Industrial Stainless Steel Strips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431612 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Stainless Steel Strips Market Size

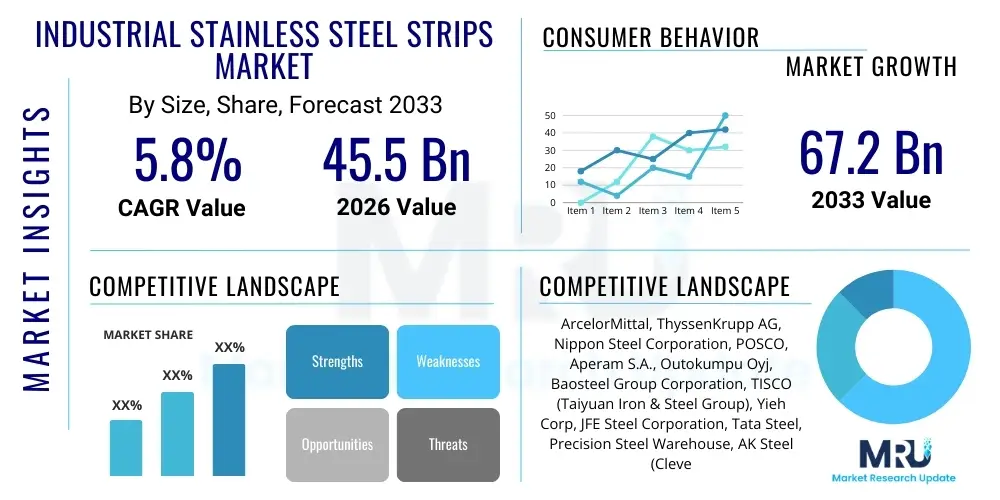

The Industrial Stainless Steel Strips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 67.2 Billion by the end of the forecast period in 2033.

Industrial Stainless Steel Strips Market introduction

The Industrial Stainless Steel Strips Market encompasses the manufacturing, distribution, and utilization of thin, long, flat sections of stainless steel, characterized by high corrosion resistance, excellent strength-to-weight ratio, and superior aesthetic qualities. These strips are predominantly produced via cold rolling processes after initial hot rolling, ensuring precise dimensional tolerances and smooth surface finishes suitable for demanding industrial applications. Stainless steel strips are typically categorized based on their thickness, width, and the specific alloy composition, such as Austenitic (300 series), Ferritic (400 series), or Duplex grades, each offering distinct mechanical and chemical properties tailored to specific end-use requirements. This foundational material is indispensable across heavy manufacturing and high-tech sectors, forming critical components in everything from household appliances to sophisticated aerospace structures.

Major applications driving the demand for industrial stainless steel strips include automotive manufacturing, particularly in exhaust systems and structural components requiring heat and corrosion resistance; construction, where they are utilized for architectural cladding, roofing, and structural reinforcement; and the electrical and electronics sector, essential for producing connectors, springs, and precision stamped parts. The intrinsic benefits of stainless steel—including its longevity, minimal maintenance requirement, and 100% recyclability—cement its status as a preferred material over conventional carbon steel in environments subject to moisture, chemical exposure, or high temperatures. Furthermore, advancements in specialized surface treatments and ultra-thin gauge production are expanding the addressable market for these products into niche, high-value segments.

Driving factors for sustained market growth include rapid urbanization and infrastructure development globally, particularly in emerging economies of Asia Pacific, necessitating robust and durable construction materials. The stringent regulatory push towards enhanced fuel efficiency and reduced emissions in the automotive sector mandates the use of lightweight, high-strength materials, favoring advanced stainless steel strips. Additionally, the flourishing medical device manufacturing industry, which relies heavily on high-grade, sterile, and non-reactive stainless steel for surgical instruments and implants, contributes significantly to market expansion. Technological innovations focused on producing advanced grades, such as high-nitrogen austenitic strips, further bolster market dynamics by offering superior performance characteristics.

Industrial Stainless Steel Strips Market Executive Summary

The Industrial Stainless Steel Strips Market is experiencing robust growth fueled by accelerated infrastructural spending, particularly across the Asia Pacific region, and technological upgrades in key end-use industries like automotive and electrical appliances. Business trends indicate a strong focus on capacity expansion, especially for cold-rolled products, alongside strategic mergers and acquisitions aimed at consolidating market share and accessing specialized alloy production capabilities. Manufacturers are increasingly investing in sophisticated rolling mills and annealing lines to achieve tighter dimensional tolerances and superior surface finishes, catering to the growing demand for precision components used in complex electronic assemblies and high-performance machinery. Furthermore, sustainability has become a central theme, prompting producers to optimize energy consumption during manufacturing and highlight the high recycled content of stainless steel products to align with global environmental mandates.

Regional trends reveal Asia Pacific maintaining its dominance, driven by massive consumption from China and India's burgeoning manufacturing and construction sectors. North America and Europe, while characterized by mature industrial bases, exhibit steady demand, primarily driven by the aerospace, medical, and specialized industrial machinery sectors that require premium and customized strip products. These Western markets are also leading innovation in advanced surface engineering and specialized corrosion-resistant grades. Segment trends highlight that the 300 series (Austenitic) stainless steel continues to hold the largest market share due to its versatility and superior welding characteristics, though the demand for Duplex stainless steel strips is growing fastest, favored in oil and gas and chemical processing due to its enhanced resistance to pitting and stress corrosion cracking.

The market faces challenges related to volatile raw material costs, specifically nickel and chrome, which directly impact production economics and pricing stability. However, the opportunity lies in the rapid adoption of thinner gauge strips (foils) for battery casings and flexible electronics, opening up entirely new application domains. Strategic imperative for market players involves supply chain resilience, vertical integration, and aggressive participation in circular economy models to secure cost advantages and meet evolving regulatory and customer expectations. The confluence of high-performance material demand and global economic recovery positions the stainless steel strips market for sustained upward trajectory through 2033.

AI Impact Analysis on Industrial Stainless Steel Strips Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Stainless Steel Strips Market frequently center on themes of operational efficiency, predictive quality control, supply chain optimization, and the potential for autonomous production lines. Users are keenly interested in how machine learning algorithms can minimize defects during the cold-rolling process, a critical factor for high-precision strips, and how AI-driven demand forecasting can mitigate the risks associated with volatile raw material prices and inventory management. Key concerns often revolve around the high initial investment required for sensor implementation and data infrastructure necessary to support AI systems, and the need for specialized training for the existing workforce to manage complex automated operations. The general expectation is that AI will revolutionize metallurgy and production scheduling, leading to significant cost reductions and unprecedented material quality consistency, crucial for advanced end-use sectors like aerospace and microelectronics.

- AI-driven predictive maintenance optimizes rolling mill uptime, reducing unplanned shutdowns by forecasting equipment failure based on real-time sensor data analysis.

- Machine Learning (ML) algorithms enhance quality control by analyzing surface finish, thickness variation, and mechanical properties instantaneously, minimizing off-spec production waste.

- AI-enabled demand forecasting improves raw material procurement (nickel, chromium, scrap steel) strategies, stabilizing inventory levels against market price volatility.

- Generative Design supported by AI is accelerating the development of novel stainless steel alloys with improved strength and corrosion characteristics for specialized strips.

- Autonomous production planning and scheduling systems optimize energy consumption during annealing and rolling processes, contributing to lower operational costs and improved sustainability metrics.

- Digital twins of rolling lines allow for virtual testing of new production parameters, accelerating process optimization without impacting physical manufacturing runs.

DRO & Impact Forces Of Industrial Stainless Steel Strips Market

The Industrial Stainless Steel Strips Market is strongly influenced by dynamic interplay between robust demand drivers stemming from infrastructure modernization and technological advancements, significant restraints posed by raw material price volatility and high energy intensity of production, and promising opportunities arising from specialized applications and sustainable manufacturing mandates. Key drivers include accelerating global construction activities, the persistent need for corrosion-resistant materials in harsh environments (e.g., marine, chemical processing), and the expansion of the electrical and electronics sector requiring precise, thin-gauge metal parts. These factors collectively push manufacturers towards higher production volumes and technological refinement, ensuring market buoyancy. However, the market’s reliance on global commodity markets, particularly for ferroalloys, introduces substantial price risk, which acts as a major restraint on long-term capital planning and stable pricing mechanisms for end-users. Furthermore, stringent environmental regulations regarding carbon emissions pressure producers to invest heavily in low-carbon production technologies.

Opportunities are centered around the rapid proliferation of high-performance specialized segments, such as Duplex and Super Duplex stainless steel strips, which command premium pricing due to their use in demanding oil and gas, desalination, and renewable energy infrastructure projects. The shift toward electric vehicles (EVs) creates new avenues for thinner, high-strength stainless steel strips used in battery enclosures and structural safety components. Furthermore, the adoption of Industry 4.0 and digital transformation across the value chain presents opportunities for improving efficiency and product quality, thereby enhancing competitive advantages. The impact forces indicate a highly competitive landscape where innovation in alloy composition and manufacturing efficiency are critical determinants of market success. The overall net impact remains moderately positive, propelled primarily by indispensable material demand across foundational global industries, despite significant cost pressures from the input side.

The market equilibrium is constantly being redefined by external economic conditions; for instance, global trade disputes or sudden shifts in mining output for key alloying elements can instantly reshape cost structures. Therefore, strategic sourcing and establishing long-term supplier agreements are paramount for mitigating restraints. Ultimately, the market trajectory is highly sensitive to the economic health of the major consuming nations, particularly China and the US, where industrial output dictates the immediate consumption rate of stainless steel strips across all primary grades and dimensions. Successful navigation requires flexibility in production schedules and a strong focus on differentiating product offerings through enhanced material performance characteristics.

Segmentation Analysis

The Industrial Stainless Steel Strips Market is comprehensively segmented based on product type (differentiated primarily by the method of manufacture and resulting mechanical properties), material grade (defined by alloy composition), thickness, and end-use application. Analyzing these segments provides crucial insights into consumption patterns and growth pockets. The segmentation by product type typically separates Cold Rolled Stainless Steel Strips from Hot Rolled Stainless Steel Strips; Cold Rolled strips dominate in terms of value due to their superior finish, tighter tolerance, and application in high-precision industries like automotive and electronics. Material grade segmentation highlights the dominance of the Austenitic series (e.g., 304, 316) due to its pervasive use across multiple general industrial applications requiring good weldability and corrosion resistance. Strategic market focus often shifts towards niche segments like Duplex grades, driven by demand for extreme performance materials in specific chemical and marine environments.

- By Product Type:

- Cold Rolled Stainless Steel Strips

- Hot Rolled Stainless Steel Strips

- By Material Grade:

- Austenitic (300 Series)

- Ferritic (400 Series)

- Martensitic

- Duplex

- Others (Precipitation Hardening, etc.)

- By Thickness:

- Thin Gauge Strips (Below 0.5 mm)

- Medium Gauge Strips (0.5 mm to 3 mm)

- Thick Gauge Strips (Above 3 mm)

- By End-Use Application:

- Automotive and Transportation

- Construction and Infrastructure

- Electrical and Electronics

- Industrial Machinery

- Consumer Goods and Appliances

- Chemical, Oil & Gas

- Medical and Precision Engineering

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Industrial Stainless Steel Strips Market

The value chain for industrial stainless steel strips is initiated at the upstream stage, which involves the mining and processing of essential raw materials—primarily iron ore, chromium, nickel, and molybdenum—and the sourcing of stainless steel scrap. Efficiency and stable pricing at this stage are critical, as the cost of ferroalloys constitutes the major portion of the final product cost. Key upstream activities include the production of stainless steel slab/billet through electric arc furnaces (EAF) or Argon Oxygen Decarburization (AOD) processes, emphasizing effective scrap utilization and alloying element management. Downstream processes involve the specialized transformation of these raw forms into strips through hot rolling (for initial thickness reduction) followed by cold rolling, which provides the final dimensional precision, surface finish, and mechanical properties necessary for industrial use. Annealing and pickling are vital intermediate steps to relieve stress and clean the surface.

The distribution channel represents a crucial intermediary stage where manufactured strips move from primary producers to final end-users. Direct sales are common for large-volume, high-specification orders, particularly to major automotive OEMs, integrated machinery manufacturers, and large-scale construction projects. This direct model ensures specialized technical support and customized supply chain logistics. Conversely, indirect distribution utilizes a network of specialized metal service centers, independent distributors, and traders, particularly for smaller orders, customized widths/lengths, or just-in-time inventory requirements. Service centers play a pivotal role by stocking diverse grades, performing secondary processing like slitting, leveling, and cutting to tailored dimensions, thereby adding significant value before reaching the ultimate buyer.

Downstream analysis focuses on the final consumption and fabrication activities undertaken by end-users. Fabricators utilize stainless steel strips for stamping, deep drawing, welding, and assembly into finished products such as heat exchangers, automotive mufflers, appliance components, and electronic device casings. The performance and quality demands imposed by these end-users—such as surface flatness for electronic parts or high fatigue strength for machinery springs—dictate the specifications required from the upstream manufacturers. The strong linkages between material technology development and end-user innovation mean that collaborations across the value chain are necessary to introduce new high-performance materials efficiently.

Industrial Stainless Steel Strips Market Potential Customers

Potential customers for industrial stainless steel strips represent a broad spectrum of high-value manufacturing and infrastructure sectors that require materials offering superior corrosion resistance, high tensile strength, and long-term durability. The largest segment of buyers includes Tier 1 and Tier 2 suppliers within the Automotive and Transportation industry, procuring strips for exhaust systems, catalytic converter components, structural body parts, and increasingly, battery enclosures in electric vehicles, demanding high-strength martensitic and ferritic grades. Another significant group comprises major Construction and Infrastructure developers, utilizing strips for architectural elements, cladding, modern roofing systems, and internal structural elements in demanding environments like coastal areas or chemical plants, often requiring austenitic grades like 316.

Beyond the high-volume sectors, the market targets specialized industrial end-users. This includes manufacturers of sophisticated Industrial Machinery and heavy equipment, requiring durable strips for precision components, gaskets, and springs capable of operating under high pressure or temperature. The Chemical, Petrochemical, Oil & Gas industry constitutes a premium customer base, specifically demanding Duplex and Super Duplex strips for storage tanks, pipes, and heat exchanger components where resistance to stress corrosion cracking is non-negotiable. Furthermore, the Electrical and Electronics sector, encompassing producers of household appliances, telecommunications hardware, and precision electronic connectors, relies on thin-gauge, highly finished strips for delicate yet robust internal parts.

The Medical and Pharmaceutical sectors form a critical, albeit smaller, segment of high-specification buyers. These customers demand highly sterile and biologically inert stainless steel, typically high-grade 304 or 316, for manufacturing surgical instruments, implants, and sterile equipment casings, where material traceability and surface quality are paramount regulatory requirements. Finally, metal service centers act as indirect buyers, purchasing large coils from primary producers and selling smaller, customized lots to a diverse array of small and medium-sized enterprises (SMEs) across various manufacturing domains, fulfilling localized and specialized fabrication needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 67.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, ThyssenKrupp AG, Nippon Steel Corporation, POSCO, Aperam S.A., Outokumpu Oyj, Baosteel Group Corporation, TISCO (Taiyuan Iron & Steel Group), Yieh Corp, JFE Steel Corporation, Tata Steel, Precision Steel Warehouse, AK Steel (Cleveland-Cliffs Inc.), Jindal Stainless Limited, Sandvik Materials Technology, Viraj Profiles Private Limited, Bristol Metals LLC, Penn Stainless Products, Schmolz + Bickenbach Group, Ulbrich Stainless Steels & Special Metals, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Stainless Steel Strips Market Key Technology Landscape

The Industrial Stainless Steel Strips market is characterized by a mature yet continuously evolving technological landscape, primarily focused on enhancing production efficiency, achieving superior mechanical properties, and minimizing environmental impact. Core processing technologies include Advanced Cold Rolling Mills (Sendzimir or 20-High mills) which utilize sophisticated automatic gauge control (AGC) systems to ensure extremely tight thickness tolerances (down to micron levels) and superior flatness required for precision stamping and electronic applications. These mills often incorporate continuous annealing and pickling lines (CAPL) integrated directly with the rolling process, which significantly reduces processing time and handling costs, while ensuring optimal material microstructure uniformity across the entire strip length. Furthermore, advancements in specialized roll texts and surface finishing techniques, such as Bright Annealing (BA), are crucial for catering to cosmetic and high-hygiene applications like consumer goods and medical devices.

In terms of material development, significant technological focus is placed on refining alloy composition and processing routes for high-performance strips. This includes advanced thermo-mechanical processing (TMP) strategies tailored for Duplex and Super Duplex stainless steels, ensuring the optimal balance of Austenitic and Ferritic phases necessary for extreme corrosion resistance and high strength. Research is heavily invested in High-Nitrogen Austenitic stainless steels, which offer enhanced strength and pitting resistance without relying excessively on expensive alloying elements like Nickel. Coating technologies, such as thin-film deposition or specialized oxidation treatments, are also gaining traction to provide supplementary resistance to wear, heat, or specific chemical agents, extending the functional application range of standard strips into niche industrial environments.

Digitalization and automation are transforming the technological baseline of the market. The integration of sensors, big data analytics, and Artificial Intelligence (AI) for real-time monitoring of casting, rolling, and annealing parameters is becoming standard practice. This data-driven approach allows for dynamic process correction, leading to substantial reduction in material scrap and energy use. Furthermore, the adoption of laser welding and plasma cutting technologies for secondary processing within service centers enables customized strip dimensions with unparalleled accuracy and minimal heat-affected zones (HAZ). Overall, the technological focus is shifting from simple capacity expansion to intelligence-driven production, emphasizing material quality, process efficiency, and environmental compliance.

Regional Highlights

The global Industrial Stainless Steel Strips market exhibits significant regional variations in terms of consumption volume, production capacity, and technological sophistication, primarily dictated by regional economic growth and the maturity of local end-use industries.

- Asia Pacific (APAC): Dominates the global market, accounting for the largest share in both production and consumption. Growth is spearheaded by industrial giants like China and India, driven by massive infrastructure investments, rapid expansion of domestic automotive manufacturing (including electric vehicle production), and burgeoning consumer electronics assembly hubs. The region benefits from lower production costs and substantial domestic demand for standard grades (300 series), though demand for high-grade, specialized strips is also rapidly increasing, particularly in Japan and South Korea, which focus on high-precision exports.

- Europe: Characterized by high technological standards and strong demand for specialized, high-performance strips. Consumption is focused on premium applications in aerospace, specialized machinery, and high-end automotive components where strict quality certifications are required. Key countries like Germany, Italy, and Sweden are leaders in producing Duplex and customized stainless steel alloys. Regulatory emphasis on circular economy and sustainable production pushes manufacturers toward efficient, low-carbon processes.

- North America: A mature market defined by steady demand, driven primarily by the high-value manufacturing segments such as oil and gas processing (demanding high-nickel and Duplex strips), medical devices, and heavy industry. While domestic production focuses on specialized and standard grades, the region is a significant importer of bulk standard strips. Market stability is supported by stable domestic demand and stringent quality requirements across all industrial sectors.

- Latin America: Represents an emerging growth market, closely tied to fluctuations in commodity prices and internal infrastructure spending, particularly in Brazil and Mexico. Demand is steadily increasing for basic and medium-grade strips used in construction, automotive parts, and general industrial fabrication, supported by regional trade agreements and localized manufacturing initiatives.

- Middle East and Africa (MEA): Growth in this region is strongly correlated with upstream oil and gas investment, coupled with significant desalination projects and large-scale urban development initiatives (e.g., in the GCC countries). The demand is particularly high for corrosion-resistant strips, including 316 and Duplex grades, necessary to withstand extreme desert and marine environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Stainless Steel Strips Market.- ArcelorMittal

- ThyssenKrupp AG

- Nippon Steel Corporation

- POSCO

- Aperam S.A.

- Outokumpu Oyj

- Baosteel Group Corporation

- TISCO (Taiyuan Iron & Steel Group)

- JFE Steel Corporation

- Tata Steel

- Precision Steel Warehouse

- AK Steel (Cleveland-Cliffs Inc.)

- Jindal Stainless Limited

- Sandvik Materials Technology

- Viraj Profiles Private Limited

- Bristol Metals LLC

- Penn Stainless Products

- Schmolz + Bickenbach Group

- Ulbrich Stainless Steels & Special Metals, Inc.

- Yieh Corp

Frequently Asked Questions

Analyze common user questions about the Industrial Stainless Steel Strips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Industrial Stainless Steel Strips Market?

The primary factor driving market growth is the accelerating global infrastructure and construction spending, coupled with stringent requirements for corrosion-resistant materials in the automotive (especially EVs) and chemical processing sectors. Asia Pacific's massive industrialization is a key consumption engine.

How are stainless steel strips differentiated by grade and application?

Strips are differentiated primarily by material grade. Austenitic (300 Series) strips are used for general fabrication and appliances due to good formability, while Ferritic (400 Series) is common in automotive exhausts. Duplex grades offer enhanced strength and corrosion resistance, specifically used in harsh environments like oil rigs and chemical plants.

What is the significance of Cold Rolled Strips versus Hot Rolled Strips?

Cold Rolled Stainless Steel Strips are highly significant as they offer superior surface finish, tighter dimensional tolerances (crucial for precision stamping), and enhanced mechanical properties compared to Hot Rolled Strips, making them indispensable for high-value applications in electronics, medical, and high-performance automotive parts.

What technological trends are impacting the production efficiency of stainless steel strips?

Key technological impacts include the adoption of Advanced Cold Rolling Mills with Automatic Gauge Control (AGC) for precision, and the integration of AI and machine learning for predictive maintenance and real-time quality control, which minimizes defects and optimizes energy consumption during annealing and rolling processes.

Which geographical region holds the largest market share for Industrial Stainless Steel Strips?

Asia Pacific (APAC) currently holds the largest market share, predominantly due to the high production and consumption volume driven by major industrial economies like China and India, fueling demand across construction, machinery, and consumer goods manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager