Industrial Venting Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435684 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Venting Membrane Market Size

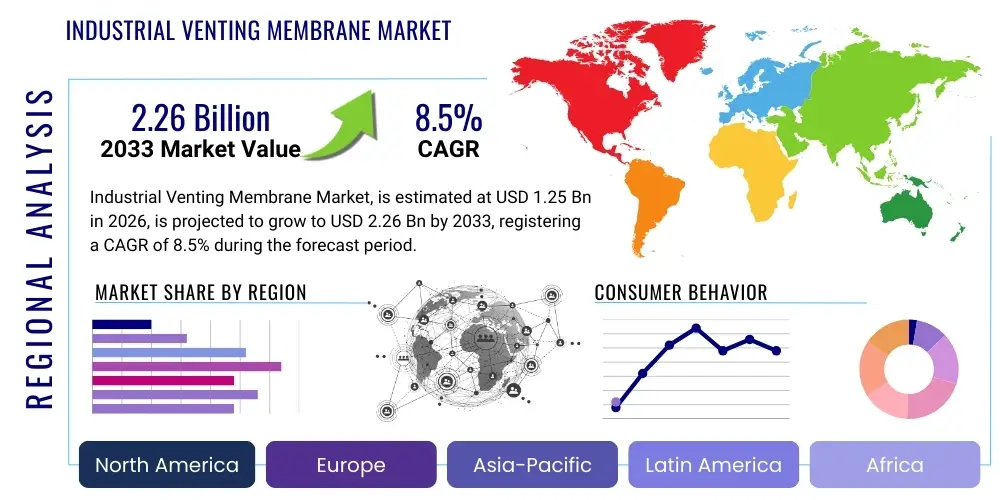

The Industrial Venting Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.26 Billion by the end of the forecast period in 2033.

Industrial Venting Membrane Market introduction

The Industrial Venting Membrane Market encompasses specialized semi-permeable materials integrated into various industrial and electronic enclosures to manage internal pressure fluctuations, prevent the intrusion of liquids and particulate matter, and facilitate gas diffusion. These membranes are critical for maintaining the operational integrity and longevity of sensitive components subjected to harsh environmental conditions, rapid temperature changes, or altitude variations. The primary function involves pressure equalization, which minimizes stress on housing seals and prevents component failure, simultaneously offering robust ingress protection (IP ratings). Key materials often include expanded Polytetrafluoroethylene (ePTFE), PTFE, and proprietary non-woven materials, selected based on porosity, hydrophobicity, and oleophobicity requirements for specific industrial applications. These components are vital in ensuring compliance with industry standards such as IP67, IP68, and even the demanding IP69K (high-pressure, high-temperature washdown resistance), which are increasingly mandated across critical infrastructure sectors.

The core product description revolves around their sophisticated micro-porous structure, typically formed via specialized processes like controlled uniaxial or biaxial stretching of polymers. This process creates tortuous pathways and precise pore size distributions, generally ranging from 0.2 to 10 micrometers, which is small enough to block liquid droplets (due to high surface tension interaction with hydrophobic polymers) but large enough to permit rapid gas exchange. Manufacturers strive to achieve the highest possible airflow capacity (CFM) at the lowest pressure differential, ensuring quick pressure equalization while maintaining maximal hydrostatic head resistance (the water column pressure the membrane can withstand before leakage). This delicate balance represents a central challenge and a key area of technological differentiation among market participants. Membranes are engineered for specific environmental stresses, including resistance to UV radiation, chemical exposure, temperature cycling, and mechanical abrasion, necessitating the use of high-performance adhesives or robust housing designs for screw-in variants.

Major applications span diverse, high-growth industrial sectors. The automotive segment is profoundly reliant on venting membranes for managing internal environments within headlamps, control units, sophisticated sensors (LiDAR, radar), and critically, large electric vehicle battery packs where temperature and pressure management directly correlate with safety and charging efficiency. The telecommunications sector utilizes these membranes extensively in outdoor enclosures for 5G small cells and remote radio heads, which must operate reliably in all weather conditions. Furthermore, in industrial automation, venting membranes protect precision sensors, control valves, and electrical cabinets against factory floor contaminants, particularly oils and dust. The essential benefits derived from adopting these membranes include enhanced reliability, substantial reduction in maintenance and warranty costs associated with environmental damage, and adherence to stringent global quality and environmental standards. Driving factors include the proliferation of connected devices (Industrial IoT), the relentless global expansion of electric vehicle manufacturing, and the stringent regulatory imperative for maintaining high operational uptime and safety in critical industrial machinery, all requiring superior enclosure protection against volatile environmental contaminants.

The market landscape is characterized by competitive innovation focused on material science. Companies are increasingly integrating sensors into venting solutions, moving toward predictive maintenance models. For instance, advanced membranes designed for high-altitude environments, like those used in aerospace avionics or high-power electronics on mountainous telecom towers, require specialized coatings that prevent icing and maintain optimal pressure equalization performance across extreme temperature gradients. The regulatory environment, particularly concerning intrinsic safety (IS) in potentially explosive atmospheres (ATEX/IECEx zones), also dictates design specifications, requiring venting components to be non-sparking and housed in certified enclosures. This demand for highly specialized, certified components further segments the market and drives specialized material development within the industrial venting membrane ecosystem.

Industrial Venting Membrane Market Executive Summary

The Industrial Venting Membrane market is experiencing vigorous growth, fundamentally propelled by global trends in electrification, digitalization, and increasing demands for robust, high-reliability components across harsh operating environments. Business trends indicate a marked shift toward solution-centric offerings, where membrane manufacturers are not merely selling components but providing integrated protection systems, often incorporating complex modeling and design consultation services to ensure optimal integration into OEM enclosures. There is a strong commercial emphasis on developing oleophobic membranes, critical for sectors exposed to lubricants and industrial fluids (such as heavy machinery and automotive under-the-hood applications). Furthermore, strategic business partnerships between material suppliers (e.g., ePTFE producers) and enclosure manufacturers are becoming common to streamline the supply chain and accelerate the introduction of certified, application-specific venting solutions to the market, enhancing product validation speed.

Regionally, the Asia Pacific (APAC) continues to lead the market expansion, capitalizing on massive production capacities for Li-ion batteries and related EV components, alongside government-backed projects focusing on smart infrastructure and rapid 5G deployment. While APAC dominates in volume, North America and Europe retain the lead in value and technological sophistication. North American demand is characterized by high requirements in specialized sectors like defense electronics and demanding environmental sensing applications, driving investment in advanced, sensor-integrated venting solutions. European markets, regulated by strict environmental and safety directives (like the REACH regulation affecting material choice), focus heavily on certified components for ATEX environments and sustainable material sourcing, influencing the regional competitive landscape towards quality and compliance over pure cost optimization.

Segment trends underscore the enduring market dominance of ePTFE materials due to their superior chemical resistance, longevity, and high-performance airflow. The product type segment is witnessing a transition in heavy industrial applications towards screw-in vents, which provide higher mechanical stability and are more serviceable than traditional adhesive patches, although adhesive vents maintain a strong position in high-volume, cost-sensitive electronics and non-critical automotive applications. Application analysis reveals pressure equalization remains the core driver, but fluid repellency, particularly protection against low-surface tension liquids, is rapidly gaining share as industries increasingly automate and use more synthetic operational fluids. Industry segmentation confirms the automotive sector, propelled by EV traction motors and battery venting, is the primary volume driver, while telecommunications and industrial automation are key segments for high-specification membrane deployment. The intersection of these trends points toward a future characterized by personalized membrane solutions tailored for specific fluid resistance and pressure management profiles.

Competitive strategy is heavily influenced by intellectual property surrounding specialized polymer processing techniques and proprietary adhesive technologies. Major global players focus on expanding their global manufacturing footprint to serve regional automotive and telecom hubs effectively, minimizing lead times and optimizing logistics costs. Smaller, specialized firms often differentiate themselves by targeting niche applications, such as medical devices requiring sterile venting, or highly specialized military electronics. The overriding executive focus remains on achieving cost optimization through manufacturing scale while simultaneously investing heavily in R&D to maintain a technological edge in permeability and environmental resistance, thereby securing long-term supply contracts with global Tier 1 and OEM clients who prioritize guaranteed performance consistency and global scalability.

AI Impact Analysis on Industrial Venting Membrane Market

User queries regarding the impact of Artificial Intelligence (AI) on the Industrial Venting Membrane Market often center around two main themes: optimization of manufacturing processes and the development of intelligent, predictive venting systems. Users are keenly interested in how AI, particularly machine learning (ML) algorithms, can optimize the precise micro-structure of membranes to enhance performance metrics like permeability and water intrusion resistance simultaneously, reducing material waste during production. There is also significant curiosity concerning the integration of smart sensors into venting components; these sensors could gather environmental data (pressure, temperature, humidity) and use AI/ML to predict when a vent might degrade or fail, moving maintenance strategies from reactive to predictive within critical industrial infrastructure.

The application of AI in material science and computational fluid dynamics (CFD) is accelerating the discovery and formulation of next-generation membrane materials with tailored pore characteristics. By simulating millions of potential molecular structures and manufacturing parameters, AI can drastically reduce the R&D cycle time required to achieve optimal hydrophobic or oleophobic performance under extreme conditions. Furthermore, AI-driven quality control systems utilizing high-resolution image analysis are being deployed on production lines. These systems ensure that every manufactured membrane meets the exact specifications regarding pore uniformity and structural integrity, crucial for maintaining IP ratings, thus improving overall product reliability and consistency that is highly valued by industrial end-users.

In terms of intelligent venting systems, the integration of AI potentially moves the industrial venting membrane from a passive component to an active system component within the IoT ecosystem. For example, in large-scale battery packs or industrial enclosures, embedded micro-sensors monitored by AI can dynamically regulate internal pressure through controlled venting mechanisms or signal preventative maintenance alarms based on anomalous pressure trends or accumulated contaminant load detected near the membrane surface. This capability enhances safety, especially in explosive environments, and significantly extends the lifespan of the underlying electronic assets, positioning the venting solution provider as a critical partner in predictive maintenance strategies.

The manufacturing process itself benefits immensely from AI-driven optimization. Robotics equipped with AI are used for precision handling and integration of delicate membrane patches onto adhesive carriers or into plastic housings, minimizing human error and maximizing efficiency. ML algorithms also optimize material consumption by analyzing real-time production yields and adjusting processing parameters dynamically, reducing waste of costly fluoropolymers. This comprehensive application across the value chain—from molecular design and material testing to quality control and field performance monitoring—establishes AI as a transformative force, enabling the production of highly customized, flawlessly performing, and maintenance-optimized industrial venting solutions necessary for the stringent demands of Industry 4.0 environments.

- AI-driven optimization of membrane microstructure and porosity design, leading to enhanced performance characteristics, maximizing airflow while maintaining high ingress protection (IP).

- Implementation of Machine Learning (ML) for predictive failure analysis of venting systems based on real-time environmental data inputs from integrated sensors (pressure, humidity).

- Enhanced quality control using AI vision systems and deep learning models to detect microscopic defects during the high-speed manufacturing process, ensuring strict IP compliance and zero-defect output.

- Simulation and modeling using computational AI (CFD analysis) to accelerate the R&D of novel hydrophobic and oleophobic coating materials specifically resistant to new industrial chemicals and synthetic fluids.

- Development of smart, connected vents (IoT integration) that utilize AI algorithms to dynamically assess the health and functional status of the membrane, enabling preventative maintenance protocols.

- AI-optimized manufacturing parameter control (e.g., stretching ratio, temperature) to maximize yield and minimize material waste of expensive polymers like ePTFE.

DRO & Impact Forces Of Industrial Venting Membrane Market

The dynamics of the Industrial Venting Membrane Market are fundamentally influenced by a complex interplay of rapid technological adoption drivers, stringent regulatory constraints, and significant market opportunities arising from industrial shifts. The foremost driver is the global energy transition, specifically the exponential growth of the Electric Vehicle (EV) industry. EV battery packs, being sealed high-energy systems, generate significant temperature fluctuations and internal pressure changes, requiring highly reliable venting membranes to prevent catastrophic failures and ensure safety—a demand that necessitates high-performance, heat-resistant, and chemically inert solutions. Concurrent with this, the massive infrastructure build-out for 5G telecommunications demands robust, environmentally sealed enclosures for outdoor equipment like base stations and small cells, where uptime is paramount and environmental protection (IP68) is non-negotiable. These macro-trends provide a sustainable, long-term foundation for market expansion, pushing suppliers to continuously increase production capacity and improve membrane performance metrics.

Despite strong driving forces, the market faces inherent restraints centered on cost and technical complexity. The reliance on specialized materials, particularly high-grade ePTFE, subjects manufacturers to volatile raw material pricing and complex fabrication processes, leading to higher component costs compared to conventional sealing solutions. This cost factor acts as a barrier in price-sensitive markets or non-critical applications. Another significant restraint is the challenge of ensuring perfect integration. The efficacy of the membrane is heavily dependent on the quality of its attachment (adhesion, welding, or mechanical screw seal) to the housing material, demanding high precision from the OEM assembly line. Sub-optimal installation can compromise the entire IP rating, leading to product failure and liability issues, which necessitates extensive technical support and rigorous testing, adding to the overall cost of implementation for end-users.

Significant opportunities are emerging through technological advancements and expansion into underserved niches. The strongest opportunity lies in the development of intelligent, sensor-equipped venting solutions, integrating the passive membrane with active monitoring capabilities. This shift aligns perfectly with Industry 4.0 principles, allowing membrane suppliers to capture additional value by providing predictive maintenance data and system health insights. Furthermore, the increasing use of industrial automation in harsh environments, such as heavy manufacturing and petrochemical processing, accelerates the demand for advanced oleophobic membranes that can effectively repel aggressive solvents and industrial coolants, representing a lucrative specialization niche. Geographical opportunities are substantial in emerging markets (LATAM, MEA) where modernization of telecommunications and rapid infrastructural projects are initiating a large, untapped demand for reliable environmental enclosure protection.

The impact forces within the market are predominantly defined by the intense bargaining power of large volume buyers (Tier 1 automotive suppliers and telecom giants), who dictate pricing and require adherence to stringent global quality standards (e.g., ISO/TS 16949). The threat of substitution, while present (e.g., alternative mechanical seals or complex hermetic sealing), is mitigated by the fact that venting membranes uniquely address the dual challenge of pressure equalization and ingress protection simultaneously, a capability often absent in substitute solutions. Competitive rivalry is high, particularly among ePTFE specialists, leading to continuous innovation cycles focused on maximizing Airflow/Hydrostatic Resistance ratios (AHR) and developing proprietary surface treatments for specialized fluid resistance. Regulatory compliance, especially concerning material safety and environmental impact (e.g., elimination of certain fluorochemicals), serves as a powerful external impact force shaping material R&D strategies.

Segmentation Analysis

The Industrial Venting Membrane Market is meticulously segmented across several critical dimensions, including material type, product type, application, and end-use industry. This structure is essential for distinguishing performance characteristics and market trends, as the choice of venting solution is entirely dependent on the specific environmental and operational challenges of the end product. Material segmentation provides the foundational understanding of capability, with high-performance polymers like expanded Polytetrafluoroethylene (ePTFE) commanding the largest share due to its superior chemical inertness, UV resistance, and the capability to maintain high airflow (permeability) even with extremely small pore sizes, ensuring robust protection across a broad spectrum of temperatures and chemical exposures. Other materials, such as standard PTFE and specialized non-woven composites, cater to cost-sensitive applications or environments where ePTFE’s specific characteristics might be over-engineered.

Product segmentation differentiates integration methods, primarily categorizing the market into adhesive vents (patches), screw-in vents, and weldable or press-fit variants. Adhesive vents are favored for high-volume, automated assembly lines in consumer and automotive electronics due to their ease of application and minimal profile, but they require highly reliable proprietary adhesives to ensure long-term seal integrity under thermal cycling. Screw-in vents, typically encapsulated in durable plastic or metal housings, are the preferred choice for heavy industrial machinery, outdoor telecom cabinets, and environments requiring frequent maintenance or where maximum mechanical resilience against vandalism and pressure washing is necessary. The selection between these product types often involves a trade-off between installation cost/speed and long-term mechanical durability and serviceability.

Application segmentation reveals the functional imperative driving demand. Pressure equalization is a universal requirement, preventing enclosure seals from stressing or failing due to rapid pressure changes encountered during altitude shifts (aerospace/transportation) or temperature cycling (solar inverters, LED lighting). Ingress Protection (IP rated solutions) focuses on meeting mandated standards (IP67/IP68/IP69K) against water and dust penetration, a baseline requirement across all industrial sectors. Crucially, the segment of Fluid Repellency, specifically oleophobicity, is growing rapidly. These specialized membranes protect electronics from lubricants, cutting fluids, and detergents prevalent in factory automation and automotive under-hood applications, demanding advanced surface treatments to maintain functionality in chemically aggressive environments.

Finally, end-use industry segmentation maps consumption patterns directly to macro-economic drivers. The Automotive sector is the largest consumer, driven by battery management systems in EVs and robust external sensor protection. Telecommunications remains a critical high-specification market, requiring longevity in outdoor equipment. Industrial Machinery and Automation dictates high volumes of durable, oleophobic components. Furthermore, the specialized segments of Medical Devices (sterile venting) and Renewable Energy (inverters, solar panel junction boxes) are key growth accelerators, each demanding unique performance profiles regarding material purity, thermal stability, and long operational lifespans. Analysis across these segments confirms that customization and verifiable performance are key competitive differentiators over simple material cost.

- By Material Type:

- ePTFE (Expanded Polytetrafluoroethylene)

- PTFE (Polytetrafluoroethylene)

- Non-woven Materials (e.g., Polypropylene, Polyester)

- Others (Specialized Composites, Silicone-based)

- By Product Type:

- Adhesive Vents/Patches (Die-cut, Laminated)

- Screw-in Vents (Plastic and Metal Housing)

- Weldable Vents/Press-fit Vents (Ultrasonically Bonded)

- By Application:

- Pressure Equalization (Thermal Cycling, Altitude Changes)

- Ingress Protection (IP Rated Solutions against Dust and Water)

- Fluid Repellency (Oleophobic Solutions against Oils and Solvents)

- By End-Use Industry:

- Automotive (EV Battery Systems, Lighting, ECUs)

- Telecommunications (5G Infrastructure, RRHs, Base Stations)

- Industrial Machinery & Automation (Sensors, Control Cabinets, Robotics)

- Consumer Electronics (Rugged Devices, Portable Equipment)

- Medical Devices (Sterile Packaging, Diagnostic Equipment)

- Others (Aerospace, Defense, Renewable Energy, Oil & Gas)

Value Chain Analysis For Industrial Venting Membrane Market

The value chain for the Industrial Venting Membrane Market begins with the highly specialized and capital-intensive upstream segment involving the synthesis and processing of advanced fluoropolymers, predominantly Polytetrafluoroethylene (PTFE). Key suppliers in this phase are large chemical corporations that manufacture the PTFE powder or resin. The next critical step is the membrane formation, where specialized manufacturers utilize proprietary expansion and stretching techniques—such as biaxial stretching for ePTFE—to create the micro-porous film structure. This stage is highly IP-sensitive, as the precise control over pore geometry, thickness, and material density directly determines the membrane's functional performance, including its hydrostatic pressure resistance and air permeability. The quality and purity of the base polymer are paramount, ensuring long-term chemical inertness and thermal stability required for demanding industrial applications.

The midstream process focuses on membrane conversion, fabrication, and integration into the final product format. This involves taking the raw membrane film and transforming it into ready-to-use components: die-cutting to exact dimensions for adhesive patches, lamination onto specialized adhesive layers (often pressure-sensitive acrylic or silicone), or integration into robust plastic or metal screw-in housings via welding or ultrasonic bonding. Precision engineering at this stage is essential to ensure that the cutting or welding processes do not compromise the integrity of the membrane's micro-structure or the critical sealing edge. Membrane manufacturers often maintain cleanroom environments for assembly to prevent contamination that could lead to pore clogging and performance degradation before deployment. Quality control systems are highly automated, employing high-resolution cameras to verify dimensional accuracy and detect minute structural flaws in the finished component.

Distribution and downstream activity are characterized by direct relationships with high-volume Original Equipment Manufacturers (OEMs) and specialized industrial distribution for Maintenance, Repair, and Operations (MRO). Direct channels handle customized solutions for automotive, telecom, and large industrial clients, often involving joint R&D efforts and long-term supply agreements. This minimizes technical risk for the OEM and secures volume for the membrane supplier. Indirect channels, through specialized distributors focused on electronic components and industrial seals, cater to smaller OEMs and the replacement market, requiring broad inventory and technical stocking capabilities. The final integration by the end-user involves affixing the vent component onto the final enclosure. Since incorrect installation is a major cause of failure, downstream value is heavily supported by engineering consultation and detailed installation guidelines provided by the membrane manufacturer, emphasizing the non-commodity nature of these components.

The overall market efficiency is driven by the strategic collaboration between the upstream polymer processors and the midstream converters. Companies that control proprietary processing techniques for ePTFE hold a significant advantage. The trend towards vertical integration, where membrane manufacturers expand their capabilities into screw-in vent housing manufacturing, helps control quality and reduce supply chain complexity. The high cost of R&D, particularly in meeting specialized requirements like high-pressure washdown resistance (IP69K) or specific chemical resistance profiles, concentrates power among established players who can afford continuous material science investment, making the value chain relatively concentrated at the highest performance tiers.

Industrial Venting Membrane Market Potential Customers

The customer ecosystem for industrial venting membranes is expansive, primarily comprising manufacturers of high-reliability electronic and mechanical systems requiring durable environmental protection and effective internal pressure management. The largest and most influential customer base resides within the global Automotive industry. Within this sector, customers include Tier 1 suppliers specializing in external lighting systems (LED/HID headlamps and taillights), electronic control units (ECUs), and particularly, manufacturers involved in the booming Electric Vehicle (EV) segment. EV customers require specialized large-format venting solutions for battery enclosures (managing potential thermal runaway gas release and routine pressure buildup), and smaller vents for traction motors and on-board chargers, prioritizing thermal stability and chemical resistance above all else. These major buyers demand high compliance (e.g., AEC-Q200 standards) and global consistency in supply.

A second critical customer segment is the Telecommunications sector, encompassing global vendors of networking infrastructure. These customers purchase venting membranes for protection of outdoor electronics, including 5G Remote Radio Heads (RRHs), cell tower enclosures, and Fiber-to-the-Home (FTTH) cabinets. Since this equipment is often deployed in remote, exposed locations and must operate continuously for decades, the customers prioritize long-term durability, maximum IP rating (IP68), and UV resistance. The rapid expansion of 5G infrastructure globally is currently the primary driver for volume purchasing within this segment, creating highly standardized, large-scale demand that favors suppliers capable of global distribution and consistent quality.

The Industrial Machinery and Automation sector represents a diverse set of customers including manufacturers of robotics, heavy-duty industrial sensors, pressure transmitters, and control cabinet manufacturers. These buyers operate in environments prone to mechanical stresses, oil, dust, and corrosive vapors. Consequently, they are significant purchasers of highly oleophobic and chemically resistant venting solutions, often preferring screw-in vent designs for superior mechanical robustness and field serviceability. For instance, manufacturers supplying the food and beverage industry are major customers, needing membranes that can withstand high-pressure, high-temperature caustic washdown procedures (IP69K rating), necessitating specialized materials and housing designs.

Furthermore, specialized segments such as medical device manufacturing and the defense/aerospace industries form high-value, though lower-volume, customer niches. Medical manufacturers utilize venting membranes for sterile pressure equalization in devices subject to autoclaving or for fluid management in portable diagnostic equipment, demanding bio-compatible and highly purified materials. Aerospace customers require extremely reliable vents for avionics and sensor housings operating under rapid and extreme changes in altitude and pressure, prioritizing lightweight, high-temperature tolerant materials and strict adherence to military specifications. These diverse end-users collectively emphasize that the purchasing decision is based less on absolute unit price and overwhelmingly on verified performance data, reliability track record, and the supplier's capacity to provide technical integration support and necessary regulatory certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.26 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | W. L. Gore & Associates, Donaldson Company, Sumitomo Electric Industries, Clarcor Inc. (Parker Hannifin), 3M Company, Saint-Gobain, Zeus Industrial Products, MicroVent Systems, Synventive, Lydall, Merck Millipore, Porex Corporation, Dexmet Corporation, Zotefoams plc, Hangzhou Cobetter Filtration Equipment Co., Ltd., Polyvent Technology, Jiangsu Huatong New Material Co., Ltd., Nitto Denko Corporation, Pall Corporation, J. W. Winco Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Venting Membrane Market Key Technology Landscape

The technological landscape of the Industrial Venting Membrane Market is defined by continuous, intense advancements in specialized polymer science, sophisticated surface modification techniques, and novel integration methodologies, all aimed at maximizing reliable component performance under the most extreme operational stresses. The foundational technology remains the controlled micro-porous structure of expanded Polytetrafluoroethylene (ePTFE), which provides an unmatched combination of high airflow capacity necessary for rapid pressure equalization and extremely low surface energy required to robustly repel water (hydrophobicity) and oils (oleophobicity). Key technological breakthroughs are focused on refining the ePTFE structure through highly precise, proprietary stretching and sintering processes to achieve an optimized pore size distribution. This optimization targets a narrow range, typically between 0.2 and 5 micrometers, which critically balances venting efficiency against the required hydrostatic head resistance, enabling certification for high-demand standards like IP68 and IP69K.

A major area of differentiation is in surface modification technologies, particularly the development of high-performance oleophobic membranes. Since standard PTFE is highly hydrophobic but only moderately oleophobic, manufacturers are utilizing proprietary fluoropolymer coatings or advanced plasma treatments applied at the nano-scale to the membrane’s fibers. These treatments significantly lower the surface energy below the critical surface tension of industrial fluids like lubricating oils, hydraulic fluids, and diesel, ensuring effective repellency and pore functionality even after prolonged exposure. This necessity for superior oil resistance is propelling specific product lines catering to heavy machinery, powertrain components, and factory automation sensors, environments where contamination by low-surface-tension hydrocarbons is inevitable and compromises traditional venting solutions. Additionally, manufacturers are investing in specialized filter media composites, where the primary venting material is laminated or combined with supporting non-woven layers or high-strength meshes. These composites enhance crucial properties such as resistance to abrasion, mechanical puncture, and high-temperature steam exposure, crucial for longevity in industrial cleaning cycles.

In terms of component integration, the technological focus is rapidly evolving towards solutions that simplify assembly and enhance long-term reliability. This includes developing next-generation adhesive systems that guarantee long-term bonding integrity to diverse housing materials (e.g., various grades of ABS, polycarbonate, or aluminum) across wide and rapid thermal cycling experienced in external environments. Advancements in automated welding and ultrasonic bonding techniques for integrating membranes into plastic housings are also critical, ensuring a hermetic seal around the membrane without damaging the porous structure itself. Modular screw-in vent designs are becoming highly sophisticated, featuring integrated gaskets (often silicone or EPDM) and modular construction that allows for rapid, tool-free installation and replacement while ensuring anti-rotation features to maintain alignment and seal pressure throughout the component lifecycle.

The convergence of material science with digital technology defines the cutting edge: the emergence of "smart venting" systems. This involves integrating micro-electro-mechanical systems (MEMS) pressure sensors and humidity sensors directly into the vent component or adjacent to the membrane. These integrated solutions leverage low-power wireless communication protocols (e.g., Bluetooth LE or specialized industrial protocols) to transmit real-time data regarding the enclosure’s internal environment and the differential pressure across the membrane. These data streams feed into IoT platforms, where AI and ML algorithms analyze trends to predict potential membrane clogging or seal failure based on anomalous pressure or humidity spikes. This technological shift positions venting membranes as critical data points for predictive maintenance regimes, adding significant value beyond mere passive protection and aligning the product category with the broader transformation toward Industry 4.0 infrastructure. Future developments are anticipated in self-cleaning membranes utilizing piezo-electric effects or advanced catalytic surfaces to actively repel contaminants and maintain long-term airflow performance without human intervention.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the primary engine of volume growth and the world's largest consumer base for industrial venting membranes, fueled primarily by its dominance in global manufacturing. The region, particularly China, South Korea, and Japan, commands massive production scales in electric vehicle components, high-volume consumer electronics, and robust 5G telecommunications infrastructure. The governmental push for widespread 5G deployment across densely populated and geographically diverse areas, including tropical, high-humidity zones in Southeast Asia, necessitates components with extreme weather resilience and reliable IP ratings, driving high-volume demand for performance-oriented ePTFE solutions. Regional competitiveness is intense, often involving a delicate balance between cost optimization for mass-market electronics and the high-performance requirements mandated by global EV and telecom OEMs operating within the region. Local manufacturers are rapidly gaining ground by improving proprietary material processing to match the technical specifications historically dominated by North American and European suppliers.

- North America: North America represents a mature, high-value, and technologically sophisticated market. Demand is characterized by extremely stringent quality requirements and a rapid adoption of high-tech applications across specialized industries like aerospace, defense, and advanced robotics. The market's high compliance burden, driven by standards bodies like UL (Underwriters Laboratories) and NEMA (National Electrical Manufacturers Association), ensures that only certified, premium venting solutions are adopted, often necessitating complex validation processes. Significant domestic investment in the EV supply chain and modernization of smart grid infrastructure fuels consistent demand for advanced, sensor-integrated venting technologies. Furthermore, the region is a leader in implementing predictive maintenance strategies (Industry 4.0), making it an early adopter of smart venting systems that provide real-time diagnostic data on enclosure integrity, driving higher average selling prices and focusing competition on innovation rather than volume alone.

- Europe: The European market is highly regulated and innovation-driven, sustained by leading players in automotive manufacturing (Germany, Italy, France) and a strong commitment to renewable energy infrastructure and industrial automation (Industry 4.0). Key drivers include aggressive emission reduction targets and the rapid phase-out of internal combustion engines, directly accelerating the demand for venting membranes in critical EV components. Europe maintains exceptionally strict regulatory standards regarding material composition (e.g., REACH compliance) and safety certifications, particularly for components used in potentially explosive atmospheres (ATEX and IECEx directives). This focus on safety and compliance ensures robust demand for specialized, certified venting solutions, pushing suppliers towards meticulous documentation and localized quality assurance. The regional market is segmented by the varying climatic conditions, from the coastal moisture to the extreme continental temperature swings, requiring tailored solutions for thermal cycling stability.

- Latin America (LATAM): Emerging market growth linked to modernization of public utilities, industrial automation, and expanding telecommunication networks. In LATAM, urbanization and subsequent industrial expansion drive the need for environmental protection solutions. The focus is often on robust, cost-effective solutions for infrastructure modernization, particularly in transportation and utility sectors, reflecting a growing awareness of ingress protection standards as infrastructure improves.

- Middle East & Africa (MEA): Growth concentrated in oil & gas exploration (requiring extreme corrosion and heat resistance) and large-scale smart city/telecom infrastructure projects; high reliance on robust, imported solutions. In the MEA region, investments in oil & gas infrastructure (where corrosion resistance is critical) and regional smart city projects are catalyzing demand for durable industrial enclosure components, including venting membranes. The market growth in these regions is primarily driven by imported technology and increasing adoption of global best practices regarding ingress protection standards, although price sensitivity remains a key factor influencing product choice.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Venting Membrane Market.- W. L. Gore & Associates, Inc.

- Donaldson Company, Inc.

- Sumitomo Electric Industries, Ltd.

- Clarcor Inc. (A Parker Hannifin Company)

- 3M Company

- Saint-Gobain S.A.

- Zeus Industrial Products, Inc.

- MicroVent Systems (Part of Gore)

- Synventive Molding Solutions (A Barnes Group Company)

- Lydall, Inc. (Now part of Unifrax)

- Merck KGaA (MilliporeSigma)

- Porex Corporation (A Filtration Group Company)

- Dexmet Corporation

- Zotefoams plc

- Hangzhou Cobetter Filtration Equipment Co., Ltd.

- Polyvent Technology Co., Ltd.

- Jiangsu Huatong New Material Co., Ltd.

- Nitto Denko Corporation

- Pall Corporation (A Danaher Company)

- J. W. Winco Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Venting Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an industrial venting membrane?

The primary function is pressure equalization and ingress protection (IP). Venting membranes allow air to pass freely to equalize pressure differentials caused by temperature changes or altitude, while simultaneously preventing the entry of water, dust, and contaminants into the electronic enclosure, thereby protecting sensitive components.

Why are ePTFE membranes preferred over standard PTFE in industrial applications?

Expanded PTFE (ePTFE) is preferred due to its superior micro-porous structure, offering high airflow rates (venting efficiency) combined with excellent hydrophobicity and oleophobicity. This combination provides higher performance IP ratings (e.g., IP68, IP69K) and greater mechanical strength compared to conventional materials.

How does the growth of Electric Vehicles (EVs) impact the demand for venting membranes?

EV growth significantly increases demand, particularly for large-format membranes used in battery packs. These membranes are crucial for managing internal pressure build-up, mitigating thermal runaway risks, and protecting sensitive electronics within the high-voltage battery enclosures from moisture and contaminants.

What is the difference between adhesive vents and screw-in vents?

Adhesive vents are flexible patches ideal for rapid, cost-effective application and low-profile integration, typically used in high-volume electronics. Screw-in vents (or molded vents) offer robust mechanical attachment, durability, and easier maintenance access, making them preferred for heavy-duty, high-vibration industrial machinery and critical infrastructure.

What role does oleophobicity play in venting membrane performance?

Oleophobicity refers to the membrane's ability to repel low-surface-tension fluids, such as oils, lubricants, and solvents commonly found in industrial environments. Oleophobic membranes ensure that contamination by these fluids does not clog the pores, maintaining critical airflow and ingress protection over the component's lifespan, especially crucial in industrial automation and automotive applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager