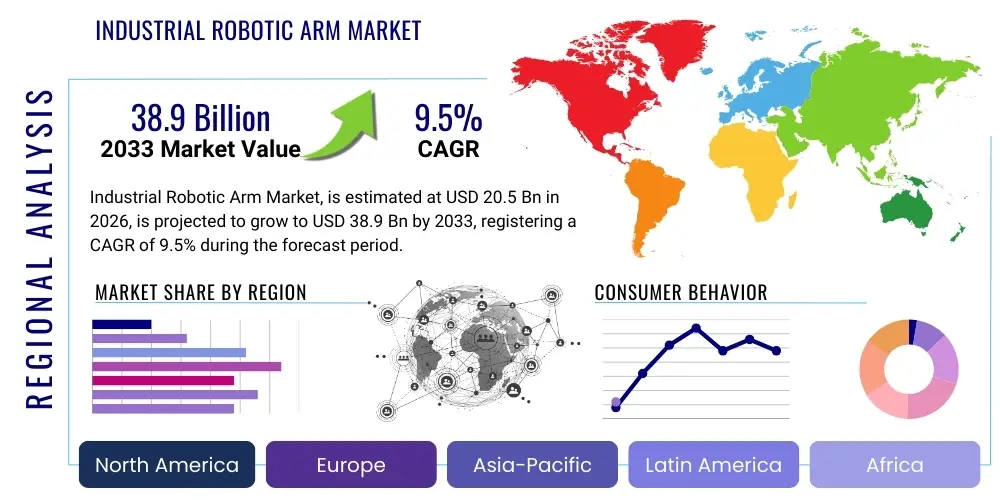

Industrial Robotic Arm Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438973 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Robotic Arm Market Size

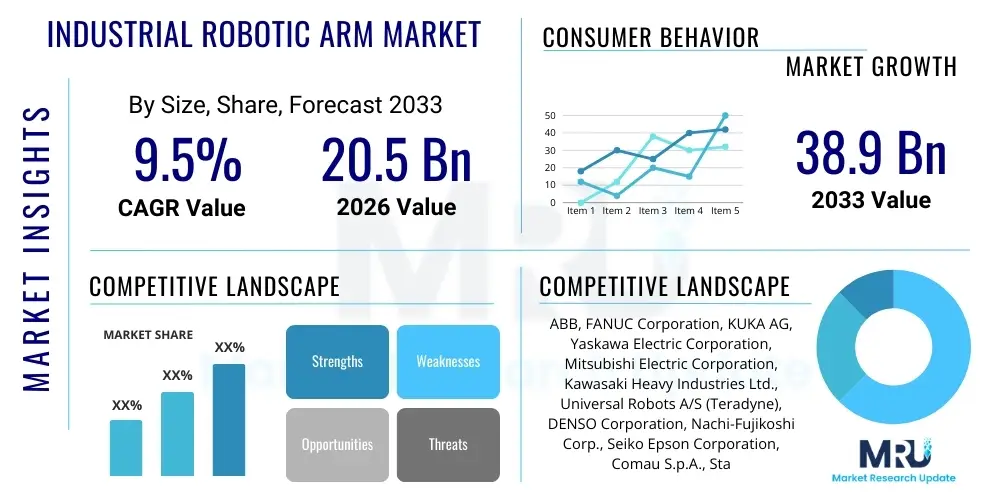

The Industrial Robotic Arm Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 38.9 Billion by the end of the forecast period in 2033. This growth trajectory reflects the accelerating adoption of automation across critical manufacturing sectors globally, driven primarily by the need for enhanced operational efficiency, precision, and the optimization of labor costs in high-volume production environments.

Industrial Robotic Arm Market introduction

The Industrial Robotic Arm Market encompasses the manufacturing, distribution, and integration of multi-axis mechanical devices designed to perform sophisticated tasks in industrial settings. These systems are essential components of modern smart factories, replacing or assisting human labor in repetitive, dangerous, or high-precision operations. Products range from high-payload articulated robots used in automotive body welding to compact, collaborative robots (cobots) deployed in precision assembly and handling tasks within the electronics and pharmaceutical industries. The core functionality of these arms is defined by their degree of freedom (axes), payload capacity, reach, and repeatability, enabling unparalleled consistency in production processes.

Major applications of industrial robotic arms span across crucial manufacturing processes including material handling, arc welding, spot welding, assembly, dispensing, painting, packaging, and quality inspection. The primary benefit derived from their deployment is the significant increase in throughput and a reduction in operational errors, leading to improved overall equipment effectiveness (OEE). Furthermore, the integration of vision systems and advanced sensors allows these robotic arms to adapt dynamically to variations in workpieces, moving beyond rigid programmed paths to incorporate adaptive manufacturing techniques, thereby supporting mass customization strategies.

The market is predominantly driven by the global push towards Industry 4.0 initiatives, necessitating connectivity, data analytics, and flexible automation solutions. Key driving factors include rising labor costs in industrialized nations, the increasing complexity and miniaturization of electronic components demanding higher precision, and the growing regulatory emphasis on worker safety in hazardous environments. The automotive industry remains a foundational adopter, but rapid growth is observed in emerging sectors like e-commerce logistics and specialized medical device manufacturing, utilizing smaller, more agile robotic solutions to meet rapid demand shifts.

Industrial Robotic Arm Market Executive Summary

The Industrial Robotic Arm Market is poised for substantial expansion, characterized by a fundamental shift from traditional heavy automation towards flexible, intelligent, and collaborative systems. Key business trends indicate increasing investment in software-defined automation, enabling robots to be reprogrammed easily for diverse tasks, thereby enhancing their return on investment across multiple manufacturing cycles. Manufacturers are heavily focusing on miniaturization, improved energy efficiency, and developing user-friendly interfaces (UIs) that democratize programming, making advanced robotics accessible to small and medium-sized enterprises (SMEs). This focus on accessibility, coupled with robust maintenance service contracts, is strengthening market resilience against economic volatility.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in volume and growth rate, primarily fueled by massive infrastructure investments in China, South Korea, and Japan aimed at modernizing their enormous manufacturing bases, particularly in electronics and electric vehicle (EV) production. North America and Europe demonstrate mature market adoption, focusing on high-value, highly complex automation tasks and the integration of advanced perception technologies (like 3D vision) to optimize supply chain logistics and assembly quality. These regions are prioritizing the adoption of collaborative robots (cobots) to work alongside human operators, enhancing productivity while maintaining ergonomic standards and workforce flexibility, reflecting a crucial regional shift toward human-robot teaming.

Segment trends reveal that articulated robots maintain the largest market share due to their versatility and high payload capabilities, crucial for the automotive and heavy machinery industries. However, SCARA and Collaborative robots are the fastest-growing segments, driven by their suitability for high-speed, repetitive assembly and pick-and-place operations, especially within the electronics, food and beverage, and logistics sectors. The application landscape is shifting, with material handling surpassing welding as the dominant application by volume, reflecting the global focus on automating warehousing, packaging, and intra-logistics processes to keep pace with e-commerce expansion. Furthermore, the convergence of robotics with cloud computing and Industrial IoT (IIoT) is creating new service models, moving toward Robotics-as-a-Service (RaaS), which lowers initial capital expenditure barriers for new adopters.

AI Impact Analysis on Industrial Robotic Arm Market

Common user questions regarding AI’s impact on industrial robotics frequently revolve around whether AI will entirely replace human programmers, how quickly robots can learn new tasks, and the reliability of AI-driven decision-making in unpredictable manufacturing environments. Users are concerned about the complexity of integration, the necessary data infrastructure, and the potential for autonomous systems to increase production variability if not properly validated. Based on these concerns, the key themes summarize that AI is fundamentally shifting robotic capabilities from rigid programming to adaptive intelligence. Users expect AI to enable robots to handle highly variable inputs, optimize energy consumption dynamically, and perform predictive maintenance, thus maximizing uptime and drastically reducing the lifecycle cost of robotic systems. The central expectation is the creation of truly smart factories where robots operate autonomously and self-correct based on real-time data analysis.

The integration of Artificial Intelligence, specifically machine learning and deep learning algorithms, is transforming industrial robotic arms from pre-programmed tools into highly adaptable and autonomous systems. AI enables functionalities such as advanced visual inspection, where robots can detect minute flaws far beyond human capacity or traditional rule-based systems. Furthermore, reinforcement learning is being applied to allow robotic arms to learn complex tasks through trial and error within simulated or controlled environments, significantly accelerating deployment time and reducing the need for extensive, specialized programming knowledge. This capability is crucial for handling highly customized production batches, a hallmark of flexible manufacturing.

AI also plays a critical role in enhancing the operational efficiency and predictive capabilities of robotic cells. By analyzing sensor data streams (e.g., vibration, temperature, current draw), AI algorithms can anticipate potential mechanical failures (Predictive Maintenance), scheduling necessary interventions before critical system failure occurs, thereby maintaining high production throughput. Moreover, AI-driven motion planning optimizes the arm's trajectory based on real-time factors, minimizing cycle time and energy consumption simultaneously. This move towards intelligent process optimization ensures that robotic arms deliver superior performance, directly impacting the bottom line for end-users and solidifying AI as an indispensable component of future robotic deployments.

- AI-powered machine vision enhances defect detection and quality control with higher accuracy than traditional systems.

- Reinforcement Learning accelerates task programming, allowing robots to adapt rapidly to changes in product specifications or environment layout.

- Predictive maintenance algorithms use AI to analyze sensor data, significantly improving robotic arm uptime and longevity.

- AI facilitates autonomous path planning and collision avoidance in dynamic collaborative workspaces.

- Natural Language Processing (NLP) is beginning to enable simpler, human-like instruction inputs for robotic systems.

- AI optimizes energy consumption by calculating the most efficient motion profiles in real time.

- Deep learning networks enable better handling of unstructured environments, crucial for logistics and sorting applications.

DRO & Impact Forces Of Industrial Robotic Arm Market

The Industrial Robotic Arm Market dynamics are shaped by powerful Drivers and significant Restraints, moderated by strategic Opportunities, which collectively determine the long-term Impact Forces. The primary drivers include the escalating global demand for high-quality, customized products, leading manufacturers to seek highly repeatable and flexible automation solutions. Conversely, major restraints involve the high initial capital investment required for integration, which poses a significant barrier for SMEs, alongside the persistent shortage of skilled labor capable of programming, maintaining, and integrating complex robotic systems. Opportunities are centered on the expansion of collaborative robotics (cobots) and the proliferation of Robotics-as-a-Service (RaaS) models, which mitigate the cost barrier and technical complexity. These factors generate impact forces that favor market consolidation among major vendors who can offer end-to-end solutions, while simultaneously pushing technological innovation toward greater user-friendliness and plug-and-play installation.

Key drivers underpinning market expansion are manifold. The automotive industry’s shift toward Electric Vehicle (EV) manufacturing necessitates new, highly flexible assembly lines requiring specialized robotic arms for battery and motor integration. Additionally, the tightening of global supply chains and the geopolitical drive toward reshoring manufacturing operations in high-cost regions mandate the utilization of automation to maintain cost competitiveness with offshore production. Furthermore, governmental initiatives across APAC and Europe supporting advanced manufacturing infrastructure, often through subsidies or tax incentives for capital equipment acquisition, act as powerful accelerators for robotic adoption across diverse industrial sectors, including textiles and construction.

Restraints are generally concentrated around economic and technological barriers. Economic uncertainty sometimes leads companies to defer large capital expenditures, temporarily slowing market growth. The complexity of integrating robotic arms into legacy manufacturing systems requires significant overhaul and interoperability challenges, which can be costly and time-consuming. From a technological standpoint, while AI integration is an opportunity, the need for vast datasets and the complexity of ensuring safety compliance for human-robot interaction (especially for cobots) require continuous research and regulatory standardization, acting as a frictional force slowing universal adoption, particularly in highly sensitive industries like food processing where hygiene standards are exceptionally stringent.

Strategic opportunities are primarily found in emerging sectors and business model innovation. The healthcare sector, particularly in pharmaceutical packaging, lab automation, and surgical assistance, presents a high-growth niche for specialized robotic arms requiring stringent cleanroom compliance. Moreover, the shift toward modular and decentralized manufacturing systems allows for smaller, localized deployment of flexible robotic arms, servicing local micro-factories. The most significant opportunity lies in scaling the RaaS model, offering usage-based subscriptions, which drastically reduces the entry threshold for SMEs and accelerates technology diffusion, transforming robotics from a pure capital expense into a manageable operating expense and ensuring long-term stable revenue streams for suppliers.

- Drivers:

- Rising labor costs and labor shortages globally.

- Increasing adoption of Industry 4.0 and smart manufacturing standards.

- Growing demand for high-precision manufacturing, especially in electronics and medical devices.

- Expansion of the Electric Vehicle (EV) production infrastructure globally.

- Emphasis on improving worker safety in hazardous work environments.

- Restraints:

- High initial capital expenditure and integration costs for robotic systems.

- Lack of highly skilled personnel for advanced programming, maintenance, and system integration.

- Complexity in customizing software and ensuring interoperability with legacy systems.

- Economic volatility leading to postponed capital investment decisions.

- Opportunities:

- Proliferation of Collaborative Robots (Cobots) easing deployment complexity.

- Development of Robotics-as-a-Service (RaaS) models to lower entry barriers for SMEs.

- Untapped potential in logistics, healthcare, and food processing industries.

- Advancements in sensor technology and AI enabling better object recognition and handling.

- Impact Forces:

- Pressure on manufacturers to develop modular, easy-to-integrate solutions.

- Increased competitive intensity favoring companies offering comprehensive software and service packages.

- Standardization of communication protocols (e.g., OPC UA) is becoming mandatory for market entry.

- Continuous innovation focusing on higher speed, repeatability, and larger working envelopes.

Segmentation Analysis

The Industrial Robotic Arm Market is segmented based on critical technical and application parameters, providing a detailed understanding of market structure and growth pockets. Key segmentation types include the configuration of the robot (Type: Articulated, SCARA, Cartesian, etc.), its carrying capacity (Payload: Low, Medium, High), the functional role it performs (Application: Welding, Handling, Assembly, etc.), and the ultimate manufacturing environment (Industry Vertical: Automotive, Electronics, Pharma). This multi-dimensional segmentation allows stakeholders to accurately gauge demand trends and tailor product development to specific operational needs, such as optimizing SCARA robots for the high-speed assembly required by the electronics industry or designing high-payload articulated systems for the heavy lifting demands of the metal and machinery sector.

The Type segment is crucial, with articulated robots dominating the installed base due to their flexibility and six or more axes of movement, making them suitable for complex tasks across almost all industries. However, the fastest growth is seen in the SCARA (Selective Compliance Assembly Robot Arm) and Collaborative Robot segments. SCARA robots are prized for speed and precision in planar operations, while cobots appeal due to their safety features and ease of integration into existing human workspaces, driving adoption among smaller businesses. Payload segmentation directly reflects industrial scale, where low payload robots are used extensively in electronics and laboratory automation, while high payload systems remain vital for automotive chassis and engine handling.

Application-wise, material handling remains the largest segment, encompassing palletizing, pick-and-place, and machine tending, reflecting the foundational need for automated movement in any production line. Welding (both arc and spot) is mature and technologically advanced, particularly in the automotive industry. However, the Assembly segment is forecast to see accelerated growth, driven by the increasing complexity of product assembly across consumer goods and electronics. Understanding these segments is paramount for strategic planning, allowing companies to invest in R&D focusing on developing vision-guided robotic solutions optimized for the highly variable demands of automated assembly, or ruggedized solutions for demanding processing applications like grinding and deburring.

- By Type:

- Articulated Robotic Arm

- SCARA Robotic Arm (Selective Compliance Assembly Robot Arm)

- Cartesian/Gantry Robotic Arm

- Parallel/Delta Robotic Arm

- Cylindrical Robotic Arm

- Collaborative Robotic Arm (Cobots)

- By Payload Capacity:

- Low Payload Robots (Less than 10 kg)

- Medium Payload Robots (10 kg to 100 kg)

- High Payload Robots (Greater than 100 kg)

- By Application:

- Material Handling (Pick-and-Place, Palletizing)

- Welding and Soldering

- Assembly and Disassembly

- Dispensing and Painting

- Processing Operations (Grinding, Cutting, Deburring)

- Inspection and Testing

- By End-use Industry:

- Automotive

- Electrical and Electronics

- Metal and Machinery

- Food and Beverage

- Pharmaceutical and Cosmetics

- Rubber and Plastics

- Logistics and Warehouse Automation

Value Chain Analysis For Industrial Robotic Arm Market

The value chain for the Industrial Robotic Arm Market begins with Upstream Analysis, which involves core component manufacturing, including specialized servo motors, high-precision gearboxes, controllers, sensors, and structural materials (e.g., lightweight composites). Key upstream suppliers, often distinct from the final robotic arm manufacturers, focus heavily on R&D to improve speed, reliability, and miniaturization of these components. The performance and cost efficiency of the final robotic arm are critically dependent on the innovation achieved in these foundational components, necessitating strong strategic partnerships between robot manufacturers and specialized component suppliers to secure supply and integrate cutting-edge technology effectively. Global geopolitical stability and the supply chain resilience for microchips and specialized metals are critical factors influencing upstream pricing and availability.

Midstream activities involve the design, assembly, and testing of the final robotic system by the major robot manufacturers (e.g., FANUC, ABB, KUKA). This stage focuses on integrating the hardware with proprietary control software and developing user-friendly programming interfaces. Downstream Analysis encompasses system integration, application engineering, installation, training, and post-sales maintenance services. System integrators, who often act as the primary distribution channel, play a vital role, adapting standardized robotic solutions to meet the unique, highly customized production requirements of end-users. The integrators' ability to deliver rapid deployment and robust, application-specific programming is a core competitive differentiator in the market.

Distribution channels are multifaceted, primarily utilizing both Direct and Indirect approaches. Major global vendors often employ a Direct channel for large, strategic accounts (e.g., major automotive OEMs) to maintain direct control over complex integration projects and high-value service contracts. However, the majority of sales, particularly to SMEs and geographically dispersed customers, rely on Indirect channels, specifically authorized distributors and certified system integrators. These integrators provide local expertise, specialized application knowledge (e.g., welding or cleanroom handling), and crucial maintenance support, making them indispensable links that bridge the gap between high-tech manufacturers and diverse industrial users. The effectiveness of the indirect channel is a major determinant of market penetration success, particularly in emerging regional markets like Southeast Asia and Latin America.

Industrial Robotic Arm Market Potential Customers

The primary End-Users/Buyers of industrial robotic arms are global manufacturing organizations seeking to enhance automation, precision, and efficiency across their production facilities. Historically, the Automotive Industry has been the largest consumer, utilizing high-payload and high-speed robots for welding, painting, and heavy material handling tasks. However, the market is diversifying rapidly, with massive growth stemming from the Electrical and Electronics (E&E) sector, which requires small, high-precision SCARA and collaborative robots for micro-component assembly and testing, driven by the continuous demand for smartphones, complex consumer electronics, and semiconductors.

In the current landscape, the Food and Beverage industry represents a significant growth vector for robotic arms, where stringent hygiene requirements necessitate stainless-steel, washdown-capable robots for packaging, palletizing, and processing sensitive materials. Similarly, the Pharmaceutical and Medical Device manufacturing sectors demand extremely precise and sterile automation, often utilizing delta and small articulated robots within cleanroom environments for drug handling, lab automation, and surgical instrument manufacturing. Logistics and warehouse automation companies are also massive buyers, deploying material handling robots (especially cartesian and SCARA types) to manage the surge in e-commerce fulfillment and sorting operations, driven by the need for speed and 24/7 operational capability.

The increasing accessibility offered by collaborative robots (cobots) has unlocked the Small and Medium-sized Enterprise (SME) segment as a powerful new customer base. SMEs, previously deterred by high costs and complexity, are now adopting cobots for simple tasks like machine tending and packaging, utilizing RaaS models to minimize financial risk. Consequently, potential customers are highly varied, ranging from global Fortune 500 corporations seeking full factory automation to local job shops requiring flexible, easy-to-reprogram systems to manage fluctuating production demands and maintain global competitiveness against large, industrialized rivals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 38.9 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Kawasaki Heavy Industries Ltd., Universal Robots A/S (Teradyne), DENSO Corporation, Nachi-Fujikoshi Corp., Seiko Epson Corporation, Comau S.p.A., Staubli International AG, Omron Adept Technologies, Inc., Hyundai Robotics, Franka Emika GmbH, Techman Robot (Quanta Storage), Estun Automation, OTC Daihen Corporation, Rethink Robotics (Hahn Group), CMA Robotics S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Robotic Arm Market Key Technology Landscape

The Industrial Robotic Arm Market is defined by continuous technological convergence, primarily driven by advancements in sensory perception, motion control, and software intelligence. A critical technology is the development of advanced multi-axis controllers that integrate real-time data processing capabilities, allowing for deterministic motion control and high-speed data exchange necessary for complex coordinated movements. Furthermore, the integration of high-resolution 3D vision systems (stereoscopic cameras and structured light sensors) has transitioned robots from blind manipulators to systems capable of accurate bin picking, randomized object handling, and precise quality inspection, crucial for automating complex tasks previously reserved for human labor.

A major focus area is enhancing human-robot collaboration. This involves incorporating advanced safety technologies, such as force-torque sensors embedded in the robot joints and proximity sensors, which allow the arm to detect and react safely to human presence, meeting stringent ISO standards (ISO/TS 15066). This safe interaction enables the proliferation of collaborative robots (cobots), which are inherently torque and speed limited, simplifying deployment and reducing the need for traditional safety caging. Furthermore, connectivity standards based on Industrial Ethernet protocols (e.g., EtherCAT, PROFINET) ensure reliable, high-speed communication between the robot controller, peripheral devices, and the centralized factory control system (PLC or MES), supporting the requirements of the Industrial Internet of Things (IIoT).

The evolution of programming methods is also foundational to the technology landscape. Traditional teach pendant programming is increasingly supplemented by innovative techniques such as lead-through programming (manual guidance of the arm to define the path), offline simulation software, and increasingly, AI-driven machine learning frameworks. These technologies drastically reduce the time and expertise required to deploy a robotic solution. Cloud robotics is an emerging trend, utilizing cloud infrastructure for computationally intensive tasks like complex path optimization or large-scale data storage for fleet management and predictive maintenance across hundreds of installed robotic arms, maximizing efficiency and enabling centralized software updates and performance monitoring.

Regional Highlights

The Industrial Robotic Arm Market exhibits distinct growth patterns across key geographic regions, reflecting varying levels of industrial maturity, labor costs, and governmental support for automation.

- Asia Pacific (APAC): APAC holds the largest market share and is projected to demonstrate the highest growth rate during the forecast period. This dominance is driven by China's massive industrial base modernization, South Korea and Japan's high automation density (especially in electronics and automotive), and rapid manufacturing expansion in emerging economies like India and Southeast Asia. Government-led initiatives, such as China’s "Made in China 2025," heavily subsidize robotics adoption.

- North America (NA): Characterized by a high demand for advanced, flexible automation and collaborative robots. The region focuses on high-mix, low-volume production and logistical automation (warehousing and fulfillment). The revitalization of the automotive sector, particularly the shift toward EV manufacturing, and strong investment in aerospace and defense drive sophisticated robotic solutions.

- Europe: A mature market with high automation density, particularly in Germany (the robotics powerhouse of the region), Italy, and France. Growth is driven by strict quality standards, the need to maintain global cost competitiveness, and strong regulatory frameworks supporting collaborative robotics (cobots) integration. The region leads in applying robotics in specialized niches like pharmaceutical production and high-precision machining.

- Latin America (LATAM): This region is an emerging market, primarily driven by resource-intensive industries (mining, oil & gas) and the automotive sector in countries like Mexico and Brazil. Adoption is accelerating, focused largely on increasing efficiency and output quality to meet export standards.

- Middle East and Africa (MEA): Currently holds the smallest share but shows potential growth driven by diversification efforts (reducing reliance on oil) and significant infrastructure projects, especially in the UAE and Saudi Arabia, necessitating construction and advanced logistics automation solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Robotic Arm Market.- ABB

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Kawasaki Heavy Industries Ltd.

- Universal Robots A/S (Teradyne)

- DENSO Corporation

- Nachi-Fujikoshi Corp.

- Seiko Epson Corporation

- Comau S.p.A.

- Staubli International AG

- Omron Adept Technologies, Inc.

- Hyundai Robotics

- Franka Emika GmbH

- Techman Robot (Quanta Storage)

- Estun Automation

- OTC Daihen Corporation

- Rethink Robotics (Hahn Group)

- CMA Robotics S.p.A.

Frequently Asked Questions

Analyze common user questions about the Industrial Robotic Arm market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Industrial Robotic Arm Market?

The Industrial Robotic Arm Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven by global manufacturing automation initiatives and the expansion of the electronics and logistics sectors.

Which type of industrial robotic arm is experiencing the fastest market growth?

Collaborative robots (Cobots) are the fastest-growing segment, largely due to their ease of integration, safety features allowing human-robot interaction without complex guarding, and suitability for small and medium-sized enterprises (SMEs).

How does AI technology impact the capabilities of modern industrial robotic arms?

AI enables advanced capabilities such as real-time, adaptive path planning, high-accuracy 3D vision for object recognition (bin picking), and predictive maintenance, fundamentally moving robots from rigidly programmed systems to autonomous, intelligent assets.

Which end-use industry is the largest consumer of industrial robotic arms?

Historically, the Automotive industry has been the largest consumer. However, the Electrical and Electronics (E&E) and Logistics sectors are rapidly increasing their market share due to intense demand for high-speed assembly and material handling automation.

What major restraint limits the widespread adoption of industrial robotic arms, especially among SMEs?

The high initial capital expenditure (CapEx) required for purchasing the robot, integrating it into existing production lines, and training specialized personnel remains the primary barrier, though Robotics-as-a-Service (RaaS) models are beginning to mitigate this challenge.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager