Industrial Remote Terminal Unit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435465 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Remote Terminal Unit Market Size

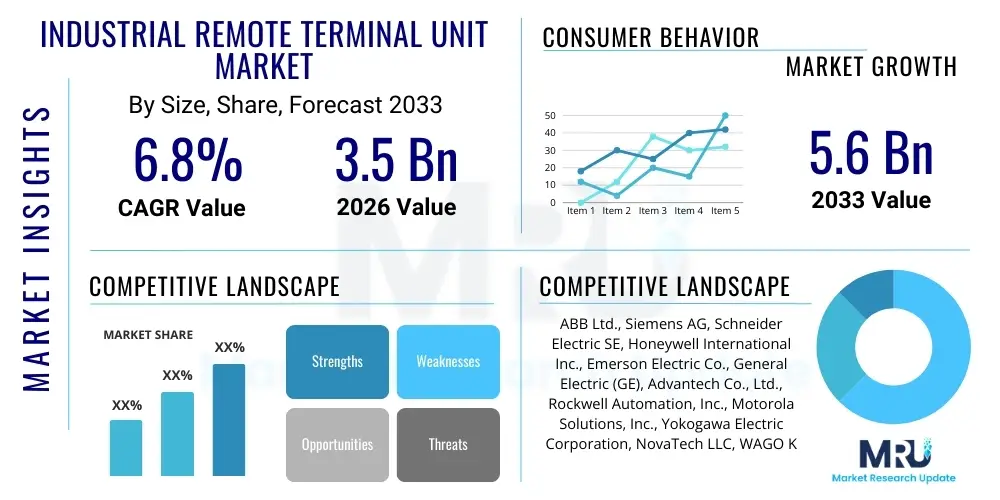

The Industrial Remote Terminal Unit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Industrial Remote Terminal Unit Market introduction

The Industrial Remote Terminal Unit (RTU) Market encompasses specialized microprocessor-controlled electronic devices crucial for modern industrial automation, telecommunications, and Supervisory Control and Data Acquisition (SCADA) systems. An RTU acts as a local endpoint, interfacing with physical field devices—such as sensors, actuators, and switches—to acquire raw data, process it, and transmit summarized information back to a central control system. These devices are designed for rugged, harsh industrial environments, offering reliable, autonomous operation and supporting various industrial communication protocols like Modbus, DNP3, and IEC 60870-5-104. The primary function of an RTU is to enable remote monitoring and control over geographically dispersed assets, thereby optimizing operational efficiency and minimizing downtime across critical infrastructure.

Major applications of industrial RTUs span vital sectors including Oil & Gas pipelines, electric power transmission and distribution grids, water and wastewater treatment facilities, and transportation systems. In the energy sector, RTUs monitor substation parameters, manage circuit breakers, and facilitate smart grid functionalities. For pipeline management, they monitor flow rates, pressure levels, and detect potential leaks in real-time. The widespread deployment of these units is driven by the escalating demand for infrastructure automation, the imperative for predictive maintenance, and stringent regulatory requirements compelling industries to enhance monitoring capabilities, especially in remote or hazardous locations where human intervention is impractical or unsafe. Their ability to operate reliably on battery backup and communicate via diverse channels (cellular, satellite, radio) makes them indispensable for critical asset management.

The market growth is fundamentally propelled by the global transition towards Industry 4.0 paradigms, integrating IoT devices and advanced analytics into operational technology (OT) environments. Key benefits derived from robust RTU implementation include enhanced operational visibility, reduction in operational costs through automated processes, improved safety compliance, and significantly faster response times to abnormal events or failures. Driving factors include massive investments in smart grid infrastructure globally, the expansion of utility networks in developing economies, and the increasing need for reliable monitoring systems to manage aging infrastructure. Furthermore, advancements in RTU technology, incorporating higher processing power, increased cybersecurity features, and edge computing capabilities, are making these units more versatile and attractive for complex industrial applications, ensuring the market trajectory remains strong through the forecast period.

Industrial Remote Terminal Unit Market Executive Summary

The Industrial Remote Terminal Unit (RTU) market is characterized by robust growth, fueled primarily by the digital transformation across critical infrastructure sectors such as utilities, energy, and water management. Business trends indicate a strong shift towards intelligent, modular RTUs that incorporate advanced functionalities like integrated cybersecurity modules, redundant power supplies, and support for multi-protocol communication, moving beyond simple data acquisition towards localized control and data preprocessing (edge computing). Key industry players are focusing on strategic partnerships and mergers to consolidate market share, leveraging software integration capabilities and specialized hardware design to cater to niche applications requiring high reliability and low-latency communication. The competitive landscape is intensely focused on offering scalable solutions that can seamlessly integrate into legacy SCADA systems while providing pathways for future integration with cloud platforms and advanced analytics, thereby ensuring longevity and future-proofing for industrial assets.

Regional trends reveal the Asia Pacific (APAC) region as the fastest-growing market, primarily driven by rapid urbanization, extensive government investments in smart city projects, and the urgent need to modernize outdated power transmission and water distribution infrastructure, particularly in countries like China and India. North America and Europe maintain significant market shares, representing mature markets where growth is concentrated on replacing legacy RTUs with modern, secure, and IoT-enabled units, driven by stringent regulatory frameworks concerning grid stability and cybersecurity (e.g., NERC CIP in North America). The Middle East and Africa (MEA) region shows accelerating adoption, specifically within the booming Oil & Gas sector, where RTUs are critical for monitoring remote upstream and midstream operations, requiring robust devices capable of withstanding extreme climatic conditions and providing reliable remote telemetry.

Segment trends underscore the dominance of the power sector in terms of market share, necessitated by complex grid management requirements and the integration of renewable energy sources, which demand granular, real-time control capabilities offered by advanced RTUs. Technology-wise, the trend is moving away from traditional RTUs towards hybrid or modular RTUs that combine the robustness of traditional systems with the flexibility and processing power of PLCs (Programmable Logic Controllers), often referred to as RTU/PLC hybrids. Communication segment analysis indicates a rapid expansion of cellular and wireless RTUs, driven by reduced installation costs and the ability to cover vast geographical areas without relying on expensive dedicated infrastructure, accelerating deployment particularly in pipeline and remote monitoring applications. The shift towards higher port density and better processing capabilities within standard industrial enclosures is defining product development across all application segments.

AI Impact Analysis on Industrial Remote Terminal Unit Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Industrial Remote Terminal Unit market predominantly revolve around three key themes: how AI enhances predictive maintenance capabilities, whether AI integration shifts processing from the central SCADA center to the RTU level (Edge AI), and the resulting impact on data bandwidth requirements and overall cybersecurity posture. Users are concerned with the practical deployment of machine learning algorithms on resource-constrained RTU hardware, expecting AI to transform raw data into actionable intelligence directly at the source. This transformation is anticipated to lead to highly optimized operations, significantly reduced false alarms, and automatic anomaly detection that precedes catastrophic failures, thereby increasing asset uptime and extending equipment life in critical infrastructure.

The integration of AI capabilities, often implemented via lightweight machine learning models, allows modern RTUs to perform sophisticated local data analysis, moving beyond simple threshold alarming. This evolution enables the RTU to learn normal operational patterns and flag deviations that human operators or standard rule-based SCADA systems might miss. Such localized intelligence significantly reduces the volume of data transmitted to the cloud or control center, mitigating bandwidth constraints and latency issues, which is particularly vital for remote sites relying on slow or intermittent cellular connectivity. Furthermore, AI-driven RTUs can autonomously adjust control parameters within safe limits in response to detected minor anomalies, adding a crucial layer of self-healing and resilience to the overall industrial control system architecture, making the entire network smarter and less reliant on constant central supervision for minor adjustments.

- AI facilitates real-time predictive maintenance by analyzing sensor data locally, reducing reliance on central processing capacity.

- Implementation of lightweight Edge AI models enhances autonomous decision-making capabilities within the RTU, improving response speed.

- AI algorithms optimize communication protocols and data transmission, reducing network load and associated operational costs.

- Integration of AI-driven cybersecurity tools within the RTU helps detect and isolate malicious intrusion attempts at the network periphery.

- Machine learning improves data quality and accuracy by performing sensor drift compensation and filtering out noise locally before transmission.

- AI contributes to energy management optimization by dynamically adjusting control outputs based on predicted demand and environmental factors.

DRO & Impact Forces Of Industrial Remote Terminal Unit Market

The Industrial RTU Market is governed by a dynamic interplay of powerful drivers, significant restraints, and emerging opportunities, collectively shaping the market's trajectory and defining the competitive landscape. A primary driver is the pervasive need for real-time monitoring and control of widely distributed critical infrastructure, especially in the utilities sector undergoing smart grid transformation, which necessitates highly reliable, standardized telemetry devices. This demand is coupled with increasing governmental mandates and regulatory pressure for energy efficiency and environmental monitoring across industrial operations. However, the market faces strong headwinds from high initial deployment costs, particularly concerning software integration, complex configuration requirements, and the substantial challenge of ensuring cybersecurity across geographically dispersed, interconnected RTU networks. Opportunities arise from the convergence of IT and OT, fostering the adoption of cloud-based SCADA solutions and the development of highly modular, subscription-based RTU services, leveraging the expansion of 5G networks to offer high-speed, low-latency communication to remote installations.

The key drivers propelling market expansion include the massive global investment in renovating aging infrastructure, particularly power transmission lines and water pipelines, requiring modern digital monitoring solutions to extend asset lifespan and improve reliability. The rapid deployment of renewable energy sources, such as solar and wind farms, inherently requires advanced RTUs for managing intermittent power generation and ensuring seamless integration with the existing grid structure. Furthermore, the operational cost reduction achieved through automated data collection, remote diagnostics, and minimized need for field visits provides a compelling financial incentive for industrial operators to upgrade their telemetry infrastructure. The flexibility offered by modern RTUs to handle diverse I/O types and communicate using open protocols is a significant facilitator of adoption across heterogeneous industrial environments, overcoming previous barriers associated with proprietary systems.

Restraints primarily revolve around the legacy system challenge, where integrating new, advanced RTUs with decades-old SCADA systems proves technically complex and resource-intensive, often leading to slow adoption cycles. The persistent shortage of skilled personnel trained in deploying, managing, and maintaining complex cyber-physical systems presents a significant operational bottleneck, particularly in emerging economies. Moreover, the increasing sophistication of cyber threats targeting industrial control systems necessitates substantial investment in RTU security features, adding to the unit cost and complexity. Impact forces, driven by technological evolution, include the decreasing cost and increased capability of microcontrollers, enabling smaller and more powerful RTUs, and the rising prominence of competing technologies, such as edge-enabled Programmable Logic Controllers (PLCs), which offer overlapping functionality and sometimes challenge the traditional RTU application space, forcing manufacturers to continuously innovate and differentiate their offerings.

Segmentation Analysis

The Industrial Remote Terminal Unit market is segmented based on critical technical and application criteria, offering diversified solutions tailored to specific industry needs and operational demands. Key segmentation approaches include categorization by component (hardware, software, services), type (conventional, modular, integrated/PLC-based), communication protocol, and application (Oil & Gas, Power Utilities, Water & Wastewater). This granular structure allows vendors to target highly specialized requirements, focusing on characteristics such as I/O density, environmental resilience, power consumption, and supported telemetry standards. The hardware segment remains the largest revenue contributor, but the services segment, encompassing integration, maintenance, and consulting, is projected to exhibit the highest growth rate due to the increasing complexity of deployment and the necessity for continuous system updates and cybersecurity management in critical infrastructure.

- By Component:

- Hardware (RTU chassis, I/O modules, power supplies)

- Software (Configuration tools, operating systems, firmware)

- Services (Consulting, Integration, Maintenance & Support)

- By Type:

- Conventional RTUs

- Modular RTUs

- Integrated/PLC-based RTUs

- By Communication Protocol:

- IEC 60870-5-101/104

- DNP3

- Modbus

- Proprietary Protocols

- By Industry Application:

- Oil & Gas (Pipeline monitoring, Wellhead automation)

- Power Utilities (Transmission & Distribution, Substation Automation)

- Water & Wastewater Management (Pumping stations, Reservoir monitoring)

- Chemicals & Petrochemicals

- Mining & Metals

- Transportation (Railways, Traffic Management)

Value Chain Analysis For Industrial Remote Terminal Unit Market

The value chain for the Industrial Remote Terminal Unit market begins with upstream activities centered on the procurement and manufacturing of electronic components and foundational technologies. This phase involves sourcing specialized semiconductors, microprocessors, robust industrial enclosures, communication chips (e.g., cellular modems), and specialized I/O modules designed to withstand harsh environments. Key suppliers include specialized semiconductor manufacturers and ruggedized enclosure fabricators. Component quality, reliability, and long-term supply stability are critical factors at this stage, as industrial RTUs often require operational lifecycles spanning 15 to 20 years. Efficient inventory management and establishing strong supplier relationships are essential for maintaining manufacturing costs and ensuring product performance specifications are met, particularly regarding temperature resilience and electromagnetic compatibility (EMC).

Moving downstream, the value chain encompasses assembly, testing, software development, and market distribution. Manufacturers integrate the sourced hardware components and develop proprietary firmware and configuration software tailored for specific industry protocols (DNP3, IEC). Thorough factory acceptance testing (FAT) and rigorous cybersecurity validation are mandatory before deployment. The distribution channel is multifaceted, relying heavily on specialized industrial system integrators (SIs) and value-added resellers (VARs) who possess deep expertise in specific end-user applications (e.g., substation automation or pipeline control). These indirect channels provide the crucial services of integration, customization, and deployment into complex brownfield or greenfield sites, bridging the gap between hardware manufacturers and the operational technology requirements of the end-user.

The distribution strategy typically employs a mix of direct sales for major utility contracts and a robust indirect network for broader market penetration. Direct sales allow manufacturers to maintain tight control over quality and pricing for large, strategic projects. In contrast, the indirect channel, managed by distributors and SIs, handles the complexity of local regulatory compliance, tailored software customization, and ongoing technical support and maintenance services. The critical final stage involves post-sales services, including system commissioning, operator training, lifecycle management, and critical firmware updates, especially those related to patching cybersecurity vulnerabilities. The overall efficiency of the value chain is increasingly measured by the speed of deployment, the reliability of the installed base, and the effectiveness of long-term support provided to critical infrastructure operators.

Industrial Remote Terminal Unit Market Potential Customers

Potential customers for Industrial Remote Terminal Units are predominantly large-scale organizations managing critical and geographically dispersed infrastructure where continuous, reliable remote monitoring and control are indispensable for safety and operational viability. The primary buyers are organizations within the Utilities sector, specifically Electric Power Generation, Transmission, and Distribution companies. These entities rely on RTUs for substation automation, managing switchgear, monitoring power quality, and integrating distributed renewable energy resources into the main grid. The transition to Smart Grid architectures globally has made advanced, secure RTUs a mandatory investment for these customers, driving high-volume procurement cycles based on standardization programs and long-term asset management strategies focused on reliability and resilience.

Another major segment comprises companies within the Oil & Gas industry, including upstream exploration and production companies, and midstream pipeline operators. These buyers utilize RTUs for monitoring wellhead automation, compressor stations, pump controls, and particularly for pipeline leak detection systems stretched across thousands of kilometers of remote terrain. The ruggedized nature and low-power requirements of industrial RTUs, often capable of running on solar or battery power in isolated locations, make them uniquely suited for these applications. The purchasing decision here is heavily influenced by durability, communication reliability (often satellite or radio telemetry), and compliance with stringent environmental and safety regulations enforced by governmental bodies.

The Water and Wastewater Management sector represents a continuously expanding customer base, encompassing municipal water treatment plants, large regional water authorities, and irrigation districts. These customers use RTUs to monitor reservoir levels, control pumping station operations, manage flow rates, and ensure the quality and safety of potable water distribution networks. Furthermore, industrial operations in Mining, Chemicals, and Rail Transportation also constitute significant customer segments. For these heavy industries, the necessity of automated safety shutdowns, equipment status monitoring in hazardous areas, and maintaining regulatory compliance drives investment in high-reliability RTU systems integrated within their existing control room infrastructure, making the end-user landscape diverse yet critically focused on mission-critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., General Electric (GE), Advantech Co., Ltd., Rockwell Automation, Inc., Motorola Solutions, Inc., Yokogawa Electric Corporation, NovaTech LLC, WAGO Kontakttechnik GmbH & Co. KG, Red Lion Controls, Schweitzer Engineering Laboratories (SEL), Arteche, Toshiba Corporation, Eaton Corporation plc, ICONICS (Mitsubishi Electric), Xylem Inc., Kingfisher RTU. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Remote Terminal Unit Market Key Technology Landscape

The Industrial Remote Terminal Unit (RTU) technology landscape is currently undergoing a significant transformation, moving towards highly networked, resilient, and intelligent devices. Central to this evolution is the adoption of robust, real-time operating systems (RTOS) and increased processing power, enabling RTUs to handle complex local logic and time-stamping with microsecond accuracy, crucial for fault analysis in power systems. Modern RTUs are leveraging standardized, high-performance communication modules, primarily integrating 4G/LTE and increasingly 5G technology to facilitate low-latency, high-bandwidth data transfer from remote assets. A major technological focus remains on multi-protocol support, ensuring interoperability with legacy SCADA protocols (like DNP3 and Modbus) while simultaneously supporting modern, secure IP-based industrial standards (such as IEC 60870-5-104 and MQTT), thereby future-proofing critical infrastructure investments and easing system integration challenges.

The most critical technological advancement driving the market is the integration of enhanced cybersecurity measures directly into the RTU firmware and hardware architecture. This includes features such as secure boot, hardware root of trust, cryptographic key management, and protocol encryption (e.g., using TLS/SSL for communication). Given that RTUs are often the first point of entry into an operational network, securing them against evolving persistent threats is paramount, driving the development of specialized industrial firewalls embedded within the RTU unit itself. Furthermore, modular design is a key technology trend, allowing end-users to customize I/O counts, communication interfaces, and processing power based on specific application needs. This modularity reduces overall system complexity and allows for easier scalability and field upgrades, extending the useful life of the installed hardware base.

The convergence of RTU functionality with Edge Computing and IoT platforms represents the frontier of technological innovation. New-generation industrial RTUs are being equipped with capabilities to run containerized applications and perform complex data analytics and machine learning inference at the edge, reducing dependence on continuous cloud connectivity. This technological shift enables applications like predictive equipment failure detection, autonomous load shedding, and localized energy optimization, providing superior operational resilience. Hardware redundancy, including dual CPUs, redundant communication paths, and battery backup systems capable of extended operation, remains a non-negotiable requirement, ensuring Maximum Availability Criteria (MAC) for mission-critical infrastructure across diverse operational environments, from freezing substations to high-temperature pipeline monitoring stations.

Regional Highlights

- North America: North America holds a substantial share of the Industrial RTU market, characterized by mature infrastructure, stringent regulatory requirements (like NERC CIP standards for critical infrastructure protection), and early adoption of Smart Grid technologies. The demand is heavily concentrated in replacing outdated RTUs with secure, advanced units capable of supporting two-way communication and advanced grid functionalities such as fault location, isolation, and service restoration (FLISR). The Oil & Gas industry, particularly in the US and Canada, drives significant demand for remote telemetry in extraction and pipeline management. Growth is steady, focused primarily on technological upgrades, cybersecurity enhancements, and integrating renewable energy monitoring systems.

- Europe: The European market is defined by ambitious decarbonization goals, leading to rapid integration of renewable energy sources and modernization of power distribution networks under initiatives like the EU's Clean Energy Package. RTU adoption is strongly supported by standardized protocols (like IEC 60870) and a focus on energy efficiency and system interoperability. Western European countries exhibit high demand for modular RTUs capable of complex automation tasks, while Eastern European countries are rapidly investing in large-scale infrastructure overhauls, boosting the overall market volume. Cybersecurity mandates stemming from NIS directives further compel utilities to procure highly secure RTU solutions.

- Asia Pacific (APAC): APAC is the fastest-growing region, projected to register the highest CAGR during the forecast period. This rapid expansion is attributed to massive infrastructure development projects, fast urbanization, and government initiatives promoting smart cities and smart grids in countries like China, India, Japan, and South Korea. India, in particular, is undertaking large-scale electricity grid modernization under schemes aiming for universal access and loss reduction, driving explosive demand for cost-effective, high-density RTUs. The region's vast, geographically diverse terrains necessitate reliance on wireless and cellular RTUs for efficient deployment.

- Latin America: The market in Latin America is growing steadily, propelled by investments in modernizing aging power infrastructure and expanding oil and gas exploration activities, particularly in Brazil, Mexico, and Argentina. Economic volatility sometimes restrains large-scale, immediate investment, but the need for reliable remote monitoring to combat utility loss and improve operational efficiency ensures consistent demand. Utility providers are increasingly looking for RTU solutions that offer superior connectivity resilience in areas with challenging telecommunications infrastructure.

- Middle East and Africa (MEA): The MEA region’s growth is anchored by extensive investments in the Oil & Gas sector and large-scale water management projects, particularly desalination and distribution networks in the Gulf Cooperation Council (GCC) countries. RTUs are crucial for monitoring pipelines and wellheads in extremely harsh desert environments, demanding devices with superior temperature tolerance and robust physical protection. In Africa, grid expansion and efforts to reduce energy theft contribute significantly to RTU deployment in transmission and distribution sectors, emphasizing solutions that are easy to deploy and maintain remotely.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Remote Terminal Unit Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- General Electric (GE)

- Advantech Co., Ltd.

- Rockwell Automation, Inc.

- Motorola Solutions, Inc.

- Yokogawa Electric Corporation

- NovaTech LLC

- WAGO Kontakttechnik GmbH & Co. KG

- Red Lion Controls

- Schweitzer Engineering Laboratories (SEL)

- Arteche

- Toshiba Corporation

- Eaton Corporation plc

- ICONICS (Mitsubishi Electric)

- Xylem Inc.

- Kingfisher RTU

Frequently Asked Questions

Analyze common user questions about the Industrial Remote Terminal Unit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between an RTU and a PLC in industrial automation?

The primary difference is functionality and design focus. RTUs (Remote Terminal Units) are optimized for data acquisition and remote telemetry across large, geographically dispersed areas, featuring robust communication protocols (DNP3, satellite) and low-power operation. PLCs (Programmable Logic Controllers) are optimized for high-speed, localized control logic within a concentrated factory or plant environment, prioritizing fast cycle times and deterministic control. Modern integrated RTU/PLCs blur this line by offering both capabilities in a single modular unit.

How significant are cybersecurity concerns impacting the adoption of new industrial RTUs?

Cybersecurity is a critical factor driving the replacement market. As RTUs connect operational technology (OT) to external networks, they represent a significant vulnerability. New RTU solutions must incorporate advanced security features like encrypted communication, secure boot processes, and role-based access control (RBAC) to comply with regulatory standards such as NERC CIP, making security compliance a primary purchasing criterion for critical infrastructure operators.

Which industry application contributes the largest revenue share to the Industrial RTU market?

The Electric Power Utilities sector, encompassing generation, transmission, and distribution, contributes the largest revenue share. This dominance is driven by the global transition to Smart Grids, the mandatory requirement for substation automation, and the proliferation of distributed energy resources (DERs), all of which rely fundamentally on high-reliability RTUs for real-time monitoring and control operations.

What role does 5G technology play in the future growth of the Industrial RTU Market?

5G technology is anticipated to be a major growth driver, enabling high-speed, ultra-reliable, and low-latency communication (URLLC) for remote industrial telemetry. This capability allows RTUs to transmit large volumes of data for edge computing and facilitates time-critical applications like automated fault isolation and network synchronization, making advanced monitoring economically viable even in highly remote geographical locations.

Are modular RTUs replacing conventional monolithic RTUs in the industrial sector?

Yes, modular RTUs are increasingly favored over conventional monolithic designs. Modular systems offer superior flexibility, allowing end-users to customize I/O density and communication interfaces to specific site requirements. This flexibility enhances scalability, simplifies maintenance, and extends the asset lifecycle by allowing targeted component upgrades without replacing the entire unit, leading to lower total cost of ownership (TCO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Remote Terminal Unit (RTU) Market Size Report By Type (Wireless Industrial RTU, Wired Industrial RTU), By Application (Oil and Gas Industry, Chemical and Petrochemical Industry, Power Generation Industry, Water and Wastewater Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Industrial Remote Terminal Unit (RTU) Market Statistics 2025 Analysis By Application (Oil and Gas Industry, Chemical and Petrochemical Industry, Power Generation Industry, Water and Wastewater Industry, Others), By Type (Wireless Industrial RTU, Wired Industrial RTU), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Remote Terminal Unit (RTU) Market Statistics 2025 Analysis By Application (Oil and Gas Industry, Chemical and Petrochemical Industry, Power Generation Industry, Water and Wastewater Industry), By Type (Wireless Industrial RTU, Wired Industrial RTU), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager