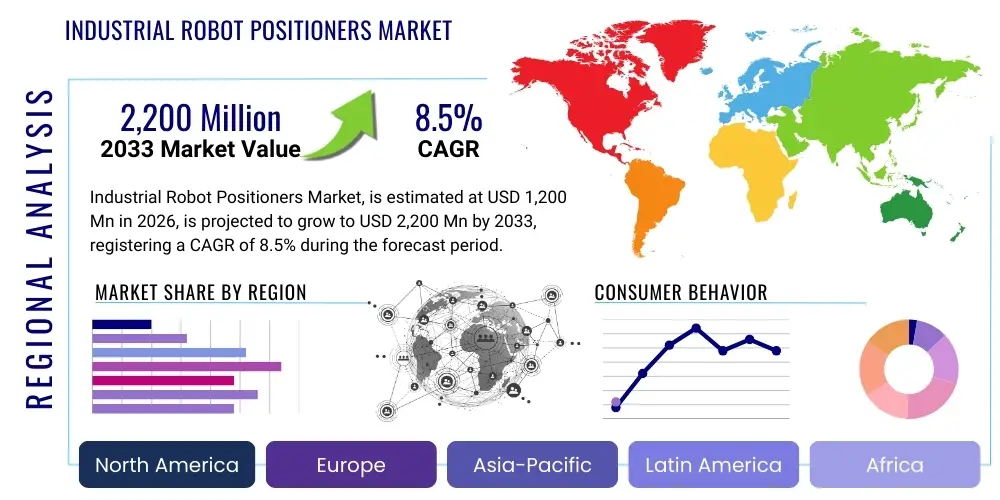

Industrial Robot Positioners Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437458 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Robot Positioners Market Size

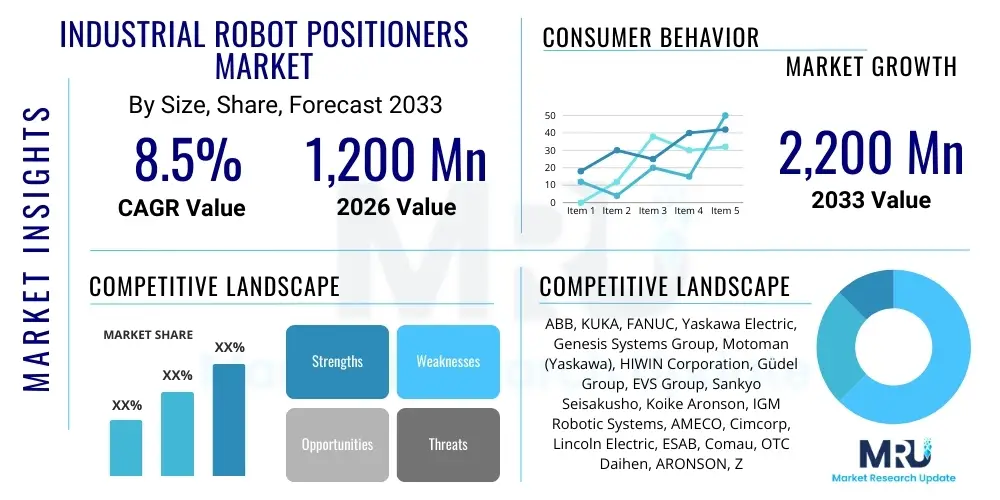

The Industrial Robot Positioners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1,200 million in 2026 and is projected to reach USD 2,200 million by the end of the forecast period in 2033. This growth trajectory is driven primarily by the escalating demand for automated welding, handling, and assembly processes across high-volume manufacturing sectors, particularly automotive and heavy machinery.

Industrial robot positioners are crucial components in modern automated manufacturing cells, designed to accurately orient workpieces relative to the robot’s operational envelope. Their increasing adoption reflects a pervasive industry need to enhance weld quality, improve process repeatability, and minimize cycle times. The transition towards high-mix, low-volume production also necessitates flexible positioning solutions capable of rapid reconfiguration, further contributing to market expansion, especially within regions undertaking substantial industrial modernization initiatives like Southeast Asia and Eastern Europe.

Industrial Robot Positioners Market introduction

The Industrial Robot Positioners Market encompasses sophisticated electro-mechanical systems used in conjunction with industrial robots to manipulate workpieces. These devices, ranging from simple rotary tables to complex multi-axis tilt-and-turn units, ensure that the robotic arm maintains optimal access and orientation for tasks such as welding, cutting, grinding, or assembly. The primary function is to enhance the efficiency, precision, and safety of automated processes by presenting the component optimally to the robot, thereby maximizing uptime and output quality. They are essential tools for manufacturers aiming for superior repeatability in complex fabrication environments.

Major applications of these positioners span high-stress environments, including automotive body-in-white welding, aerospace component fabrication, and the heavy machinery sector where large and cumbersome parts must be precisely managed. Key benefits include improved ergonomic conditions, reduction in manual material handling, consistently high production quality through accurate positioning, and increased overall system flexibility. The market is fundamentally driven by global trends toward Industry 4.0, which mandates seamless automation integration, coupled with the persistent need for labor cost reduction and enhanced manufacturing consistency across competitive global supply chains. Furthermore, advancements in robotic control systems and safety standards are enabling wider deployment of complex, collaborative positioning solutions.

Industrial Robot Positioners Market Executive Summary

The Industrial Robot Positioners Market exhibits strong growth driven by the acceleration of automation investments across Asia Pacific and North America. Business trends indicate a shift towards highly flexible, modular positioning units capable of handling diverse payload capacities, meeting the demands of high-mix manufacturing. Segmentation trends emphasize the dominance of dual-axis positioners due to their versatility in welding applications, while the adoption of high-payload positioners is surging in heavy industries like shipbuilding and infrastructure component manufacturing. Technologically, the integration of smart sensors, predictive maintenance capabilities, and advanced simulation software (digital twins) is defining competitive differentiation among vendors.

Regionally, Asia Pacific maintains its leadership, fueled by extensive automotive manufacturing in China, Japan, and South Korea, coupled with rapidly expanding electronics production. North America demonstrates robust demand, particularly for advanced, collaborative positioners supporting high-precision aerospace and medical device fabrication. European markets, characterized by stringent quality standards, show high adoption rates of premium, multi-axis systems integrated with sophisticated safety protocols. The market faces constraints primarily related to the high initial capital investment required for heavy-duty, customized positioning systems and the need for highly skilled technicians for complex programming and maintenance, particularly in emerging economies.

AI Impact Analysis on Industrial Robot Positioners Market

User inquiries regarding AI's influence typically revolve around how AI can optimize motion planning, enhance predictive maintenance of mechanical systems, and facilitate rapid changeovers in high-mix environments. Users frequently ask if AI-driven controls can dynamically adjust the positioner’s movement in real-time based on sensory inputs (like thermal expansion or weld pool dynamics) to improve quality beyond the capabilities of traditional path planning. They also seek information on AI models predicting component wear in high-stress gearboxes and bearings. The core theme is leveraging AI to move from fixed, programmed positioning sequences to adaptive, intelligent positioning that maximizes throughput and extends the lifespan of expensive machinery by minimizing unnecessary physical stress.

AI's integration primarily affects the control software layer, enabling intelligent automation systems that optimize the synchronization between the robot arm and the positioner. This results in superior path following, collision avoidance, and reduced overall cycle time. By analyzing vast datasets derived from production runs—including torque loads, vibration signatures, and output quality metrics—AI algorithms can refine the positioning sequence adaptively. Furthermore, AI contributes significantly to predictive failure analysis, detecting subtle anomalies in motor current or positional feedback, allowing operators to schedule maintenance precisely before catastrophic failure, thereby minimizing costly unplanned downtime inherent to heavy mechanical systems.

- AI-Optimized Motion Control: Enables real-time, dynamic path correction and synchronization between the robot and positioner, reducing cycle time by up to 15%.

- Predictive Maintenance: AI algorithms analyze vibration and temperature data to forecast positioner component failure (e.g., gearboxes, rotary joints), extending operational lifespan.

- Adaptive Process Control: AI facilitates real-time adjustment of orientation based on in-process sensor feedback (e.g., laser tracking or vision systems) to compensate for part inconsistencies.

- Enhanced Calibration: Uses machine learning to automate and refine system calibration, drastically reducing setup time for complex multi-axis positioners.

- Digital Twin Simulation: AI powers sophisticated simulation models, allowing manufacturers to optimize positioner load distribution and movement sequences virtually before physical implementation.

DRO & Impact Forces Of Industrial Robot Positioners Market

The Industrial Robot Positioners Market is propelled by the critical need for manufacturing precision and speed (Drivers), while facing challenges related to initial capital expenditure and complexity (Restraints). Opportunities lie in developing advanced modular and collaborative systems suitable for SME adoption and exploiting the growth of specialized applications like laser welding and additive manufacturing. The market impact forces are dominated by intense competitive pressure leading to rapid technological advancements in control systems and safety features, alongside pervasive regulatory requirements favoring increased automation efficiency and worker safety standards across key industrialized nations.

Key drivers include the global expansion of electric vehicle (EV) production, which relies heavily on high-precision welding and assembly cells requiring advanced positioning capabilities, and the pervasive shortage of skilled manual labor in fabrication industries, compelling accelerated automation adoption. Conversely, the primary restraint is the significant upfront investment required for integrating and customizing heavy-duty multi-axis positioners, particularly problematic for smaller and medium-sized enterprises (SMEs). Furthermore, technical restraints include managing the complex interface and integration challenges between the positioner control system and the primary robot controller, demanding specialized engineering expertise.

Segmentation Analysis

The Industrial Robot Positioners Market is extensively segmented across Type, Payload Capacity, Application, and End-Use Industry, reflecting the diversity of manufacturing requirements globally. The segmentation by Type, specifically distinguishing between single-axis, dual-axis, and multi-axis configurations, highlights the trade-off between cost, complexity, and operational flexibility. Dual-axis positioners, offering rotation and tilt, remain the standard for high-volume arc welding due to their optimal balance of accessibility and cost-effectiveness. Meanwhile, multi-axis systems, often incorporating tracks or overhead gantries, are reserved for highly complex large-scale parts or demanding geometric specifications found in aerospace fabrication.

Segmentation by Payload Capacity is crucial as it directly relates to the positioner's structural robustness, motor torque requirements, and pricing structure. The high-payload segment (above 2000 kg) experiences significant growth, driven by investments in heavy machinery and energy sector infrastructure projects, where massive components must be rotated accurately. Application-based segmentation reveals that welding remains the predominant use case, although material handling and component assembly are emerging as rapid growth areas, especially with the introduction of vision-guided robots requiring precise and repeatable component presentation.

- Type: Single-axis (Rotary tables), Dual-axis (Tilt and Turn), Multi-axis (3-6 axis, including headstock/tailstock with tracks)

- Payload Capacity: Low (Under 500 kg), Medium (500 kg - 2000 kg), High (Above 2000 kg)

- Application: Welding (Arc, Laser, Spot), Machining, Assembly, Inspection, Material Handling, Painting and Coating

- End-Use Industry: Automotive (Body-in-White, Chassis), Electronics and Electricals, Metal Fabrication (General), Aerospace and Defense, Heavy Machinery and Construction, Others (Medical Devices, Shipbuilding)

Value Chain Analysis For Industrial Robot Positioners Market

The value chain for industrial robot positioners begins with the upstream raw material suppliers, predominantly specializing in high-grade steels, precision bearings, and robust servomotors, which dictate the ultimate load capacity and accuracy of the unit. The core manufacturing stage involves the precision engineering and assembly of mechanical components, followed by the integration of sophisticated control systems, often proprietary or closely linked to major robot manufacturers (OEMs). Optimization and quality assurance at this stage are paramount to guaranteeing the required repeatability and durability under strenuous industrial conditions.

Downstream analysis involves system integrators and distributors who customize and deploy the positioners as part of a complete robotic cell solution, providing programming, testing, and post-installation support tailored to the end-user’s specific manufacturing process. Direct distribution is common for major robotic brands (like KUKA or FANUC) selling standardized components, whereas complex, customized, high-payload solutions almost exclusively rely on specialized system integrators (indirect channels) to manage project risk and integration complexity. The efficiency of the value chain is increasingly reliant on strong vertical integration, where component manufacturing is tightly controlled to ensure supply chain resilience and performance consistency across various applications.

Industrial Robot Positioners Market Potential Customers

The primary customers for industrial robot positioners are organizations engaged in high-volume, precision manufacturing that utilize industrial robotics for fabrication and assembly. These include Tier 1 and Tier 2 suppliers in the global automotive industry, particularly those focused on electric vehicle battery enclosures and chassis welding, which demand the highest levels of accuracy and throughput. Furthermore, general metal fabrication shops, especially those involved in structural steel and complex component welding, represent a vast and growing customer base seeking to automate repetitive tasks and mitigate labor shortages.

Aerospace and defense contractors constitute a high-value customer segment, requiring extremely large, high-precision, multi-axis positioners for handling critical components like engine mounts and fuselage sections. The heavy machinery and construction equipment sector, which deals with exceptionally heavy and geometrically challenging workpieces (often exceeding 5,000 kg), is rapidly adopting customized positioners to handle components previously deemed too large for automated handling. The purchasing decision for these end-users is heavily influenced by total cost of ownership (TCO), maximum payload capacity, inherent safety features, and the ease of integration with existing or planned robotic infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,200 Million |

| Market Forecast in 2033 | USD 2,200 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, KUKA, FANUC, Yaskawa Electric, Genesis Systems Group, Motoman (Yaskawa), HIWIN Corporation, Güdel Group, EVS Group, Sankyo Seisakusho, Koike Aronson, IGM Robotic Systems, AMECO, Cimcorp, Lincoln Electric, ESAB, Comau, OTC Daihen, ARONSON, Zayer |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Robot Positioners Market Key Technology Landscape

The technological landscape of industrial robot positioners is characterized by advancements focused on improving repeatability, load capacity, and seamless integration with high-speed robotic systems. Crucially, the transition from conventional hydraulic and pneumatic systems to high-precision servo-electric drives has enabled superior dynamic performance and energy efficiency. These servo systems are equipped with high-resolution encoders, facilitating micro-positioning accuracy essential for specialized processes like friction stir welding and laser cladding. A major development is the increased use of robust harmonic drives and high-rigidity gearboxes, which minimize backlash and deflection, ensuring the positioner maintains geometrical accuracy even under extreme and asymmetric loads typical of heavy component manipulation.

Furthermore, contemporary positioners incorporate advanced safety technology, often utilizing redundant braking systems and certified safety encoders (SIL 3 rated) to ensure worker safety within collaborative environments. Software integration is also a critical technological battleground; modern positioners leverage unified programming environments (UPES) that allow the positioner axes to be managed directly by the main robot controller (Kinetiq or similar technology), simplifying complex path planning involving six robot axes plus multiple positioner axes. This integrated control architecture reduces latency and improves overall system synchronization, crucial for achieving high-quality welds and consistent assembly processes.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC holds the largest market share, driven by robust industrialization in China, South Korea, and Japan. China remains the world’s largest consumer and manufacturer of industrial robots and associated components. This dominance is underpinned by massive government support for smart manufacturing initiatives, particularly in the automotive and electronics supply chains. The region sees high demand for standardized dual-axis positioners for high-volume spot and arc welding applications, while rising labor costs are pushing manufacturers in Southeast Asia (Vietnam, Thailand) toward automation.

- North America (NA) High Growth: North America is projected to exhibit a high CAGR, propelled by the reshoring of manufacturing operations and substantial investment in the aerospace and defense sectors, which demand complex, high-tolerance positioning solutions. The market here is characterized by early adoption of advanced technologies, including large-format, custom-engineered positioners integrated with sophisticated machine vision and safety protocols, particularly in Mexico's burgeoning automotive corridor and the US heavy machinery fabrication hubs.

- Europe (EU) Precision Market: Europe, led by Germany and Italy, maintains a strong position emphasizing quality and specialized applications. The European market demands highly flexible, modular positioning systems that support diverse batch sizes and frequently changing product lines, aligning with Industry 4.0 standards. The focus is heavily on energy-efficient servo technology and the seamless integration of positioners within highly automated, interconnected manufacturing ecosystems. The market is mature but continuously evolving, driven by stringent quality certifications in sectors like medical devices and complex tooling.

- Latin America (LATAM) Emerging Demand: LATAM, specifically Brazil and Mexico, presents significant emerging opportunities. Growth is closely tied to foreign direct investment, particularly in the automotive and mining equipment sectors. The demand often focuses on reliable, rugged medium-payload positioners capable of operating in demanding industrial environments, though market adoption can be volatile due to macroeconomic instabilities.

- Middle East & Africa (MEA) Infrastructure Investment: The MEA market growth is primarily concentrated in the Gulf Cooperation Council (GCC) states, driven by significant infrastructure, oil and gas, and diversified manufacturing investments (e.g., steel fabrication). Demand is concentrated towards extremely high-payload positioners necessary for handling large pipes, structural elements, and heavy processing components critical for infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Robot Positioners Market.- ABB

- KUKA

- FANUC

- Yaskawa Electric Corporation (Motoman)

- Genesis Systems Group

- HIWIN Corporation

- Güdel Group

- EVS Group

- Sankyo Seisakusho Co., Ltd.

- Koike Aronson Inc./Ransome

- IGM Robotic Systems AG

- AMECO

- Cimcorp Oy

- Lincoln Electric Company

- ESAB Corporation

- Comau S.p.A.

- OTC Daihen Corporation

- ARONSON (A division of Koike Aronson)

- Zayer S.A.

- Staubli International AG

Frequently Asked Questions

Analyze common user questions about the Industrial Robot Positioners market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the adoption of multi-axis robot positioners?

The primary drivers are the necessity for high-precision welding and assembly of geometrically complex parts, the need to achieve 100% robot accessibility (avoiding manual repositioning), and the increasing adoption of automated solutions in heavy industries suchasing aerospace and construction equipment manufacturing where large, irregularly shaped components must be manipulated with extreme accuracy and repeatability. Multi-axis systems offer superior flexibility and reduced cycle times compared to manual positioning or fixed fixtures.

How does payload capacity segmentation influence the market for positioners?

Payload segmentation dictates both the engineering complexity and the target industry. High-payload positioners (over 2000 kg) require specialized, heavy-duty gearing, larger motors, and advanced safety features, serving capital-intensive sectors like shipbuilding and heavy machinery, which results in higher unit costs but fewer sales volume. Low-to-medium payload systems dominate the market volume, targeting the automotive and general fabrication sectors where standardized dual-axis positioners are widely utilized for standardized robotic welding cells, emphasizing speed and modularity over sheer brute force capacity.

What role do system integrators play in the Industrial Robot Positioners value chain?

System integrators are crucial indirect distribution channels, responsible for integrating the positioner, the robot, welding equipment, and the safety periphery into a cohesive, functional manufacturing cell. They provide customized engineering, specialized programming (especially for complex synchronized motion), installation, and operator training. For complex or bespoke positioner solutions, particularly those requiring tight synchronization with multiple robots, the expertise of the system integrator is often more valuable than the hardware cost itself.

What are the main technological advancements enhancing the performance of robot positioners?

Key technological advancements include the pervasive adoption of high-resolution servo-electric drives and advanced gear reduction mechanisms (e.g., harmonic drives) to boost accuracy and rigidity. Furthermore, the development of integrated control architectures (unified programming) allows the positioner axes to function as external axes seamlessly controlled by the robot controller, streamlining complex path planning and improving dynamic performance. Sensor integration for real-time positional feedback and predictive maintenance algorithms powered by AI are also critical performance enhancers.

Which region currently leads the Industrial Robot Positioners Market and why?

The Asia Pacific (APAC) region currently leads the market due to high levels of automation investment, primarily driven by China's extensive manufacturing base and its world-leading robot adoption rates. The region's dominance is underpinned by large-scale production requirements in the automotive, electronics, and general metal fabrication industries, coupled with governmental policies actively supporting industrial modernization and the replacement of manual processes with automated robotic solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager