Industrial Safety Relays and Timers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432223 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Safety Relays and Timers Market Size

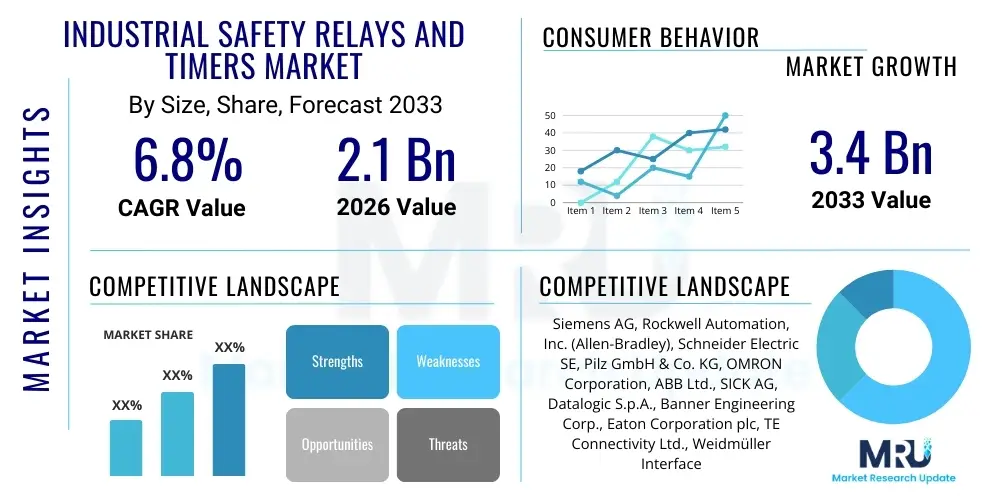

The Industrial Safety Relays and Timers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

The consistent expansion of the market is primarily driven by rigorous regulatory mandates concerning occupational safety across global industrial sectors, including manufacturing, process industries, and energy. As automation levels escalate, the necessity for reliable and high-performance safety circuits—guaranteed by certified safety relays and timers—becomes paramount. These devices are crucial for achieving predefined safety integrity levels (SIL) or performance levels (PL) as defined by international standards like IEC 61508 and ISO 13849, ensuring machine and operator protection against catastrophic failures or unexpected start-ups. The market growth trajectory reflects a necessary shift from traditional, hard-wired safety logic to more flexible, often semiconductor-based solutions that offer advanced diagnostics and reduced downtime.

Furthermore, capital expenditure in modernized production facilities, particularly in developing economies, increasingly incorporates advanced functional safety components from the design phase. The push toward Industry 4.0 methodologies, integrating complex machinery and collaborative robotics, demands safety systems that are not only robust but also capable of high-speed monitoring and integrated communication protocols. This technological convergence enhances the demand for modular and configurable safety relays and multifunction timers that can communicate diagnostic data back to central control systems, thereby improving predictive maintenance capabilities and overall operational efficiency within hazardous industrial environments.

Industrial Safety Relays and Timers Market introduction

The Industrial Safety Relays and Timers Market encompasses electronic and electromechanical components designed specifically to monitor safety functions in industrial machinery and processes, ensuring compliance with strict global safety regulations. These devices form the core logic solvers in safety circuits, preventing hazardous situations by monitoring critical inputs (such as emergency stop buttons, light curtains, safety mats, and two-hand controls) and executing a controlled shutdown or enabling safety-related outputs when necessary. Products range from basic single-function electromechanical safety relays to sophisticated, configurable electronic safety relays and multi-channel safety timers, all certified to meet specific functional safety standards.

Major applications of these safety components are widespread across discrete and process manufacturing, including automotive production lines, food and beverage processing, packaging machinery, chemical plants, and heavy fabrication facilities. The primary benefits derived from the deployment of industrial safety relays and timers include unparalleled reduction in occupational injuries, minimizing equipment damage, compliance with legal safety mandates, and maintaining operational continuity through fail-safe design principles. They provide essential reliability and redundancy, often featuring self-monitoring capabilities (dual channel inputs) to detect internal faults, thereby significantly exceeding the safety performance achievable by standard control relays.

The primary driving factors propelling this market include increasingly stringent global enforcement of safety standards, mandatory machine risk assessments requiring certified safety solutions, and the accelerating pace of factory automation which introduces new hazards requiring mitigation. Moreover, technological advancements leading to compact, easily programmable, and diagnostic-rich safety components are facilitating easier integration into complex safety architectures. The inherent need for safety standardization and the legal accountability associated with industrial accidents guarantee sustained demand for these foundational functional safety components across all industrial verticals seeking to improve their safety footprint and operational reliability.

Industrial Safety Relays and Timers Market Executive Summary

The Industrial Safety Relays and Timers Market exhibits robust growth, primarily fueled by global mandates for improving worker safety and the pervasive trend of industrial digitalization and automation, particularly within high-growth sectors like automotive and logistics. Business trends indicate a strong move away from traditional, large, and inflexible safety systems toward compact, modular, and configurable electronic safety relays offering advanced diagnostic capabilities accessible via industrial communication protocols such as IO-Link or EtherNet/IP. Key manufacturers are focusing heavily on developing hybrid products that bridge the gap between simple relay logic and complex safety PLCs, offering cost-effective, decentralized safety solutions suitable for small to medium-sized machinery applications and enhancing overall systems integration efficiency across the manufacturing value chain.

Regional trends highlight that North America and Europe remain mature markets driven by replacement cycles and adherence to established, high safety standards (e.g., OSHA, Machinery Directive 2006/42/EC). However, the Asia Pacific (APAC) region, spearheaded by rapid industrial expansion and modernization in China and India, is registering the fastest growth rate. This accelerated growth is supported by increasing foreign investment establishing high-standard manufacturing facilities, necessitating immediate adoption of certified safety infrastructure. Segment trends reveal that configurable safety relays and solid-state timing functions are gaining significant traction over traditional electromechanical counterparts due to their superior reliability, longevity, faster response times, and embedded diagnostic capabilities crucial for modern predictive maintenance strategies.

In terms of component breakdown, the safety timer segment, while smaller, is witnessing innovation focused on precision and multi-functionality, allowing complex safety-related time delays for sequenced shutdowns or startup procedures, critical in process safety applications. The competitive landscape is characterized by strategic partnerships and a focus on compliance certifications, with key players expanding their portfolio to offer complete functional safety packages, including safety sensors and integration software, further solidifying their market position by providing comprehensive, end-to-end safety solutions that simplify procurement and compliance management for end-users operating globally.

AI Impact Analysis on Industrial Safety Relays and Timers Market

User queries regarding AI's influence on the Industrial Safety Relays and Timers Market frequently revolve around whether AI will automate the safety logic design process, how machine learning can enhance predictive failure diagnostics in safety systems, and if AI will ultimately render fixed-function hardware relays obsolete. The consensus among these inquiries suggests high user expectation for AI to improve the reliability and response time of safety infrastructure, particularly by analyzing sensor data patterns in real-time to predict component fatigue or operational drift long before a safety function is compromised. Users are keen to understand how AI-driven anomaly detection can be integrated with existing safety relay systems to move beyond simple fault detection toward proactive, intelligent safety management, thereby reducing nuisance trips and minimizing safety-related downtime in highly dynamic manufacturing environments.

- AI enables advanced predictive maintenance by analyzing relay performance data, predicting lifespan, and scheduling replacements before failure, enhancing Safety Integrity Level (SIL) maintenance.

- Machine learning algorithms optimize safety parameters and operational thresholds in complex systems, reducing false shutdowns caused by environmental variability or sensor noise.

- AI integration supports sophisticated fault diagnostics, allowing safety relays to communicate precise failure modes directly to maintenance teams, speeding up recovery.

- Development of AI-powered safety validation tools assists engineers in automated testing and compliance verification of safety circuit designs utilizing relays and timers.

- AI enhances human-robot collaboration safety by dynamically adjusting safety zones and relay trip parameters based on real-time kinematic predictions of collaborative robots.

DRO & Impact Forces Of Industrial Safety Relays and Timers Market

The Industrial Safety Relays and Timers Market is propelled by stringent global safety legislation and the necessity for industrial modernization (Drivers), yet it faces challenges related to high initial implementation costs and complexity in integrating disparate safety components across legacy systems (Restraints). Opportunities abound in the burgeoning demand for configurable and IoT-enabled safety relays that facilitate seamless data exchange and remote diagnostics, aligning perfectly with Industry 4.0 paradigms. The primary impact forces include the critical role of international standardization bodies (IEC, ISO) in defining minimum performance levels, coupled with the relentless pressure from insurance and liability requirements driving proactive safety investment across all manufacturing and processing sectors.

Key drivers center around legislative compliance, specifically the adoption and enforcement of standards such as ISO 13849 (Performance Levels) and IEC 62061 (Safety Integrity Levels), which necessitate the use of certified safety components to minimize operational liability. Furthermore, the global trend towards increasing automation, especially in high-speed machinery and complex robotic cells, creates inherent risks that only reliable, dedicated safety relays can manage effectively by ensuring rapid and safe cessation of movement under fault conditions. The growing awareness among small and medium enterprises (SMEs) regarding the long-term cost benefits of proactive safety investment, including reduced accidents, lower insurance premiums, and improved operational uptime, further fuels demand for these foundational safety components.

Conversely, significant restraints include the technical complexity and substantial time required for safety circuit design, validation, and maintenance, often requiring specialized engineering expertise that is scarce. Additionally, the initial capital outlay associated with upgrading legacy machinery with modern, certified safety relays and complex wiring can deter adoption in price-sensitive markets. However, the market possesses substantial growth opportunities driven by the rise of configurable safety relays, which offer the flexibility of safety PLCs at a lower cost point, making advanced functional safety more accessible. The potential for integrating safety data into Enterprise Resource Planning (ERP) systems via smart relays represents a strong technological opportunity for enhancing operational intelligence and driving proactive safety culture adoption.

Segmentation Analysis

The Industrial Safety Relays and Timers Market is primarily segmented based on the component type, the application function, the safety category achieved, and the end-user industry. The core segmentation relies on differentiating between traditional electromechanical safety relays, electronic safety relays, and dedicated safety timers. Electronic safety relays, particularly the configurable variety, represent the fastest-growing segment due to their flexibility, advanced diagnostic capabilities, and ability to handle multiple safety functions simultaneously, vastly simplifying wiring compared to hard-wired electromechanical solutions. Application segmentation focuses on critical safety functions such as emergency stop monitoring, monitoring of safety interlocks, light curtain monitoring, and two-hand control circuits, reflecting the diverse protection needs across the industrial spectrum.

- By Component Type:

- Electromechanical Safety Relays (Single-function, Hard-wired)

- Electronic/Solid State Safety Relays (Configurable, Multifunction)

- Safety Timers (Single-function, Multi-function)

- Safety Expansion Modules

- By Function:

- Emergency Stop Monitoring

- Light Curtain/Safety Laser Scanner Monitoring

- Safety Gate and Interlock Monitoring

- Two-Hand Control Monitoring

- Pressure/Temperature Monitoring

- By Safety Standard/Level:

- SIL 1 & 2 (Safety Integrity Level)

- SIL 3 & 4 (Safety Integrity Level)

- PL c, d, e (Performance Level)

- By End-User Industry:

- Automotive and Transportation

- Food and Beverage Processing

- Packaging and Logistics

- Chemical and Petrochemical

- Metals and Machinery Manufacturing

- Pharmaceuticals and Healthcare

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Industrial Safety Relays and Timers Market

The value chain for the Industrial Safety Relays and Timers Market begins with upstream activities focused on the sourcing and processing of specialized components, including high-reliability electronic circuits, semiconductor components for solid-state relays, and specialized plastics and metals for housing and electromechanical contacts. Manufacturers in the upstream segment must ensure components meet stringent quality standards and comply with material restrictions (e.g., RoHS, REACH), requiring deep collaboration with raw material suppliers and specialized component providers. Key success factors at this stage involve achieving economies of scale in component procurement and maintaining a robust quality control system to ensure the inherent reliability of the final safety product, often involving dual redundant components and comprehensive testing protocols essential for certification.

The core manufacturing stage involves sophisticated assembly, rigorous testing, and crucially, obtaining functional safety certifications (e.g., TÜV, UL) for every product line, a high barrier to entry for new market entrants. Midstream activities involve the fabrication of the final certified relay or timer, followed by integration into larger safety systems. The distribution channel plays a vital role, often utilizing a mix of direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales through highly specialized industrial automation distributors and system integrators. These system integrators are pivotal, as they possess the necessary expertise to design, install, and validate complex safety circuits using these components, translating component features into compliant machine safety solutions for end-users.

Downstream activities center on deployment, maintenance, and replacement cycles. Direct distribution channels are often preferred by large, multinational end-users in sectors like automotive, which require standardized products and global support contracts. Indirect channels, through local distributors, cater predominantly to maintenance, repair, and overhaul (MRO) demand and smaller regional integrators. The value delivery to the end-user is not just the physical product but the assurance of compliance and reliability; therefore, after-sales support, technical training on safety standards, and lifecycle management services provided by distributors and manufacturers are critical factors in the competitive landscape and contribute significantly to overall customer loyalty and market penetration.

Industrial Safety Relays and Timers Market Potential Customers

Potential customers for Industrial Safety Relays and Timers primarily encompass any industrial entity operating machinery or processes that pose inherent risks to personnel or assets, necessitating compliance with functional safety standards. These customers range from large multinational Original Equipment Manufacturers (OEMs) who integrate safety relays directly into the machinery they manufacture, such as robotics or CNC machines, to vast populations of end-users responsible for the operation and maintenance of these machines. OEMs seek standardized, globally certified, compact, and high-performance relays that simplify machine design and global deployment, often driving volume sales for manufacturers.

The largest end-user segments include the automotive industry, which requires extensive safety interlocking for assembly lines and press shops, and the packaging and logistics sector, characterized by high-speed machinery and automated material handling systems where immediate, reliable safety stops are non-negotiable. Furthermore, process industries like chemical, oil and gas, and pharmaceutical manufacturing are critical buyers, utilizing safety relays and timers for safety shutdown systems (SIS) and burner management systems, ensuring process safety and preventing catastrophic environmental or operational failure within highly regulated environments. These customers prioritize components that achieve the highest possible Safety Integrity Levels (SIL 3/4) and offer extreme resistance to environmental factors.

In addition to large-scale manufacturers, Machine Builders and System Integrators constitute a significant customer base, acting as intermediaries who specify and procure safety relays and timers based on the customized safety requirements of diverse clients. Their purchasing decisions are heavily influenced by ease of installation, compatibility with existing control architectures (e.g., PLC brands), advanced diagnostic features, and the availability of clear technical documentation and software tools for validation. The ongoing drive for retrofitting existing machinery to meet updated safety regulations guarantees a steady stream of MRO (Maintenance, Repair, and Overhaul) demand from virtually all operational factories worldwide, sustaining the market through replacement and modernization cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Rockwell Automation, Inc. (Allen-Bradley), Schneider Electric SE, Pilz GmbH & Co. KG, OMRON Corporation, ABB Ltd., SICK AG, Datalogic S.p.A., Banner Engineering Corp., Eaton Corporation plc, TE Connectivity Ltd., Weidmüller Interface GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, Schmersal Group, Honeywell International Inc., IDEC Corporation, Mitsubishi Electric Corporation, Pepperl+Fuchs GmbH, and Murrelektronik GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Safety Relays and Timers Market Key Technology Landscape

The technological landscape of Industrial Safety Relays and Timers is undergoing a significant transformation driven by the shift from traditional electromechanical devices to advanced, solid-state, and network-capable electronic platforms. Key advancements focus on enhancing diagnostic coverage, reducing commissioning time, and facilitating decentralized safety architectures. Configurable safety relays are at the forefront, leveraging embedded microprocessors and application-specific integrated circuits (ASICs) to allow users to define multiple safety functions (e.g., speed monitoring, E-stop, interlock) within a single compact module via intuitive software interfaces, drastically reducing wiring complexity and panel space requirements compared to conventional modular systems.

The integration of safety relays into the Industrial Internet of Things (IIoT) ecosystem represents another pivotal technological trend. Modern safety components are increasingly equipped with communication interfaces, such as IO-Link Safety, which not only transmits the binary safety status but also extensive diagnostic data, including temperature, operating cycles, and potential failure warnings, back to the central control system or cloud platforms. This capability moves the market beyond mere reactive fault detection toward proactive, data-driven safety management, supporting sophisticated condition monitoring and predictive maintenance strategies essential for high-availability systems running Safety Integrity Level (SIL) 3 processes, ensuring maximum uptime and reliability.

Furthermore, technology development is heavily centered on achieving higher Performance Levels (PL e) in smaller form factors, particularly crucial for integration into compact, high-speed machinery and robotic cells. Innovations in dual-channel monitoring circuitry, redundant power supplies, and highly reliable contactor materials for electromechanical relays (where still used) continue to ensure fail-safe operation. The increasing adoption of decentralized safety I/O modules, which often incorporate safety relay functions directly near the guarded machinery, minimizes long cable runs and simplifies fault localization, further enhancing system efficiency and responsiveness in large-scale automated facilities. These advancements reflect a market demand for smart, scalable, and communication-enabled safety infrastructure.

Regional Highlights

- North America: This region is characterized by high adoption rates driven by strict federal and state safety regulations (e.g., OSHA), particularly in the highly automated automotive, aerospace, and general manufacturing sectors. The market here is mature but experiences robust growth fueled by continuous modernization, replacement cycles, and a strong preference for configurable and networked safety solutions that comply with ANSI and NFPA standards. Investments in advanced robotic manufacturing are a primary driver for high-performance, compact safety relay demand.

- Europe: Europe leads the global market in terms of established safety culture and regulatory framework, primarily governed by the Machinery Directive (2006/42/EC) and its reliance on EN ISO 13849 and EN IEC 62061 standards. Germany and Italy are major hubs for machine builders (OEMs), driving consistent demand for certified safety relays and timers. The trend is strongly geared towards safety-over-ethernet communication integration and modular safety solutions, aiming for seamless integration across complex production sites while focusing heavily on sustainability and energy efficiency in component design.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by massive industrialization, rapid infrastructure development, and the relocation of global manufacturing activities, especially to China, India, and Southeast Asia. While cost sensitivity remains a factor, increasing regulatory enforcement (often mirroring Western standards) and the influx of advanced manufacturing technologies are significantly boosting the adoption of certified safety components. The shift from basic safety components to advanced electronic and configurable safety relays is a dominant trend in this region, particularly within the electronics assembly and automotive manufacturing sectors.

- Latin America (LATAM): Growth in LATAM is steady, primarily driven by investments in the mining, oil & gas, and food & beverage processing industries. Market growth is often uneven, tied closely to commodity price fluctuations and localized industrial expansion projects. Adoption is accelerating as multinational corporations implement global safety standards in their regional operations, pushing local manufacturers to upgrade existing safety systems with certified relays and timers to mitigate operational and liability risks.

- Middle East & Africa (MEA): The MEA market growth is concentrated in the Gulf Cooperation Council (GCC) countries, focusing on the oil & gas, petrochemicals, and large-scale infrastructure projects. Safety integrity is paramount in these high-risk environments, necessitating the use of certified safety relays and timers that meet high SIL requirements (typically SIL 3). Demand is highly specialized, favoring robust, high-reliability components capable of operating effectively under severe environmental conditions, with procurement often tied to large capital projects managed by international engineering firms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Safety Relays and Timers Market.- Siemens AG

- Rockwell Automation, Inc. (Allen-Bradley)

- Schneider Electric SE

- Pilz GmbH & Co. KG

- OMRON Corporation

- ABB Ltd.

- SICK AG

- Datalogic S.p.A.

- Banner Engineering Corp.

- Eaton Corporation plc

- TE Connectivity Ltd.

- Weidmüller Interface GmbH & Co. KG

- Phoenix Contact GmbH & Co. KG

- Schmersal Group

- Honeywell International Inc.

- IDEC Corporation

- Mitsubishi Electric Corporation

- Pepperl+Fuchs GmbH

- Murrelektronik GmbH

- Contrinex AG

Frequently Asked Questions

Analyze common user questions about the Industrial Safety Relays and Timers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary distinction between a standard control relay and an industrial safety relay?

The primary distinction lies in their inherent design and certification for functional safety. An industrial safety relay features redundant internal architecture, often with forcibly guided contacts and comprehensive self-monitoring circuits, ensuring that if an internal component fails, the system defaults to a safe state. Standard relays lack this redundant safety logic and fail-safe design, making them unsuitable for circuits requiring certified Safety Integrity Levels (SIL) or Performance Levels (PL).

How do Safety Integrity Levels (SIL) relate to the selection of safety relays?

Safety Integrity Levels (SIL, defined by IEC 61508) quantify the required reliability and risk reduction of a safety function. When selecting a safety relay, engineers must choose a device certified to meet or exceed the SIL requirement (e.g., SIL 3) dictated by the machine's risk assessment. The higher the SIL (from 1 to 4), the lower the probability of dangerous failure, thus requiring more sophisticated and certified safety relay technologies, typically dual-channel electronic systems.

Are configurable safety relays replacing traditional hard-wired safety relays?

Configurable safety relays are rapidly replacing multiple traditional hard-wired relays, especially in complex machinery, due to their ability to manage numerous safety inputs and outputs within a single module via software configuration. While traditional hard-wired relays remain cost-effective and essential for very simple, single-function safety circuits (like a single E-stop), configurable relays offer significant advantages in flexibility, diagnostics, space-saving, and reduced wiring effort, accelerating the transition to advanced safety architectures.

What role does IIoT connectivity play in modern safety timers and relays?

IIoT connectivity (e.g., via IO-Link Safety or industrial Ethernet) enables modern safety relays and timers to transmit detailed diagnostic information and device status proactively to higher-level control systems and cloud platforms. This capability is crucial for predictive maintenance, allowing users to monitor component wear, anticipate potential failures, and verify compliance documentation remotely, significantly improving operational uptime and maintaining prescribed safety performance levels.

Which end-user industries are driving the highest demand for advanced safety timers?

Industries requiring precise sequencing and time-delayed safety shutdowns, particularly the process industries (Oil & Gas, Chemical, Pharmaceuticals) and high-speed packaging/robotics sectors, are driving the highest demand for advanced safety timers. These timers ensure controlled, safe stopping procedures that prevent equipment damage or material spillage during an emergency stop, where instantaneous shutdown is often undesirable or hazardous to the process itself.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager