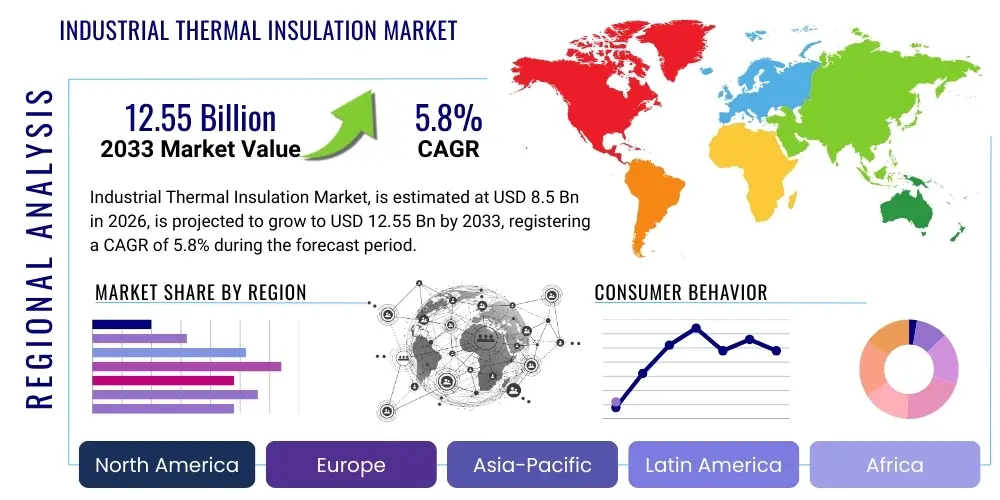

Industrial Thermal Insulation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437994 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Industrial Thermal Insulation Market Size

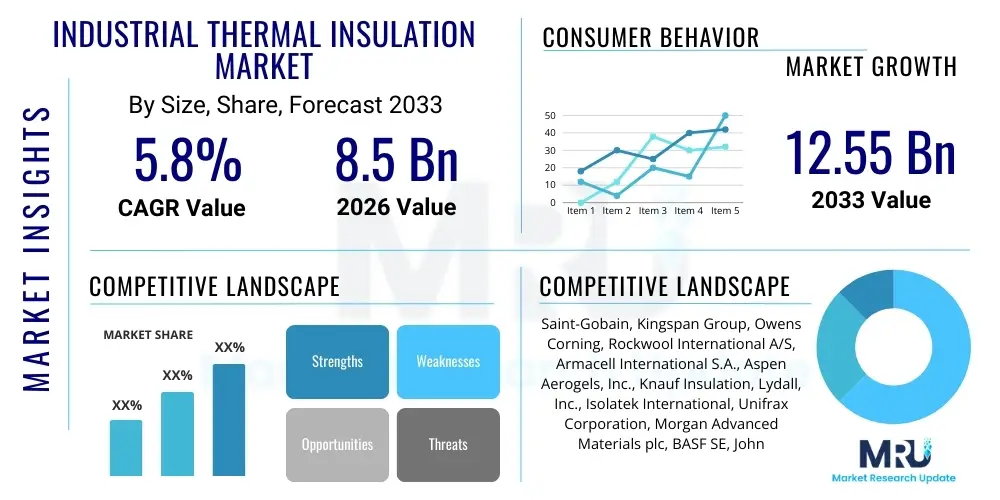

The Industrial Thermal Insulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 billion in 2026 and is projected to reach USD 12.55 billion by the end of the forecast period in 2033.

Industrial Thermal Insulation Market introduction

The Industrial Thermal Insulation Market encompasses specialized materials and systems designed to mitigate heat transfer—both heat loss and heat gain—in various industrial environments, including power generation facilities, chemical processing plants, refineries, and manufacturing operations. These insulation products, ranging from mineral wool and fiberglass to advanced materials like aerogels and vacuum insulated panels (VIPs), are crucial for maintaining specific process temperatures, ensuring operational safety, and maximizing energy efficiency. Effective industrial insulation prevents thermal bridging, reduces greenhouse gas emissions, and protects personnel from exposure to extreme temperatures, making it a fundamental component of modern industrial infrastructure globally.

The primary function of industrial thermal insulation is to optimize energy consumption. By minimizing heat loss from high-temperature equipment (e.g., boilers, piping, furnaces) and preventing heat gain in cryogenic or chilled systems, industries can significantly lower their operational costs associated with fuel or electricity use. Furthermore, insulation plays a pivotal role in process control, ensuring that raw materials undergo necessary chemical or physical transformations at precise temperatures, thus improving product quality and consistency across sectors such as petrochemicals, food and beverage, and pharmaceuticals. The longevity and reliability of these materials, often requiring resistance to high mechanical stress, moisture ingress, and corrosive environments, are key considerations for end-users.

Major applications driving market demand include piping insulation, equipment insulation (reactors, storage tanks), and cryogenic applications (LNG, industrial gases). The inherent benefits—including substantial cost savings through reduced energy bills, enhanced equipment lifespan by mitigating thermal stress, and strict adherence to environmental regulations concerning carbon emissions—propel market expansion. Key driving factors involve stringent global mandates for energy conservation, the rapid expansion of the oil and gas infrastructure in developing economies, and continuous technological advancements leading to the development of higher-performance, thinner, and fire-resistant insulating materials.

Industrial Thermal Insulation Market Executive Summary

The Industrial Thermal Insulation Market exhibits robust growth, primarily propelled by the worldwide emphasis on industrial decarbonization and energy performance improvement. Business trends indicate a strong shift toward sustainable and bio-based insulation materials, such as bio-mineral wool and recycled content products, driven by corporate sustainability mandates and stricter regulatory frameworks across the OECD nations. Strategic initiatives, including mergers and acquisitions focusing on vertical integration and geographical expansion, are common among leading manufacturers aiming to secure raw material supplies and penetrate high-growth markets, particularly in Asia Pacific. Furthermore, the increasing complexity of industrial processes necessitates insulation systems capable of operating efficiently across extreme temperature ranges, leading to greater adoption of premium products like microporous insulation and high-density calcium silicate.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive industrialization projects in China, India, and Southeast Asian nations, particularly in power generation (both conventional and renewable), refining, and heavy manufacturing. North America and Europe, characterized by mature infrastructure, focus heavily on insulation refurbishment, maintenance, and adherence to extremely high energy efficiency standards (e.g., EU Energy Efficiency Directive). The Middle East and Africa (MEA) region presents significant opportunities driven by ongoing investments in new liquefied natural gas (LNG) terminals and petrochemical capacity expansion, demanding large volumes of specialized cryogenic and high-temperature insulation.

Segment trends underscore the rising prominence of the materials segment, with mineral wool retaining market leadership due to its excellent fire resistance and cost-effectiveness. However, the fastest growth is observed in advanced materials like aerogels, favored for their superior thermal performance in space-constrained applications, despite their higher cost. Application-wise, the petrochemical and oil & gas segment remains the largest consumer, driven by extensive pipeline networks and processing equipment requiring continuous high-temperature management. The increasing global focus on clean energy is boosting demand for insulation in concentrated solar power (CSP) plants and hydrogen production facilities, creating specialized niches for high-performance thermal barriers.

AI Impact Analysis on Industrial Thermal Insulation Market

Common user questions regarding AI's impact on industrial thermal insulation often revolve around predictive maintenance schedules, optimizing manufacturing efficiency, and developing smarter, adaptive insulation materials. Key concerns center on how AI can monitor the real-time degradation of insulation properties, identify subtle thermal anomalies indicating potential failures (e.g., CUI - Corrosion Under Insulation), and automate the design process for complex industrial geometries. The expectation is that AI algorithms, particularly machine learning and deep learning models applied to sensor data (IoT integration), will move insulation management from reactive maintenance to prescriptive optimization. Users anticipate that AI will enhance material quality control during production and provide better tools for calculating the optimal thickness and material choice based on fluctuating operational parameters, thus maximizing the return on investment for insulation systems.

- AI-driven Predictive Maintenance: Utilizing thermal imaging and integrated IoT sensors to predict insulation degradation or failure, specifically minimizing the risk associated with Corrosion Under Insulation (CUI) by early detection of moisture ingress.

- Optimized Manufacturing Processes: Applying machine learning algorithms to fine-tune curing times, density consistency, and dimensional stability during the production of insulation materials (e.g., foam, mineral wool boards), reducing waste and ensuring product quality.

- Automated System Design and Specification: AI tools assisting engineers in calculating optimal insulation thickness, material selection, and energy savings projections based on real-time operational temperatures and fluctuating environmental conditions, leading to prescriptive insulation design.

- Smart Insulation Development: Integrating AI with nanotechnology to create adaptive or 'smart' insulation materials that can autonomously adjust thermal resistance based on external or internal temperature signals, offering unparalleled energy efficiency.

- Enhanced Supply Chain Efficiency: Using predictive analytics to forecast demand for specialized insulation products (e.g., cryogenic vs. high-temperature) across different industrial sectors, optimizing inventory management and reducing lead times for complex projects.

DRO & Impact Forces Of Industrial Thermal Insulation Market

The market is significantly influenced by powerful internal and external dynamics encompassing Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's trajectory and profitability. A primary Driver is the globally tightening regulatory environment, particularly mandates targeting reduced industrial energy consumption and lower carbon footprints, forcing industries to invest in high-performance insulation upgrades. Simultaneously, the persistent volatility of energy prices incentivizes industrial operators to seek insulation solutions that guarantee long-term operational cost savings. Restraints often include the significant initial capital outlay required for specialized materials (like vacuum insulation panels or aerogels) and the inherent technical challenge of CUI, which necessitates costly preventative measures and maintenance, sometimes leading to hesitancy in major long-term insulation investments.

Opportunities for growth are abundant, stemming from the rapid expansion of niche industrial sectors. The burgeoning hydrogen economy, requiring extensive insulation for production, storage, and transport infrastructure (especially liquid hydrogen at cryogenic temperatures), presents a lucrative new application segment. Furthermore, the sustained growth in renewable energy sectors, specifically concentrated solar power (CSP), demands specialized high-temperature insulation capable of withstanding extreme, cyclical thermal loads. Technological innovation in the form of thin, highly effective insulation materials allows for efficient retrofit projects in space-constrained existing facilities, opening up the large, mature refurbishment market.

The primary Impact Forces driving market change include environmental sustainability pressures and material innovation. Sustainability acts as a pull factor, favoring recyclable and low-embodied energy materials. Material innovation, meanwhile, is a push factor, introducing revolutionary products like advanced fiberglass compositions and flexible aerogel blankets that offer superior performance characteristics (lower thermal conductivity) compared to traditional materials, enabling thinner profiles and improved efficiency. The combination of mandatory efficiency upgrades and continuous product improvement ensures consistent demand, mitigating cyclical downturns in specific end-user industries.

Segmentation Analysis

The Industrial Thermal Insulation Market is highly diversified, segmented based on material type, application, end-user industry, and region. Segmentation allows manufacturers to target specific performance requirements, such as temperature range, mechanical strength, and chemical inertness. The market breadth ranges from low-cost, traditional materials used in basic process heating to advanced, high-performance materials critical for complex cryogenic operations or specialized high-temperature reactors. Analyzing these segments provides crucial insights into growth pockets driven by technological shifts and regional industrialization trends.

- By Material Type:

- Mineral Wool (Glass Wool, Rock Wool, Slag Wool)

- Calcium Silicate

- Cellular Glass

- Plastic Foams (Polyurethane, Polyisocyanurate, Phenolic Foam)

- Ceramic Fibers

- Aerogels and Microporous Insulation

- Others (Perlite, Vermiculite)

- By Application:

- Piping Insulation

- Equipment Insulation (Tanks, Vessels, Boilers, Furnaces)

- HVAC Systems

- Duct Insulation

- By End-User Industry:

- Petrochemical and Oil & Gas

- Power Generation (Conventional and Nuclear)

- Chemical and Pharmaceutical

- Food and Beverage

- Metals and Mining

- Cement and Glass

- Others (Textiles, Paper & Pulp)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Industrial Thermal Insulation Market

The value chain for industrial thermal insulation is intricate, commencing with the extraction and processing of fundamental raw materials and culminating in the professional installation and maintenance at end-user sites. Upstream analysis involves the procurement of essential components such as silicates, basalt rock, petrochemical derivatives (for foams), and specialized additives. Raw material quality directly dictates the thermal, mechanical, and fire-resistant properties of the final product. Key challenges in the upstream segment include fluctuating energy costs, which impact manufacturing costs significantly, and maintaining a stable supply of high-purity inputs for advanced materials like aerogels. Manufacturers often focus on process innovation to use recycled or secondary materials to improve sustainability and stabilize input costs.

Midstream activities involve the conversion processes, such as fiber spinning (for mineral wool), casting and molding (for calcium silicate and cellular glass), and foaming/curing (for plastic foams). This stage is capital-intensive and requires high precision to meet stringent industry standards for thermal conductivity and dimensional stability. Distribution channels are varied: direct sales are common for large, specialized projects (e.g., refinery turnarounds or power plant construction) where technical expertise is required for specification and installation. Indirect channels involve large industrial distributors and specialized insulation contractors who manage the logistics, storage, and just-in-time delivery of standard materials to smaller projects or maintenance operations.

Downstream analysis focuses on installation, maintenance, and end-user engagement. Specialized insulation contractors play a critical role, as the effectiveness of the insulation system heavily relies on correct installation practices, ensuring vapor barriers are intact and joints are properly sealed. The ongoing demand for maintenance and replacement, particularly due to aging infrastructure and the constant threat of CUI, generates a stable aftermarket revenue stream. The ability of manufacturers to provide comprehensive technical support, compliance documentation, and training to installers is a key differentiator in this highly specification-driven market.

Industrial Thermal Insulation Market Potential Customers

Potential customers for industrial thermal insulation are primarily large-scale entities operating temperature-dependent processes, where energy efficiency, process safety, and reliability are paramount concerns. The primary buyer segment remains the Petrochemical and Oil & Gas industry, encompassing refineries, chemical plants, offshore platforms, and LNG facilities. These buyers require vast quantities of insulation for extensive piping, complex distillation columns, heat exchangers, and storage vessels, demanding materials capable of handling temperatures ranging from deep cryogenic to extremely high operational heat.

Another major customer segment is Power Generation, including coal, natural gas, nuclear, and renewable (CSP) power stations. These facilities require specialized high-temperature insulation for boilers, turbines, steam lines, and flue gas ducts to minimize heat loss and maximize thermodynamic efficiency. Nuclear facilities, in particular, demand non-combustible, high-integrity materials for safety and containment purposes. Investment cycles in this sector, driven by infrastructure replacement and decarbonization efforts, dictate large, periodic insulation procurement demands.

Furthermore, the Chemical and Pharmaceutical industries represent consistent customers, valuing materials with specific properties such as resistance to chemical attack, non-shedding characteristics (especially in cleanroom environments), and validated thermal performance. The Food and Beverage industry, requiring strict temperature control for chilling, freezing, and cooking processes, relies heavily on hygienic, moisture-resistant insulation, typically specialized foams or cellular glass, to ensure product safety and energy compliance across their extensive cold chain and processing facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.55 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain, Kingspan Group, Owens Corning, Rockwool International A/S, Armacell International S.A., Aspen Aerogels, Inc., Knauf Insulation, Lydall, Inc., Isolatek International, Unifrax Corporation, Morgan Advanced Materials plc, BASF SE, Johns Manville, PPG Industries, Recticel NV/SA, Etex Group, KAEFER Isoliertechnik GmbH & Co. KG, Thermax Limited, The DOW Chemical Company, Wacker Chemie AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Thermal Insulation Market Key Technology Landscape

The technological landscape of industrial thermal insulation is undergoing continuous evolution, driven by the need for materials that offer superior thermal performance in thinner profiles and enhanced sustainability characteristics. A major area of innovation is in nanotechnology, particularly the refinement of silica aerogels. Aerogels offer the lowest thermal conductivity of any solid material, making them ideal for high-performance applications where space is limited, such as complex equipment vessels or offshore piping. Recent developments focus on reducing the manufacturing cost and increasing the flexibility of these materials, enabling wider adoption beyond niche high-value projects.

Another significant technological advancement involves the creation of next-generation plastic foams, specifically high-density polyisocyanurate (PIR) and specialized phenolic foams. These materials are optimized for low-temperature and medium-temperature applications (cryogenic to process heating), focusing on achieving high closed-cell content to minimize moisture absorption and ensure long-term thermal integrity, crucial for preventing CUI. Furthermore, manufacturers are incorporating fire-retardant additives and developing low-smoke, low-toxicity formulations to comply with increasingly stringent safety standards, particularly in enclosed industrial environments and marine applications.

The integration of digital technology is redefining insulation management. Smart insulation systems, involving embedded fiber optic sensors or passive RFID tags, are emerging to monitor parameters such as internal temperature, moisture accumulation, and vibration in real time. This integration supports the shift towards predictive maintenance, allowing plant managers to monitor the health of their insulation envelope proactively. Technological advances in insulation jackets and removable covers also play a key role, enabling faster maintenance access and minimizing heat loss during temporary removal, thereby improving overall operational efficiency and reducing downtime.

Regional Highlights

The global Industrial Thermal Insulation Market exhibits diverse growth patterns influenced by regional industrial maturity, regulatory frameworks, and infrastructure investment cycles. Asia Pacific (APAC) stands out as the epicenter of market expansion, driven by unprecedented growth in processing industries—namely, chemicals, refining, power generation (coal, gas, and nuclear), and infrastructure development in China, India, and ASEAN countries. The demand in APAC is volume-driven, with significant uptake of traditional materials like mineral wool and calcium silicate for new plant construction and capacity additions, coupled with a growing need for advanced materials for sophisticated petrochemical complexes.

North America and Europe represent mature markets characterized by replacement demand, strict energy efficiency mandates, and a high focus on sustainable solutions. European markets are highly regulated, emphasizing materials with low embodied energy, superior fire ratings, and high acoustic performance, thereby favoring premium products and certified installers. In North America, the revitalization of the oil and gas sector (especially LNG export facilities) and ongoing upgrades to aging power infrastructure sustain stable demand, particularly for large diameter piping insulation and high-performance cryogenic systems.

The Middle East and Africa (MEA) region is a critical area for high-end specialized insulation due to massive investments in large-scale energy projects. This includes new mega-refineries, vast natural gas processing plants, and major petrochemical hubs, requiring insulation capable of enduring high solar radiation and extreme process temperatures. Latin America, driven primarily by Brazil and Mexico’s industrial output and infrastructure modernization, shows consistent, albeit slower, growth focusing on maintaining and expanding existing processing facilities and pipelines.

- Asia Pacific (APAC): Dominant market share and fastest growth driven by new capacity additions in refining, power, and manufacturing; high demand for traditional materials like mineral wool.

- North America: Stable market focused on high-performance materials for LNG, chemical processing, and rigorous CUI prevention programs; strong emphasis on refurbishment and maintenance.

- Europe: Characterized by stringent environmental regulations, favoring sustainable, bio-based, and high-specification insulation (e.g., A-rated fire safety); mature market driven by energy efficiency directives and upgrades.

- Middle East & Africa (MEA): High demand for specialized high-temperature and cryogenic insulation due to large-scale petrochemical and LNG infrastructure expansion projects.

- Latin America: Growth linked to commodity price stability and investments in oil & gas exploration and processing infrastructure modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Thermal Insulation Market.- Saint-Gobain

- Kingspan Group

- Owens Corning

- Rockwool International A/S

- Armacell International S.A.

- Aspen Aerogels, Inc.

- Knauf Insulation

- Lydall, Inc.

- Isolatek International

- Unifrax Corporation

- Morgan Advanced Materials plc

- BASF SE

- Johns Manville

- PPG Industries

- Recticel NV/SA

- Etex Group

- KAEFER Isoliertechnik GmbH & Co. KG

- Thermax Limited

- The DOW Chemical Company

- Wacker Chemie AG

Frequently Asked Questions

Analyze common user questions about the Industrial Thermal Insulation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Corrosion Under Insulation (CUI) and how does the industry mitigate it?

CUI is the corrosion of industrial equipment, primarily pipes and vessels, beneath the thermal insulation layer, typically caused by moisture ingress. Mitigation strategies include using moisture-resistant materials (e.g., cellular glass), applying specialized coatings, implementing protective jacketing systems, and adopting smart sensor technology for early moisture detection.

Which material type dominates the Industrial Thermal Insulation Market and why?

Mineral wool (including rock wool and glass wool) currently dominates the market. Its dominance is attributed to its excellent fire resistance, non-combustibility, cost-effectiveness, and versatility across a wide range of operational temperatures, making it suitable for standard piping and equipment in petrochemical and power plants.

How do global energy efficiency regulations influence insulation demand?

Stringent global energy efficiency regulations, such as those promoted by the EU and various national energy agencies, mandate the reduction of heat loss in industrial processes. This directly drives demand for high-performance insulation materials (like aerogels or advanced foams) and necessitates frequent insulation upgrades and replacements to ensure regulatory compliance and maximize energy savings.

What are the primary applications of advanced materials like aerogels in this market?

Aerogels are primarily used in high-value, space-constrained industrial applications, including critical subsea oil and gas pipelines, complex valve assemblies, and high-temperature reactors. Their superior thermal performance allows for much thinner insulation layers while maintaining high energy efficiency, particularly crucial for cryogenic and offshore environments.

Which region offers the most significant growth opportunities for insulation manufacturers?

Asia Pacific (APAC) presents the most significant growth opportunities, driven by rapid industrialization, large-scale investment in new manufacturing capacity, and the massive build-out of power generation and refining infrastructure, particularly in emerging economies like India, China, and Indonesia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager