Industrial Standard Fastener Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431999 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Standard Fastener Market Size

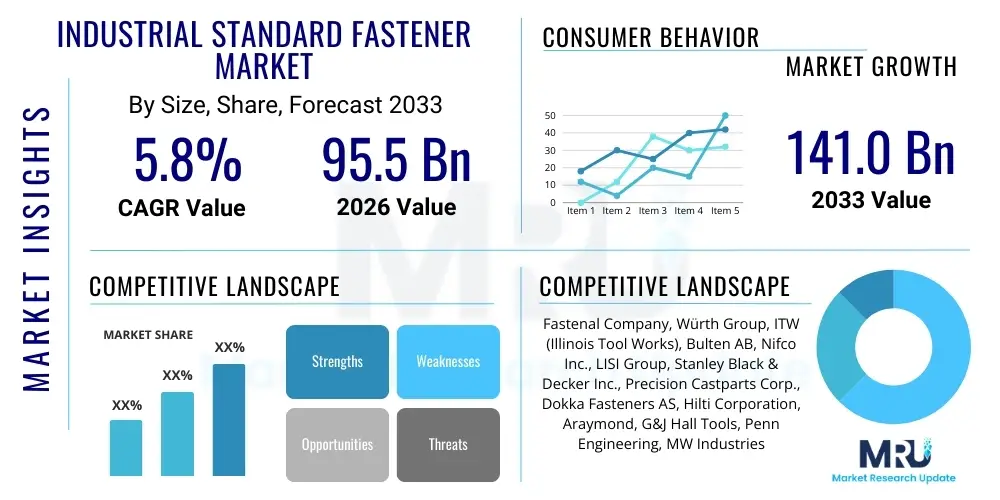

The Industrial Standard Fastener Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 95.5 Billion in 2026 and is projected to reach USD 141.0 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the robust recovery and subsequent growth of major end-user industries globally, including automotive, construction, and heavy machinery manufacturing. The increasing complexity of modern manufacturing processes, which necessitate high-performance, standardized joining solutions, contributes significantly to market resilience and valuation.

Industrial Standard Fastener Market introduction

The Industrial Standard Fastener Market encompasses a broad range of mechanical components designed to join two or more objects, primarily utilizing threading, adhesion, or friction. These essential components include bolts, screws, nuts, rivets, washers, studs, and specialized standard parts manufactured according to international specifications (such as ISO, DIN, ANSI). These fasteners are indispensable across almost every manufacturing and assembly sector, providing structural integrity and ease of disassembly for maintenance. The market serves both Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) sectors, forming the backbone of global industrial production.

The primary applications of industrial standard fasteners span critical infrastructure projects, transportation manufacturing, and general engineering. In the automotive sector, high-tensile fasteners are crucial for engine assembly and chassis construction, while specialized lightweight materials are increasingly adopted in electric vehicles (EVs) and aerospace applications to reduce overall weight and enhance fuel efficiency or battery range. Furthermore, the burgeoning wind energy and solar power installation segments represent significant high-growth opportunities, demanding fasteners with superior corrosion resistance and durability to withstand harsh environmental conditions over extended operational lifetimes. These applications necessitate adherence to stringent quality controls and material certifications, driving innovation in surface treatments and material science.

Key benefits driving market adoption include the inherent reliability, standardization, and cost-effectiveness of these components. Standardization facilitates global interchangeability and simplifies supply chain management for multi-national corporations. Major driving factors include increased global infrastructure spending, particularly in developing economies, the continued shift towards lightweighting in transport industries, and the integration of automated assembly lines, which require consistent, high-precision standard fasteners. Technological advancements, such as the introduction of smart fasteners equipped with sensors for tension monitoring, are also enhancing the utility and value proposition of these products in critical structural applications, ensuring predictive maintenance and improved safety profiles.

Industrial Standard Fastener Market Executive Summary

The Industrial Standard Fastener Market is characterized by intense competition, driven primarily by raw material cost volatility, technological shifts towards lighter materials, and significant regional disparities in manufacturing output. Business trends indicate a strong move toward specialized, high-performance fasteners, particularly those made from titanium, specialized alloys, and carbon composites, addressing the demands from high-stress environments like aerospace and precision machinery. Consolidation among major players continues as companies seek economies of scale and vertical integration to mitigate supply chain risks and stabilize pricing structures. Furthermore, sustainability and regulatory compliance, especially concerning end-of-life disposal and material traceability, are emerging as crucial competitive differentiators, influencing purchasing decisions across regulated industries.

Regional trends highlight the Asia Pacific (APAC) region as the dominant manufacturing hub, accounting for the largest market share due to the concentration of automotive, consumer electronics, and heavy machinery production, particularly in China, India, and Japan. North America and Europe, while slower in terms of sheer volume growth, command higher Average Selling Prices (ASPs) due to stringent quality requirements and a greater emphasis on specialty, high-tensile, and corrosion-resistant fasteners utilized in aerospace, defense, and high-end automotive manufacturing. Investment in Industry 4.0 initiatives across these developed regions is spurring demand for digitally traceable and precision-engineered fastening solutions, optimizing automated assembly processes.

Segment trends reveal that the product type segment is heavily dominated by externally threaded fasteners (bolts and screws), essential for structural connections. However, the internally threaded components (nuts) segment is experiencing parallel growth. Material analysis indicates steel remains the primary material source, but the fastest growth trajectory is observed in lightweight materials like aluminum alloys and titanium, driven by aerospace and EV lightweighting objectives. The end-use segment demonstrates robust performance in the automotive industry, particularly the transition to EV platforms, which requires specialized vibration-dampening fasteners. The construction segment also exhibits resilience, fueled by massive government investments in sustainable infrastructure projects worldwide, demanding durable and reliable fastening solutions for bridges, high-rise buildings, and modular construction systems.

AI Impact Analysis on Industrial Standard Fastener Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Standard Fastener Market predominantly revolve around three critical areas: optimizing the complex supply chain, enhancing fastener quality and inspection, and implementing predictive maintenance protocols for installed fasteners. Users are concerned about how AI-driven demand forecasting will manage the volatility of raw material prices (steel, aluminum) and prevent stockouts of critical components. Furthermore, the potential for AI-powered visual inspection systems to replace traditional manual quality control—identifying microscopic defects in threading or coating applications at high speed—is a major focus, driven by the need for zero-defect output in safety-critical applications like aerospace and medical devices. Finally, the long-term potential of integrating sensors (smart fasteners) with AI platforms to monitor bolt tension and structural health in real-time, thereby maximizing operational lifespan and reducing catastrophic failure risks, represents a key area of expectation and investment focus for end-users seeking enhanced operational reliability.

The integration of machine learning algorithms is fundamentally reshaping the manufacturing floor within the fastener industry. AI models are now being deployed to optimize press machine parameters, heat treatment cycles, and coating deposition processes, reducing material wastage and energy consumption while ensuring highly consistent mechanical properties across massive production runs. This shift towards AI-enhanced process control directly addresses the core industrial challenge of maintaining high-volume production efficiency without compromising the precise tolerances required for high-stress applications. Consequently, AI acts not only as a quality control tool but as a catalyst for sustainable, high-precision manufacturing, lowering the long-term cost of production for specialized fasteners.

In the downstream market, AI is revolutionizing inventory and procurement management. Sophisticated neural networks analyze thousands of variables—including seasonal demand, geopolitical events affecting raw material extraction, commodity trading prices, and historical performance data—to generate highly accurate demand forecasts. This capability allows manufacturers and large distributors to minimize expensive safety stock while ensuring the availability of critical standard fasteners, mitigating the risks associated with global supply chain fragmentation. Additionally, AI-driven sorting and packaging systems are accelerating the fulfillment process for diverse MRO orders, improving efficiency and reducing human error in the highly variable aftermarket segment.

- AI-Enhanced Predictive Maintenance: Utilizing sensor data from smart fasteners to predict tension loss or material fatigue, ensuring proactive replacement and minimizing structural failure risk.

- Supply Chain Optimization: Machine learning algorithms forecasting material demand and predicting raw material price fluctuations (steel, zinc, nickel) to optimize procurement strategies.

- Automated Quality Inspection: Deployment of AI-powered vision systems for high-speed, non-destructive inspection of thread dimensions, coating thickness, and surface integrity, ensuring zero-defect compliance.

- Process Parameter Optimization: ML models adjusting cold forming, heat treatment, and coating processes in real-time to maximize material yield and tensile strength consistency.

- Digital Fastener Traceability: AI platforms tracking the entire lifecycle of critical fasteners from melt source to final assembly point, crucial for regulated industries like aerospace and defense.

DRO & Impact Forces Of Industrial Standard Fastener Market

The Industrial Standard Fastener Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and competitive landscape. The primary driver is the pervasive and non-negotiable requirement for joining solutions across foundational global industries, including the cyclical demands of the automotive sector, the long-term growth in construction and infrastructure development, and the continuous need for MRO activities. Counterbalancing this demand, significant restraints exist, notably the high volatility and unpredictable pricing of key raw materials like steel and specialty alloys, which severely impact profit margins and necessitate constant adjustments to pricing strategies. Furthermore, the intense competition from low-cost producers, particularly in high-volume, standardized segments, exerts downward pressure on profitability for established high-quality manufacturers, forcing a strategic shift towards proprietary and high-performance products.

A crucial opportunity lies in the rapid technological transition occurring within the transport sector, specifically the global pivot towards Electric Vehicles (EVs) and advanced aerospace platforms. EVs require specialized, lightweight fasteners that also offer superior vibration resistance and insulation properties, creating premium market niches for innovation. Similarly, the growing demand for renewable energy infrastructure, such as utility-scale wind turbines and solar panel arrays, requires highly durable, anti-corrosion fasteners capable of enduring extreme environmental stress. These niche high-growth applications allow manufacturers to differentiate themselves from bulk commodity producers and command higher profit margins, leveraging expertise in material science and specialized coating technologies.

The impact forces within the market are predominantly characterized by shifting regulatory standards and the imperative for supply chain resilience. Global regulations regarding product traceability, material origin, and environmental compliance (e.g., REACH in Europe) are forcing manufacturers to invest heavily in robust quality management systems and advanced documentation processes. Geopolitical tensions and trade protectionism have exacerbated supply chain fragility, prompting large buyers to diversify their supplier base and prioritize local or regional sourcing, creating opportunities for domestic manufacturers in previously import-dominated markets. Ultimately, successful players in this market must demonstrate a dual capability: managing high-volume, low-margin standard production efficiently, while simultaneously innovating high-value, high-performance specialty fasteners that address emerging technological demands and stringent regulatory criteria.

Segmentation Analysis

The Industrial Standard Fastener Market is comprehensively segmented based on material, product type, and end-use industry, providing a granular view of market dynamics and specialized demand areas. The material segmentation highlights the continued reliance on steel, including carbon steel, alloy steel, and stainless steel, due to its favorable strength-to-cost ratio and widespread availability. However, the emerging trend toward lightweighting drives significant growth in aluminum, titanium, and various superalloys, crucial for aerospace and high-performance automotive applications where weight reduction is paramount. Analyzing these material segments helps stakeholders understand shifts in raw material consumption patterns and the underlying technological drivers of specific industry segments.

Product type segmentation reveals the market structure, classifying components into external threading (bolts, screws, studs), internal threading (nuts), washers and rivets, and specialized proprietary components. Bolts and screws remain the largest volume segment, being foundational to nearly all mechanical assemblies. The growth within this segment is often tied directly to global manufacturing output indices. Conversely, the specialized and proprietary segment, though smaller in volume, offers higher profit margins and is driven by customized requirements for specific machinery or highly specialized functional needs, such as self-locking features, tamper-proof designs, or integrated sealing capabilities, which add significant value to the component.

End-use industry analysis is critical for strategic planning, showing where the primary demand originates. The automotive industry historically dominates, followed closely by construction and heavy machinery. The rapid expansion of the Electric Vehicle (EV) segment introduces unique demands for electrically isolating and vibration-resistant fastening solutions. The aerospace industry, characterized by low volume but extremely high-performance requirements, remains a key segment for advanced materials and premium pricing. Understanding these application differences allows manufacturers to tailor their production, certification processes, and distribution channels to maximize penetration within high-value target sectors that require specialized compliance and quality assurance protocols.

- By Material:

- Steel (Carbon Steel, Alloy Steel, Stainless Steel)

- Aluminum

- Titanium

- Brass

- Plastic and Polymer Fasteners

- Exotic Alloys (Nickel-based, Chrome, Inconel)

- By Product Type:

- External Threaded Fasteners (Bolts, Screws, Studs)

- Internal Threaded Fasteners (Nuts)

- Washers

- Rivets

- Others (Pins, Rings, Inserts, Clips)

- By End-Use Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles, Electric Vehicles)

- Aerospace and Defense

- Construction (Residential, Commercial, Infrastructure)

- Industrial Machinery (Heavy Equipment, Machine Tools)

- MRO (Maintenance, Repair, and Operations)

- Electrical and Electronics

- Wind Energy and Renewable Power

- By Sales Channel:

- Direct Sales (OEM Supply)

- Distributors/Wholesalers (MRO and Tier 2 Supply)

- Online/E-commerce

Value Chain Analysis For Industrial Standard Fastener Market

The value chain for the Industrial Standard Fastener Market begins with the sourcing and processing of raw materials, primarily steel wire rods, aluminum billets, and specialty alloys. This upstream segment is highly concentrated and susceptible to global commodity price volatility, which significantly influences the subsequent manufacturing costs. Key upstream activities involve primary metal processing, followed by drawing and forming processes to create wire stock suitable for cold-forming or hot-forging. Manufacturers must maintain strategic relationships with steel mills and material suppliers, often engaging in long-term contracts to secure consistent quality and buffer against price spikes, as material costs typically constitute the largest portion of the final product expense.

The core manufacturing stage involves forming, threading, heat treatment, and surface finishing (plating or coating). Modern manufacturing relies heavily on highly automated cold-forming machinery, which provides high throughput and precision for standard products. Specialized fasteners, however, often require hot forging or extensive machining, increasing the complexity and cost. Quality control and rigorous testing—especially for tensile strength, torque specifications, and corrosion resistance—are critical value-added steps in this stage, differentiating premium manufacturers. Certifications (e.g., ISO, AS9100 for aerospace) act as necessary barriers to entry, validating the manufacturer's capability to deliver products meeting demanding application requirements.

Distribution channels are categorized into direct and indirect sales, catering to distinct market needs. Direct sales predominantly involve high-volume, long-term contracts supplying OEMs in sectors like automotive and heavy machinery, often managed through specialized vendor-managed inventory (VMI) programs. Indirect channels, which utilize wholesalers, distributors, and e-commerce platforms, serve the extensive MRO and small-to-medium enterprise segments. These distributors provide essential services such as inventory consolidation, technical support, and rapid fulfillment of diverse product mixes, adding significant value by bridging the gap between large-scale production and dispersed end-user demand. Efficient logistics and robust inventory management systems are paramount for maintaining cost-effectiveness across the entire downstream segment, ensuring minimal lead times for essential components.

Industrial Standard Fastener Market Potential Customers

Potential customers for the Industrial Standard Fastener Market are broadly categorized into two major groups: Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) buyers, spanning virtually every industrial sector. OEMs, which include global automotive companies, aerospace prime contractors, heavy machinery producers (e.g., agricultural, mining, construction equipment), and electronics manufacturers, require large volumes of standardized, highly consistent fasteners that are integrated directly into their final products. These customers prioritize quality assurance, long-term supply stability, stringent compliance with technical specifications, and competitive pricing based on large procurement contracts. Their buying decisions are often influenced by the ability of suppliers to innovate and provide value-added services such as specialized coatings, material certifications, and supply chain transparency.

The MRO segment comprises diverse entities, including independent repair shops, large industrial facilities (chemical plants, power stations, refineries), and infrastructure maintenance departments. These customers require a wide variety of fasteners, often in smaller, less predictable quantities, necessitating rapid access and extensive product range availability. MRO buyers prioritize availability, efficient distribution networks, and component reliability for immediate replacement needs. This segment is typically served through industrial distributors and specialized aftermarket suppliers who can provide technical assistance and consolidated inventory management, ensuring minimal downtime for critical assets.

Additionally, the burgeoning renewable energy sector represents a high-growth customer segment. Companies specializing in the installation and maintenance of wind turbines, solar farms, and related infrastructure require specialized fasteners (often galvanized or stainless steel) designed for extreme weather conditions and long service life without maintenance. These buyers seek products with exceptional resistance to corrosion, fatigue, and vibration loosening. Governmental entities and large infrastructure projects (railways, bridges, public works) also represent substantial customers, demanding certified, high-tensile fasteners that adhere to strict public safety and engineering standards, frequently procured through competitive tendering processes where both quality and price are heavily weighted evaluation criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.5 Billion |

| Market Forecast in 2033 | USD 141.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fastenal Company, Würth Group, ITW (Illinois Tool Works), Bulten AB, Nifco Inc., LISI Group, Stanley Black & Decker Inc., Precision Castparts Corp., Dokka Fasteners AS, Hilti Corporation, Araymond, G&J Hall Tools, Penn Engineering, MW Industries Inc., SFS Group AG, ATF Inc., Bossard Group, EJOT Holding GmbH & Co. KG, Nippon Steel Corporation, Trelleborg AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Standard Fastener Market Key Technology Landscape

The technological landscape of the Industrial Standard Fastener Market is evolving rapidly, driven by the dual needs for higher performance and enhanced manufacturing efficiency. A primary area of focus is advanced material science and surface engineering. This includes the development of lightweight alloys, such as high-strength aluminum and advanced titanium grades, specifically tailored for demanding applications in aerospace and electric vehicle battery structures where mass reduction is critical. Concurrently, specialized surface treatments, including PVD (Physical Vapor Deposition) and various proprietary anti-corrosion coatings (e.g., zinc-nickel, geomet), are vital for extending the service life of fasteners in harsh environments, such as marine, offshore, and petrochemical facilities, thus significantly reducing maintenance costs and improving structural safety.

Another significant technological innovation is the rise of smart fastening systems, or 'IoT-enabled' fasteners. These components integrate micro-sensors, strain gauges, or RFID tags, allowing for real-time monitoring of critical parameters like pre-load tension, vibration, temperature, and structural integrity. This technology shifts maintenance strategies from reactive or periodic schedules to genuine predictive maintenance, particularly in critical infrastructure (bridges, wind turbines) and high-speed machinery. While currently a premium niche, the decreasing cost of sensors and connectivity is expected to accelerate the adoption of smart fasteners, providing invaluable data for asset management and failure prevention, which is a major value proposition for asset-intensive industries.

Furthermore, manufacturing technologies are being optimized through Industry 4.0 principles. Advanced automation, coupled with Artificial Intelligence and machine vision systems, is standardizing and accelerating the cold-forming and threading processes, dramatically improving geometric precision and reducing variability in mechanical properties. Additive manufacturing (3D printing) is also emerging as a viable technology for producing highly complex, customized, and low-volume tooling or specialized fastening prototypes quickly, offering flexibility outside the constraints of traditional high-volume forming processes. These manufacturing advancements ensure that fasteners can meet increasingly tight tolerances and complex geometric requirements demanded by modern, highly integrated product designs.

Regional Highlights

The regional analysis of the Industrial Standard Fastener Market reveals distinct growth patterns and market characteristics shaped by local industrial activity, infrastructure investment, and regulatory frameworks. The Asia Pacific (APAC) region stands as the undisputed global market leader, primarily driven by the colossal manufacturing output of China and the rapidly expanding industrial bases of India and Southeast Asian nations. APAC’s dominance is fueled by large-scale production across the automotive, consumer electronics, and heavy machinery sectors, coupled with aggressive government spending on infrastructure and urbanization. The region is characterized by high volume consumption of standard and medium-performance fasteners, though demand for high-grade components is rapidly increasing due to foreign direct investment in sophisticated manufacturing capabilities.

North America and Europe represent mature markets characterized by higher technological complexity and demanding regulatory environments. These regions demonstrate moderate volume growth but command significantly higher revenues due to specialized demand from the aerospace, medical device, and high-end automotive (including EV) sectors. North America’s demand is strongly influenced by the defense industry and the revitalized domestic automotive manufacturing sector focusing on advanced materials and high-tensile components. Europe, particularly Germany and the Nordic countries, leads in sustainability standards and engineering excellence, driving demand for premium fasteners with advanced corrosion resistance and material traceability features, often adhering to strict directives like REACH and RoHS.

The Latin America (LATAM) and Middle East and Africa (MEA) regions present substantial, though variable, growth potential. LATAM's market is highly dependent on commodity prices and foreign investment in construction and mining. Brazil and Mexico are key hubs, benefiting from regional automotive production and infrastructure modernization projects. The MEA region is driven by massive investment in oil and gas infrastructure, which requires highly specialized, corrosion-resistant fasteners, alongside diversification efforts into tourism, logistics, and renewable energy, particularly in the GCC countries. While these regions currently hold smaller market shares, large-scale, ongoing capital projects and industrial diversification initiatives are expected to accelerate their consumption rates of industrial fasteners during the forecast period.

- Asia Pacific (APAC): Dominant market share due to China's manufacturing volume and rapid industrialization in India and ASEAN nations. Key driver: Automotive, Electronics, and Infrastructure development. Focus on large-volume, cost-effective standard fasteners.

- North America (NA): High-value market segment focusing on high-performance materials (titanium, specialty alloys) driven by aerospace, defense, and advanced automotive manufacturing (EVs). Emphasis on stringent quality and traceability.

- Europe: Characterized by strong demand for premium, specialized fasteners, adhering to strict environmental and quality standards. Growth spurred by the machine building industry, wind energy installations, and high-end automotive production.

- Latin America (LATAM): Growth tied to infrastructure projects, mining operations, and regional automotive assembly, with Brazil and Mexico acting as primary consumer markets.

- Middle East & Africa (MEA): Demand heavily influenced by oil and gas infrastructure maintenance and expansion, alongside significant governmental investment in diversification projects (construction, renewable energy). Focus on corrosion resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Standard Fastener Market.- Fastenal Company

- Würth Group

- ITW (Illinois Tool Works)

- Bulten AB

- Nifco Inc.

- LISI Group

- Stanley Black & Decker Inc.

- Precision Castparts Corp.

- Dokka Fasteners AS

- Hilti Corporation

- Araymond

- G&J Hall Tools

- Penn Engineering

- MW Industries Inc.

- SFS Group AG

- ATF Inc.

- Bossard Group

- EJOT Holding GmbH & Co. KG

- Nippon Steel Corporation

- Trelleborg AB

- Auckland Fasteners Limited

- Acument Global Technologies

- Beacon Fasteners and Components

- Bolt Threads Inc.

- Continental Engineering

- Deepak Fasteners Ltd.

- Ferro-Alloy Resources Limited

- Huck International Inc.

- Infastech

- Kamax Holding GmbH & Co. KG

- KVT-Fastening GmbH

- MacLean-Fogg Company

- NORMA Group

- Parker-Kalon Corporation

- Progressive Fastener Inc.

- Ramco Specialties, Inc.

- Semblex Corporation

- Shims Fasteners

- Skyway Precision Inc.

- TR Fastenings plc

- White Knight Products

- Zhejiang Zhongsheng Fasteners Co., Ltd.

- Dongbei Special Steel Group Co., Ltd.

- Tianbao Fastener Co., Ltd.

- Tong Ming Enterprise Co., Ltd.

- Vaswani Fasteners

- Xinchi Fastener Manufacturing Co., Ltd.

- YFS Co., Ltd.

- Zonpak Fasteners Co. Ltd.

- Aalberts surface technologies

- Alcoa Fastening Systems

- Allstate Fasteners Corporation

- Anixter International Inc.

- Barnes Group Inc.

- Birmingham Fastener and Supply

- Bolts and Nuts Corporation

- California Industrial Fasteners

- Carpenter Technology Corporation

- Cobb Industrial Fasteners

- Disc-Lock International

- Emhart Teknologies

- Fisher Scientific

- Gregg Industries

- Hangzhou Washer Co., Ltd.

- Indiana Steel & Engineering Co.

- Jergens Inc.

- K Line Fasteners

- Lake Erie Screw Corporation

- Lewis Bolt & Nut Company

- Martin Sprocket & Gear, Inc.

- Midas Co. Ltd.

- Mid-West Screw Products

- Millennium Fasteners Inc.

- MSC Industrial Supply Co.

- ND Industries

- Nylok LLC

- Optimas Solutions

- Pacific Fasteners Corp.

- PCC Fasteners

- Perfect Fasteners

- Pivot Point Inc.

- Precision Aerospace Products

- RivetKing

- Security Fasteners

- Simmons Fasteners

- Specialty Screw Corporation

- Sunbelt Bolts & Screws

- Superior Washer & Gasket Corp.

- Texcel Fasteners

- The Eastern Company

- Threaded Fasteners, Inc.

- US Bolt Manufacturing

- Valley Fasteners

- Voss Industries

- Western Power Sports

- Wrought Washer Manufacturing Inc.

- Zamac Nordeste S.A.

Frequently Asked Questions

Analyze common user questions about the Industrial Standard Fastener market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth in demand for specialized lightweight fasteners?

The primary driver is the global focus on energy efficiency and performance in transportation sectors, particularly the rapid expansion of Electric Vehicles (EVs) and the need for weight reduction in commercial aircraft. Lightweight materials like titanium and high-strength aluminum alloys reduce mass, thereby increasing fuel efficiency or battery range, justifying their higher unit cost.

How is raw material price volatility impacting fastener manufacturers?

Fluctuations in the prices of key materials such as steel, aluminum, and zinc directly affect production costs and profit margins. Manufacturers mitigate this risk through advanced hedging strategies, long-term procurement contracts, and strategic inventory management, often passing stabilized costs through complex pricing adjustments to large OEM clients.

What role do smart fasteners play in industrial maintenance?

Smart fasteners integrate sensors and IoT technology to provide real-time data on parameters like tension, vibration, and temperature. This capability is crucial for implementing predictive maintenance protocols in critical infrastructure and heavy machinery, preventing catastrophic failures, extending asset lifespan, and significantly reducing unforeseen downtime.

Which geographical region holds the largest market share for industrial standard fasteners?

The Asia Pacific (APAC) region currently holds the largest market share, driven overwhelmingly by the sheer scale of manufacturing activities in countries like China and India. The region dominates production across key end-use sectors, including automotive, construction, and consumer electronics assembly.

What is the competitive landscape regarding quality standards in the market?

The market is bifurcated: high-volume segments are price-competitive, while specialized segments prioritize adherence to rigorous standards (e.g., ISO, AS9100). Premium competition centers on material traceability, precision tolerances, superior anti-corrosion coatings, and the capacity for integrated supply chain management and technical design support.

What are the key technological trends influencing fastener production efficiency?

Key trends include the integration of Industry 4.0 automation, focusing on optimizing cold-forming processes through AI, implementing advanced non-destructive testing (NDT) methods like eddy current and ultrasonic inspection, and leveraging additive manufacturing for rapid prototyping of complex geometries, ensuring high precision and reducing production lead times.

How is the construction industry contributing to the fastener market demand?

The construction industry is a major consumer, particularly due to global infrastructure modernization and the adoption of modular construction techniques. Demand is high for heavy-duty structural bolts, anchoring systems, and specialized corrosion-resistant fasteners required for bridges, tunnels, and high-rise commercial buildings, often driven by government stimulus packages.

Are plastic or polymer fasteners gaining traction, and in which applications?

Yes, plastic and polymer fasteners are gaining significant traction, particularly in electronics, appliance manufacturing, and certain non-critical automotive assemblies. Their advantages include superior electrical insulation, corrosion resistance, and extremely lightweight properties, often replacing metal components where structural strength requirements are moderate.

What is the primary difference in buying requirements between OEMs and MRO segments?

OEMs require high-volume, continuous supply with stringent quality certifications, often favoring direct, long-term contracts. MRO (Maintenance, Repair, and Operations) buyers require lower volume, highly diversified inventory, rapid delivery, and technical support, typically sourcing through extensive distributor networks and aftermarket suppliers.

How does fastener coating technology enhance product performance?

Advanced coating technologies, such as zinc-nickel plating, mechanical plating, and specialized Teflon-based polymers, enhance performance primarily by improving corrosion resistance, preventing galling or thread seizing, and controlling the coefficient of friction to ensure accurate torque-tension control during installation, extending the operational life in severe conditions.

What regulatory factors are important for fastener manufacturers in Europe?

European manufacturers must strictly comply with directives such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances), which mandate chemical safety and limit the use of certain heavy metals in coatings and materials, driving innovation towards environmentally friendly alternatives.

What are self-locking fasteners and why are they important in vibration-prone applications?

Self-locking fasteners are designed with mechanisms, often including specialized thread geometries, polymer patches, or integral washers, to resist loosening caused by severe dynamic loads and vibration. They are critical in safety-related applications like aerospace, high-speed rail, and heavy machinery to maintain structural integrity and prevent component failure.

How is the aerospace industry influencing material demands in the fastener market?

The aerospace sector demands ultra-high performance, lightweight fasteners made predominantly from certified titanium alloys and specialized nickel-based superalloys. Requirements focus on extreme resistance to fatigue, stress corrosion cracking, and high-temperature performance, necessitating full material traceability and stringent quality control protocols (AS9100 certification).

What is Vendor-Managed Inventory (VMI) and its significance in the fastener supply chain?

VMI is a system where the fastener supplier is responsible for managing and replenishing the customer's inventory at their assembly line or warehouse. It significantly reduces procurement costs, ensures continuous supply, minimizes stockouts, and optimizes the assembly process, particularly vital for large, complex OEM operations.

How are geopolitical factors affecting the sourcing of steel for fasteners?

Geopolitical tensions and retaliatory trade tariffs have led to supply chain fragmentation and increased sourcing complexity, forcing manufacturers to diversify their steel procurement strategies. This turbulence encourages localized manufacturing and regional supply chain consolidation to ensure supply resilience against international trade restrictions and duties.

What are the prospects for recycled material use in industrial fasteners?

While the demand for high-integrity fasteners often necessitates virgin materials to guarantee specific mechanical properties, there is growing pressure to increase the use of recycled steel and aluminum, particularly for non-critical, standard fasteners. This shift is driven by sustainability goals and corporate social responsibility mandates from major end-users.

What distinguishes specialized industrial fasteners from standard commodity fasteners?

Specialized fasteners feature unique designs, proprietary coatings, advanced materials, and precise geometric tolerances required for niche, high-stress, or custom applications. Unlike high-volume commodity fasteners, specialized products often require custom tooling, rigorous non-standard testing, and are sold at a premium due to their unique functional capabilities.

How is the machine building industry contributing to segment growth?

The machine building sector requires precise, durable, and vibration-resistant fasteners for assembly lines, robots, and production equipment. As global automation rates increase, the demand for precision-engineered standard fasteners that facilitate fast, reliable, and automated assembly processes grows proportionately, supporting the high-volume segment.

What challenges do new entrants face in the Industrial Standard Fastener Market?

New entrants face significant hurdles, including high capital investment required for advanced manufacturing machinery, the need for extensive quality certification and compliance protocols, and the challenge of competing with established players who benefit from immense economies of scale and deep-rooted supply chain relationships with major OEMs.

How do advancements in torque control affect fastener reliability?

Improved torque control technologies, including digital wrenches and automated tightening systems, ensure fasteners are installed precisely to specification, preventing over-tightening (which causes material failure) or under-tightening (which causes vibration loosening). Accurate torque control is paramount for guaranteeing the designed structural performance and safety of the joint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager