest and fastest-growing market globally, fueled by rapid industrialization, extensive infrastructure development, and significant production capacities in China, India, Japan, and Southeast Asian countries. The region's robust growth in the iron & steel, cement & lime, and glass industries creates immense demand for both traditional and advanced refractory materials. Increasing urbanization and governmental investments in manufacturing further propel market expansion, though cost-effectiveness remains a critical purchasing criterion.

- Latin America: Characterized by growing industrial output and infrastructure development, particularly in countries like Brazil and Mexico. The region's demand for refractories is primarily driven by the expansion of its mining, steel, and cement sectors. While a developing market, there is an increasing adoption of modern refractory solutions to improve operational efficiency and competitiveness in the global market.

- Middle East and Africa (MEA): This region is witnessing substantial investments in oil & gas, petrochemicals, mining, and construction sectors, which are stimulating demand for industrial refractory materials. Countries like Saudi Arabia, UAE, and South Africa are key markets, driven by ongoing industrial projects and a focus on diversifying their economies beyond traditional resource extraction. The need for high-performance refractories to withstand harsh operating conditions in these industries is a significant factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Refractory Materials Market.- RHI Magnesita

- Vesuvius plc

- Krosaki Harima Corporation

- Shinagawa Refractories Co., Ltd.

- Morgan Advanced Materials

- Saint-Gobain

- Imerys S.A.

- Resco Products Inc.

- Dolomite Franchi S.p.A.

- H.C. Starck GmbH

- Orient Refractories Ltd.

- IFGL Refractories Ltd.

- Calderys

- Allied Mineral Products

- HarbisonWalker International

- Minteq International Inc.

- Posco C&C

- Refratechnik Group

- Magnezit Group

- P-D Refractories

Frequently Asked Questions

What are industrial refractory materials used for?

Industrial refractory materials are high-temperature resistant substances primarily used to line furnaces, kilns, incinerators, and reactors in various heavy industries. They protect equipment from extreme heat, chemical corrosion, and mechanical stress, ensuring operational efficiency, safety, and extending the lifespan of critical industrial assets in sectors like steel, cement, glass, and chemicals.

What are the main applications of refractory materials?

The main applications include lining blast furnaces, electric arc furnaces, ladles, and tundishes in the iron and steel industry; rotary kilns in cement and lime production; melting furnaces in the glass industry; and various processing units in non-ferrous metals, ceramics, chemicals, and power generation sectors. They are indispensable wherever high-temperature processes are involved.

What drives the growth of the industrial refractory materials market?

Market growth is primarily driven by robust industrialization and infrastructure development, especially in emerging economies, increasing global demand for steel, cement, and glass, and a rising focus on energy efficiency. Technological advancements leading to higher-performance and more sustainable refractory solutions also significantly contribute to market expansion.

What are the key challenges faced by the refractory industry?

Key challenges include the volatility of raw material prices, stringent environmental regulations affecting production and waste management, and high research and development costs associated with innovating new materials. The long product lifecycle of installed refractories can also lead to slower replacement cycles, impacting consistent demand for new products.

How is sustainability impacting the industrial refractory materials market?

Sustainability is profoundly impacting the market by driving demand for eco-friendly production methods, materials with lower carbon footprints, and solutions that promote resource efficiency. Manufacturers are focusing on developing longer-lasting refractories to reduce waste, enhancing recyclability, and innovating energy-efficient materials that contribute to lower operational emissions for end-users, aligning with global environmental goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager