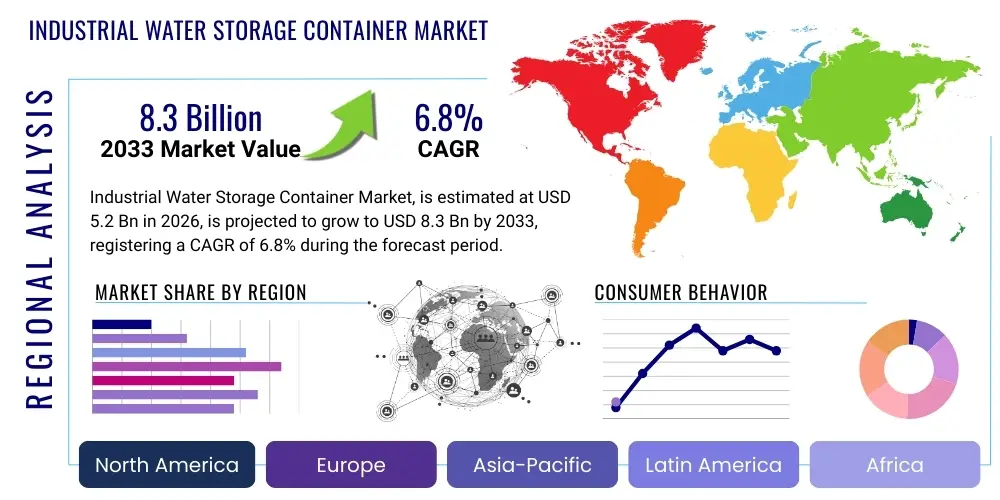

Industrial Water Storage Container Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437548 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Water Storage Container Market Size

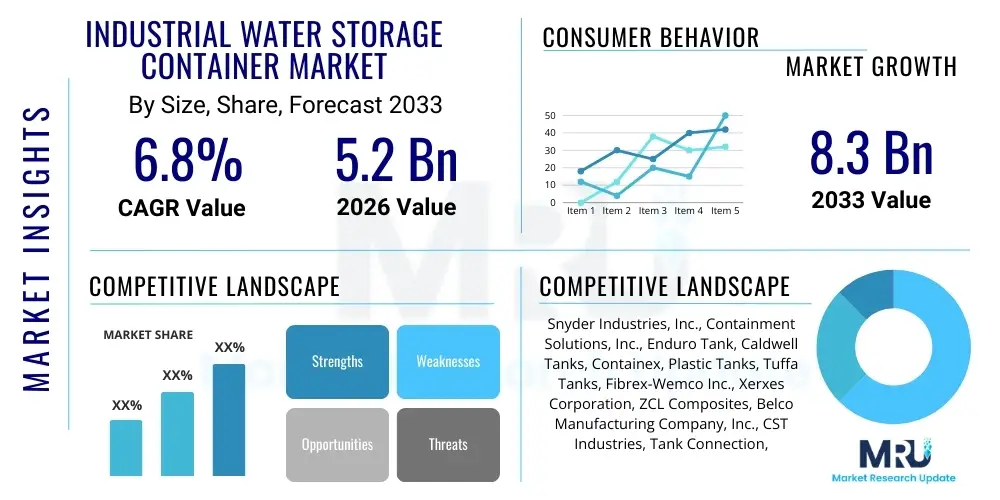

The Industrial Water Storage Container Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

Industrial Water Storage Container Market introduction

The Industrial Water Storage Container Market encompasses the design, manufacture, and deployment of large-scale vessels and tanks specifically engineered to hold significant volumes of water for various industrial operations. These containers are critical infrastructure components used across sectors ranging from heavy manufacturing and chemical processing to food and beverage production, and municipal services. They serve essential functions such as maintaining reserve water supply for fire suppression systems, storing processed water, managing effluent and wastewater before treatment, or ensuring a consistent supply of non-potable or potable water for operational continuity. The diversity in container types, spanning materials like fiberglass, steel, concrete, and high-density polyethylene (HDPE), reflects the wide array of environmental and chemical challenges faced by different industries, necessitating specialized solutions for durability, corrosion resistance, and regulatory compliance. The fundamental product characteristic is reliable, large-capacity storage tailored to harsh industrial conditions.

Major applications driving the demand for these industrial storage solutions include the growing need for sophisticated wastewater management systems in manufacturing hubs, the increasing reliance on large capacity tanks for hydraulic fracturing operations in the oil and gas sector, and the stringent requirements for fire safety reserves in large-scale industrial complexes. Furthermore, the global push towards sustainable water usage and conservation mandates that industries implement efficient storage solutions to minimize waste and manage resources effectively. The containers must often meet strict standards concerning material integrity, seismic resistance, and leakage prevention, making engineering expertise a key differentiator in the market. The essential benefits provided by these containers are enhanced operational resilience, regulatory adherence, and optimized water resource utilization, which directly contribute to reduced operational downtime and improved overall efficiency.

The primary driving factors propelling the expansion of this market include rapid global industrialization, especially in developing economies, leading to increased factory and plant installations requiring robust water infrastructure. Regulatory shifts demanding improved environmental compliance and wastewater treatment standards necessitate investments in advanced storage tanks. Additionally, the heightened focus on disaster preparedness and business continuity planning drives demand for reliable, large-volume reserves for emergency scenarios, particularly fire suppression. Technological advancements in corrosion-resistant materials, smart monitoring systems integrated into the containers, and modular, quickly deployable tank designs are further accelerating market uptake by offering enhanced longevity and flexibility.

Industrial Water Storage Container Market Executive Summary

The Industrial Water Storage Container Market is currently experiencing robust growth, driven primarily by sustained urbanization and industrial expansion across Asia Pacific and specific regions of the Middle East and Africa, coupled with stringent environmental regulations mandating better water treatment and storage practices globally. Key business trends indicate a strong shift towards advanced material solutions, specifically Fiberglass Reinforced Plastic (FRP) tanks, favored for their excellent corrosion resistance and lighter installation footprint compared to traditional steel or concrete structures. Companies are increasingly focusing on providing turnkey solutions that include not just the container but also integrated monitoring, maintenance, and asset management services, moving the market away from simple product sales towards comprehensive infrastructural partnerships.

Regional trends highlight that North America and Europe maintain maturity, characterized by high replacement cycles and a focus on integrating smart sensors and IoT capabilities for real-time monitoring of water quality and volume, particularly within the petrochemical and municipal sectors. Conversely, the Asia Pacific region is forecast to demonstrate the highest Compound Annual Growth Rate (CAGR), fueled by massive investment in manufacturing facilities, power generation plants, and large-scale agricultural projects requiring substantial water reserves and wastewater handling capabilities. The Middle East is notable for high demand driven by desalination plants and necessary infrastructure for oil and gas operations in challenging arid environments, favoring highly durable and specialized material constructs.

Segment trends reveal that the 'Above 20,000 Gallons' capacity segment dominates the market revenue, reflecting the large-scale needs of heavy industries and municipal facilities. From an application perspective, Wastewater Management and Chemical Processing segments are exhibiting the fastest growth due to global tightening of discharge regulations and complex industrial processes requiring multiple storage phases. In terms of material, while Steel remains essential for high-pressure or extreme temperature applications, the Polyethylene/Plastic segment is gaining significant traction in small-to-medium capacity requirements within the food & beverage and agriculture sectors due to cost-effectiveness and ease of installation. Overall, the market remains highly competitive, with differentiation based on material innovation, customization capabilities, and compliance with increasingly complex international safety standards.

AI Impact Analysis on Industrial Water Storage Container Market

Common user inquiries regarding AI's influence on the Industrial Water Storage Container Market center on predictive maintenance, smart leakage detection capabilities, and optimizing supply chain logistics related to oversized container transportation and installation. Users are seeking to understand how AI algorithms can transform reactive maintenance schedules into proactive asset management by analyzing operational data from sensors embedded in the tanks, such as pH levels, stress metrics, temperature fluctuations, and volume levels. A major theme is the expectation that AI should significantly reduce the risk of catastrophic failure (like major leaks or structural collapses) and minimize unnecessary physical inspections. Concerns often revolve around the initial investment costs of retrofitting existing infrastructure with the necessary IoT sensors and the complexity of integrating diverse data streams from tanks made of different materials (steel, FRP, concrete) into a unified AI-driven maintenance platform. Users anticipate that AI will facilitate better capital expenditure planning by providing precise, data-driven estimates of remaining useful life for storage assets.

- AI-powered Predictive Maintenance: Algorithms analyze sensor data (corrosion rates, pressure, vibration) to forecast equipment failure, dramatically reducing unscheduled downtime and optimizing inspection schedules for industrial water tanks.

- Optimized Logistics and Installation: AI tools enhance route planning for oversized container delivery and site logistics, accounting for transport restrictions, weather, and terrain, resulting in lower shipping costs and faster project completion.

- Smart Water Quality Monitoring: Machine learning models process real-time chemical and biological data within stored industrial water, instantly identifying deviations or contamination events, crucial for sectors like food & beverage and pharmaceutical manufacturing.

- Enhanced Leak Detection and Integrity Monitoring: AI utilizes acoustic sensing and complex pressure mapping data to pinpoint structural weaknesses or nascent leaks long before they become visible, improving tank safety and environmental compliance.

- Demand Forecasting for Manufacturing: AI analyzes historical production cycles and seasonal industrial water demand to optimize the tank manufacturing and inventory processes, ensuring manufacturers meet fluctuating industrial procurement needs efficiently.

DRO & Impact Forces Of Industrial Water Storage Container Market

The dynamics of the Industrial Water Storage Container Market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces dictating market trajectory. Major drivers stem from accelerating global industrialization, particularly the growth of power generation, mining, and chemical processing facilities which inherently require massive, reliable water storage infrastructure for operations and waste handling. Concurrently, government mandates related to environmental protection, stringent wastewater discharge limits, and mandatory industrial fire suppression protocols act as powerful external forces compelling industries to invest in new, compliant storage solutions. These drivers ensure a consistent baseline demand, regardless of minor economic fluctuations, positioning storage containers as non-negotiable capital assets.

Conversely, significant restraints hinder market growth. The high initial capital expenditure associated with constructing and installing large-scale industrial tanks, particularly those made of highly durable materials like specialty alloys or reinforced concrete, can deter small and medium enterprises. Furthermore, the volatility in raw material prices, notably steel and key petrochemicals used in FRP and plastic manufacturing, introduces cost uncertainties for container producers and end-users alike. Another key constraint involves the complex, varied, and often geographically specific regulatory approval processes required for tank installation, especially concerning land use, hazardous material storage permits, and environmental impact assessments, which can significantly delay project timelines.

Despite these challenges, substantial opportunities exist, primarily through technological innovation and expanding into underserved application areas. The increasing adoption of modular and prefabricated tank systems offers reduced installation time and improved flexibility, addressing a core restraint. The development of advanced composite materials offers superior longevity and resistance to highly corrosive industrial fluids, opening avenues in specialized chemical storage. The overarching opportunity lies in the integration of digital technologies—IoT and AI—to offer 'smart tanks' that provide remote monitoring, automated inventory management, and predictive maintenance services, transforming the value proposition from a static asset into an actively managed component of industrial operations. The cumulative impact force suggests a strong upward trajectory, provided manufacturers can mitigate raw material cost volatility and standardize innovative material solutions across diverse regulatory landscapes.

Segmentation Analysis

The Industrial Water Storage Container Market is comprehensively segmented based on material composition, storage capacity, the specific application of the stored water, and the type of industrial end-user. This layered segmentation allows for a precise understanding of specialized market needs, as the requirements for a petrochemical facility needing corrosion-resistant FRP tanks for highly acidic wastewater differ fundamentally from a food and beverage plant requiring stainless steel or high-grade plastic tanks for potable water storage. Analyzing these segments helps stakeholders target the fastest-growing niches, such as high-capacity containers in emerging markets and specialized material usage in highly regulated sectors.

The segmentation by material is crucial as it dictates durability, cost, and suitability for various chemical environments; materials include Fiberglass Reinforced Plastic (FRP), which dominates chemical applications, Steel (used for high pressure or extreme temperatures), Plastic/Polyethylene (favored for smaller volumes and chemical resistance), and Concrete (used primarily for massive, underground municipal reservoirs). Capacity segmentation reflects industrial scale, ranging from smaller operational tanks (0–5,000 Gallons) to mega-reservoirs (Above 20,000 Gallons) necessary for municipal or large power generation plants. Application segmentation captures the end-purpose, spanning essential areas like Fire Suppression, complex Wastewater Management, and critical Drinking Water Storage.

- By Material:

- Fiberglass Reinforced Plastic (FRP)

- Steel (Carbon Steel, Stainless Steel)

- Plastic/Polyethylene (HDPE, LLDPE)

- Concrete

- By Capacity:

- 0–5,000 Gallons

- 5,001–20,000 Gallons

- Above 20,000 Gallons

- By Application:

- Drinking Water Storage (Potable)

- Fire Suppression Systems

- Wastewater Management and Effluent Treatment

- Chemical Processing and Hazardous Waste Storage

- Irrigation & Agriculture

- Manufacturing Process Water

- By End-User:

- Oil & Gas

- Chemical & Petrochemical

- Food & Beverage

- Manufacturing (Heavy and Light)

- Construction and Infrastructure

- Municipal Water Treatment and Utilities

Value Chain Analysis For Industrial Water Storage Container Market

The value chain for the Industrial Water Storage Container Market begins with the upstream sourcing of raw materials, which is highly critical and segmented based on the container type. For steel tanks, this involves sourcing rolled steel plates and specialty coatings; for FRP tanks, it requires resins (polyester or vinyl ester) and glass fibers; and for plastic tanks, the procurement of high-grade polymer granules (HDPE or LLDPE) is necessary. Price volatility and supply chain stability for these core inputs significantly influence the final manufacturing cost and delivery timelines. Manufacturers focus on efficient fabrication, including complex welding processes for steel tanks or filament winding techniques for FRP, coupled with strict quality control to meet industrial safety and integrity standards. Innovation at this stage focuses on material science to enhance corrosion resistance and structural longevity.

Midstream activities involve the primary manufacturing processes, including custom design engineering tailored to specific industrial loads (e.g., seismic zones, wind loads, specific chemical exposure), fabrication, modular pre-assembly, and rigorous testing. The distribution channel then plays a vital role in connecting the specialized product to the industrial end-user. Due to the large size and high complexity of industrial containers, direct distribution models, often involving specialized transportation and heavy lifting logistics, are common for major, customized projects. However, indirect channels, utilizing engineering procurement and construction (EPC) firms and specialized industrial distributors, are frequently used for standard or high-volume sales, particularly in the plastic and small-to-medium steel tank segments, offering local installation and maintenance support.

Downstream activities center on installation, commissioning, maintenance, and eventual decommissioning or replacement. Installation requires highly specialized civil engineering and construction services, as the foundation and integration into the existing industrial piping network are crucial for safe operation. After-market services, including routine inspections, repairs, regulatory compliance checks, and the provision of integrated monitoring systems (sensors, telemetry), represent a growing revenue stream and a key competitive differentiator. Direct engagement with the end-users throughout the container’s lifecycle is increasingly important, as manufacturers leverage operational data to improve future designs and offer long-term service contracts, thus solidifying customer relationships and ensuring repeat business during replacement cycles.

Industrial Water Storage Container Market Potential Customers

Potential customers for industrial water storage containers are characterized by operations that involve high-volume water consumption, require extensive wastewater treatment capabilities, or necessitate large, secure reserves for emergency and safety protocols. These end-users span the gamut of heavy industry and critical infrastructure sectors globally. One major customer segment is the Oil & Gas industry, particularly in upstream exploration and midstream refining, where massive volumes of water are needed for hydraulic fracturing, process cooling, and complex separation processes, often requiring chemically resistant storage solutions. The Chemical & Petrochemical sector is another core consumer, demanding tanks that can safely store corrosive industrial solvents, acids, and process effluent under rigorous environmental mandates, often preferring specialized linings or FRP construction.

Another significant group comprises Municipal Water Treatment and Utilities, which rely on monumental reservoirs and storage tanks, frequently concrete or large-scale bolted steel, to manage potable water distribution, maintain system pressure, and handle raw sewage and processed sludge. These customers prioritize longevity, public health safety compliance, and massive capacity. The Food & Beverage industry, characterized by continuous wash-down processes and high-purity water requirements, represents a rapidly growing niche, favoring stainless steel or specialized plastic tanks to prevent contamination and meet stringent hygiene standards. Furthermore, the Manufacturing sector, encompassing automotive, electronics, and general fabrication, utilizes these containers for cooling tower makeup water, process water recycling, and mandatory fire suppression reserves.

Beyond the core industrial consumers, emerging potential customers include large-scale commercial real estate developers integrating sustainable water reuse systems into new complexes, and the Agriculture and Irrigation sector, particularly in arid regions, where large, durable tanks are required for harvesting rainwater or storing treated irrigation water. The common thread among all these buyers is the non-negotiable need for infrastructure that ensures continuous, compliant, and safe handling of water resources, directly impacting their operational viability and regulatory standing. Procurement decisions among these potential customers are heavily influenced by lifecycle cost, adherence to industry-specific certifications (e.g., API 650 for steel tanks, FDA standards for food contact), and the proven track record of the supplier regarding engineering capability and installation expertise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Snyder Industries, Inc., Containment Solutions, Inc., Enduro Tank, Caldwell Tanks, Containex, Plastic Tanks, Tuffa Tanks, Fibrex-Wemco Inc., Xerxes Corporation, ZCL Composites, Belco Manufacturing Company, Inc., CST Industries, Tank Connection, Mueller Company, Roth Industries, Varec, Balmoral Tanks, Tremcar Inc., Denali Incorporated, and Highland Tank. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Water Storage Container Market Key Technology Landscape

The technological landscape of the Industrial Water Storage Container Market is evolving from traditional, static asset manufacturing towards smart, integrated infrastructure solutions designed for maximum operational efficiency and lifecycle performance. A primary area of innovation is in material science, focusing on developing advanced composite materials, particularly next-generation Fiber Reinforced Polymers (FRPs) that offer improved resistance to high temperatures, aggressive chemicals, and UV degradation, extending the maintenance cycle significantly. This includes the development of specialized resin systems and advanced winding techniques that ensure uniform strength and reduced permeability, critical for storing sensitive industrial liquids or high-purity water. Similarly, advanced corrosion-resistant coatings, such as specialized epoxies and polyurethane linings, are continuously being refined for steel tanks to prolong their structural integrity in harsh environments like saline or highly acidic process water storage.

The most transformative technology currently being adopted is the integration of Internet of Things (IoT) sensors and telemetry systems directly into the storage containers. These technologies enable real-time monitoring of critical parameters such as internal pressure, temperature, water level, structural stress via strain gauges, and chemical composition (e.g., pH, conductivity). This real-time data stream is essential for shifting from time-based maintenance to condition-based and predictive maintenance models. Smart monitoring systems can detect minute deviations that signal early-stage issues like coating failure or micro-cracks in concrete, allowing industrial operators to intervene before a failure results in catastrophic leakage or environmental contamination, thereby significantly enhancing safety and regulatory compliance.

Furthermore, technology is impacting design and manufacturing processes through the increased use of computational fluid dynamics (CFD) modeling and finite element analysis (FEA). These advanced simulation tools allow manufacturers to optimize tank geometry for better structural stability against seismic or wind forces, and ensure efficient mixing or sedimentation processes within the container. Modular tank designs, utilizing standardized bolted panels (especially common in steel tanks), represent a logistical innovation, allowing for quicker, more flexible deployment and relocation capabilities compared to field-welded or cast-in-place solutions. The synergy between material science, digital monitoring (IoT/AI), and modern manufacturing techniques defines the current technological competitive edge within this essential infrastructure market.

Regional Highlights

- North America: The market is characterized by high demand for replacement and retrofitting of aging infrastructure, especially in the municipal and oil & gas sectors. The stringent regulatory environment, particularly concerning environmental protection and leak detection (e.g., EPA standards), drives the adoption of advanced materials like double-walled FRP and integrated smart monitoring systems. The US remains a dominant consumer, focusing heavily on technology integration for asset lifecycle management and fire suppression capacity.

- Europe: Growth is steady, primarily fueled by strong environmental protection regulations requiring sophisticated wastewater management and clean water storage solutions. Western Europe focuses on high-quality, long-lifespan composite tanks and modular solutions. Germany, France, and the UK lead the demand, emphasizing sustainable production methods and energy-efficient installation techniques for industrial water systems.

- Asia Pacific (APAC): This region is the fastest-growing market globally, driven by massive industrialization across China, India, and Southeast Asian nations. Rapid expansion in manufacturing, power generation, and urban water infrastructure necessitates enormous new storage capacity. While cost is a major factor, leading to significant use of standard steel and polyethylene tanks, increasing regulatory pressure is pushing major industrial zones towards adopting higher-specification FRP and specialized solutions.

- Latin America: Market expansion is supported by substantial growth in the mining, agriculture, and chemical industries, particularly in Brazil and Mexico. Demand is highly sensitive to economic stability and commodity prices. There is a strong need for reliable, medium-to-large capacity tanks in remote locations, favoring rugged, easy-to-install solutions that can handle variable terrain and climatic conditions.

- Middle East and Africa (MEA): Growth is dominated by large-scale infrastructural projects related to desalination plants, petrochemical facilities, and expansive oil and gas exploration activities. The extreme environmental conditions (high heat, salinity) necessitate highly engineered steel and specialized lining systems, with significant project flow concentrated in Saudi Arabia, UAE, and Qatar. Demand in Africa is emerging, primarily focused on localized mining and municipal water security projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Water Storage Container Market.- Snyder Industries, Inc.

- Containment Solutions, Inc.

- Enduro Tank

- Caldwell Tanks

- Containex

- Plastic Tanks

- Tuffa Tanks

- Fibrex-Wemco Inc.

- Xerxes Corporation

- ZCL Composites

- Belco Manufacturing Company, Inc.

- CST Industries

- Tank Connection

- Mueller Company

- Roth Industries

- Varec

- Balmoral Tanks

- Tremcar Inc.

- Denali Incorporated

- Highland Tank

Frequently Asked Questions

Analyze common user questions about the Industrial Water Storage Container market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the adoption of Fiberglass Reinforced Plastic (FRP) tanks over traditional steel tanks?

FRP tanks are increasingly preferred due to their superior resistance to corrosion from industrial chemicals and wastewater, lighter weight facilitating easier installation, and lower lifecycle maintenance costs. They are highly suitable for chemical processing and wastewater treatment applications where conventional steel requires expensive, complex internal linings.

How does the integration of IoT technology benefit industrial water storage operations?

IoT integration allows for real-time remote monitoring of critical parameters like water level, temperature, and structural integrity. This enables highly accurate predictive maintenance, early detection of leaks or structural stress, optimizing inventory levels, and ensuring continuous regulatory compliance without requiring constant manual inspection.

Which end-user segment is expected to show the highest growth rate during the forecast period?

The Municipal Water Treatment and Utilities segment, coupled with the Wastewater Management application area, is projected to exhibit the highest sustained growth. This is driven by global urbanization, the necessity of replacing aging municipal infrastructure, and increasingly strict international regulations governing water quality and effluent discharge standards.

What are the major challenges related to the installation and maintenance of industrial water storage containers?

Major challenges include high initial capital expenditure, complex and often lengthy permitting processes due to regulatory requirements (especially for large-capacity or hazardous content tanks), and the necessity for specialized, heavy-duty logistical services for delivery and complex on-site foundation preparation and installation.

In which geographic region is the market anticipated to experience the most significant demand increase?

The Asia Pacific (APAC) region is anticipated to experience the most significant demand increase, fueled by rapid, large-scale industrial expansion in developing economies like China and India, substantial investments in manufacturing capabilities, and accelerated development of urban water and sewage infrastructure projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager