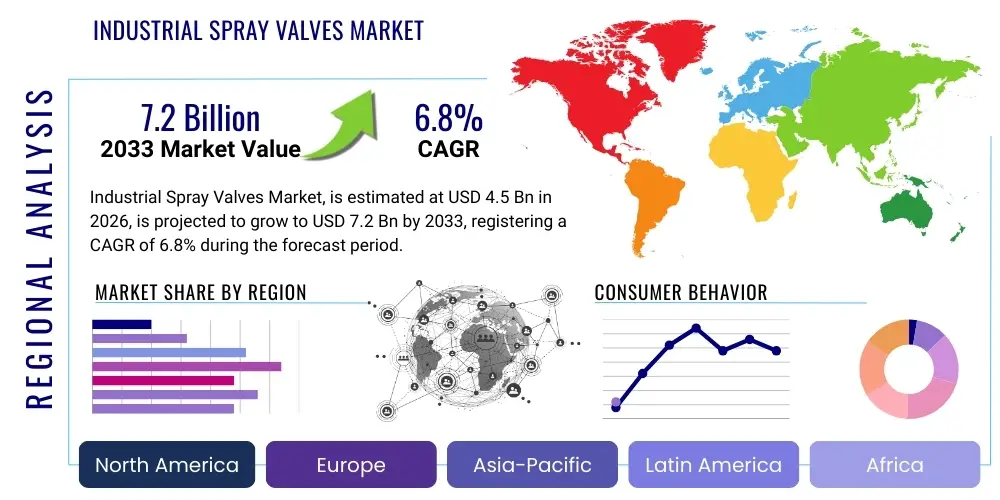

Industrial Spray Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437399 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Spray Valves Market Size

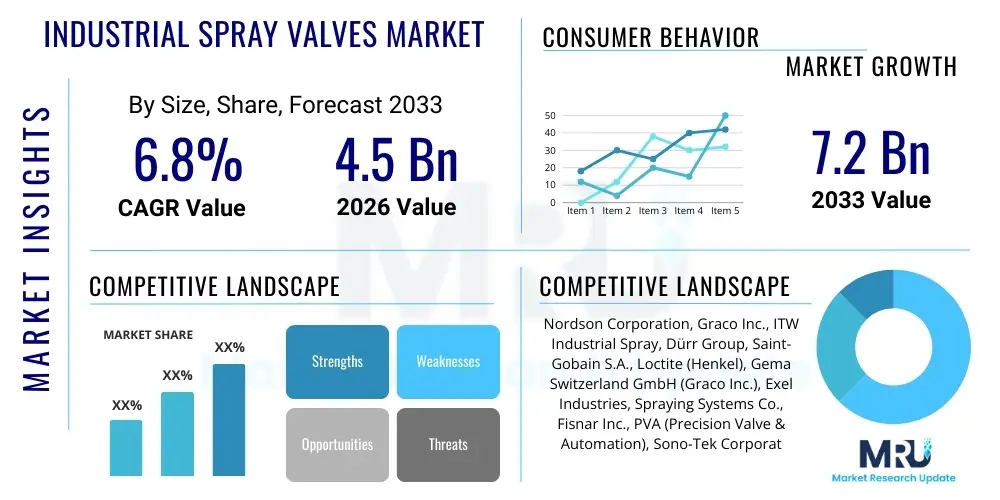

The Industrial Spray Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Industrial Spray Valves Market introduction

The Industrial Spray Valves Market encompasses the design, manufacturing, and distribution of specialized fluid control components used primarily for precise application of liquids, lubricants, coatings, and adhesives across various industrial processes. These valves are critical in operations requiring high accuracy, repeatability, and minimal waste, distinguishing them from standard on/off valves. Key product offerings include air-assisted spray valves, high-pressure hydraulic spray valves, and precision dispensing valves, often featuring advanced nozzle designs and electronically controlled actuation systems. The growing focus on automation and process efficiency, particularly within high-tech manufacturing and complex assembly lines, underpins the fundamental demand for sophisticated spray valve technology.

Major applications of industrial spray valves span multiple high-growth sectors. In the automotive industry, they are essential for applying lubricants in stamping processes, sealants, and precision coatings in painting booths. The electronics sector utilizes these valves for flux dispensing in printed circuit board (PCB) manufacturing and applying conformal coatings for protection. Furthermore, in the food and beverage industry, spray valves facilitate the accurate application of oils, flavorings, and release agents on processing equipment or final products. The necessity of maintaining strict quality control and regulatory compliance across these sectors drives the adoption of high-performance valve systems capable of handling a diverse range of fluid viscosities and particulate content efficiently.

The core benefits derived from implementing advanced industrial spray valves include significant reductions in material consumption due to enhanced precision, increased throughput resulting from faster application cycles, and improved product quality consistency. Driving factors contributing to market expansion include the global push towards Industry 4.0, which mandates integration of smart components capable of real-time monitoring and data feedback. Additionally, stringent environmental regulations regarding Volatile Organic Compounds (VOCs) and waste minimization compel manufacturers to invest in highly efficient, low-overspray dispensing technologies. The continuous innovation in material science for valve construction, enabling resistance to harsh chemicals and high temperatures, further solidifies the market's growth trajectory, positioning industrial spray valves as indispensable components in modern automated manufacturing.

Industrial Spray Valves Market Executive Summary

The Industrial Spray Valves Market is experiencing robust expansion, fundamentally driven by pervasive manufacturing automation trends and the acute industry need for enhanced precision and material efficiency. Business trends highlight a significant shift towards smart, interconnected spray valve systems equipped with sensors and IoT capabilities, facilitating predictive maintenance and optimized process control. Leading manufacturers are intensely focused on developing modular designs that allow for rapid customization across diverse viscosity ranges and pressure requirements, catering specifically to highly specialized applications in medical device manufacturing and advanced electronics assembly. Furthermore, competitive strategies are increasingly revolving around offering comprehensive fluid management solutions, integrating dispensing hardware with proprietary software for operational intelligence, which positions vendors not just as component suppliers but as strategic automation partners.

Regional trends indicate that Asia Pacific (APAC) currently dominates the market, primarily due to the rapid growth and expansion of high-volume manufacturing sectors, including automotive assembly, consumer electronics, and heavy machinery production, particularly in China, Japan, and South Korea. North America and Europe, while mature markets, are experiencing growth fueled by replacement cycles, stringent quality standards in aerospace and medical device production, and a high rate of adoption of advanced robotic dispensing systems. These regions are prioritizing highly accurate micro-dispensing capabilities, leveraging local expertise in advanced automation integration. Government initiatives supporting manufacturing resilience and re-shoring efforts in these Western economies also contribute positively to localized demand for high-tech industrial spraying equipment.

Segmentation trends reveal that air-assisted atomizing spray valves maintain a dominant market share due to their versatility and suitability for low-viscosity coatings, though non-contact micro-jetting technologies are rapidly gaining traction, particularly in electronics due to their ability to achieve extremely precise application volumes without physical contact. Segment analysis by end-use highlights the substantial and consistent demand from the automotive sector for corrosion protection and noise vibration harshness (NVH) material application, followed closely by the fast-growing demand from the electronics sector for flux and adhesive application. The trend indicates a future where digitalization and the integration of artificial intelligence will fundamentally change how spray applications are monitored and optimized, driving demand for premium, sensor-equipped valve variants capable of feeding real-time performance data back into centralized manufacturing execution systems (MES).

AI Impact Analysis on Industrial Spray Valves Market

User queries regarding the impact of Artificial Intelligence (AI) on the Industrial Spray Valves Market primarily center on the feasibility of integrating machine learning for predictive maintenance, the potential for AI algorithms to optimize spray patterns in real-time, and how AI-driven analytics can improve material efficiency and reduce waste. Users are particularly keen to understand whether AI can autonomously adjust fluid pressure, temperature, and flow rate based on instantaneous environmental factors or material batch variations, thereby ensuring zero-defect coating or dispensing. The key themes summarized from user concerns focus on AI's ability to transition spray processes from reactive control to proactive, self-optimizing systems, addressing complexities like viscosity drift and ensuring high consistency in high-speed, demanding production environments where human intervention is slow or impractical. Expectations are high that AI will significantly reduce operational costs and enhance regulatory compliance by offering verifiable, data-backed proof of performance for every application cycle.

The direct application of AI involves integrating machine learning models with advanced vision systems and valve sensors. These models analyze high-dimensional data streams—including valve actuation timing, pressure fluctuations, temperature readings, and visual feedback on the applied spray pattern—to identify subtle deviations that precede critical failures or quality defects. For instance, AI can detect minor inconsistencies in atomization quality invisible to the human eye or standard QA checks. This capability allows manufacturers to automatically adjust spray parameters (such as air pressure or material volume) fractions of a second after a potential deviation is detected, maintaining stringent quality specifications without halting production. This shift moves the maintenance paradigm from time-based or volume-based schedules to true condition-based monitoring, dramatically increasing uptime.

Furthermore, AI is pivotal in optimizing material usage, a major operational expense for industrial manufacturers. By simulating and learning optimal spray trajectories and valve opening times under diverse production scenarios, AI algorithms can minimize overspray and material pooling, leading to material savings that can exceed 10-15% in high-volume applications like painting and lubrication. This optimization is particularly impactful in industries like aerospace or high-end automotive where material costs are substantial and precision requirements are absolute. The implementation of AI also facilitates compliance reporting by generating highly accurate logs of operating parameters, which is increasingly required for quality auditing and traceability standards in regulated sectors like medical devices and pharmaceutical manufacturing. Consequently, AI is transforming industrial spray valves from simple actuators into intelligent endpoints within the smart factory ecosystem.

- AI enables predictive maintenance by analyzing sensor data to forecast potential valve wear or component failure, maximizing uptime.

- Machine learning algorithms optimize spray parameters (pressure, flow rate, timing) in real-time, adjusting for viscosity and temperature changes.

- Integrated vision systems linked to AI models provide instant quality feedback, minimizing defects and ensuring pattern consistency.

- AI drives material efficiency by calculating optimal dispensing volumes, significantly reducing overspray and material waste.

- Autonomous process adjustment enhances regulatory compliance by maintaining validated operating windows continuously.

- Data generated by AI integration supports enhanced traceability and operational transparency for quality audits.

DRO & Impact Forces Of Industrial Spray Valves Market

The Industrial Spray Valves Market is powerfully influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), creating significant market impact forces. Key drivers center around the global surge in manufacturing automation, specifically the adoption of robotic dispensing systems across sectors such as automotive, electronics, and medical devices, where precision and high throughput are non-negotiable prerequisites for operational success. The increasing complexity of industrial coatings and adhesives, demanding specialized application equipment capable of handling multi-component materials and highly viscous fluids with extreme accuracy, acts as a primary technological driver. Furthermore, stricter environmental regulations compelling industries to reduce volatile organic compound (VOC) emissions and minimize material waste directly favor the adoption of advanced spray valve technologies that offer superior transfer efficiency and precision control over traditional methods. These drivers collectively push manufacturers to continuously upgrade their dispensing infrastructure to maintain competitiveness and comply with global standards.

However, the market faces notable restraints, predominantly the high initial capital investment required for purchasing and integrating advanced, intelligent spray valve systems, coupled with the specialized training needed for operating and maintaining these complex fluid dynamics systems. This cost barrier disproportionately affects small and medium-sized enterprises (SMEs), potentially slowing broader market penetration. Another restraint is the technical challenge posed by standardizing fluid delivery across diverse operational conditions and material properties; changes in temperature or pressure can drastically alter fluid viscosity, requiring constant, fine-tuned adjustments. Furthermore, the longevity and reliability of seals and moving parts in environments exposed to abrasive or highly corrosive chemicals remain a persistent engineering challenge, necessitating frequent maintenance and component replacement, which can increase the total cost of ownership (TCO).

Significant opportunities exist in the burgeoning fields of additive manufacturing and micro-dispensing for advanced electronics, where requirements for ultra-fine and highly accurate material deposition are rapidly increasing. Developing customized, compact, and energy-efficient spray valve solutions tailored for these emerging applications represents a substantial area for growth. The opportunity space is also defined by the integration of Industry 4.0 technologies, including the deployment of IIoT (Industrial Internet of Things) sensors and cloud-based analytics, offering remote monitoring and predictive diagnostics, adding premium value to basic valve hardware. Furthermore, expanding into emerging economies, particularly those ramping up domestic manufacturing capabilities and prioritizing automated production lines, offers fertile ground for market expansion, provided manufacturers can offer scalable and cost-effective solutions appropriate for local industrial infrastructure and production scale requirements. These forces dictate the market trajectory, rewarding innovation in precision and connectivity.

Segmentation Analysis

The Industrial Spray Valves Market is fundamentally segmented based on factors such as valve type, actuation method, flow rate capability, and end-use application, providing a granular view of market dynamics and specialized demand pockets. Segmentation allows vendors to tailor product development and marketing efforts towards specific industrial needs, ranging from high-pressure cleaning applications to precise micro-depositions in semiconductor manufacturing. The core segmentation by valve type—air-assisted, airless, hydraulic, and electric/piezoelectric—reflects varying operational requirements concerning atomization quality, pressure handling, and fluid viscosity suitability. Analyzing these segments provides critical insights into technological preference shifts, such as the increasing demand for high-speed, non-contact piezoelectric valves in precision assembly lines.

A critical component of the market structure is segmentation by actuation method, distinguishing between manually operated, pneumatically driven, and electrically controlled valves. Pneumatic valves remain highly prevalent due to their robust nature and simplicity, especially in heavy industrial environments. However, electrically actuated valves are rapidly gaining share because they offer superior control and faster response times, essential for high-frequency dispensing tasks and seamless integration with complex PLC (Programmable Logic Controller) or CNC systems. The shift toward electric and smart actuation is a testament to the industry's increasing emphasis on digital control and real-time data feedback to ensure repeatable quality and efficient utilization of expensive materials.

Segmentation based on end-use application further clarifies the market landscape, identifying key demand drivers across major verticals. The automotive sector dominates due to the extensive need for spraying various liquids, including paint, sealants, anti-corrosion materials, and lubricants. Meanwhile, the electronics segment, driven by the need for flux, solder paste, and conformal coatings on delicate components, demands the highest level of precision and miniaturization. Analyzing these end-use sectors reveals distinct regional consumption patterns and regulatory pressures, informing strategic decisions regarding product specialization and geographic resource allocation. The continuous evolution of these industrial processes ensures sustained, diverse demand for tailored spray valve solutions.

- By Valve Type:

- Air-Assisted Atomizing Spray Valves

- Airless Hydraulic Spray Valves

- Precision Dispensing/Micro-Jetting Valves (Piezoelectric, Solenoid)

- Pressure-Fed Spray Valves

- By Actuation Method:

- Pneumatically Operated Valves

- Electrically Operated Valves

- Manually Operated Valves

- By Flow Rate:

- Low Flow (Micro-Dispensing)

- Medium Flow

- High Flow (Bulk Coating/Lubrication)

- By End-Use Industry:

- Automotive (Painting, Sealing, Lubrication)

- Electronics and Semiconductor (Flux, Conformal Coating, Adhesives)

- General Manufacturing and Machinery

- Aerospace and Defense

- Food and Beverage

- Medical Devices and Pharmaceutical

- By Material Type:

- Stainless Steel Valves

- Engineered Polymer Valves

- Alloy Valves (Specialized for high pressure/corrosion)

Value Chain Analysis For Industrial Spray Valves Market

The value chain for the Industrial Spray Valves Market begins with the Upstream Analysis, which is highly dependent on specialized raw material suppliers and component manufacturers. Key upstream inputs include precision-machined metals (such as stainless steel and specialized alloys required for chemical resistance and high pressure tolerance), advanced seals and elastomers (critical for preventing leaks and enduring high temperatures), and sophisticated electronic components (sensors, solenoids, and piezoelectric actuators for high-speed control). The quality and reliability of these upstream components directly dictate the performance characteristics, lifespan, and competitive positioning of the final spray valve product. Manufacturers often engage in long-term contractual relationships with certified suppliers to ensure material traceability and consistency, given the stringent quality requirements of end-user industries like aerospace and medical devices.

The Midstream component focuses on the core activities of design, engineering, manufacturing, and assembly. This stage involves complex fluid dynamics modeling, precision CNC machining of valve bodies and nozzles, assembly in cleanroom environments (especially for electronics-grade valves), and rigorous quality testing. Value is primarily added through proprietary nozzle geometries that maximize transfer efficiency and minimize overspray, and the development of intelligent control systems integrated directly into the valve body. Leading valve manufacturers often invest heavily in R&D to develop patented actuation mechanisms, particularly in piezoelectric technology, which offers superior speed and repeatability compared to traditional pneumatic or solenoid approaches. Successful midstream operations are characterized by efficient, lean manufacturing processes that allow for customization while maintaining high-volume production capabilities.

The Downstream analysis covers distribution channels and end-user engagement. Distribution is multifaceted, involving both Direct and Indirect channels. Large, multinational valve manufacturers often utilize Direct sales teams and application engineers to handle complex custom orders, large-scale projects, and provide extensive post-sales technical support, particularly in highly specialized sectors like aerospace and semiconductor manufacturing. Indirect distribution relies on a network of specialized industrial distributors, automation integrators, and system builders who package the spray valves with robotic arms, controllers, and fluid metering systems to deliver complete turnkey solutions to SMEs and general manufacturing clients. The choice between direct and indirect channels is often dictated by the complexity of the application and the geographical spread of the customer base, with indirect channels proving crucial for market penetration in geographically diverse regions and local customer support.

Industrial Spray Valves Market Potential Customers

The potential customers for the Industrial Spray Valves Market represent a broad and diverse spectrum of manufacturing and processing industries, all sharing the common need for precise, controlled application of fluids, coatings, or adhesives. These end-users, or buyers, are typically large manufacturing entities, specialized contract manufacturers, and system integrators who incorporate these valves into larger automated dispensing or coating systems. The largest and most consistent buying segment remains the Automotive industry, encompassing OEMs and Tier 1 suppliers who purchase valves for various high-volume processes: body coating (E-coat and topcoat application), precision sealing (hem flanges and interior seams), and applying specialized functional fluids like high-temperature lubricants and sound-dampening materials. The necessity of maintaining impeccable finish quality and vehicle longevity ensures continuous demand for state-of-the-art spray technology capable of flawless operation under demanding conditions.

A rapidly expanding segment of potential customers is the Electronics and Semiconductor industry. Buyers here include manufacturers of printed circuit boards (PCBs), display panels, microchips, and electronic assemblies, who require ultra-precise micro-dispensing capabilities. These customers invest heavily in piezoelectric and micro-jetting valves to accurately dispense flux, solder mask, underfill epoxies, and conformal coatings onto highly miniaturized and sensitive components. The key purchasing criteria in this sector are speed, non-contact operation, and the ability to dispense volumes down to the nanoliter range with exceptional repeatability. As consumer electronics become smaller and more complex, the demand for highly specialized, miniaturized spray valve solutions from this customer base will continue to drive premium pricing and technological innovation within the market.

Furthermore, other significant potential buyers include manufacturers in the Aerospace and Defense sector, where functional coatings, sealants, and fire-retardant materials must be applied with certified precision and documentation for safety-critical components. The Food and Beverage industry also constitutes a key customer group, utilizing spray valves for sanitation processes, applying release agents to baking molds, and precisely distributing flavorings or oils onto processed foods in high-speed production environments where hygiene and cleanability are paramount design requirements. The market is also supported by General Industrial Manufacturing and Machinery producers who require valves for lubrication, cooling, and industrial cleaning applications, confirming that the customer base is fundamentally tied to the health and growth of global industrial output and manufacturing complexity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Graco Inc., ITW Industrial Spray, Dürr Group, Saint-Gobain S.A., Loctite (Henkel), Gema Switzerland GmbH (Graco Inc.), Exel Industries, Spraying Systems Co., Fisnar Inc., PVA (Precision Valve & Automation), Sono-Tek Corporation, Techcon Systems, Asymtek (Nordson Corporation), I&J Fisnar (ITW), Eisenmann SE, Amsler & Frey AG, C.A. Technologies, Sames Kremlin, Sealant Equipment & Engineering Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Spray Valves Market Key Technology Landscape

The Industrial Spray Valves Market is characterized by continuous technological evolution aimed at enhancing precision, increasing speed, and improving material transfer efficiency, often driven by the demands of complex, high-mix manufacturing environments. A critical technological trend is the proliferation of piezoelectric jetting technology, moving away from traditional contact dispensing or slower pneumatic actuation. Piezoelectric valves utilize rapid electrical signals to deform a ceramic element, ejecting highly accurate droplets of fluid without physical contact between the valve and the substrate. This non-contact micro-dispensing capability is indispensable in the electronics sector for applying high-viscosity, expensive materials like underfill and conductive adhesives onto delicate components at speeds often exceeding 1,000 deposits per second, providing substantial competitive advantages in speed and quality consistency over conventional methods.

Another pivotal area in the technology landscape is the integration of Smart Valve technology, fueled by the push towards Industry 4.0 connectivity. Modern industrial spray valves are increasingly equipped with integrated sensors that monitor critical operating parameters such as fluid temperature, pressure, flow rate, and even vibrational patterns. These sensors feed real-time data back to centralized control systems or the cloud, enabling closed-loop feedback mechanisms. This level of digitalization allows for automatic, dynamic adjustment of valve settings to compensate for variations in ambient conditions or material batches, ensuring highly reliable, repeatable performance. Furthermore, connectivity standards like IO-Link are simplifying the integration of these sophisticated valves into diverse industrial networks, reducing commissioning time and facilitating predictive maintenance strategies based on operational data analysis.

The ongoing development in nozzle and material science also forms a significant part of the technology landscape. Manufacturers are investing heavily in computational fluid dynamics (CFD) modeling to design specialized nozzle geometries that maximize atomization and pattern uniformity while minimizing overspray and air consumption, leading to superior material utilization, especially for paints and specialized coatings. Concurrently, there is increased use of advanced materials such as ceramics, specialized polymers, and high-grade carbides in valve construction. These materials significantly extend the operational life of the valves by offering superior resistance to wear, erosion, and chemical attack from highly corrosive industrial fluids, thereby reducing maintenance downtime and the total cost of ownership in demanding applications like pharmaceutical and chemical processing environments. The confluence of micro-actuation, IoT integration, and material innovation defines the cutting-edge of the industrial spray valve technology sector.

Regional Highlights

Regional analysis of the Industrial Spray Valves Market demonstrates distinct patterns of adoption and growth dictated by local manufacturing maturity, automation levels, and specific industrial focus. Asia Pacific (APAC) currently holds the dominant market share and is projected to exhibit the highest growth rate during the forecast period. This dominance is intrinsically linked to the immense scale and rapid expansion of manufacturing capabilities, particularly in China, India, South Korea, and Japan, covering high-volume production for consumer electronics, automotive components, and heavy machinery. The region’s aggressive push toward factory automation to manage rising labor costs and increase efficiency fuels the consistent demand for advanced, high-speed dispensing and coating solutions, positioning APAC as the primary global hub for production volume and technological deployment in industrial spray valves.

North America and Europe represent mature, yet highly valuable, markets characterized by stringent quality controls, robust regulatory frameworks, and a high concentration of high-value manufacturing sectors such as aerospace, medical devices, and precision engineering. While growth is slower compared to APAC, the demand focuses heavily on premium, technologically advanced valves—specifically micro-dispensing and AI-integrated systems—that cater to high-precision and safety-critical applications. These regions drive innovation in specialized materials and custom automation integration, emphasizing traceability and compliance features. Replacement cycles and industrial upgrades aimed at enhancing sustainability (reducing VOC emissions and material waste) are key drivers sustaining the robust demand for energy-efficient and highly accurate spray valve replacements in these established industrial economies.

Latin America, and the Middle East and Africa (MEA), represent emerging markets with substantial long-term growth potential. In Latin America, expansion in automotive assembly and regional manufacturing bases creates a growing need for foundational and medium-complexity spray valve systems. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees increasing demand driven by large-scale infrastructure projects, expansion in localized manufacturing, and investment in petrochemical and energy-related industries, which require robust, corrosion-resistant valve technologies for coating and sealing applications. As industrialization accelerates and regional governments prioritize diversification away from commodity exports, the adoption of modern, automated fluid application systems will rapidly increase, opening new avenues for market entry and localized distribution network expansion for global spray valve manufacturers.

- Asia Pacific (APAC): Dominates the market due to expansive electronics and automotive manufacturing bases, driven by high volume and aggressive automation adoption in China and South Korea.

- North America: Focuses on high-value segments like aerospace and medical devices, prioritizing advanced micro-dispensing technologies and integration with smart factory ecosystems.

- Europe: High demand driven by strict environmental regulations and the need for precision in high-end automotive and machinery sectors; strong focus on energy efficiency and material saving.

- Latin America: Emerging market growth fueled by expanding automotive assembly operations and general industrial production upgrades.

- Middle East and Africa (MEA): Growth potential linked to infrastructure development, petrochemical industries, and regional industrial diversification efforts requiring robust sealing and coating solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Spray Valves Market.- Nordson Corporation

- Graco Inc.

- ITW Industrial Spray

- Dürr Group

- Saint-Gobain S.A.

- Loctite (Henkel)

- Gema Switzerland GmbH (Graco Inc.)

- Exel Industries

- Spraying Systems Co.

- Fisnar Inc.

- PVA (Precision Valve & Automation)

- Sono-Tek Corporation

- Techcon Systems

- Asymtek (Nordson Corporation)

- I&J Fisnar (ITW)

- Eisenmann SE

- Amsler & Frey AG

- C.A. Technologies

- Sames Kremlin

- Sealant Equipment & Engineering Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Spray Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-precision industrial spray valves?

The primary driver is the accelerating trend of manufacturing automation and Industry 4.0 integration, which necessitates repeatable, ultra-precise fluid application (coatings, adhesives, lubricants) to ensure zero-defect production and optimize material utilization across sectors like electronics and automotive.

How do piezoelectric spray valves differ from traditional pneumatic valves, and where are they most commonly used?

Piezoelectric valves use electrical signals for rapid, non-contact jetting, offering superior speed and precision (nanoliter volumes) compared to traditional pneumatic valves which rely on pressurized air for atomization. Piezoelectric technology is predominantly used in high-tech electronics, semiconductor manufacturing, and medical device assembly for micro-dispensing critical fluids.

What major restraining factor affects the widespread adoption of advanced spray valve systems, particularly for smaller companies?

The high initial capital investment required for purchasing and integrating advanced, intelligent spray valve systems, along with the necessity for specialized technical training and system integration expertise, acts as a significant financial restraint, especially for Small and Medium-sized Enterprises (SMEs).

Which geographic region currently leads the Industrial Spray Valves Market, and why?

The Asia Pacific (APAC) region leads the market, driven by the massive scale of its manufacturing base, particularly in automotive and consumer electronics production in countries like China and South Korea, which are aggressively adopting high-throughput automated dispensing solutions.

What role does Artificial Intelligence (AI) play in modern industrial spray valve operations?

AI integrates with smart valves and vision systems to enable real-time parameter optimization (pressure, flow rate) based on sensor feedback. This capability facilitates predictive maintenance, minimizes material waste through optimized spray patterns, and ensures sustained product quality consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager