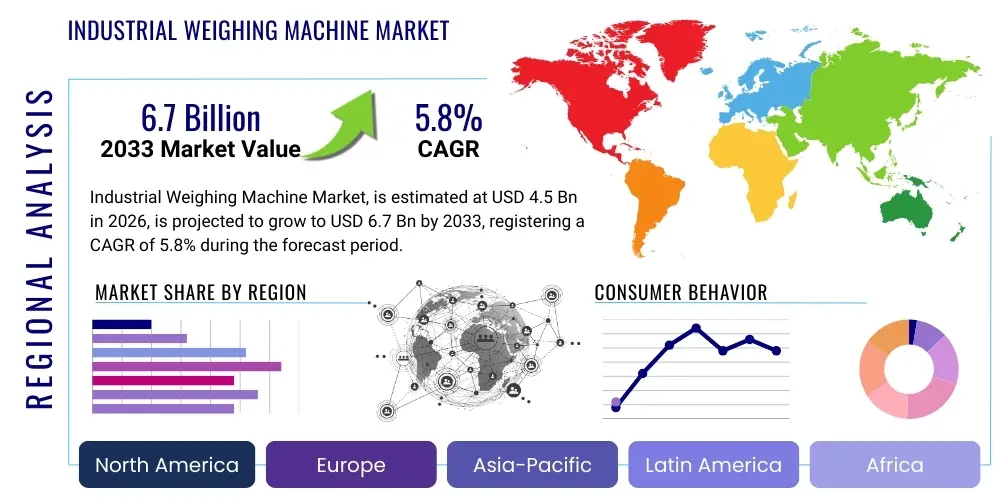

Industrial Weighing Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438714 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Industrial Weighing Machine Market Size

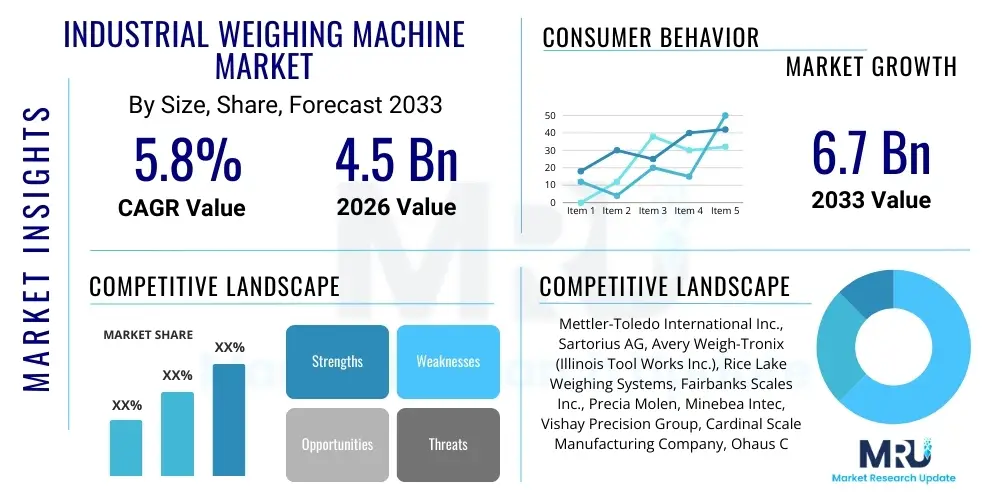

The Industrial Weighing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Industrial Weighing Machine Market introduction

The Industrial Weighing Machine Market encompasses a vast array of precision measurement devices essential for mass determination across demanding industrial environments, including manufacturing, logistics, chemicals, mining, and food & beverage processing. These critical instruments range from high-resolution balances and counting scales to heavy-capacity floor scales, vehicle scales, and sophisticated in-motion systems like checkweighers and belt scales. Their fundamental purpose is to ensure rigorous quality control, manage inventory accuracy, facilitate certified trade transactions, and maintain compliance with stringent legal metrology standards globally. Core product reliability hinges on advanced load cell technologies, primarily strain gauges, which convert force into measurable electrical signals, providing the foundational accuracy required for industrial operations.

The operational scope of industrial weighing solutions extends beyond simple measurement; modern systems are integral to optimizing production processes and enhancing supply chain efficiency. Key applications involve batching and formulation control in chemical and pharmaceutical manufacturing, ensuring accurate filling and packaging in the food industry, and monitoring material flow in large-scale mining and construction projects. The immediate benefits include significant reductions in material waste, minimization of production errors due to inconsistent ingredient weights, and overall labor cost savings resulting from automation. Furthermore, in commercial logistics, certified vehicle and cargo scales are non-negotiable for adhering to axle load limits and ensuring precise billing based on weight, thereby supporting global trade logistics infrastructure.

The market growth is primarily driven by escalating global manufacturing activity, particularly in emerging economies, coupled with increasing regulatory pressure from bodies like the OIML (International Organization of Legal Metrology) which mandates certified accuracy for commercial transactions (Legal-for-Trade status). Technological driving factors include the rapid adoption of Industry 4.0 principles, necessitating weighing equipment with robust digital connectivity (IoT/IIoT compatibility) and advanced data processing capabilities. These modern machines offer seamless integration with Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES), transforming static weighing points into dynamic data generation nodes crucial for achieving smart factory goals and predictive maintenance schedules.

Industrial Weighing Machine Market Executive Summary

The Industrial Weighing Machine Market demonstrates robust growth, propelled by the worldwide focus on manufacturing efficiency, automation integration, and adherence to stringent quality and legal metrology standards. Key business trends indicate a strong shift toward digital, connected weighing solutions capable of real-time data integration and remote diagnostics, driven largely by sectors undergoing rapid digitalization, such as pharmaceuticals and packaged goods. Market incumbents are concentrating on developing highly durable systems optimized for harsh environments, alongside specialized software platforms that facilitate compliance reporting and predictive maintenance, thereby providing enhanced value beyond basic weight measurement.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market expansion, fueled by massive infrastructure development, explosive growth in manufacturing output, and significant capital investments in modernizing production facilities in countries like China, India, and Southeast Asian nations. North America and Europe, while mature, continue to show sustained growth, particularly in the adoption of sophisticated automation technologies like high-speed checkweighers and advanced robotics integration for weighing tasks. The demand in these established regions is skewed towards high-precision and technologically advanced solutions that maximize throughput and minimize operational footprint, aligning with high labor cost structures.

Segmentation trends highlight the dominance of the static weighing segment (floor scales, truck scales) by volume, given their fundamental necessity across all industrial operations. However, the dynamic weighing segment (in-motion scales, belt weighers) is experiencing the fastest CAGR due to increasing demand for high-throughput, continuous process environments. Technology-wise, the demand for electronic scales with digital load cells is rapidly superseding traditional analog systems, offering superior accuracy, faster response times, and easier calibration. Furthermore, the capacity segment is seeing intensified innovation in ultra-heavy-duty solutions for the mining and transportation sectors, balanced by parallel innovation in micro-precision scales for high-value substance handling in laboratories and pharmaceutical production.

AI Impact Analysis on Industrial Weighing Machine Market

Common user inquiries regarding AI’s influence on the Industrial Weighing Machine Market primarily revolve around how artificial intelligence and machine learning (ML) enhance operational efficiency, predictive accuracy, and compliance reporting. Users frequently ask about the capabilities of AI in eliminating measurement errors, optimizing batching processes in real-time, and utilizing data from networked scales to predict equipment failure or required calibration schedules. A core concern is the transition from reactive maintenance to true predictive maintenance (PdM) enabled by ML algorithms analyzing historical load data, vibration patterns, and environmental variables captured by smart weighing terminals. Users expect AI to transform raw weight data into immediate, actionable insights, particularly in areas like identifying subtle anomalies in packaged goods (over/under fill detection) beyond simple tolerance checks, thereby improving yield and reducing regulatory risk.

AI's primary influence is moving industrial weighing solutions from simple data collection points to intelligent decision-making hubs. ML algorithms are already being deployed to analyze high-frequency data streams generated by dynamic weighing systems (e.g., checkweighers), enabling adaptive control loops that automatically adjust upstream filling machinery to maintain target weights consistently, minimizing product giveaway and optimizing material usage. This level of automated process refinement is unattainable with conventional statistical process control (SPC) methods, showcasing AI's transformative potential in high-volume production lines. Moreover, AI aids in complex calibration processes by analyzing drift patterns and environmental compensation requirements, drastically reducing the need for manual recalibration checks and maximizing system uptime.

The long-term expectations center on integrating sophisticated vision systems and AI-powered weight analysis to achieve comprehensive quality assurance. For example, in pharmaceutical blister packaging or complex food sorting, AI can correlate weight data with visual inspection data to verify product count, integrity, and mass simultaneously with unprecedented speed and accuracy. This convergence of sensory input and intelligent processing provides a holistic view of quality. Furthermore, leveraging AI for anomaly detection in large-scale operations, such as identifying unauthorized material bypasses or misuse of vehicle scales, significantly enhances security and operational integrity within logistics and raw material handling environments, moving the industry toward fully autonomous, self-regulating measurement systems.

- AI enhances predictive maintenance by analyzing load cell drift and usage patterns.

- Machine learning optimizes filling and batching processes through real-time adaptive control loops.

- AI-powered anomaly detection improves quality control (QC) by identifying subtle deviations in packaged product weight.

- Intelligent data analysis aids in compliance automation and accurate regulatory reporting (e.g., OIML verification).

- Integration with vision systems enables holistic quality checks correlating weight, count, and visual integrity.

DRO & Impact Forces Of Industrial Weighing Machine Market

The Industrial Weighing Machine Market is primarily driven by rigorous quality control standards, global manufacturing expansion, and the increasing demand for supply chain visibility and automation across sectors. Restraints include the high initial capital investment required for legal-for-trade certified heavy-capacity systems, complexity in integrating older analog weighing infrastructure into modern digital networks, and the requirement for frequent, expensive calibration and maintenance to sustain regulatory compliance. Opportunities are abundant in the rapid digitalization of emerging markets, the growing specialized demand for high-precision micro-weighing in high-value industries like biotechnology, and the proliferation of IoT-enabled smart scales that offer advanced remote diagnostic and management capabilities, mitigating the traditional hurdles of physical maintenance.

The key driving forces include stringent governmental regulations mandating accurate mass measurement for taxation and safety, notably in road transport and international shipping, which boosts demand for certified truck and rail scales. Furthermore, the global trend toward automated production lines (Industry 4.0) necessitates seamless integration of checkweighers and filling scales with robotics and automated material handling systems, driving innovation in connectivity standards and speed. The necessity to reduce product giveaway and optimize raw material usage, particularly in competitive sectors like food and beverage, acts as a continuous financial incentive for manufacturers to invest in higher accuracy weighing technology, ensuring maximized yield from every production run.

The significant restraints involve the inherent technological limitations of load cells under extreme temperature or vibration conditions, which mandates specialized, often cost-prohibitive, environmental shielding and compensation systems. Another challenge is the lack of standardized global protocols for data exchange from varied weighing terminals, complicating the transition to a fully unified MES ecosystem for multinational corporations. Impact forces—such as rapid technological advancement (e.g., magnetic levitation weighing), geopolitical trade shifts affecting manufacturing locations, and the fluctuating prices of critical components (like specialized alloys for load cells)—continuously reshape market competition and product development strategies, forcing rapid adaptation by key market players to maintain relevance and technical superiority in niche applications.

Segmentation Analysis

The Industrial Weighing Machine Market is highly segmented based on critical factors including product type, capacity, end-use industry, and technology, reflecting the diverse and specialized requirements of modern industrial processes. Understanding these segments is crucial as product capabilities—ranging from minute micro-balances to massive rail scales—are dictated by the specific precision and capacity needs of the application. The dynamic weighing segment (e.g., checkweighers and belt scales) is distinguished by its integration into high-speed production lines, requiring rapid data acquisition and minimal disruption to material flow, contrasting sharply with the static weighing segment (e.g., bench and floor scales) which prioritizes high capacity and certified legal accuracy for discrete measurement events.

By technology, the shift is decisively toward electronic scales, which utilize advanced digital load cells and sophisticated electronics to deliver superior performance and easier integration compared to outdated mechanical or hydraulic systems. The end-use segmentation highlights the food and beverage industry as a major driver, utilizing systems for portion control and packaging, alongside the metals and mining sector which demands extremely rugged, high-capacity equipment for bulk material handling. These distinct demands mean manufacturers must offer a specialized portfolio addressing reliability in harsh environments versus high precision in controlled cleanroom settings, leading to fragmented market leadership across different capacity and application niches.

Furthermore, geographic segmentation reveals stark differences in adoption rates and technological maturity; mature markets prioritize upgrades to smart, networked systems, while developing markets focus on initial capacity installation and reliable, mid-range electronic scales to support nascent industrialization. This complex structure necessitates highly targeted marketing and product development strategies, ensuring that scales not only meet capacity requirements but also comply with local legal metrology requirements (e.g., European MID, US NTEP, or OIML standards), which often involves significant investment in specialized certification processes for each jurisdiction.

- By Product Type:

- Platform Scales (Floor Scales, Bench Scales)

- Truck Scales (Weighbridges)

- Rail Scales

- Crane/Hanging Scales

- Checkweighers & In-Motion Scales

- Tank/Hopper Weighing Systems

- Counting Scales

- By Capacity:

- Below 100 kg (Light Capacity)

- 100 kg to 500 kg (Medium Capacity)

- Above 500 kg (Heavy Capacity)

- By Technology:

- Electronic Scales (Digital Load Cells)

- Mechanical Scales

- Hybrid Scales

- By End-Use Industry:

- Food & Beverage

- Chemicals

- Metals & Mining

- Pharmaceuticals & Healthcare

- Logistics & Transportation

- Manufacturing (General)

Value Chain Analysis For Industrial Weighing Machine Market

The value chain for the Industrial Weighing Machine Market is fundamentally driven by specialized component manufacturing and complex system integration, starting upstream with the procurement of critical raw materials like high-grade stainless steel and specialized alloys for load cells, along with sophisticated electronic components and microprocessors for indicators and terminals. The upstream segment is dominated by highly specialized manufacturers of force sensors (load cells) and precision electronics, where stringent quality control is paramount as the accuracy of the final product is entirely dependent on the quality of these core components. Differentiation at this stage involves proprietary strain gauge technologies, advanced sealing methods (IP ratings), and certification compliance (e.g., explosion-proof certifications for hazardous environments).

Midstream activities center on the design, assembly, and rigorous calibration of the final weighing systems. Manufacturers integrate the load cells, mechanical structure, software, and indicator interface. This stage includes significant investment in R&D to develop durable mechanical frames capable of handling extreme loads (for truck scales) and sophisticated software for complex applications like recipe formulation or in-motion sorting. Calibration and certification by authorized bodies (NTEP, OIML) represent a crucial value-add, as a significant portion of industrial scales must meet "Legal-for-Trade" standards to be legally used in commercial transactions, acting as a high barrier to entry for new competitors.

Downstream distribution channels are segmented into direct sales, particularly for large, custom installations (e.g., weighbridges for mining companies), and indirect sales through a network of specialized, certified distributors and service providers. Distributors often provide essential value-added services such as installation, initial calibration, ongoing maintenance contracts, and repair services, which are critical given the frequent regulatory checks required for this equipment. The maintenance and service segment forms a significant and high-margin component of the downstream value chain, ensuring prolonged system accuracy and operational longevity, thus tying the customer back to the original equipment manufacturer or authorized service agent.

Industrial Weighing Machine Market Potential Customers

The potential customers for industrial weighing machines span nearly the entirety of the manufacturing, logistics, and raw material sectors globally, driven by the universal need for accurate mass measurement in commercial operations. End-users fall primarily into high-volume processing industries such as Food & Beverage, which utilizes checkweighers for regulatory compliance and yield optimization of packaged goods, and the Pharmaceutical & Healthcare sector, which requires extremely precise balances and formulation systems for active ingredient control in laboratories and production facilities. These industries demand high sanitation standards, connectivity, and rigorous calibration records, making them high-value customers for specialized, certified equipment.

Another major customer segment includes the heavy industries: Metals, Mining, and Construction. These users require robust, heavy-capacity solutions like pit-type truck scales, rail scales, and crane scales designed to withstand exceptionally harsh operating environments, including extreme weather, dust, and heavy mechanical shock. Their purchasing decisions are focused on durability, reliability, and ease of field service, as downtime in these operations can incur severe economic losses. Logistics and transportation companies represent a third critical customer group, relying on weigh-in-motion systems and static vehicle scales to comply with weight enforcement laws and optimize cargo capacity for profitable shipping operations, both nationally and internationally.

Finally, general manufacturing and chemical processing industries constitute a steady demand base, utilizing platform scales, tank weighing systems, and batch controllers for internal process control, inventory management of raw materials, and accurate blending of chemical compounds. These customers often seek integrated systems that can communicate weight data directly to control systems (PLCs), emphasizing the importance of sophisticated software integration and modular design for scalability and adaptability within evolving production lines. The diversity of needs necessitates manufacturers to maintain broad portfolios, from benchtop models for precise counting to customized, explosion-proof systems for volatile chemical environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler-Toledo International Inc., Sartorius AG, Avery Weigh-Tronix (Illinois Tool Works Inc.), Rice Lake Weighing Systems, Fairbanks Scales Inc., Precia Molen, Minebea Intec, Vishay Precision Group, Cardinal Scale Manufacturing Company, Ohaus Corporation, Shimadzu Corporation, A&D Company Limited, Bizerba SE & Co. KG, Walz Scale, Thermo Fisher Scientific, Pesa-Waagenbau GmbH, HBM Test and Measurement (Hottinger Brüel & Kjær), Alfa Laval, Tedea-Huntleigh, Shekel Brainweigh Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Weighing Machine Market Key Technology Landscape

The technology landscape of the industrial weighing market is undergoing a profound transformation, moving rapidly from traditional analog systems to fully digitized and networked measurement solutions. The primary technological driver remains the load cell, with a significant shift towards digital load cells (often utilizing proprietary signal processing) over conventional analog strain gauges. Digital load cells offer superior noise immunity, simplified multi-cell calibration, and built-in diagnostic capabilities that significantly enhance system reliability and accuracy over time, thereby reducing operational lifetime costs. Advanced materials and sealing techniques (achieving high IP ratings) are also crucial, enabling load cells to function accurately in extremely wet, dusty, or explosive environments typical of chemical and mining operations.

Another major technological advancement is the integration of advanced connectivity protocols, enabling scales to communicate via Industrial Ethernet (e.g., EtherNet/IP, PROFINET), Wi-Fi, and specialized fieldbus systems. This seamless integration capability is essential for aligning with Industry 4.0 standards, allowing weighing data to be instantly transferred to Supervisory Control and Data Acquisition (SCADA) systems and cloud-based analytical platforms. Furthermore, the development of sophisticated weighing terminals and indicators featuring high-resolution touchscreens, graphical interfaces, and embedded application software (for complex batching or formulation) enhances user experience and reduces operational errors, positioning the scale as a powerful data gateway rather than merely a display unit.

Niche technologies, while not yet mainstream, are shaping the high-end precision segment. These include Electromagnetic Force Restoration (EMFR) technology, offering ultra-high accuracy for laboratory and small-scale dosing applications far exceeding standard strain gauge capabilities, and specialized dynamic stabilization technologies used in high-speed checkweighers to compensate for conveyor vibration and movement, ensuring rapid, accurate weight determination at speeds exceeding 500 packages per minute. Finally, the growing incorporation of machine diagnostics, utilizing micro-vibration sensors and predictive algorithms within the load cell housing, signals a crucial shift toward self-monitoring and condition-based maintenance, maximizing uptime and reducing unplanned regulatory non-compliance issues.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to rapid industrialization, large-scale infrastructural investments, and burgeoning manufacturing output, particularly in food processing, automotive, and logistics sectors across China, India, and Southeast Asia. The region is characterized by high demand for both heavy-duty static scales (for infrastructure and bulk material handling) and cost-effective, high-throughput dynamic systems.

- North America: This region is a leading adopter of advanced, high-precision, and automated weighing solutions, driven by stringent regulatory enforcement (NTEP requirements) and high labor costs necessitating automation. The pharmaceutical, specialized manufacturing, and advanced logistics sectors are key consumers, focusing heavily on integrating IoT-enabled scales for real-time inventory and supply chain management.

- Europe: Characterized by mature industrial bases and extremely strict legal metrology standards (MID compliance), Europe demands premium, certified weighing equipment with robust software for quality assurance and traceability. Growth is focused on upgrading existing analog infrastructure to smart, digital systems, with strong adoption of complex batching and filling systems within the chemical and food industries, prioritizing energy efficiency and high operational security.

- Latin America (LATAM): Growth in LATAM is tied closely to commodity exports (mining, agriculture) and infrastructure development. The market shows steady demand for heavy-capacity truck and rail scales, though technological adoption tends to favor reliable, mid-range electronic scales over cutting-edge, high-cost automation systems, primarily due to budgetary constraints and fragmented regulatory landscapes.

- Middle East and Africa (MEA): This region is witnessing growth spurred by large government-backed infrastructure projects (ports, logistics hubs) and expansion of the oil and gas sector. Demand focuses on explosion-proof (ATEX/IECEx certified) scales for hazardous environments and heavy-duty, high-capacity systems for handling raw materials and construction goods, with regulatory requirements increasingly prioritizing OIML certification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Weighing Machine Market.- Mettler-Toledo International Inc.

- Sartorius AG

- Avery Weigh-Tronix (Illinois Tool Works Inc.)

- Rice Lake Weighing Systems

- Fairbanks Scales Inc.

- Precia Molen

- Minebea Intec

- Vishay Precision Group

- Cardinal Scale Manufacturing Company

- Ohaus Corporation

- Shimadzu Corporation

- A&D Company Limited

- Bizerba SE & Co. KG

- Walz Scale

- Thermo Fisher Scientific

- Pesa-Waagenbau GmbH

- HBM Test and Measurement (Hottinger Brüel & Kjær)

- Alfa Laval

- Tedea-Huntleigh

- Shekel Brainweigh Ltd.

Frequently Asked Questions

Analyze common user questions about the Industrial Weighing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Industrial Weighing Machine Market?

Market growth is predominantly fueled by strict regulatory requirements for weight accuracy (Legal-for-Trade compliance), the global surge in manufacturing and logistics activities requiring automated measurement, and the accelerating integration of industrial scales into IoT and Industry 4.0 ecosystems for real-time data analysis and operational optimization.

How is the adoption of Industry 4.0 influencing the design of industrial weighing machines?

Industry 4.0 mandates have shifted scale design toward advanced digital load cells and integrated connectivity solutions (Industrial Ethernet). Modern machines are now designed as smart, networked devices capable of self-diagnostics, remote calibration, and seamless data exchange with MES and ERP systems, moving beyond simple measurement.

What is the difference between static weighing and dynamic weighing systems?

Static weighing measures the mass of a stationary object (e.g., floor scales, truck scales) and prioritizes certified high accuracy. Dynamic (or in-motion) weighing, such as checkweighers or belt scales, measures mass while the object is moving, prioritizing high throughput, speed, and continuous process monitoring.

Which end-use industry holds the largest market share for industrial weighing equipment?

The Food & Beverage industry typically holds a significant market share, driven by high-volume production needs for packaging, portion control, and strict regulatory demands regarding product weight consistency to minimize giveaway and ensure consumer protection standards are met.

What role do load cells play in modern industrial scales, and are digital load cells replacing analog technology?

Load cells are the foundational force sensors that convert weight into an electrical signal. Digital load cells are increasingly replacing analog ones because they offer superior accuracy, inherent noise immunity, and integrated diagnostic features, significantly simplifying maintenance and calibration procedures, especially in multi-cell applications like weighbridges.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager