Industrial Weighing Scales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432918 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Weighing Scales Market Size

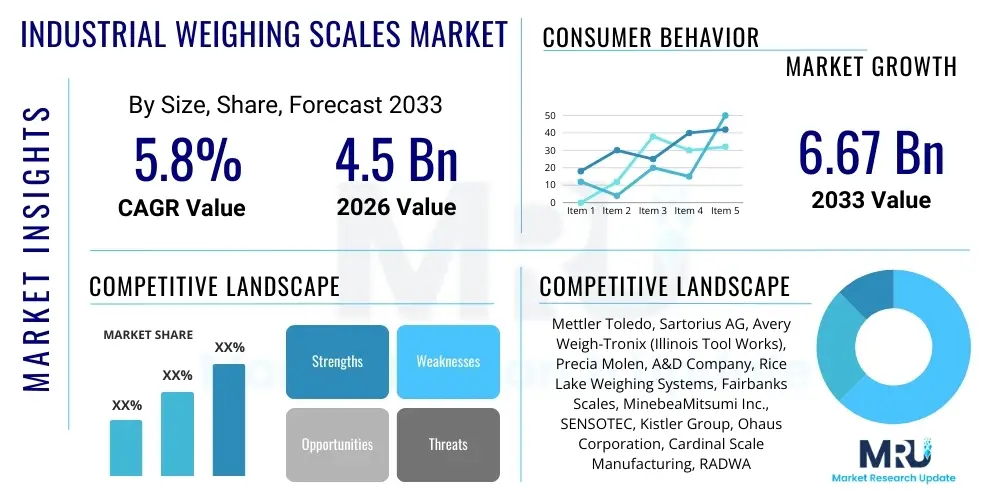

The Industrial Weighing Scales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.67 Billion by the end of the forecast period in 2033.

Industrial Weighing Scales Market introduction

The Industrial Weighing Scales Market encompasses a diverse range of high-precision instruments designed for measuring mass, capacity, and density across various industrial sectors. These devices are critical components in quality control, inventory management, trade transactions, and process automation, ensuring compliance with stringent regulatory standards and optimizing operational efficiency. Products range from compact bench scales used in laboratories and packaging lines to heavy-duty truck scales and floor scales essential for logistics and large-scale manufacturing operations. The core function is to provide reliable, accurate, and repeatable measurement data in demanding industrial environments.

The functionality of modern industrial scales extends far beyond simple weight measurement, increasingly incorporating advanced features such as data logging, network connectivity (IoT integration), automated calibration, and complex software interfaces for statistical process control (SPC). Key applications span critical processes in the food and beverage industry (portioning and checkweighing), chemical processing (batch control and formulation), logistics (dimensional weighing and freight management), and pharmaceuticals (ingredient dispensing and validation). These scales are engineered for robustness, durability, and high throughput, addressing the diverse requirements for static, dynamic, and continuous weighing tasks.

Market expansion is primarily driven by escalating global manufacturing activities, the rapid digitalization of industrial processes (Industry 4.0), and the necessity for enhanced traceability and product safety mandated by regulatory bodies worldwide. The increasing focus on precision manufacturing and minimizing material waste across sectors like construction and chemicals further propels the demand for sophisticated and integrated weighing solutions. Benefits derived from deploying advanced industrial scales include significant reductions in operational costs, improved product consistency, accurate billing based on verifiable weight data, and crucial support for compliance audits, making them indispensable capital equipment investments for modern enterprises.

Industrial Weighing Scales Market Executive Summary

The Industrial Weighing Scales Market is experiencing robust growth, primarily fueled by the accelerating adoption of automation technologies and the global proliferation of stringent quality and safety regulations, particularly within the pharmaceutical and food processing sectors. Major business trends indicate a definitive shift toward digital and intelligent weighing solutions that offer seamless integration with existing Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES). Key industry players are focusing on developing hybrid technologies, combining high-resolution load cells with advanced software analytics, enabling predictive maintenance, remote diagnostics, and real-time process optimization to enhance overall equipment effectiveness (OEE).

Regional dynamics highlight the Asia Pacific (APAC) as the dominant growth engine, driven by massive investments in infrastructure development, rapid urbanization, and the expansion of the manufacturing base, particularly in emerging economies such as China and India. North America and Europe maintain significant market share, characterized by high demand for sophisticated, high-precision scales utilizing advanced features like dynamic weighing and advanced moisture analysis, often mandated by specialized industry requirements. The trend in established markets leans heavily toward replacement cycles, favoring IoT-enabled, high-durability products that promise lower total cost of ownership (TCO) and enhanced cybersecurity protocols.

Segmentation analysis reveals that the digital/electronic segment continues to dominate the technology landscape due to superior accuracy, speed, and connectivity capabilities, while mechanical scales are being relegated primarily to niche, explosion-proof, or purely rugged applications where power supply is unreliable. By type, floor scales and truck scales maintain substantial market value, critical for logistics and bulk material handling, but the checkweigher segment exhibits the highest growth rate, driven by the escalating demand for high-speed, automated inspection systems in packaging lines globally. End-use trends demonstrate sustained robust demand from the Food & Beverage and Manufacturing sectors, which are continuously upgrading equipment to meet evolving consumer expectations for product quality and weight consistency.

AI Impact Analysis on Industrial Weighing Scales Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Industrial Weighing Scales Market frequently revolve around the potential for predictive maintenance, enhanced accuracy through self-correction algorithms, and the integration of machine vision for automated dimensional weighing and defect detection. Users are keenly interested in how AI can move scales beyond mere measurement devices into proactive process control tools. Key themes include the feasibility of using deep learning models to analyze subtle measurement variations over time, thereby predicting component failure before it occurs, and the optimization of dynamic weighing processes, such as checkweighing, to reduce false rejects and increase throughput efficiency in high-speed manufacturing environments. Furthermore, there is significant user concern regarding data governance, the cybersecurity implications of connecting sensitive weight data to AI platforms, and the necessary skill upgrades required for technical personnel to manage and leverage these intelligent systems effectively.

The integration of AI into industrial weighing systems is fundamentally transforming operational capabilities by enabling intelligent data interpretation at the edge, shifting the focus from simply reporting weight to contextualizing and acting upon deviations in real-time. AI algorithms are increasingly employed for advanced calibration management, utilizing environmental variables such as temperature, humidity, and vibration levels to perform micro-adjustments that maintain peak accuracy over extended periods without manual intervention. This application drastically reduces downtime associated with routine calibration checks and mitigates the impact of environmental noise, which traditionally compromises precision, especially in harsh industrial settings. Moreover, AI facilitates the development of self-optimizing weighing processes, learning normal patterns of material flow and alerting operators only when statistically significant abnormalities are detected, leading to a substantial reduction in false alarms and improved process monitoring integrity.

Furthermore, the synergy between AI and weighing technology extends into sophisticated inventory and material tracking systems. By leveraging machine learning, companies can utilize real-time weight data from storage silos, tanks, or scales on conveyor belts to accurately forecast consumption rates, optimize procurement schedules, and minimize stockouts or overstocking situations. This predictive inventory management capability is highly valuable in commodity-sensitive industries like chemicals and bulk food processing. The incorporation of AI-powered anomaly detection in checkweighers, combined with vision systems, allows for simultaneous verification of product weight, count, and integrity (e.g., detecting broken products or missing components based on weight signatures), thereby enforcing compliance with highly specific quality specifications with unparalleled speed and reliability, directly enhancing regulatory adherence and consumer trust.

- AI enhances predictive maintenance by analyzing load cell drift and environmental factors.

- Machine learning algorithms optimize dynamic weighing processes, reducing checkweighing errors and improving throughput.

- AI facilitates intelligent data contextualization, moving scales into proactive process control tools.

- Automated calibration adjustments based on real-time environmental data maintain optimal precision.

- AI integration supports sophisticated, real-time inventory forecasting and material consumption tracking.

- Deep learning models improve dimensional weighing accuracy when integrated with machine vision.

- Enhanced cybersecurity protocols are developed to protect sensitive, AI-processed weight data.

DRO & Impact Forces Of Industrial Weighing Scales Market

The Industrial Weighing Scales Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant Impact Forces that dictate market direction and investment strategies. Key drivers include the relentless global push toward industrial automation and the implementation of Industry 4.0 principles, necessitating accurate, connected, and reliable measurement devices at every stage of the manufacturing and logistics chain. Additionally, strict global regulations from agencies such as the FDA, GMP, and local weights and measures authorities mandate the use of certified, high-accuracy weighing equipment for product quality, safety, and commercial trade, creating a baseline demand across nearly all industrial sectors. The rising cost of raw materials further compels industries to adopt precision weighing solutions to minimize material wastage and optimize batch control, directly improving profit margins through resource efficiency.

Conversely, significant restraints hinder optimal market growth, notably the high initial capital investment required for advanced, high-precision industrial weighing systems, particularly large truck scales or automated checkweighing units. Furthermore, the complexity involved in integrating these sophisticated digital scales with disparate legacy systems within older manufacturing facilities often presents technical hurdles and requires specialized IT expertise, contributing to slower adoption rates in certain regions. The market also faces challenges from fluctuating raw material prices (especially steel and advanced electronics components) used in scale manufacturing, which affects the final product cost. The requirement for periodic, specialized calibration and maintenance services adds to the operational expenditures for end-users, posing a constraint for small and medium-sized enterprises (SMEs).

Opportunities for expansion are abundant, primarily centered on the untapped potential within emerging markets undergoing rapid industrialization and the continuous development of specialized weighing applications tailored for new industries, such as battery manufacturing and advanced recycling facilities. The proliferation of IoT technology offers substantial opportunities for developing cloud-based monitoring and predictive maintenance services, transforming the scale from a hardware purchase into a comprehensive subscription-based service model (Weighing-as-a-Service, WaaS). The growing trend towards developing ruggedized, intrinsically safe (Ex-proof) scales for hazardous environments (oil & gas, certain chemical processing zones) represents a lucrative niche. Impact forces driving market evolution include intense competitive pressure to reduce the footprint of high-capacity scales, enhance wireless connectivity standards for remote operations, and integrate seamlessly with complementary technologies such as robotics and augmented reality (AR) for enhanced operator efficiency and maintenance protocols.

Segmentation Analysis

The Industrial Weighing Scales Market is systematically segmented based on Type, Technology, Capacity, and End-Use Industry, reflecting the diverse application landscape and specific functional requirements across the industrial ecosystem. Analyzing these segments provides a granular view of market dynamics, growth drivers, and areas poised for significant technological evolution. The segmentation by Type, for instance, highlights the volumetric importance of static scales (like floor and truck scales) versus the dynamic growth potential of automation-focused scales (such as checkweighers and conveyor scales), each catering to different stages of the production or logistics pipeline. Understanding these distinctions is crucial for manufacturers tailoring product development and sales strategies to specific industry needs.

Technology segmentation underscores the ongoing shift from traditional mechanical systems, known for their ruggedness and simplicity, towards modern digital and electronic solutions which offer unparalleled accuracy, speed, and connectivity. Digital scales, driven by advanced load cell technology (e.g., strain gauge, electromagnetic force restoration) and sophisticated microprocessors, dominate current and future market growth due to their essential role in complying with contemporary data logging and traceability mandates. Capacity segmentation (low, medium, high) directly correlates with end-use applications, with high-capacity scales being critical for infrastructure and heavy industry, while low-capacity scales serve precision applications in pharmaceuticals and high-value manufacturing.

Furthermore, segmentation by End-Use Industry demonstrates the essential role of weighing scales in global supply chains. The Food & Beverage sector remains a foundational consumer, necessitating highly sanitary and washdown-compliant scales for portion control and safety inspection. The logistics and transportation segment is growing rapidly, driven by the need for efficient dimensioning and weight verification to optimize shipping costs and regulatory compliance. Each industry places unique demands on scale design, material composition, software integration, and measurement certification, compelling market players to offer highly specialized and vertically integrated solutions.

- By Type:

- Bench Scales (Precision measurement for small packages and parts)

- Floor Scales (High-capacity, often used in warehouses and general manufacturing)

- Checkweighers (High-speed, dynamic weighing for quality control in packaging lines)

- Truck Scales/Weighbridges (Heavy-duty weighing of large vehicles and bulk materials)

- Crane Scales (Suspended weighing for inventory and logistics handling)

- Rail Scales (Specialized scales for train car weighing)

- Tank & Hopper Scales (For inventory control in chemical and food processing tanks)

- Other Specialized Scales (Retail scales for industrial use, Laboratory balances)

- By Technology:

- Digital/Electronic Scales (Dominant technology offering accuracy and connectivity)

- Mechanical Scales (Used in hazardous or non-powered environments)

- Hybrid Scales (Combining mechanical structure with digital indicators)

- By Capacity:

- Low Capacity (Up to 100 kg) (Pharmaceuticals, small parts manufacturing)

- Medium Capacity (100 kg to 10,000 kg) (General manufacturing, shipping, standard warehousing)

- High Capacity (Above 10,000 kg) (Logistics, construction, mining, agriculture)

- By End-Use Industry:

- Food & Beverage (Sanitary, washdown compliant, checkweighing)

- Chemicals (Hazardous environment scales, batching, tank weighing)

- Manufacturing & Processing (General industrial weighing, counting, quality control)

- Logistics & Transportation (Truck weighing, dimensional measurement, inventory control)

- Healthcare & Pharmaceuticals (High-precision balances, dosage verification, regulatory compliance)

- Waste & Recycling (Waste stream management, bulk materials)

- Construction & Mining (Heavy-duty vehicle and material weighing)

Value Chain Analysis For Industrial Weighing Scales Market

The Value Chain for the Industrial Weighing Scales Market begins with Upstream Analysis, which involves the procurement and processing of critical raw materials and components, including high-grade steel, aluminum, and advanced electronics. Key components sourced include high-precision load cells (the core sensing element, often utilizing strain gauge or electromagnetic force restoration technology), digital indicators, microprocessors, and specialized software modules. Manufacturing activities involve precise machining, assembly of the mechanical structures (e.g., scale platforms, frames, truck scale segments), and the critical integration and calibration of the electronic components. Research and development (R&D) plays a vital upstream role, focusing on improving load cell accuracy, minimizing drift, enhancing connectivity protocols, and developing specialized enclosures for harsh environments (IP ratings).

The Midstream phase focuses on the assembly, quality assurance, and certification of the finalized weighing instruments. This stage includes stringent calibration testing against national and international standards (such as OIML or NTEP certification) which is essential for ensuring scales are legally acceptable for trade. Distribution channels are complex and highly specialized. Direct channels involve manufacturers selling high-value, bespoke systems (like custom weighbridges or fully automated checkweighing lines) directly to large industrial end-users, allowing for personalized installation, training, and long-term maintenance contracts. Indirect channels utilize a network of certified distributors, value-added resellers (VARs), and system integrators who provide regional sales support, localized calibration services, and integration expertise for standardized product lines such as bench and floor scales.

Downstream Analysis focuses on the end-user interaction and post-sales service, which is a crucial differentiator in this market. Post-sales services, including routine calibration, preventative maintenance, repair, and software updates, constitute a significant revenue stream and directly impact customer loyalty. The successful integration of the weighing scale into the customer’s IT infrastructure (e.g., connecting to ERP, WMS, or MES systems) often determines the overall value proposition. Direct distribution often ensures tighter control over service quality and responsiveness, particularly for mission-critical applications, while indirect channels leverage local expertise to provide rapid response times for calibration and emergency repairs, catering effectively to the dispersed nature of the industrial customer base.

Industrial Weighing Scales Market Potential Customers

Potential customers for Industrial Weighing Scales are broadly segmented across every industry that requires precise measurement of mass for quality control, inventory management, regulatory compliance, or commerce. The primary end-users are large multinational manufacturing corporations requiring standardized, networked weighing solutions across multiple global sites, and mid-sized enterprises focused on optimizing specific production processes. Within the Food and Beverage sector, potential customers include large food processors, bottling plants, dairies, and packaging companies that rely heavily on checkweighers for legal fill requirements and portion control, alongside using bench and floor scales for raw ingredient batching and warehouse inventory monitoring. These customers prioritize sanitation, fast throughput, and high washdown capabilities (high IP ratings).

The second major group comprises logistics, transportation, and bulk handling companies, including freight forwarders, railway operators, port authorities, and warehouses. These customers are the primary purchasers of high-capacity equipment such as truck scales (weighbridges), rail scales, and dimensioning systems. Their need is driven by commercial billing accuracy and legal load limits on roadways and railways, emphasizing robustness, durability, and reliable integration with logistics management software. In the pharmaceutical and healthcare sectors, the potential customer base consists of drug manufacturers, compounding pharmacies, and R&D laboratories who demand ultra-high precision balances and scales (often utilizing electromagnetic force restoration technology) for critical dosage formulation and verification, making regulatory compliance (like 21 CFR Part 11) a non-negotiable requirement.

Finally, the chemical, oil & gas, and mining industries represent highly specialized customer segments. Chemical companies require intrinsically safe (Ex-proof) scales for hazardous zones, utilizing tank and hopper scales for precise batch control in reactions and formulations. Mining and construction customers utilize heavy-duty, high-capacity scales for material extraction measurement, vehicle loading management, and raw material inventory tracking. These diverse customer needs necessitate a market approach that offers both standardized, robust hardware and highly customizable software interfaces capable of integrating with specialized industrial protocols (like PROFINET or EtherNet/IP) specific to their operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.67 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler Toledo, Sartorius AG, Avery Weigh-Tronix (Illinois Tool Works), Precia Molen, A&D Company, Rice Lake Weighing Systems, Fairbanks Scales, MinebeaMitsumi Inc., SENSOTEC, Kistler Group, Ohaus Corporation, Cardinal Scale Manufacturing, RADWAG Wagi Elektroniczne, Weightron Bilanciai, ISHIDA CO., LTD., Coti Global Sensors, Essae Technologics, Bizerba, Dibal, Tanita Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Weighing Scales Market Key Technology Landscape

The Industrial Weighing Scales Market is undergoing rapid technological evolution, moving away from purely mechanical systems toward sophisticated digital, connected, and often intelligent devices. The foundation of this technological landscape rests on advanced load cell technology. While conventional strain gauge load cells remain prevalent for general-purpose applications due to their cost-effectiveness and reliability, the increasing demand for ultra-high accuracy in pharmaceutical and specialized manufacturing sectors drives the adoption of technologies like Electromagnetic Force Restoration (EMFR) and vibrating wire load cells. EMFR technology, typically used in high-end laboratory balances, offers exceptional resolution and stability, increasingly finding its way into industrial processes requiring extremely precise material dispensing or dosage verification, often integrated into automated robotics systems to maintain clean room integrity.

A major technological frontier is the extensive integration of the Internet of Things (IoT) and wireless communication capabilities. Modern industrial scales are equipped with sophisticated communication interfaces (Ethernet, Wi-Fi, Bluetooth, cellular) to seamlessly transmit real-time weight data directly to cloud platforms, centralized ERP systems, or supervisory control and data acquisition (SCADA) systems. This connectivity is paramount for remote diagnostics, centralized data logging, and the implementation of predictive maintenance protocols, allowing service providers and end-users to monitor the health and calibration status of scales globally from a single dashboard. Furthermore, the development of specialized software for statistical process control (SPC) and traceability is crucial, enhancing the scale’s functionality by providing historical trend analysis, deviation reporting, and auditing capabilities necessary for compliance in regulated industries.

Innovation is also highly concentrated in enhancing robustness and performance in demanding environments. This includes the development of scales with extremely high IP ratings (e.g., IP68 or IP69K) suitable for repeated high-pressure washdowns in the food and beverage industry, and the engineering of intrinsically safe (Ex-proof) barriers and components required for deployment in explosive atmospheres within the chemical and oil & gas sectors. Additionally, dynamic weighing technologies, particularly for high-speed checkweighers, are leveraging faster digital signal processing (DSP) techniques and vibration dampening algorithms to maintain high accuracy at maximum throughput, directly addressing the efficiency demands of modern packaging lines. The incorporation of machine vision and dimensioning capabilities (often using laser or infrared technology) combined with weighing data is establishing a new standard for efficient freight auditing and logistics management, creating comprehensive data profiles for every item measured.

Regional Highlights

Regional analysis indicates significant differences in growth trajectories, technological adoption rates, and market maturity across the globe, reflecting underlying industrialization levels and regulatory environments.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing and largest market throughout the forecast period. This dominance is attributed to rapid infrastructural development, massive government investments in manufacturing and logistics expansion (especially in China, India, and Southeast Asia), and the accelerated adoption of automated weighing solutions to improve factory output and product consistency. The region is characterized by high demand for both high-capacity scales (due to construction and mining booms) and automated checkweighers (driven by a rapidly expanding consumer goods sector).

- North America: North America holds a substantial market share, driven primarily by the high adoption rate of advanced, high-precision electronic scales and sophisticated software integration. The market focuses heavily on replacement of older mechanical systems with IoT-enabled devices and compliance-driven investments in the pharmaceutical and complex manufacturing sectors. Stringent food safety regulations (FDA) and advanced logistics demands necessitate continuous technology upgrades and superior calibration services.

- Europe: Europe represents a mature market characterized by high regulatory requirements (OIML, CE marking) and a strong emphasis on quality and environmental standards. Growth here is steady, fueled by the demand for specialized, high-accuracy instruments in precision engineering, chemicals, and pharmaceuticals. The European market leads in the adoption of sustainable manufacturing practices, driving demand for scales that aid in resource efficiency and waste minimization.

- Latin America (LATAM): The LATAM region shows promising growth, particularly in countries such as Brazil and Mexico, linked to industrial recovery and expansion in the food processing, agriculture, and mining sectors. The market often favors cost-effective, robust solutions, but there is increasing investment in mid-range digital scales to enhance international trade compliance and traceability.

- Middle East and Africa (MEA): MEA presents specialized opportunities, primarily driven by large-scale infrastructure projects, oil & gas operations, and rapidly modernizing port and logistics hubs (e.g., UAE, Saudi Arabia). Demand is concentrated in heavy-duty truck scales, crane scales, and intrinsically safe weighing solutions for hazardous environments, with growth closely tied to commodity prices and infrastructure spending cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Weighing Scales Market.- Mettler Toledo

- Sartorius AG

- Avery Weigh-Tronix (Illinois Tool Works)

- Precia Molen

- A&D Company

- Rice Lake Weighing Systems

- Fairbanks Scales

- MinebeaMitsumi Inc.

- SENSOTEC

- Kistler Group

- Ohaus Corporation

- Cardinal Scale Manufacturing

- RADWAG Wagi Elektroniczne

- Weightron Bilanciai

- ISHIDA CO., LTD.

- Coti Global Sensors

- Essae Technologics

- Bizerba

- Dibal

- Tanita Corporation

Frequently Asked Questions

Analyze common user questions about the Industrial Weighing Scales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-precision industrial weighing scales?

The core driver is the increasing stringency of global regulatory standards, particularly in the Food & Beverage and Pharmaceutical sectors, which mandate extremely precise weight measurement for quality control, legal compliance (e.g., minimum fill quantity), and consumer safety. Additionally, the need for resource efficiency in manufacturing to reduce material waste significantly boosts demand for high-accuracy systems.

How does Industry 4.0 influence the Industrial Weighing Scales Market?

Industry 4.0 drives the shift toward intelligent, networked weighing solutions. This includes integrating scales with IoT platforms for real-time data transmission, remote monitoring, and seamless connection to MES/ERP systems. This connectivity enables advanced functionalities like predictive maintenance and automated statistical process control (SPC).

Which technology segment exhibits the highest growth rate?

The Digital/Electronic Scales segment, particularly high-speed Checkweighers and advanced Tank & Hopper Scales utilizing modern digital load cells, shows the highest growth rate. This is due to their superior accuracy, rapid throughput, and essential connectivity capabilities required for modern automated production lines and inventory management.

What are the main challenges associated with implementing new industrial scales?

Key challenges include the high initial capital investment required for sophisticated automated systems, the complexity of integrating new digital scales with diverse legacy manufacturing systems (system compatibility), and the necessity for specialized, ongoing calibration and maintenance services to maintain accuracy and compliance.

What role does Artificial Intelligence play in modern weighing applications?

AI is used to optimize scale performance through predictive analytics, analyzing measurement drift and environmental noise to predict failures and automate micro-adjustments for calibration. AI also enhances dynamic weighing processes, reducing errors in high-speed checkweighing, and improves inventory forecasting accuracy using real-time weight data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager