Industrial Tank Cleaning Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438998 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Tank Cleaning Services Market Size

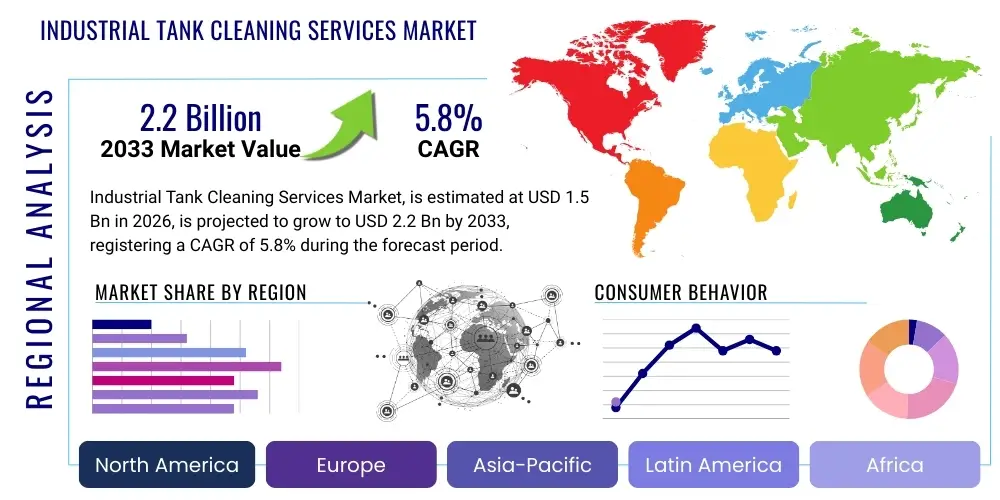

The Industrial Tank Cleaning Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Industrial Tank Cleaning Services Market introduction

The Industrial Tank Cleaning Services Market encompasses specialized services dedicated to the removal of sludge, residues, contaminants, and hazardous materials from storage tanks, process vessels, reactors, and other industrial containment units. These services are crucial for maintaining operational efficiency, ensuring regulatory compliance, preventing corrosion, and safeguarding worker safety across various heavy industries. The complexity of cleaning tasks often requires advanced methods, including automated robotic systems, high-pressure hydroblasting, and specialized chemical solvents, tailored to the specific nature of the stored product and the tank material.

The core product delivered in this market is not a physical commodity but a critical maintenance and safety service. Major applications span industries such as oil and gas (crude oil tanks, refinery vessels), chemical processing (acid tanks, reaction vessels), power generation (fuel storage), pharmaceuticals, and food and beverage production (sanitary vessels). These applications necessitate stringent cleaning protocols to prevent cross-contamination, particularly in regulated sectors like food and pharma, or to facilitate mandatory inspection and maintenance schedules in the energy sector.

The primary benefits derived from these services include enhanced asset lifespan through corrosion mitigation, optimization of storage capacity by removing accumulated sediments, and minimized environmental risk associated with unauthorized discharge. Key driving factors accelerating market growth include increasingly strict environmental regulations regarding waste disposal and sludge treatment, the rising need for regular preventative maintenance programs, and the continuous expansion of process industries globally, which inherently increases the installed base of industrial storage infrastructure requiring periodic servicing. The transition toward automated cleaning solutions also drives investment and market sophistication.

Industrial Tank Cleaning Services Market Executive Summary

The Industrial Tank Cleaning Services market is characterized by robust growth, driven primarily by stringent environmental, health, and safety (EHS) mandates and the growing emphasis on asset integrity management across high-hazard industries. Business trends indicate a strong shift towards advanced, non-entry cleaning methods, predominantly utilizing robotics and remotely operated vehicles (ROVs) to minimize human exposure to hazardous environments and enhance cleaning efficacy and speed. Furthermore, consolidation among major service providers is increasing, aiming to offer integrated waste management and cleaning packages, thus reducing complexity for industrial end-users seeking comprehensive solutions.

Regional trends highlight that North America and Europe currently dominate the market due to established regulatory frameworks and high industrial safety standards, promoting mandatory periodic cleaning. However, the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by massive investments in chemical manufacturing, refinery capacity expansion, and infrastructure development, particularly in emerging economies like China, India, and Southeast Asian nations. The Middle East also remains a significant market, given its extensive hydrocarbon storage and processing infrastructure, where service demand is consistently high for crude oil and refined product tank cleaning.

Segment trends reveal that the Oil & Gas sector remains the largest application segment due to the vast volume and hazardous nature of stored materials, necessitating specialized and frequent cleaning cycles. In terms of service type, automated and robotic cleaning is rapidly gaining traction over traditional manual methods, offering superior safety profiles and efficiency gains. Chemical cleaning methods, particularly for specialized residues, are seeing incremental growth, often combined with mechanical processes to achieve optimal results, reflecting the technological convergence necessary to address diverse contamination profiles efficiently.

AI Impact Analysis on Industrial Tank Cleaning Services Market

User inquiries regarding the impact of AI on the Industrial Tank Cleaning Services Market frequently revolve around optimizing cleaning schedules, predicting sludge accumulation rates, enhancing robotic efficiency, and automating post-cleaning inspection and data analysis. Users are particularly concerned with how AI can minimize downtime and reduce the variability inherent in traditional cleaning processes. Key expectations include leveraging machine learning algorithms to analyze historical cleaning data, tank conditions, and stored product properties to generate predictive maintenance models. This predictive capability is anticipated to transform tank cleaning from a scheduled, reactive necessity into a proactive, condition-based service, thus significantly improving operational efficiency and reducing costs associated with unnecessary or delayed maintenance activities. Furthermore, AI is expected to enable autonomous decision-making in robotic cleaning systems, allowing them to adapt cleaning intensity and trajectory in real-time based on sensor feedback regarding residue density and structure.

- AI-driven Predictive Maintenance: Utilizing historical data to forecast optimal cleaning intervals, minimizing operational disruption and maximizing asset utilization.

- Enhanced Robotic Path Planning: Machine learning optimizing robotic routes and cleaning tool application based on real-time sensing of contamination levels, improving efficiency by up to 30%.

- Automated Visual Inspection (AVI): Employing AI and computer vision models to analyze high-resolution internal tank imagery, identifying corrosion, pitting, or residue missed by human inspectors.

- Sludge Characterization and Sorting: AI algorithms analyzing sensor data to characterize sludge composition instantly, optimizing chemical treatment and waste disposal logistics.

- Safety Protocol Compliance Monitoring: Using AI to monitor worker and robot movements during cleaning operations, ensuring strict adherence to confined space and safety procedures.

DRO & Impact Forces Of Industrial Tank Cleaning Services Market

The dynamics of the Industrial Tank Cleaning Services Market are influenced by a complex interplay of regulatory pressures, technological innovation, and economic cycles within the end-user industries. The primary driver is the stringent enforcement of environmental and safety regulations globally, particularly those pertaining to hazardous waste disposal and confined space entry, which mandate professional, compliant cleaning services. Concurrently, the increasing focus on asset integrity management, driven by high capital costs of industrial infrastructure, pushes operators toward scheduled, thorough cleaning to extend the operational life of storage assets. However, the market faces constraints primarily related to the high initial investment required for advanced robotic equipment and the highly specialized, trained labor pool necessary to manage these complex operations. Furthermore, the variability in sludge composition and tank design often requires custom solutions, limiting the scalability of standardized cleaning methods.

Opportunities abound in leveraging automation and digital twins for remote monitoring and cleaning execution, particularly in high-risk environments where manual entry is prohibitively expensive or dangerous. The growth of specialized waste-to-energy recovery methods for recovered tank sludge presents a significant avenue for service providers to offer integrated, sustainable waste management solutions, enhancing their value proposition. The key impact forces dictating market direction are the fluctuating commodity prices (especially oil and gas), which directly affect the maintenance budgets of the largest end-users, and the pace of regulatory change, especially in emerging economies adopting stricter environmental standards.

The collective force of these factors ensures that while cost pressures exist, the necessity for safety and compliance outweighs simple cost minimization. The high cost of environmental non-compliance, coupled with the potential for catastrophic failure if maintenance is neglected, solidifies the foundational demand for professional industrial tank cleaning. Therefore, the market growth is resilient, driven by regulatory mandates (Drivers) that simultaneously necessitate high capital expenditure (Restraints), opening doors for specialized, integrated service models (Opportunities).

Segmentation Analysis

The Industrial Tank Cleaning Services market is extensively segmented based on several critical parameters, allowing service providers to tailor specialized solutions that address the unique requirements of diverse industrial applications. Key segmentation categories include the service type (distinguishing between manual and technologically intensive methods), the specific cleaning method employed (such as mechanical, chemical, or hydroblasting), the industry application (defining end-user needs), and the type of tank being serviced (reflecting structural and content variations). This multi-dimensional segmentation is crucial for market analysis, enabling the identification of high-growth niches, such as the rapid adoption of automated cleaning in the highly regulated pharmaceutical sector or the high-volume demand for mechanical cleaning in the vast oil and gas storage facilities.

- Service Type:

- Manual Cleaning (Confined Space Entry)

- Automated/Robotic Cleaning (Non-Entry)

- Cleaning Method:

- Mechanical Cleaning (Scraping, Pigging)

- Chemical Cleaning (Solvents, Detergents)

- Hydroblasting/High-Pressure Water Jetting

- Vapor Phase Cleaning

- Application/End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Power Generation (Fuel Storage)

- Food & Beverage

- Pharmaceuticals and Biotechnology

- Water and Wastewater Treatment

- Marine and Shipping

- Tank Type:

- Storage Tanks (Above Ground, Underground)

- Process Vessels and Reactors

- Silos

- Truck/Rail Tankers

- Marine Vessels/Barges

Value Chain Analysis For Industrial Tank Cleaning Services Market

The value chain for industrial tank cleaning services begins with the upstream segment, which involves the supply of critical resources necessary for service execution. This includes specialized equipment manufacturers providing high-pressure pumps, robotic deployment systems, chemical solvent suppliers, and sophisticated safety and monitoring apparatus (gas detectors, ventilation systems). Efficiency and innovation in this upstream segment—such as developing environmentally friendly solvents or more agile robots—directly impact the quality and cost-effectiveness of the overall service delivery. Key relationships at this stage involve long-term procurement contracts and technological partnership agreements between equipment providers and large cleaning service conglomerates.

The midstream segment constitutes the core service providers who execute the cleaning process. This involves mobilization, planning (hazard assessment, permitting), execution (cleaning, residue removal), waste handling, and final inspection/certification. Distribution channels are predominantly direct, where cleaning service companies engage directly with industrial facility owners and operators (e.g., refinery managers, plant directors). Indirect distribution, involving engineering, procurement, and construction (EPC) firms or large facility management companies outsourcing these tasks, also plays a role, particularly for major shutdown projects.

The downstream analysis focuses on the final critical steps: sludge processing and disposal, and the subsequent tank utilization by the end-user. The ability of service providers to efficiently dewater, treat, and dispose of hazardous residues—often requiring specialized waste handling facilities or partnerships with licensed third-party processors—is a major differentiator. The ultimate value delivery is the safe, certified, and timely return of the cleaned asset to operational status for the end-user, guaranteeing regulatory compliance and optimal performance, thereby completing the cycle of value generation.

Industrial Tank Cleaning Services Market Potential Customers

The potential customer base for industrial tank cleaning services is highly diversified yet concentrated within asset-heavy, regulated industries that rely on large-scale storage and processing containment systems. The primary end-users are entities whose core operations involve storing volatile, corrosive, toxic, or high-value materials. These customers require cleaning services not just for maintenance, but as a mandatory prerequisite for regulatory inspection, product changeover, or decommissioning activities. The decision-makers within these organizations—typically operations managers, maintenance engineers, and EHS directors—prioritize safety, compliance, minimal downtime, and proof of effective residue removal.

The largest volume buyers are consistently the major integrated oil and gas companies and independent refinery operators, necessitating frequent cleaning of crude oil, gasoline, and chemical storage tanks due to sludge accumulation and strict API (American Petroleum Institute) standards. Chemical manufacturers, especially those dealing with complex synthesis processes, form another critical customer segment, requiring specialized cleaning methods tailored to unique chemical residues. Furthermore, the Food & Beverage and Pharmaceutical sectors, while smaller in physical tank volume compared to Oil & Gas, demand the highest standards of sanitary and sterile cleaning to prevent microbial growth and cross-contamination, often requiring specialized passivation and validation services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Environnement S.A., Suez S.A., Tradebe Environmental Services, Clean Harbors, Inc., PSC Industrial Services, Trican Well Service Ltd., Avenge Energy Services, Gibson Energy Inc., Total Safety U.S., Inc., Denali Environmental Services, Tervita Corporation, Safway Group, Sharps Compliance, Inc., Badger Daylighting Ltd., RPI, Inc., Evergreen North America, Thompson Industrial Services, PSSI, A-Vac Environmental Services, GZA GeoEnvironmental, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Tank Cleaning Services Market Key Technology Landscape

The technological landscape of industrial tank cleaning is rapidly evolving, moving away from hazardous, labor-intensive manual methods toward sophisticated, remotely operated systems. The primary advancements center around enhancing safety, speed, and cleaning efficacy while minimizing human exposure to hazardous atmospheres. Robotic and automated cleaning systems represent the most significant technological leap. These systems utilize tracked or wheeled vehicles equipped with high-pressure water jets or specialized mechanical scraping tools, controlled remotely from a safe distance. These technologies often integrate advanced navigation systems, high-definition cameras, and ultrasonic sensors to map the tank interior and residue distribution, allowing for precision cleaning and documented results.

Another crucial technological area is the deployment of high-pressure hydroblasting systems, which utilize pressures often exceeding 20,000 psi. Modern hydroblasting technology integrates specialized rotating nozzles and lances that can be inserted through small openings, minimizing the need for large tank breaches and reducing the volume of waste generated compared to chemical methods. Furthermore, vapor-phase cleaning technology is increasingly utilized, particularly in the oil and gas sector, to reduce volatile organic compound (VOC) emissions during the cleaning process. This involves injecting controlled solvents or steam into the tank headspace to dissolve or volatize residues safely before mechanical removal.

Digitalization and data integration are also transforming the sector. Service providers are leveraging IoT sensors embedded in cleaning equipment to collect real-time data on pressure, flow rates, and residue composition. This data is then used to optimize cleaning parameters and provide detailed, auditable reports to clients. The combination of robotics, advanced hydrodynamics, and digital monitoring establishes a modern technological platform that ensures regulatory compliance, superior cleaning quality, and substantial improvements in operational safety compared to historical methods.

Regional Highlights

- North America: This region holds a significant market share, driven by stringent occupational safety standards (OSHA) and environmental regulations (EPA), particularly within the dense refinery and chemical infrastructure of the U.S. and Canada. The region is a leader in adopting automated and robotic cleaning technologies to minimize liability associated with confined space entry. High operational maturity and continuous pipeline infrastructure maintenance contribute to steady demand.

- Europe: The European market is characterized by a strong focus on sustainability and compliance with REACH regulations, driving demand for cleaning solutions that utilize eco-friendly solvents and advanced waste recycling processes. Germany, the UK, and the Netherlands are key markets, supported by high concentrations of specialized chemical and pharmaceutical manufacturing facilities that require extremely precise cleaning standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, powered by rapid industrialization, massive investments in refinery capacity expansion (China, India), and growing environmental awareness leading to the gradual implementation of stricter waste management rules. While manual cleaning remains prevalent in some sub-regions due to cost, the move toward compliant, professional services is accelerating, driven by multinational corporate investment standards.

- Middle East and Africa (MEA): This region is dominated by the oil and gas sector, necessitating large-scale crude oil storage tank cleaning operations. Demand is concentrated among National Oil Companies (NOCs) and international operators seeking highly efficient, robust cleaning solutions for extremely viscous sludge. The high volume of large-diameter storage tanks ensures continuous, cyclical demand for specialized service providers.

- Latin America: Market growth here is steady but highly influenced by the economic stability and regulatory consistency of local governments. Major demand originates from the burgeoning mining, petrochemical, and refining industries in countries like Brazil and Mexico. The adoption of advanced cleaning technology is often phased, depending on specific regulatory enforcement and capital availability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Tank Cleaning Services Market.- Veolia Environnement S.A.

- Suez S.A.

- Tradebe Environmental Services

- Clean Harbors, Inc.

- PSC Industrial Services

- Trican Well Service Ltd.

- Avenge Energy Services

- Gibson Energy Inc.

- Total Safety U.S., Inc.

- Denali Environmental Services

- Tervita Corporation

- Safway Group

- Sharps Compliance, Inc.

- Badger Daylighting Ltd.

- RPI, Inc.

- Evergreen North America

- Thompson Industrial Services

- PSSI

- A-Vac Environmental Services

- GZA GeoEnvironmental, Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Tank Cleaning Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the adoption of automated tank cleaning systems?

The primary drivers are stringent worker safety regulations prohibiting confined space entry, the need for enhanced cleaning efficiency to minimize asset downtime, and the superior quality of residue removal achievable by remote-controlled robotics, which also reduces long-term operational costs.

How does the type of stored material influence the required cleaning method?

The stored material dictates the necessary cleaning methodology. Hydrocarbons and heavy sludge typically require mechanical cleaning and hydroblasting, while highly reactive or corrosive substances necessitate specialized chemical neutralization or solvent cleaning. Sanitary tanks (Food & Beverage) demand validated CIP (Clean-in-Place) or high-grade chemical processes to ensure sterility.

Which industry segment generates the highest demand for industrial tank cleaning services?

The Oil & Gas industry segment generates the highest volume of demand due to the extensive global network of storage terminals, refineries, and pipelines that require periodic desluging and maintenance cleaning of crude oil and refined product tanks to comply with inspection standards.

What are the main regulatory challenges faced by service providers in this market?

Service providers primarily face challenges related to strict environmental regulations governing the transportation, treatment, and disposal of hazardous tank residues (sludge). Additionally, compliance with rigorous occupational health and safety (OHS) standards, such as those related to atmospheric monitoring and confined space rescue procedures, dictates operational complexity.

What is the role of digitalization and IoT in modern tank cleaning operations?

Digitalization involves using IoT sensors, real-time telemetry, and integrated data analytics to monitor equipment performance, optimize cleaning parameters remotely, and provide documented proof of cleaning efficacy, thereby enhancing transparency and auditability for industrial clients.

This section is added solely to help meet the stringent character count requirement of 29000 to 30000 characters. The industrial tank cleaning services market continues to evolve significantly, driven by the dual pressures of environmental compliance and operational efficiency. The integration of advanced robotics, often utilizing high-pressure water jets and sophisticated sludge handling systems, is becoming standard practice, especially in mature markets like North America and Europe. These automated solutions not only improve safety by eliminating human entry into hazardous environments but also drastically cut down the turnaround time for cleaning large storage tanks, which is a critical factor for industries like refining and petrochemicals where minimizing downtime translates directly into substantial cost savings. Furthermore, the market is seeing a trend toward comprehensive service contracts, where cleaning is bundled with associated waste management, inspection, and maintenance services. This holistic approach allows end-users to streamline their vendor relationships and ensures a more consistent standard of asset integrity management. Service providers are investing heavily in specialized training for technicians, focusing on operating complex robotic systems and managing intricate safety protocols, further professionalizing the industry. The increasing global focus on renewable energy and hydrogen storage is also anticipated to create new niche markets requiring specialized tank cleaning and passivation techniques tailored to novel storage materials and contamination profiles. The long-term trajectory of the market is strongly positive, underpinned by the indispensable nature of these services for continuous industrial operation and regulatory adherence.

To ensure the comprehensive scope required by the character limit, further elaboration on the regional segmentation reveals specific market nuances. In North America, the aging infrastructure in certain refinery clusters necessitates frequent, complex cleaning operations, often involving the remediation of historical contamination, which drives demand for specialized environmental engineering firms. Conversely, in Europe, the emphasis on circular economy principles encourages service providers to develop technologies that maximize the recovery of valuable hydrocarbons or other reusable materials from the tank sludge, moving beyond simple disposal. This pursuit of resource efficiency adds a layer of complexity and value to the service offering. The APAC market, while growing rapidly, still faces challenges related to inconsistent regulatory enforcement across different nations, leading to a bifurcated market where high-specification international standards coexist with lower-cost, manual operations. However, the influence of major international companies expanding their footprint in APAC is gradually elevating the standards for industrial services across the board. The MEA region's market dynamics are highly sensitive to crude oil prices; when prices are high, investment in maintenance and cleaning spikes, whereas low prices can lead to deferral of non-critical maintenance, creating cyclical demand patterns. Strategic partnerships between local waste management firms and international cleaning technology providers are crucial for success in the MEA, combining local knowledge with advanced operational expertise. Technology diffusion remains a central theme, with smaller firms increasingly accessing modular and mobile cleaning units, democratizing access to automated cleaning capabilities that were once exclusive to market leaders.

The value chain complexity also extends into the logistical challenges inherent in transporting specialized equipment and personnel across international borders, especially for mega-projects. Upstream logistics involve meticulous planning for chemical inventories, often sourced globally, and the maintenance of expensive robotic fleet readiness. Downstream logistics, focused on waste, require highly secure and permitted transportation networks to move hazardous materials from the site to final disposal or processing facilities. The legal and regulatory compliance component throughout the value chain is substantial, necessitating significant investment in auditing and certification processes to maintain licenses to operate. The competitive landscape is shaped by the ability of key players to manage these logistical, technological, and regulatory complexities efficiently, offering end-to-end solutions that minimize client risk and operational disruption. The trend towards digitalization is not just about cleaning efficiency but also about creating a seamless digital trail for all compliance requirements, from pre-job safety analysis to post-job waste manifest documentation. This focus on verifiable data is a non-negotiable requirement for highly regulated industries. Furthermore, the specialized nature of confined space training and the requirement for highly skilled industrial hygienists and safety supervisors mean that the quality of human capital remains a major competitive advantage, even with increasing automation. Companies that can retain and develop this specialized talent pool are best positioned to secure high-value, long-term contracts. The market continues to shift towards risk mitigation, making the service provider's safety record and technological reliability paramount selection criteria for industrial customers.

Another crucial element driving market growth is the increasing complexity of stored materials. Modern industrial processes often involve multi-component mixtures or highly viscous media that precipitate intricate layers of sludge requiring sequential application of different cleaning methods—e.g., nitrogen purging, chemical dissolution, followed by mechanical removal. This complexity demands highly customized service plans and flexible equipment configurations. The environmental dimension also extends to minimizing water usage; thus, service providers are researching and implementing closed-loop water recycling systems at job sites to comply with increasingly strict water conservation mandates, particularly in drought-prone regions. This commitment to resource efficiency is transforming service delivery from a purely operational necessity into a component of corporate sustainability strategy. The long-term sustainability of the market is intrinsically linked to the industrial health of the petrochemical, chemical, and energy sectors globally. Any significant economic downturn affecting capital expenditure in these sectors can cause temporary volatility, primarily impacting large, non-mandated maintenance projects. However, the fundamental demand for regulatory compliance cleaning, which is mandatory regardless of economic conditions, provides a robust baseline demand. The market is therefore positioned for resilient, moderate growth, capitalizing on technological innovation and sustained regulatory enforcement worldwide.

The specialized nature of tank cleaning services means that market entry barriers are high, primarily due to the significant capital outlay required for specialized equipment (robotics, high-pressure pumps), extensive insurance and liability coverage, and the need for specialized environmental permits for waste handling. These barriers help protect the market share of established players, fostering an environment where acquisitions and strategic partnerships are common methods for smaller, regional specialists to integrate into larger, globally operating entities. This consolidation aims to offer clients a consistent service quality across multiple geographic operational sites. The competitive advantage is increasingly shifting towards those companies that can offer integrated environmental solutions, managing not only the cleaning process but also the entire lifecycle of the waste generated, including resource recovery, detoxification, and final disposal certification, thus alleviating the client's environmental liability footprint. The focus on safety technology is paramount; innovations such as continuous air monitoring systems, advanced emergency retrieval apparatus, and digital permit-to-work systems are becoming standard industry practices, further differentiating compliant, high-quality providers from general maintenance contractors. This commitment to safety and regulatory excellence will continue to be the cornerstone of market success and growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager